List of Contents

What is the Manufacturing Analytics Market Size?

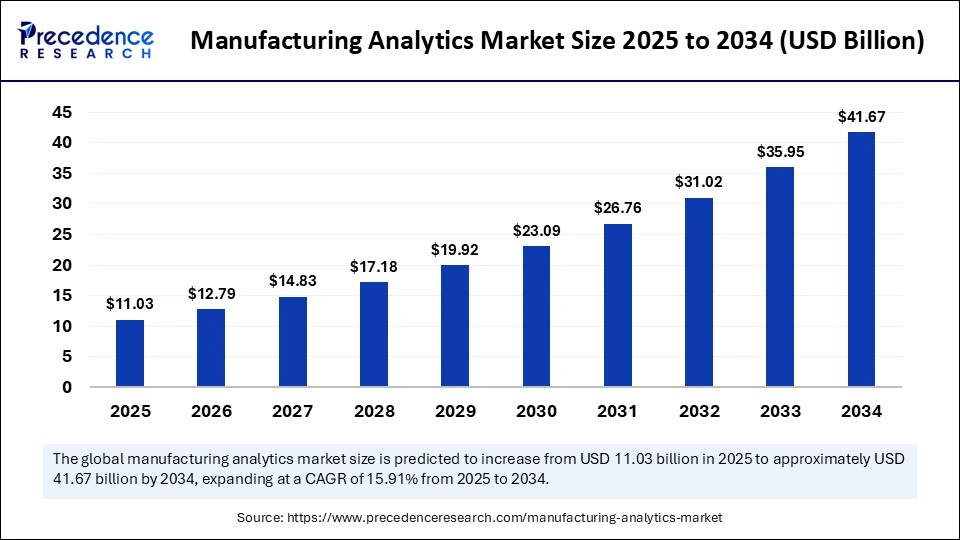

The global manufacturing analytics market size is calculated at USD 11.03 billion in 2025 and is predicted to increase from USD 12.79 billion in 2026 to approximately USD 41.67 billion by 2034, expanding at a CAGR of 15.91% from 2025 to 2034. The manufacturing analytics market is driven by the rising adoption of AI, IoT, and big data to enhance operational efficiency and predictive maintenance in manufacturing processes.

Market Highlights

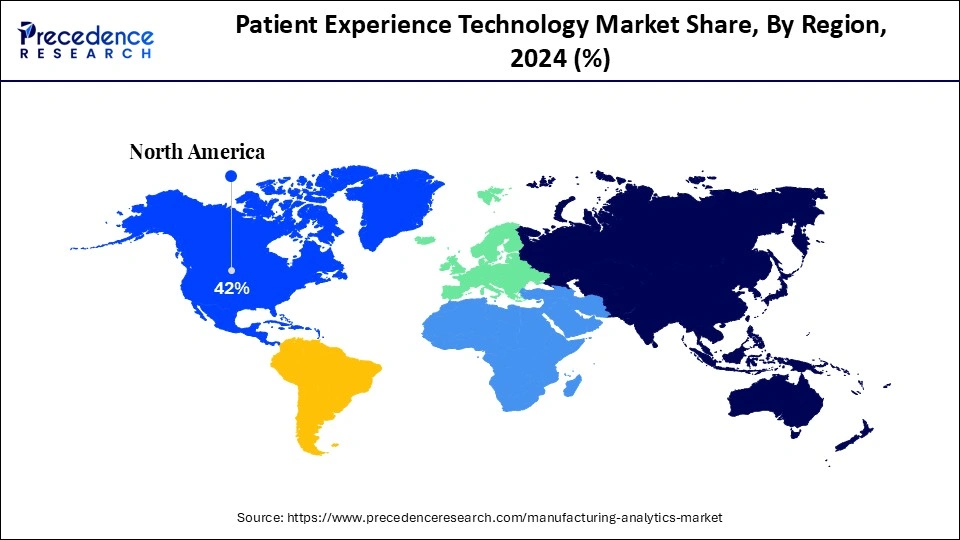

- North America dominated the global market with the largest market share of 42% in 2024.

- The Asia Pacific is anticipated to witness the fastest CAGR of 26% from 2025 to 2034.

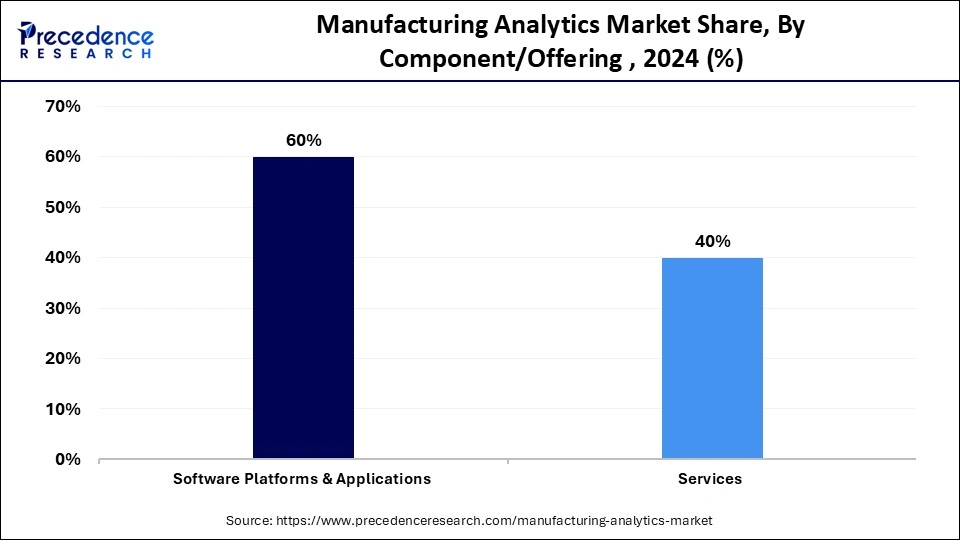

- By component/offering, the software platforms & applications segment captured more than 60% of market share in 2024.

- By component/offering, the services segment is expanding at a 25% of CAGR from 2025 to 2034.

- By deployment model, the on-premises segment led the market while holding a 55% market share in 2024.

- By deployment model, the cloudâ€based / saas segment is growing at a notable CAGR of 28% in 2024.

- By application/use case, the predictive maintenance & asset management segment held the major market share of 38% in 2024.

- By application/use case, the inventory & supply chain optimization segment is expanding at a strong CAGR of 22% between 2025 and 2034.

- By industry vertical, the automotive manufacturing segment contributed the major market share of 30% in 2024.

- By industry vertical, the electronics & semiconductor manufacturing segment is poised to grow at a solid CAGR of 24% from 2025 to 2034.

Analytics in Manufacturing: The Journey From Data to Value

The global manufacturing analytics market is a disruptive component of the industrial environment since it enables manufacturers to utilize the power of data to make more intelligent decisions and improve the performance of their organizations. It consists of several software, platforms, and analysis tools that are designed to amass, process, and analyze machine, sensor, production-line, and supply-chain generated data. The solutions help to simplify major processes in the organization, such as predictive, quality, process automation, and energy management, which reduce downtime and enhance productivity.

The market of manufacturing analytics is growing due to the rapid rate of adoption of Industry 4.0 and smart manufacturing initiatives to facilitate improved operational visibility and efficiency. An increasing need to develop predictive maintenance solutions that will help reduce equipment failure and production losses is one of the driving factors, and it is facilitated by the implementation of IoT-based sensors and cloud applications for analytics. The growing interest in sustainability and energy efficiency in the manufacturing process also leads to the demand for analytics tools, which will help to use the resources as optimally as possible and minimize waste. Moreover, real-time monitoring and optimization of complex manufacturing networks are undergoing increased expansion due to the increasing popularity of edge computing, digital twins, and augmented analytics.

AI-Powered Manufacturing: The Next Productivity Frontier

The incorporation of artificial intelligence in the manufacturing analytics market is changing the landscape as it is making decisions smart, faster, and more precise. To identify the trends and anticipate failures, and to simplify production processes with limited human intervention, AI-based analytics systems are based on machine learning algorithms and IoT sensors to generate real-time data. AI reduces equipment downtimes and operations, predictive maintenance, quality inspection, and defect detection by computer vision. As factories become autonomous and interconnected ecosystems, AI improves the visibility of the supply chains, distribution of resources, and energy management.

Manufacturing Analytics Market Outlook

The manufacturing analytics market is characterized by healthy growth based on the adoption of Industry 4.0 technologies and the need to make decisions that rely on data. Firms are becoming more efficient, reducing downtimes, and productive due to real-time insights that analytics provide to manufacturers.

North America, Europe, and the Asia Pacific are rapidly becoming industrialized digitally and helping to expand the world. Emerging economies are moving to analytics to modernize their manufacturing systems with the support of smart factories and automation by the government.

To help AI, IoT, and predictive analytics be more useful, big investors such as Siemens, IBM, Microsoft, SAP, and GE Digital are actively investing in R&D. Venture capital firms are also investing in innovative analytics startups to accelerate the process of industrial transformation.

The manufacturing analytics startup ecosystem works well because companies develop niche AI-predictive and prescriptive applications. New entrants are working on cloud-based and scalable software and architectures that can be readily incorporated into existing production systems to deliver real-time data intelligence.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.03 Billion |

| Market Size in 2026 | USD 12.79 Billion |

| Market Size by 2034 | USD 41.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.91% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component / Offering, Deployment Model, Application / Use Case, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Manufacturing Analytics Market Segment Insights

Component / Offering Insights

The software platforms & applications segment held a 60% share in the manufacturing analytics market in 2024, owing to the growing use of more advanced analytics platforms that can track operations in real time, visualize performance, and predictive analytics across manufacturing operations. These platforms provide descriptive, predictive, and prescriptive analytics modules, which are applicable in the achievement of inefficiencies, maximization of machine performance, and reduction of unexpected downtime. As the Industry 4.0 and IoT models are increasingly applied by manufacturers, smart factories have become mostly dependent on software intelligence.

The services segment captured a 25% share of the market in 2024 and is expected to grow significantly. This category covers consulting, implementation, managed services, and continuing technical support to provide successful integration of analytics and optimization of performance. With more complex and data-intensive manufacturing infrastructures, enterprises are increasingly outsourcing specialized services to facilitate deployment, data interoperability, and increasing returns on investment.

Deployment Model Insights

The on-premises segment held a 55% share in the manufacturing analytics market in 2024. Manufacturers with sensitive data to operate, intellectual property, and proprietary production processes have embraced on-premise deployment to have total ownership of the data infrastructure and reduce cybersecurity risk. This model supports organizations to tailor analytics models on their current IT systems and regulatory demands in industries like automotive, aerospace, and defense, where data privacy and real-time operations management a key priorities.

The cloud‐based / saas segment is poised for substantial growth in the market, holding a 28% share in 2024. Scalability, cost-effectiveness, and remote accessibility make cloud-based deployment highly appropriate for manufacturers seeking flexibility in managing distributed operations. As the world goes digital, cloud platforms can facilitate a smooth integration of analytics across global production facilities, supply chains, and partner networks. These systems can offer real-time visibility and support predictive insight and prescriptive insight without capital-intensive systems.

The hybrid deployment model, which combines on-premise and cloud-based systems, is gaining strong traction in the manufacturing analytics market because it offers both control and flexibility. Manufacturers prefer this approach because it allows them to keep sensitive operational data securely on-premises while using the cloud for large-scale data processing, real-time analytics, and cross-site collaboration. This setup supports faster decision-making by enabling seamless data flow between factory floors and enterprise systems without compromising data privacy. Hybrid deployment also helps reduce infrastructure costs by optimizing workloads between local servers and the cloud, ensuring high performance and scalability.

Application / Use Case Insights

The predictive maintenance & asset management segment held a 38% share in the manufacturing analytics market in 2024, due to the full usage of advanced analytics, IoT sensors, and machine learning algorithms. This segment keeps the machinerys real-time health under control, identifies anomalies, and predicts potential failures even before they occur. The manufacturers will be able to save a lot of space during unexpected downtime, extend equipment life, and reduce repair costs by enabling proactive maintenance scheduling. Predictive analytics can also assist in the optimal use of resources and continuation of production, and reduce the disruption in the complex manufacturing lines. Digital twins and AI-powered diagnostics also allow the maintenance systems to be even more precise and responsive.

The inventory & supply chain optimization segment is expected to grow substantially in the manufacturing analytics market, with a 30% market share. The analytics-based inventory systems are based on real-time data, AI algorithms, and demand forecast models to optimize stock levels, minimize idle inventory, and avoid stockouts. These solutions provide end-to-end visibility in warehouses, production units, as well as distribution networks that would enable faster and more precise decision-making. With the increasing use of lean manufacturing and just-in-time production methods, the efficient use of inventory and supply-chain efficiency has become a primary concern. The predictive analytics and automation can enable manufacturers to predict the changes in demand, streamline logistics, and enhance the coordination of suppliers.

Quality control and defect analytics have become central to the growth of the manufacturing analytics market, driven by the need for precision, consistency, and waste reduction in production lines. Using advanced analytics, manufacturers can monitor real-time data from sensors, machines, and inspection systems to detect even the smallest variations that may lead to defects. Predictive models help identify root causes early, allowing teams to take corrective action before product quality is compromised. This proactive approach not only improves production efficiency but also reduces rework, downtime, and material loss. By integrating AI and machine learning, manufacturers can continuously refine their quality benchmarks, ensuring each product meets strict standards and customer expectations

Industry Vertical Insights

The automotive manufacturing segment led the market while holding a 30% share in 2024, due to the high precision engineering, quality control, and operation efficiency requirements of the sector. Extensive applications of analytics solutions in this vertical include optimization of production lines, improvement of designing processes, and strict adherence to the safety and environmental regulations. Predictive analytics also allows proactive maintenance of assembly-line machines so that production is not interrupted and costs are saved. In addition, the development of connected vehicle technologies, the electric car manufacturing, and the automation of the inspection systems are intertwined with the necessity to consider advanced analytics tools.

The electronics & semiconductor manufacturing segment is projected to grow at a significant CAGR over the forecast period, holding a 24% share in 2024. The use of analytics is ubiquitous in terms of quality control of production, minimizing cycle times, and the enhancement of consistency in processes of semiconductor manufacturing and electronic component assembly. Using predictive analytics and machine learning, the manufacturers can identify the anomalies in time, avoid equipment errors, and ensure strict control over the process.

Metal and machinery manufacturing is emerging as one of the key adopters of analytics-driven transformation within the manufacturing analytics market. These industries deal with complex production processes that require high precision, real-time monitoring, and tight quality control. By using manufacturing analytics, metal and machinery producers can track machine performance, energy consumption, and production efficiency across multiple stages of fabrication and assembly. Predictive maintenance powered by data analytics helps reduce equipment downtime, extend asset lifespan, and lower maintenance costs.

Manufacturing Analytics MarketRegion Insights

The North America manufacturing analytics market size is estimated at USD 4.63 billion in 2025 and is projected to reach approximately USD 17.50 billion by 2034, with a 15.90% CAGR from 2025 to 2034.

Why Did North America Lead the Global Manufacturing Analytics Market in 2024?

North America led the global market with the highest market share of 42% in 2024, due to the high level of technology and the early adoption of Industry 4.0 programs. The area has large analytics vendors, industrial automation giants, and cloud service providers, which are busy working on integrated data-driven manufacturing solutions. The widespread knowledge among companies about the advantages of high-tech analytics has stimulated the rapid implementation of advanced analytics in industries, including higher productivity, fewer downtimes, and quality management.

The innovation, sustainability, and digital transformation have placed the region at the forefront in the use of predictive maintenance, digital twins, and smart factory systems. The involvement of technology giants, startups, and industrial automation companies in collaboration is driving innovation in more advanced data visualization and machine learning applications.

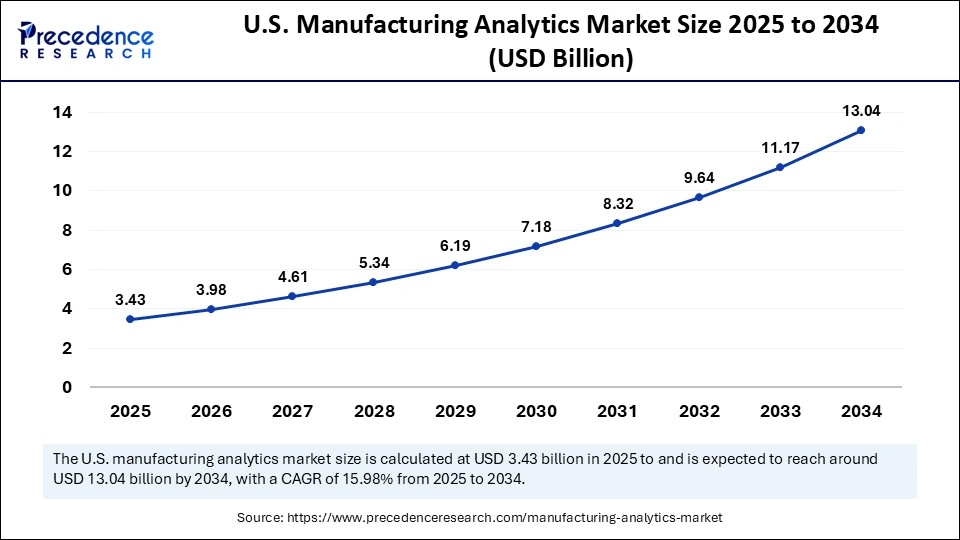

The U.S. manufacturing analytics market size is calculated at USD 3.43 billion in 2025 and is expected to reach nearly USD 13.04 billion in 2034, accelerating at a strong CAGR of 15.98% between 2025 and 2034.

U.S. Manufacturing Analytics Market Trends

The U.S. manufacturing analytics market is marked by a high level of accelerated digitalization and orientation towards operational intelligence. The automotive, aerospace, and electronic industries are witnessing manufacturers use AI-based analytics to enhance equipment performance and minimize waste, and improve manufacturing throughput. The increase of cloud-based analytics and edge computing is in favor of real-time decision-making and scalability among distributed manufacturing locations. Carmel and sustainability analytics are also being invested in by U.S. companies in order to match the energy efficiency targets and environmental requirements. Moreover, the U.S. is becoming an international center of advanced manufacturing analytics solutions through government programs that encourage reshoring and smart manufacturing.

Asia Pacific has been estimated to achieve the highest CAGR throughout the forecast period with a 26% market share. The increasing digitalization of industries, the use of smart factory technologies, and the increased governmental support of Industry 4.0 projects. China, Japan, South Korea, and India are very actively investing in the IoT, AI, and cloud-based analytics to improve efficiency, quality control in production, and visibility of the supply chain. The massive manufacturing footprint in the area, through automotive, electronics, semiconductors, and heavy industries, makes the demand for real-time analytics to enhance competitiveness and agility in operations enormous. Moreover, the trend in the increase of data-driven production, escalation of labor expenses, and an inclination to automate are prompting businesses to implement predictive and prescriptive analytics models.

China Manufacturing Analytics Market Trends

China is the leader of the Asian Pacific in terms of the production of analytics, which is pre-destined by the large industry and national interest in the sphere of smart production as a part of the program Made in China 2025. The Chinese manufacturers are also rapidly adding IoT-based sensors, robotics, and AI analytics in their manufacturing lines to increase the accuracy of their production, reduce defects, and make the production lines more energy efficient. The intense governmental push in the direction of the digitalization of the sector, not to mention the high level of investments into 5G and edge computing, is putting China on the edge of manufacturing analytics advancement and broadening its use.

The European manufacturing analytics market is witnessing sustainable growth. The use of analytics is becoming more common among The European manufacturing analytics market is growing on a sustainable basis. Analytics is additionally becoming more widespread among European manufacturers to enhance the efficiency of their operations, reduce their carbon footprints, and comply with the rigorous environmental and safety regulations. Efforts such as Industry 5.0 and the Digital Europe Program created by the EU are accelerating the implementation of AI, IoT, and other advanced data analytics in systems of production. Germany, France, and Italy are among the countries that have been leading in the adoption of smart manufacturing that is supported by government incentives for digital innovation and automation.

UK Manufacturing Analytics Market Trends

The UK market of manufacturing analytics is steadily growing, which is facilitated by the fact that the country pays much attention to the modernization of its industrial sector by using digital technologies. Analytics have allowed manufacturers in the UK to enhance their production planning, asset utilization, and the level of energy efficiency. The development of intelligent factories and the use of cloud computing pre-calculation systems are facilitating the creation of a continuous exchange of data between manufacturing sites and supply chains. The increasing focus on sustainability, as well as the necessity to stay competitive in an international market after Brexit, still contributes to the high pace at which the UK develops manufacturing analytics implementation and innovation.

Manufacturing Analytics Market Value Chain

This stage provides the technological foundation that enables manufacturing analytics solutions to capture and process industrial data. It includes:

- Data Sources: Industrial equipment, sensors, programmable logic controllers (PLCs), manufacturing execution systems (MES), enterprise resource planning (ERP) systems, and IoT devices generating operational data.

- Connectivity Infrastructure: Industrial networks (Ethernet, 5G, LPWAN), gateways, and edge computing devices that aggregate and transmit data securely and in real time.

- Data Storage and Cloud Platforms: Cloud service providers (AWS, Microsoft Azure, Google Cloud) and industrial data lakes offering scalable storage and computing environments.

- Upstream value is captured by companies that deliver high-reliability data capture, low-latency connectivity, and secure data infrastructure. Firms with proprietary industrial protocols, cybersecurity capabilities, and pre-integrated IoT ecosystems (e.g., Siemens MindSphere, PTC ThingWorx) hold a competitive advantage.

This is the heart of the value chain, where raw manufacturing data is transformed into actionable intelligence through advanced analytics, artificial intelligence, and visualization tools. It includes:

- Analytics Software and Tools: Machine learning platforms, predictive maintenance modules, process optimization algorithms, and quality analytics engines.

- Integration and Middleware: APIs and connectors linking operational data (OT) with business systems (IT), enabling end-to-end visibility from the factory floor to the enterprise level.

- Consulting, Customization, and Systems Integration: Vendors and service providers tailor analytics platforms to the unique production, quality, and compliance requirements of each manufacturer.

Value capture at this stage is driven by algorithmic sophistication, domain expertise, and scalability. Vendors that combine AI-driven analytics with deep manufacturing domain knowledge generate the highest margins. Software developers also capture recurring revenue via subscription models (SaaS), managed analytics services, and cloud hosting fees.

Companies like IBM, SAP, Siemens, Rockwell Automation, and GE Digital dominate this midstream segment by offering integrated analytics ecosystems that combine hardware, software, and industrial expertise.

This downstream stage covers the deployment, adoption, and value realization of analytics solutions within manufacturing operations. Activities include:

- Deployment and Training: Implementation of analytics platforms on-premises or in the cloud, data model calibration, and workforce training for operators and engineers.

- Operational Analytics: Real-time monitoring of production lines, predictive maintenance scheduling, quality deviation alerts, supply chain optimization, and energy management.

- Decision Support and Continuous Improvement: Integration of analytics insights into lean manufacturing initiatives, performance dashboards, and strategic planning.

- Value at this stage is captured by manufacturers that successfully translate data insights into productivity improvements, reduced downtime, and cost savings. Service providers and consulting firms (Accenture, Capgemini, Deloitte) add value through change management, digital transformation consulting, and ROI measurement frameworks.

Manufacturing Analytics Market Companies

Corporate Information

- Headquarters: Walldorf, Baden Wurttemberg, Germany

- Year Founded: 1972

- Ownership Type: Publicly Traded (FWB: SAP; NYSE: SAP)

History and Background

SAP SE was founded in 1972 by former IBM engineers Dietmar Hopp, Hasso Plattner, Claus Wellenreuther, Klaus Tschira, and Hans Werner Hector with the goal of developing standard application software for real-time business processing. Today, SAP is one of the largest enterprise software providers in the world, offering integrated solutions across industries including manufacturing, finance, supply chain, and analytics.

In the Manufacturing Analytics Market, SAP provides advanced solutions through its SAP Digital Manufacturing Cloud (DMC) and SAP S/4HANA platforms. These systems integrate data from production, quality, and logistics processes, enabling manufacturers to gain real-time insights, optimize operations, and achieve predictive analytics capabilities. SAP analytics tools combine IoT, AI, and machine learning to empower data-driven decision-making and continuous improvement in manufacturing environments.

Key Milestones / Timeline

- 1972: Founded in Walldorf, Germany

- 2004: Introduced SAP NetWeaver for enterprise integration

- 2015: Launched SAP S/4HANA for real-time enterprise analytics

- 2018: Released SAP Digital Manufacturing Cloud for Industry 4.0 integration

- 2024: Enhanced AI and predictive analytics modules for smart factory applications

Business Overview

SAP SE provides integrated enterprise resource planning (ERP), supply chain, and analytics platforms that connect shop-floor operations with enterprise-level decision-making. Its manufacturing analytics solutions enable visibility across the entire production lifecycle tracking performance, predicting downtime, and improving resource utilization.

Business Segments / Divisions

- Applications, Technology & Services

- Business Network

- Cloud ERP Solutions

- Intelligent Spend and Supply Chain Management

Geographic Presence

SAP operates in more than 180 countries with major offices in Germany, the United States, India, China, and the United Kingdom.

Key Offerings

- SAP Digital Manufacturing Cloud (DMC) Cloud-based platform integrating IoT data for shop-floor analytics

- SAP S/4HANA Manufacturing Suite Unified ERP and analytics solution for real-time manufacturing visibility

- SAP Analytics Cloud Predictive analytics and AI-driven insights for manufacturing performance optimization

- SAP Business Technology Platform (BTP) Integration and data management foundation supporting analytics applications

Financial Overview

SAP SE reports annual revenues exceeding 32 billion (approx. $35 billion USD), with cloud and analytics solutions contributing significantly to its growth in the industrial technology segment.

Key Developments and Strategic Initiatives

- March 2023: Released predictive quality management module within SAP DMC

- October 2023: Partnered with Siemens to enhance interoperability between ERP and manufacturing execution systems

- May 2024: Integrated AI-based production anomaly detection into SAP Analytics Cloud

- January 2025: Announced new digital twin analytics capabilities for smart manufacturing ecosystems

Partnerships & Collaborations

- Collaboration with Siemens Digital Industries for smart manufacturing solutions

- Partnership with AWS and Google Cloud for scalable analytics deployment

- Alliances with industrial automation vendors for IoT integration

Product Launches / Innovations

- SAP Digital Manufacturing Cloud for Insights (2023)

- AI-driven predictive maintenance feature (2024)

- Integration with SAP Sustainability Control Tower for energy-efficient manufacturing (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, predictive analytics, AI/ML, IoT integration, and digital twins

- Research Infrastructure: Global innovation centers in Germany, the U.S., and India

- Innovation focus: Real-time analytics, autonomous process control, and sustainability insights

Competitive Positioning

- Strengths: Strong ERP backbone, global presence, and deep integration across manufacturing processes

- Differentiators: Seamless linkage between operational data and enterprise analytics

SWOT Analysis

- Strengths: Market leadership in ERP and analytics integration, global customer base

- Weaknesses: Complex implementation for smaller manufacturers

- Opportunities: Expansion in Industry 4.0 and AI-driven analytics solutions

- Threats: Competition from agile cloud-native analytics providers

Recent News and Updates

- April 2024: SAP launched integrated predictive manufacturing analytics tool within DMC

- August 2024: Formed partnership with Microsoft Azure for enhanced data interoperability

- January 2025: Announced cloud-native expansion for SAP Analytics Cloud in manufacturing performance monitoring

Corporate Information

- Headquarters: Austin, Texas, United States

- Year Founded: 1977

- Ownership Type: Publicly Traded (NYSE: ORCL)

History and Background

Oracle Corporation was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates as Software Development Laboratories (SDL), later renamed Oracle in 1982. The company pioneered relational database management systems (RDBMS) and has since expanded into a comprehensive provider of cloud infrastructure, enterprise software, and analytics platforms.

In the Manufacturing Analytics Market, Oracle offers advanced, cloud-based analytical solutions that unify operational, financial, and supply chain data to optimize manufacturing performance. Through Oracle Fusion Cloud Manufacturing and Oracle Analytics Cloud, the company empowers manufacturers to leverage data-driven insights for process optimization, predictive maintenance, and real-time decision-making across distributed production networks.

Key Milestones / Timeline

- 1977: Founded as Software Development Laboratories (SDL)

- 1982: Released Oracle Database 2, pioneering relational database systems

- 2016: Launched Oracle Cloud Infrastructure (OCI)

- 2020: Introduced Oracle Fusion Cloud Supply Chain & Manufacturing (SCM)

- 2024: Integrated AI and IoT analytics into Oracle Cloud Manufacturing applications

Business Overview

Oracle operates as a global technology corporation offering end-to-end enterprise software and cloud services. In the manufacturing sector, Oracle analytics capabilities focus on enabling smart manufacturing and digital transformation by integrating data from ERP, MES, and IoT systems. Its solutions enhance quality control, reduce downtime, and improve supply chain efficiency through AI-driven process insights.

Business Segments / Divisions

- Oracle Cloud Infrastructure (OCI)

- Oracle Fusion Cloud Applications

- Analytics and Data Management

- Industry-Specific Solutions (Manufacturing, Healthcare, Finance, etc.)

Geographic Presence

Oracle serves clients in over 175 countries, with major research and cloud infrastructure facilities in the United States, India, Japan, and the United Kingdom.

Key Offerings

- Oracle Fusion Cloud Manufacturing End-to-end production management and analytics platform

- Oracle Analytics Cloud (OAC) Advanced analytics suite for manufacturing KPIs and process optimization

- Oracle IoT Cloud Real-time monitoring and predictive maintenance for industrial assets

- Oracle Cloud SCM Integrated supply chain visibility and operations intelligence

Financial Overview

Oracle reports annual revenues exceeding $50 billion USD, with its cloud and analytics divisions driving robust growth through digital manufacturing transformation initiatives.

Key Developments and Strategic Initiatives

- March 2023: Integrated AI-based root cause analysis for production anomalies in Oracle Analytics Cloud

- October 2023: Introduced new manufacturing performance dashboards within Oracle Fusion Cloud SCM

- May 2024: Launched predictive factory operations platform with embedded machine learning

- January 2025: Enhanced interoperability between Oracle Analytics Cloud and industrial IoT platforms

Partnerships & Collaborations

- Partnerships with industrial automation providers for data integration with Oracle Cloud

- Collaborations with manufacturing leaders for digital twin and Industry 4.0 applications

- Alliances with AWS and Azure for hybrid cloud analytics deployment

Product Launches / Innovations

- Oracle Fusion Cloud Smart Manufacturing Suite (2023)

- AI-powered Factory Analytics Platform (2024)

- IoT-enabled Predictive Maintenance Module (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, AI/ML, IoT analytics, and predictive modeling

- Research Infrastructure: Oracle Labs and global data centers supporting advanced analytics R&D

- Innovation focus: Intelligent factory analytics, edge-to-cloud data orchestration, and AI-driven production optimization

Competitive Positioning

- Strengths: Strong data infrastructure, scalable cloud architecture, and integrated analytics platform

- Differentiators: Deep AI and IoT integration enabling real-time factory insights and predictive optimization

SWOT Analysis

- Strengths: Proven enterprise analytics ecosystem, global scale, and robust AI capabilities

- Weaknesses: The Complexity of system integration for smaller enterprises

- Opportunities: Growth in Industry 4.0 and edge-to-cloud manufacturing analytics

- Threats: Intense competition from SAP, Microsoft, and emerging data analytics vendors

Recent News and Updates

- April 2024: Oracle launched an AI-driven analytics layer for manufacturing process optimization

- August 2024: Collaborated with an automotive manufacturer on digital twin integration using Oracle Cloud

- January 2025: Announced expansion of Oracle Analytics Cloud for real-time predictive manufacturing insights

Other Manufacturing Analytics Market Companies

- IBM Corporation: IBM provides advanced industrial analytics and AI-driven software solutions through its Watson and Maximo platforms. The companys technologies enable predictive maintenance, asset optimization, and real-time operational analytics for manufacturing, utilities, and industrial enterprises.

- Microsoft Corporation: Microsoft delivers industrial data analytics and IoT integration through its Azure cloud ecosystem. Its AI, data visualization, and automation tools help organizations optimize production efficiency, energy management, and predictive insights across digital manufacturing environments.

- SAS Institute Inc: SAS offers powerful data analytics and industrial intelligence platforms designed for manufacturing, energy, and logistics sectors. Its solutions combine machine learning, quality analytics, and real-time monitoring to improve performance, reduce downtime, and enhance process control.

- Siemens AG: Siemens integrates data analytics and automation through its MindSphere and Industrial Edge platforms. The company provides end-to-end digitalization solutions for smart factories, leveraging AI and IoT to drive process efficiency, energy optimization, and predictive maintenance.

- GE Digital (General Electric): GE Digital provides industrial software solutions such as Predix and APM (Asset Performance Management) that enable predictive analytics, process optimization, and operational efficiency across sectors including energy, aviation, and manufacturing.

- ABB Ltd.: ABB offers industrial analytics and automation software that supports smart manufacturing and energy management. Its ABB Ability platform integrates AI and IoT technologies for real-time asset tracking, process diagnostics, and data-driven decision-making.

- Rockwell Automation: Rockwell Automation combines industrial automation with data analytics through its FactoryTalk Analytics suite. The company enables manufacturers to collect, visualize, and act on production data for efficiency, safety, and performance improvements.

- TIBCO Software Inc.: TIBCO provides enterprise analytics and data integration platforms that support industrial data processing and predictive insights. Its technologies enable connectivity across IoT systems and manufacturing workflows for enhanced operational intelligence.

- Alteryx Inc.: Alteryx delivers low-code analytics and automation tools that empower industrial enterprises to streamline data preparation, visualization, and modeling. Its solutions enable faster decision-making through data blending and predictive analytics for process optimization.

- Tableau Software (Salesforce): Tableau, a Salesforce company, provides powerful data visualization and analytics tools for industrial and manufacturing environments. Its intuitive dashboards enable engineers and managers to monitor performance metrics, quality data, and predictive trends.

- PTC Inc.: PTC offers industrial analytics solutions integrated with its ThingWorx and Kepware platforms, enabling manufacturers to connect, monitor, and analyze industrial systems. Its focus on digital twins and IoT analytics supports predictive maintenance and smart manufacturing initiatives.

- Schneider Electric SE: Schneider Electric provides analytics and automation solutions through its EcoStruxure platform, offering real-time insights for energy management, industrial control, and asset performance optimization. The company emphasizes sustainability and digital transformation across industries.

- Wipro Limited: Wipro delivers industrial analytics and AI-based process optimization through its Industry 4.0 and cloud transformation solutions. The company focus on IoT integration, predictive maintenance, and smart factory design supports digital manufacturing and operational excellence.

Recent Developments

- In June 2024, Parsable introduced its AI-Powered Analytics product, which is a significant advance in frontline manufacturing intelligence. The product will help to remove the guesswork in the operations by providing real-time, AI-based insights to improve decision-making and productivity.(Source: https://www.teksystems.com)

- In May 2023, TEKsystems Global Services launched TEKsystems AMPGStm Modern Manufacturing Analytics, an out-of-the-box solution on the Snowflake Manufacturing Data Cloud. The partnership enables the manufacturers to utilize industrial data safely to digitalize and create agility, visibility, and economic viability using AI-generated insights.(Source: https://www.rootstock.com)

- In May 2023, Rootstock Software was released in the Spring 23 Release, and it also has Enterprise Insights, a manufacturing-specific analytics solution. It comes with five inbuilt modules, including sales, spend, inventory, manufacturing, and financial analytics to make rapid and data-based strategic and operational choices.(Source: https://www.enterprisetimes.co.uk)

Manufacturing Analytics MarketSegments Covered in the Report

By Component/Offering

- Software Platforms & Applications

- Descriptive Analytics Modules

- Predictive & Prescriptive Analytics Modules

- Services

- Consulting & Implementation

- Managed Services & Support

By Deployment Model

- On-Premises Deployment

- Cloud‐Based/SaaS Deployment

- Hybrid Deployment

By Application/Use Case

- Predictive Maintenance & Asset Management

- Quality Control & Defect Analytics

- Inventory & Supply Chain Optimization

- Energy & Resource Efficiency Analytics

- Production Throughput & OEE (Overall Equipment Efficiency) Analytics

By Industry Vertical

- Automotive Manufacturing

- Electronics & Semiconductor Manufacturing

- Metal & Machinery Manufacturing

- Food & Beverage Manufacturing

- Pharmaceutical & Chemical Manufacturing

- Other Discrete & Process Manufacturing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client