List of Contents

What is the Medical Device Contract Manufacturing Market Size?

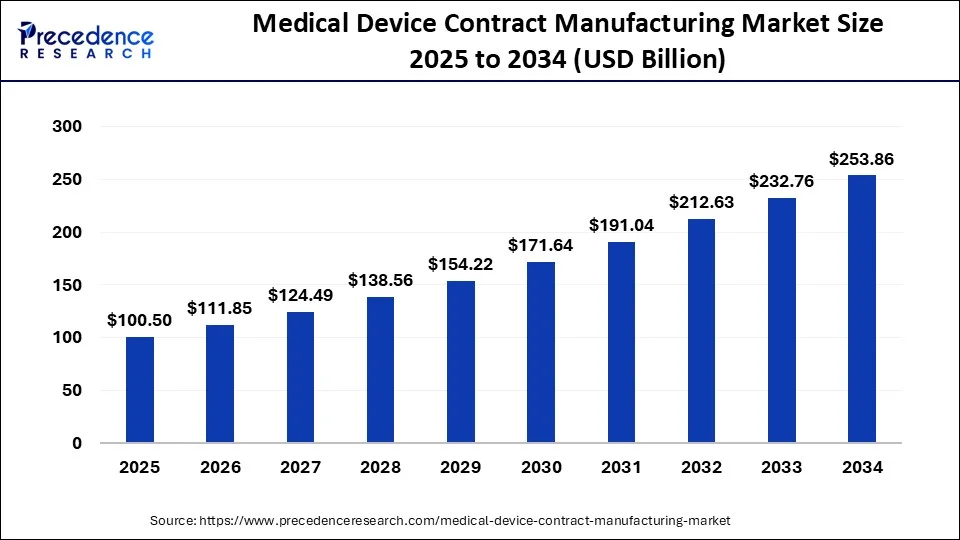

The global medical device contract manufacturing market size is accounted at USD 100.50 billion in 2025 and predicted to increase from USD 111.85 billion in 2026 to approximately USD 253.86 billion by 2034, representing a CAGR of 10.89% from 2025 to 2034. Rising prevalence of non-invasive surgical procedure are propelling the demand for medical devices and medical device contract manufacturing market across the world.

Medical Device Contract Manufacturing Market Key Takeaways

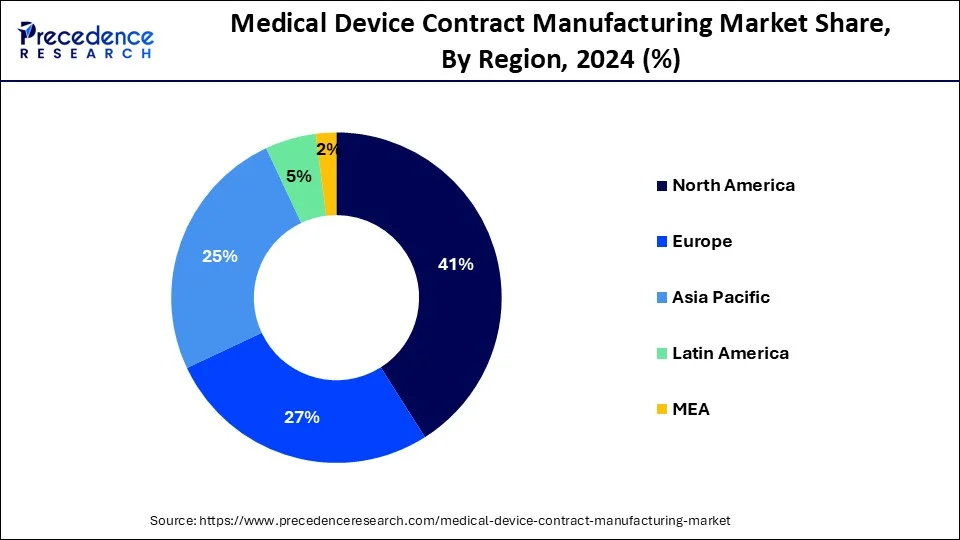

- North America leads the market with a share of 41% in 2024.

- By Device Type, the IVD devices segment has held the largest market share in 2024.

- By Service, the device development and manufacturing services segment generated over 54% of revenue share in 2024.

- By Application, the orthopedic segment had the largest market share in 2024.

- By Application, the orthopedic segment is expected to expand at a CAGR of 12.9% over the projected period.

What is Medical Device Contract Manufacturing?

The medical device contract manufacturing market is driven by the growing outsourcing from OEMs along with emerging healthcare needs in different parts of the world. Medical device contract manufacturing refers to the process of a company outsourcing the production of medical devices to a specialized third-party manufacturer.

What is the Role of AI in the Medical Device Contract Manufacturing Market?

Integration of artificial intelligence (AI) in medical device contract manufacturing is changing the landscape of the industry. With AI and Internet of Things (IoT) technology combination is helping real-time data tracking and analysis with improved connectivity is possible. There is a rise in demand for personalized and customized medicine, which is easily doable with AI. An AI based program can help manufacture customized and personalized needs specifically tailored for individual patients. This caters to patients that have a requirement of personalized devices. Combining AI and machine learning (ML) will boost the efficiency in manufacturing and improve performance of the medical device, It helps in reducing downtime, aids in quality control and identifies any defects during manufacturing process itself. AI can enhance productivity and efficiency that will help the growth of medical device contract manufacturing market.

Medical Device Contract Manufacturing Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the growing demand for high-quality medical devices coupled with surging adoption of portable healthcare devices by doctors.

- Major Investors: Several market players and strategic investors are actively entering this market, drawn by collaborations, R&D and joint ventures. Various medical device companies such as TE Connectivity Ltd., Kimball Electronics, Inc., Viant Medical, Celestica International Lp. and some others have started investing rapidly for providing CDMO services to other companies.

- Startup Ecosystem: Various startup brands are engaged in providing CDMO services across the world. The important startup companies dealing in CDMO services consists of Benchmark Electronics Inc., Integer Holdings Corporation, Gerresheimer AG and some others.

Medical Device Contract Manufacturing Market Growth Factors

Activity in the global medical device contract manufacturing market is driven by growing pressure on OEMs for medical devices to reduce manufacturing costs. In addition, macro-economic factors such as an increasing aging population across the globe paired with increasing prevalence of non-invasive surgical procedures are driving demand for medical devices and global medical device contract manufacturing market as well. In order to remain competitive in extremely specialized and increasingly segmented markets, OEMs need to rely on CMOs for everything from added manufacturing capabilities to product design and technical expertise.

Growing demand for R&D and post-market product support services for medical devices is expected to help the medical device contract manufacturing Industry to grow further. In the last few years, there has been a move towards outsourcing essential processes such as design, development, evaluation, feasibility testing, regulatory enforcement and post-market manufacturing activities such as product maintenance and upgrades.

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 253.86 Billion |

| Market Size in 2026 | USD 111.85 Billion |

| Market Size in 2025 | USD 100.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Device Type Insights

IVD devices, drug delivery devices, diagnostic imaging devices, patient monitoring devices, therapeutic patient assistive devices, minimally access surgical instruments, and others are the product type covered in the global medical device contract manufacturing market.

IVD devices accounted the considerable revenue share in product type segment of the global medical device contract manufacturing market in 2024 owing to growing adoption of point-of-care testing coupled with adoption of fully automated instruments and automation in laboratories is expected to support the growth of IVD devices in years tocome. In addition, changing lifestyle and rising chronic diseases is expected to fuel the growth of patient monitoring devices segment in near future and the segment will grow at a CAGR of 13.1%

Service Insights

The service segment of global medical device contract manufacturing market categorized device development and manufacturing services, quality management services and final goods assembly services. Amongst them, device development and manufacturing services held the largest share and accounted over 54% of revenue share in 2024. The growth of this segment is mainly driven by increasing demand for device engineering paired with device manufacturing services.

Application Insights

Growing demand for different orthopedic implants and device especially in elder population is predicted to propel orthopedic application segment massively in near future. The orthopedic application segment is estimated to grow at a CAGR of 12.9% in the analysis period.

Regional Analysis

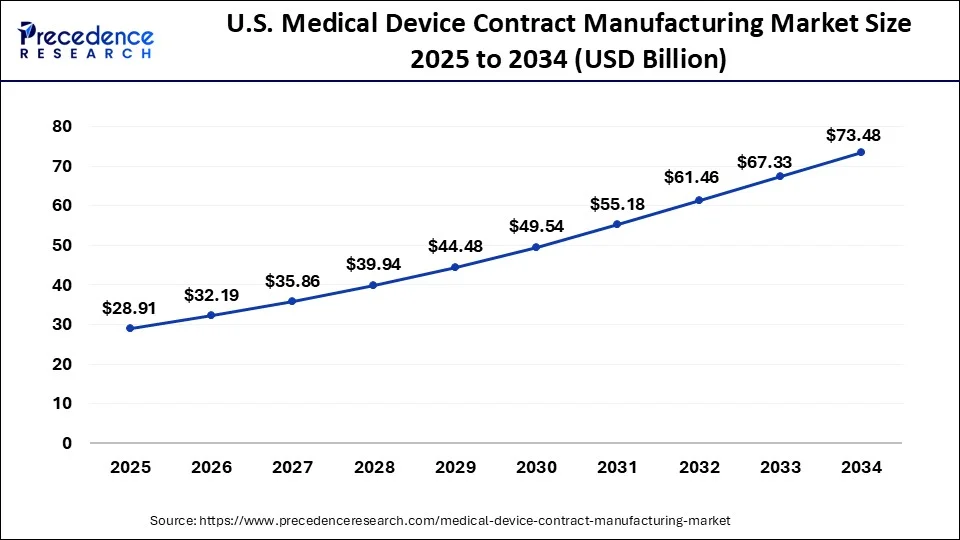

U.S. Medical Device Contract Manufacturing Market Size and Growth 2025 to 2034

The U.S. medical device contract manufacturing market size is valued at USD 28.91 billion in 2025 and is expected to be worth around USD 73.48 billion by 2034, poised to grow at a CAGR of 11% from 2025 to 2034.

Currently North America leads the global medical device contract manufacturing market closely followed by Asia Pacific region. The growth of North America region is mainly driven by increasing in-house manufacturing costs that encourages medical device companies to adopt contract manufacturing as cost-cutting measures. Further, presence of leading medical device players is expected to drive the U.S.medical device contract manufacturing market.

Low labor cost. Increasing aging population in Japan, growing access to healthcare facilities in India is estimated to be major driving factor in Asia Pacific region. The Asia Pacific region is predicted to overtake the North America region by late of 2024

Growing investments in health care especially in Africa and improvement of health care infrastructure across MEA is expected to open up massive opportunities for market players in coming years.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The increasing emphasis of healthcare companies to delegate their production capabilities to third-party companies has boosted the market expansion. Additionally, the presence of numerous market players in the UAE, South Africa, Qatar and some others is expected to boost the growth of the medical device contract manufacturing market in this region.

Why Asia Pacific held a significant share of the market?

Asia Pacific held a significant share of the industry. The growing demand for drug delivery devices and diagnostic imaging devices from the hospitals has driven the market expansion. Additionally, rapid investment by government for developing the healthcare sector in prominent countries such as India, China, Japan and some others is expected to propel the growth of the medical device contract manufacturing market in this region.

What led Latin America to hold a considerable share of the industry?

Latin America held a considerable share of the market. The increasing demand for portable medical devices in Brazil and Argentina has boosted the market growth. Also, partnerships among CDMO providers and medical device companies for developing advanced healthcare devices is expected to foster the growth of the medical device contract manufacturing market in this region.

Key Players in Medical Device Contract Manufacturing Market & Their Offerings

- Flex, Ltd.: Flex, Ltd is a global manufacturing services company that provides design, engineering, manufacturing, and supply chain services to clients across various industries, including automotive, healthcare, and consumer devices

- Nortech Systems, Inc.:Nortech Systems, Inc. is an electronics manufacturing services (EMS) provider that offers design and manufacturing solutions for complex electromechanical systems, including printed circuit board and wire/cable assemblies

- Sanmina Corporation:Sanmina Corporation is a global, integrated manufacturing solutions provider that offers end-to-end design, engineering, manufacturing, and logistics services for Original Equipment Manufacturers (OEMs).

- Nipro Corporation:Nipro Corporation is a Japanese medical equipment manufacturer founded in 1954, headquartered in Osaka. The company develops, manufactures, and sells a wide range of healthcare products, including medical devices for dialysis and infusions, pharmaceuticals, and pharmaceutical glass.

- Jabil Inc.: Jabil Inc. is a global manufacturing services company headquartered in St. Petersburg, Florida, that provides design, engineering, and manufacturing solutions for a wide range of products and industries. The company specializes in electronics and offers services including supply chain management, product design, and after-market services

- Nemera Development S.A.: Nemera Development S.A. is a global leader in the design, development, and manufacturing of drug delivery devices for the pharmaceutical, biotechnology, and generics industries. The company's core mission is to be patient-centric, offering a wide range of products and services, including eye droppers, pumps, nasal sprays, inhalers, auto-injectors, and some others.

Other Major Companies

- TE Connectivity Ltd.

- Kimball Electronics, Inc.

- Viant Medical

- Celestica International Lp.

- Plexus Corp.

- SMC Ltd.

- Phillips-Medisize Corporation

- Benchmark Electronics Inc.

- Integer Holdings Corporation

- Gerresheimer AG

- Consort Medical PLC

- Tessy Plastics Corp

- Tecomet, Inc.

Recent Developments

- In November 2025, Forj Medical launched CDMO service in the U.S. This service is launched in a partnership of Intricon and Minnetronix Medical.

(Source: designnews.com) - In November 2025, SK Capital Partners acquired LISI Group's Medical Division. This acquisition is done for launching a CDMO platform in the U.S.

(Source: businesswire.com) - In September 2025, Spark Biomedical announced to partner with Velentium Medical. This partnership is aimed at launching OhmBody.

(Source: businesswire.com) - In January 2024, TekniPlex Healthcare completed its acquisition of Seisa Medical following the strategic agreement. This acquisition helped TekniPlex expand their product portfolio in minimal invasive and interventional therapies.

- In July 2024, Tube Investment of India (TII) announced their plans to strengthen contract manufacturing operations for their medical branch with a new facility in the state of Andhra Pradesh in India.

- In August 2024, a new company in healthcare, Salt Medical that is a contract development and manufacturing organization (CDMO). They focus on medical devices and decided to move into Claregalway Corporate Park in County Galway, Ireland, to explore innovative opportunities.

Segments Covered in the Report

By Device Type

- IVD Devices

- Drug Delivery Devices

- Diagnostic Imaging Devices

- Patient Monitoring Devices

- Therapeutic Patient Assistive Devices

- Minimally Access Surgical Instruments

- Others

By Service

- Device Development and Manufacturing Services

- Quality Management Services

- Final Goods Assembly Services

By Application

- Laparoscopy

- Pulmonary

- Urology & Gynecology

- Cardiovascular

- Orthopedic

- Oncology

- Neurovascular

- Radiology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client