List of Contents

What is the AI annotation Market Size?

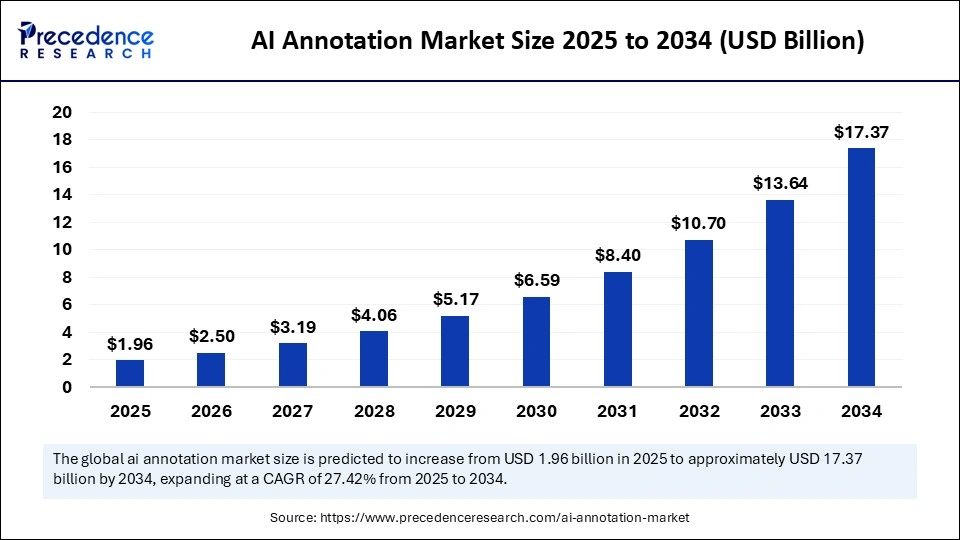

The global AI annotation market size is calculated at USD 1.96 billion in 2025 and is predicted to increase from USD 2.50 billion in 2026 to approximately USD 17.37 billion by 2034, expanding at a CAGR of 27.42% from 2025 to 2034. The market is proliferating due to the expansion of AI technologies across several sectors, which is generating massive datasets that need to be labelled for training AI models with high-quality tags, and growing government and private sector investments to integrate AI technologies for regional growth and overall global dominance.

Market Highlights

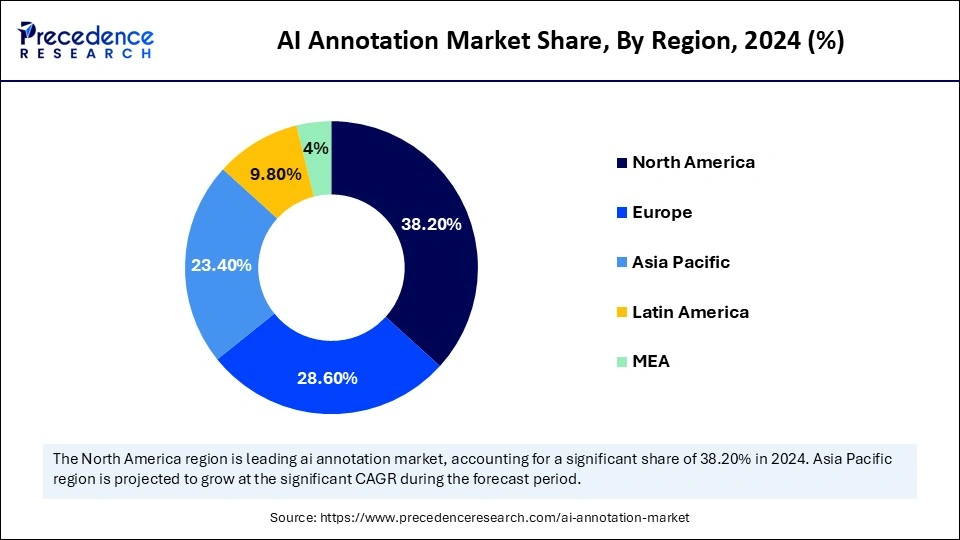

- North America held the largest market share of 38.20% in 2024.

- The Asia Pacific is expected to grow at the fastest CAGR of 29.80% from 2025 to 2034.

- By data type, the image data annotation segment contributed the largest market share of 34.70% in 2024.

- By data type, the sensor/LiDAR/point cloud annotation segment is growing at a notable CAGR of 30.90% between 2025 and 2034.

- By annotation technique, the manual annotation segment held the largest market share of 41.30% in 2024.

- By annotation technique, the automated annotation segment is growing at a CAGR of double-digit CAGR of 33.20% from 2025 to 2034.

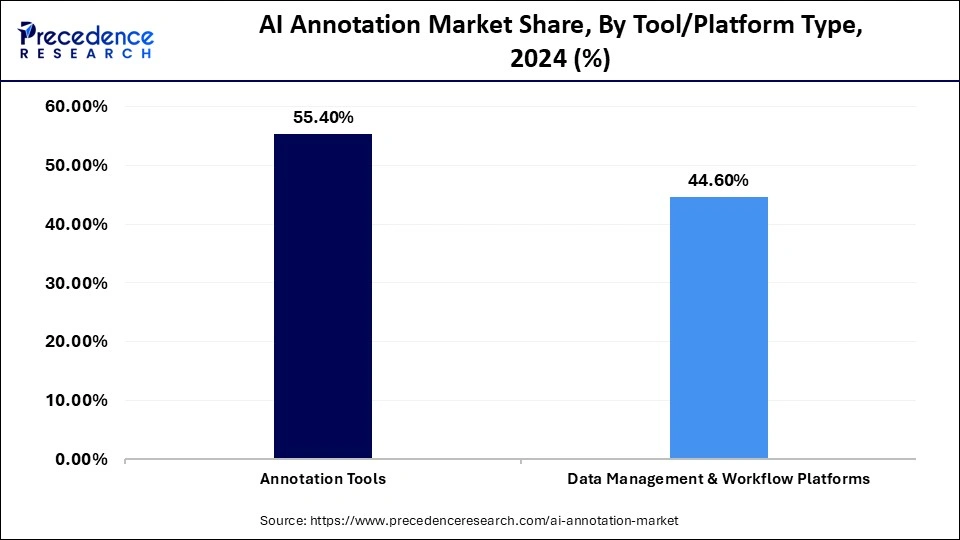

- By tool/platform type, the annotation tools segment generated the biggest market share of 55.40% in 2024.

- By tool/platform, the data management & workflows platforms segment is growing at the fastest CAGR of 28.40% from 2025 to 2034.

- By end-use industry, the automotive & transportation segment accounted for the largest market share of 28.60% in 2024.

- By end user industry, the healthcare & life sciences segment is expanding at a notable CAGR of 29.70% from 2025 to 2034.

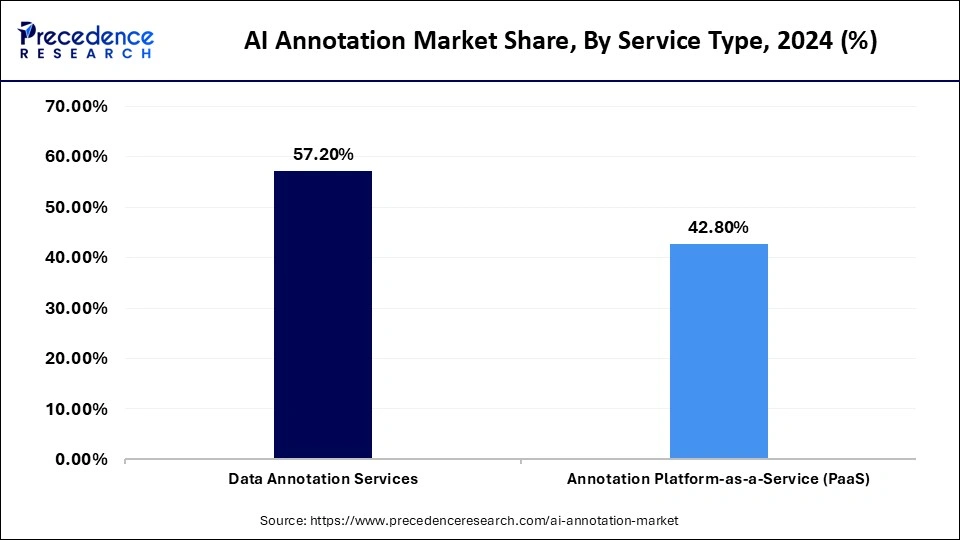

- By service type, the data annotation services segment recorded more than 57.20% of market share in 2024.

- By service type, the annotation platform-as-a-service segment is expected to witness the fastest CAGR of 29.70% from 2025 to 2034.

AI annotation Market Means

AI annotation is the process of labelling or tagging raw data to make it easier for machine learning models to understand, which is crucial for training these models efficiently. The AI system cannot solely grasp details of raw data and interpret it inherently. It needs a Human-in-the-loop process to get the necessary context to learn patterns and precise predictions. The increasing need for data labelling driven by the massive data generation across several industries is a major driver of the AI annotation market globally.

Can AI-based Computer Vision Techniques Ensure Quality AI Annotation?

It is absolutely possible to achieve high-quality annotation with the support of advanced computer vision techniques. These technologies are designed to handle complex and intricate datasets that traditional methods may struggle with. Through processes such as semantic segmentation, instance segmentation, and key point detection, computer vision systems can identify and label objects, regions, and features with remarkable accuracy. This detailed level of labeling ensures that images and videos are annotated with precision, improving how AI models interpret and learn from the data.

Moreover, AI-based computer vision techniques go beyond simple labeling by introducing automation and error detection. They can monitor the annotation process in real time, recognizing inconsistencies or mistakes and making corrections immediately. This reduces human error and ensures that datasets remain clean and reliable. The use of algorithms that adapt and learn from previous annotations also means that the system continues to improve over time.

These technologies are particularly beneficial in industries like healthcare, autonomous driving, and surveillance, where accurate labeling can directly affect model safety and decision-making. For example, in medical imaging, AI-based computer vision can differentiate subtle tissue variations, enabling highly detailed and consistent annotations across large datasets. In essence, by combining automation, precision, and self-improvement, computer vision-based annotation systems help create stronger, more efficient AI models that perform better in real-world scenarios.

AI Annotation Market Outlook

The growth of the AI annotation market can be attributed to the increasing integration of AI/ML models across sectors, including sensitive ones such as healthcare and finance, which require precise predictions based on facts and numbers. The rapid adoption of data-centric AI approaches, which improve data quality, and the increasing launch of semi-automated and automated labelling tools further support the markets expansion.

AI annotation can be further used for sustainable practices, where data annotation can be used for projects like training AI models for wildlife conservation or help with initial medical diagnostics. Crowdsourcing is an ideal example of a sustainable model for AI annotation, allowing start-ups to scale their working effectively.

Venture capital funding for AI-based startups has witnessed a major surge in 2025 as AI startups attracting significant funding in the current year. The leading companies like Scale AI and Bezos Expeditions are highly investing in AI annotation and data infrastructure companies linked to it.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size in 2026 | USD 2.50 Billion |

| Market Size by 2034 | USD 17.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Data Type, Annotation Technique, Tool/Platform Type, End-use Industry, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI annotation Market Segmental Insights

Data Type Insights

The image data annotation segment held the largest market share of 34.70% in 2024. The segment is dominated due to its critical role in training computer vision models. It is driven majorly by increasing applications in various sectors like autonomous vehicles, medical imaging, retail, and robotics. High volume of data generation is another key driver.

The sensor/LiDAR/point cloud annotation segment is expected to witness the fastest CAGR of 30.90% during the foreseeable period. The segment is growing due to the high demand from autonomous vehicles to safely navigate and 3D understanding of self-driving cars. Many autonomous vehicles use various sensors like camera, LiDAR and radar where data annotation is crucial.

Text Data Annotation: Text data annotation segment is playing a significant role in the market as it is beneficial in improving model accuracy and performance, which enhances automation and allows for personalization. Text data annotation is further advancing NLP tasks such as named entity recognition and sentiment analysis.

Video Data Annotation: This segment provides various impactful benefits like offering context, capturing motion of objects from every angle, and offers highly realistic training data for machine learning models instead of steady images. Video data annotation is majorly helping to train models in crucial sectors like healthcare, security surveillance and autonomous vehicles.

Annotation Technique Insights

The manual annotation segment held the largest market share of 41.30% in 2024. The segment is dominant due to its precise results, integrity, and capacity to handle highly complex datasets. This technique can offer nuanced insights, making it highly applicable across applications such as medical imaging and autonomous vehicles.

The automated annotation segment is expected to witness the fastest CAGR of 33.20% during the foreseeable period of 2025-2034. The segment is growing due to its offerings like increased efficiency, minimized costs, and enhanced scalability while comparing with the manual method. It further accelerates data preparation and enables faster training of AI models.

Semi-automated Annotation

The semi-automated annotation segment is also notably growing, offering a combination of speed, cost-effective solutions, and precise results by leveraging AI for pre-labeling data, which will be helpful for human review. This method is particularly well-suited to large datasets, as AI models retrain with human feedback.

Tool/Platform Type Insights

The annotation tools segment held the largest market share in 2024, at 55.40%. The segment is dominant due to the growing demand for highly advanced AI systems that require pixel-level understanding of visual data. Also, the evolution of AI applications, advances in technology, and the increasing demand for AI across major sectors are key drivers of the segments growth.

The data management & workflows platforms segment is expected to witness the fastest CAGR of 28.40% during the foreseeable period. The segment is growing due to its ability to address core problems in AI development. AI models like Generative AI models require massive, consistently labelled datasets, which these platforms easily provide.

Image & Video Labelling Software: Image and video labelling software offers various benefits for AI annotation, improving efficiency and data accuracy while enabling more sophisticated AI model development. These platforms are playing a critical role in developing high-quality training datasets that offer vision to models to interpret the environment.

Integration APIs for ML Pipelines: The segment is notably growing, as it offers significant benefits for ML pipelines in AI annotation by improving efficiency, scalability, and workflow comprehensiveness. Also, APIs support interoperability among various annotation platforms, data sources, and ML frameworks.

End-Use Industry Insights

The automotive & transportation segment held the largest market share of 28.60% in 2024. The segment is dominant due to the increasing demand for high-quality complex data training datasets for the automotive and transport sectors. The development of autonomous vehicles, ADAS systems, and AI-based mobility solutions is also a key driver of the segment.

The healthcare & life sciences segment is expected to witness the fastest CAGR of 29.70% during the foreseeable period. AI in the healthcare and life sciences are fueling due to the exceptional benefits offered by AI to medical diagnosis, imaging, and research and development areas of life sciences. It generates complex datasets that require precise annotation.

Agriculture: The agriculture sector leverages AI annotation significantly as AI models need to recognize various plant diseases, pest control needed for crops to grow effectively, and efficient farming practices. By turning a large amount of raw data into labelled data, it helps farmers increase overall crop yield and sustainability.

Service Type Insights

The data annotation services segment held the largest market share of 57.20% in 2024. The segment is dominant because it is essential to generate high-quality, authentic, and precise training data, which is primarily driven by the rapid expansion of AI applications in areas such as computer vision and autonomous driving.

The annotation platform-as-a-service segment is expected to witness the fastest CAGR of 29.70% during the foreseeable period of 2025-2034. The segment is growing rapidly due to its ability to eliminate major obstacles to AI development, such as high initial costs, infrastructure management, and technical complexity.

Outsourced Labelling Services: Outsourcing limits the costs associated with hiring, training, and managing a house team for manual labelling. Providers can easily scale annotation resources up or down to fulfil fluctuating demand without compromising on internal resources.

AI annotation Market Regional Insights

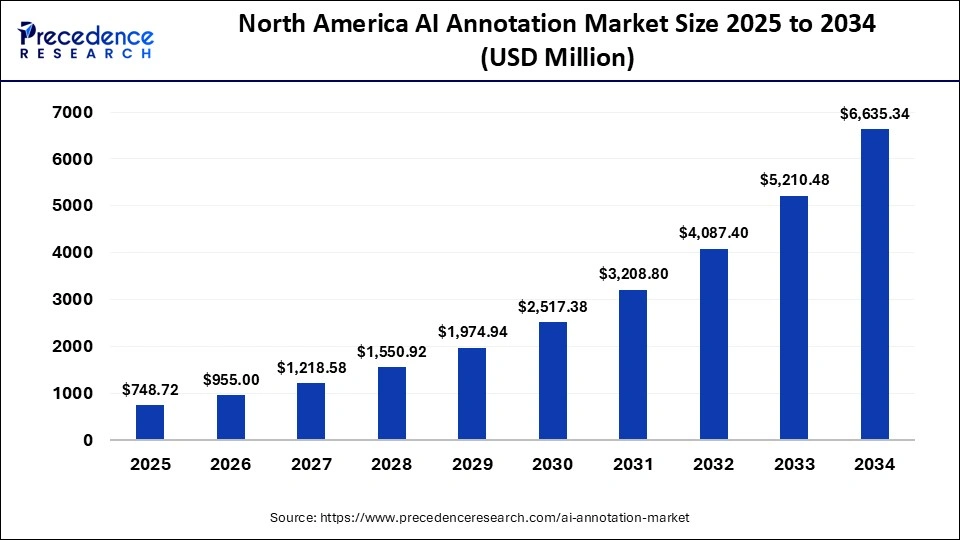

The North America AI annotation market size is estimated at USD 748.72 million in 2025 and is projected to reach approximately USD 6,635.34 million by 2034, with a 27.42% CAGR from 2025 to 2034.

What Factors Made North America a Dominant Force in the AI Annotation Market?

North America held the largest market share of 38.20% in 2024. The region is dominant due to a combination of factors, including the presence of leading technology companies, widespread adoption of AI, and cutting-edge innovation supported by a skilled workforce and strong digital infrastructure. Major organizations across industries such as healthcare, automotive, retail, and finance are integrating AI into their operations, which has significantly increased the demand for accurately labelled datasets. To train high-performing AI models, these industries require structured and high-quality data that enables precise predictions and better automation outcomes.

The regions strong investment ecosystem and active participation from both private and public sectors have also contributed to its leadership. Government initiatives promoting digital transformation and AI research have provided an additional boost to data annotation and labeling companies. In addition, North America benefits from a mature data governance framework that helps maintain quality and compliance standards in annotation processes. The presence of universities and research institutions focusing on AI has also ensured a continuous supply of skilled professionals who can manage complex annotation workflows and data validation systems.

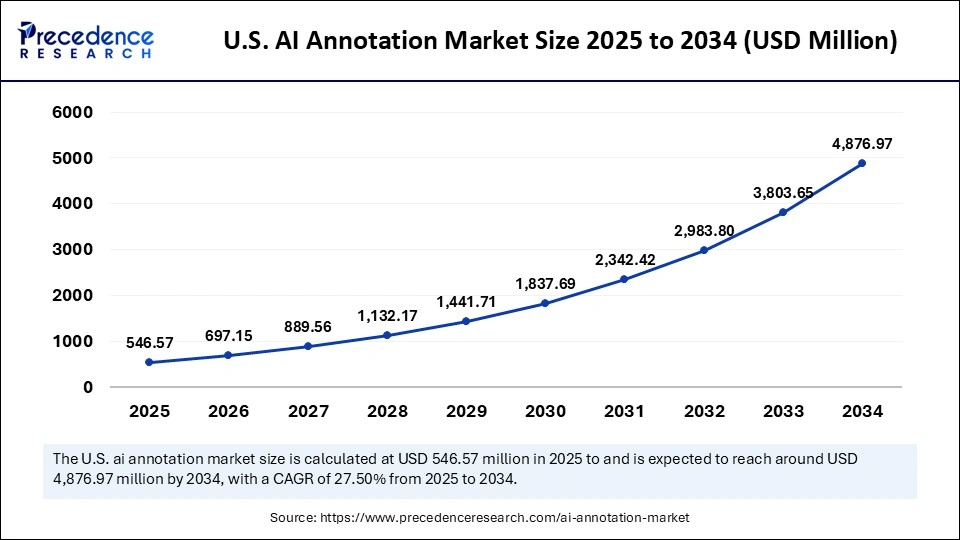

The U.S. AI annotation market size is calculated at USD 546.57 million in 2025 and is expected to reach nearly USD 4,876.97 million in 2034, accelerating at a strong CAGR of 27.50% between 2025 and 2034.

U.S. AI Annotation Market Trends

The United States continues to drive most of the growth in North Americas AI annotation market. The region is expanding due to increasing sector-specific demand for high-quality labelled data across healthcare, automotive, and retail, supported by rapid advancements in automation tools and cloud-based solutions. In healthcare, AI-powered diagnostic systems rely heavily on annotated medical imaging and clinical datasets for training. In the automotive sector, the rise of autonomous vehicles and advanced driver-assistance systems has created a constant need for precise image and video annotation.

Moreover, the expansion of AI and machine learning technologies, driven by the efforts of major U.S. tech companies, continues to shape the overall market landscape. Cloud computing platforms are making large-scale data storage and annotation more accessible, allowing faster project turnaround and global collaboration. These advancements, combined with innovation in automated labeling, are helping organizations cut costs and increase efficiency while maintaining high data accuracy. Overall, the U.S. remains the cornerstone of global AI annotation development, setting benchmarks in technology adoption, infrastructure, and regulatory maturity.

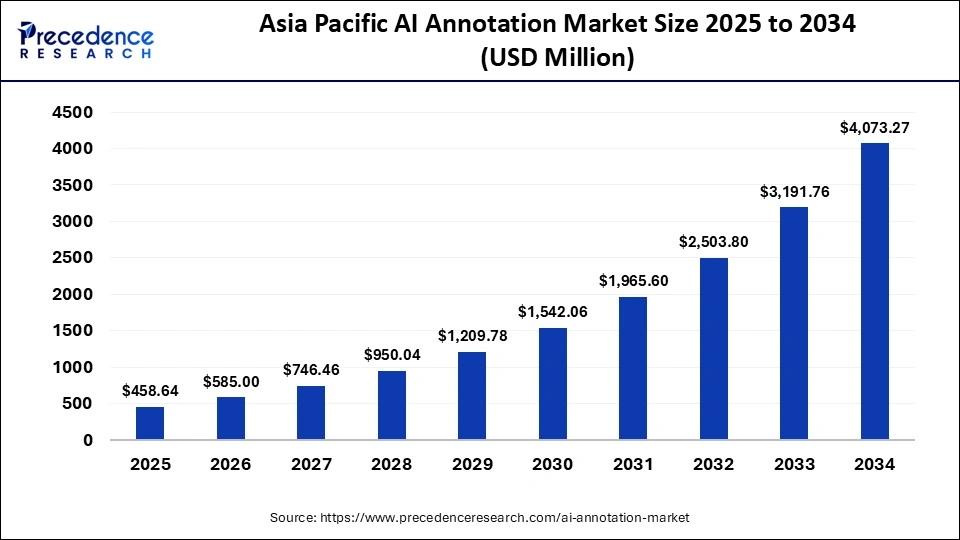

The Asia Pacific AI annotation market size is expected to be worth USD 4,073.27 million by 2034, increasing from USD 458.64million by 2025, growing at a CAGR of 27.44% from 2025 to 2034.

Why is Asia Pacific AI Annotation Market Significantly Growing?

Asia Pacific is expected to witness the fastest CAGR of 31.50% during the foreseeable period of 2025-2034. The regions growth can be attributed to the rapid digital transformation in the leading Asian countries, the integration of AI/ML technologies across several sectors like healthcare, e-commerce, BFSI, and manufacturing. Also, the push towards smart city initiatives and advancement in autonomous vehicles is a key driver of the region growth. A vibrant startup ecosystem in Asia Pacific has driven massive data generation, accelerating innovation in AI and data annotation methods.

China AI Annotation Market Trends

China has a large population, and widespread digital technology generates massive datasets that need sophisticated training for AI models. National initiatives and strategic planning, like the New Generation Artificial Intelligence Development Plan, offer huge funding and support, favorable grounds for AI development.

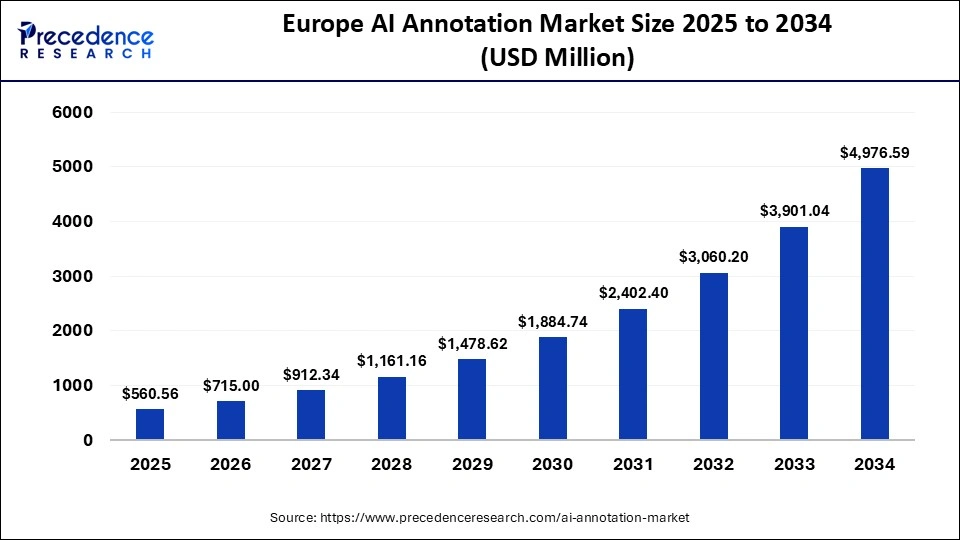

The Europe AI annotation market size has grown strongly in recent years. It will grow from USD 2 billion in 2025 to USD 5 billion in 2034, expanding at a compound annual growth rate (CAGR) of 2% between 2025 and 2034.

The European AI annotation market is rapidly growing due to key factors like robust regulatory frameworks, like GDPR for data security, that encourage high-quality annotation solutions and government initiatives for digital transformation with AI-powered solutions. AI is increasingly integrated across sectors such as healthcare, retail, automotive, and manufacturing, accelerating demand for high-quality labelled data and supporting the markets growth in the region.

The Middle East and Africa AI annotation market is driven majorly by huge investments in AI annotation technologies by countries like the UAE and Saudi Arabia, with large-scale infrastructure like data centers, and increasing adoption of AI technologies in the regions leading sectors like automotive and healthcare. An increasing awareness of data-driven strategies and their benefits to businesses is also leading the markets growth in the region.

UAE AI Annotation Market

The UAE AI annotation market is expanding steadily, driven by the UAE Artificial Intelligence Strategy 2031, which promotes the use of AI across healthcare, transport, education, and public services. The governments strong focus on digital transformation and smart infrastructure has created a favorable environment for AI and data-driven technologies. Growing investments in data centers, automation, and local talent development are enhancing the countrys capacity for large-scale annotation projects. With its advanced infrastructure and clear regulatory framework, the UAE is emerging as a leading regional hub for high-quality data labeling and AI innovation.

AI annotation Market Value Chain

This stage focuses on collecting raw, unannotated data from multiple sources such as images, videos, audio files, text documents, and sensor outputs. The quality and diversity of this data form the foundation for all subsequent AI training and annotation processes. Once gathered, the data is securely stored using cloud-based or on-premise solutions, ensuring accessibility, scalability, and protection against loss or unauthorized access. Many companies also use automated tools to categorize and index data for easier retrieval and management.

Key Players: Appen, Defined.ai, TagX, AWS, and Google Cloud Platform.

This is the most critical stage in the value chain, where raw data is annotated or labeled to make it understandable for AI models. The annotation can be done manually by skilled professionals or automatically using AI-assisted systems. Techniques such as bounding boxes, semantic segmentation, keypoint detection, and text tagging are applied depending on the use case. Quality control is vital during this stage to ensure data consistency and accuracy. The use of hybrid annotation models that combine human expertise with automation is also increasing, helping companies achieve both speed and precision in large-scale projects.

Key Players: Labelbox, Scale AI, SuperAnnotate, CloudFactory, iMerit, and Appen.

This stage involves using the annotated datasets to train AI models while maintaining strict quality checks to ensure data accuracy and relevance. Validation techniques are applied to verify that the annotations meet required standards before being fed into training systems. Automated validation frameworks and performance metrics are used to detect and eliminate inconsistencies or biases within the dataset. Companies in this segment often provide tools that monitor model behavior and fine-tune training data to achieve optimal results. This stage ensures that the final model performs well across real-world scenarios and maintains reliability over time.

Key Players: DataRobot, H2O.ai, Databricks, Entrans, Cigniti Technologies, and Galileo AI.

AI annotation Market Companies

Corporate Information

- Headquarters: Seattle, Washington, United States

- Year Founded: 2006 (as a subsidiary of Amazon.com, Inc.)

- Ownership Type: Subsidiary of Amazon.com, Inc. (NASDAQ: AMZN)

History and Background

Amazon Web Services (AWS) was launched in 2006 as a cloud computing division of Amazon, providing on-demand infrastructure and services to enterprises worldwide. Over time, AWS has become the global leader in cloud infrastructure, data management, and machine learning platforms. Its offerings have expanded to include tools that accelerate AI model development, data labeling, and annotation, foundational processes for training accurate and reliable artificial intelligence systems.

In the AI Annotation Market, AWS provides end-to-end solutions for data preparation through its Amazon SageMaker Ground Truth platform. This service enables automated, semi-automated, and human-in-the-loop annotation for diverse data types, including text, image, video, and 3D sensor data. By combining human intelligence with machine learning, AWS helps enterprises enhance data labeling efficiency and accuracy for AI model training.

Key Milestones / Timeline

- 2006: Launch of AWS as Amazons cloud services platform

- 2017: Introduction of Amazon SageMaker for end-to-end ML model development

- 2018: Launch of SageMaker Ground Truth for large-scale AI data annotation

- 2022: Enhanced SageMaker Ground Truth Plus with managed labeling services

- 2024: Integrated generative AI for automated label generation and validation

Business Overview

AWS operates as a leading cloud computing and AI infrastructure provider, offering scalable and secure services for enterprises developing AI-driven solutions. In the data annotation market, AWS focuses on enabling organizations to efficiently prepare, label, and validate datasets using human and AI-assisted workflows within its scalable cloud ecosystem.

Business Segments / Divisions

- Compute and Storage

- AI and Machine Learning

- Data Analytics and Business Intelligence

- Developer Tools and Cloud Infrastructure

Geographic Presence

AWS operates in over 30 geographic regions with 100+ availability zones worldwide, providing global coverage for AI and cloud services.

Key Offerings

- Amazon SageMaker Ground Truth AI-powered data labeling platform supporting text, image, video, and 3D sensor data annotation

- SageMaker Ground Truth Plus Fully managed data labeling service with human-in-the-loop verification

- Amazon Rekognition Pre-trained computer vision models for automated image and video labeling

- Amazon Comprehend Natural language annotation for entity recognition, sentiment, and categorization

Financial Overview

AWS contributes more than $90 billion USD annually to Amazons total revenue, with continued growth in AI, ML, and data services segments.

Key Developments and Strategic Initiatives

- April 2023: Introduced automated labeling templates for visual datasets in SageMaker Ground Truth

- October 2023: Launched new ML-assisted workflows for 3D sensor data annotation

- May 2024: Integrated generative AI to enhance label verification and reduce annotation cycle time

- January 2025: Expanded Ground Truth Plus capabilities for healthcare and autonomous vehicle datasets

Partnerships & Collaborations

Partnerships with major enterprises for large-scale annotation in automotive, healthcare, and retail AI

Collaborations with labeling service providers to enhance managed annotation workflows

Integration with AWS Marketplace partners for domain-specific annotation tools

Product Launches / Innovations

- SageMaker Ground Truth Plus (2022)

- ML-assisted 3D annotation workflow (2023)

- Generative AI-driven automated annotation validation (2024)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, machine learning automation, human-in-the-loop systems, and generative AI

- Research Infrastructure: AWS AI Labs and R&D centers in Seattle, Berlin, and Singapore

- Innovation focus: Automation of labeling workflows, self-learning annotation systems, and multimodal data management

Competitive Positioning

- Strengths: Scalable infrastructure, advanced automation, and integration with AWS ML ecosystem

- Differentiators: Seamless end-to-end annotation pipeline within the AWS cloud and access to large pre-trained models

SWOT Analysis

- Strengths: Global cloud infrastructure, strong AI portfolio, and automation capabilities

- Weaknesses: Complex cost structure for small and medium-scale projects

- Opportunities: Expansion into vertical-specific annotation (autonomous driving, healthcare, retail)

- Threats: Competition from specialized annotation platforms and open-source labeling tools

Recent News and Updates

- March 2024: AWS expanded SageMaker Ground Truth Plus for life sciences and geospatial annotation

- August 2024: Introduced generative AI-assisted labeling for image segmentation tasks

- January 2025: Partnered with leading automotive OEMs for large-scale training data annotation pipelines

Corporate Information

- Headquarters: Mountain View, California, United States

- Year Founded: 1998

- Ownership Type: Subsidiary of Alphabet Inc. (NASDAQ: GOOGL)

History and Background

Google LLC, founded by Larry Page and Sergey Brin in 1998, evolved from a search engine company into one of the most dominant technology leaders in AI, cloud computing, and digital innovation. Through its AI division and Google Cloud, the company has developed robust tools that empower businesses to build, train, and deploy AI models at scale.

In the AI Annotation Market, Google provides comprehensive data labeling and management solutions through Google Cloud AI Platform Data Labeling Service and Vertex AI. These tools support large-scale annotation workflows for text, image, video, and audio data, enabling organizations to prepare high-quality training datasets using AI-assisted automation and human feedback loops.

Key Milestones / Timeline

- 1998: Founded as a search engine startup

- 2017: Declared AI-first strategic transformation

- 2019: Launched Google Cloud Data Labeling Service for supervised ML datasets

- 2021: Released Vertex AI unified machine learning and annotation platform

- 2024: Introduced AI-powered data quality monitoring tools for annotation pipelines

Business Overview

Google operates as a global technology and AI innovation leader. In the data annotation ecosystem, its Google Cloud division provides the infrastructure and tools for data labeling, dataset management, and ML training. By integrating human-in-the-loop annotation and pre-trained AI models, Google helps accelerate dataset creation while maintaining high accuracy for computer vision, NLP, and multimodal learning applications.

Business Segments / Divisions

- Google Cloud (AI and ML Services)

- Search and Advertising

- YouTube and Media Services

- Hardware and Enterprise Software

Geographic Presence

Google operates in more than 200 countries with major AI research and data infrastructure hubs in the United States, Europe, and Asia-Pacific.

Key Offerings

- Vertex AI End-to-end ML platform with integrated data labeling workflows

- Google Cloud Data Labeling Service Custom annotation for image, video, and text datasets

- AutoML Vision and AutoML Natural Language Automated labeling and model training

- TensorFlow Data Validation (TFDV) Open-source framework for dataset analysis and annotation quality

Financial Overview

Googles parent company, Alphabet Inc., reports annual revenues exceeding $300 billion USD, with Google Cloud contributing more than $35 billion USD, driven by AI and data platform adoption.

Key Developments and Strategic Initiatives

- February 2023: Enhanced Data Labeling Service with pre-trained model suggestions for labeling

- August 2023: Integrated AI-driven annotation validation and quality control in Vertex AI

- April 2024: Introduced multimodal annotation capabilities for image-text paired data

- January 2025: Launched enterprise-level annotation automation suite using Gemini AI models

Partnerships & Collaborations

- Partnerships with enterprise clients for large-scale data labeling projects in retail, manufacturing, and autonomous systems

- Collaborations with third-party annotation service providers for specialized domain labeling

- Alliances with open-source communities for developing AI-assisted annotation tools

Product Launches / Innovations

- Vertex AI Data Labeling Upgrade (2023)

- AI-assisted multimodal annotation engine (2024)

- Gemini-powered annotation automation platform (2025)

Technological Capabilities / R&D Focus

- Core technologies: Machine learning automation, generative AI, computer vision, and NLP

- Research Infrastructure: Google DeepMind, Google Research, and Google Cloud AI Labs

- Innovation focus: Scalable AI-assisted annotation, active learning models, and automated dataset curation

Competitive Positioning

- Strengths: Advanced AI research, integrated ML ecosystem, and robust cloud capabilities

- Differentiators: Unified AI pipeline combining labeling, training, and deployment under one cloud platform

SWOT Analysis

- Strengths: Industry leadership in AI innovation, scalable infrastructure, and advanced automation

- Weaknesses: Dependence on enterprise-level clients for profitability

- Opportunities: Expansion of annotation automation using generative AI (Gemini)

- Threats: Growing competition from AWS and open-source annotation frameworks

Recent News and Updates

- April 2024: Google announced AI-powered multimodal annotation capabilities in Vertex AI

- September 2024: Released data validation suite to monitor annotation accuracy and bias

- January 2025: Launched Gemini-driven data labeling automation across global enterprise clients

Other Companies in the AI Annotation Market

- Appen Limited: Appen is a global leader in AI data collection and annotation services, providing high-quality labeled datasets for machine learning and artificial intelligence models. The company supports computer vision, NLP, and speech recognition applications with scalable human-in-the-loop annotation across multiple industries, including automotive, tech, and retail.

- Scale AI: Scale AI delivers end-to-end data annotation and AI training infrastructure for enterprises and government clients. Its platform combines automation with human validation to produce high-quality data for computer vision, generative AI, and large language model development.

- Lionbridge AI (TELUS International): Lionbridge AI, now part of TELUS International, specializes in data annotation, linguistic labeling, and AI training data services. The company provides multilingual data preparation for NLP, autonomous systems, and AI-driven analytics across global markets.

- Surge AI: Surge AI offers high-precision annotation services optimized for large language models and generative AI applications. Its human-in-the-loop workforce focuses on data quality, context-aware labeling, and feedback loops that enhance model reasoning and factual accuracy.

- CloudFactory : CloudFactory provides managed workforce solutions for scalable data annotation and processing. The company combines skilled human annotation teams with workflow automation to deliver accurate datasets for computer vision, autonomous vehicles, and AI-based content moderation.

- iMerit: iMerit delivers enterprise-grade data annotation, enrichment, and labeling services for AI and ML systems. Its capabilities span computer vision, geospatial analysis, and NLP, serving sectors such as healthcare, autonomous driving, and financial technology.

- Labelbox: Labelbox offers an integrated data annotation platform that streamlines the labeling, collaboration, and management of AI training datasets. Its software enables teams to build, iterate, and scale data pipelines for computer vision and natural language applications.

- Playment: Playment provides managed data annotation and quality assurance services for machine learning models, particularly in the automotive and geospatial sectors. Its full-stack labeling platform supports 2D/3D image annotation, semantic segmentation, and object tracking.

- Clickworker Gmb: Clickworker operates a large crowd-based platform for data labeling, text creation, and AI dataset generation. The company supports scalable annotation for speech, image, and text data, leveraging a global workforce for high-volume AI training requirements.

- Neurala, Inc.: Neurala develops AI and vision-based annotation technologies that accelerate model training for industrial and robotics applications. Its Brain Builder platform enables users to efficiently label and validate visual data for edge AI and quality inspection use cases.

- Hive: Hive provides AI data annotation and model training solutions with a focus on media, security, and retail applications. The company offers a combination of pre-trained models and labeling services that deliver high-quality annotated datasets for visual and language AI systems.

- Cogito Tech LLC: Cogito Tech offers professional data annotation and labeling services for AI and ML training, including image, video, and text data. The company specializes in sentiment analysis, autonomous vehicle datasets, and conversational AI, providing both managed and customized annotation workflows.

Recent Developments

- In September 2025, the Massachusetts Institute of Technology introduced a new AI system that could accelerate clinical research by enabling rapid annotation in medical images. This tool will help scientists study or map disease progression.(Source: https://news.mit.edu)

- In October 2025, Google AI Studio gets a new Annotation mode for visual app editing, allowing users to make visual edits directly within the interface. It eliminates the need for complex codes and is replaced by simple prompts.(Source: https://www.fonearena.com)

AI annotation MarketSegments Covered in the Report

By Data Type

- Text Data Annotation

- Named Entity Recognition (NER)

- Sentiment & Intent Annotation

- Part-of-Speech (POS) Tagging

- Document Classification

- Linguistic & Conversational Labeling

- Image Data Annotation

- Object Detection & Bounding Boxes

- Image Classification

- Semantic & Instance Segmentation

- Landmark Annotation (Facial/Body Keypoints)

- Polygon/Polyline Annotation

- Video Data Annotation

- Frame-by-frame Object Tracking

- Temporal Event Labeling

- 3D Bounding Box Annotation

- Activity Recognition

- Audio & Speech Annotation

- Speech-to-Text Transcription

- Speaker Diarization & Emotion Labeling

- Acoustic Event Detection

- Phonetic & Linguistic Annotation

- Sensor/LiDAR/Point Cloud Annotation

- 2D 3D Object Mapping

- Sensor Fusion Labeling

- Environment Segmentation for Autonomous Systems

By Annotation Technique

- Manual Annotation

- Human-in-the-Loop Labeling

- Expert-driven Medical/Scientific Annotation

- Semi-automated Annotation

- Active Learning-assisted Labeling

- Pre-labeling with Human Validation

- Automated Annotation

- AI-assisted Auto-labeling Tools

- Synthetic Data & Generative Annotation

By Tool/Platform Type

- Annotation Tools

- Text Annotation Tools

- Image & Video Labeling Software

- Audio Annotation Tools

- 3D Point Cloud Annotation Platforms

- Data Management & Workflow Platforms

- Data Quality Control Systems

- Project Management Dashboards

- Integration APIs for ML Pipelines

By End-use Industry

- Automotive & Transportation

- Autonomous Vehicles

- Advanced Driver Assistance Systems (ADAS)

- Healthcare & Life Sciences

- Medical Imaging Analysis

- Diagnostics Model Training

- Retail & E-commerce

- Product Recognition

- Sentiment & Customer Behaviour Analysis

- BFSI

- Fraud Detection & Document Annotation

- Sentiment Analytics

- IT & Telecom

- Chatbot & NLP Training

- Network Event Classification

- Agriculture

- Crop & Pest Image Annotation

- Drone Image Analytics

- Manufacturing

- Predictive Maintenance Model Training

- Defect Detection & Quality Control

- Media & Entertainment

- Content Recommendation Engines

- Audio/Video Tagging for Streaming Platforms

- Government & Security

- Surveillance & Facial Recognition Training

- Document Digitization Projects

By Service Type

- Data Annotation Services

- Outsourced Labelling Services

- Managed Annotation Projects

- Annotation Platform-as-a-Service (PaaS)

- Self-serve Labelling Platforms

- Integrated AI/ML Training Environments

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client