List of Contents

What is the Contract Pharmaceutical Fermentation Services Market Size?

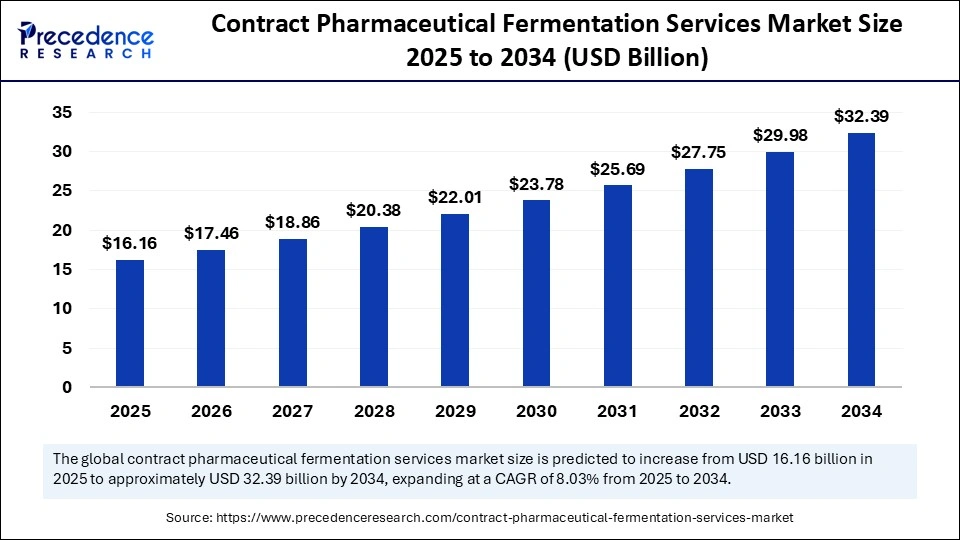

The global contract pharmaceutical fermentation services market size accounted for USD 16.16 billion in 2025 and is predicted to increase from USD 17.46 billion in 2026 to approximately USD 32.39 billion by 2034, expanding at a CAGR of 8.03% from 2025 to 2034. The market is driven by increasing demand for biologics, rising outsourcing among pharma companies, and advancements in microbial and cell-culture fermentation technologies.

Market Highlights

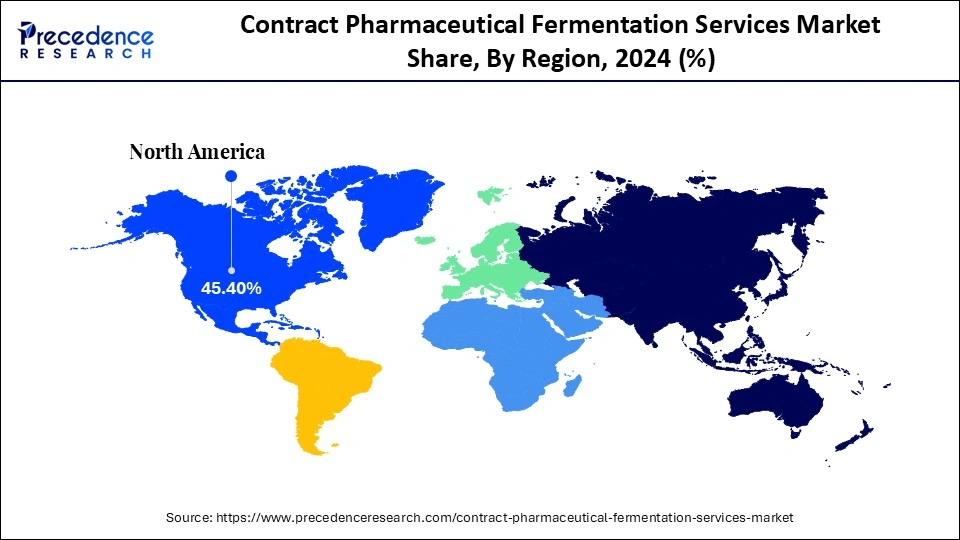

- North America dominated the market, with a 45.4% market share in 2024.

- The Europe is expected to grow at the fastest CAGR of 8.8 between 2025 and 2034.

- By service type, the commercial GMP manufacturing segment held the major market share of 37.4% in 2024.

- By service type, the process development & tech transfer segment is expected to grow at a solid CAGR of 8.2% between 2025 and 2034.

- By scale/capacity, the large-scale commercial segment contributed the highest market share of 54.4% in 2024.

- By scale/capacity, the lab/pilot scale segment is growing at a solid CAGR of 8.3% in between 2025 and 2034.

- By organism/host system, the mammalian cell culture segment generated the biggest market share of 52.10% in 2024.

- By organism/host system, the viral vector/cell therapy platforms is growing at a solid CAGR of 8.1% between 2025 and 2034.

- By product type, the mAbs segment Accounted for the major market share of 40.1% in 2024.

- By product type, the cell & gene therapy (viral vectors) segment is expected to expand at a strong CAGR of 8.0% between 2025 and 2034.

- By end-user, the large pharma & biotech segment held the largest share of 42.5% in the AI in telemedicine market during 2024.

- By end-user, the biotechnology companies/biotechs are set to grow at a remarkable share of 8.4% CAGR between 2025 and 2034.

Redefining Biologic Manufacturing: How Contract Fermentation Service is Driving the Next Pharmaceutical Innovation

Contract pharmaceutical fermentation services that offer specialized third-party services in biologics, vaccines, recombinant proteins, enzymes, and fermentation-derived API manufacturing. With microbial (bacterial and yeast) and mammalian cell systems, Contract Development and Manufacturing Organizations (CDMOs) provide a complete set of services in the upstream fermentation development, process optimization, scale-up, and a GMP-compliant manufacturing solution. CDMOs provide individualized fermentation capacity and technical expertise, which allow a pharmaceutical or biotech firm to speed up product pipelines with high-quality and compliance rates, without the financial investment of in-house infrastructure.

The upsurge in biologics and biosimilars, the increasing investment in R&D, and the rising outsourcing of the manufacturing process. Pharmaceutical companies are searching to find fast and low-cost remedies to handle sophisticated fermentation procedures and comply with world regulatory standards. Due to the continued reliance of biologic therapies on therapeutic pipelines, the necessity to have scalable, high-yield, and efficient fermentation is causing increased collaboration between drug developers and CDMOs. Moreover, automation, AI-enhanced process optimization, and fermentation systems are being deployed by service providers due to the increasing demand for personalized medicine and sustainable techniques of biomanufacturing.

Smart Fermentation: AI Redefines Biopharma Manufacturing

The contract pharmaceutical fermentation service market is transforming with the revolution of artificial intelligence that optimizes the operations, forecasts, and regulates quality. The AI-based algorithms can be used to monitor fermentation parameters, including the pH, temperature, and oxygen, in real-time and guarantee the right production yield and reduced variability. Firms such as Lonza, Thermo Fisher Scientific, and WuXi Biologics are implementing AI-based systems to manage bioprocesses to speed up process development and scale-up, and to minimize the cost of operation. In addition, the integration with robotics and automation increases the compliance with GMP, traceability, and reproducibility of batches. Through the integration of biotechnology and AI intelligence, CDMOs will be able to develop more sustainable, safe, and faster biologics production that will redefine the pharmaceutical fermentation processes.

Contract Pharmaceutical Fermentation Services Market Outlook

The increasing growth of biologics demand and outsourcing of complex fermentation processes is leading to the steady growth of the market. Lonza Group, Catalent, and Thermo Fisher Scientific are considered to be the pioneers of the development of scalable and compliant manufacturing solutions.

WuXi Biologics, Samsung Biologics, and AGC Biologics are global CDMOs that are expanding capacity to satisfy the demand for international biologics. Asia and Europe are developing emerging markets that are becoming vital fermentation and biomanufacturing centers.

The advanced fermentation plants are being funded by leading investors such as Boehringer Ingelheim, Fujifilm Diosynth Biotechnologies, and Merck KGaA (BioReliance). They are interested in enhancing biologics, biosimilars production, as well as vaccine production on a global level.

Biotech startups such as MycoTechnology, and Geltor have made use of the services of CDMOs to offer flexible fermentation. These innovators are interested in synthetic biology, precise fermentation, and sustainable protein development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.16 Billion |

| Market Size in 2026 | USD 17.46 Billion |

| Market Size by 2034 | USD 32.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Scale/Capacity, Organism/Host System, Product Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Contract Pharmaceutical Fermentation Services Market Segment Insights

Service Type Insights

Commercial GMP Manufacturing: The commercial GMP manufacturing segment held a 37.4% share in the contract pharmaceutical fermentation services market in 2024, driven by increasing demand for large-scale production of biologics and biosimilars. The pharmaceutical and biotech companies are more inclined to contract manufacturers with better fermentation plants and GMP-approved plants, as they ensure the quality, safety, and compliance of products. High-throughput fermentation required in a GMP setting is also expected to be high with the emergence of the global pipelines of biologics.

Process Development & Tech Transfer: The process development & tech transfer segment captured an 8.2% market share in 2024 and is expected to grow significantly. The linkage of laboratory innovation and large-scale GMP manufacturing through assurance of reproducible yields, consistency of yield, and compliance. The general trend toward process analytical technology (PAT), quality-by-design (QbD) concepts, and more tech transfer approaches driven by data is increasing the partnership between drug developers and CDMOs, eventually leading to higher production rates and faster drug market penetration of complex biologics.

Clinical-Scale Manufacturing: The clinical scale manufacturing segment is increasing with biopharma companies outsourcing an increased amount of manufacturing of early-stage biologics and vaccine manufacturing to specialized CDMOs. These services include the adaptability and capability necessary to manufacture in small batches of GMP-compliant products to support clinical trials. The growing number of new biologic candidates, cell and gene therapies, and microbial-based vaccines drives the growth. Fermentation systems that are provided by CDMOs in a modular and single-use format are especially appreciated to cut the time-to-clinic and limit potential contamination.

Scale/Capacity Insights

Large Scale Commercial (>2,000 L): The large-scale commercial (>2,000 L) segment of the market in the contract pharmaceutical fermentation services market in 2024 had a share of 54.4% due to the increased demand in large-scale production of biologics, biosimilars, and microbial-based APIs. The pharmaceutical and biotech institutions are increasingly collaborating with the CDMOs that operate large bioreactors and continuous fermentation plants to achieve economies of scale and homogeneity in the quality of products. Also, the prevalence of the outsourcing model by the large biopharma players to cut costs and shorten time-to-market only serves to enhance the dominance of this segment.

Lab/Pilot Scale (<200 L): The lab/pilot scale (<200 L) segment captured an 8.3% share of the contract pharmaceutical fermentation services market in 2024, and this was supported by increasing early-stage R&D, strain screening, and proof-of-concept research in biologics development. The targeting research institutions, biotech start-ups, and early-stage pharmaceutical programs that need small-scale fermentation for preclinical validation and process feasibility testing. CdMOs with lab-scale modular and flexible fermenters will enable rapid experimentation and data acquisition that will be mandatory in future decisions about scale-up. Increasing technological advances in the field of synthetic biology and microbial engineering have further increased the requirement for pilot-scale fermentation services.

Clinical Scale (200 to 2,000 L): The clinical scale segment is a vital factor between laboratory development of process and commercial scale production. It serves biopharmaceutical organizations that are using Phase I-III trials that need GMP-compliant fermentation in medium batch sizes. The growth of the segment is driven by the growth of the biologics pipeline, particularly monoclonal antibodies, recombinant proteins, and vaccines in clinical development. The mid-scale fermenters in CDOs allow the desired flexibility and speed of optimizing the process, improving yield, and documenting regulatory compliance to support Investigational New Drug (IND) applications.

Organism / Host System Insights

Mammalian Cell Culture: The mammalian cell culture (CHO) segment led the market while holding a 52.1% share in 2024, motivated by its popular use in the manufacture of complex biologics, monoclonal antibodies, and recombinant proteins demanding human-like post-translational processing. The Chinese Hamster Ovary (CHO) cells have continued to be the gold standard in the industry owing to their capacity to scale, stability, and high productivity in the GMP. There is an upward trend in the use of CDMOs whose expression systems are sophisticated CHOs to fulfill regulatory and quality requirements of therapeutic proteins.

Viral Vector/Cell Therapy Platforms: The viral vector/cell therapy platforms segment is expected to grow at a significant CAGR over the forecast period, with an 8.1% market share, due to the growing pipeline of gene and cell therapies. The growing demand for deploying adeno-associated and lentiviral vectors in the personalized and regenerative medicine industry has amplified the move towards outsourcing to the ability of CDMOs to design, develop, and commercially produce vectors based on their own biosafety and containment requirements. These systems require a large amount of process control and regulatory compliance, which is provided through the contract manufacturers in the form of advanced bioprocessing and scalable viral vectors production.

Microbial (E. Coli, Yeast): The effective generation of enzymes, vaccines, and therapeutic proteins, the microbial (E. Coli, yeast) segment remains a vital part of the contract pharmaceutical fermentation services market. The benefits of E. Coli and yeast systems include: rapid growth, easy to manipulate genetically, and low-cost large-scale fermentation. Their use was necessitated by the need to use biosimilars, peptide hormones, and non-glycosylated recombinant proteins. The solutions of microbial fermentation offered by CDOs include optimized fermentation platforms, fed-batch, or continuous fermentation, and downstream purification.

Product Type Insights

Monoclonal Antibodies (mAbs): The mAbs segment held a 40.1% share in the contract pharmaceutical fermentation services market in 2024, as a result of the rising demand for monoclonal antibody-based therapeutics in the world against cancer, autoimmune, and infectious diseases. CMOs are offering bigger platforms of fermentation and purification based on CHO to enable the developing pipeline of biosimilars and next-generation antibodies. The growing use of continuous bioprocessing, single-use technologies, and AI-based optimization of the process adds to the efficiency of production, which contributes to the high market share of this category.

Cell & Gene Therapy: The cell & gene therapy (viral vectors) segment is poised for substantial growth in the contract pharmaceutical fermentation services market, holding an 8.0% share in 2024, due to the popularity of gene-modified and regenerative therapies in the world. The growing requirement for clinical trials of adeno-associated and lentiviral vectors has formed a strong demand for specialized fermentation services. Biotech companies are increasingly dependent on CDMOs that specialize in viral vectors production and regulatory compliance with bio safety, as well as high-end bioreactor setup.

Recombinant Enzymes and Recombinant Proteins: There has been constant growth in the recombinant proteins & enzymes segment due to their large-scale application in the therapeutics and diagnostics fields and in industrial bioprocessing. Optimized strains, fed-batch and perfusion fermentation technologies, and high-throughput screening are emerging trends used by CDMOs to improve the yields and lower the cost of production. Outsourcing to contract manufacturers is also being driven by the ever-increasing need to use specialty enzymes, hormone analogs, and vaccine antigens. With the move by the pharmaceutical companies to diversified biologic portfolios, the recombinant proteins and enzymes continue to play a part in the ecosystem of fermentation services.

End-User Insights

Large Pharma & Biotech: The large pharma & biotech segment led the market while holding a 42.5% share in 2024, led by their deep biologics pipelines, worldwide manufacturing needs, and strategic offshoring. Pharmaceutical giants are becoming more cooperative with CDMOs to streamline productivity and minimize operational risk and speed time-to-market of biologics, biosimilars, and vaccines. The transition to the flexible and outsourced fermentation capacity enables large players to remain focused on the R&D and commercialization. Furthermore, long-term relations and networks of multi-site production support the leadership of the segment in the world contract fermentation system.

Biotechnology companies/biotechs: The biotechnology companies/biotechs segment is projected to grow at a significant CAGR over the forecast period, holding an 8.4% share in 2024, because of the amplified activity of research and development and creation of therapeutic biologics, enzymes, and microbial products. Start-up biotech firms lack their own fermentation plants and rely on CDMOs to provide process development and manufacturing on a clinical scale as well as regulatory services. The specified outsourcing model is capable of scaling faster and using less capital, alongside accessing innovative technologies, such as single-use bioreactors and AI-driven optimization of bioprocesses.

Vaccine Developers: The vaccine developers market segment has been growing because of the activities of global immunization programs and preparations to deal with pandemics, which have stimulated persistent investment in vaccine R&D and manufacturing. This segment experienced increased cooperation with the CDMOs that provide microbial and mammalian fermentation systems that are specially designed to manufacture antigen and recombinant protein vaccines. Also, governments and international health authorities are increasingly collaborating with CDMOs to guarantee scalable capacity of vaccine manufacturing on a rapid basis, which strengthens the increasing role of this segment in the broader market of contract fermentation services.

Contract Pharmaceutical Fermentation Services MarketRegion Insights

The North America contract pharmaceutical fermentation services market size is estimated at USD 7.34 billion in 2025 and is projected to reach approximately USD 14.72 billion by 2034, with a 8.04% CAGR from 2025 to 2034.

Why Did North America Lead the Global Contract Pharmaceutical Fermentation Services Market in 2024?

North America led the global market with the highest market share of 45.4% in 2024, driven by robust biopharmaceutical innovation, a robust infrastructure, and the existence of large CDMOs with large-scale fermentation. The incentive of the leadership of the region includes the voluminous pipeline of biologics, biosimilars, and cell-based therapies, high rates of investment into R&D, and compliance with the regulations. Strategic Outsourcing of processes can be employed among the big pharma and biotech companies to enable them to have expedited commercialization and efficiency in their operations. Also, demand for the services is further stimulated by high investment in the next-generation therapeutics like monoclonal antibodies, gene therapies, and recombinant proteins.

The U.S. contract pharmaceutical fermentation services market size is calculated at USD 5.43 billion in 2025 and is expected to reach nearly USD 10.97 billion in 2034, accelerating at a strong CAGR of 8.11% between 2025 and 2034.

U.S Contract Pharmaceutical Fermentation Services Market Analysis

The U.S. market is leading the development of the region because American pharmaceutical firms are turning even more to the manufacturability of their products by outsourcing fermentation services that provide a reliable production output and efficiency. A high level of concentration of large CDMOs, biotech companies, and pharmaceutical giants that are using microbial and mammalian systems of biologics, vaccines, as well as enzyme manufacturing in the country. Strong regulatory frameworks, combined with fast paces of automation, single-use technologies, and digitalized systems of bioprocess control, augment the production capacity of the country.

Europe is estimated to achieve the highest CAGR throughout the forecast period with 8.8% market share. The growth of the region is based on growing investments in biopharmaceutical innovation, high compatibility of the region with the requirements of the EMA, and the active use of the newest technologies in fermentation. To boost the growing demand for biologics, vaccines, and biosimilars, European CDMOs are increasing microbial and mammalian cell fermentation capacity. Also, the increasing market is being strengthened by government investment in biotechnology research and development and sustainability-related production projects. The increasing trend of outsourcing by the pharmaceutical companies and the strong clinical research base of Europe are making the region a strategic center of high-value contract fermentation services.

UK Contract Pharmaceutical Fermentation Services Market Trends

The UK contract pharmaceutical fermentation services market is currently experiencing momentum, which is due to the continuous modernization of pharmaceuticals, biotechnology, as well as the introduction of specialty production applications. Advanced contract fermentation systems are increasingly being incorporated in British pharmaceutical and biotech companies to increase efficiency, guarantee compliance with GMP, and conform to internationally accepted quality. The UK boasts of optimization of bioprocesses, automation, and regulatory excellence that enhance its core competence in the fermentation industry in Europe. Also, the continued need for flexible and high-capacity CDMO alliances is being driven by national pharmaceutical programs that focus on manufacturing performance during drug development. This effort towards innovation, compliance, and scalability has still been driving the UK to be a strategic hub of biologics as well as fermentation-based production services.

The Asia Pacific contract pharmaceutical fermentation services market is witnessing sustainable growth due to the growing biopharmaceutical industry of the region, affordable production capacities, and the growing investments in the development of modern fermentation facilities. China, India, Japan, and South Korea are becoming the new centers of outsourcing in the world due to favorable policies by their governments, availability of technical talent and increased biologic drug development, low production costs, and increased therapeutic demand. Automation and optimization of the workflows using AI, as well as the use of single-use bioreactor systems, contribute to the increased efficiency of the operations even more. As global pharma moves to the regionalized supply chain, the Asia Pacific remains a key market in this process of obtaining fermentation services.

- In October 2024, the Prime Minister, Narendra Modi, virtually opened the first active pharmaceutical ingredient (API) fermentation plant in Nalagarh, Himachal Pradesh, which was inaugurated by him. The plant is a significant step towards increasing the self-sufficiency of India through decreased dependency on imported APIs and increased biomanufacturing capability within India.

Japan Contract Pharmaceutical Fermentation Services Market Trends

The Japanese contract pharmaceutical fermentation services market focuses on control of manufacturing quality, regulatory quality, and compatibility with a more developed pharmaceutical infrastructure, which shows that Japan has a high level of technology. The biopharmaceutical and biotechnology applications of high specifications, which have been aided by constant R&D in manufacturing science, drive demand. The Japanese companies emphasize a steady performance improvement, quality of service, and comprehensive documentation of regulations in accordance with the stringent national and international pharmaceutical guidelines. In addition, cell culture system innovation, automation, and data-based process monitoring also increase the reliability and competitiveness of production in Japan.

Contract Pharmaceutical Fermentation Services Market Value Chain

Inputs include microbial strains, cell lines, seed banks, culture media, raw materials, and process chemicals. Proprietary or optimized microbial strains and access to high-quality seed stock materially affect yields and impurity profiles. Suppliers of GMP-grade media components and molecular biology reagents capture value when they supply reproducible, scalable inputs. Early access to well-characterized strains, freedom-to-operate and secure supply agreements reduce technical risk for downstream scale-up.

This midstream stage is the primary value engine. Activities include strain engineering support, bench-scale process development, DoE optimization, scale-up strategy, analytical method development, and tech transfer packages to manufacturing. Success depends on demonstrating robust, reproducible titers, controlled impurity profiles, and scalable process parameters. Firms offering rapid, reliable tech transfer and comprehensive analytical support command premium pricing because they materially shorten time to clinical or commercial batches.

This is the capex-intensive manufacturing layer where value is realized through stable, compliant production at pilot and commercial scales. It covers single-use and stainless steel bioreactors, upstream control systems, utilities, containment for high-potency or microbial agents, and operational excellence in batch or continuous fermentation modes. CDMOs with flexible capacity, multi-modal facilities, and stringent biosafety systems capture higher contract premiums and long-term client relationships.

Downstream processing transforms harvest material into purified API or intermediate. Activities include cell removal, chromatography, ultrafiltration/diafiltration, viral clearance validation for biologics, formulation compatibility testing, and fill-finish readiness. Integration of downstream and fill-finish services reduces cycle time and contamination risk, increasing value capture for full-service CDMOs.

Contract Pharmaceutical Fermentation Services Market Companies

Corporate Information

- Headquarters: Basel, Switzerland

- Year Founded: 1897

- Ownership Type: Publicly Traded (SIX: LONN)

History and Background

Lonza Group AG was founded in 1897 in Gampel, Switzerland, originally as a producer of electricity and calcium carbide. Over the decades, Lonza evolved into one of the world leading contract development and manufacturing organizations (CDMOs) specializing in biopharmaceuticals, cell and gene therapies, and microbial fermentation. The companys transformation from a chemical manufacturer to a biopharmaceutical services leader has positioned it as a critical partner for global pharmaceutical and biotech firms.

In the Contract Pharmaceutical Fermentation Services Market, Lonza is a global frontrunner, offering end-to-end microbial fermentation and bioprocessing solutions for the production of biologics, therapeutic proteins, enzymes, and small molecules. The companys fermentation technologies are designed for scalability, efficiency, and regulatory compliance, supporting clients from early-stage development through large-scale commercial manufacturing.

Key Milestones / Timeline

- 1897: Founded in Switzerland as a chemicals and hydroelectric company

- 1970s: Expanded into microbial fermentation and biotechnology production

- 2006: Acquired Arch Chemicals microbial control business

- 2017: Acquired Capsugel, enhancing integrated biomanufacturing and delivery technologies

- 2023: Expanded microbial manufacturing facility in Visp, Switzerland for large-scale fermentation services

- 2024: Announced investments in next-generation digital fermentation control and automation

Business Overview

Lonza operates as a global CDMO, providing biopharmaceutical companies with custom manufacturing and development services. Within fermentation services, Lonza specializes in bacterial and yeast-based expression systems (E. coli, Pichia pastoris) for the production of active pharmaceutical ingredients (APIs), enzymes, and biologics. The company integrates process optimization, quality assurance, and regulatory support into its full-service model.

Business Segments / Divisions

- Biologics

- Small Molecules

- Cell & Gene Technologies

- Capsules & Health Ingredients

Geographic Presence

Lonza operates manufacturing and R&D facilities in more than 30 countries, including major sites in Switzerland, the United States, the United Kingdom, China, and Singapore.

Key Offerings

- Microbial fermentation for APIs, biologics, and enzymes

- Custom strain development and process optimization

- Scale-up and GMP-compliant commercial fermentation

- End-to-end support from process development to regulatory submission

- Integrated analytical and downstream purification services

Financial Overview

Lonza reports annual revenues of approximately CHF 6.7 billion (around $7.4 billion USD), with its Biologics segment, including fermentation services, representing the companys fastest-growing division.

Key Developments and Strategic Initiatives

April 2023: Expanded Visp, Switzerland fermentation facility to support high-capacity biologics production

September 2023: Partnered with emerging biotech firms for novel enzyme fermentation platforms

May 2024: Introduced AI-driven fermentation monitoring and process optimization systems

January 2025: Launched digital twin technology for predictive process scale-up and control

Partnerships & Collaborations

- Partnerships with major pharmaceutical and biotech companies for fermentation-based drug production

- Collaborations with academic institutions for microbial strain engineering and process intensification

- Strategic alliances with technology providers for bioprocess digitalization and data analytics

Product Launches / Innovations

- AI-enhanced fermentation optimization suite (2024)

- Automated microbial process control system (2025)

- Next-generation bioreactor platform with continuous monitoring capabilities (in development)

Technological Capabilities / R&D Focus

- Core technologies: Microbial fermentation, process intensification, strain engineering, and advanced analytics

- Research Infrastructure: Global R&D centers in Visp (Switzerland) and Portsmouth (U.S.)

- Innovation focus: Sustainable microbial bioprocessing, digital control systems, and high-yield fermentation

Competitive Positioning

- Strengths: Strong global footprint, scalability, and long-term client relationships in the biopharmaceutical sector

- Differentiators: End-to-end fermentation capabilities combined with regulatory and digital process support

SWOT Analysis

- Strengths: Industry leadership, advanced fermentation infrastructure, and extensive regulatory expertise

- Weaknesses: High capital intensity for facility expansions

- Opportunities: Growth in biologics, biosimilars, and enzyme-based therapeutics

- Threats: Competition from emerging Asian CDMOs and pricing pressure in fermentation outsourcing

Recent News and Updates

- May 2024: Lonza announced investment in AI-based fermentation analytics platform

- August 2024: Opened new microbial R&D wing focused on strain evolution and metabolic pathway optimization

- January 2025: Secured multiple long-term microbial manufacturing contracts with global biotech firms

Corporate Information

- Headquarters: Somerset, New Jersey, United States

- Year Founded: 2007 (spun off from Cardinal Health)

- Ownership Type: Publicly Traded (NYSE: CTLT)

History and Background

Catalent, Inc. was established in 2007 as an independent entity following its spin-off from Cardinal Health Pharmaceutical Technologies and Services division. Since then, it has become one of the most prominent global CDMOs, specializing in drug development, delivery technologies, and manufacturing services for small molecules, biologics, and advanced therapeutics.

In the Contract Pharmaceutical Fermentation Services Market, Catalent provides comprehensive microbial fermentation and biologics development services, with expertise in E. coli expression systems, yeast-based platforms, and plasmid DNA manufacturing. Its state-of-the-art microbial development centers enable efficient production of complex biologics, therapeutic enzymes, and vaccine intermediates.

Key Milestones / Timeline

- 2007: Established as a spin-off from Cardinal Health

- 2012: Expanded biologics capabilities through acquisition of Aptuit clinical manufacturing assets

- 2019: Opened new biologics manufacturing site in Madison, Wisconsin

- 2021: Expanded microbial manufacturing capacity at its Bloomington, Indiana facility

- 2024: Launched continuous microbial fermentation technology for faster biologics production

Business Overview

Catalent operates as a global CDMO offering solutions from early development through commercial-scale production. Its microbial fermentation services are part of its Biologics and Advanced Delivery Technologies segment, which supports production of enzymes, therapeutic proteins, vaccines, and nucleic acids. Catalent focuses on flexible manufacturing, scalability, and integration of single-use and continuous fermentation systems.

Business Segments / Divisions

- Biologics and Advanced Delivery Technologies

- Oral & Specialty Drug Delivery

- Gene Therapy and Cell Therapy

- Clinical Supply Services

Geographic Presence

Catalent operates over 50 facilities across North America, Europe, and Asia, with key fermentation centers in Wisconsin (U.S.), Anagni (Italy), and Limoges (France).

Key Offerings

- Microbial fermentation for enzyme and protein production

- Custom process development and scale-up under GMP conditions

- Plasmid DNA and mRNA precursor fermentation for gene therapy applications

- Downstream purification, fill-finish, and analytical testing

- Continuous fermentation for reduced production timelines

Financial Overview

Catalent reports annual revenues of approximately $4.3 billion USD, with its Biologics division, encompassing fermentation services, representing a significant portion of total revenue.

Key Developments and Strategic Initiatives

- April 2023: Expanded microbial development lab in Madison, Wisconsin for enzyme production

- October 2023: Implemented digital process analytics for microbial fermentation control

- May 2024: Introduced continuous fermentation platform for high-yield microbial processing

- January 2025: Announced capacity expansion in Europe for vaccine-related microbial manufacturing

Partnerships & Collaborations

- Partnerships with biotech firms for microbial expression and plasmid production

- Collaborations with academic institutions for strain optimization and bioprocess engineering

- Alliances with technology firms for bioprocess automation and digital monitoring

Product Launches / Innovations

- Continuous Microbial Fermentation Platform (2024)

- AI-assisted process development toolkit (2025)

- Integrated single-use bioreactor fermentation suite (2025)

Technological Capabilities / R&D Focus

- Core technologies: Microbial fermentation, expression optimization, plasmid DNA production, and bioprocess automation

- Research Infrastructure: Advanced fermentation centers in Madison, Wisconsin, and Limoges, France

- Innovation focus: Continuous manufacturing, digital process optimization, and hybrid bioreactor design

Competitive Positioning

- Strengths: Broad service portfolio, strong biologics expertise, and global GMP manufacturing network

- Differentiators: Integration of fermentation services with gene therapy and biologics manufacturing capabilities

SWOT Analysis

- Strengths: Global reach, diverse client base, and advanced microbial fermentation technologies

- Weaknesses: High dependency on biologics sector performance

- Opportunities: Growth in demand for microbial production of biologics and nucleic acids

- Threats: Regulatory delays and competitive pressure from emerging CDMOs

Recent News and Updates

- March 2024: Catalent expanded microbial GMP capacity in the U.S. and Europe

- July 2024: Launched digital monitoring suite for real-time fermentation performance analytics

- January 2025: Partnered with global vaccine manufacturer for large-scale microbial protein production

Other Contract Pharmaceutical Fermentation Services Market Companies

- Catalent, Inc.: Catalent provides advanced biologics and microbial fermentation services supported by end-to-end capabilities including process development, fill-finish, and regulatory support. The companys fermentation platforms are designed to ensure high yield, scalability, and compliance with global quality standards across therapeutic protein and enzyme production.

- Thermo Fisher Scientific (Patheon / Pharma Services): Thermo Fisher offers scalable microbial fermentation and biologics manufacturing solutions under its Patheon division. Its expertise spans from process development to commercial-scale production, supported by global regulatory compliance and analytical excellence to ensure reproducibility and quality in biopharmaceutical manufacturing.

- WuXi Biologics: WuXi Biologics operates a comprehensive biologics manufacturing network specializing in microbial and mammalian cell fermentation. The companys single-use bioreactor and continuous fermentation technologies support rapid, high-quality, and flexible biologics production, catering to global biopharma clients.

- Samsung Biologics: Samsung Biologics provides large-scale microbial and mammalian fermentation capabilities within its state-of-the-art facilities. The company focuses on speed, capacity, and global scalability, offering process development, clinical, and commercial biologics production services with full regulatory support.

- Boehringer Ingelheim (BioXcellence): Boehringer Ingelheim BioXcellence division offers contract manufacturing of biologics through advanced microbial and mammalian fermentation technologies. Its expertise covers the entire value chain, from strain development to large-scale production and fill-finish, emphasizing quality and regulatory compliance.

- Fujifilm Diosynth Biotechnologies: Fujifilm Diosynth Biotechnologies provides microbial fermentation and biologics contract manufacturing services for biopharmaceutical clients. The company global facilities are equipped for both batch and continuous fermentation, supporting vaccines, enzymes, and protein therapeutics production.

- Novasep: Novasep delivers integrated bioprocessing services combining microbial fermentation, purification, and downstream processing. The company strength lies in producing complex biomolecules, including enzymes and biopharmaceutical intermediates, through advanced chromatographic and separation technologies.

- AGC Biologics: AGC Biologics offers microbial fermentation services ranging from process development to GMP commercial production. The company facilities specialize in therapeutic proteins, plasmid DNA, and viral vectors, providing flexible and scalable solutions tailored to client requirements.

- Biocon Biologics: Biocon Biologics provides microbial fermentation-based manufacturing for biosimilars, enzymes, and biopharmaceutical intermediates. With strong expertise in process optimization and global regulatory compliance, Biocon supports cost-effective and large-scale bioproduction services.

- Rentschler Biopharma SE: Rentschler Biopharma delivers microbial and mammalian fermentation services focusing on therapeutic proteins and biopharmaceuticals. The company provides comprehensive CDMO solutions from cell line development to commercial manufacturing under GMP-compliant conditions.

- KBI Biopharma (Cytiva ecosystem): KBI Biopharma, now part of Cytiva, specializes in microbial fermentation and biopharmaceutical contract manufacturing. Its services include process development, analytical support, and clinical production, with a focus on precision, scalability, and quality assurance.

- Syngene International Ltd.: Syngene International provides microbial fermentation and biomanufacturing services as part of its integrated biologics contract research and manufacturing offerings. The company supports upstream and downstream process development for biologics and biosimilar production.

- Evonik Industries (BioProcess Division): Evoniks BioProcess Division provides contract fermentation services focused on producing amino acids, peptides, and biopolymers. The company combines microbial engineering expertise with large-scale industrial bioprocessing capabilities for both pharmaceutical and specialty applications.

- Merck KGaA (MilliporeSigma / BioReliance): Merck KGaA, through its BioReliance and MilliporeSigma divisions, provides end-to-end fermentation and biologics production services. Its capabilities include microbial strain development, bioprocess optimization, and analytical validation, serving the needs of global pharmaceutical and biotechnology clients.

Recent Developments

- In December 2024, Lonza decided to leave the capsules and health ingredients business to enhance its core Contract Development and Manufacturing Organization (CDMO) services. The relocation will enable it to increase its high-value biologics and advanced therapeutic modalities fermentation capacity.

- In December 2024, A joint venture of Zydus Lifescience and Perfect Day, named Sterling Biotech Limited, started building a precision fermentation-based dairy protein production plant in Bharuch, Gujarat. The new plant will be operational in Q1 2026, and it will also increase the biomanufacturing capacity of India to produce sustainable proteins.

- In October 2023, MycoTechnology introduced Fermentation-as-a-Service (FaaS) to assist startups and companies in accessing Indiefermentation infrastructure and expertise on a scale. The project assists firms in making bioproducts, including proteins, enzymes, and probiotics, to overcome the challenges of capacity and scale-up.

Contract Pharmaceutical Fermentation Services Market Segments Covered in the Report

By Service Type

- Process Development & Optimization

- Clinical-Scale Manufacturing

- Commercial GMP Manufacturing

- Downstream Purification & Fill-Finish

- Analytical & QC Services

By Scale/Capacity

- Lab/Pilot Scale(<200 L)

- Clinical Scale(200 to 2,000 L)

- Large-Scale Commercial(>2,000 L)

By Organism/Host System

- Microbial (E. coli, Yeast)

- Yeast

- Mammalian Cells (CHO, HEK)

- Viral Vector/Cell Therapy Platforms

By Product Type

- Monoclonal Antibodies(mAbs)

- Recombinant Proteins & Enzymes

- Vaccines

- Cell & Gene Therapy(AAV, Lentivirus)

- Biosimilars

By End-User

- Large Pharmaceutical Companies

- Biotechnology Companies/Biotechs

- Vaccine Developers

- Academic Spinouts/SMEs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client