List of Contents

What is the Bioinformatics Services Market Size?

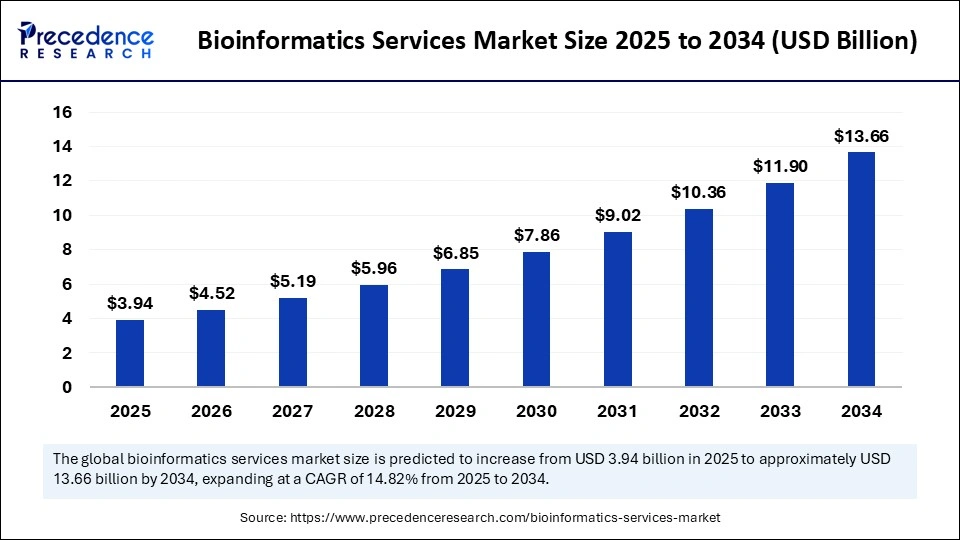

The global bioinformatics services market size is calculated at USD 3.94 billion in 2025 and is predicted to increase from USD 4.52 billion in 2026 to approximately USD 13.66 billion by 2034, expanding at a CAGR of 14.82% from 2025 to 2034. The bioinformatics services market is driven by increased funding and investment, growing adoption of cloud-based solutions, and the integration of artificial intelligence and machine learning for biological data processing and analysis.

Market Highlights

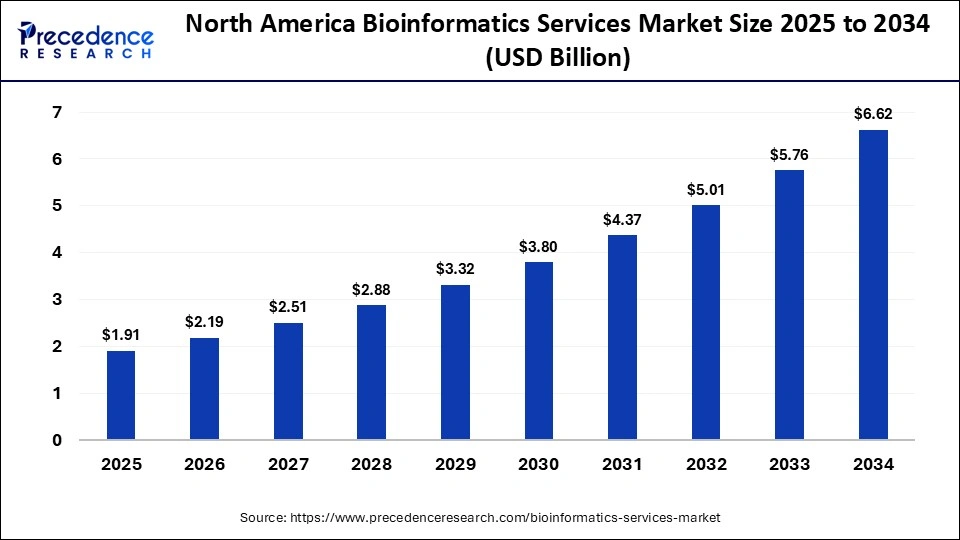

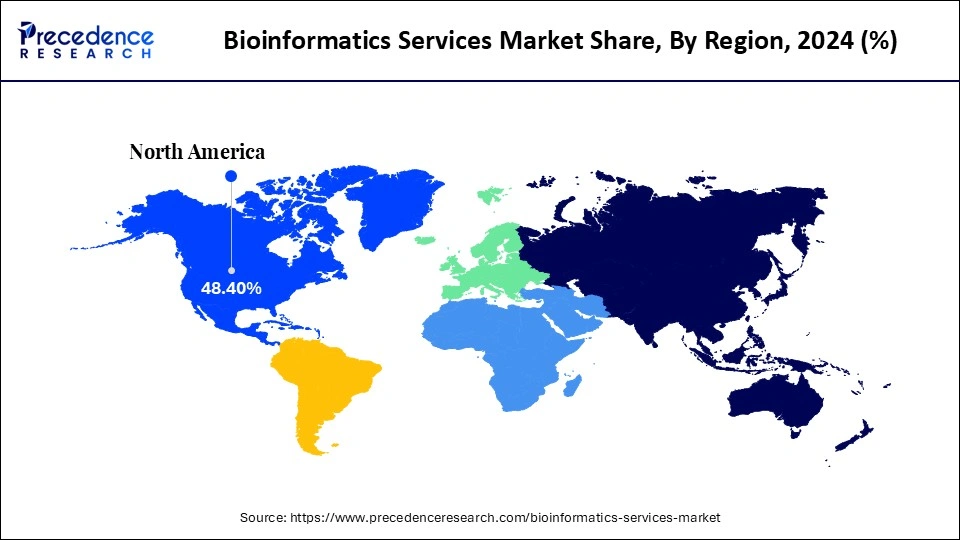

- North America led the bioinformatics services market with around 48.4% of the market share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the sequencing services segment captured the 47.3% of market share in 2024.

- By type, the data analysis services segment is expected to grow at a 11.6% CAGR from 2025 and 2034.

- By application, the genomics segment held a major market share of 56.4% in 2024.

- By application, the proteomics segment is growing at a CAGR of 12.1% from 2025 to 2034.

- By deployment mode, the cloud-based segment held major market share of 61.4% in 2024.

- By deployment mode, the hybrid model segment is growing at a strong CAGR of 11.5% between 2025 and 2034.

- By end-user, the pharmaceutical & biotechnology companies segment captured more than 48.8% of market share in 2024.

- By end-user, the hospitals & clinical laboratories segment is growing at a strong CAGR of 11.7% from 2025 to 2034.

Factors Contributing to Market Growth of Bioinformatics Services

The bioinformatics services market is experiencing robust growth, driven by increased demand for data-driven research in genomics, proteomics, and precision medicine. Bioinformatics services use computational tools and software to process, analyze, and interpret biological data, thereby facilitating advancements in drug discovery, molecular diagnostics, and personalized medicine.

They are widely utilized by pharmaceutical companies, biotechnology firms, academic institutions, and healthcare organizations. Market growth is driven by advancements in next-generation sequencing (NGS), AI-driven analytics, personalized medicine, and rising demand for outsourced bioinformatics expertise and cloud-based computational infrastructure.

AI is Changing the Future of the Bioinformatics Services Industry

AI is transforming bioinformatics services through faster, smarter analysis of complex biological data. Innovations in deep learning and neural networks are improving accuracy in genome sequencing, protein structure predictions, and the integration of multi-omics data. An increasing number of AI models are predicting disease susceptibility and facilitating drug discovery and personalized medicine through data-driven insights.

In April 2025, Signios Biosciences, a science-first biotechnology company at the leader of multiomics and AI-powered bioinformatics, announced the Launch of an AI-driven bioinformatics and advanced multiomics platform to power the future of precision medicine and drug discovery.

Bioinformatics services use machine learning to automate previously tedious or repetitive tasks, extracting useful or meaningful biological patterns that were difficult or impossible to identify. Educational initiatives and industry collaborations are helping to broaden the scope for the use of AI for molecular diagnostics and genetic studies, thus narrowing the gap between data science and life sciences. As AI systems grow, bioinformatics services will play an increasingly important role in developing personalized and predictive healthcare innovations.

Bioinformatics Services Market Outlook

The rise in the amount of genomic and omics data is creating a need for dedicated computing services, with the National Human Genome Research Institute estimating that genomic research may produce 40 exabytes of data in the near future. The scale of the data implies opportunities and a demand for related services from bioinformatics companies, including data storage, analysis, interpretation, and cloud-related infrastructure.

Governments and international research organizations are providing funding within the bioinformatics space for infrastructure and training to increase taxpayer-funded access: for example, the National Institute of Health (United States) is matching grants with the purpose of investing in bioinformatics and computational biology to create a capacity-building program globally.

Key motivators include rapidly expanding amounts of biological/clinical data that need special services, the human genome sequence generates about 200 GB of data, simply as an example, increased emphasis on precision medicine and targeted therapies, which naturally require bioinformatics for biomarker identification and patient-specific analytics, and cross-market applications for agriculture and environmental genomics that broaden the addressing market outside human health.

Significant headwinds exist: even though this space is growing quickly, many institutions still under-invest in analytics/infrastructure or develop in-house capabilities, which minimize downsizing opportunities. Further, the technical difficulty and expense of building pipelines that are scalable and reproducible, for example, exa/peta-bytes of data, complicate pipelines and require data handling and sophisticated infrastructure setup.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.94 Billion |

| Market Size in 2026 | USD 4.52 Billion |

| Market Size by 2034 | USD 13.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Deployment Mode, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Bioinformatics Services Market Segment Insights

Type Insights

Sequencing Services comprise the largest segment of the bioinformatics services market, with a 47.3% share, driven by their widespread use in large-scale genomic initiatives, clinical diagnostics, and personalized medicine. Rapid advancements in next-generation sequencing technologies, combined with lower costs, have increased the adoption of sequencing services across the healthcare and research sectors and the demand for reliable, affordable sequenced genomes.

The fastest-growing sector is data analysis services, driven by demand for better computational tools to analyze and interpret vast amounts of biological data. The increasing use of artificial intelligence and machine learning in bioinformatics has enabled deeper analysis of genetic patterns, disease prediction, and precision therapeutics, and growth in clinical and research settings.

Drug discovery informatics plays a crucial role in enhancing the efficiency and accuracy of pharmaceutical research. By integrating advanced computational techniques, such as molecular modeling, compound screening, and target validation, the process of identifying and optimizing potential drug candidates is streamlined. Through predictive modeling and virtual screening, drug discovery informatics significantly reduces both the time and cost associated with traditional experimental methods. This data-driven approach not only accelerates R&D productivity but also improves decision-making, enabling researchers to identify the most promising therapeutic compounds with higher precision and confidence.

Application Insights

Genomics is the leading segment in the bioinformatics services market, with 56.4% market share, driven by increasing genomic sequencing activities and initiatives in personalized medicine and population-based genetics. The integration of computational and artificial intelligence tools for genome interpretation and disease prediction, coupled with advancements in precision medicine and clinical research, has reinforced the role of genomics.

Proteomics is the fastest-growing segment due to increased emphasis on protein characterization, biomarker discovery, and understanding disease mechanisms. The increasing incorporation of bioinformatics into proteome mapping and structural proteomic analysis supports drug discovery, enabling researchers to identify targets and explore protein-based strategies to treat disease across many therapeutic areas.

The use of metabolomics applications is rapidly expanding as researchers employ metabolomic approaches to study metabolic pathways that inform disease biomarkers and drug responses. The incorporation of bioinformatics into metabolomics applications supports the analysis of complex datasets, identifies metabolites of interest, and generates information on molecular mechanisms. Bioinformatics in metabolomics presents significant opportunities for clinical diagnostics, nutrition-related research, and precision medicine research, development, and commercialization.

Deployment Mode Insights

The cloud-based solutions lead the bioinformatics services market with a 61.4% share, as they are needed to manage large genomic and proteomic datasets due to their scalability, cost-effectiveness, and ease of data sharing across global research networks. Integration of secure cloud infrastructure also allows for faster computation, collaboration, and real-time analytics in bioinformatics research.

The fastest-growing deployment segment is the Hybrid Model, driven by balanced control and flexible features. The hybrid model combines the security of an on-premises system with the scalability of the cloud, enabling the organization to best manage sensitive biological data while still accessing and using advanced computational resources to analyze and model it.

On-Premise deployment remains relevant, as it enables organizations and institutions to comply with strict data governance and regulatory requirements. Specifically, it also allows organizations to increase control over their data, whether for storage or for the security of their infrastructure. As pharmaceutical and government research facilities use confidential genomic and clinical datasets, on-premises management enables researchers to control access to their sensitive data and other computational resources.

End User Insights

Pharmaceutical & biotechnology companies lead the bioinformatics services market with a 48.8% market share. Their significant use of bioinformatics in drug development, molecular modeling, and biomarker discovery helps achieve faster research and development outcomes. The integration of genomic and proteomic data accelerates the development of personalized drugs, clinical trials, and precision therapeutics, strengthening their position in this market segment.

The hospitals & clinical laboratories segment is the fastest-expanding as the use of bioinformatics in diagnostic genomics and molecular testing expands. The growing focus on personalized medicine, early disease detection, and clinical data interpretation is driving hospitals to adopt bioinformatics tools to improve patient outcomes and treatment efficiency.

Academic and research institutes continue to be significant contributors to growth in the fast-expanding bioinformatics services market segment, developing innovative algorithms, conducting genomic and proteomic research, and training computational biologists and bioinformaticians. Academic institutions and research institutes develop bioinformatics capabilities in conjunction with industry participants for both translational and fundamental research.

Bioinformatics Services Market Regional Insights

The North America bioinformatics services market size is estimated at USD 1.91 billion in 2025 and is projected to reach approximately USD 6.62 billion by 2034, with a 14.84% CAGR from 2025 to 2034.

Why North America Dominates the Bioinformatics Services Market?

North America's advantage is structural: an abundance of concentrated home bases for pharmaceuticals and biotech, top-tier academic institutions, cloud and AI infrastructure, and significant public funding & research programs that deliver continuous, high-volume, high-quality omics data.

This constellation creates durable demand for outsourcing analytics and data analysis, data platform services, and regulatory data pipelines that are relevant and scalable to drug development, diagnostics, and logging for personalized medicine pilot efforts. The investment focuses on data science and standards, and on secure, managed data sharing, which has further professionalized commercial bioinformatics setup services, reducing the effort required for vendors to provide clinical and translational workflows.

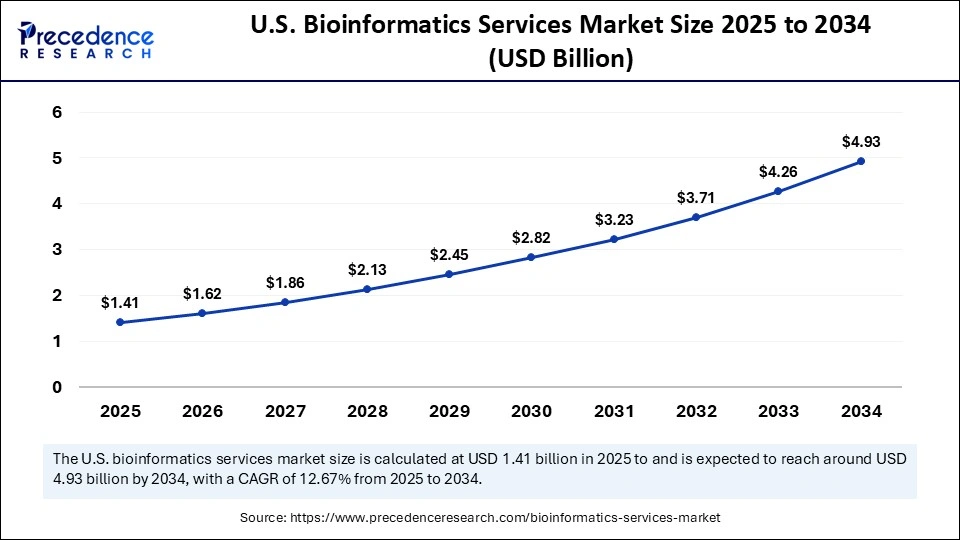

The U.S. bioinformatics services market size is calculated at USD 1.41 billion in 2025 and is expected to reach nearly USD 4.93 billion in 2034, accelerating at a strong CAGR of 12.67% between 2025 and 2034.

U.S. Bioinformatics Services Market Trend

The U.S. leads the North American region due to federal and other patron initiatives, NIH strategic plans, large cohort initiatives, and direct public funding to support data science, interoperability, and cloud-native applications, all of which drive commercial bioinformatics. Industry research and development, organize sequencing and multi-omics spending in the U.S., creating consistent high-value/high-margin work for service providers. This ecosystem fosters rapid adoption of early-stage methods and enables a well-developed regulatory pathway, accelerating the process of commercial contracts for clinical analytics and the interpretation of regulatory-grade reporting.

The fastest growth in Asia Pacific is driven by simultaneous capacity building, sequencing labs, bio-clouds, national genomic initiatives, and aggressive local service players that offer lower-cost, high-volume sequencing and analytics. Governments and large private sequencing companies are expanding the capacity to meet domestic research and clinical testing needs. International partnerships are providing clinical workflows and regulatory know-how from the West, which is facilitating rapid scaling of end-to-end services (sample to insight) while also increasing the outsourcing of sequencing, informatics, and analytics to Asia from regional pharmaceutical, CRO, and hospital customers that require local data governance and/or cost savings.

China Bioinformatics Services Market Trends

China is leading the way with large sequencing and genomics-integrated companies that combine high-throughput laboratory infrastructure with in-house bioinformatics stacks, enabling faster turnaround times for population-scale projects and partnerships with commercial enterprises. Many of these organizations invest in automation, local reference panels, and artificial intelligence tools to reduce the cost per sample and time-to-result, which is highly attractive for regional drug R&D, agricultural genomics, and public health genomics. China's corporates and research-based institutions are also partnering internationally, helping validate new methods for use in China and creating new export opportunities for data analytics and platform licensing.

Europe's Vorteile lie in the ability to deliver national centralised programs, combined with strong public health sequencing pipelines and multiparty research consortia that have recurring needs for advanced analytics and standards-based interpretation. Investment in clinical genomics and coordinated data governance structures makes Europe an attractive location for clinical validation projects and translational research services. European buyers tend to be risk-averse and value regulatory-compliant vendors that can implement data protection policy-compliant pipelines using explainable analytics, creating a premium for service providers who can meet the strict governance and interoperability requirements.

United Kingdom Bioinformatics Services Market Trend

The UK's Genomics England programs and the NHS Genomic Medicine Service have acted as a catalyst: large sequencing projects and routine WGS services for rare disease and oncology create quality repeatable workloads for bioinformatics vendors and spinouts to act on. The public-facing milestones of their work (number of genomes completed), targeted funding for equity and access, and longitudinal datasets with the same data points critical for training and validating the commercial diagnostic algorithms inform the research and health delivery sectors.

The bioinformatics services sector in the Middle East is growing rapidly due to increasing investments in genomics, precision medicine, and biotechnology research. Governments across the region, particularly in Saudi Arabia and the United Arab Emirates, are funding large-scale genome projects and digital health initiatives to advance personalized healthcare. The expansion of research infrastructure, growing collaborations with global biotech firms, and rising demand for data-driven diagnostics are further accelerating market development.

Saudi Arabia Bioinformatics Services Sector Market

Saudi Arabia's bioinformatics market is emerging as one of the most robust in the Middle East, driven by strong government initiatives such as the Saudi Human Genome Program and Vision 2030. Significant investments in genomics research, healthcare digitalization, and local data infrastructure are fueling rapid growth. Collaborations with international biotechnology and informatics firms are further strengthening the country's position as a regional leader in precision medicine and bioinformatics innovation.

Overview of Global Government-Funded Bioinformatics Institutes

| Institute Name | Location | Affiliation/Funding Body | Primary Services & Key Databases/Tools |

| National Center for Biotechnology Information (NCBI) | Bethesda, Maryland, USA | U.S. National Institutes of Health (NIH) | GenBank, PubMed, RefSeq, dbSNP, BLAST |

| European Bioinformatics Institute (EMBL-EBI) | Hinxton, Cambridge, UK | European Molecular Biology Laboratory (EMBL) | Ensembl, UniProt, ArrayExpress, InterPro |

| DNA Data Bank of Japan (DDBJ) | Mishima, Shizuoka, Japan | National Institute of Genetics (NIG), MEXT (Japan) | DDBJ Sequence Database, BioProject, BioSample; supports genome analysis and INSDC data sharing. |

| Swiss Institute of Bioinformatics (SIB) | Lausanne, Switzerland | Swiss Government, Universities & Research Grants | ExPASy, SWISS-MODEL, STRING, UniProt; focuses on proteomics and computational biology. |

| China National Center for Bioinformation (CNCB) / National Genomics Data Center (NGDC) | Beijing, China | Chinese Academy of Sciences (CAS) | GSA, Genome Warehouse, BioProject China; national genomics data and bioinformatics standards. |

| DOE Joint Genome Institute (JGI) | Walnut Creek, California, USA | U.S. Department of Energy (DOE) | Environmental and energy genomics, metagenomics, and microbial diversity databases. |

| National Centre for Cell Science (NCCS) | Pune, Maharashtra, India | Department of Biotechnology (DBT), Govt. of India | Cell line repository, molecular biology research, and access to global databases like UniProt, Pfam, and PDB. |

| Institute of Genomics and Integrative Biology (IGIB) | Delhi, India | Council of Scientific & Industrial Research (CSIR), Govt. of India | Genomic medicine, structural biology, computational genomics, and disease gene discovery. |

| National Institute of Biomedical Genomics (NIBMG) | Kalyani, West Bengal, India | Department of Biotechnology (DBT), Govt. of India | Biomedical genomics, population genetics, and data analysis for health and disease. |

| ELIXIR (European Research Infrastructure for Bioinformatics) | Distributed across Europe | European Commission and Member States | The integration of national bioinformatics centers supports data sharing and standards across Europe. |

| Genome Canada | Ottawa, Ontario, Canada | Government of Canada | National genomics coordination, data commons, and project funding for bioinformatics. |

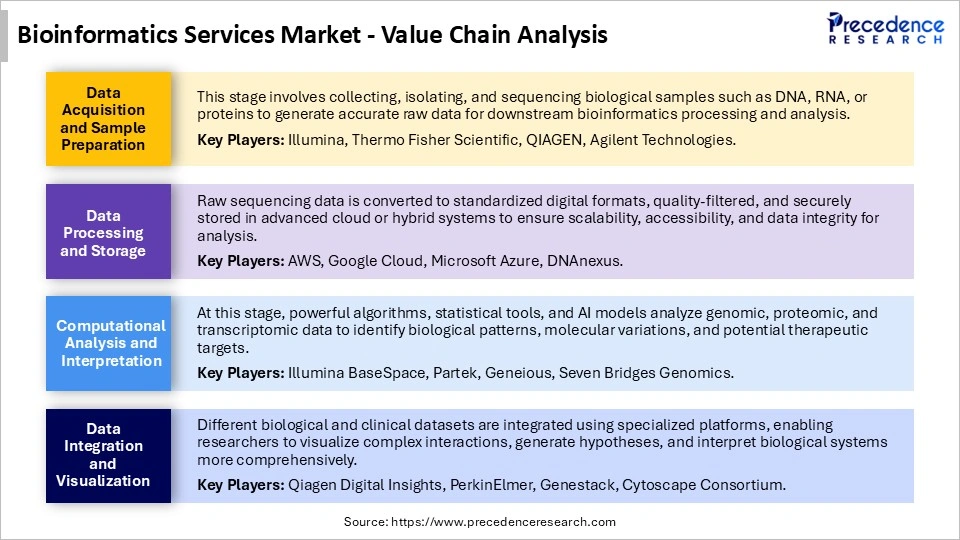

Bioinformatics Services Market Value Chain

Bioinformatics Services Market Companies

Corporate Information

- Headquarters: San Diego, California, United States

- Year Founded: 1998

- Ownership Type: Publicly Traded (NASDAQ: ILMN)

History and Background

Illumina, Inc. was founded in 1998 and has become a global leader in genomic sequencing, array-based technologies, and bioinformatics solutions. The company revolutionized genetic research by making next-generation sequencing (NGS) scalable, cost-effective, and accessible to research and clinical laboratories worldwide.

In the Bioinformatics Services Market, Illumina operates as a Tier-1 provider, offering a suite of cloud-based bioinformatics platforms that integrate data management, analysis, and interpretation for NGS workflows. Its flagship product, the BaseSpace Sequence Hub, enables researchers to perform genomic data analysis without the need for dedicated computational infrastructure, streamlining bioinformatics for laboratories across various domains, including oncology, infectious diseases, and genetic diagnostics.

Key Milestones / Timeline

- 1998: Founded in San Diego to develop high-throughput genotyping technology

- 2006: Acquired Solexa, gaining proprietary next-generation sequencing technology

- 2012: Launched BaseSpace Sequence Hub, a cloud-based genomics data analysis platform

- 2021: Introduced Illumina Connected Analytics for enterprise-level genomic data management

- 2024: Expanded bioinformatics services to include integrated AI and machine learning-based variant interpretation

Business Overview

Illumina provides comprehensive genomic and bioinformatics solutions that cover the full NGS workflow, from sequencing to data analysis and interpretation. Its bioinformatics services are designed to simplify the computational burden on laboratories while ensuring scalability, compliance, and interoperability across research and clinical environments.

Business Segments / Divisions

- Sequencing Platforms

- Microarray Solutions

- Bioinformatics and Cloud Services

- Consumables and Reagents

Geographic Presence

Illumina operates globally with major facilities in the United States, the United Kingdom, Singapore, and China.

Key Offerings

- BaseSpace Sequence Hub for scalable, cloud-based NGS data analysis

- Illumina Connected Analytics (ICA) for enterprise bioinformatics and multi-omics data management

- DRAGEN Bio-IT Platform for high-performance genomic data analysis

- Illumina Connected Insights for clinical variant interpretation and reporting

- Custom bioinformatics services for data integration and visualization

Financial Overview

Illumina reports annual revenues of approximately $4.5 billion USD, with bioinformatics and data analysis services representing a growing component of its NGS ecosystem.

Key Developments and Strategic Initiatives

- April 2023: Enhanced BaseSpace Sequence Hub with real-time analytics and AI-enabled quality control

- September 2023: Introduced modular bioinformatics APIs for third-party integration

- May 2024: Expanded DRAGEN platform with support for multi-omics data analysis

- January 2025: Launched cloud-based variant interpretation services for clinical genomics

Partnerships & Collaborations

- Collaborations with pharmaceutical companies for genomic data analytics in drug discovery

- Partnerships with cloud providers (AWS and Google Cloud) for scalable bioinformatics processing

- Alliances with hospitals and clinical networks for NGS workflow automation

Product Launches / Innovations

- DRAGEN v4.3 for faster genomic variant calling (2023)

- Illumina Connected Analytics AI Suite (2024)

- Cloud-integrated BaseSpace workflow management for clinical labs (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, machine learning for variant analysis, and multi-omics data integration

- Research Infrastructure: Global bioinformatics R&D hubs in San Diego, Cambridge (UK), and Singapore

- Innovation focus: Automation of bioinformatics workflows and AI-driven genomic data interpretation

Competitive Positioning

- Strengths: End-to-end NGS and bioinformatics integration, high data accuracy, and scalable infrastructure

- Differentiators: Seamless integration between sequencing instruments and cloud-based analysis tools

SWOT Analysis

- Strengths: Industry leader in sequencing and data analytics integration

- Weaknesses: Dependence on cloud infrastructure and subscription pricing models

- Opportunities: Expansion in clinical bioinformatics and personalized medicine

- Threats: Increased competition from cloud-native bioinformatics startups

Recent News and Updates

- March 2024: Illumina launched real-time variant detection capabilities in BaseSpace

- July 2024: Partnered with NIH for AI-based genomic data analysis research

- January 2025: Released upgraded BaseSpace interface for improved data visualization and multi-user collaboration

Corporate Information

- Headquarters: Waltham, Massachusetts, United States

- Year Founded: 2006 (through merger of Thermo Electron Corporation and Fisher Scientific International)

- Ownership Type: Publicly Traded (NYSE: TMO)

History and Background

Thermo Fisher Scientific, Inc. was formed in 2006 through the merger of Thermo Electron and Fisher Scientific, combining expertise in analytical instruments, laboratory equipment, reagents, and informatics solutions. The company has since evolved into one of the world’s leading providers of end-to-end laboratory and data analysis solutions, serving the academic, clinical research, pharmaceutical, and biotechnology sectors.

In the Bioinformatics Services Market, Thermo Fisher Scientific is a Tier-1 player providing comprehensive, end-to-end bioinformatics solutions for next-generation sequencing (NGS). Its services integrate data acquisition, analysis, interpretation, and secure cloud storage, helping researchers manage the complexities of large-scale genomic and multi-omics datasets.

Key Milestones / Timeline

- 2006: Established following the merger of Thermo Electron and Fisher Scientific

- 2015: Expanded bioinformatics portfolio with launch of Ion Torrent bioinformatics suite

- 2020: Integrated cloud-based analysis capabilities for NGS data management

- 2023: Introduced the Thermo Fisher Cloud Bioinformatics platform for multi-omics analysis

- 2024: Added AI-driven predictive analytics for genomic and proteomic research

Business Overview

Thermo Fisher provides integrated NGS and bioinformatics services that support genomics, transcriptomics, and proteomics research. The company’s platforms allow users to automate data analysis pipelines, perform high-throughput sequence alignment, and interpret results with clinical-grade precision. Its services are tailored for research institutions, pharmaceutical companies, and clinical laboratories.

Business Segments / Divisions

- Life Sciences Solutions

- Analytical Instruments

- Specialty Diagnostics

- Laboratory Products and Biopharma Services

Geographic Presence

Thermo Fisher operates in more than 100 countries, with bioinformatics development hubs in the United States, Germany, and Singapore.

Key Offerings

- Thermo Fisher Cloud for genomic data analysis and management

- Ion Torrent Genexus Bioinformatics Suite for automated NGS interpretation

- Proteome Discoverer Software for proteomics data integration

- Oncomine Knowledgebase for clinical oncology variant annotation

- Custom bioinformatics services for genomics, transcriptomics, and epigenomics research

Financial Overview

Thermo Fisher Scientific reports annual revenues exceeding $42 billion USD, with bioinformatics and data services representing a fast-growing segment within its Life Sciences Solutions division.

Key Developments and Strategic Initiatives

- April 2023: Expanded Thermo Fisher Cloud with AI-driven predictive analytics for genomic data

- September 2023: Partnered with biopharmaceutical firms for bioinformatics-enabled biomarker discovery

- May 2024: Released integrated Genexus workflow connecting NGS sequencing and cloud analytics

- January 2025: Introduced a multi-omics bioinformatics pipeline for integrated data interpretation

Partnerships & Collaborations

- Collaborations with hospitals and research centers for clinical bioinformatics implementation

- Partnerships with pharmaceutical firms for biomarker discovery and drug development analytics

- Alliances with major cloud providers for secure and scalable data management solutions

Product Launches / Innovations

- Ion Torrent Genexus Bioinformatics Suite (2023)

- Thermo Fisher Cloud Multi-Omics Analysis Platform (2024)

- AI-Powered Variant Interpretation Engine (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud-based analytics, NGS data integration, machine learning, and multi-omics interpretation

- Research Infrastructure: Bioinformatics R&D hubs in Massachusetts, Germany, and Singapore

- Innovation focus: AI-assisted data analysis, real-time variant annotation, and predictive genomic modeling

Competitive Positioning

- Strengths: Integrated laboratory-to-bioinformatics workflow and strong global presence

- Differentiators: Full end-to-end NGS and cloud analytics ecosystem tailored for scalable genomics

SWOT Analysis

- Strengths: Industry-leading infrastructure, automation, and cross-platform integration

- Weaknesses: The Complexity of implementation for smaller labs

- Opportunities: Expansion of AI-based clinical bioinformatics and personalized medicine solutions

- Threats: Market competition from Illumina, Qiagen, and emerging cloud-native analytics providers

Recent News and Updates

- March 2024: Thermo Fisher launched the updated Genexus suite, integrating proteomic data

- August 2024: Partnered with academic institutions for AI-enhanced bioinformatics education programs

- January 2025: Announced expansion of bioinformatics cloud infrastructure for faster genomic data processing

Other Players in the Market for Bioinformatics Services

- QIAGEN N.V.: QIAGEN provides comprehensive bioinformatics software and services through its CLC Genomics platform, designed to streamline genomic data analysis and reduce computational bottlenecks. The company's solutions support next-generation sequencing (NGS), RNA-seq, and variant analysis workflows for researchers in genomics, diagnostics, and drug discovery.

- PerkinElmer, Inc. – PerkinElmer offers advanced bioinformatics and informatics solutions for managing and interpreting large-scale biological data. Its software platforms integrate multi-omics data processing, visualization, and predictive modeling, supporting applications in precision medicine, diagnostics, and life sciences research.

- DNAnexus, Inc: DNAnexus provides a secure, cloud-based bioinformatics platform for genomic data analysis, storage, and sharing. The company's platform supports diverse data types, including DNA, RNA, and proteomics, enabling scalable, collaborative research in clinical genomics and population health initiatives.

- BGI Genomics Co., Ltd: BGI Genomics delivers next-generation sequencing and bioinformatics services leveraging its proprietary DNBse technology. The company provides genomic, transcriptomic, and epigenetic analysis solutions for applications in human health, agriculture, and biodiversity research.

- Eurofins Scientific: Eurofins Genomics offers a wide range of sequencing and bioinformatics services, including NGS, Sanger sequencing, and oligonucleotide synthesis. As one of Europe's first providers of NGS using the Roche/454 GS20 system, Eurofins continues to deliver high-quality data interpretation and analysis support for research institutions and biopharma clients.

- Fios Genomics Ltd.: Fios Genomics provides bioinformatics data analysis services for pharmaceutical, biotechnology, and academic clients. The company specializes in integrating genomics, transcriptomics, proteomics, and metabolomics data, supporting drug discovery, preclinical, and clinical development projects.

- Seven Bridges Genomics (Velsera): Seven Bridges, now part of Velsera, offers a robust cloud-based bioinformatics platform integrating tools such as the GRA Suite for next-generation sequencing (NGS) analysis. The company supports end-to-end data management, analysis, and collaboration for genomics research and clinical data science.

- Biomax Informatics AG: Biomax Informatics develops knowledge management and bioinformatics software for data integration and systems biology. Its BioXM platform helps life science companies and research institutions manage complex biological data and derive actionable insights for R&D.

- GENEWIZ (Azenta Life Sciences): GENEWIZ, now operating under Azenta Life Sciences, provides sequencing, gene synthesis, and bioinformatics services for genomics research. The company's bioinformatics solutions include data analysis pipelines for NGS, single-cell sequencing, and metagenomics applications.

- Macrogen, Inc: Macrogen offers a full range of genomic sequencing and bioinformatics services, including human whole-genome sequencing, transcriptomics, and clinical genomics. The company's bioinformatics division provides data interpretation and reporting for precision medicine and genetic research.

- Pine Biotech, Inc.: Pine Biotech provides bioinformatics education and analysis platforms such as the T-BioInfo portal, which supports transcriptomics, metagenomics, and machine learning-based data analysis. The company focuses on democratizing bioinformatics tools for researchers and educators worldwide.

- Dassault Systemes (BIOVIA): BIOVIA, a division of Dassault Systemes, offers informatics and bioinformatics solutions that integrate life sciences data modeling, molecular simulation, and research workflow management. Its platforms enable data-driven decision-making in biopharmaceutical R&D and precision medicine.

- Genedata AG: Genedata develops enterprise bioinformatics software for automating and scaling omics data analysis. Its solutions, such as Genedata Profiler and Genedata Screener, support biopharmaceutical research, biomarker discovery, and translational medicine programs.

Recent Developments

- In February 2025, HaploX Group established its Japanese subsidiary HaploX JAPAN K.K. in Osaka to offer cancer-genetic testing, sequencing and multi-omics services, supported by Japan External Trade Organization's IBSC.(Source: https://www.jetro.go.jp)

- In November 2024, Solis Agrosciences the trusted partner for high-quality AgTech research services acquired Ferris Genomics' sequencing and bioinformatics platform to deliver end-to-end genotyping and bioinformatics services for agriculture.(Source: https://www.globenewswire.com)

- In November 2024, Sequentia Biotech secured €10million Series A, led by Seventure Partners, a French Venture Capital & Growth investment company with an extensive experience in Life Sciences.(Source: https://www.businesswire.com)

- In September 2024, Almaden Genomics announced launch of new Data Management and Informatics Services business to support its bioinformatics and computational biology solutions with vision of transforming the bioinformatics landscape by making complex data management more accessible and actionable.(Source: https://catalyze.partners)

Exclusive Insights

From a market research perspective, the bioinformatics services market is on a multi-year growth trajectory driven by declining sequencing costs, increased adoption of bioinformatics-as-a-service in the cloud, and increased outsourcing by pharma and clinical organizations. Advancements in AI, particularly protein language models and ML-driven variant interpretation, should increase throughput, clinical-grade reporting, and modular subscription offerings.

Commercial opportunities will likely include managed clinical pipelines, analytics for compliant companion diagnostics, and collaborations with sequencing clinics or CROs. Principal risk factors include data privacy and consent frameworks, a lack of standardization and interoperability, an insufficient number of skilled talent, and reproducibility. Firms that invest in validated pipelines, compliance and regulatory assessments, domain experts, and geographic expansion options will likely accrue asymmetrical market value.

Bioinformatics Services MarketSegments Covered in the Report

By Type

- Sequencing Services

- Data Analysis Services

- Database Management Services

- Drug Discovery Informatics

- Molecular Modeling & Simulation

By Application

- Genomics

- Proteomics

- Metabolomics

- Transcriptomics

- Cheminformatics

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid Model

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Clinical Laboratories

- Contract Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client