List of Contents

What is the Toluene Diisocynate Market Size?

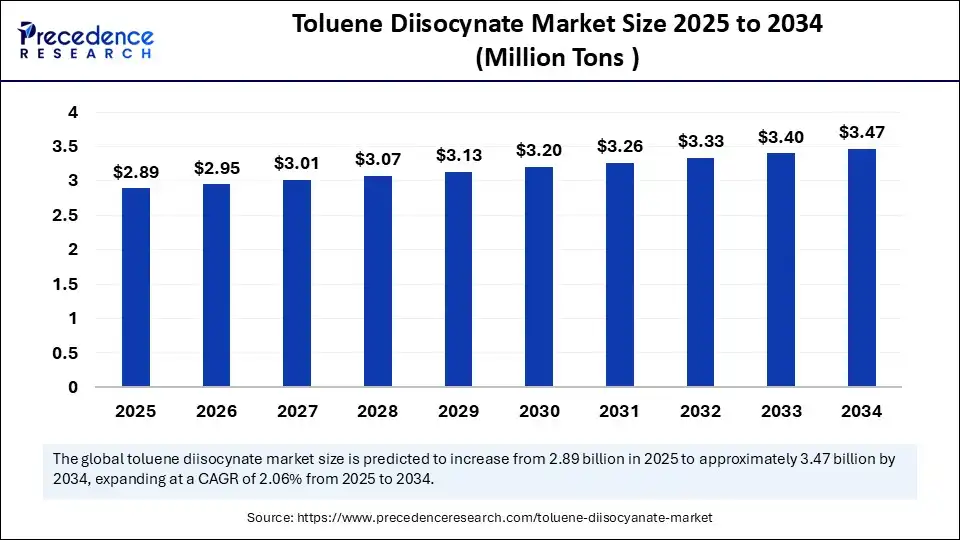

The global toluene diisocynate market size is calculated at 2.89 million tons in 2025 and is predicted to increase from 2.95 million tons in 2026 to approximately 3.47 million Tons by 2034, expanding at a CAGR of 2.06% from 2025 to 2034. The toluene diisocynate market is driven by growing polyurethane demand in the automotive and construction sectors.

Market Highlights

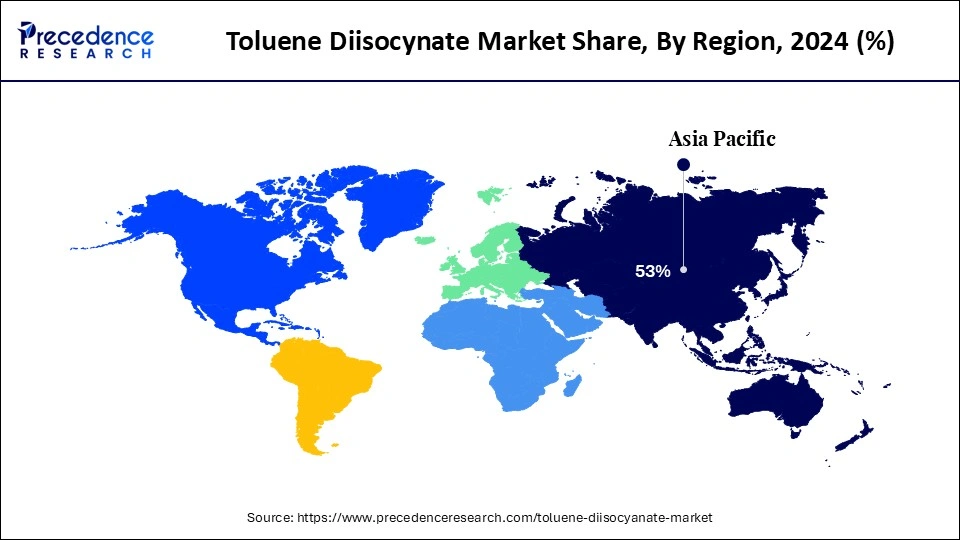

- The Asia Pacific dominated the global market with the largest market share of 53% in 2024.

- The Middle East & Africa is expected to grow the fastest CAGR from 2025 to 2034.

- By application, the flexible polyurethane foam segment led the market while holding a 68% share in 2024.

- By application, the coatings segment is anticipated to show considerable growth in the market between 2025 and 2034.

- By grade, the pure grade (2,4-TDI) segment contributed more than 80% of market share in 2024.

- By grade, the modified grades segment is expected to grow considerable CAGR between 2025 and 2034.

- By end-use industry, the furniture and bedding segment held the major market share of 40% share in 2024.

- By end-use industry, the automotive industry segment is growing at a strong CAGR from 2025 to 2034.

- By isomer type, the 2,4-TDI segment contributed more than 80% of market share in 2024.

- By isomer type, the mixed isomers (80:20 or 65:35 blends) segment is growing at a solid CAGR between 2025 and 2034.

Driving Industrial Innovation: How AI and Sustainability Are Shaping the Toluene

Diisocynate Value Chain

The toluene diisocynate market is one of the most critical markets in the global chemical industry, with its diverse market uses in polyurethane manufacturing. TDI is an important raw material in the production of flexible polyurethane foams, which find plenty of application in furniture, mattresses, automotive seating, as well as packaging materials. Another application of the compound is in coating, adhesive, sealant, and elastomer, which is flexible and offers strength. The products made of TDI are in growing demand as the industry has embraced the need to use lightweight, tough, and energy-efficient materials.

The market growth has been enhanced by rapid industrialization in the emerging economies, increased urban infrastructure development, and increased consumer expenditure on home furnishings and automobiles. The market is growing largely due to the increasing demand for flexible polyurethane foams, particularly in the furniture and automobile industries. TDI is needed in the automotive industry to provide lightweight and high comfort seats, which help increase the fuel efficiency of vehicles. The use of TDI-based insulation materials is gaining popularity in the building industry because of their thermal resistance and energy conservation properties.

AI Shifts in the Toluene Diisocynate Market

Artificial intelligence is transforming the toluene diisocynate market by improving the efficiency of production, control of processes, and sustainability. Predictive analytics, powered by AI, allow manufacturers to trace the actual chemical reaction in real-time, optimize the performance of raw materials, and reduce the energy usage, as the end result is a cost-efficient and less polluted production of TDI. Quality management is being supported by machine learning programs that expose impurities and anomalies at the initial level of the production cycle and reduce the amount of waste, and ensure uniformity of the product. In addition, AI demand prediction systems can be used to help businesses predict market fluctuations, stock, and supply chain management. With the environmental effect and control of emissions growing more stringent, AI-based digital twins and process simulations will help manufacturers to reach compliance goals.

Toluene Diisocynate Market Outlook

The toluene diisocynate market is developing in a positive manner owing to the increase in the demand for flexible polyurethane foams in the furniture, bedding, and automotive industries. The global market position is further enhanced by the rise in industrialization and improvements in the consumers lifestyle.

Asia-Pacific is the region that dominates the TDI market by having robust production and consumption in China and India. In the meantime, Europe and North America are focusing on manufacturing that is environmentally friendly to meet the environmental standards and increase their chances of export.

The major organizations, such as BASF SE, Covestro AG, Wanhua Chemical Group, and Mitsui Chemicals, are making significant investments in capacity and research and development. They are interested in strengthening the global supply chain and sustainable production.

New companies are inventing bio-based technology of TDI and green technology of polyurethane. They are transforming the market with greener chemical solutions in support of the sustainability accelerators.

Market Scope

| Report Coverage | Details |

| Market Demand in 2025 | USD 2.89 Million Tons |

| Market Demand in 2026 | USD 2.95 Million Tons |

| Market Demand by 2034 | USD 3.47 Million Tons |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.06% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Grade, End-Use Industry, Isomer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Toluene Diisocynate Market Segment Insights

Application Insights

Flexible Polyurethane Foam: The flexible polyurethane foam segment was the market leader as it had a share of 68% in 2024. This has been attributed to its broad usage in furniture cushions, mattresses, automotive seating, and packaging applications. Its lightness, robustness, and high elasticity make it perfect for comfort-based and energy-absorbing products. The urbanization, increased spending on home furnishing by consumers, and the expanding automotive industry have further boosted demand. Also, AI-based manufacturing technologies are improving the precision and quality control of the foam formulation and minimizing production wastes.

Coatings: The coatings segment is expected to grow at a significant CAGR over the forecast period. Toluene diisocynate is an important ingredient in creating durable and high-performance, and weather-resistant finishes. The trend of low-VOC and waterborne formulations complies with the international environmental standards and enhances cleaner production processes. The growth of the market is also driven by the rapid development of infrastructure in the Asia-Pacific and the increasing need for lightweight and corrosion-resistant products in the transport and machinery industry. Additionally, AI-based optimization of formulation is facilitating manufacturers to optimize the efficiencies of coatings, anticipate endurance, and cut expenses, which supports the trend of this segment.

Adhesives & Sealants: The toluene diisocynate market is also being influenced by the adhesives and sealants segment because the segment has a high bonding power, flexibility, and is resistant to chemicals. The TDI-based formulations find extensive application in construction, automobiles, footwear, and packaging industries to achieve consistent adhesion on a wide range of substrates. This is further increasing the demand for polyurethane adhesives because of the increasing demand for lightweight vehicles and modular construction materials. Moreover, the high level of consistency and performance in adhesive practices is guaranteed through technological innovations that are backed by AI-controlled process control.

Grade Insights

Pure Grade (2,4-TDI): The pure grade (2,4-TDI) segment led the market while holding an 80% share in 2024. Its high reactivity, stability, and purity make it a desirable choice for manufacturing high-quality flexible polyurethane foams in furniture, bedding, and automotive interiors, as well as packaging. The high performance of the grade and its ability to be incorporated with the more advanced catalysts to promote foam yield and durability help to promote the performance of the grade in large-scale industrial use. Also, the introduction of AI-based quality control and automatic synthesis has enhanced the accuracy of the processes and reduced the amount of impurities in manufacturing. As industries focus on efficiency and consistency of products, 2,4-TDI continues to be the backbone of TDI demand, making it a stronghold in both the developed and emerging economies.

Modified Grades: The modified grades (blends and custom formulations) segment is expected to grow at a significant CAGR over the forecast period, since the specialty coating, sealants, and rigid foams are expected to demand custom-made performance. The grades provide better processing flexibility, better mechanical strength, and controlled reactivity that meets individual industry requirements. To create tailored molecular structures that can be performance-compliant and environmentally safe, manufacturers are taking advantage of AI-based modeling to design their own models. The modified TDI blends are gaining importance with more industries, such as the automotive industry, aerospace, and construction, having shifted to using specialized polyurethane systems.

Crude TDI: Crude TDI still finds its niche in the polyurethane manufacturing and the synthesis of intermediate chemicals. It provides an affordable raw material substitute to the manufacturers who want to refine or develop their own TDI blends to produce specialized end-use goods. Its usage is frequently restricted because of the impurities and the necessity of additional purification, though it is useful in R&D and some industrial processes. Crude TDI handling is being made more efficient with emerging process automation and AI-driven purification systems, and is more environmentally friendly.

End-Use Industry Insights

Furniture & Bedding: The furniture & bedding segment held a 40% share in the toluene diisocynate market in 2024, driven by its prevalence in the manufacture of pliable polyurethane foams for cushions, mattresses, and furniture. The growing urbanization, lifestyle improvement, and the growing needs among consumers to enhance comfort in their homes through home furnishings have increased the rate of foam consumption. The TDI is also enhanced by the growth of the hospitality and residential sectors, as well as the emergence of e-commerce sales of furniture. The manufacturers are also adopting AI-regulated production to determine unspoken foam density, reduce chemical use, and minimize negative environmental impact.

Automotive (Seating, interiors, coatings): The automotive segment is expected to grow substantially in the toluene diisocynate market, motivated by the rising application of lightweight polyurethane foams and coatings in car interiors. The materials of TDI are widely applicable in the seat, headrests, door panels, and the seat coating to enhance comfort, insulation, and durability. The accelerated growth in electric cars is increasing the pressure in favor of lighter and more energy-efficient materials to facilitate the fuel economy and performance. Moreover, AI-driven material design helps manufacturers improve the polyurethane formulations to increase their safety, recyclability, and thermal stability.

Construction (Insulation materials, sealants, coatings): Construction is a new key industry that is likely to take off in the toluene diisocynate market, owing to the worlds preference for energy saving and durable polyurethane-based insulation materials, sealants, and coatings. TDI foams are the most suitable in residential, commercial, and industrial construction in terms of thermal insulation, structure, and repelling water. The expanding construction activity in the emerging economies and the government initiatives that promote green buildings are fostering the development of the market. Besides, AI-based modeling and process simulations are also making it possible to generate environmentally friendly TDI formulations to meet the evolving safety and environmental requirements.

Isomer Type Insights

2,4-TDI: The 2,4-TDI segment held an 80% share in the toluene diisocynate market in 2024, driven by its great reactivity, stability, and improved foam-forming properties. The high order of reaction enables it to be highly responsive, enabling a high level of control in its processing and even consistency in product, which facilitates large-scale production in many sectors of the end-use. The benefits of the AI-based process systems are that the producers can gain profit due to the high yield, monitoring purity, and spending less energy in the manufacturing process. Depending to the fact that the requirements of lightweight, strong, and comfortable foam products are continually rising all over the world, 2, 4-TDI is the most cost-effective and widespread isomer in the TDI sector.

Mixed Isomers (80:20 or 65:35 blends): The mixed isomers (80:20 or 65:35 blends) segment is expected to grow substantially in the toluene diisocynate market. It is likely to grow remarkably on the ground that it possesses optimised reactivity and good mechanical performance. Applications such as specialty foams, coatings, sealants, and elastomers are making heavy use of such blends and require a trade-off between flexibility and strength. They may be applied in premium automotive, industrial, and construction due to their adaptability to varied processing conditions. The mixed isomers are becoming the choice of high-performance formulation as industries require custom-engineered polyurethane materials for specialized functions.

2,6-TDI: The 2,6-TDI segment is smaller in volume but is relevant in the application where a lower reactivity and higher elasticity are required. It is applied together with 2,4-TDI to adjust the material characteristics of polyurethane foams, coatings, and adhesives. The reduced reactivity of it results in smoother surfaces and better mechanical strength in the further part of its lower reactivity profile, which enables it to have more control during the manufacturing process. The segment is gaining interest in high-quality material formulations where flexibility, softness, and durability are the most important. With AI-assisted chemical modelling and optimization of processes, manufacturers are considering new uses of 2,6-TDI in niche markets, e.g., specialty finishes and industrial foams.

Toluene Diisocynate Market Regional Insights

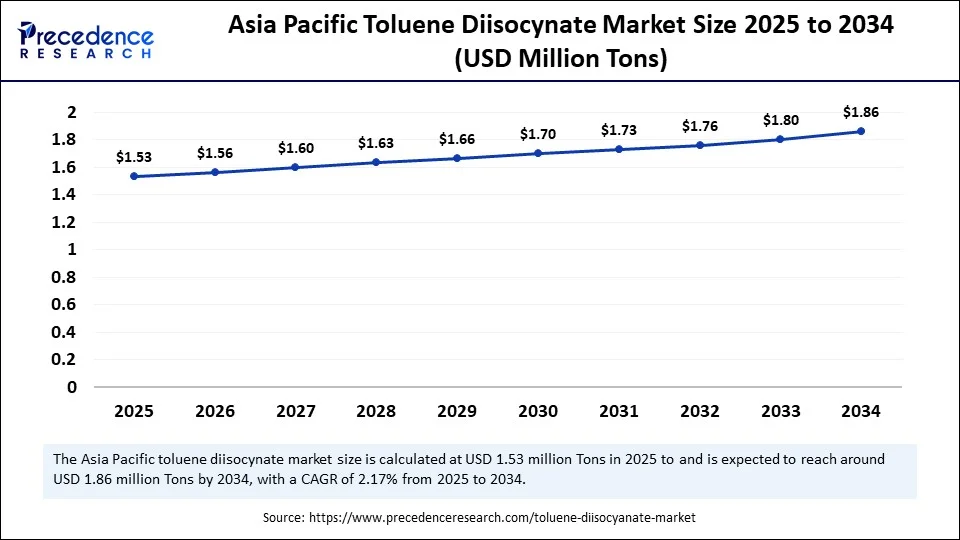

The Asia Pacific toluene diisocynate market demand is expected to reach 1.86 million tons by 2034, increasing from 1.53 million tons by 2025, growing at a CAGR of 2.17% from 2025 to 2034.

Why Did Asia Pacific Lead the Global Toluene Diisocynate Market in 2024?

Asia Pacific led the global market with the highest market share of 53% in 2024, propelled by strong manufacturing and consumption in China, South Korea, and India. The growing automotive, furniture, and construction industries in the region are key manufacturers of the increasing demand in TDI-based polyurethane foams, coatings, and adhesives. China is the largest supplier of TDI in the world, with India and Southeast Asia recording robust increases in downstream polyurethane applications. The efficiency and the quality of the products of the plants in the regions are also improved further by AI-based manufacturing technologies, automation, and sustainable production practices. With governments encouraging the use of energy-efficient materials and low-emission production, the Asia Pacific region remains the single largest global manufacturing centre, as well as a rapidly expanding market in terms of TDI usage.

China Toluene Diisocynate Market Trends

China is the leader in the Asia Pacific market, and it has the strength of its huge production capacity, intertwined supply chain, and rising polyurethane industries. Intense industrialization, coupled with the increasing demand for furniture, automotive, and building materials in the country, has established its leadership in the world in TDI production. Both Chinese manufacturers are embracing the concept of process monitoring through AI and smart plant technology to enhance their yields and minimize carbon emissions. Moreover, the domestic manufacturers like Wanhua Chemical Group and Cangzhou Dahua are also increasing their manufacturing capacities and are investing in the field of green chemistry.

The Middle East & Africa have been estimated to achieve the highest CAGR throughout the forecast period with 25% market share. The high rate of infrastructure development, increased urbanization, and increased demand for polyurethane-based products in construction, furniture, and automotive industries are creating a high market momentum in the region. The UAE, Egypt, South Africa, and Nigeria are experiencing massive housing, smart cities, and industrial investments. Also, the government support programs to diversify economies and enhance the local chemical manufacturing base are boosting the adoption of TDI. The rising foreign investments, rising consumer spending, and transition to energy-efficient construction materials further make the region a vibrant TDI growth hub.

Saudi Arabia Toluene Diisocynate Market Trends

Saudi Arabia is becoming a major toluene diisocynate consumer in the Middle East due to the fast industrial growth and huge infrastructure development under Saudi Vision 2030. The construction and housing industries in the country are booming and creating a lot of demand for polyurethane foams, coatings, and sealants. Also, the automotive and furniture sectors are embracing the use of TDI-based materials in the lightweight and durable applications of products. The domestic supply capabilities are being enhanced through strategic partnerships with international chemical manufacturers and investments in downstream petrochemical plants.

The North American toluene diisocynate market is witnessing sustainable growth due to the modernization of infrastructure, the development of the automotive industry, and growing construction activity. The high rate of sustainability and energy saving within the region has increased the rate at which polyurethane-based foams, sealants, and coatings can be used both in residential and industrial markets. Car producers are also incorporating more materials derived from TDI to provide more comfort to the vehicles, decrease the weight, and increase the fuel efficiency. In addition, optimization of manufacturing and supply chain through AI is facilitating an improved quality control, waste reduction, and quality assurance in the U.S and Canadian manufacturing plants. The trend of green buildings and environmentally-friendly product formulas is also driving the TDI demand.

U.S. Toluene Diisocynate Market Analysis

The U.S is the largest contributor to the North American market with developed manufacturing facilities and consumption in the furniture, bedding, and automobile industries. The growth of TDI-based foam and insulation demand is being geared into more construction activity with smart homes and other energy-saving structures. The research infrastructure and emphasis on sustainable chemistry are driving research in the low-VOC coatings and bio-based polyurethane materials. As the demand for lightweight and durable materials grows, the U.S. market is projected to have a consistent growth trend, which will support it in being a significant player in the global polyurethane value chain.

Toluene Diisocynate Market Value Chain

Key inputs are toluene, nitric acid or other nitration reagents for conversion to toluene diamine (TDA), phosgene for phosgenation to TDI, solvents, catalysts, utilities and steam. Access to competitively priced toluene and secure phosgene handling capabilities are critical. Suppliers of high-quality feedstocks and utilities capture value when they provide reliable, cost-effective, and regulatory-compliant supplies. Upstream risk factors include crude oil derivatives price volatility, phosgene availability and regulation, and raw material logistics constraints.

This is the principal value-creation stage. Processes include nitration and hydrogenation to produce TDA, phosgenation of TDA to generate TDI isomers, quench and neutralization steps, distillation and fractionation to separate 2,4- and 2,6-TDI fractions, and finishing steps to specification (monomer content, free TDA limits, oligomer control). Facilities require specialized containment, phosgene management systems, corrosion-resistant materials, and high levels of process safety instrumentation. Value is captured by producers that combine low cost per ton, high yield, consistent quality, and proven safety and environmental controls. High entry barriers arise from capital intensity, hazardous chemistry, permitting complexity, and the need for experienced operators.

TDI is sold to polyurethane polymer producers, flexible foam manufacturers, coatings, adhesives, sealants and elastomers formulators. Downstream players convert TDI into polyols and prepolymers, craft foam formulations for furniture, bedding and automotive seating, and formulate specialty coatings or adhesives. Value downstream accrues to companies that secure long-term offtake, provide technical support for formulations, and offer supply chain continuity. Logistics and tank storage, safe handling expertise, and trade compliance for hazardous chemicals are important components of downstream value capture.

Toluene Diisocynate Market Companies

Corporate Information

- Headquarters: Ludwigshafen, Rhineland-Palatinate, Germany

- Year Founded: 1865

- Ownership Type: Publicly Traded (FWB: BAS)

History and Background

Founded in 1865, BASF SE (Badische Anilin- und Soda-Fabrik) is one of the worlds largest and most diversified chemical companies. The company has a long legacy of innovation in industrial chemicals, performance materials, and polymer intermediates, supplying products across a vast range of industries including automotive, construction, electronics, and consumer goods.

In the Toluene Diisocyanate (TDI) Market, BASF SE is a global leader in both production capacity and technological innovation. The company manufactures TDI primarily for use in flexible polyurethane foams, which are critical components in furniture, automotive seating, bedding, and packaging. BASFs proprietary TDI production processes emphasize energy efficiency, low emissions, and enhanced yield, aligning with its broader sustainability goals.

Key Milestones / Timeline

- 1865: Founded in Mannheim, Germany

- 1930: Began industrial-scale polyurethane chemistry research

- 1990: Expanded TDI production facilities globally

- 2015: Opened world-scale TDI plant in Ludwigshafen with annual capacity exceeding 300,000 metric tons

- 2023: Introduced low-carbon footprint TDI as part of BASFs sustainable product portfolio

- 2024: Implemented AI-driven process optimization for TDI manufacturing efficiency

Business Overview

BASF operates as a fully integrated global chemical enterprise with a focus on value chain efficiency and circular chemistry. Within the TDI market, BASF operations encompass production, R&D, and application development for polyurethane intermediates. The company products are integral to the manufacture of soft foam materials, coatings, adhesives, and elastomers.

Business Segments / Divisions

- Chemicals

- Materials (including Polyurethanes and Performance Materials)

- Industrial Solutions

- Surface Technologies

Geographic Presence

BASF operates production and R&D sites in more than 90 countries, with TDI manufacturing facilities in Germany, China, and North America.

Key Offerings

- Lupranate TDI High-performance toluene diisocyanate for flexible polyurethane foam production

- Eco-balanced TDI Low-emission variant developed under BASFs Biomass Balance sustainability approach

- Customized TDI formulations for coatings, adhesives, and sealants

- Process optimization and technical support for downstream manufacturers

Financial Overview

BASF SE reported annual revenues exceeding 68 billion (approx. 73 billion USD) in 2024, with its Materials division, which includes TDI, contributing a significant portion through polyurethane intermediates.

Key Developments and Strategic Initiatives

- April 2023: Expanded low-emission TDI portfolio for sustainable polyurethane production

- September 2023: Announced digital transformation of TDI production lines for efficiency and carbon tracking

- May 2024: Partnered with automotive OEMs to supply sustainable TDI-based foams for seating applications

- January 2025: Began pilot production of renewable feedstock-based TDI in Ludwigshafen plant

Partnerships & Collaborations

- Collaborations with automotive and furniture manufacturers for eco-friendly polyurethane foams

- Partnerships with raw material suppliers for circular feedstock utilization

- Joint R&D initiatives with chemical engineering firms for process optimization and carbon capture

Product Launches / Innovations

- Eco-balanced Lupranate TDI (2023)

- Smart Manufacturing System for TDI plants (2024)

- Next-gen TDI catalysts for energy-efficient production (2025)

Technological Capabilities / R&D Focus

- Core technologies: Advanced polyurethane chemistry, gas-phase phosgenation, and circular carbon utilization

- Research Infrastructure: Global R&D centers in Ludwigshafen, Shanghai, and Wyandotte (U.S.)

- Innovation focus: Sustainable isocyanate production, process automation, and carbon emission reduction

Competitive Positioning

- Strengths: Global scale, integrated chemical network, and innovation leadership in polyurethane intermediates

- Differentiators: Industry-leading low-carbon TDI technology and advanced automation in manufacturing

SWOT Analysis

- Strengths: High production capacity, R&D strength, and sustainability leadership

- Weaknesses: Exposure to volatility in crude oil-derived feedstocks

- Opportunities: Rising demand for sustainable polyurethane foams and automotive lightweighting

- Threats: Regulatory pressure on isocyanate emissions and global market overcapacity

Recent News and Updates

- April 2024: BASF announced a collaboration with Dow for low-carbon polyurethane materials

- August 2024: Expanded green TDI supply chain to support European automotive sustainability targets

- January 2025: Launched pilot project for renewable TDI feedstocks under BASF net-zero initiative

Corporate Information

- Headquarters: Leverkusen, North Rhine-Westphalia, Germany

- Year Founded: 2015 (spun off from Bayer MaterialScience)

- Ownership Type: Publicly Traded (FWB: 1COV)

History and Background

Covestro AG was established in 2015 following the spin-off of Bayer MaterialScience, inheriting decades of expertise in polymer chemistry and advanced materials. Today, Covestro is one of the world largest producers of high-performance polymers, supplying industries such as automotive, construction, and consumer goods with sustainable and innovative materials.

In the Toluene Diisocyanate (TDI) Market, Covestro is a global leader in polyurethane feedstocks, producing TDI as a critical raw material for flexible foams, coatings, and elastomers. Covestros TDI technology is centered on energy-efficient gas-phase phosgenation processes that minimize environmental impact while maintaining high production yields.

Key Milestones / Timeline

- 2015: Founded as a spin-off from Bayer MaterialScience

- 2018: Opened world-scale TDI plant in Dormagen, Germany

- 2021: Announced production of mass-balanced, low-carbon TDI using bio-attributed feedstocks

- 2023: Expanded collaboration with downstream manufacturers for circular TDI applications

- 2024: Integrated advanced digital process control and carbon accounting technologies across TDI facilities

Business Overview

Covestro develops, manufactures, and markets high-performance materials, including isocyanates (MDI, TDI), polyols, and thermoplastic polyurethanes. In the TDI market, Covestro focuses on sustainable production, circular economy principles, and product innovation to support global transitions toward environmentally responsible polyurethane manufacturing.

Business Segments / Divisions

- Performance Materials

- Solutions & Specialties

- Coatings, Adhesives, and Specialty Raw Materials

Geographic Presence

Covestro operates over 50 production sites worldwide, with major TDI facilities in Dormagen (Germany), Caojing (China), and Brunsbuttel (Germany).

Key Offerings

- Toluene Diisocyanate (TDI) for flexible polyurethane foam applications

- TDI for coatings, adhesives, and elastomer formulations

- ISCC PLUS-certified mass-balanced TDI with renewable feedstocks

- Technical support and downstream application optimization services

Financial Overview

Covestro reports annual revenues of approximately �15.9 billion (approx. $17 billion USD), with its Performance Materials segment, including TDI, representing a core part of its operations.

Key Developments and Strategic Initiatives

- March 2023: Expanded low-carbon TDI portfolio under ISCC PLUS certification

September 2023: Integrated renewable raw materials in European TDI production - June 2024: Developed circular polyurethane materials through chemical recycling partnerships

- January 2025: Introduced AI-driven digital twins for process optimization in TDI manufacturing plants

Partnerships & Collaborations

- Partnerships with automotive and furniture industries for sustainable polyurethane foam development

- Collaborations with renewable feedstock suppliers for green TDI production

- Alliances with recycling technology firms for circular polyurethane ecosystems

Product Launches / Innovations

- ISCC PLUS-certified TDI (2023)

- Circular TDI initiative for polyurethane sustainability (2024)

- AI-enabled TDI process simulation platform (2025)

Technological Capabilities / R&D Focus

- Core technologies: Gas-phase phosgenation, renewable feedstock integration, and circular polymer chemistry

- Research Infrastructure: Innovation hubs in Leverkusen, Shanghai, and Pittsburgh

- Innovation focus: Sustainable TDI production, digitalized plant operations, and process decarbonization

Competitive Positioning

- Strengths: Strong sustainability roadmap, efficient production technologies, and advanced polymer expertise

- Differentiators: First-mover advantage in renewable and mass-balanced TDI products

SWOT Analysis

- Strengths: Industry leadership in sustainable TDI, global manufacturing network

- Weaknesses: Dependence on polyurethane market demand cycles

- Opportunities: Growth in eco-friendly furniture, construction, and automotive sectors

- Threats: Raw material volatility and global TDI overcapacity

Recent News and Updates

- April 2024: Covestro announced expansion of renewable TDI production in Dormagen

- August 2024: Partnered with IKEA and furniture manufacturers for carbon-neutral polyurethane foams

- January 2025: Introduced next-generation digitalized TDI control systems for energy efficiency and emission tracking

Other Companies in the Toluene Diisocynate Market

- Wanhua Chemical Group Co., Ltd.: Wanhua Chemical is one of the worlds largest producers of polyurethane raw materials, including toluene diisocyanate (TDI). The company advanced production technologies and large-scale integrated facilities in China ensure high-quality TDI output for applications in flexible foam, coatings, adhesives, and elastomers.

- Dow Inc.: Dow manufactures TDI and related polyurethane intermediates for use in flexible polyurethane foams, coatings, and sealants. The company emphasizes innovation in isocyanate chemistry and sustainable production practices, serving global automotive, furniture, and construction industries.

- Huntsman Corporation: Huntsman produces TDI through its Polyurethanes division, supplying materials for flexible foam manufacturing used in furniture, bedding, and automotive interiors. The companys global footprint and R&D capabilities strengthen its position in the polyurethane chemicals market.

- Mitsui Chemicals, Inc: Mitsui Chemicals manufactures TDI and other isocyanates as part of its comprehensive polyurethane materials portfolio. The company serves industries such as automotive, construction, and coatings, focusing on high-performance and environmentally responsible chemical production.

- Tosoh Corporation: Tosoh produces TDI and polyurethane intermediates for use in flexible foams, coatings, and adhesives. The company strong technological base supports consistent product quality and efficiency across industrial manufacturing applications.

- OCI Company Ltd.: OCI manufactures TDI and other chemical intermediates used in polyurethane production. Its integrated chemical facilities in Asia ensure reliable supply for downstream industries including automotive seating, insulation, and footwear manufacturing.

- Sadara Chemical Company (JV of Dow & Saudi Aramco): Sadara operates one of the worlds largest chemical complexes, producing TDI and related polyurethane feedstocks. The joint venture combines Dows process technology with Saudi Aramcos feedstock advantages to supply high-performance TDI products for regional and global markets.

- Vencorex Holding: Vencorex, a joint venture between PTT Global Chemical and Perstorp, specializes in aliphatic and aromatic isocyanates including TDI. The company provides high-purity TDI grades for coatings, adhesives, sealants, and elastomers, focusing on advanced polyurethane formulations.

- Chemtura Corporation (part of LANXESS): Now integrated under LANXESS, Chemtura produces specialty chemicals including TDI and polyurethane intermediates. The company supports applications in coatings, adhesives, and sealants with a focus on performance enhancement and chemical sustainability.

- Karoon Petrochemical Company: Based in Iran, Karoon Petrochemical produces TDI and methylene diphenyl diisocyanate (MDI) for domestic and export markets. Its focus lies in supporting regional polyurethane manufacturing through localized production and feedstock integration.

- GNFC (Gujarat Narmada Valley Fertilizers & Chemicals Ltd.): GNFC is a key TDI producer in India, supplying domestic and international markets with high-quality toluene diisocyanate. The company production plant in Bharuch supports a wide range of applications in furniture, bedding, and automotive foams.

- Hanwha Solutions Corporation:Hanwha Solutions manufactures chemical intermediates including TDI for use in flexible foams, coatings, and adhesives. The company diversification into polyurethane raw materials supports its growing footprint in the global chemical industry.

- DIC Corporation: DIC produces polyurethane materials and specialty chemicals, including TDI for coatings, adhesives, and elastomers. The company focus on performance polymers and resin innovation enhances its product portfolio for industrial applications.

- Shandong Juli Chemical Co., Ltd.: Shandong Juli Chemical manufactures TDI and polyurethane feedstocks for the furniture, automotive, and construction industries. The company operates modern facilities in China with a focus on quality consistency and export competitiveness.

- Rubicon LLC (Huntsman JV): Rubicon LLC, a joint venture between Huntsman and BASF, produces TDI and other polyurethane intermediates. The company large-scale production facilities in the United States supply flexible foam and coatings manufacturers globally.

- Yantai Juli Fine Chemical Co., Ltd: Yantai Juli Fine Chemical specializes in the production of isocyanates, including TDI, for polyurethane-based materials. Its operations emphasize process innovation, safety, and adherence to environmental standards.

- Bayer MaterialScience (legacy production line): Bayer MaterialScience, now operating as Covestro, has historically been a leading producer of TDI and polyurethane raw materials. Its legacy technology and process innovations continue to influence modern TDI production standards.

- Shandong Dongda Chemical Industry Co., Ltd.: Shandong Dongda Chemical produces TDI and related polyurethane intermediates, supplying flexible foam and coating manufacturers. The company R&D initiatives focus on process optimization and environmental sustainability in chemical production.

Recent Developments

- In August 2025, Wanhua inaugurated its 2 nd Phase II Toluene Diisocynate (TDI) facility in Fujian Industrial Park, having a capacity of 360,000 tonnes/year, which increased its total TDI production to 1.44 million tonnes/year. The growth will enable Wanhua to have an enhanced market in the global market and reinforce the growth in polyurethane demand.(Source: https://www.echemi.com/)

- In March 2025, Covestro modernized its TDI plant in Dormagen and made it more energy-efficient, and decreased the annual CO2 emissions by 22,000 tons. The upgrade enhances the sustainability performance and increases the competitiveness of the plant in the long run in the global markets.(Source: https://www.pudaily.com)

Toluene Diisocynate Market Segments Covered in the Report

By Application

- Flexible Polyurethane Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Rigid Foams

- Others (Binders, Insulation materials)

By Grade

- Pure Grade (2,4-TDI)

- Crude TDI

- Modified Grades (Blends and custom formulations)

By End-Use Industry

- Furniture & Bedding

- Automotive (Seating, interiors, coatings)

- Construction (Insulation materials, sealants, coatings)

- Packaging

- Footwear & Textiles

By Isomer Type

- 2,4-TDI (Dominant)

- 2,6-TDI

- Mixed Isomers (80:20 or 65:35 blends)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client