List of Contents

What is the Aromatic Solvents Market Size?

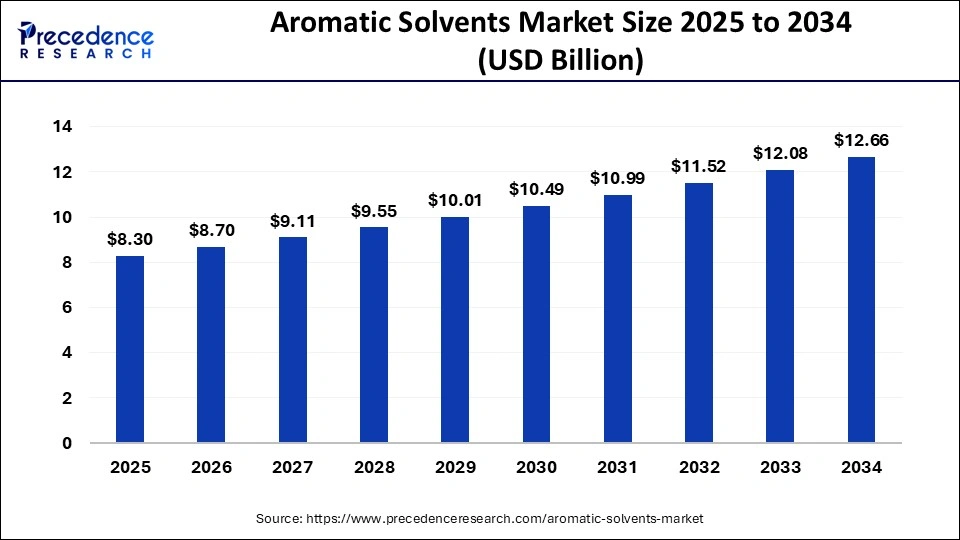

The global aromatic solvents market size is accounted at USD 8.30 billion in 2025 and predicted to increase from USD 8.70 billion in 2026 to approximately USD 12.66 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034.

Aromatic Solvents Market Key Takeaways

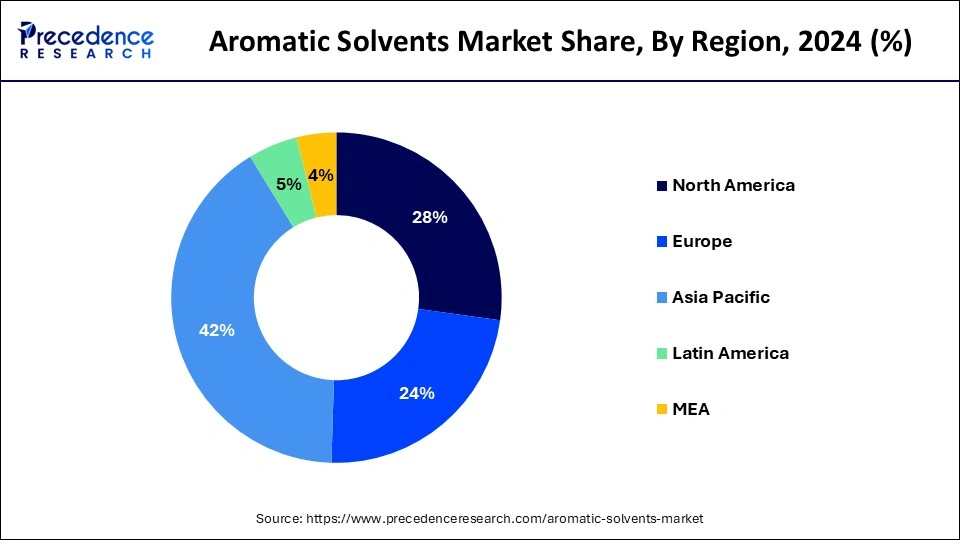

- Asia Pacific led the global market with the highest market share of 42% in2024.

- By Product, the toluene segment has held the largest market share of 50% in2024.

- By Application, the paints & coatings segment captured the biggest revenue share in2024.

Aromatic Solvents Market Growth Factors

Aromatic solvents have high rate of solvency that helps in the formation of efficient homogenous solution. In addition, these solvents are well known for their high evaporation rate that helps in speeding up the drying and curing processes. These all above mentioned properties of aromatic solvents are the major factor behind their diverse application across various industries such as paints & coatings, automotive, oilfield chemicals, pharmaceuticals, varnishes, nail polish remover, and many others.

Moreover, spontaneous growth in the automotive sector further aids in the profound growth of the aromatic solvents market. Rising demand for electric vehicles along with autonomous vehicles expected to further boost the sales in automotive sector that spurs the demand for aromatic solvents consequently. The automotive industry is on the verse of massive transformation that is shaping the future of automotive sales such as shared mobility, alternative drivetrains, connectivity, and many others. As per International Energy Agency (IEA), automotive sales were 80 million units in the year 2017 and the figure expected to reach billions of units in the coming years. Hence, the prominent growth in the automotive industry results in the market growth of aromatic solvents market.

Other than automotive, aromatic solvents are excellently used in construction, oil & gas, and various other general industries. In paints & coatings industry, these aromatic solvents are largely used as thinners. Hence, the accelerating growth rate of paint & coatings market along with exponential growth in construction sector particularly in the developing nations expected to flourish the aromatic solvents market in the upcoming years.

Aromatic Solvents Market Outlook:

- Global Expansion: Prominently impacted by the ongoing urbanization, industrialization, and expansion in construction and automotive production.

- Major investor: In May 2025, Haltermann Carless initiated a new hydrogenation unit at its Speyer site to boost product quality and sustainability for speciality aromatic solvents.

- Startup Ecosystem: Mevaldi, a startup, secured funding to escalate its green chemistry technology.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 8.70 Billion |

| Market Size in 2025 | USD 8.30 Billion |

| Market Size by 2034 | USD 12.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Product Insights

Based on product, the global market for aromatic solvents is bifurcated into benzene, xylene, toluene, and others. Toluene accounted to hold majority of the revenue share of approximately 50% in the year 2024 and expected to seek significant growth over the forecast period. Toluene-based aromatic solvent increases viscosity in adhesive films and are largely used in adhesive applications because of their high evaporation rates. Moreover, the toluene-based products are prominently used in the production process of paint thinners for cosmetics, inks, correction fluids, and many others. Hence, the outstanding growth in the cosmetic sector is anticipated to propel the market growth for toluene segment.

Other segments in the global aromatic solvents market includes mixed xylenes, ethylbenzene, and others. These products are prominently used in the manufacturing of other industry chemical products. In addition, xylene is the second largest product segment in terms of revenue. Because of low toxicity and high solvency power xylene anticipated to exhibit profound growth during the upcoming years.

Application Insights

By application, paints & coatings segment dominated the global aromatic solvents market in terms of revenue in the year 2023 and anticipated to exhibit similar trend during the forthcoming period. Paints & coatings segment captured nearly half of the total market revenue in 2023. This is mainly attributed to the prominent growth in the paints & coatings market globally because of increasing product consumption in various sectors such as automotive, construction, and general industries.

The application type segments is classified into Pharmaceuticals, Automotive, Oilfield Chemicals, Paints & Coatings, Others. Increasing demand for packaging products for food and beverages contributing the growth of packaging industry in the aromatic solvents market.

Regional Insights

Asia Pacific Aromatic Solvents Market Size and Growth 2025 to 2034

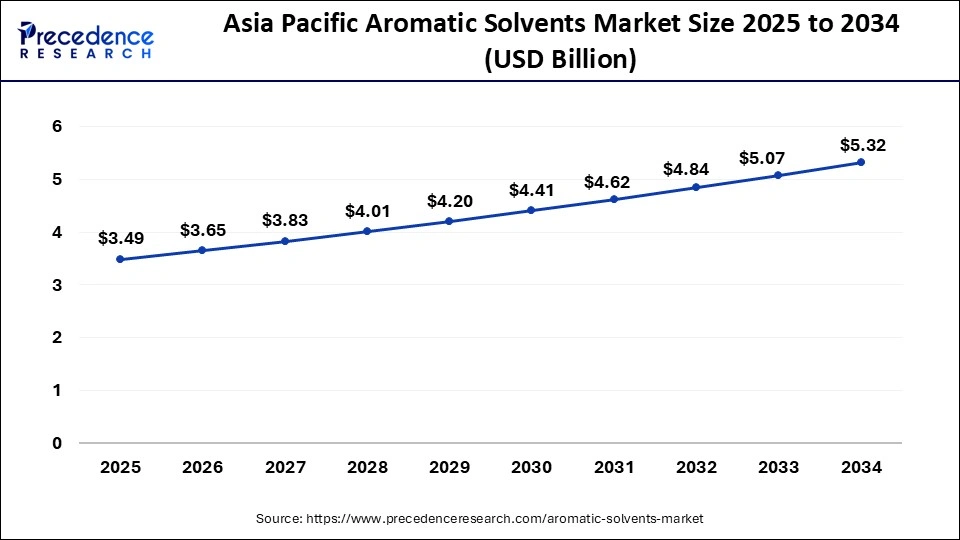

The Asia Pacific aromatic solvents market size is estimated at USD 3.49 billion in 2025 and is predicted to be worth around USD 5.32 billion by 2034, at a CAGR of 4.90% from 2025 to 2034.

The Asia Pacific estimated to be the most promising market in terms of revenue and growth in the global aromatic solvents market. Magnificent growth of automotive, construction, and general industry sectors because of the presence of large consumer base in the region accounts for the prime factor that drives the growth of the region. Further, significant investments in the developing nations under various development acts also supports the exponential growth of the aromatic solvents industry. Rising per capita disposable income, urbanization, and rising demand for automobiles particularly in the emerging nations that include India, China, and South Korea.

North America is another important market to hit revenue share of 28% in 2024. The U.S. construction industry is predicted to generate high revenue to the overall market. The major automobile manufacturers are expected to drive growth in the region.

North America is another important market to hit revenue share of 28% in 2024. The U.S. construction industry is predicted to generate high revenue to the overall market. The major automobile manufacturers are expected to drive growth in the region.

Robust Manufacturing Sector: Key Trend of North American Aromatic Solvents Market

North America is anticipated to witness significant growth in the forecast period, driven by regional industries, like automotive, construction, and general industries. These industries drive high-range demand for aromatic solvents for applications, including coating, paints, and oilfield chemicals. The stringent VOC emission regulations and increasing competition from green products are likely to hamper the regional market. However, ongoing innovations in sustainable production and government initiatives will help the region to foster the market.

The United States is the major player in the regional market, growth driven by the country's robust manufacturing sector for automotive, aerospace, and consumer goods, drives demand for aromatic solvents. The United States is offering advanced aromatic solvent technology, including high-performance solvents. Rising focus on sustainability and eco-friendly packaging solutions is encouraging key vendors to invest in recycling and biodegradable aromatic solvents.

Accelerating Demand in Various Industries is Fueling Europe

Europe is experiencing a notable expansion in the aromatic solvents market due to the rising demand for aromatic solvents in diverse areas, such as automotive, construction, and pharmaceutical industries. Along with this, Europe is reinforcing stringent environmental regulations, which are promoting the development and adoption of sustainable, low-VOC (Volatile Organic Compound) and bio-based options.

Emerging Green Chemistry & Other Innovations: Impacts on the German Market

The German Market is increasingly focusing on heavy investment in progressing green chemistry and solvent recycling. This further leverages demand for bio-based and de-aromatised solvents to meet stringent environmental legislation. Alongside, the leading companies in Germany are widely embracing innovative circular technologies, like well-sophisticated solvent recovery and closed loops.

Significant Regulatory Changes are Impacting South America

The aromatic solvents market in South America has been expanding, with the major regulatory changes, whereas Colombia's Decree No. 1630/2021 on chemical management is one of the key transformations. This further presents the requirement of registration of industrial chemicals and the execution of the Globally Harmonized System (GHS) for labelling and Safety Data Sheets (SDS) in Spanish.

Emphasis on Automotive & Product Launches: Forges Brazilian Market

Especially, Brazilian players are focusing mainly on the automotive industry to accelerate vehicle production, which further evolves demand for these solvents to use in paints, coatings, and adhesives for bonding parts. Alongside, they are leveraging product launches, such as BASF unveiled low-VOC organic solvents for coatings and printing applications, and Mitsubishi Chemical Group launched bio-based solvent blends using renewable ethanol feedstocks.

Presence of Plenty Feedstock & Government Support is Driving the MEA Market

The lucrative growth of the aromatic solvents market in MEA is influenced by the possession of the robust oil and gas feedstock, which offers an affordable and reliable source of petrochemical feedstock (including benzene, toluene, and xylene). Additionally, various initiatives by governments, such as Saudi Arabia and the UAE, are encouraging national plans (e.g., Saudi Vision 2030, UAE Operation 300bn) to modify their economies and expand local manufacturing, particularly in the chemicals sector.

Key Companies & Market Share Insights

The global market for aromatic solvents consists of few major players that operate globally with large production capacities because of this the market is highly consolidated in nature. For instance, Reliance Industries Limited (RIL) is the second largest producer of Paraxylene (PX) across the world with total production capacity of 4.3 MMTPA. Aromatic solvents are the major product line among the company's petrochemical sector with a total capacity of 5.7 MMTPA. Similarly, other companies in the market have significant product capacity and restricts the entry of new players in the market. Brand recognition and customer loyalty also plays a major role in market consolidation. Other than this, industry participants also focus prominently towards forward and backward integration to gain advantage over product price.

Aromatic Solvents Market: Value Chain Analysis

- Feedstock Procurement

This executes sourcing petroleum-based streams, such as naphtha, reformate, and pyrolysis gasoline, which are rich in aromatic compounds.

Key Players: ExxonMobil Corporation, Royal Dutch Shell plc, etc. - Distribution to Industrial Users

The market comprises order processing, packaging, hazardous material transportation, quality control checks at the receiving site, secure storage, and internal distribution.

Key Players: Mehta Petro-refineries Limited, Memba Chem Industries Pvt Ltd, GR Pahwa Enterprises, etc. - Regulatory Compliance and Safety Monitoring

OSHA, EPA, and GHS are focusing on the protection of human health and the environment from the hazards linked with these volatile organic compounds (VOCs).

Key Players: SGS, Sumerra, Gasmet Technologies, etc.

Key Players & Research Steps: Empowering the UAE Market

The presence of major leaders, like Trice Chemicals Industrial LLC, Al Khowahir Chemicals Mat. Trading L.L.C., etc., are bolstering the overall developments. Whereas the latest studies, which are funded by the UAE University, are implementing green extraction solutions using Natural Deep Eutectic Solvents (NADES) integrated with techniques, including ultrasound-assisted extraction (UAE).

Key Players Offering:

- Exxon Mobil Corporation- It has branded its solvents specifically under the ExxonMobil Aromatic and Solvesso product lines.

- China Petroleum & Chemical Corporation- A player offers benzene, toluene, and xylene (BTX), with crude aromatics, naphthalene fractions, and others.

- SK Global Chemical Co., Ltd.- A major leader facilitating aliphatic and de-aromatised ones, as part of its performance chemical portfolio.

- BASF SE- It usually provides a specific non-amine solvent, N-Formyl Morpholine (NFM), used in the extractive distillation of aromatics.

Aromatic Solvents Market Companies

- Royal Dutch Shell PLC

- Lyondellbasell Industries Holdings B.V.

- Reliance Industries Limited (RIL)

- China National Petroleum Corporation (CNPC)

- Chinese Petroleum Corporation (CPC)

- Total S.A.

Recent Developments

- On May 5, 2025, LANXESS announced the presentation of its extensive portfolio of aroma chemicals at SIMPPAR 2025, the international exhibition of raw materials for perfumery, which is taking place on June 4-5 at Espace Champerret in Paris.

- In January 2025, nucleophilic aromatic substitution (SNAr), a class of transformation that is widely used across the chemical industries, including pharmaceuticals and agrochemicals, was published in Nature. This process offers a greener, more efficient alternative to traditional chemical synthesis. Researchers from the Manchester Institute of Biotechnology and the Department of Chemistry at the University of Manchester describe the role of a new enzyme in significantly changing the way essential chemicals and medicines are made.

- In December 2024, chemists from Heinrich Heine University Düsseldorf (HHU) published an article titled "Fluorinated Squareimines for Molecular Sieving of Aromatic over Aliphatic Compounds" in the journal Angewandte Chemie International Edition, about an innovative molecular sieve made of partially fluorinated macrocycles that can separate these compounds selectively.

Segments Covered in the Report

By Product Type

- Benzene

- Xylene

- Toluene

- Others

By Application Type

- Pharmaceuticals

- Automotive

- Oilfield Chemicals

- Paints & Coatings

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client