List of Contents

What is the Healthcare Quality Management (QMS) Market Size?

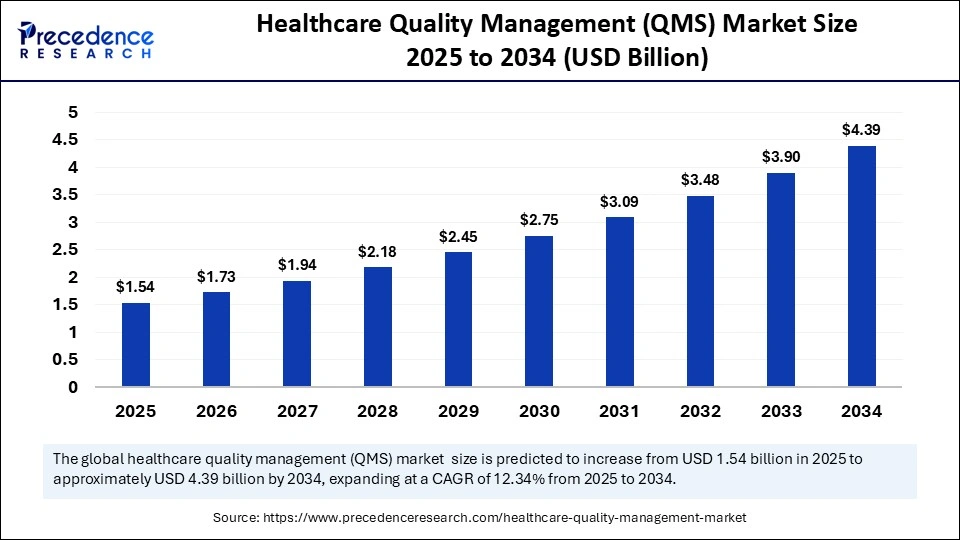

The global healthcare quality management (QMS) market size is calculated at USD 1.54 billion in 2025 and is predicted to increase from USD 1.73 billion in 2026 to approximately USD 4.39 billion by 2034, expanding at a CAGR of 12.34% from 2025 to 2034. The healthcare quality management (QMS) market is driven by increasing digital transformation, regulatory compliance needs, and rising adoption of AI-based quality monitoring systems across healthcare facilities.

Market Highlights

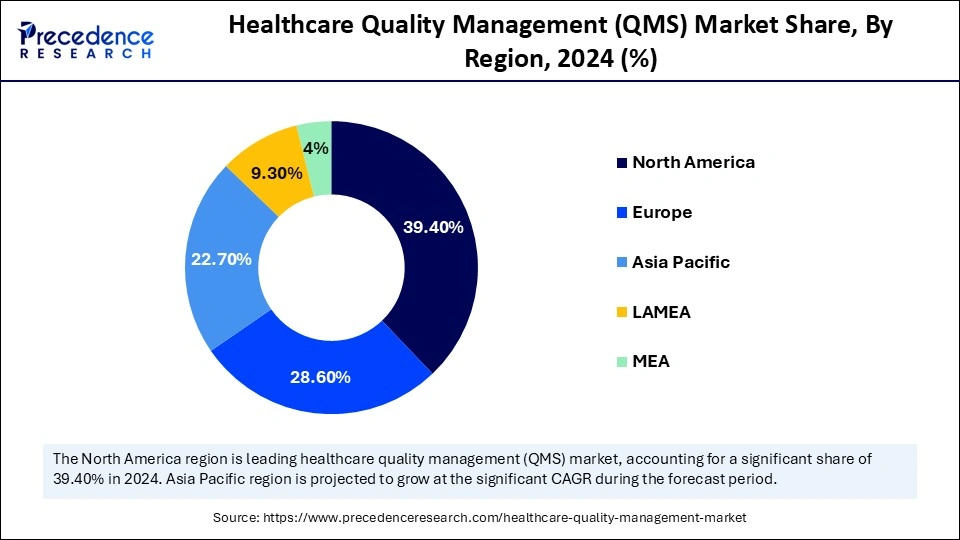

- North America led the healthcare quality management (QMS) market with around 39.40% of the market share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

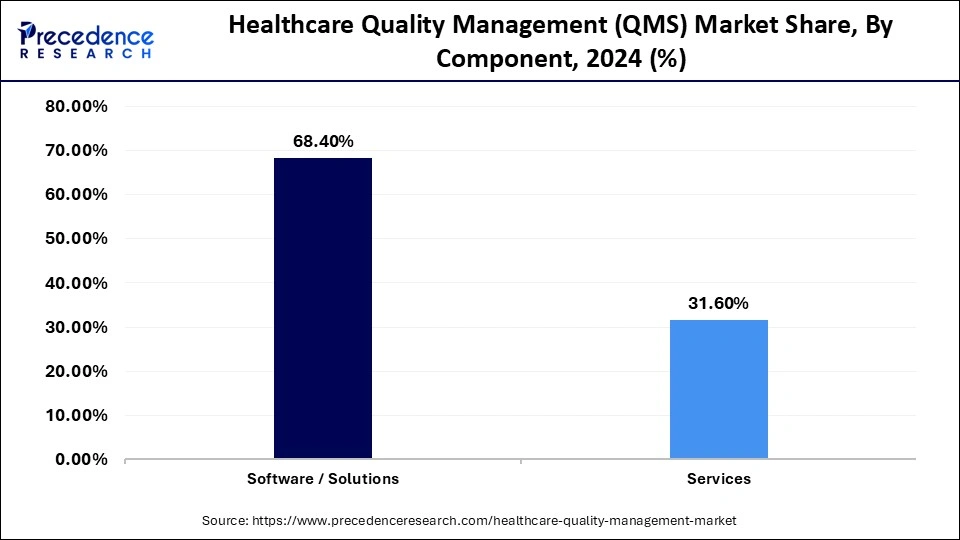

- By component, the software/solutions segment held the major market share of 68.40% of in 2024.

- By component, the services segment is growing at a notable CAGR between 2025 and 2034.

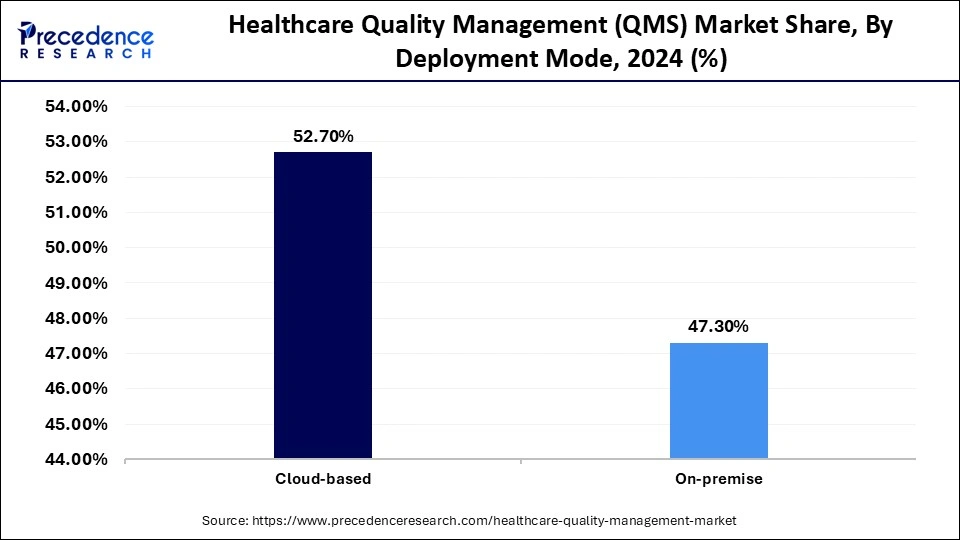

- By deployment mode, the cloud-based segment captured approximately 52.70% of market share in 2024.

- By deployment mode, the hybrid deployment segment is expanding at a strong CAGR grom 2025 to 2034.

- By functionality/application, the document management segment contributed the highest share of 20.80% in 2024.

- By functionality/application, the performance & KPI analytics segment is projected to grow at a notable CAGR between 2025 and 2034.

- By end-user industry, the hospitals segment held the largest market share of 41.6 in 2024.

- By end-user industry, the pharmaceutical & biotechnology companies segment is poised to grow at a solid CAGR from 2025 to 2034.

- By technology integration, the AI & predictive analytics segment accounted for the biggest market share of 26.90% in 2024.

- By technology integration, the blockchain for document integrity & compliance segment is expected to expand at a notable CAGR from 2025 to 2034.

Improving Patient Outcomes Through Quality and Innovation

A heightened focus on reducing errors in healthcare, improving patient safety, and social accountability around healthcare compliance has positioned quality management systems (QMS) to support healthcare organizations around the globe. QMS systems automate the management of health-related data, streamlined workflows, and performance tracking operationally across healthcare organizations. The healthcare quality management (QMS) market represents the systems, related software, and QA services to help hospitals, clinics, and life sciences company to compliance with standardized quality protocols that meet inspection requirements.

Industry integration with Electronic Health Records (EHRs), built-in analytics, and applications of automation technologies will further drive nimbleness in decision-making frameworks and combined optimizations to operational efficiency. Strong digital transformation in healthcare, coupled with a growing emphasis on patient-centered care, is also increasing worldwide QMS platform utilization towards continuous quality improvement and outcome-driven healthcare delivery.

AI and Analytics: Powering Continuous Quality Improvement

Artificial intelligence is transforming quality management systems (QMS) in healthcare by automating documentation, compliance tracking, and risk assessment. The U.S. FDA has cited over 1,000 AI-enabled medical devices that have been cleared for healthcare quality management (QMS) market use, and this reflects increasing regulatory trust in machine-learning devices compliant with good manufacturing practices (GMP) and ISO 13485. The FDA recent guidance on systems for managing the AI lifecycle highlights the importance of explainability and the need for validation within a QMS, leading vendors to address AI-based audit and corrective-action tools.

- In April 2025, the Cleveland Clinic and AKASA announced a strategic collaboration to deploy generative AI tools to support efficient and accurate medical coding practices.

In fact, the FDA is also using AI-based assistants to expedite scientific reviews and clinical evaluations, signaling trust in intelligent automation. More healthcare organizations and device manufacturers are using AI to detect deviations, improve document control, and predict compliance, which shifts from traditional QMS work from being reactive to proactive, with quality assurance based on data.

Healthcare Quality Management (QMS) Market Trends

- Revolutionizing Healthcare: Data, Patients, and Continuous Quality Transformation Driven by Data- Hospitals are realizing the potential of analytics-powered quality management systems (QMS) platforms that leverage real-time information to monitor performance, forecast risk, and improve clinical outcomes through evidence-based decision-making and continuous improvement of their processes.

- Quality Systems Focused on Patients: Modern QMS platforms incorporate patient feedback and experience metrics data to ensure the delivery of care is relevant to emotional and clinical needs, over time contributing to improved engagement, satisfaction, and overall health outcomes.

- Culture of Continuous Improvement: The continuous quality improvement (CQI) process encourages organizations to continually reflect upon, implement, and improve upon healthcare practices, therefore moving quality management away from compliance-based systems, to quality management as an opportunity for character-backed cultural change driven by data.

- Interoperable Quality Platforms: Healthcare organizations are beginning to use cloud-based, interoperable QMS platforms that allow departments to connect with each other for communication, with all departments working towards unified tracking of quality across many locations and levels of care.

- Compliance as Quality Management Strategy: Regulatory compliance is beginning to take on the role of motivator for quality improvement, allowing organizations to learn from the integrated data compliance offers in order to reveal inefficacies, streamline operations, and enhance patient safety initiatives.

Healthcare Quality Management (QMS) Market Outlook

The healthcare quality management (QMS) market is growing rapidly in the face of the WHO reporting that one in 10 patients would face harm during healthcare, and that one-half of these events would have been avoidable- a clear indication of the need for more advanced QMS technology.

WHO reports that as many as 134 million adverse events take place annually in low- and middle-income countries to stimulate global actions designed to utilize QMS frameworks aimed at improving patient safety and standardized healthcare quality in developed and developing regions alike.

R&D investments are increasing in exploring analytics, interoperability, and real-time data tracking as part of QMS platforms to help healthcare organizations shift to more predictive and proactive systems of quality improvement versus predominately retrospective error audits.

The market drivers include regulatory mandates, an increase in value-based healthcare programs, and digital advancements in hospitals as government organizations in multiple countries have developed more sentinels of patient safety, leading programs to be favourably disposed towards advanced QMS technologies.

Challenges to successful implementation and deployment of QMS technology include high cost, lack of an overall digital maturity, and workforce limitations. These can significantly hinder QMS adoption in smaller healthcare practices or in developing countries, as they contend with the advancing technology of healthcare quality management.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.54 Billion |

| Market Size in 2026 | USD 1.73 Billion |

| Market Size by 2034 | USD 4.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Functionality/Application, End Use Industry, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare Quality Management (QMS) MarketSegment Insights

Component Insights

Software solutions continue to own the largest share of the healthcare quality management (QMS) market, at 68.4%, as healthcare providers increasingly adopt digital healthcare quality platforms to support compliance, corrective actions, and audit tracking. These digital tools interface directly with an organization hospital information systems, create workflows that enable standardization, minimize human manual error, and ensure ISO 13485 and FDA 21 CFR Part 820 compliance. The further emphasis on patient safety and immediate quality monitoring continues to bolster opportunities for QMS software utilization in hospitals and life science organizations.

Services, including system integration, installation, or training, are the fastest-growing segment. Healthcare organizations are using third-party services that create custom QMS software to address unique operational requirements based on individual regulatory environments. The increasing complexity and nature of healthcare regulations have made managed services and consulting support an important product component for QMS software to promote software transition, updates, and ongoing maintenance of compliance documentation.

Deployment Mode Insights

Cloud-based: Cloud deployments are the leading deployment for healthcare quality management systems (QMS) with a share of 52.70% in 2024 as it offers scalability, ease of integration, and most important cost savings by centralizing data access, enabling real-time collaboration in a distributed network with compliance monitoring efficiency; all of which make cloud-based deployments a leading model for quality management, to achieve digital transformation.

Hybrid Deployment: Hybrid deployment is the fastest-growing model because it optimally combines the flexibility of cloud systems with the security and compliance of on-premises deployment. Healthcare professionals are beginning to prefer this model because it allows them to host sensitive patient data internally and utilize cloud capabilities to support analytics, remote audits, and performance management reporting. In hybrid deployments, the model provides access to cloud capabilities without compromising patient confidentiality or data security.

On-Premise Deployment: On-premise continues to be a viable option for providers with extensive regulatory requirements or internal data governance policies. On-premise deployments host full control of the IT infrastructure; IT staff also have a complete option for QMS system customizations. Data sovereignty concerns drive hospitals or healthcare providers with limited cloud scenarios or critical patient privacy needs to maintain on-premise deployment scenarios to support their quality management systems while ensuring secured and uninterrupted functions.

Functionality/Application Insights

Document management will lead the healthcare quality management (QMS) market in 2024 with a 20.80% of the overall market share, as regulatory pressures continue to impose specific demands, such as data traceability, versioning, and audit-ready compliance. These systems give healthcare providers a way to document, track, and share highly accurate and compliant records of patient information, while providing a streamlined oversight, approval, and review process that mitigates manual error and adequately aligns with regulatory compliance regarding FDA, ISO, or HIPAA regulations.

Performance & KPI Analytics: Performance & KPI analytics is the fastest-growing application segment, as hospitals and life sciences companies increasingly adopt data-driven tools for monitoring quality indicators, identifying non-value-added or inefficient quality indicators, and enhancing operational performance outcomes. These solutions allow users the ability to easily assess actionable insights into their process performance, enabling data-driven decision support systems and continuous quality improvement initiatives across and throughout their health care delivery systems.

Risk Management Segment: Risk management solutions are particularly developing because organizations are shifting to predictive and preventive quality approaches. The integration of AI and machine learning is enabling risk management loans to capture aberrancies from normal practice, forecast possible breaches of compliance, and connect affirmatively to patient safety. This segment is helping healthcare organizations transition from reactive quality assurance systems to proactive quality assurance frameworks.

End User Insights

Hospitals: Hospitals account for a commanding share of the healthcare quality management systems (QMS) market with 41.60% in 2024, as healthcare continues to push the emphasis on patient safety improvements, regulatory accreditation, and the presence of initiatives for digitally tracking quality and compliance processes. Hospitals utilize QMS platforms to enable centralized documentation, limit errors and issues, and measure performance in real-time while ensuring compliance with quality standards, including, but not limited to, IHR 13485 and Joint Commission regulatory standards.

Pharmaceutical and Biotechnology Companies: Pharmaceutical and biotechnology companies will be the fastest-growing end-user group, as they continue to adopt QMS tools to manage regulatory submissions, clinical data quality, and manufacturing. The quality management solutions enhance plans for audit readiness, provide traceability in R&D and manufacturing, and alleviate the negative impacts associated with a lack of knowledge or non-compliance with regulations in developing drugs and biologics.

Ambulatory care centers are adopting QMS platforms to ensure the delivery of consistent quality and safe services across decentralized sites. The systems also help standardize documentation of workflow, manage incident reporting, and support adherence to standards of outpatient care, leading to effective managerial quality in providing consistent patient-centered quality service.

Technology Integration Insights

AI & Predictive Analytics: AI & predictive analytics are expected to account for 26.90% of the healthcare quality management systems (QMS) market in 2024 because they enable intelligent automation, predictive compliance monitoring, and real-time error detection. This means healthcare organizations are capable of predicting quality errors or gaps, increasing system transparency, and improving overall decision-making based on data, insights, and real-time process improvement.

Machine Learning for Risk Prediction: Machine learning for risk prediction is the fasted growing of the three segments. In healthcare, machine learning for risk prediction helps healthcare providers predict adverse safety events and compliance failures before they occur. By utilizing historical information and real-time operational data, machine learning (ML) models can help develop proactive risk management strategies that improve patient outcomes as well as overall quality assurance.

Blockchain for Document Integrity & Compliance: Blockchain is also being prioritized for document integrity and compliance. Blockchain is used to verify authenticity and visualize secure traceability in healthcare QMS. Blockchain uses tamper-proof audit trails, increases trust and confidence once records are provided to regulatory oversight organizations, and can also prevent potential investigations of sensitive clinical and manufacturing documentation. By prioritizing blockchain, transparency is introduced into multi-site healthcare, and verification of data integrity is simplified.

Healthcare Quality Management (QMS) MarketRegional Insights

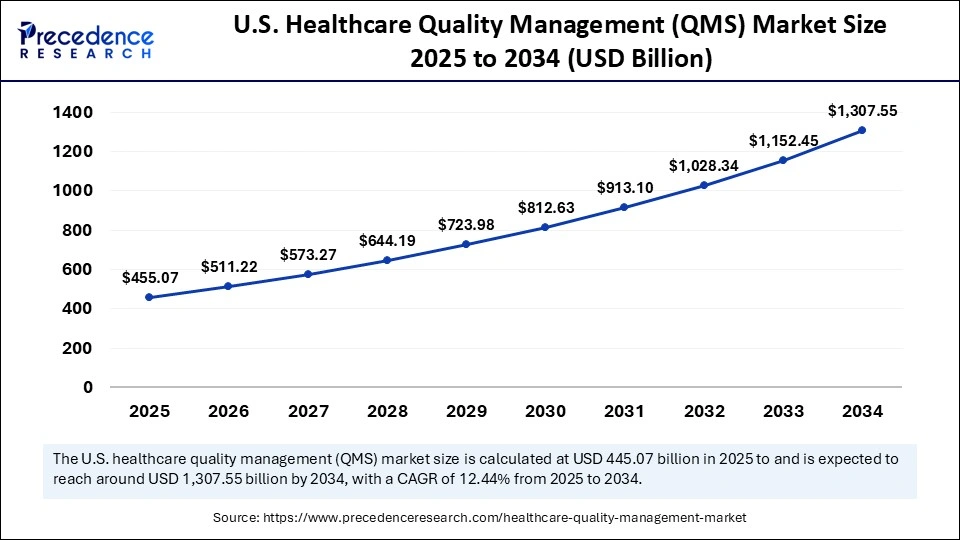

The North America healthcare quality management market size is estimated at USD 606.76 billion in 2025 and is projected to reach approximately USD 1,731.86 billion by 2034, with a 12.36% CAGR from 2025 to 2034.

What Makes North America The Leading Healthcare Quality Management Systems (QMS)?

North Americas QMS demand is based on regulatory tightening, payer and accreditation pressure, and rapid digitalization of hospitals. Health systems are formalizing enterprise QMS to bind patient safety, incident reporting, audit, CAPA, and data analytics together shifting from project pilots to integrated workflows that connect clinical, device, and IT teams. North America pushes hospitals and device makers to invest in continuous-improvement systems that document compliance with national standards and, as a consequence, integrate evidence-based performance measures and public reporting that present different levels of risk.

The U.S. healthcare quality management market size is calculated at USD 455.07 billion in 2025 and is expected to reach nearly USD1,307.55 billion in 2034, accelerating at a strong CAGR of 12.44% between 2025 and 2034.

U.S Healthcare Quality Management Systems (QMS) Market Trend

U.S. adoption is driven by federal and accreditation signals: the FDA recent amendments and guidance on quality management for medical devices and higher expectations coming from The Joint Commission both increase the bar for institutional QMS programs. Hospitals turn those external drivers into internal investments by standardizing incident workflows, developing centralized quality teams, and integrating QMS processes into EHR and patient-safety dashboards to reduce variation and liability exposure. Thus, the U.S. ecosystem (manufacturers, providers, payers) treats QMS as both compliance infrastructure and marketplace infrastructure for competitiveness.

In September 2025, Philips, Philips Foundation, and MedShare collaborated and launched a program to strengthen the U.S. from healthcare challenges caused by natural disasters, which provides financial aid along with advanced ultrasound systems and essential mother-and-child care products.

The fastest growth in Asia Pacific is propelled by large publicly funded digital health programs, the growth of private health platforms, and the drive for accreditation and standards to modernize hospital process control and quality reporting. Governments and national health authorities are focusing on interoperability, common standards, and data-driven quality improvements - thus accidentally deploying QMS alongside telehealth, EMR upgrades, and analytics projects to mitigate care variation between urban and rural systems.

India Healthcare Quality Management Systems (QMS) Market Trends

India exemplifies the momentum in AP: national accreditation and new digital health standards are driving public and private hospitals to formalize QMS and digital accreditation programs (e.g., NABH pilot digital health accreditation program reached ~100 hospitals). In parallel, large domestic platforms and health-IT providers are expanding offerings beyond patient apps to hospital software and quality modules for accreditation, claims validation, and supporting clinical KPIs, enabling integrated QMS workflows. The blend of regulation, accreditation, with scalable vendor platforms makes India a terrific QMS growth center.

Europe QMS expectations stem from the strong device and diagnostics regulation and regional commitment to optimizing post-market surveillance, clinical evidence, and traceability. MDR/IVDR enforcement and ongoing regulatory clarity pressure device manufacturers and hospitals to enhance post-market surveillance, CAPA, supplier controls, and documentation workflows not only to comply, but to retain market access. The net of QMS adoption is to center on traceable processes and data collection, enhance governance of suppliers, and implement connected clinical-to-regulatory data pathways across multi-country jurisdictions.

Germany Healthcare Quality Management Systems (QMS) Market Trend

Germany is Europe largest medtech industry, where regulatory demands align with advanced manufacturing and digitization in hospitals. German device manufacturers and large hospital systems in Germany are prioritizing integrated QMS to meet EU MDR demands, improve and streamline the technical documentation to reduce time-to-market for their EU portfolios. Policy and investment signals in German hospitals and manufacturers favor QMS that links R&D, regulatory, manufacturing, and clinical data, allowing Germany to be a critical market for testing enterprise QMS solutions and, in turn, a market for buying QMS solutions.

Overall growth in MEA is lopsided, but growth is visible where governments and private systems invest in digital licensing, accreditation, and hospital IT. Large city hubs, governments, and hospitals are implementing modernization of regulatory infrastructure and centralizing credentials (in various ways) that drive quality expectations and demands of digital systems that manage compliance, workforce credentials, and incident reporting, to name a few. In many of the MEA markets, rapid private hospital expansion, demands for international accreditation, and vendor partnerships (that bring scalable analytics and BI modules into quality programs) are forcing QMS adoption.

United Arab Emirates Healthcare Quality Management Systems (QMS) Trend

The UAE is certainly the most visible MEA leader with national digital licensing and unified health platforms (recently announced initiatives to centralize licensing and digitize regulatory processes), and build an administrative backbone that spurs hospital and clinic chains to formally invest in QMS, electronic credentialing, and standardized safety reporting. This top-down digital policy places the UAE in a first mover position for integrated QMS solutions.

- In May 2025, Oracle Health, the Cleveland Clinic, and G42 announced a strategic partnership in the UAE to develop an AI-based healthcare delivery platform to improve patient care and health management by leveraging AI, nation-scale data analytics, and intelligent clinical applications to create secure, scalable, and accessible care models.

Healthcare Quality Management (QMS) Approaches

| Organization/Authority | Framework/Reference | Core Elements/Domains |

| National Health Systems Resource Center (India) | National Quality Assurance Standards (NQAS) | Service Provision; Patient Rights; Inputs; Support Services; Clinical Care; Infection Control; Quality Management; Outcome |

| ISO (International Organization for Standardization) | ISO 7101:2023 Healthcare Quality Management Systems | Leadership; Planning; Risk Management; Efficient and Effective; Data-Driven Decision Support; People-oriented, timely, and safe |

| Alberta Health (Canada) | Healthcare Quality & Safety Management: A Framework for Alberta (2017) | Conceptual models; foundational enablers (leadership, culture, information systems); practical scenarios |

| AHRQ (Agency for Healthcare Research and Quality, USA) | Six Domains of Healthcare Quality | Safe; Effective; Patient-Centered; Timely; Efficient; Equitable |

| WHO (World Health Organization) | WHO Quality Management Framework | Products and services, Social Accountability and Impact, Organizational Alignment, Strategic Principles, Organizational Management |

| Healthcare Improvement Scotland | Quality Management System (QMS) Scotland | Quality Planning; Quality Control; Quality Improvement; Quality Assurance |

Healthcare Quality Management (QMS) Market Value Chain

This upstream layer supplies the normative, clinical, and administrative content that defines QMS functionality. Core inputs include regulatory frameworks, accreditation standards, clinical guidelines, quality indicators, electronic health record data, claims and billing data, and patient-reported outcome measures.

Value creation at this stage comes from curated, validated content libraries and interoperable data feeds that reduce integration work and legal risk for downstream vendors. Organizations that maintain high-quality clinical ontologies, regulatory mapping engines, and longitudinal outcome datasets capture upstream leverage through licensing and integration partnerships. Challenges include fragmented regulatory environments, inconsistent data quality across regions, and privacy compliance obligations.

This is the central value-creation layer. Software vendors and systems integrators design modular QMS platforms offering incident reporting, CAPA workflows, audit management, policy and document control, risk registers, performance dashboards, clinical decision support, and compliance reporting. Integration with EHRs, medical device telemetry, HR, and procurement systems is a critical capability.

Value capture here is substantial because platforms scale via SaaS subscriptions, service bundles, and IP in analytics and workflow automation. Differentiation factors include configurable clinical workflows, certified interoperability (FHIR, HL7), robust cybersecurity, and embedded predictive models. Investment drivers are R&D, regulatory validation, and platform certification. Barriers to entry include certification complexity, the need for clinical validation, and the cost of achieving enterprise-grade reliability and security.

This downstream-enablement layer converts product capability into clinical adoption and measurable quality improvements. Services include project management, clinical workflow redesign, education and training, integration engineering, pilot validation, and organizational change management. Managed services and configuration-as-a-service models are common for large health systems.

Value here is created by reducing clinician friction, accelerating time-to-benefit, and ensuring data integrity during rollout. Implementation partners and consultancies capture margin through professional services and outcome-based contracts. The key challenges are long procurement cycles, resistance to workflow change, and the requirement to demonstrate early ROI to secure further deployments.

After deployment, the platform must support ongoing monitoring, root-cause analysis, performance benchmarking, and continuous improvement programs. This layer encompasses real-time dashboards, predictive risk analytics, natural language processing of incident narratives, automated audit trails, and integration with clinical governance bodies.

High value accrues to vendors providing validated analytics that reliably correlate QMS activity with clinical outcomes and financial metrics. Recurring revenue streams arise from analytics subscriptions, premium reporting services, and benchmarking programs. Data governance, model explainability, and evidence linking interventions to outcomes are essential to sustain trust and expand market penetration.

Healthcare Quality Management (QMS) Market Companies

- Headquarters: Chicago, Illinois, United States

- Year Founded: 2015

- Ownership Type: Privately Held

History and Background

MorCare, LLC was established in 2015 following its spin-off from Morrisey Associates, with a dedicated focus on healthcare quality management, care coordination, and regulatory compliance solutions. Building on decades of healthcare software expertise, MorCare developed an integrated suite of products designed to enhance hospital performance, patient safety, and outcomes measurement across complex healthcare systems.

In the Healthcare Quality Management (QMS) Market, MorCare has established itself as a trusted provider of enterprise-level quality, safety, and risk management solutions. Its modular QMS platform enables hospitals and health systems to automate workflows, monitor performance metrics, track accreditation compliance, and streamline reporting for continuous quality improvement (CQI) initiatives.

Key Milestones / Timeline

- 2015: Founded as an independent company specializing in healthcare QMS and care management software

- 2017: Launched MorCare Quality and Safety Suite for hospital and health system deployment

- 2019: Expanded platform capabilities for patient safety and clinical event tracking

- 2022: Introduced cloud-based MorCare Connect for enhanced interoperability and analytics

- 2024: Integrated AI-driven predictive analytics into quality and risk management modules

Business Overview

MorCare provides cloud-based software and professional services tailored to healthcare quality improvement, patient safety, and regulatory compliance. Its comprehensive QMS solutions empower healthcare organizations to align with accreditation standards (The Joint Commission, CMS, and DNV), improve patient outcomes, and enhance organizational accountability.

Business Segments / Divisions

- Quality Management and Patient Safety Solutions

- Care Coordination and Case Management

- Risk and Performance Management Systems

Geographic Presence

MorCare serves clients primarily across the United States, with expanding partnerships in Canada and select regions in the Middle East and Europe.

Key Offerings

- MorCare Quality Management System (QMS)

- MorCare Patient Safety & Event Reporting

- Performance Analytics and Benchmarking Tools

- Accreditation and Compliance Tracking Modules

- AI-powered risk prediction and reporting dashboards

Financial Overview

MorCare is a privately held company with estimated annual revenues between $20-30 million USD, derived primarily from software licensing, SaaS subscriptions, and consulting services for healthcare organizations.

Key Developments and Strategic Initiatives

- April 2022: Expanded MorCare platform to include enterprise-level risk and event management tools

- September 2023: Introduced data-driven predictive analytics for clinical quality indicators

- June 2024: Partnered with healthcare systems to develop AI-enabled patient safety benchmarking

- January 2025: Launched automated accreditation management module integrated with EHR systems

Partnerships & Collaborations

- Collaborations with hospital networks and healthcare systems for performance improvement initiatives

- Partnerships with EHR vendors for seamless data integration

- Engagements with accreditation agencies to align compliance reporting frameworks

Product Launches / Innovations

- MorCare Connect (2022) Cloud-native QMS platform

- AI-driven Quality Insights module (2023)

- Automated accreditation compliance management system (2024)

Technological Capabilities / R&D Focus

Core technologies: SaaS-based workflow automation, AI analytics, data interoperability, and reporting dashboards

Research Infrastructure: R&D center focused on healthcare informatics and regulatory analytics

Innovation focus: AI-enhanced QMS modules, predictive compliance, and continuous quality improvement tools

Competitive Positioning

- Strengths: Industry specialization, user-friendly interface, and strong compliance alignment with major standards

- Differentiators: Integration of risk, safety, and quality management within one modular platform

SWOT Analysis

- Strengths: Comprehensive healthcare QMS platform, compliance expertise, and customer retention

- Weaknesses: Limited global footprint and brand recognition compared to large enterprise vendors

- Opportunities: Expansion into population health and international healthcare accreditation markets

- Threats: Competition from larger QMS and healthcare IT firms

Recent News and Updates

- February 2024: MorCare launched a new patient experience analytics platform integrated with QMS tools

- August 2024: Signed a multi-year agreement with a major U.S. health system for enterprise-wide quality management deployment

- January 2025: Announced pilot AI-based predictive risk management system for hospitals

- Headquarters: Dubai, United Arab Emirates

- Year Founded: 2010

- Ownership Type: Privately Held

History and Background

Karminn Consultancy Network was founded in 2010 as a management and healthcare consultancy firm specializing in healthcare quality systems, accreditation readiness, and performance excellence programs. Over the years, Karminn has become a prominent regional player in the Healthcare Quality Management (QMS) Market, providing consulting, training, and implementation services for hospitals, clinics, and regulatory bodies across the Middle East, Asia, and Africa.

The firm is recognized for its comprehensive QMS consulting frameworks designed around international standards such as ISO 9001, Joint Commission International (JCI), and Accreditation Canada. Karminn approach emphasizes performance optimization, clinical governance, and risk management within healthcare institutions seeking quality certification and operational excellence.

Key Milestones / Timeline

- 2010: Founded as a healthcare management consultancy focused on quality and accreditation services

- 2013: Began implementation of ISO 9001 and JCI readiness programs for hospitals in the GCC region

- 2018: Expanded into digital quality management training and QMS audits for public healthcare authorities

- 2022: Introduced a hybrid consultancy model integrating digital and on-site QMS implementation

- 2024: Launched Karminn Quality Clou, a platform for remote QMS monitoring and compliance reporting

Business Overview

Karminn Consultancy Network provides end-to-end quality management consulting and advisory services to healthcare organizations. Its services include QMS development, accreditation preparation, internal audits, performance measurement, and continuous improvement program design. The company assists healthcare providers in meeting global healthcare standards and achieving operational excellence.

Business Segments / Divisions

- Healthcare Quality and Accreditation Consulting

- Training and Capacity Building Programs

- Digital Quality Management and Remote Compliance Monitoring

Geographic Presence

Headquartered in Dubai, with operations and partner offices in Saudi Arabia, Qatar, Oman, India, and Kenya.

Key Offerings

- Karminn Quality Cloud Digital QMS tracking and audit platform

- Accreditation readiness and gap analysis services

- Customized ISO 9001 and JCI QMS implementation consulting

- Performance and patient safety improvement frameworks

Financial Overview

Karminn Consultancy Network is a privately owned company with estimated annual revenues of $10-15 million USD, primarily from consulting contracts, QMS audits, and accreditation support projects across hospitals and regulatory bodies.

Key Developments and Strategic Initiatives

- May 2022: Launched hybrid consultancy model combining in-person and virtual QMS support

- October 2023: Developed Karminn Quality Cloud for digital quality monitoring

- April 2024: Expanded regional training partnerships for healthcare quality certification

- January 2025: Initiated digital compliance pilot projects for healthcare regulators in GCC countries

Partnerships & Collaborations

- Partnerships with accreditation bodies and healthcare regulators for QMS training programs

- Collaborations with hospitals and public health ministries for quality standardization projects

- Alliances with technology firms for QMS software integration and data management solutions

Product Launches / Innovations

- Karminn Quality Cloud Remote QMS and compliance platform (2023)

- Quality Management Digital Audit Toolkit (2024)

- Benchmarking and performance evaluation module for hospital quality teams (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud-based QMS platforms, digital auditing tools, and KPI monitoring systems

- Research Infrastructure: Consulting innovation hub focused on healthcare standards and performance analytics

- Innovation focus: Automation of quality auditing, digital compliance tools, and real-time performance dashboards

Competitive Positioning

- Strengths: Strong regional expertise, deep understanding of healthcare accreditation frameworks, and customizable consulting approach

- Differentiators: Integration of consulting expertise with digital QMS platforms and multilingual regional support

SWOT Analysis

- Strengths: Proven track record in healthcare accreditation consulting and quality system implementation

- Weaknesses: Limited scalability beyond consulting projects

- Opportunities: Digital transformation of QMS services and expansion into government healthcare projects

- Threats: Rising competition from international consulting and technology-based QMS providers

Recent News and Updates

- March 2024: Launched quality improvement training partnership with a major healthcare authority in Saudi Arabia

- August 2024: Announced strategic expansion into East African healthcare consulting markets

- January 2025: Released a new version of Karminn Quality Cloud with enhanced compliance reporting and AI-based audit scheduling

Other Companies in the Healthcare Quality Management (QMS) Market

- Intelex Technologies: Intelex Quality Management Software helps organizations manage people, processes, and assets, driving operational excellence, continuous improvement, and regulatory compliance across healthcare environments.

- Effivity: Effivity QMS is an adaptable, cloud-based, and budget-friendly quality management platform designed to streamline documentation, audit tracking, and performance monitoring for healthcare providers.

- Okkala Solutions Private Limited: Okkala Solutions develops healthcare quality management software to help hospitals and clinics meet accreditation requirements, improve process efficiency, and maintain compliance.

- MEG: MEG is a cloud-based quality management platform tailored for healthcare, enabling hospitals to manage audits, compliance, risk, and patient safety initiatives digitally and in real time.

- Premier, Inc.: Premier is a leading healthcare analytics and consulting firm providing technology-driven solutions for quality improvement, benchmarking, and performance optimization within hospital networks.

- Qualityze Inc: Qualityze delivers EQMS and EHS solutions that empower healthcare organizations to strengthen compliance, elevate safety standards, and digitize their quality management practices.

- OdiTek Solutions: OdiTek Solutions offers NABH/JCI-focused quality management software that integrates hospital operations with accreditation and performance requirements to enhance organizational governance.

- Ideagen: Ideagen provides healthcare-specific quality management solutions such as Ideagen Healthcare Guardian and Ideagen Quality Management, supporting compliance, audit readiness, and continuous improvement initiatives.

Recent Developments

- In March 2025, Authenticx launched a healthcare-specific AI solution for contact-center quality management, automating evaluation, agent coaching, and insight generation to elevate QA practices and patient experience.

- In September 2025, India developed an indigenous RT-PCR kit for Mpox detection, approved by CDSCO. Manufactured by Siemens Healthineers in Vadodara, it delivers results in 40 minutes and detects both clade I and II variants.

- In March 2025, Philips and Ibex Medical Analytics expanded their partnership and released the Philips IntelliSite Pathology 6.0 platform, integrating AI-enabled digital pathology workflows to improve diagnostic reliability, efficiency, and quality of care.

Exclusive Insights

Analysts observe that the healthcare quality management (QMS) industry will see growth as both providers and payors demand metrics that show improved patient safety, compliance, and operational effectiveness. Momentum for change will come from the integration of EHR systems in the community, the use of AI-enabled analytics, and the existence of cloud-native SaaS that enables continuous monitoring and predictive risk identification. Many commercial opportunities exist, including modular QMS platforms, dashboards that provide real-time performance metrics, workflows that are automated workflows, or patient experience modules that lead to reduced adverse events and savings.

Concerns exist regarding data interoperability, levels of data quality, clinician burden resulting from poorly designed tools, and rising scrutiny of security and regulation. Companies and vendors that produce validated outcomes, fully integrate with EHRs, provide high security, and effectively consider the clinician experience will be the favored enterprise vendor. As a global industry, opportunities for partnership and change management will drive uptake and use.

Healthcare Quality Management (QMS) MarketSegments Covered in the Report

By Component

- Software/Solutions

- Quality Management System (QMS) Platforms

- Risk Management & Compliance Software

- Document Control & Record Management Systems

- Audit Management Software

- Non-conformance & CAPA (Corrective and Preventive Actions) Tools

- Performance & KPI Monitoring Dashboards

- Supplier Quality Management Software

- Services

- Implementation & Integration Services

- Consulting & Compliance Advisory

- Support & Maintenance Services

- Training & Education

By Deployment Mode

- Cloud-based

- SaaS (Software-as-a-Service)

- Hosted QMS Platforms

- On-premise

- Hybrid Deployment

By Functionality/Application

- Document Management

- Policy & Procedure Management

- Version Control & Approval Workflows

- Risk Management

- Incident Tracking & Root Cause Analysis

- Preventive Action Management

- Audit Management

- Internal & External Audit Scheduling

- Real-time Audit Trails

- Change Management

- Process & Policy Modification Tracking

- Change Request Approvals

- Training & Competency Management

- Staff Credentialing & Certification Tracking

- E-learning Integration

- Complaint Handling & Non-conformance Management

- Adverse Event Reporting Systems

- CAPA Workflows

- Supplier & Vendor Quality Management

- Supplier Qualification & Audits

- Vendor Risk Scoring

- Performance & KPI Analytics

- Benchmarking Dashboards

- Continuous Improvement Analytics

By End User

- Hospitals

- Large / Multi-specialty Hospitals

- Community & Small Hospitals

- Ambulatory Care Centers

- Outpatient Clinics

- Specialty Centers

- Long-term Care & Rehabilitation Centers

- Clinical Laboratories

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Payers & Insurance Providers

- Public Health Agencies

By Enterprise Size

- Large Enterprises

- Small & Medium-sized Healthcare Facilities

By Technology Integration

- Artificial Intelligence (AI) & Predictive Analytics

- Machine Learning for Risk Forecasting

- Blockchain for Document Integrity & Compliance

- IoT-enabled Quality Monitoring Systems

- Integration with EHR/EMR & ERP Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client