List of Contents

What is the Extended Migraine Prophylactics Market Size?

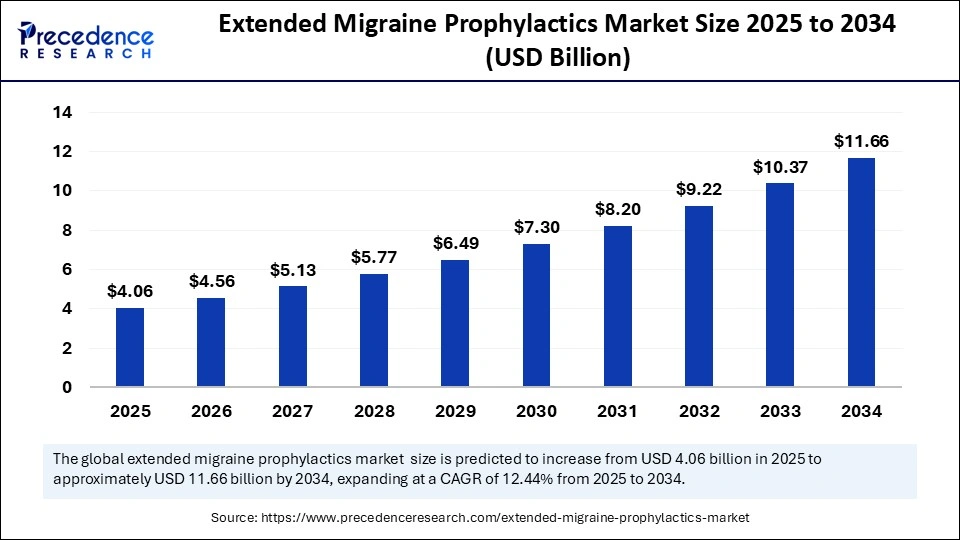

The global extended migraine prophylactics market size is calculated at USD 4.06 billion in 2025 and is predicted to increase from USD 4.56 billion in 2026 to approximately USD 11.66 billion by 2034, expanding at a CAGR of 12.44% from 2025 to 2034. This market is growing due to the rising prevalence of chronic migraines and increasing adoption of long-acting preventive therapies that offer improved patient compliance and sustained symptom relief.

Market Highlights

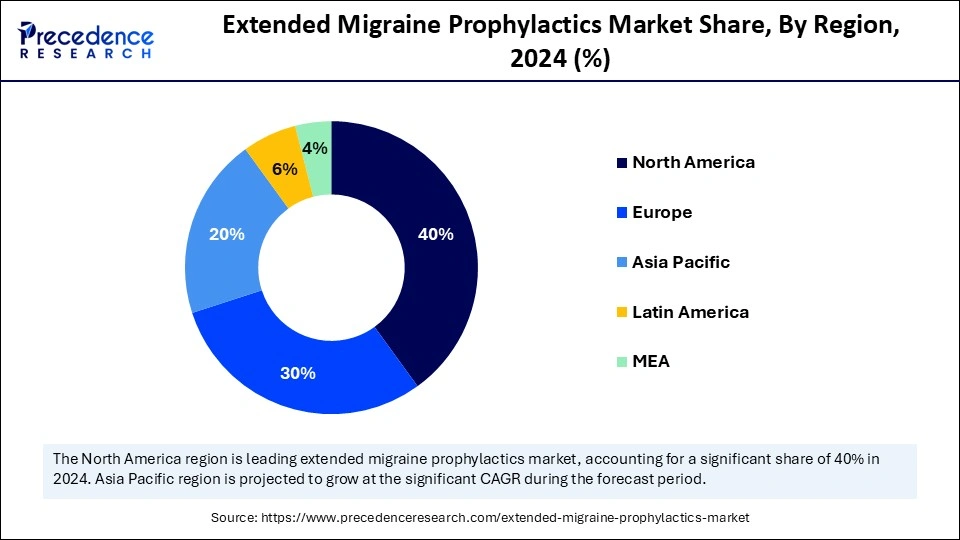

- North America dominated the market, holding the largest market share of 40% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 30% between 2025 and 2034.

- By product type, the oral tablets & capsules segment contributed the major market share of 55% in 2024.

- By product type, the injectables/biologics segment is expected to grow at a remarkable CAGR of 20% between 2025 and 2034.

- By mechanism of action, the calcitonin gene-related peptide (CGRP) inhibitor segment captured the highest market share of 40% in 2024.

- By mechanism of action, the beta-blockers segment is growing at a strong CAGR of 25% between 2025 and 2034.

- By route of administration, the oral segment accounted for the largest share of 65% in 2024.

- By route of administration, the injectable segment is expanding at a strong CAGR of 20% between 2025 and 2034.

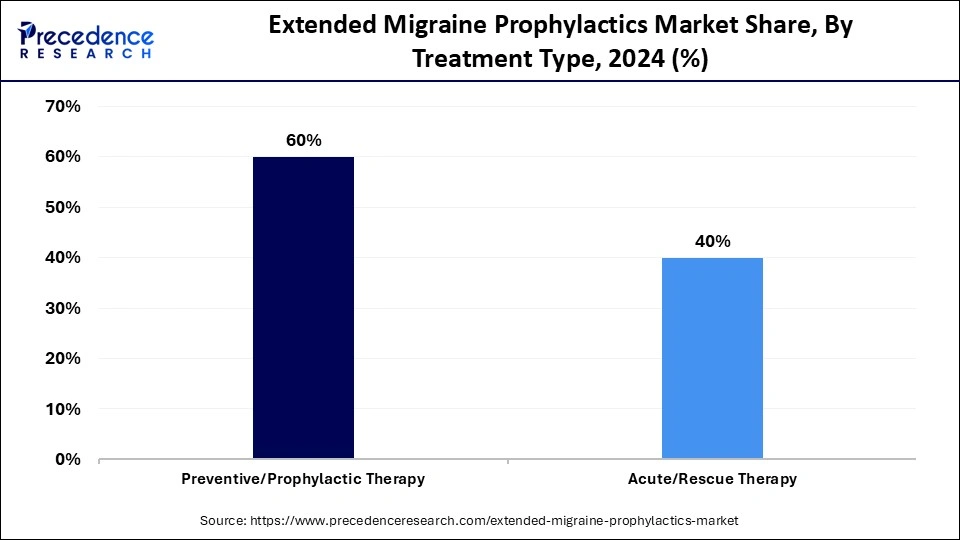

- By treatment type, the preventive/prophylactic therapy segment held the major market share of 60% in 2024.

- By treatment type, the acute/rescue therapy segment is growing at a solid CAGR between 2025 and 2034.

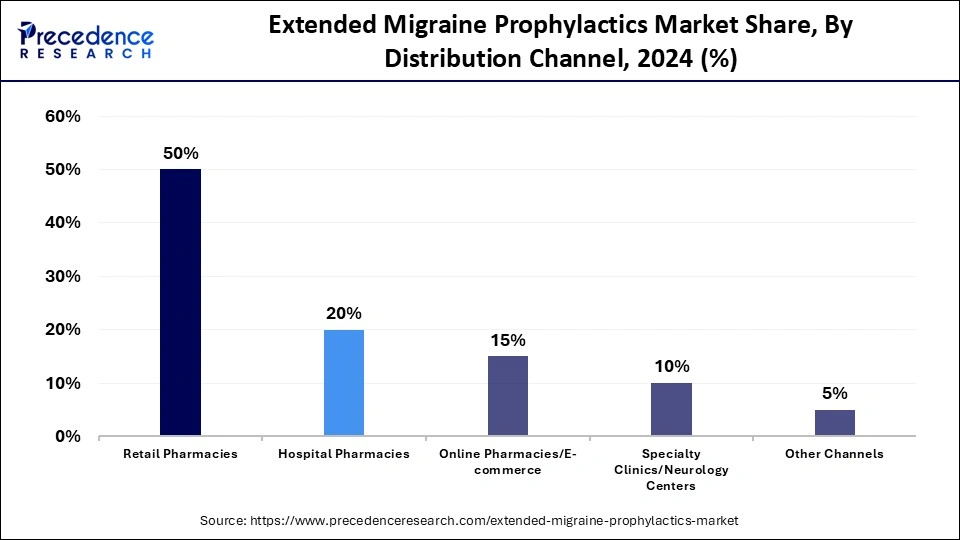

- By distribution channel, the retail pharmacies segment generated the highest market share of 66.50% in 2024.

- By distribution channel, the online pharmacies/e-commerce segment is expanding at a strong CAGR of 15% between 2025 and 2034.

What is Extended Migraine Prophylactics?

The extended migraine prophylactics market is witnessing strong growth, driven by the growing number of migraine sufferers and the growing use of long-acting preventive medications that enhance treatment adherence. In addition, new CGRP-based treatments growing approvals across age groups and increased awareness of migraine management are driving up market demand.

Case Study: In August 2025, Teva Pharmaceuticals received FDA approval expanding AJOVY use for pediatric migraine prevention.

Extended Migraine Prophylactics Market Outlook

The extended migraine prophylactic market is growing fast, driven by an increase in long-acting preventive medication use and migraine cases. CGRP inhibitor developments and improved patient compliance are driving industry growth.

To lessen their influence on the environment, businesses are implementing digital healthcare tools, cutting waste, and embracing eco-friendly production and packaging. These programs support international green healthcare objectives.

With an emphasis on AI-based diagnostics, digital therapeutics, and innovative drug delivery methods, a robust startup ecosystem is developing. Innovative migraine prevention solutions are being introduced by the market by new players with funding support and partnerships.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.06 Billion |

| Market Size in 2026 | USD 4.56 Billion |

| Market Size by 2034 | USD 11.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mechanism of Action, Route of Administration, Treatment Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biopharma's Next Horizon: Cell and Gene Therapies Transforming Chronic Disease Management

| Technological Shift | Impact on the Extended Prophylactics Market |

| CGRP-Targeted Therapies | Revolutionary targeted treatment: Specific drugs block key pain molecules (CGRP) for highly effective monthly/quarterly dosing. |

| Advanced Drug Delivery | Enhanced convenience & adherence: Self-administered auto-injectors and ODTs simplify treatment routines. |

| Neuromodulation Devices | Drug-free alternatives: Wearable non-invasive stimulators provide a safe option for prevention. |

| AI and Machine Learning | Personalized medicine: Predicts best treatments, minimizing trial and e,rror and accelerating drug discovery. |

| Digital Therapeutics | Empowered self-management: Apps and platforms for remote monitoring, trigger tracking, and CBT support. |

| Next-Gen Biosensors | Proactive prevention: Wearables continuously monitor biomarkers to forecast attacks in real-time. |

Extended Migraine Prophylactics Market Segmental Insights

Product Type Insights

Oral Tablets & Capsules: The oral tablets & capsules segment dominates the market, with a 55% share, driven by affordability, accessibility, and ease of use across both retail and hospital pharmacies. Due to their reliable outcomes and ease of self-administration, patients favor these dosage forms. Additionally, their market position is being strengthened by ongoing advancements in formulation technology and the introduction of extended-release formulations. The segment is the cornerstone of migraine prophylaxis due to its proven clinical results and dependability.

Injectables / Biologics: The injectables/biologics segment is the fastest-growing in the extended migraine prophylactics industry, with a 20% CAGR, as long-acting CGRP monoclonal antibodies are becoming increasingly popular among patients seeking prolonged migraine prevention. By providing long-lasting relief with fewer doses, these treatments increase patient compliance. Strong R&D pipelines and growing neurologist adoption because of demonstrated clinical efficacy benefit the segment. Its rapid growth is being fueled by increased awareness and technological developments in biologic formulations.

Nasal Sprays: Nasal sprays are becoming an important part of the extended migraine prophylaxis market because they offer rapid, effective drug delivery via the nasal route. This method allows medication to reach the bloodstream faster, providing faster relief and improving patient adherence. Nasal sprays are particularly useful for patients who experience nausea or difficulty swallowing during migraine attacks. The development of long-acting nasal formulations is also helping extend the duration of preventive effects. As research continues, nasal sprays are expected to play a larger role in both acute and preventive migraine management.

Mechanism of Action Insights

Beta-blockers: Beta-blockers segment is dominating the extended migraine prophylactics market by holding a share of 25% due to their widespread clinical use, cost-effectiveness, and consistent therapeutic response in migraine management. These drugs are commonly prescribed as first-line therapies and have well-established safety profiles. Their broad availability, physician preference, and affordability continue to maintain their leadership. Furthermore, ongoing clinical studies are enhancing their role in combined treatment regimens.

Calcitonin Gene-Related Peptide (CGRP) Inhibitors: Calcitonia gene-related peptide (CGRP) inhibitors segment is the fastest growing in the market, with a CAGR of 40% credited to long-lasting effectiveness, low adverse effects, and high specificity. By specifically addressing the root neuropeptide pathway, these medications mark a new era in precision migraine treatment. Adoption is further fueled by increased accessibility, patient satisfaction, and approvals through healthcare reimbursement programs. Their market presence is also being expanded through international partnerships and next-generation formulations.

Antiepileptics / Neuromodulators: Antiepileptics and neuromodulators are key drug classes in the market due to their proven ability to stabilize nerve activity and prevent migraine onset. These medications work by regulating abnormal electrical impulses in the brain, reducing the frequency and severity of migraine episodes. Commonly used options, such as topiramate and valproate, have shown effectiveness in chronic migraine management. The growing preference for these drugs is supported by their long-term efficacy and suitability for patients who do not respond well to traditional therapies. As research advances, newer neuromodulators with fewer side effects are expected to further enhance migraine prevention outcomes.

Route of Administration Insights

Oral: Oral segment is dominating the extended migraine prophylactics market by holding a share of 65% motivated by the accessibility of oral formulations, ease of administration, and high patient compliance. Because they are affordable, non-invasive, and appropriate for long-term migraine treatment, tablets and capsules continue to be the most popular. This dominance is further reinforced by the expanding development of CGRP-targeted oral therapies and extended-release oral formulations. For patients managing chronic conditions, oral delivery also provides convenient and flexible dosing.

Injectable: Injectable segment is the fastest growing in the extended migraine prophylactics market, with a CAGR of 20% because monoclonal antibody-based migraine treatments and long-acting biologics are becoming more and more popular. These formulations considerably lower migraine frequency and improve patient outcomes due to their quick onset and extended duration of action. They are a preferred option for patients who are resistant to oral medications because of their capacity to provide targeted therapy with few systemic side effects. Additionally, improvements in auto-injectors and pre-filled syringes have made patient self-administration safer and easier.

Nasal: Nasal therapies are gaining attention in the extended migraine prophylactics market because they provide a fast and convenient method for drug delivery. The nasal route allows medication to bypass the digestive system and enter the bloodstream quickly, offering rapid relief and improved treatment efficiency. This approach is especially beneficial for patients who experience nausea or vomiting during migraine episodes, as it ensures consistent absorption even when oral medications are difficult to take. Ongoing research is also exploring long-acting nasal formulations that can extend preventive benefits and reduce the frequency of migraine attacks.

Treatment Type Insights

Preventive / Prophylactic Therapy: This segment is dominating the extended migraine prophylactics industry by holding a share of 60% due to the increasing emphasis on long-term migraine management and reducing attack recurrence. Preventive treatments aim to lessen migraine frequency, intensity, and duration, significantly improving quality of life. Pharmaceutical companies are investing in new classes of preventive drugs, such as CGRP inhibitors, beta-blockers, and antidepressants, that target migraine root causes. In addition, early diagnosis and lifestyle integration programs are boosting demand for preventive care solutions.

Acute / Rescue Therapy: The segment is the fastest growing in the extended migraine prophylactics sector, with a CAGR of 40% driven by increased knowledge of faster-acting medication formulations and options for instant migraine relief. During migraine attacks, these treatments offer patients immediate pain and neurological symptom relief, giving them more control over their care. The development of sophisticated nasal sprays, injectables, and dissolvable tablets has completely changed the way that acute migraines are treated. Furthermore, e-pharmacies and telemedicine are becoming more widely used, which is improving patient access to immediate migraine relief.

Distribution Channel Insights

Retail Pharmacies: This segment dominates the extended migraine prophylaxis market with a 50% share, driven by extensive availability, reliable pharmacist advice, and robust distribution systems. For migraine drugs, both prescription and over-the-counter, these stores are the main source, especially in urban and semi-urban areas. Their market dominance is further reinforced by the growing collaboration between pharmaceutical companies and regional pharmacy chains, as well as the availability of a diverse product line. Additionally, patients with chronic migraines now find it easier to buy from retail stores thanks to increased insurance coverage and refill programs.

Online Pharmacies / E-commerce: This segment is the fastest growing in the extended migraine prophylactics sector, with a CAGR of 15% due to rising digital health adoption and home delivery convenience. Consumers increasingly prefer online platforms for subscription-based refills, discounts, and doorstep delivery of migraine treatments. The shift toward digital healthcare ecosystems and mobile-based prescription services is accelerating this growth trend. Moreover, global telehealth platforms and e-pharmacy partnerships are broadening access to specialized migraine medications in remote regions.

Extended Migraine Prophylactics MarketRegional Insights

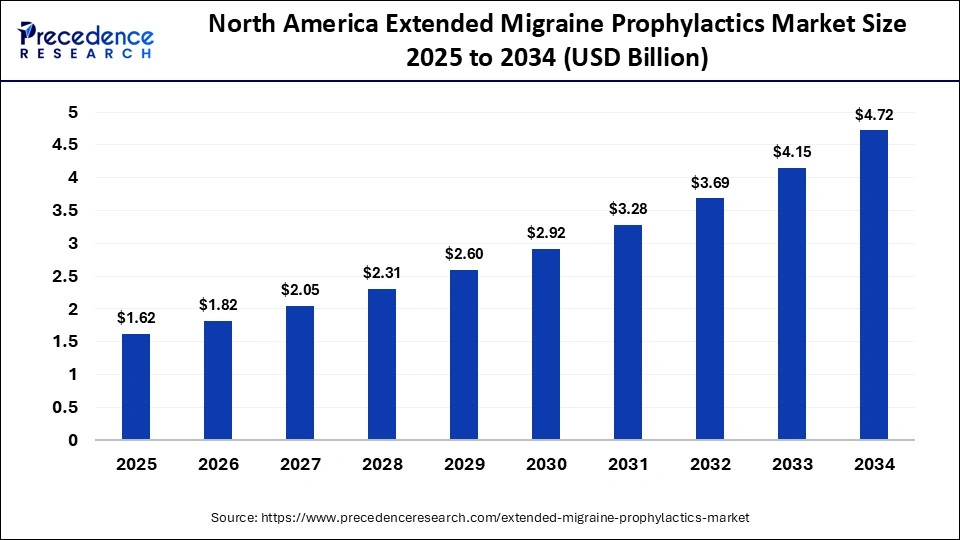

The North America extended migraine prophylactics market size is estimated at USD 1.62 billion in 2025 and is projected to reach approximately USD 4.72 billion by 2034, with a 12.61% CAGR from 2025 to 2034.

Why Did North America Dominate the Extended Migraine Prophylactics Market in 2024?

North America dominated the market in 2024 by holding a share of 40% supported by advanced healthcare infrastructure, high treatment awareness, and the strong presence of major pharmaceutical companies. The region market growth is driven by the rapid adoption of preventive biologics, favorable reimbursement frameworks, and active clinical research programs. Technological integration in healthcare, including telemedicine and AI-based migraine monitoring tools, is further enhancing patient outcomes and accessibility.

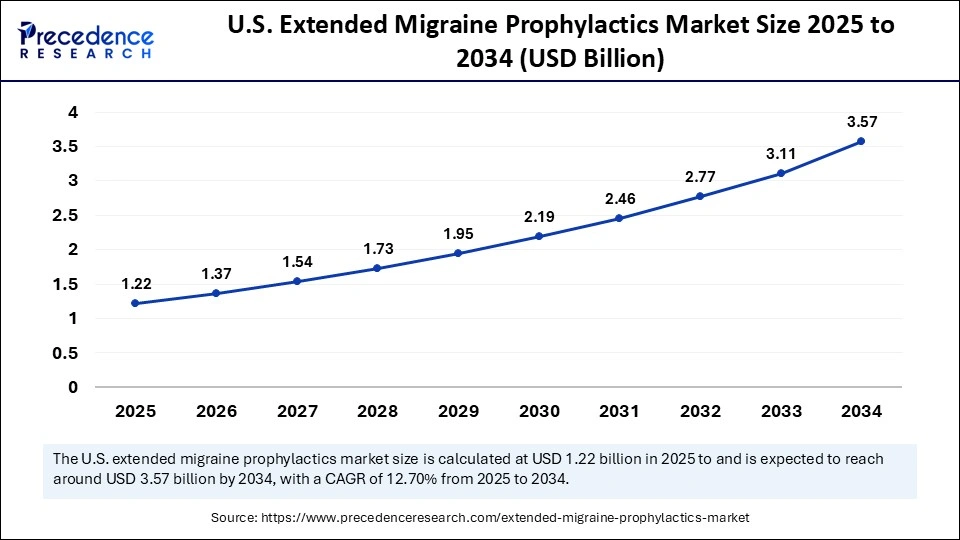

The U.S. extended migraine prophylactics market size is calculated at USD 1.22 billion in 2025 and is expected to reach nearly USD 3.57 billion in 2034, accelerating at a strong CAGR of 12.70% between 2025 and 2034.

How is the U.S. Transforming the Extended Migraine Prophylactics Market Trends?

The U.S. is at the forefront of the extended migraine prophylactics market, propelled by high patient awareness, quick innovation, and the presence of worldwide pharmaceutical leaders. Growing investments in biologics, CGRP inhibitors, and digital migraine management tools, as well as the nation robust regulatory support from the FDA, are driving market adoption. Rising telehealth use and AI-based monitoring systems are transforming migraine prevention into a more personalized and data-driven approach. Additionally, expanding insurance coverage and increasing consumer preference for long-acting preventive drugs are accelerating growth across the nation.

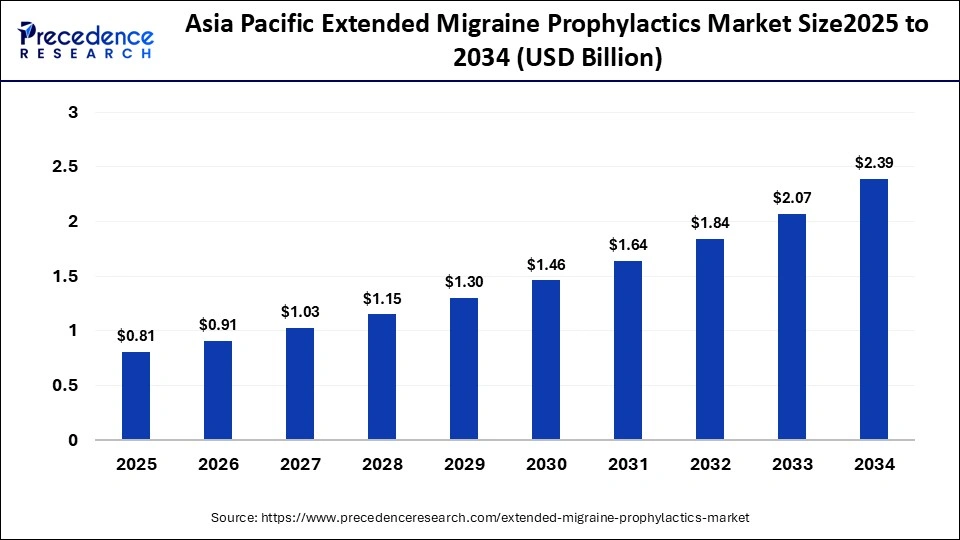

The Asia Pacific extended migraine prophylactics market size is expected to be worth USD 2.39 billion by 2034, increasing from USD 0.81 billion by 2025, growing at a CAGR of 12.75% from 2025 to 2034.

Why Is the Asia Pacific the Fastest Growing in the Extended Migraine Prophylactics Market?

Asia Pacific is the fastest-growing region in the extended migraine prophylactics market, with a CAGR of 30% because of increased healthcare spending and growing awareness of migraine management. The growing number of affordable medications and the growth of online pharmacies are opening migraine treatments to a wider range of people. Market expansion in emerging economies is also being fueled by government initiatives that encourage the adoption of preventive treatments and early diagnosis.

India Extended Migraine Prophylaxis Market Trends

India extended migraine prophylactics market is growing rapidly, encouraged by increased awareness, easier access to preventive treatments, and reasonably priced medications. Accessibility is increasing in urban and semi-urban areas due to the move toward generic and affordable CGRP inhibitors. The governments increased emphasis on neurological health and the growing collaborations between Indian pharmaceutical companies and international innovators are driving market growth. Additionally, patients nationwide are managing migraine conditions more effectively thanks to the growth of teleconsultation platforms and e-pharmacy services.

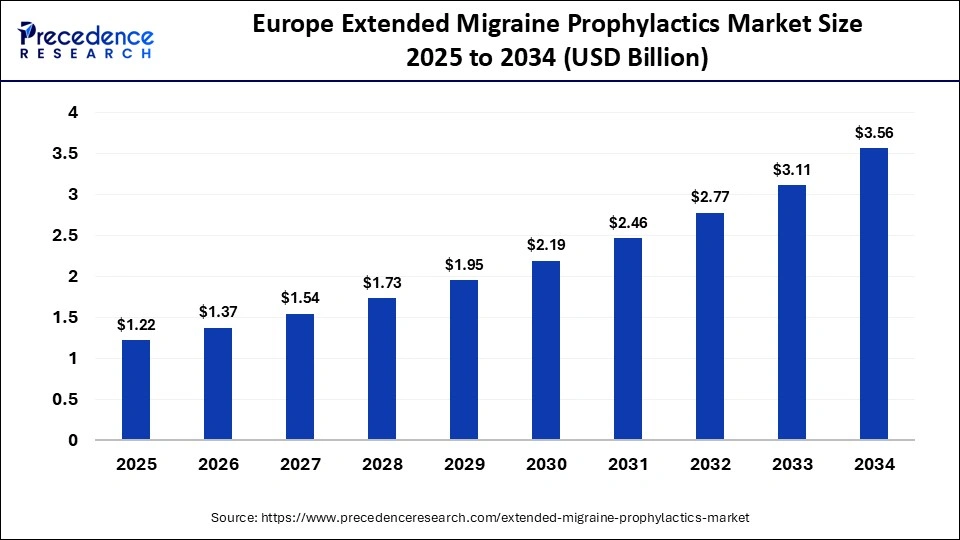

The Europe extended migraine prophylactics market size has grown strongly in recent years. It will grow from USD 2 billion in 2025 to USD 5 billion in 2034, expanding at a compound annual growth rate (CAGR) of 12.67% between 2025 and 2034.

Europe is experiencing strong expansion in the extended migraine prophylactics market due to increasing awareness of migraine as a chronic neurological disorder, rising diagnosis rates, and broader access to advanced preventive treatments. The region has seen accelerated adoption of long-acting CGRP monoclonal antibodies and gepants, supported by favorable reimbursement policies in countries such as Germany, the U.K., France, and the Nordics. Furthermore, Europes well-established healthcare infrastructure, a large patient population suffering from episodic and chronic migraines, and ongoing clinical research into next-generation preventive therapies continue to boost market growth.

Germany Trends

- Rising Adoption of CGRP Monoclonal Antibodies: Germany has seen rapid uptake of long-acting CGRP mAbs such as erenumab, fremanezumab, and galcanezumab due to strong physician acceptance and broad insurance reimbursement.

- High Prevalence of Chronic Migraine Patients: A growing population diagnosed with chronic and high-frequency episodic migraines is increasing long-term demand for extended prophylactic therapies.

- Strong Role of Neurology Clinics and Headache Centers: Germanys large network of specializedneurology and headache centers promotes early diagnosis and treatment optimization, encouraging the use of advanced, long-term preventive drugs.

- Increased Use of Digital Therapeutics and e-Health Tools: Digital migraine tracking apps and tele-neurology platforms are supporting personalized treatment plans and improving patient adherence to extended prophylactic regimens.

- Growing Pharmaceutical Investment in R&D and Local Trials: Major pharma companies continue to partner with German research institutions to test new long-acting prophylactic agents, including next-generation CGRP inhibitors and neuromodulation-based therapies.

The Middle East has shown notable growth in the extended migraine prophylactics market due to rising awareness of neurological health and increasing access to specialized treatments. Lifestyle changes, urban stress, and higher diagnostic rates have led to more people seeking preventive solutions rather than relying only on acute pain relief. Governments in the region are investing heavily in healthcare modernization and encouraging the adoption of advanced therapies, including biologics and long-acting injectables. Partnerships between global pharmaceutical firms and regional healthcare providers have also improved the availability of innovative migraine prevention drugs. With an expanding middle-class population and a growing focus on quality of life, the regions demand for long-term migraine management continues to strengthen.

UAE Extended Migraine Prophylaxis Market

The UAE is emerging as one of the key markets for extended migraine prophylaxis in the Middle East, supported by its advanced healthcare infrastructure and strong commitment to innovation in medical care. The growing awareness of migraine as a serious neurological condition has led to early diagnosis and increased use of preventive treatments across hospitals and specialty clinics. The governments focus on personalized medicine and digital health is further helping healthcare professionals identify and manage chronic migraine cases more effectively. In addition, collaborations between international drug manufacturers and UAE-based healthcare institutions are improving access to new biologic and injectable therapies. As a result, the UAE is positioning itself as a regional leader in migraine prevention, offering patients better outcomes and long-term relief.

Extended Migraine Prophylactics Market Value Chain

This upstream stage focuses on the discovery and preclinical development of migraine prophylactic therapies, including CGRP (calcitonin gene-related peptide) monoclonal antibodies, serotonin receptor modulators, ion channel modulators, and neurostimulation device components. Key inputs include biological reagents, cell lines, chemical intermediates, peptides, and polymer excipients, sourced from specialized biotech suppliers and chemical manufacturers.

Value creation arises through innovative target identification, molecular design, and preclinical validation. Firms with deep expertise in neurobiology, pain signaling, and peptide chemistry capture strategic advantage at this stage. Biotech firms and academic research institutions often lead this phase, later partnering with or being acquired by major pharmaceutical companies to advance candidates into clinical trials.

Upstream suppliers capture moderate value through high-purity reagents, contract research services, and early IP licensing, though margins remain limited compared to midstream value capture. Barriers include stringent GMP requirements for biologic materials, reproducibility of biological assays, and long R&D cycles.

This is the most capital- and IP-intensive stage of the value chain. It involves Phase I to III clinical trials, large-scale manufacturing, formulation optimization, and regulatory submission. Manufacturers may develop injectable biologics (CGRP antagonists, eptinezumab, galcanezumab, fremanezumab), oral small molecules (gepants, ditans), or extended-release delivery systems that sustain therapeutic activity for weeks or months.

Contract Development and Manufacturing Organizations (CDMOs) play a major role in scaling up biologics and sterile formulations, ensuring compliance with cGMP and regional regulatory standards (FDA, EMA, PMDA). Biotech innovators or pharma sponsors capture the highest value through patented molecules, biologic delivery technologies, and successful clinical outcomes.

Extended Migraine Prophylactics Market Companies

Corporate Information

- Headquarters: North Chicago, Illinois, United States

- Year Founded: 2013 (spun off from Abbott Laboratories)

- Ownership Type: Publicly Traded (NYSE: ABBV)

History and Background

AbbVie Inc. was established in 2013 following its spin-off from Abbott Laboratories, with a mission to focus on advanced biopharmaceutical innovation. Since its inception, AbbVie has become one of the worlds largest pharmaceutical companies, known for its strong portfolio in immunology, neuroscience, oncology, and virology.

In the Extended Migraine Prophylactics Market, AbbVie is a global leader, particularly through its CGRP (calcitonin gene-related peptide) antagonist therapies, notably BOTOX (onabotulinumtoxinA) and QULIPTA (atogepant). These products represent cornerstone therapies for preventive migraine treatment, addressing both chronic and episodic migraine conditions. AbbVies commitment to advancing migraine prophylaxis has strengthened its position as a front-runner in neurological therapeutics.

Key Milestones / Timeline

- 2013: Established as an independent biopharmaceutical company after Abbott spin-off

- 2017: Acquired rights to BOTOX through the acquisition of Allergan plc

- 2021: Launched QULIPTA (atogepant) for preventive treatment of episodic migraine

- 2023: QULIPTA expanded indication for chronic migraine prevention

- 2024: Began clinical development of next-generation CGRP antagonists for long-term migraine management

Business Overview

AbbVie operates as a research-driven biopharmaceutical company, emphasizing neurological and immunological disorders. Within the migraine prophylactics market, AbbVie therapies target both neuromuscular and CGRP-mediated migraine pathways, offering multiple mechanisms for sustained migraine prevention. The company migraine portfolio combines injectable biologics and oral therapies, giving clinicians flexible options for individualized patient management.

Business Segments / Divisions

- Immunology

- Neuroscience

- Oncology

- Virology and General Medicine

Geographic Presence

AbbVie operates in more than 75 countries, with manufacturing and R&D centers in the United States, Germany, and Ireland.

Key Offerings

- BOTOX (onabotulinumtoxinA)-FDA-approved for chronic migraine prevention since 2010

- QULIPTA (atogepant)-Oral CGRP receptor antagonist for episodic and chronic migraine prevention

- UBRELVY (ubrogepant)-Acute migraine treatment complementing AbbVie prophylactic portfolio

- Pipeline CGRP antagonists and novel formulations for long-acting migraine prevention

Financial Overview

AbbVie reports annual revenues exceeding $54 billion USD, with its neuroscience division, driven by migraine therapies, contributing a steadily increasing share.

Key Developments and Strategic Initiatives

- April 2023: Expanded QULIPTA approval for chronic migraine prophylaxis

- September 2023: Published long-term efficacy data for BOTOX in chronic migraine management

- May 2024: Announced new oral CGRP antagonist in development with extended dosing duration

- January 2025: Launched real-world evidence program assessing long-term patient adherence for QULIPTA

Partnerships & Collaborations

- Collaborations with neurology clinics and academic research centers for migraine pathophysiology studies

- Partnerships with digital health companies to support migraine tracking and patient engagement platforms

- Alliances with patient advocacy groups to expand access and education in migraine care

Product Launches / Innovations

- QULIPTA (2021)

- QULIPTA chronic migraine indication expansion (2023)

- Long-acting CGRP antagonist (Phase II trials in 2024)

Technological Capabilities / R&D Focus

- Core technologies: CGRP receptor inhibition, neurotoxin delivery systems, and neuromodulation research

- Research Infrastructure: Global neuroscience research centers in Illinois, Massachusetts, and Germany

- Innovation focus: Long-term migraine prevention, personalized dosing schedules, and improved tolerability

Competitive Positioning

- Strengths: Broad migraine therapy portfolio, proven long-term safety profile, and global brand strength

- Differentiators: Dual approach using neuromuscular and CGRP-targeted prophylactic treatments

SWOT Analysis

- Strengths: Established leadership in migraine prevention, diverse treatment portfolio

- Weaknesses: Patent expiry risk for BOTOX in certain markets

- Opportunities: Expansion of CGRP antagonists and potential combination therapies

- Threats: Competitive pressure from Amgen, Lilly, and other emerging CGRP-focused firms

Recent News and Updates

- March 2024: AbbVie reported strong QULIPTA growth driven by expanded chronic migraine indication

- July 2024: Announced AI-based migraine tracking collaboration with wearable technology developers

- January 2025: Initiated trials for sustained-release CGRP antagonist for once-monthly prophylaxis

Corporate Information

- Headquarters: Thousand Oaks, California, United States

- Year Founded: 1980

- Ownership Type: Publicly Traded (NASDAQ: AMGN)

History and Background

Amgen Inc., founded in 1980, is one of the world leading biotechnology companies, specializing in the discovery, development, and manufacture of innovative human therapeutics. Built on cutting-edge molecular biology research, Amgen portfolio spans oncology, inflammation, cardiovascular disease, and neuroscience.

In the Extended Migraine Prophylactics Market, Amgen is a key innovator through its pioneering development of CGRP-targeted monoclonal antibody therapies, particularly Aimovig (erenumab-aooe), the world first FDA-approved CGRP receptor antagonist for migraine prevention. Aimovig revolutionized migraine prophylaxis by offering a long-acting, self-administered injection that significantly reduces migraine frequency and severity.

Key Milestones / Timeline

- 1980: Founded in California as Applied Molecular Genetics (Amgen)

- 2018: FDA approval of Aimovig (erenumab-aooe), first-in-class CGRP receptor inhibitor for migraine prevention

- 2020: Expanded migraine research collaborations for CGRP pathway innovation

- 2023: Published long-term data confirming sustained efficacy and safety of Aimovig over five years

- 2024: Advanced development of next-generation monoclonal antibody for refractory migraine prevention

Business Overview

Amgen focuses on biotechnology-based therapeutics targeting diseases with high unmet needs. In migraine prophylaxis, the companys monoclonal antibody therapy Aimovig represents a milestone in CGRP-targeted neuromodulation, enabling monthly or quarterly preventive treatment. Amgen approach emphasizes long-acting, patient-friendly therapies supported by strong clinical data and post-market surveillance.

Business Segments / Divisions

- Oncology

- Cardiovascular and Neuroscience

- Inflammation

- Biosimilars and Rare Diseases

Geographic Presence

Amgen operates in more than 100 countries with major production and research facilities in the United States, Ireland, and Singapore.

Key Offerings

- Aimovig (erenumab-aooe) Monoclonal antibody targeting the CGRP receptor for migraine prevention

- Pipeline monoclonal antibodies for refractory and chronic migraine

- Digital adherence support systems for migraine patients

Financial Overview

Amgen reports annual revenues exceeding $28 billion USD, with strong contributions from neuroscience and specialty biologics, including Aimovig

Key Developments and Strategic Initiatives

- May 2023: Published real-world data demonstrating Aimovig sustained reduction in migraine frequency over five years

- October 2023: Expanded access programs to improve patient affordability and adherence

- June 2024: Initiated Phase II trial for next-generation CGRP mAb with extended half-life

- January 2025: Announced AI-driven patient monitoring initiative for chronic migraine treatment optimization

Partnerships & Collaborations

- Co-development partnership with Novartis for Aimovig commercialization

- Collaborations with digital health startups for patient adherence tracking

- Alliances with healthcare providers for migraine outcome benchmarking studies

Product Launches / Innovations

- Aimovig (2018)

- Next-generation CGRP monoclonal antibody (in development, 2024)

- AI-based migraine patient monitoring tool (2025)

Technological Capabilities / R&D Focus

- Core technologies: Monoclonal antibody design, protein engineering, and receptor-ligand modulation

- Research Infrastructure: Global biotechnology R&D centers in California and Massachusetts

- Innovation focus: Enhanced antibody half-life, improved administration convenience, and personalized migraine treatment algorithms

Competitive Positioning

- Strengths: First-mover advantage in CGRP-targeted prophylaxis, robust safety profile, and global market presence

- Differentiators: Long-term real-world efficacy data and strong biopharmaceutical manufacturing capabilities

SWOT Analysis

- Strengths: Strong scientific foundation, proven efficacy of Aimovig, and durable treatment outcomes

- Weaknesses: Dependence on a single flagship migraine biologic for this segment

- Opportunities: Expansion into combination therapies and next-gen CGRP innovations

- Threats: Competitive biologics from AbbVie and Eli Lilly in the CGRP space

Recent News and Updates

- April 2024: Amgen announced the development of a new mAb with a biannual dosing interval

- August 2024: Released long-term data reaffirming Aimovigs efficacy in chronic migraine prevention

- January 2025: Reported strategic collaboration with Novartis to co-develop extended-release CGRP migraine therapies

Other Players in the Market

- Eli LillyEli Lilly is a leading research-based pharmaceutical company that develops biologics and small-molecule therapies for neurological disorders, including migraine prevention. Its product Emgality (galcanezumab) is a calcitonin gene-related peptide (CGRP) monoclonal antibody approved for migraine prophylaxis and cluster headache management, positioning Lilly as a major player in the preventive migraine market.

- Novartis: Novartis offers Aimovig (erenumab), one of the first CGRP receptor antagonists for migraine prevention, co-developed with Amgen. The company leverages advanced R&D and digital health tools to expand its neuroscience portfolio, focusing on improving treatment adherence and outcomes in chronic migraine patients.

- Teva Pharmaceuticals : Teva provides Ajovy (fremanezumab), a long-acting monoclonal antibody targeting CGRP for preventive migraine treatment. Its focus on dosing flexibility and accessibility, combined with its global distribution network, makes Teva a key competitor in migraine prophylaxis.

- Novo Nordisk: Novo Nordisk is expanding its chronic disease expertise into neurology through partnerships and research in neurovascular and metabolic links to migraine. The company long-term focus on hormonal and neurobiological pathways positions it for future innovation in migraine management.

- Pfizer: Pfizer develops and markets therapeutics targeting neurological and pain-related disorders. Following its acquisition of Biohaven Pharmaceuticals, Pfizer gained access to rimegepant (Nurtec ODT) and zavegepant, expanding its presence in both acute and preventive migraine therapies.

- Johnson & Johnson: Johnson & Johnson, through its Janssen Pharmaceuticals division, conducts research in neuroinflammation and pain modulation. Its innovation in biologics and neuroscience is shaping next-generation treatments that may extend to migraine prevention and chronic headache management.

- UCB: UCB specializes in neurological and immunological diseases, focusing on monoclonal antibody and peptide-based therapeutics. The companys expanding neuroscience pipeline includes candidates targeting central sensitization and pain pathways relevant to migraine prophylaxis.

- Merck & Co.: Merck has a history of innovation in pain and neurology, including early migraine research. Its ongoing work in neurobiology and anti-inflammatory therapeutics continues to support the development of advanced migraine prevention solutions.

- Allergan (an AbbVie company): Allergan, now part of AbbVie, remains a major player in migraine prophylaxis with Botox (onabotulinumtoxinA), approved for chronic migraine prevention. AbbVie acquisition of Allergan has strengthened its portfolio with both biologic and small-molecule options targeting multiple migraine pathways.

- Biohaven Pharmaceuticals: Biohaven, acquired by Pfizer, pioneered CGRP receptor antagonists for acute and preventive migraine treatment, including Nurtec ODT (rimegepant) and zavegepant. The company innovative dual-action therapies and patient-centric models have set new standards in migraine care.

- Lundbeck: Lundbeck focuses on neurological and psychiatric diseases, offering migraine prophylactic drugs such as Vyepti (eptinezumab), a CGRP monoclonal antibody administered intravenously. Its neuroscience expertise and patient-oriented innovation make it a major contributor to the migraine prevention landscape.

- Avanir Pharmaceuticals: Avanir, a subsidiary of Otsuka, develops treatments for central nervous system disorders, including migraine and pain syndromes. The company research in neuroinflammation and neurotransmitter regulation supports its pipeline of potential migraine prophylactic therapies.

- Chugai Pharmaceutical: Chugai, part of the Roche Group, develops antibody-based therapeutics and targeted biologics that extend into pain and neurological disorder management. Its focus on molecularly targeted drugs aligns with emerging strategies in migraine prevention.

- Kyowa Kirin: Kyowa Kirin develops and commercializes novel biologics for neurological and immunological disorders. The companys pipeline includes innovative small molecules and antibodies with potential applications in chronic migraine prophylaxis and pain modulation.

- Amneal Pharmaceuticals: Amneal produces generic and specialty pharmaceuticals, including neurology-focused formulations. The company is expanding its presence in migraine and central nervous system therapies, providing affordable access to preventive and acute treatments.

- Dr. Reddy's Laboratories: Dr. Reddy manufactures generic formulations for neurological and pain disorders, contributing to cost-effective migraine management. The company R&D in biosimilars and specialty injectables supports broader access to migraine prophylactic therapies.

- Sun Pharma: Sun Pharmaceutical Industries develops and markets specialty therapeutics across neurology and chronic pain management. The company is investing in migraine-related R&D and distribution partnerships to expand its role in preventive and symptomatic treatment markets.

Recent Developments

- In April 2025, Click Therapeutics Inc. announced FDA marketing authorization for CT-132, the first prescription digital therapeutic for the preventive treatment of episodic migraine in adults.(Source: https://www.clicktherapeutics.com)

- In September 2025, H. Lundbeck A/S showcased new clinical data highlighting the long-term preventive effectiveness of Eptinezumab in patients with severe migraine. (Source: https://www.prnewswire.com)

Extended Migraine Prophylactics MarketSegments Covered in the Report

By Product Type

- Oral Tablets & Capsules

- Immediate-release tablets

- Extended-release tablets

- Capsules

- Injectables/Biologics

- Pre-filled syringes

- Vials/ampoules

- Nasal Sprays

- Metered-dose sprays

- Liquid formulations

- Transdermal Patches

- Oral Liquids/Solutions

- Combination Formulations

- Other Dosage Forms

By Mechanism of Action

- Calcitonin Gene-Related Peptide (CGRP) Inhibitors

- Beta-blockers

- Antiepileptics/Neuromodulators

- Tricyclic Antidepressants (TCAs)

- Serotonin Antagonists/SSRIs

- Other Mechanisms

By Route of Administration

- Oral

- Injectable

- Nasal

- Transdermal

- Other Routes

By Treatment Type

- Preventive/Prophylactic Therapy

- Acute/Rescue Therapy

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies/E-commerce

- Specialty Clinics/Neurology Centers

- Other Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client