List of Contents

What is the Glycobiology Market Size?

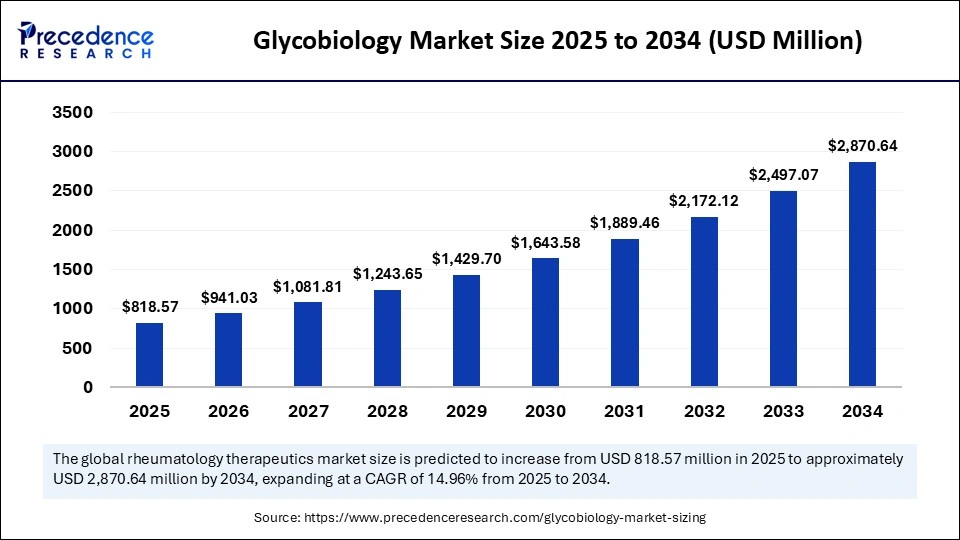

The global glycobiology market size is estimated at USD 818.57 million in 2025 and is predicted to increase from USD 941.03 million in 2026 to approximately USD 2,870.64 million by 2034, expanding at a CAGR of 14.96% from 2025 to 2034. The glycobiology market is driven by advancements in glycomics research, rising demand for biopharmaceuticals, and expanding applications in diagnostics and therapeutic development.

Market Highlights

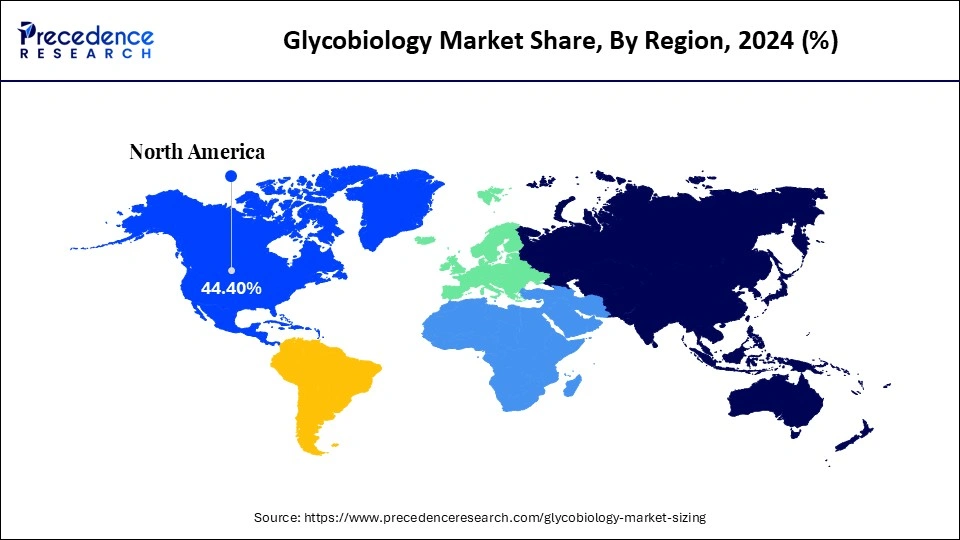

- North America led the glycobiology market, holding more than 44.4% of market share in in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the enzymes segment held the major market share of 42.4% share in 2024.

- By product type, the instruments segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By application, the drug discovery & development segment captured approximately 48.2% of market share in 2024.

- By application, the diagnostics / immunology segment is expanding at a strong CAGR from 2025 to 2034.

- By end-user, the pharmaceutical & biotechnology companies segment generated the highest market share of 52.4% in 2024.

- By end-user, the Contract Research Organizations (CROs) segment is expected to expand at a notable CAGR over the projected period.

Advances in Cell and Molecular Biology Research Fueling Next-Generation Therapeutics

The glycobiology market is being propelled forward in large part by interest in drug agents to address specific cancers and diseases, as well as the precision diagnostics aspects of glycobiology. Glycobiology is the field of study of carbohydrates and glycoconjugates regarding their structure, function, and biology as they relate to their critical role in intercellular communication and cellular mechanisms of disease. The glycobiology market is gaining traction as it is applied to cancer, vaccine, and regenerative medicine research.

Further, interest in glycobiology technologies is growing across biotechnology and pharmaceutical R&D. The development of analytical instruments and glycomics technologies, in particular, will drive discoveries in glycobiology, placing it at the forefront of biomedical and therapeutic research.

Intelligent Automation Reshaping Scientific Discovery

AI is accelerating glycobiology by turning slow, expert-driven glycan annotation into seconds-long, reproducible analysis. AI-enabled models now allow researchers to analyze vast amounts of glycomics data faster and more precisely, and detect features that cannot be fathomed manually. In February 2025, a group of scientists mapped protein-glycan interactions using deep learning algorithms to improve early cancer detection and diagnostic accuracy.

Similarly, some studies demonstrated that AI-based modeling in vaccine glycoprotein engineering improved the prediction of immune responses. These advances will promote enhanced efficiency in therapeutic design and personalized medicine using in silico analysis of multi-omics datasets, thus shrinking the research timeframe significantly. As we continue to see advancements in AI overall, we will also begin to see a paradigm of discovery in glycobiology redefined and the translation of complex biological processes brought into clinical science.

Market Trends

- Glycobiologys Next Frontier: Innovations Powering the Future of Biomedicine

- Glycan-based drugs garnering momentum in biopharma: Biopharma companies are creating therapeutics derived from glycan engineering to enhance the drug stability and efficacy. These drugs are changing how we treat some cancers, autoimmune diseases, and infectious diseases.

- Glycan profiling for personalized medicine: Glycan profiling is leading to individualized patient care by delineating unique molecular signatures per person. This means precise diagnostics and targeted therapy can be achieved, particularly in oncology and neurology.

- Mass spectrometry improves glycan profiling: New mass spectrometry innovations offer further detail of complex glycan structures. These advancements will enhance the discovery of biomarkers, protein analysis, and quality control of biologics in manufacturing.

- Academia-Industry partnerships for innovation: Academic institutions and biotech collaborations are enabling glycol-engineering breakthroughs. Collaborations are helping facilitate novel vaccine development and expand the role of glycobiology in translational medicine.

Glycobiology Market Outlook

Funding programs from the government sector, such as the NIH Common Fund Glycoscience Program, are expanding tool-development efforts to make glycan science available to all, signaling maturation in the fields research infrastructure.

Research communities around the globe are ramping up efforts on glycobiology; associations (such as immunology, Oncology, and neuroscience) are integrating glycan-based principles, suggesting a larger geographic and application reach.

Advancements in glycan-binding receptor function, glycol-engineering, and high-throughput glycomics platforms are opening new therapeutic and diagnostic pipelines, elevating the business importance of glycobiology tools.

As glycans are drivers of processes and disease mechanisms at the cellular level, the opportunity for more precise, targeted therapeutics (vs broad-actives) offers potential for reduced wastage and efficiency of R&D, in line with a cost and sustainability-driven business strategy.

Recognizing glycosylation changes in health within the major disease areas (cancer, autoimmune disease), and there is increasing demand for precise diagnostic and biologics using glycan modifications.

The business is faced with constraints from the high technical complexity of glycan analysis, slow commercial scalability due to poor standardization of glycomic workflows, and the need for specialized technical expertise & instrumentation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 818.57 Million |

| Market Size in 2026 | USD 941.03 Million |

| Market Size by 2034 | USD 2,870.64 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.96% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Glycobiology MarketSegment Insights

Product Insights

Enzymes lead the glycobiology market, with approximately a 42.4% share of the market due to their significance in analyzing, synthesizing, and modifying glycan structure. Enzymes are widely used to enhance the efficacy and accuracy of studying complex biological systems in applications such as protein engineering, drug development, and diagnostics. The increasing development of enzyme-based assays continues to solidify enzymes as a central component of glycobiology research.

Instruments are the fastest-growing product type, due to advances in technology in glycan profiling and advances in mass spectrometry platforms. Combining high-throughput instruments and automation instruments allows researchers to make precise structural elucidation and discover biomarkers. This ultimately increases precision in analytical accuracy for glycobiology laboratories globally.

Kits are also important in easing lab workflows in the research community of detections and quantifications for viral studies. Enzyme-based kits and pre-formulated kits fit well in laboratories due to their simplicity and assay formats, which can allow for quick identification and characterization of viruses based on glycan. Convenience and reproducibility for any aspect of glycan research work properly, including infectious disease work and vaccine development.

Application Insights

Drug Discovery and Development dominates this application segment with 48.2% market share, as glycobiology provides key insights into glycan-targeted therapeutics. Glycobiology can help pharmaceutical companies develop better biologics and monoclonal antibodies, as well as develop insights from glycosylation that impact drug effectiveness and stability.

Diagnostics has the fastest growth, as the importance of glycan biomarkers increases in early disease diagnosis and precision medicine. The role of glycomics in testing has the potential to be better than usual testing, providing a possibility of higher precision in diagnostics, especially for autoimmune and metabolic disease states. Furthermore, some diagnostic instruments are increasingly employing glycan profiling for non-invasive early disease screening.

Oncology application is experiencing rapid improvement, focusing on tumor-associated carbohydrate antigens (TACAs) for the discovery of cancer biomarkers. Analysis of TACAs can facilitate early tumor detection or act as target therapeutics. Furthermore, glycan profiling will play a vital role in precision oncology and the development of immunotherapies.

End User Insights

The pharmaceutical and biotechnology companies are leading end-users of glycobiology, where 52.4% is due to their extensive applications of glycobiology for biologics manufacture, glycoprotein characterization, and biosimilars development, as well as growing investments of R&D toward glycan-based therapeutics and vaccine development accelerating their competitive stance in the market.

Contract Research Organizations (CROs) are the fastest growing end-user by providing glycobiology services that specialize in supporting the drug discovery and quality testing of therapeutic products. In addition, their capabilities in glycan analysis and bioinformatics support pharmaceutical companies on development timelines and pharmacy operational expenditures.

Academic and research institutes are key to supporting viral detection and quantification studies in the glycoanalytics research landscape by focusing on glycan-virus interactions, as well as vaccine-target identification based on co-reference interactions with glycans. Academic and research institutes frequently benefit from partnerships with industry, which support innovation and their primary capabilities in conducting glycoanalytics studies, leading to advancements in virology and public health diagnostics.

Glycobiology MarketRegional Insights

The North America glycobiology market size is estimated at USD 363.45 million in 2025 and is projected to reach approximately USD 1,276.00 million by 2034, with a 14.97% CAGR from 2025 to 2034.

What Makes North America The Leading?

North America combines rich translational pipelines, sustained public funding of glycoscience tools, and dense pharma CRO ecosystems that facilitate lab-to-clinic work. Massive federal initiatives to create accessible glyco-resources and informatics, together with technology centers to commercialize mass-spec and glycan-array platforms, position the region as a pragmatic hub of biomarker and therapy R&D and not simply discovery. These capabilities allow for reduced validation timelines for glyco-assays and deepen partnerships with biotech and contract labs, leading to a self-reinforcing innovation cluster.

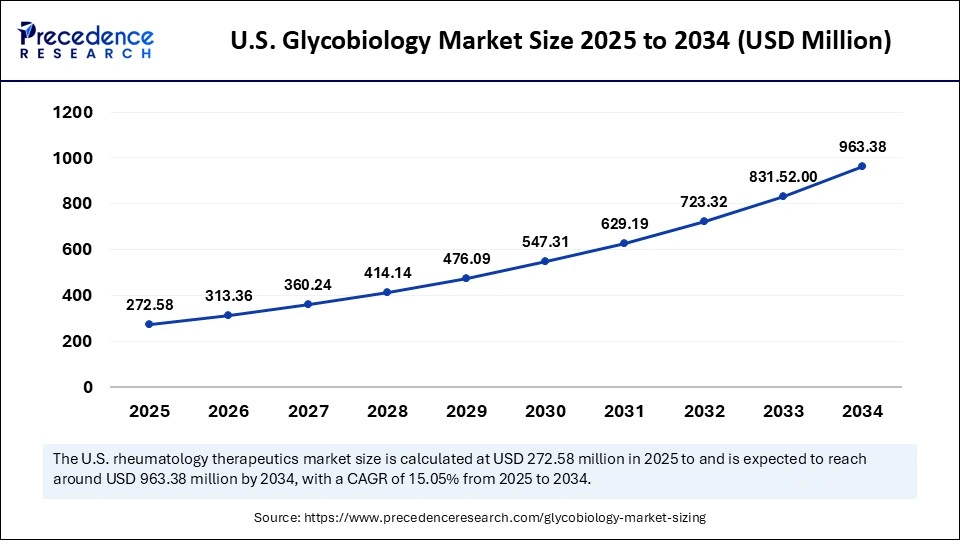

The U.S. glycobiology market size is calculated at USD 272.58 million in 2025 and is expected to reach nearly USD 963.38 million in 2034, accelerating at a strong CAGR of 15.05% between 2025 and 2034.

U.S. Glycobiology Market Trend

The U.S. benefits from the NIH Common Fund investments and national centers (National Center for Functional Glycomics), which produce shared reagents, arrays, and databases that are now widely accessible; this further lowers barriers to entry for academic and industry groups to conduct glycomics studies and biomarker programs. As strong translational focus, high-throughput mass-spec workflows, and examples of nanopore and glycan-DIA methodologies emerging in the literature point to a rich commercial landscape for glyco-diagnostics and glyco-therapeutics, proximity to big pharma, venture capital, etc., only amplifies this.

The Asia-Pacific region is moving rapidly to build capacity; new institutes, expanding publication volume, and new clinical cohorts have created an acceleration in clinical adoption of glyco-analytics in diagnostics and drug discovery. This has been driven in part by governments and research institutes that are funding the development of glycomics tools and platforms; regionally, we are also seeing a burgeoning generation of next-gen mass-spec and informatics workflows coming from laboratories. Fast commercial uptake is driven by the performance of large patient cohorts for biomarker validation and rapidly improving analytical infrastructure, compared with the same period several years ago.

China Glycobiology Market Trend

Chinas research output and institutional capacity, university centers and institutes involved in glycomics, become a greater number and more domestic journals and conferences is rapidly expanding; for example, in recent reviews and method papers, it is clear that Chinese groups are actively developing methods and translating glyco-assays to clinical settings. Coupled with national goals for strengthening life-science related infrastructure and scaling translational research, these factors confirm that China is early stage, but the region is the main engine for near-term growth in glycobiology research & development and commercialization.

Europes comparative advantage resides in coordinated capacity-building. Pan-European roadmaps, Horizon educational projects, and networks (such as the European Glycoscience Community, GLYCOTwinning, and EUROCARB) are meant to standardize methods, fund training, and create bridging opportunities between academic labs and commercial applications. This enhances smaller national environments into a continental ecosystem for glyco-bioinformatics, standards, and translational consortia, a fertile foundation for clinical validation projects and specialist service providers. Regular specialist symposia and bioinformatics initiatives create and sustain the visibility of growing, organized research momentum.

Germany Glycobiology Market Trend

Germany is home to significant glyco-bioinformatics and methods meetings, among them the Beilstein Glyco-Bioinformatics Symposium, and at strong universities, bridging chemistry, analytics, and informatics. The focus of German labs on instrumentation and standards and open-tool development is key to reproducible glycomics workflows and it is then the broader European consortia facilitate scaling which makes Germany a key anchor point for coordination across the continent and for high-quality method development.

MEA growth is a function of purposeful state investments, the emergence of new life-science hubs or hubs, and collaborative approaches by the state with private and public providers that seek to grow capability quickly through importation. While health and medical R&D capacity remains less developed than mature markets, targeted funding agencies, infrastructure projects, and partnerships with leading global providers are accelerating the advancement of local translational projects and cultivating market demand for glyco-assays and services. Projects for developing human capacity and inclusion, incubators to support start-ups, and advances in local production are all maturing into regional supply chains for biotechnology.

United Arab Emirates Glycobiology Market Trend

Initiatives that are being undertaken in the UAE are explicit in targeting life-sciences scale-up, data infrastructure, and clinical sequencing; partnerships among sovereign investors, AI/tech companies, and health providers are accelerating localized translational projects. UAE projects make it the center of gravity in MEA for commercializing advanced diagnostics and for attracting international glyco-service providers to the region.

Glycobiology Market Value Chain

The upstream stage involves the sourcing of raw materials, biochemical reagents, enzymes, and analytical consumables essential for glycobiological research. Key inputs include glycosidases, lectins, sugar nucleotides, labeling reagents, chromatography resins, and assay kits. Suppliers in this stage are typically specialized biotechnology firms that develop high-purity, research-grade materials used for glycan sequencing, synthesis, and modification.

The quality, stability, and specificity of these reagents are critical to the reproducibility of analytical results and biomanufacturing efficiency. Companies that offer proprietary enzyme systems or synthetic pathways for complex glycans capture strong upstream value. Strategic partnerships between chemical suppliers and research organizations help ensure consistent supply and innovation alignment.

Regulatory compliance, cold-chain logistics, and scalability in reagent production are also key challenges that influence cost structure and reliability in this stage. The global distribution of laboratory consumables from players such as Agilent Technologies, Merck KGaA, and New England Biolabs establishes the foundational layer of this value chain.

This is the core value-creation stage within the glycobiology market. It encompasses the design, manufacture, and integration of advanced analytical instruments and platforms used for glycan characterization, glycoproteomics, and molecular interaction studies. Major technologies include mass spectrometry, HPLC, capillary electrophoresis, glycan microarrays, and bioinformatics software for structural analysis.

Manufacturers add value through continuous R&D in sensitivity, accuracy, and throughput. Integration of artificial intelligence and machine learning in glycomics data interpretation further enhances the analytical precision of complex carbohydrate structures. Instrumentation companies that provide end-to-end solutions, combining instruments, reagents, and analytical software, capture significant market share through bundled offerings and long-term service contracts.

This stage also includes contract research organizations (CROs) and specialized analytical service providers that assist pharmaceutical and biotechnology firms in glycan mapping, biomarker discovery, and therapeutic glycoengineering. Such firms play a crucial role in bridging research and commercialization, particularly in monoclonal antibody development and vaccine design.

Value creation is centered on data accuracy, platform interoperability, and regulatory compliance. Companies with validated analytical workflows, clinical-grade instrumentation, and data integration capabilities hold the strongest midstream advantage.

The downstream stage involves the application of glycobiological tools in pharmaceutical, diagnostic, and academic research environments. Major end-use sectors include drug discovery, biopharmaceutical development, disease biomarker research, vaccine formulation, and personalized medicine.

Pharmaceutical companies utilize glycoengineering techniques to optimize therapeutic proteins for improved efficacy, stability, and reduced immunogenicity. Diagnostic companies develop glycan-based assays and biomarkers for oncology, infectious diseases, and autoimmune disorders. Academic and clinical research institutions represent a key user segment, leveraging glycobiology tools to advance structural biology and functional genomics.

Distribution and commercialization are facilitated through global sales networks, laboratory distributors, and digital platforms. Companies that provide integrated support, ranging from technical consultation to post-sale analytics, generate recurring value through service contracts and software subscriptions. Brand reliability, regulatory certification, and technical expertise drive long-term customer retention.

Downstream value capture is highest among firms that successfully translate glycobiological insights into commercially viable therapeutic and diagnostic solutions. Strategic collaborations between instrument manufacturers, pharma companies, and bioinformatics providers are central to sustaining innovation and ensuring market penetration.

Exclusive Insights

Analysts observe that the glycobiology market is on a consistent growth trajectory fueled by emerging analytical tools, AI-enabled bioinformatics, and glycan engineering, leading to advances in disease diagnostics, biologics development, and personalized medicine. The increased focus on precision therapies and vaccines is creating active R&D partnerships between biopharmaceutical companies and academia.

The glycobiology space is not without challenges, however, with high instrument costs, complex data output from glycan profiling, and a lack of trained professionals in glycomics being a few of the barriers to wider market expansion. Despite these challenges, there is an opportunity for advances in glycan use across immunology, oncology, and regenerative medicine. Additionally, the continued and growing acceptance of automated and AI-based glycan structure analysis will likely enhance workflow and translatable research opportunities.

Glycobiology Market Companies

- Headquarters: Waltham, Massachusetts, United States

- Year Founded: 2006 (merger of Thermo Electron Corporation and Fisher Scientific International)

- Ownership Type: Publicly Traded (NYSE: TMO)

History and Background

Thermo Fisher Scientific, Inc. was formed in 2006 through the merger of Thermo Electron Corporation and Fisher Scientific International, combining scientific instrumentation expertise with laboratory supply and service capabilities. Over the years, Thermo Fisher has grown into one of the worlds largest providers of analytical instruments, reagents, consumables, and software solutions for research, healthcare, and industrial applications.

In the Glycobiology Market, Thermo Fisher Scientific plays a central role by offering comprehensive tools for glycan analysis, glycoprotein characterization, enzymatic modification, and glycomics research. The companys advanced technologies support academic, biopharmaceutical, and clinical researchers in studying carbohydrate structures and their biological roles, particularly in drug development and disease diagnostics.

Key Milestones / Timeline

- 2006: Formation of Thermo Fisher Scientific through the merger of Thermo Electron and Fisher Scientific

- 2011: Acquired Dionex Corporation to enhance chromatography and analytical chemistry capabilities

- 2017: Expanded glycoprotein research tools with the acquisition of Patheon and Affymetrix technologies

- 2022: Launched next-generation mass spectrometry platforms for glycan and glycoprotein analysis

- 2024: Introduced automation and AI-enhanced workflows for glycomics and biopharmaceutical glycan profiling

Business Overview

Thermo Fisher Scientific operates as a leading provider of life sciences research and analytical solutions. Within the Glycobiology Market, the company delivers instruments, reagents, and software platforms that enable precise glycan structure elucidation, quantitative analysis, and biotherapeutic characterization. Its integrated portfolio supports research across pharmaceuticals, diagnostics, and academia.

Business Segments / Divisions

- Life Sciences Solutions

- Analytical Instruments

- Specialty Diagnostics

- Laboratory Products and Biopharma Services

Geographic Presence

Thermo Fisher operates in more than 150 countries, with major manufacturing and R&D centers in the United States, Germany, China, and Singapore.

Key Offerings

- High-resolution mass spectrometry systems for glycan and glycopeptide analysis

- Glycan labeling kits and enzymes for structural and functional studies

- Ion chromatography and HPLC systems for glycoprotein characterization

- GlycoPro and Pierce reagents for enzymatic and analytical glycomics applications

Financial Overview

Thermo Fisher Scientific reports annual revenues exceeding $43 billion USD, with continued growth driven by biopharmaceutical and analytical instrumentation demand. The companys glycobiology segment is supported by its life sciences and bioproduction divisions.

Key Developments and Strategic Initiatives

- March 2023: Launched new LC-MS workflow for glycan analysis in biotherapeutic quality control

- August 2023: Released AI-powered software for automated glycoprotein identification

- April 2024: Announced expansion of glycan sample preparation kits and analytical enzymes

- January 2025: Introduced integrated platform for end-to-end glycomics research and data visualization

Partnerships & Collaborations

- Collaborations with major biopharma companies for glycoprotein drug characterization

- Partnerships with research institutes for glyco-biomarker discovery

- Alliances with technology firms for AI and automation in glycan analysis

Product Launches / Innovations

- Orbitrap Eclipse Mass Spectrometer for glycan analysis (2023)

- Pierce GlycoPro workflow kits for glycoprotein purification (2024)

- AI-enhanced GlycoAnalyzer software for structural elucidation (2025)

Technological Capabilities / R&D Focus

- Core technologies: Mass spectrometry, chromatography, enzymatic glycan analysis, AI-based data interpretation

- Research Infrastructure: Global innovation centers and demo laboratories for proteomics and glycomics

- Innovation focus: Glycoproteomics automation, biotherapeutic glycoform profiling, and glycan quantification

Competitive Positioning

- Strengths: Comprehensive product ecosystem, robust global presence, and leadership in analytical instrumentation

- Differentiators: Integration of hardware, software, and reagents for complete glycobiology workflows

SWOT Analysis

- Strengths: Market leadership in analytical tools, strong brand credibility, and large global footprint

- Weaknesses: High equipment cost and complex analytical workflows for smaller labs

- Opportunities: Expansion in biopharma glycoanalytics and biomarker discovery applications

- Threats: Competition from niche analytical equipment providers and emerging low-cost alternatives

Recent News and Updates

- April 2024: Thermo Fisher launched an upgraded glycan quantitation workflow with enhanced sensitivity

- September 2024: Partnered with top biopharma firms for integrated glycoanalysis automation projects

- January 2025: Released GlycoAnalyzer 3.0 for rapid structural annotation and visualization of complex glycans

- Headquarters: Darmstadt, Germany

- Year Founded: 1668

- Ownership Type: Publicly Traded (FWB: MRK)

History and Background

Merck KGaA, founded in 1668, is one of the worlds oldest and most diversified science and technology companies. With operations across life sciences, healthcare, and electronics, Merck KGaA has evolved into a global leader in bioprocessing and molecular biology innovation. The companys life science business, operated under MilliporeSigma in North America, provides advanced tools and reagents for biopharmaceutical research and manufacturing.

In the Glycobiology Market, Merck KGaA is a leading provider of enzymes, reagents, analytical kits, and chromatography media for glycan research and biotherapeutic production. Its MilliporeSigma division offers one of the most comprehensive portfolios for glycan purification, structural analysis, and glycoengineering, key technologies in biologics and biosimilars development.

Key Milestones / Timeline

- 1668: Founded in Darmstadt, Germany

- 2010: Acquired Millipore Corporation, expanding into bioprocessing and life science solutions

- 2015: Introduced glycan purification and analysis kits for biologics characterization

- 2021: Launched glycoengineering products for biopharmaceutical development

- 2024: Expanded glycobiology R&D portfolio to include AI-driven glycoanalytics and biosimilar glycan optimization

Business Overview

Merck KGaA operates as a global science and technology company with strong expertise in pharmaceuticals, life sciences, and performance materials. In the Glycobiology Market, Merck offerings focus on analytical and preparative tools that support glycan profiling, glycoprotein purification, and structural analysis. These technologies are widely adopted in biologics, vaccines, and glycomics research.

Business Segments / Divisions

- Life Science (MilliporeSigma)

- Healthcare (Biopharmaceuticals and Specialty Medicines)

- Electronics (Materials and Semiconductor Solutions)

Geographic Presence

Merck KGaA operates in more than 60 countries with manufacturing and research facilities in Germany, the United States, Ireland, Switzerland, and Singapore.

Key Offerings

- Sigma-Aldrich glycan analysis reagents and enzymes

- Millipore chromatography columns for glycoprotein separation

- GlycoProfile kits for enzymatic and fluorescence-based glycan analysis

- Cell-based glycoengineering tools for biotherapeutic optimization

Financial Overview

Merck KGaA reports annual revenues exceeding �22 billion (approx. $24 billion USD), with the Life Science segment contributing more than 45% of total revenue. The glycobiology market forms part of its growing biopharma and analytical portfolio.

Key Developments and Strategic Initiatives

- March 2023: Expanded MilliporeSigma glycan purification product range

- September 2023: Introduced glycoengineering reagents for biotherapeutic quality control

- May 2024: Announced integration of AI-driven analytical software for glycan mapping

- January 2025: Launched next-generation GlycoProfile kits for faster, high-resolution glycan analysis

Partnerships & Collaborations

- Collaborations with academic research institutions for glycomics tool development

- Partnerships with global pharmaceutical companies for glycoengineering workflows

- Alliances with technology providers for digital and automated glycoanalysis solutions

Product Launches / Innovations

- GlycoProfile High-Speed Analysis Kits (2023)

- Millipore GlycanPur chromatography resins (2024)

- AI-enhanced glycoanalytics platform for biopharma labs (2025)

Technological Capabilities / R&D Focus

- Core technologies: Chromatography, mass spectrometry, enzymatic glycan processing, and bioinformatics

- Research Infrastructure: Global R&D and manufacturing sites supporting MilliporeSigma life science operations

- Innovation focus: Streamlined glycan workflows, biotherapeutic glycoform optimization, and real-time glycan monitoring

Competitive Positioning

- Strengths: Long-standing expertise in life sciences, broad reagent and bioprocessing portfolio, strong brand trust

- Differentiators: Integration of bioprocessing and analytical tools for end-to-end glycobiology solutions

SWOT Analysis

- Strengths: Global distribution, comprehensive glycobiology portfolio, established R&D infrastructure

- Weaknesses: Reliance on high-cost analytical systems and complex supply chain

- Opportunities: Expansion into biosimilar glycan optimization and digital glycoanalytics

- Threats: Rising competition from specialized glycomics and instrumentation providers

Recent News and Updates

- April 2024: Merck launched the AI-enhanced GlycoProfile platform for high-throughput glycan screening

- August 2024: Partnered with biopharma firms for glycan consistency and biosimilar characterization projects

- January 2025: Expanded biomanufacturing collaboration integrating glycobiology tools with digital analytics suites

Recent Developments

- In June 2025, Vector Laboratories announced its pioneering Glysite Scout Glycan Screening Kits to facilitate glycobiology research. These kits will allow for the accurate detection and analysis of glycan structures, aiding in the workflow of glycobiology research in biomedical and glycoscience therapeutic studies.(Source: https://vectorlabs.com)

- In August 2024, the University of Georgia announced it had received an $18 million NSF award to widen access to glycoscience. The program is designed to increase access for researchers to glycoscience tools, training tools, and resources to access data to foster innovative, collaborative, and scientific developments.(Source: https://research.uga.edu)

- In February 2024, Croatian longevity startup GlycanAge announced they raised �3.9 million to progress personalized preventive healthcare. The funding will allow GlycanAge to develop AI-driven glycyobiology advances to track biological age and assess the risk of early disease by using glycan-based biomarkers.(Source: https://www.eu-startups.com)

Other Companies in the Glycobiology Market

- Agilent Technologies, Inc.: Agilent provides advanced analytical instrumentation and consumables for glycomics research, including HPLC, LC-MS, CE-MS, and glycan labeling kits. Its tools support glycan profiling, structural elucidation, and biopharmaceutical quality control, making it a leading provider of analytical workflows for glycan and protein characterization.

- Bruker Corporation: Bruker offers high-performance mass spectrometry (MS) and nuclear magnetic resonance (NMR) systems for detailed glycan structure analysis and quantification. Its MALDI-TOF and timsTOF platforms are widely used in glycoproteomics and biomarker discovery, enabling high-resolution, high-throughput glycan analysis.

- Waters Corporation: Waters is a global leader in chromatography and mass spectrometry solutions for glycomics. Its ACQUITY UPLC and Xevo MS systems, along with specialized GlycoWorks kits, facilitate precise glycan identification, quantitation, and glycoprotein profiling in biopharmaceutical research and QA/QC applications.

- New England Biolabs (NEB): NEB provides enzymes, reagents, and kits for glycan modification, release, and labeling. Its GlycoEnzymes and Glycobiology product line enable enzymatic digestion, sialylation, and desialylation workflows, supporting academic and industrial glycomics applications in diagnostics and therapeutics.

- Takara Bio Inc.: Takara Bio develops glycosylation-related enzymes and molecular biology tools for recombinant protein expression and glycan engineering. Its expertise in cell-based and enzymatic glycoengineering supports precision biomanufacturing and therapeutic protein optimization.

- Danaher Corporation: Through its subsidiaries Cytiva, SCIEX, and Beckman Coulter, Danaher provides integrated platforms for glycan analysis, bioseparation, and capillary electrophoresis. Its end-to-end bioprocessing and analytical solutions facilitate glycoprotein characterization and biopharmaceutical quality control.

- Shimadzu Corporation: Shimadzu offers LC-MS and GC-MS platforms tailored for glycan analysis and glycoprotein mapping. Its MALDI and HPLC systems are widely used in glycomics research and biopharma QA/QC, supported by software for automated glycan identification and quantitation.

- Bio-Techne Corporation: Bio-Techne develops glycoproteins, glycans, and analytical reagents through its brands such as R&D Systems and Tocris Bioscience. The companys product portfolio supports glycan profiling, glycoprotein standards, and biomarker validation across research and clinical applications.

- Z Biotech, LLC: Z Biotech specializes in glycan microarray technology for high throughput glycan protein interaction studies. Its proprietary 3D glycan arrays and assay services are widely used for biomarker discovery, vaccine development, and immune profiling in glycomics research.

- Lectenz Bio (U.S.): Lectenz Bio offers enzyme-based glycan detection and quantification tools, including GlycoSense and GlycoEnzCheck kits, which simplify glycoprofiling workflows. The companys innovations enable rapid, label-free analysis of glycan structures in research and bioprocess monitoring.

- GLYcoDiag (France): GLYcoDiag focuses on glycan interaction assays and diagnostic applications. Its proprietary GLYcoPROFILE technology allows the study of glycan protein interactions for biomedical research, therapeutic development, and quality control in glycoprotein production.

- Chemily Glycoscience (U.S.): Chemily Glycoscience offers custom synthesis of oligosaccharides, glycans, and glycoproteins, along with glycoanalytical services. The company supports R&D in vaccine design, diagnostics, and therapeutic glycoengineering, catering to both academia and biotech clients.

- Asparia Glycomics (Spain): Asparia Glycomics provides analytical and data-driven glycomics solutions for biopharmaceutical glycoanalysis, biomarker discovery, and structural glycan characterization. The company integrates mass spectrometry, LC, and bioinformatics platforms for high-throughput glycan analysis and data interpretation.

Glycobiology MarketSegments Covered in the Report

By Product Type

- Enzymes

- Instruments

- Kits

- Reagents & Chemicals

- Carbohydrates / Standards

By Application

- Drug Discovery & Development

- Diagnostics

- Oncology

- Immunology

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Academic & Research Institutes

- Other End-Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client