List of Contents

What is the Rheumatology Therapeutics Market Size?

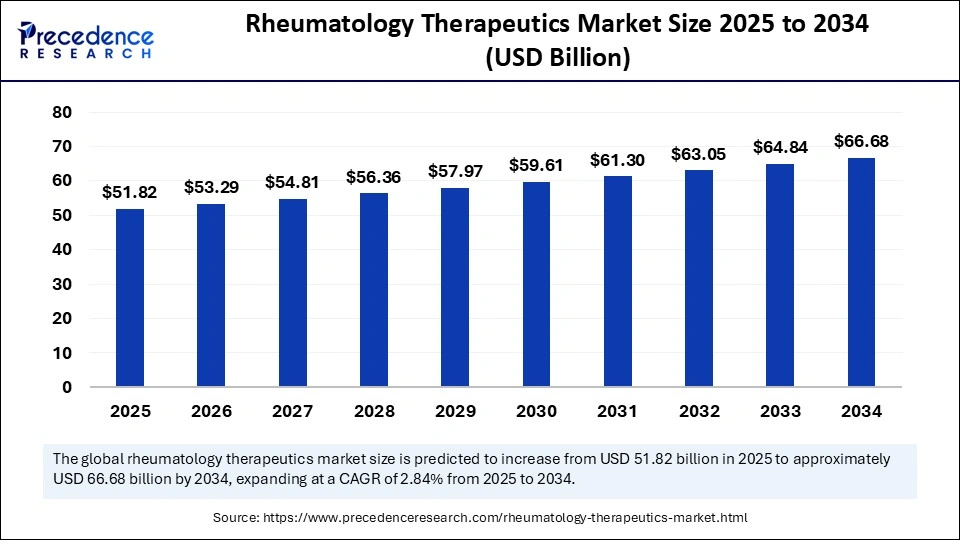

The global rheumatology therapeutics market size is calculated at USD 51.82 billion in 2025 and is predicted to increase from USD 53.29 billion in 2026 to approximately USD 66.68 billion by 2034, expanding at a CAGR of 2.84% from 2025 to 2034. Market growth is driven by the rising prevalence of autoimmune diseases, the growing adoption of biologics, and the integration of advanced technologies, including AI, for personalized treatment.

Market Highlights

- North America segment held a dominant presence in the market in 2024, accounting for an estimated 41% market share.

- The Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By drug type, the DMARDs segment accounted for the biggest market share of 55% in 2024.

- By drug type, the biologic DMARDs segment is projected to experience the highest growth rate between 2025 and 2034.

- By disease indication, the rheumatoid arthritis segment led the market, accounting for an estimated 42% market share in 2024.

- By disease indication, the gout segment is set to experience the fastest rate from 2025 to 2034.

- By route of administration, the oral segment held the major market share of 60% in 2024.

- By route of administration, the injectable/infusion segment is anticipated to grow with the highest CAGR between 2025 and 2034.

Advancing Therapeutics in Autoimmune and Inflammatory Diseases

The rising popularity of autoimmune disorders, including rheumatoid arthritis (RA), is stimulating the use of artificial intelligence (AI) in rheumatology therapy. The use of AI technologies is based on sophisticated data analysis, which enables early diagnosis, tailored treatment regimens, and better patient outcomes. AI algorithms have shown that they assist clinical professionals in predicting treatment response in RA patients, enabling clinicians to select more appropriate treatment options.

The U.S. Centers for Medicare & Medicaid Services (CMS) has acknowledged the importance of precision medicine in rheumatology, with tests such as PrismRA endorsed to predict treatment response. Thus, treatment decisions are made to mitigate unnecessary disease progression and resultant healthcare expenses. Besides, the report of the Digital Rheumatology Network conference highlights growing interest and cooperation in AI applications in rheumatology, as 15 countries were represented by their participants, discussing progress and issues in the field.

AI and Analytics in Life Sciences: From Hype to Real-World Value

Artificial intelligence (AI) is transforming the therapeutic experience in rheumatology by improving drug discovery, clinical decision-making, and patient care. Firms are developing AI-based models to identify new targets for autoimmune and inflammatory diseases, maximize opportunities in biologics and small molecules, and better predict patient responses. Moreover, artificial intelligence enhances supply chain and production operations, ensuring on-time deliveries and preserving biological stability for temperature-sensitive products.

Unlocking Growth Through Innovation in Life Sciences

- Rising Adoption of Biologic Therapies: Growing clinical evidence and patient preference for targeted biologics are boosting market expansion and treatment effectiveness.

- Expansion of Telemedicine and Digital Health Tools: The integration of remote monitoring and AI-enabled platforms is driving more personalized care and improved disease management.

- Increasing Clinical Trial Initiatives: Rising global clinical trial volumes for novel autoimmune therapies are fuelling innovation and faster drug approvals.

- Growing Awareness of Early Diagnosis: Enhanced educational campaigns and patient screening programs are propelling early intervention and improved treatment outcomes.

- Rising Investment in Biopharmaceutical R&D: Growing funding by biotech and pharmaceutical companies is boosting pipeline development and next-generation therapeutics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 51.82 Billion |

| Market Size in 2026 | USD 53.29 Billion |

| Market Size by 2034 | USD 66.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Disease Indication, Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory Landscape Table for the Rheumatology Therapeutics Market

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. FDA (Food and Drug Administration) | Biologics License Application (BLA) IND (Investigational New Drug) FDA Guidance on Biosimilars | Clinical trial approval Biologic safety & efficacy Manufacturing standards | The FDA provides fast-track and breakthrough therapy designations for RA biologics. Real-world evidence increasingly informs regulatory decisions. |

| European Union | EMA (European Medicines Agency) | Centralized Marketing Authorization Advanced Therapy Medicinal Products (ATMP) Regulation Biosimilar Guidelines | Safety and efficacy of biologics Biosimilar approval pathways Post-marketing surveillance | EMA leads in biosimilar approvals for RA; it encourages harmonized clinical trial requirements across member states. |

| China | NMPA (National Medical Products Administration) | Drug Administration Law Technical Guidelines for Biologics and Biosimilars | Biologic registration Clinical trial authorization Good Manufacturing Practice (GMP) compliance | Recent reforms aim to speed up approval for innovative biologics; local clinical trials are often required for market entry. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency) | Pharmaceutical and Medical Device Act Guidelines for Biologics and Biosimilars | Pre-market approval Post marketing surveillance Manufacturing quality | Japan has a dedicated pathway for biosimilars, with emphasis on demonstrating similarity to reference products. |

| India | CDSCO (Central Drugs Standard Control Organization) | Drugs and Cosmetics Act Guidelines on Biosimilars Clinical Trial Rules, 2019 | Approval of biologics and biosimilars Clinical trial oversight Pharmacovigilance | India is expanding biosimilar adoption; local clinical trial data are often required for regulatory approval. |

| Brazil | ANVISA (Agencia Nacional de Vigilancia Sanitaria) | Brazilian Health Regulatory Agency Regulations for Biologics Clinical Trials Regulations | Biologic registration Clinical trial approval Pharmacovigilance | ANVISA has a simplified pathway for biosimilars; post-marketing surveillance is mandatory. |

| South Korea | MFDS (Ministry of Food and Drug Safety) | Pharmaceutical Affairs Act Biologics and Biosimilars Guidelines | Clinical trial approval Biologics safety and efficacy GMP compliance | South Korea emphasizes robust clinical trial data for biosimilars; rapid approval is encouraged for unmet medical needs. |

| Australia | TGA (Therapeutic Goods Administration) | Therapeutic Goods Act Guidelines for Biosimilars | Pre-market approval Safety monitoring Post-market reporting | TGA aligns biosimilar guidelines closely with EMA; it encourages international clinical trial data submission. |

Charting the Future of Rheumatology Therapies: Global Data, Clinical Advances, and Access Insights

- As of 2021,17.9 million people globally live with rheumatoid arthritis (RA), with an age-standardized prevalence of 208.8 per 100,000 population. High-income countries report the highest prevalence rates, reflecting better diagnosis and reporting systems. This rising prevalence drives demand for advanced biologic therapies.

- Women make up 70% of the global RA population, with 55% over 55 years of age. The higher disease burden among older adults increases the need for effective long-term biologic treatments. Age and gender factors influence prescribing trends and market penetration of targeted therapies.

- In 2023, 13 million RA patients experience moderate-to-severe disease, indicating high unmet medical need. These patients are the primary candidates for biologic therapies, driving prescription volumes and market growth. Advanced therapies improve disease control, reduce complications, and influence market adoption trends.

- An estimated 2.4 million patients require rehabilitation for joint function and mobility in 2022. Integration of biologic therapies with physical therapy improves outcomes. Addressing rehabilitation needs influences market growth and therapy adherence in both developed and emerging markets.

- As of 2024, over 1,100 clinical trials for rheumatoid arthritis (RA) have been initiated since 2018. Mainland China leads with 58% of these trials, followed by South Korea and the United States. This concentration reflects Chinas significant role in RA research and development.

- The global RA pipeline comprises over 80 treatment therapies developed by more than 75 key companies. These therapies include both small molecules and biologics, addressing various aspects of RA management. The distribution of these therapies varies by region, with North America and Europe hosting a significant portion of the pipeline.

- Between 2021 and 2023, pharmaceutical companies invested over $21 billion globally into autoimmune disease research, development, and production capacity expansion. In North America, R&D investments exceeded $9.8 billion, with multiple phase II and III programs targeting rheumatoid arthritis, systemic lupus, psoriasis, and inflammatory bowel disease.

- In H1 2025, significant R&D partnerships were formed, including a $3.4 billion deal between Syneron Bio and AstraZeneca, and a $1.7 billion collaboration between Earendil Labs and Sanofi. These partnerships focus on advancing therapies for autoimmune diseases, highlighting the industrys commitment to innovation.

- China has emerged as a global leader in life sciences R&D, surpassing the U.S. in the number of clinical trials conducted. In 2024, China conducted over 7,100 clinical trials, compared to about 6,000 in the U.S., reflecting a strategic national focus on biopharmaceutical innovation.

Rheumatology Therapeutics MarketSegment Insights

Drug Type Insights

The DMARDs segment dominated the rheumatology therapeutics market in 2024, accounting for an estimated 55% market share, due to their use as the first-line therapy in patients who have just tested positive. Traditional synthetic DMARDs, including methotrexate and sulfasalazine, were widely accepted for their form of long-standing use, excellent safety, and affordability.

The biologic DMARDs / targeted synthetic DMARDs segment is expected to grow at the fastest rate in the coming years, accounting for 22% of market share, owing to the expansion of the indications set and the increase in access. Developments in personalized medicine, biomarker-based therapy, and biologics with longer dosing schedules will likely drive tsDMARDs to even greater areas.

Disease Indication Insights

The rheumatoid arthritis segment held the largest revenue share in the rheumatology therapeutics market in 2024, holding a market share of about 42%, due to the high prevalence in the world, chronic management, and high penetration of therapeutics.

Worldwide statistics on health show that an estimated 18 million individuals are living with RA according to the Global Burden/WHO estimates. The healthcare systems reported a rising rate of diagnostics and monitoring in 2024, which contributes to the higher rate of therapy acceptance. Furthermore, the high-income nations modified reimbursement pathways to assist those patients who qualify to be in the treat-to-target category, thus likely to maintain prescription volumes and long-term disease-control plans.

The gout segment is expected to grow at the fastest CAGR in the coming years, accounting for 19% rheumatology therapeutics market share, owing to the increased disease recognition, prevalence of metabolic comorbidities, and clinical momentum. In 2024, Clinical research activity increased, ACR Convergence received about 70 gout abstracts, and late-stage research tested next-generation urate-lowering agents.

Biologic approaches to refractory disease, which industry observers estimated increased therapeutic options and specialist referrals. Moreover, the increased prescription of newer agents in patients who ultimately do not respond to conventional urate-lowering therapy thus drives market penetration in mature and emerging markets.

Route of Administration Insights

Oral segment dominated the rheumatology therapeutics market in 2024, accounting for 60% market share, due to the convenience and at-home administration, which enhances compliance and saves time by minimizing the number of visits to the clinic. Additionally, the JAK inhibitors, including tofacitinib, baricitinib, and upadacitinib, were expanded across the indications of inflammatory arthritides and will likely lead to sustained oral uptake with rapid onset and flexibility in dosing.

The injectable infusion segment is expected to grow at the fastest rate in the coming years, which held a market share of about 25%. Investments in the infusion capacity and home-infusion service are likely to result in greater access to complex regimens in hospitals and specialty clinics. Regulatory approvals of new biologics and biosimilars are likely to increase therapeutic options and competition, thus further fuelling the segment.

Rheumatology Therapeutics MarketRegional Insights

The North America rheumatology therapeutics market size is estimated at USD 21.25 billion in 2025 and is projected to reach approximately USD 27.67 billion by 2034, with a 2.96% CAGR from 2025 to 2034.

Is North Americas Clinical and Biologic Prowess Keeping It at the Helm of the Global Rheumatology Therapeutics Market?

North America led the rheumatology therapeutics market, capturing the largest revenue share in 2024, which held a market share of about 41%, due to strong patient advocacy networks and the FDAs easy path to approving biologic and biosimilar drugs. The American College of Rheumatology (ACR) clinical guidelines encourage early intervention and combination therapy that stimulates an increase in prescription volumes and retention of biologic use. Furthermore, the excellent healthcare facilities and high autoimmune diagnosis rates further boost the region.

The U.S. rheumatology therapeutics market size is calculated at USD 15.72 billion in 2025 and is expected to reach nearly USD 20.62 billion in 2034, accelerating at a strong CAGR of 3.04% between 2025 and 2034.

The Powerhouse of Precision Rheumatology

The United States is the heavyweight of innovation in rheumatology therapeutics that runs the better part of North America. In 2024, the FDA gave approval to a number of pipeline drugs and biosimilars, such as JAK, IL-6 receptor blockers, and increasing therapeutic diversity and affordability. Additionally, as the digital therapeutics infiltration increases, the continuity of the treatment plays a key role in making the U.S. the best market for rheumatology therapeutics to have precision rheumatology.

Asia Pacific is anticipated to grow at the fastest rate in the rheumatology therapeutics market during the forecast period, accounting for 22% market share, owing to the increasing access to healthcare, growing awareness of the disease, and swiftly accelerated regulatory approvals. The overall uptake of the therapies in the region is expected to increase faster with the growing populations of the middle class and the access to biologics because of price regulation and the inclusion of reimbursement.

China: Asia Biologic Vanguard in Rheumatic Care

China is leading the rise in the pace of growth in Asia-Pacific, driven by the increased healthcare coverage and local biologic production. In 2024, the Chinese Rheumatology Association (CRA) estimated that close to 0.5% of the adult population in China has rheumatoid arthritis, due to lifestyle and metabolic-related reasons. Furthermore, the greater number of rheumatology training centers in large hospitals and the application of AI-based diagnostic imagery further propel the market in the coming years.

The Europe region is expected to hold a notable revenue share of the rheumatology therapeutics market, due to the clinical governance and extensive use of biosimilars. The findings of health technology assessments undertaken by bodies, including NICE (UK), HAS (France), and IQWiG (Germany), are still being used to assess cost-effectiveness in order to promote sustainable access to innovative therapies. Moreover, increasing the number of patients that can be reached and making them more affordable further facilitates the regions growth.

Germany: Europe Clinical Engine for Next-Gen Rheumatics

Germany is the anchor of the rheumatology scene in Europe, with huge uptake of biologics and developed clinical facilities. As reported by the German Society of Rheumatology (DGRh), in the year 2024, more than 1.8 million people in the country needed long-term rheumatic treatment, and nearly a quarter of the specialist visits were caused by rheumatoid arthritis. Additionally, the major biopharmaceutical firms like Boehringer Ingelheim and Bayer AG, and the world players, AbbVie and Novartis, have strong clinical trial operations and manufacturing facilities in the country.

Rheumatology Therapeutics Market Value Chain

The foundation of rheumatology therapeutics begins with the discovery of novel small molecules, biologics, and biosimilars targeting autoimmune pathways. Research focuses on key mechanisms such as TNF inhibitors, JAK inhibitors, IL-6 inhibitors, and B-cell therapies.

Key Players: Pfizer, AbbVie, Roche, Novartis, Eli Lilly

Promising therapeutic candidates undergo in vitro and in vivo testing to evaluate safety, efficacy, pharmacokinetics, and toxicology before moving to human trials.

Key Players: Lonza, Charles River Laboratories, Covance, WuXi AppTec

Candidates enter Phase I to III clinical trials to assess safety, dosage, efficacy, and long-term outcomes in RA and other autoimmune populations. Trials are conducted across multiple countries to generate robust data for regulatory approval.

Key Players: IQVIA, Parexel, ICON plc, Medpace

Successful trial data is submitted to regulatory agencies (FDA, EMA, PMDA, NMPA, CDSCO) for approval. Regulatory compliance ensures patient safety, efficacy standards, and post-marketing surveillance.

Key Players: U.S. FDA, EMA, PMDA (Japan), NMPA (China), CDSCO (India)

Approved therapies are manufactured under strict GMP conditions, including sterile biologic production, lyophilization, and formulation into injectables, oral tablets, or infusion products.

Key Players: Lonza, Samsung Biologics, WuXi Biologics, Catalent

Therapies are distributed globally through specialty pharmacies, hospitals, and clinics, often requiring cold chain management for biologics and high-value therapies.

Key Players: McKesson, Cardinal Health, AmerisourceBergen, UPS Healthcare

Drugs are administered to patients in hospitals, clinics, or via self-injection at home. Integration with patient support programs and monitoring improves adherence and outcomes.

Key Players: Hospitals, rheumatology clinics, specialty pharmacies, home healthcare providers

Rheumatology Therapeutics Market Companies

- Headquarters: North Chicago, Illinois, United States

- Year Founded: 2013 (spun off from Abbott Laboratories)

- Ownership Type: Publicly Traded (NYSE: ABBV)

History and Background

AbbVie Inc. was established in 2013 as a spin-off from Abbott Laboratories, inheriting Abbotts proprietary pharmaceutical division. The company rapidly emerged as a leading global biopharmaceutical enterprise with a strong portfolio spanning immunology, oncology, neuroscience, and virology. AbbVies strategic focus on advanced biologics and targeted therapies has positioned it as one of the dominant players in the Rheumatology Therapeutics Market.

AbbVies flagship immunology drug Humira (adalimumab) revolutionized the treatment of autoimmune and inflammatory conditions, including rheumatoid arthritis (RA), psoriatic arthritis, and ankylosing spondylitis. Building on Humiras success, AbbVie has introduced next-generation rheumatology therapies such as Rinvoq (upadacitinib), a selective JAK inhibitor, and Skyrizi (risankizumab), expanding its leadership in the immuno-inflammatory segment.

Key Milestones / Timeline

- 2013: Established following Abbott Laboratories corporate split

- 2014: Achieved global commercial success with Humira, establishing AbbVies dominance in autoimmune therapy

- 2019: Launched Rinvoq (upadacitinib) for rheumatoid arthritis

- 2020: Skyrizi approved for psoriatic arthritis and other autoimmune indications

- 2023: Expanded Rinvoq label to include non-radiographic axial spondyloarthritis

- 2025: Advanced development of next-generation biologics and oral agents for autoimmune disorders

Business Overview

AbbVie operates as a research-based biopharmaceutical company focusing on the discovery and commercialization of innovative medicines. In the Rheumatology Therapeutics Market, AbbVis portfolio centers on targeted biologics and small-molecule therapies addressing chronic inflammatory diseases. The company continues to lead in therapeutic innovation for immune-mediated disorders through its strong R&D capabilities and biologics manufacturing expertise.

Business Segments/Divisions

- Immunology

- Oncology

- Neuroscience

- Virology and General Medicine

Geographic Presence

AbbVie operates in more than 75 countries with major research, manufacturing, and commercial hubs in the United States, Germany, Ireland, and Japan.

Key Offerings

- Humira (adalimumab)-TNF inhibitor for rheumatoid arthritis and related diseases

- Rinvoq (upadacitinib)-JAK inhibitor for moderate-to-severe rheumatoid arthritis

- Skyrizi (risankizumab)-IL-23 inhibitor for psoriatic arthritis and other inflammatory conditions

- Pipeline therapies targeting novel immune pathways in rheumatology

Financial Overview

AbbVie reports annual revenues exceeding $54 billion USD, with the immunology division contributing the majority share. The company maintains strong financial performance supported by diversified biologics and next-generation immunology drugs.

Key Developments and Strategic Initiatives

- March 2023: Expanded Rinvoq indications for non-radiographic axial spondyloarthritis

- September 2023: Reported strong Phase III results for a new oral JAK inhibitor in autoimmune disorders

- April 2024: Announced partnership for advanced biologics manufacturing targeting next-generation rheumatology biologics

- January 2025: Initiated clinical trials for a dual-pathway inhibitor addressing refractory rheumatoid arthritis

Partnerships & Collaborations

- Partnership with academic institutions for autoimmune disease research

- Collaboration with manufacturing and biotech firms for biologics scalability

- Joint initiatives with healthcare organizations for access to biologic therapies in emerging markets

Product Launches / Innovations

- Rinvoq (upadacitinib) expanded indications (2023)

- Next-generation oral immunomodulator for arthritis (2024)

- Novel I-17/23 dual inhibitor in early-stage trials (2025)

Technological Capabilities / R&D Focus

- Core technologies: Monoclonal antibodies, small-molecule inhibitors, and immunomodulatory therapies

- Research Infrastructure: Global R&D centers in Illinois, Massachusetts, Germany, and Ireland

- Innovation focus: Precision medicine in rheumatology, biomarker-driven therapy development, and dual-mechanism biologics

Competitive Positioning

- Strengths: Deep immunology expertise, robust biologics pipeline, established global rheumatology presence.

- Differentiators: Combination of biologic and small-molecule portfolio addressing multiple inflammatory pathways

SWOT Analysis

- Strengths: Market leadership in immunology, extensive R&D investment, proven biologic therapies

- Weaknesses: Patent expirations impacting Humira revenue

- Opportunities: Growth of next-generation oral and biologic rheumatology drugs

- Threats: Increasing biosimilar competition and regulatory pricing pressures

Recent News and Updates

- February 2024: AbbVie reported positive results for Rinvoq in psoriatic arthritis patients refractory to biologics

- July 2024: Announced strategic collaboration for AI-assisted drug discovery in inflammatory diseases

- January 2025: Launched new real-world evidence initiative to evaluate long-term outcomes of biologic therapy in rheumatology

- Headquarters: New York, New York, United States

- Year Founded: 1849

- Ownership Type: Publicly Traded (NYSE: PFE)

History and Background

Pfizer Inc. was founded in 1849 by Charles Pfizer and Charles Erhart as a fine chemicals manufacturer in Brooklyn, New York. Over the past century, Pfizer has grown into one of the largest biopharmaceutical companies in the world, with a diverse portfolio spanning vaccines, oncology, cardiovascular, infectious diseases, and immunology.

In the Rheumatology Therapeutics Market, Pfizer has established a strong position through its targeted immunomodulatory therapies, particularly with Xeljanz (tofacitinib), one of the first approved JAK inhibitors for rheumatoid arthritis. The company continues to advance its immunology pipeline, leveraging biologics and small-molecule innovation to address unmet needs in inflammatory and autoimmune diseases.

Key Milestones / Timeline

- 1849: Founded in Brooklyn, New York

- 2012: FDA approved Xeljanz (tofacitinib) for rheumatoid arthritis

- 2017: Expanded Xeljanz approval to psoriatic arthritis and ulcerative colitis

- 2021: Strengthened immunology research portfolio with advanced biologics and JAK inhibitors

- 2024: Advanced clinical-stage molecules targeting novel pathways in rheumatology, including TYK2 inhibitors

Business Overview

Pfizer operates as a global biopharmaceutical company focusing on the discovery, development, and commercialization of innovative therapies across multiple therapeutic areas. In rheumatology, Pfizer approach combines targeted small molecules and biologics to treat autoimmune and inflammatory conditions such as rheumatoid arthritis, psoriatic arthritis, and ankylosing spondylitis.

Business Segments / Divisions

- Inflammation and Immunology

- Vaccines

- Oncology

- Internal Medicine and Rare Diseases

Geographic Presence

Pfizer operates in more than 125 countries with R&D and manufacturing centers in the United States, Belgium, Ireland, and Singapore.

Key Offerings

- Xeljanz (tofacitinib)-JAK inhibitor for rheumatoid and psoriatic arthritis

- Cibinqo (abrocitinib)-JAK1 inhibitor approved for autoimmune conditions

- Pipeline biologics targeting novel cytokine and kinase pathways for rheumatology

- Comprehensive immunology R&D platform for autoimmune and inflammatory diseases

Financial Overview

Pfizer reports annual revenues exceeding $55 billion USD, with a growing share from its inflammation and immunology business segment driven by Xeljanz and emerging JAK inhibitor products.

Key Developments and Strategic Initiatives

- April 2023: Expanded Cibinqo approvals into new autoimmune indications

- September 2023: Advanced development of a TYK2 inhibitor for rheumatoid arthritis

- May 2024: Entered a strategic alliance to co-develop next-generation biologics for autoimmune diseases

- January 2025: Announced data from late-stage studies comparing Xeljanz and emerging JAK inhibitors for long-term safety

Partnerships & Collaborations

- Collaborations with biotechnology firms to co-develop small-molecule immunotherapies

- Partnerships with clinical research organizations for real-world outcomes studies

- Alliances with patient advocacy groups for rheumatology awareness and access initiatives

Product Launches / Innovations

- Cibinqo expansion into autoimmune conditions (2023)

- Next-generation TYK2 inhibitor candidate in Phase III development (2024)

- Advanced oral JAK platform for multi-pathway immune regulation (2025)

Technological Capabilities / R&D Focus

- Core technologies: Small-molecule immunomodulators, cytokine-targeted biologics, and kinase inhibitors

- Research Infrastructure: Global R&D centers in Cambridge, Massachusetts, and Groton, Connecticut

- Innovation focus: Selective kinase inhibition, immune system reprogramming, and inflammation biology

Competitive Positioning

- Strengths: Deep experience in immunology, strong JAK inhibitor portfolio, extensive R&D pipeline

- Differentiators: Early leadership in oral rheumatology therapeutics and commitment to long-term safety research

SWOT Analysis

- Strengths: Proven success with Xeljanz, broad immunology expertise, global reach

- Weaknesses: Increased regulatory scrutiny on JAK inhibitors

- Opportunities: Expansion into next-generation TYK2 inhibitors and biologics

- Threats: Patent expirations, evolving safety regulations, and biosimilar competition

Recent News and Updates

- March 2024: Pfizer announced positive Phase II data for a novel TYK2 inhibitor in rheumatoid arthritis

- July 2024: Partnered with a biotech firm to develop multi-target immunology therapies

- January 2025: Reported new real-world safety data reinforcing long-term use of Xeljanz in rheumatoid arthritis patients

Other Companies in the Rheumatology Therapeutics Market

- Johnson & Johnson (Janssen Pharmaceuticals): Janssen leads in biologic immunotherapies with Remicade (infliximab) and Simponi (golimumab). The companys pipeline includes IL-23 and IL-12 inhibitors targeting immune-mediated inflammatory diseases, with ongoing research into combination therapies and next-gen biologics for arthritis and lupus management.

- Amgen Inc.: Amgens rheumatology franchise centers on Enbrel (etanercept) and itsbiosimilars, used extensively in rheumatoid and psoriatic arthritis. The companys R&D pipeline focuses on osteoporosis, inflammatory cytokine modulation, and T-cell regulation, reinforcing its legacy in immune and bone health therapeutics.

- Bristol-Myers Squibb Company (BMS): BMS markets Orencia (abatacept), a CTLA-4 immunoglobulin fusion protein for RA and juvenile idiopathic arthritis. The company is advancing novel checkpoint and cytokine inhibitors to address unmet needs in autoimmune rheumatic disorders, supported by strong biologic development expertise.

- Novartis AG: Novartis offers Cosentyx (secukinumab), an IL-17A inhibitor indicated for psoriatic arthritis and ankylosing spondylitis, and Ilaris (canakinumab) for systemic autoinflammatory diseases. Its focus on IL-targeted and biologic therapies positions it as a major innovator in chronic inflammation management.

- UCB S.A.: UCB is a key player in autoimmune and inflammatory disorders, marketing Cimzia (certolizumab pegol) for RA, psoriatic arthritis, and ankylosing spondylitis. The company pipeline includes bimekizumab, a dual IL-17A/F inhibitor, demonstrating its strength in next-generation biologics for immunology.

- Eli Lilly and Company: Lillys rheumatology portfolio features Taltz (ixekizumab), an IL-17A inhibitor for psoriatic and axial spondyloarthritis, and Olumiant (baricitinib), a JAK inhibitor for RA. The company continues to expand its immunology and inflammation division, exploring oral and biologic therapies with improved patient outcomes.

- Gilead Sciences, Inc.: Gilead has established a foothold in rheumatology through JAK inhibitor-based therapies, notably filgotinib (Jyseleca), developed with Galapagos NV. The company focuses on oral targeted immunomodulators and strategic partnerships to enhance its inflammation and autoimmune therapeutic pipeline.

- Takeda Pharmaceutical Company Ltd.: Takedas rheumatology portfolio emphasizes immunoglobulin therapies and biologics addressing systemic autoimmune diseases. The company invests in novel anti-inflammatory pathways and personalized immunotherapy platforms targeting both rheumatologic and gastrointestinal immune disorders.

- Roche Holding AG: Roche, through its Genentech division, markets Actemra (tocilizumab), an IL-6 receptor inhibitor used for rheumatoid arthritis and giant cell arteritis. The companys continued innovation in B-cell depletion and cytokine blockade reinforces its leadership in immune-targeted biologics.

- AstraZeneca plc: AstraZeneca is expanding in rheumatology via its Alexion Pharmaceuticals acquisition, focusing on rare autoimmune and complement-mediated disorders. Its biologics and precision-medicine pipeline target lupus, vasculitis, and other systemic autoimmune diseases.

- Sandoz (Novartis): Sandoz leads the biosimilars market with affordable alternatives to major biologics such as etanercept and adalimumab. Its focus on expanding global access to rheumatology biologics underpins its strength in the cost-competitive segment of immune therapies.

- Biogen Inc.: Biogen is developing immunology therapeutics targeting B-cell modulation and inflammatory signaling. The companys collaboration and pipeline investments in anti-TNF biosimilars and autoimmune therapies broaden its footprint in rheumatologic indications.

- Sanofi S.A.: Sanofi, in collaboration with Regeneron, offers Kevzara (sarilumab), an IL-6 receptor antagonist for rheumatoid arthritis. The company robust immunology R&D also includes Dupixent (dupilumab), extending into systemic inflammatory diseases relevant to rheumatology.

Recent Developments

- In October 2025, Fate Therapeutics, Inc. unveiled fresh and updated findings from the first ten patients treated with FT819, an investigational iPSC-derived off-the-shelf cell therapy, in a Phase 1 trial for moderate-to-severe systemic lupus erythematosus (SLE). The announcement came during the American College of Rheumatology (ACR) Convergence 2025 in Chicago, underscoring Fates ongoing efforts to make advanced cellular immunotherapies broadly accessible to patients. (Source:https://ir.fatetherapeutics.com)

- In October 2025, Novartis confirmed it will present 27 abstracts spanning its Immunology pipeline and portfolio at the ACR Convergence 2025. The presentations will include pivotal Phase III data from the NEPTUNUS-1 and NEPTUNUS-2 trials assessing ianalumab in Sj�gren disease, as well as new biomarker insights from a Phase 1/2 study of rapcabtagene autoleucel in severe refractory SLE. The company will also share fresh results on Cosentyx across multiple rheumatology indications. (Source: https://www.novartis.com)

- In October 2025, Artiva Biotherapeutics, Inc. announced that the U.S. FDA had granted Fast Track Designation to its investigational therapy AlloNK (AB-101) for refractory rheumatoid arthritis (RA) in combination with rituximab. The company named refractory RA its lead program, marking a significant milestone for AlloNK, which is considered the first deep B-cell depleting therapy to receive this designation in RA. (Source: https://investors.artivabio.com)

- In July 2025, SetPoint Medical reported FDA approval for its innovative SetPoint System, a neuroimmune modulation device designed to treat adults suffering from moderate-to-severe rheumatoid arthritis (RA) who have shown inadequate response or intolerance to biologic or targeted synthetic DMARDs. The approval positions the SetPoint System as a novel, device-based alternative in RA therapy. (Source: https://setpointmedical.com)

- IN October 2025, UCB shared new three-year follow-up data from Phase 3 clinical studies and open-label extensions evaluating BIMZELX (bimekizumab-bkzx) in patients with psoriatic arthritis (PsA), non-radiographic axial spondyloarthritis (nr-axSpA), and ankylosing spondylitis (AS). As the first therapy to selectively block interleukin-17A and interleukin-17F, BIMZELX continued to show durable inflammation control and strong efficacy across these rheumatologic conditions.(Source: https://www.prnewswire.com)

Rheumatology Therapeutics MarketSegments Covered in the Report

By Drug Type

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Corticosteroids

- Disease-Modifying Anti-Rheumatic Drugs (DMARDs)

- Conventional Synthetic DMARDs

- Biologic DMARDs

- Targeted Synthetic DMARDs/JAK Inhibitors

- Uric-Acid-Lowering Agents (for gout)

By Disease Indication

- Rheumatoid Arthritis (RA)

- Osteoarthritis (OA)

- Gout

- Ankylosing Spondylitis (AS)

- Lupus

- Others

By Route of Administration

- Oral

- Injectable / Infusion

- Topical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client