List of Contents

What is the Patient Experience Technology Market Size?

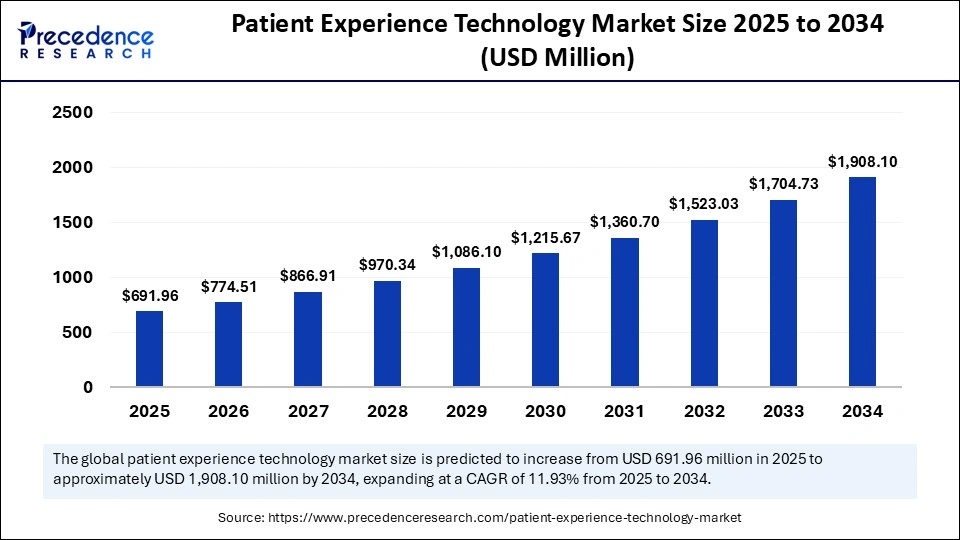

The global patient experience technology market size is calculated at USD 691.96 million in 2025 and is predicted to increase from USD 774.51 million in 2026 to approximately USD 1,908.10 million by 2034, expanding at a CAGR of 11.93% from 2025 to 2034. This market is growing due to rising demand for personalized, seamless, and digitally integrated healthcare solutions that enhance patient engagement and satisfaction.

Market Highlights

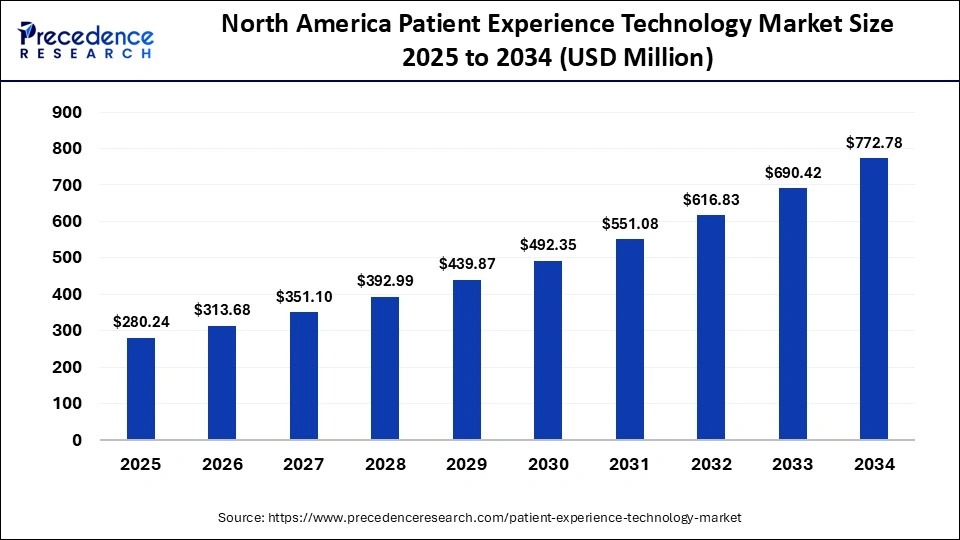

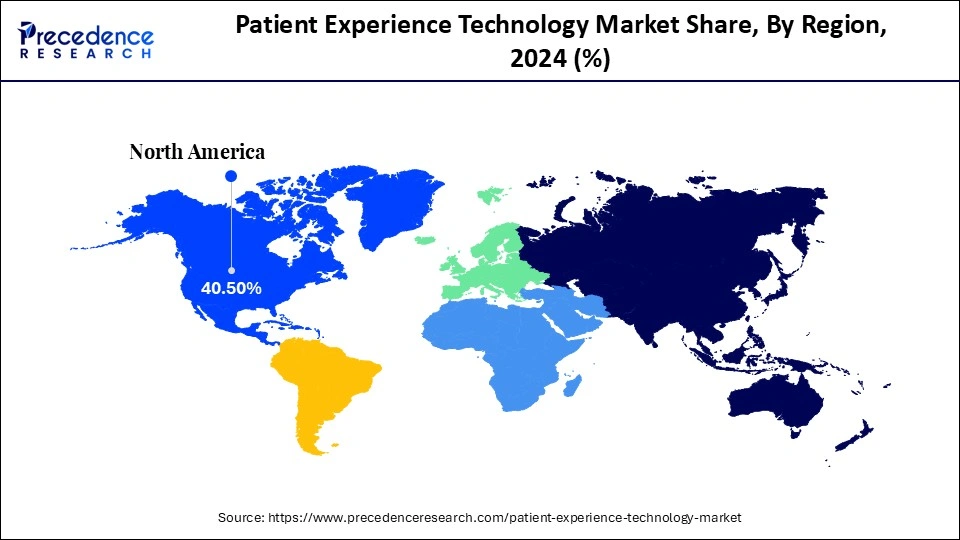

- North America dominated the market, holding the largest market share of 40.50% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 11.60 between 2025 and 2034.

- By component, the software/platforms segment held the largest share of 46.50% in 2024.

- By component, the services segment is projected to grow at a remarkable CAGR of 10.60% between 2025 and 2034.

- By deployment, the cloud-based/SaaS platforms segment contributed the largest market share of 52% in 2024.

- By deployment, the hybrid deployment segment hybrid deployment segment is set to grow at a strong CAGR of 10.20% between 2025 to 2034.

- By end user, the hospitals segment accounted for the major market share of 39.50% in 2024.

- By end user, the home healthcare provider segment is growing at a solid CAGR of 11.40% between 2025 and 2034.

- By technology integration, the AI & Chatbox-assisted communication segment held the largest share of 29.20% in 2024.

- By technology integration, the IoT-enabled patient rooms/smart beds are set to grow at a remarkable CAGR of 12% between 2025 and 2034.

Why do Hospitals & Clinics Need to Build an AI-Powered Virtual Health Assistant?

The patient experience technology market is witnessing rapid growth as more healthcare professionals use digital tools to enhance care coordination, communication, and transparency. AI-powered chatbots, virtual health assistants, and smart hospital platforms are just a few examples of how technology is transforming patient engagement with healthcare systems. Patients around the world are experiencing a more connected, effective, and fulfilling healthcare journey as a result of this shift toward personalization and convenience.

Case Study: Enhancing Patient Engagement Through Digital Innovation

- In March 2024, Philips Healthcare launched its AI-driven Patient Experience Platform, improving real-time communication and feedback in hospitals. Within months, satisfaction scores increased by 28%, highlighting how digital tools can make healthcare more patient-focused.

Key Trends in Patient Experience Technology Market

- Personalized Digital Care: Increasing use of analytics and AI to provide personalized healthcare experiences based on each patients needs.

- Expansion of Virtual Care: Telehealth remote consultations and home-based monitoring for ongoing care are being monitored for ongoing care are being quickly adopted.

- Rise of Wearable Devices: Increased use of health trackers and smartwatches for real-time monitoring.

- Shift Toward Value-Based Care: Patient outcome-focused strategies replace volume-driven models in healthcare systems.

Key Technological Shifts in the Patient Experience Technology Market

| Technology | Description | Impact on Patient Experience |

| AI & Machine Learning | Used in chatbots, predictive analytics, and personalization tools to tailor the care journey | Enables 24/7 assistance, faster diagnosis, and customized treatment plans |

| Telehealth & Remote Monitoring | Offers virtual consultations and real-time tracking through connected devices | Expands access to care, reduces hospital visits, and supports continuous monitoring. |

| Cloud-Based Healthcare Platform | Centralizes patient data and streamlines information sharing between providers | Improves coordination, transparency, and efficiency in care delivery. |

| Internet of Medical Things | Integrates smart devices for data collection and remote patient tracking | Enhances preventive care and real-time health management |

Patient Experience Technology MarketOutlook

The market is expanding as medical facilities use digital tools, telehealth, and AI to increase patient satisfaction and engagement. The growing demand for connected individualized care is driving rapid global expansion.

Digital solutions like remote monitoring and virtual care cut down on energy use, travel, and paper use, improving the efficiency and environmental friendliness of healthcare.

Startups focused on smart healthcare delivery and digital patient engagement are being supported by investors like 1616z, Rock Health, and Flare Capital.

With AI assistant digital platforms that improve the patient experience overall and remote monitoring, thinking healthcare startups are bringing about change.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 691.96 Million |

| Market Size in 2026 | USD 774.51 Million |

| Market Size by 2034 | USD 1,908.10 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, End User, Technology Integration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Patient Experience Technology MarketSegmental Insights

Component Insights

The software/platforms segment dominates the market with a 46.50% share in 2024 due to the greater demand for patient data management and communication systems. Patient interaction and experience are improved by ongoing innovation in analytics, mobile applications, and automation tools.

The services segment is expected to be the fastest-growing segment in the market, bolstered by the growing demand for training integration and maintenance services. This expansion is accelerated by the trend toward outsourcing healthcare IT management. The growing use of managed services is improving long-term market growth.

The hardware sub-segment has shown notable growth in the patient experience technology market due to the rising use of connected medical devices, smart wearables, and advanced hospital infrastructure. Devices such as patient monitoring systems, digital kiosks, and bedside terminals are helping improve communication and comfort within healthcare facilities. Hospitals are increasingly investing in interactive hardware solutions that allow patients to control room settings, access information, and connect with care teams in real time.

Deployment Mode Insights

The cloud-based/SaaS platforms segment dominated the market with a 52% share in 2024 due to remote access, scalability, and reduced initial costs. Adoption in clinics and hospitals is driven by the growing demand for flexible, secure data hosting. The use of cloud analytics is growing, improving patient outcomes and decision-making.

The hybrid deployment segment is expected to be the fastest-growing segment in the market during the forecast period, as businesses seek greater data control and flexibility. It provides a compromise between on-premises data security and cloud convenience. Hybrid model adoption is being driven by the growing need for data security compliance.

The on-premises subsegment has experienced steady growth in the patient experience technology market, as many healthcare organizations continue to prioritize data control, security, and system customization. Hospitals and clinics with established IT infrastructure often prefer on-premise solutions because they allow direct management of sensitive patient information and compliance with local data regulations. These systems also offer greater flexibility for integrating specialized hardware and software within existing hospital networks.

End User Insights

The hospital segment dominated the market in 2024 due to the large number of new patients and the growing use of digital tools to improve satisfaction and optimize workflows. Dominance is bolstered by investments in EMR integration, and smart hospitals are prioritizing virtual care solutions to improve continuity of care.

The home healthcare providers segment is expected to be the fastest-growing in the market during the forecast period, reinforced by the move toward individualized care and remote monitoring. This expansion is driven by the aging population and the need for at-home healthcare solutions. The efficiency and accessibility of home care are being improved by wearable technology and mobile health platforms.

Rehabilitation centers are becoming a key part of the patient experience technology market as they increasingly adopt digital tools to enhance recovery and care coordination. These centers are using technologies such as virtual rehabilitation platforms, wearable sensors, and patient progress tracking systems to deliver personalized therapy and monitor outcomes in real time. Digital engagement tools help patients stay motivated, follow treatment plans, and maintain communication with therapists even after discharge.

Technology Integration Insights

The AI & chatbot-assisted communication segment dominated the market with a 29.2% share through facilitating quicker query resolution, predictive care insights, and round-the-clock patient engagement. These tools increase employee satisfaction while lowering the workload. Support systems and patient interaction are being revolutionized by the growing use of genetic AI.

- In June 2025, Microsoft introduced Dragon Copilot, a next-generation AI assistant, to streamline clinical documentation and automate administrative tasks.

The IoT-enabled patient rooms/smart beds segment is growing rapidly, with a 12% share, driven by the need for automation and real-time health monitoring to improve patient safety and comfort in hospitals, and is increasingly incorporating sensors and connected devices. This trend is encouraging the creation of fully connected smart healthcare environments.

- In January 2024, Artisight raised 42 million in Series B funding to scale and advance its AI-driven smart hospital platform.

Virtual Reality and Augmented Reality are transforming the patient experience technology market by creating more immersive, engaging, and personalized care environments. Healthcare providers are using VR and AR to reduce patient anxiety, improve pain management, and enhance therapy sessions through interactive simulations. In rehabilitation, these technologies help patients practice movements and exercises in safe, controlled virtual settings that make recovery more engaging. Hospitals are also using AR to guide patients through facilities or educate them about procedures in a more visual and reassuring way.

Patient Experience Technology Market Regional Insights

The North America patient experience technology market size is estimated at USD 280.24 million in 2025 and is projected to reach approximately USD 772.78 million by 2034, with a 11.93% CAGR from 2025 to 2034.

What Made North America Dominate the Patient Experience Technology Market?

North America dominated the market in 2024 due to early adoption of AI-driven health solutions, the presence of important players, and the sophisticated healthcare infrastructure. Its emphasis on data-driven care models and digital patient engagement keeps the regions leadership strong.

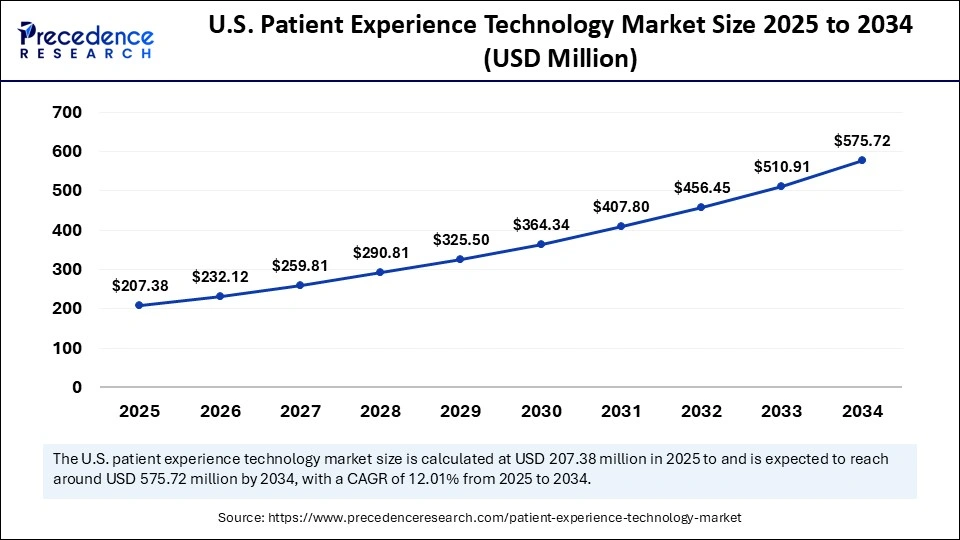

The U.S. patient experience technology market size is calculated at USD 207.38 million in 2025 and is expected to reach nearly USD 575.72 million in 2034, accelerating at a strong CAGR of 12.01% between 2025 and 2034.

How is the U.S. Transforming the Patient Experience Technology Market?

The U.S. patient experience technology market is growing rapidly due to the widespread use of digital technologies, AI-powered treatments, and a focus on value-based healthcare. Further bolstering market expansion are investments in cloud and telehealth platforms as well as supportive government policies. Its expansion is being reinforced by the growing need for individualized care and real-time engagement.

Asia Pacific became the fastest-growing region in the patient experience technology market, driven by the rapid adoption of digital health systems and strong government support for healthcare modernization. The regions large and aging populations, along with a rising middle class, have increased demand for better and more efficient patient services. Hospitals and clinics are focusing on digital platforms such as mobile health apps, patient portals, and teleconsultation tools to improve accessibility and satisfaction.

In many countries, the absence of outdated legacy systems enabled providers to move directly to advanced technologies, accelerating digital transformation. The widespread use of smartphones and telemedicine has also pushed healthcare providers to invest in solutions that create a more personalized and connected patient experience.

India Patient Experience Technology Market Trends

Indias patient experience technology market is expanding rapidly, driven by rising telehealth usage, digital hospital systems, and support from the Ayushman Bharat Digital Mission. Startups and private hospitals, along with investments in AI and mobile health apps to improve patient engagement, affordable digital tools, and growing health awareness, are driving its rapid growth.

The Middle East region has become a standout for patient-experience technology, thanks to a strong push towards digitised healthcare, backed by national visions and large infrastructure investments. For example, many Gulf countries have adopted advanced IT systems, telemedicine, and mobile health first, letting them leap ahead in patient engagement tools. In surveys and reports, patients in the region have shown high expectations for convenience, access, and quality of care, pushing providers to adopt solutions that support smoother communication, portals, feedback platforms, and remote monitoring. Private-public partnerships and regulatory reforms are also favouring tech-driven models of care, with digital health initiatives positioning the region as a testing ground for patient-centric models.

Saudi Arabia Patient Experience Technology Market

Saudi Arabia stands out as one of the most notable countries in the Middle East for advancing patient experience technology. The governments Vision 2030 initiative has placed digital transformation at the center of its healthcare reform, driving investment in telemedicine, electronic health records, and integrated patient engagement platforms. Hospitals across the kingdom are implementing digital portals that allow patients to book appointments, access medical information, and communicate with providers more easily. The Ministry of Health digital health programs, such as the Seha and Mawid apps, have expanded access to virtual consultations and improved transparency of services.

Patient Experience Technology Market Value Chain

Research and Development in the patient experience technology market is centered on designing and refining advanced digital healthcare solutions that enhance patient engagement and operational efficiency. Companies are investing heavily in developing wearable health devices, telehealth platforms, and AI-driven systems to personalize care delivery. The focus extends beyond innovation to ensuring interoperability between systems, user-friendly design, and compliance with healthcare regulations. Collaboration with clinicians and patients during the R&D stage also helps align technology features with real-world healthcare needs, resulting in solutions that are both effective and practical.

This stage involves integrating hardware, software, and intuitive user interfaces to deliver dependable, secure patient experience technologies. It includes product engineering, interface design, and the seamless blending of data analytics with device functionality. The goal is to ensure that systems such as hospital kiosks, mobile apps, monitoring tools, and communication platforms work together smoothly to enhance patient convenience. Testing for data accuracy, cybersecurity, and usability is critical in this phase, as healthcare providers prioritize technologies that are safe, efficient, and easy for patients and staff to operate.

The patient support and services phase plays a vital role in ensuring successful adoption and sustained use of patient experience technologies. This involves comprehensive training programs for healthcare teams, onboarding assistance for patients, and continuous technical support. Real-time troubleshooting, software updates, and feedback mechanisms are essential for maintaining trust and satisfaction. Service providers also collect user insights at this stage to improve system performance and patient outcomes over time. By offering consistent support and a responsive service model, healthcare organizations strengthen patient loyalty and maximize the long-term value of their technology investments.

Patient Experience Technology Market Companies

- Headquarters: Verona, Wisconsin, United States

- Year Founded: 1979

- Ownership Type: Privately Held

History and Background

Epic Systems Corporation was founded in 1979 by Judith Faulkner as Human Services Computing, with the mission of improving healthcare delivery through better data management. Over the decades, Epic has become one of the world most influential healthcare technology companies, providing electronic health record (EHR) systems and integrated platforms used by leading hospitals and health systems globally.

In the Patient Experience Technology Market, Epic Systems is a leader in developing digital engagement tools, patient portals, telehealth platforms, and interoperability solutions that enhance communication between patients and providers. Its MyChart platform revolutionized patient engagement by allowing individuals to access health information, schedule appointments, manage medications, and communicate securely with clinicians all in one unified interface.

Key Milestones / Timeline

- 1979: Founded as Human Services Computing

- 1983: Released the first integrated hospital record system

- 2001: Launched MyChart, one of the first comprehensive patient portals

- 2015: Expanded to include mobile and telehealth patient engagement solutions

- 2023: Integrated generative AI tools into EHR for patient-provider interaction support

- 2024: Introduced ambient intelligence features for patient experience personalization

Business Overview

Epic Systems provides software solutions for healthcare providers, focusing on data interoperability, clinical efficiency, and patient empowerment. In the patient experience technology domain, Epics systems create connected ecosystems where patients can engage with providers through personalized digital interfaces. Epic also integrates with wearable devices and remote monitoring platforms, aligning with the industry shift toward value-based and patient-centered care.

Business Segments / Divisions

- Electronic Health Records (EHR Systems)

- Patient Engagement and Experience Solutions

- Population Health and Analytics

- Telehealth and Remote Monitoring Platforms

Geographic Presence

Epic serves healthcare organizations across the United States, Europe, the Middle East, and Asia-Pacific, with a strong footprint among major academic medical centers and integrated delivery networks.

Key Offerings

- MyChart Comprehensive patient engagement and communication portal

- Care Everywhere Interoperability network connecting patient data across systems

- Epic Cheers Customer relationship management (CRM) for patient experience

- Epic Garden Plot Cloud-based platform for smaller healthcare organizations

Financial Overview

Epic Systems generates estimated annual revenues exceeding $4.5 billion USD, driven by long-term partnerships with large healthcare systems and growing adoption of patient experience and digital engagement tools.

Key Developments and Strategic Initiatives

- April 2023: Integrated AI-driven conversational tools into MyChart for real-time patient support

- August 2023: Expanded digital front door solutions for multi-site healthcare providers

- February 2024: Released new personalization features using patient behavior analytics

- January 2025: Launched predictive communication module for improving patient satisfaction

Partnerships & Collaborations

- Collaborations with leading health systems for digital patient engagement research

- Partnerships with device manufacturers for wearable integration into EHR systems

- Alliances with cloud providers for scalable data storage and access solutions

Product Launches / Innovations

- MyChart AI Assistant (2023)

- Epic Cheers CRM for healthcare (2024)

- Expanded MyChart Video Visits and self-service modules (2025)

Technological Capabilities / R&D Focus

- Core technologies: EHR systems, cloud-based interoperability, AI analytics, and patient interface design

- Research Infrastructure: Innovation labs at headquarters focusing on AI in healthcare interaction

- Innovation focus: Generative AI, voice-driven patient engagement, and real-time personalization

Competitive Positioning

- Strengths: Deep healthcare expertise, integrated ecosystem, and leading interoperability framework

- Differentiators: Unified patient-provider experience through connected systems and high data integrity

SWOT Analysis

- Strengths: Market leadership in EHR and patient engagement, scalability, and proven reliability

- Weaknesses: High implementation costs for smaller providers

- Opportunities: Expansion of AI-enabled patient engagement and global healthcare digitalization

- Threats: Competition from emerging cloud-native healthcare platforms

Recent News and Updates

- March 2024: Epic announced MyChart AI Companion to assist patients with care navigation

- July 2024: Partnered with a major U.S. health system for full-scale digital experience transformation

- January 2025: Rolled out new patient experience analytics suite for healthcare network optimization

Corporate Information

- Headquarters: Kansas City, Missouri, United States

- Year Founded: 1979 (Acquired by Oracle Corporation in 2022)

- Ownership Type: Subsidiary of Oracle Corporation (NYSE: ORCL)

History and Background

Cerner Corporation was founded in 1979 by Neal Patterson, Paul Gorup, and Cliff Illig as a healthcare information technology company specializing in digital records and hospital management systems. In 2022, Oracle Corporation acquired Cerner and rebranded it as Oracle Health, marking a strategic expansion into cloud-based healthcare solutions.

In the Patient Experience Technology Market, Oracle Health delivers next-generation cloud-based digital health platforms designed to enhance engagement, accessibility, and continuity of care. The company integrates Cerners clinical systems with Oracles AI, analytics, and cloud infrastructure to create a unified environment for personalized patient experiences, virtual care, and data-driven insights.

Key Milestones / Timeline

- 1979: Founded in Kansas City as a healthcare software company

- 2002: Introduced Cerner Millennium EHR platform

- 2015: Expanded HealtheLife patient engagement platform

- 2022: Acquired by Oracle Corporation and rebranded as Oracle Health

- 2024: Launched Oracle Cloud for Healthcare, integrating AI, analytics, and patient experience tools

Business Overview

Oracle Health operates as Oracle healthcare division, combining Cerner medical record expertise with Oracle enterprise technology. Its solutions support patient engagement, population health, and data integration across hospitals, clinics, and payers. The division focuses on providing patient-centered digital ecosystems that simplify care navigation, enhance transparency, and foster personalized interactions through predictive analytics.

Business Segments / Divisions

- Electronic Health Records (EHR)

- Patient Engagement Platforms

- Data Analytics and Cloud Infrastructure

- Healthcare AI and Virtual Care

Geographic Presence

Oracle Health serves healthcare organizations across more than 40 countries, with a strong presence in North America, Europe, and the Middle East, and expanding operations in Asia-Pacific.

Key Offerings

- Oracle Health EHR Cloud Unified clinical and patient data platform

- Oracle Health Experience Platform Personalized digital engagement and self-service portal

- HealtheLife Mobile and web-based patient engagement platform

- Oracle Analytics Cloud for predictive patient insights

Financial Overview

Oracle Health contributes to Oracle Corporation annual revenue of over $50 billion USD, with the healthcare division growing steadily through cloud-based digital transformation initiatives.

Key Developments and Strategic Initiatives

- March 2023: Launched Oracle Health Cloud for patient data unification and experience management

- October 2023: Expanded HealtheLife with integrated telehealth and digital communication features

- May 2024: Deployed predictive analytics module for proactive patient engagement and satisfaction

- January 2025: Announced a generative AI-powered conversational platform for healthcare providers and patients

Partnerships & Collaborations

- Partnership with the U.S. Department of Veterans Affairs for nationwide digital health modernization

- Collaborations with health systems and governments for unified patient data ecosystems

- Alliances with Oracle Cloud customers for AI-driven population health and experience improvement

Product Launches / Innovations

- Oracle Health Experience Platform (2023)

- HealtheLife Advanced Telehealth Suite (2024)

- Oracle Health AI Conversational Assistant (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, AI analytics, data interoperability, and user experience design

- Research Infrastructure: Oracle Labs and Cerner innovation centers focusing on clinical and patient data systems

- Innovation focus: Predictive engagement, AI-based conversational tools, and cross-platform integration

Competitive Positioning

- Strengths: Strong Oracle Cloud backbone, advanced analytics capabilities, and healthcare data expertise

- Differentiators: Unified cloud-based architecture enabling seamless integration of clinical and patient engagement systems

SWOT Analysis

- Strengths: Global presence, scalable cloud solutions, and AI-driven engagement innovation

- Weaknesses: Integration challenges from legacy Cerner systems

- Opportunities: Expansion into AI-assisted healthcare and international cloud health platforms

- Threats: Competitive pressure from Epic and emerging digital health startups

Recent News and Updates

- April 2024: Oracle Health launched a cloud-based patient engagement hub for multi-hospital systems

- August 2024: Announced collaboration with a major U.S. health network to improve patient digital access

- January 2025: Introduced Oracle Health AI Assistant for enhancing clinical communication and patient self-service experiences

Other Market Companies

- Press Ganey: Press Ganey is a leading provider of patient experience and performance improvement solutions for healthcare organizations. Its platforms measure patient satisfaction, collect multi-channel feedback, and deliver analytics that help hospitals and clinics enhance care quality, safety, and service outcomes.

- Medallia Inc.: Medallia specializes in experience management, offering an AI-driven platform that unifies patient, staff, and caregiver feedback across multiple channels. Its healthcare solutions enable organizations to identify service gaps, predict satisfaction trends, and drive continuous improvement through actionable insights.

- Medhost: Medhost delivers integrated healthcare IT solutions, including enterprise EHR systems, patient engagement platforms, and operational analytics. The company supports hospitals and clinics with tools that enhance workflow efficiency, patient communication, and care coordination.

- athenahealth: athenahealth provides cloud-based healthcare IT solutions, including EHR, practice management, and patient engagement tools. Its analytics and reporting capabilities help healthcare providers streamline operations, improve patient satisfaction, and enhance care delivery outcomes.

- NextGen Healthcare: NextGen Healthcare offers comprehensive electronic health record and patient experience management solutions for ambulatory and specialty care providers. Its platform integrates patient feedback mechanisms with clinical workflows to improve engagement and care coordination.

- CareCloud: CareCloud provides modern cloud-based EHR, practice management, and patient experience solutions. Its technology enables providers to optimize digital engagement, streamline administrative tasks, and enhance the patient journey through intuitive data analytics.

- eClinicalWorks: eClinicalWorks develops healthcare IT systems with strong patient engagement and analytics capabilities. Its tools, including patient portals and real-time satisfaction tracking, help providers improve communication, monitor outcomes, and personalize care delivery.

- Meditech: Meditech offers integrated EHR solutions with built-in patient experience and reporting modules. The company focuses on interoperability and patient-centered design, helping healthcare systems capture feedback, measure satisfaction, and enhance operational performance.

- Allscripts: Allscripts provides connected healthcare IT platforms that combine EHR, population health, and patient experience management. Its solutions allow healthcare organizations to gather feedback, analyze performance metrics, and strengthen provider-patient relationships across the continuum of care.

Recent Developments

- In October 2025, Actium Health launched a new AI-powered patient communication automation platform aimed at improving digital engagement and care coordination.(Source: https://finance.yahoo.com)

- In August 2025, PEP Health announced the peer-reviewed publication of its AI-powered patient experience platform, demonstrating 99% accuracy in predicting satisfaction scores from online reviews.(Source: https://www.prnewswire.com)

Patient Experience Technology MarketSegments Covered in the Report

By Component

- Hardware

- Kiosks & Check-in Terminals

- Patient Room Tablets / Smart Displays

- Bedside Terminals & Entertainment Systems

- Wearable Devices & Smart Wristbands

- Interactive Voice Response (IVR) Systems

- Software / Platforms

- Patient Engagement Platforms

- Feedback & Survey Management Software

- Telehealth & Virtual Care Platforms

- Mobile Health (mHealth) Applications

- Customer Relationship Management (CRM) Systems

- Healthcare Analytics & Sentiment Analysis Tools

- Services

- Implementation & Integration Services

- Consulting & Training

- Support & Maintenance

- Managed Services

By Deployment Mode

- Cloud-Based/SaaS Platforms

- On-Premise

- Hybrid Deployment

By End User

- Hospitals

- Multi-specialty Hospitals

- Specialty / Single-Specialty Hospitals

- Ambulatory Surgical Centers (ASCs)

- Clinics & Physician Practices

- Rehabilitation Centers

- Long-term Care Facilities / Nursing Homes

- Home Healthcare Providers

By Technology Integration

- AI & Chatbot-assisted Communication

- IoT-enabled Patient Rooms / Smart Beds

- Virtual Reality (VR) & Augmented Reality (AR) for Experience Enhancement

- Blockchain for Secure Patient Feedback

- Big Data Analytics & Predictive Modelling

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client