List of Contents

What is the Fluorescent In Situ Hybridization (FISH) Probe Market Size?

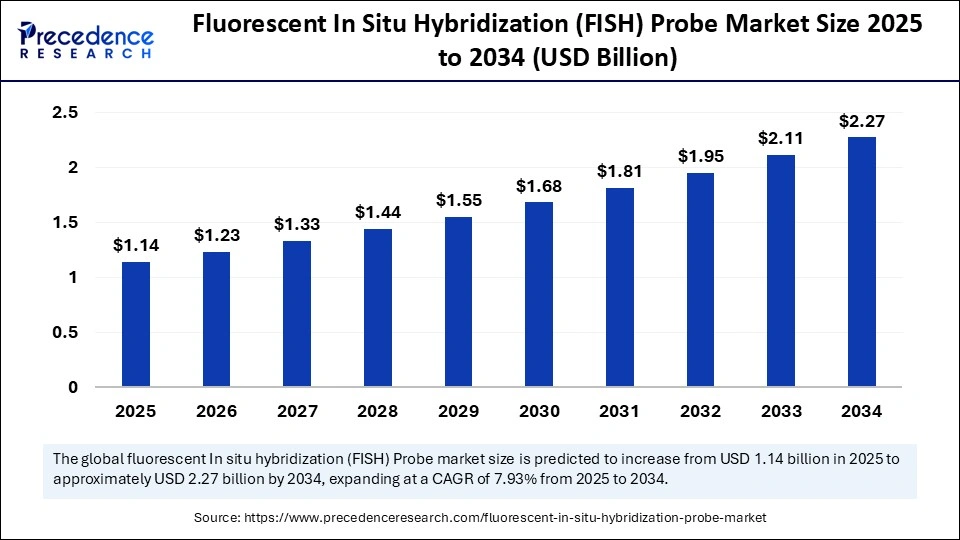

The global fluorescent in situ hybridization (FISH) probe market size is calculated at USD 1.14 billion in 2025 and is predicted to increase from USD 1.23 billion in 2026 to approximately USD 2.27 billion by 2034, expanding at a CAGR of 7.93% from 2025 to 2034. The rising prevalence of genetic disorders and cancer, coupled with the growing adoption of precision diagnostics, is propelling strong growth in the global fluorescent in situ hybridization (FISH) probe market.

Fluorescent In Situ Hybridization (FISH) Probe Market Key Takeaways

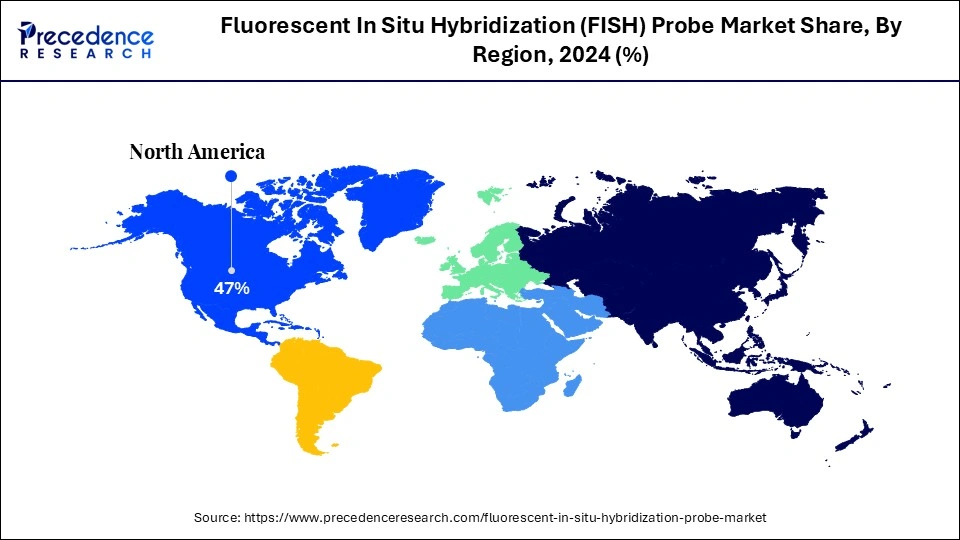

- North America dominated the fluorescent in situ hybridization (FISH) probe market with about 47% of market share in 2024.

- Asia Pacific is expected to grow at the fastest rate from 2025 to 2034.

- By probe type, the DNA probes segment held the major market share of 45% in 2024.

- By probe type, the RNA probes segment is growing at the fastest CAGR from 2025 to 2034.

- By label type, the fluorescent dyes segment led the market while holding a 50% of market share in 2024.

- By label type, the quantum dots segment is expected to expand at a significant CAGR from 2025 to 2034.

- By application, the oncology segment held the largest market share of 55% in 2024.

- By application, the prenatal & genetic disorder diagnosis segment is expected to grow at the fastest rate from 2025 to 2034.

- By end user, the hospitals & diagnostic centers segment dominated the market with a 50% share in 2024.

- By end user, the research & academic institutes segment is poised to grow at the fastest rate from 2025 to 2034.

Fluorescence In Situ Hybridization (FISH) Is a Laboratory Technique Used to Detect and Locate a Specific DNA Sequence on a Chromosome

Fluorescent in situ hybridization (FISH) probes are short, fluorescently labeled DNA or RNA sequences used to detect and localize specific genes or chromosomal regions within cells or tissues. They work by binding, or “hybridizing,” to complementary DNA sequences, allowing researchers and clinicians to visualize genetic abnormalities, gene expression patterns, and chromosomal rearrangements under a fluorescence microscope. FISH probes are widely used in clinical diagnostics, cancer cytogenetics, genetic disorder detection, and biomedical research for their high sensitivity, specificity, and ability to provide spatial genetic information directly within intact cells.

The fluorescent in situ hybridization (FISH) probe market involves fluorescently labeled nucleic acid probes used to detect and localize specific DNA or RNA sequences in cell or tissue samples. They are composed of various materials such as oligonucleotides, fluorophores, linkers and spacers, blocking reagents, and hybridization buffers.

These probes are essential components in fields like cytogenetics, cancer diagnostics, prenatal screening, and infectious disease research. The market's growth is driven by the increasing prevalence of genetic disorders and complex types of cancers, the adoption of precision medicine, advances in molecular diagnostics, and the integration of FISH technology into clinical workflows. They are mainly used in hospitals, diagnostic laboratories, research institutes, and biotech companies. Technological advancements such as multiplex FISH, automated imaging, and digital analysis tools are further enhancing market expansion.

Fluorescent In Situ Hybridization (FISH) Probe Market Outlook

The fluorescent in situ hybridization (FISH) probe market is experiencing significant growth, driven by the increasing applications in cancer diagnostics, genetic disorder detection, and prenatal testing. Advancements in molecular cytogenetics and rising demand for precise, rapid, and visual genomic analysis are further fueling market expansion globally.

A key trend in the fluorescent in situ hybridization (FISH) probe market is the growing adoption of advanced imaging techniques and multiplexing capabilities. These technological improvements enhance diagnostic accuracy, shorten analysis time, and make it easier to detect multiple genetic abnormalities. The market is seeing integration of advanced probes, fluorescent dyes, and imaging software, which allows for more detailed visualization of chromosomal structures and gene expression patterns, thereby advancing the market. Non-invasive prenatal testing (NIPT) is another trend transforming healthcare by enabling detection of fetal chromosomal abnormalities through a simple blood test. FISH probes are increasingly vital in NIPT, as they improve the identification of specific chromosomal disorders.

Major investors in the market include leading life sciences companies such as Thermo Fisher Scientific, Agilent Technologies, Roche Diagnostics, Bio-Techne, and Abbott Laboratories. These organizations drive market growth through strategic investments in research and development, expanding product portfolios, and enhancing global distribution networks. Their commitment to advancing molecular diagnostics and precision medicine fosters innovation and broadens the clinical applications of FISH technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.14 Billion |

| Market Size in 2026 | USD 1.23 Billion |

| Market Size by 2034 | USD 2.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Probe Type, Label Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Genetic Disorders

The growing prevalence of genetic disorders worldwide is a major factor driving the growth of the fluorescent in situ hybridization (FISH) probe market. FISH probes are extensively used to detect structural abnormalities linked to genetic disorders, such as deletions, duplications, inversions, and translocations. They also play a crucial role in diagnosing microdeletion and microduplication syndromes, which are difficult to identify with standard microscopes. Additionally, FISH probes enable the detection of repeat expansions, helping to diagnose complex disorders like Huntington's disease, fragile X syndrome, and myotonic dystrophy. This capability allows for the assessment of gene copy number changes, assisting healthcare professionals in disease classification, predicting treatment responses, and guiding personalized therapy decisions. Consequently, this advances both the healthcare industry and the market.

Restraint

High Costs

Despite significant market growth prospects, several challenges could slow its growth and development. One of the main challenges is the high cost that is associated with FISH-based diagnostic tests, which can limit access to this technology, especially when it comes to small scale businesses and underdeveloped regions. FISH technology requires specialized equipment and reagents, which can be quite expensive to source and maintain, thus increasing the overall cost of diagnostic procedures and slowing down market penetration.

Furthermore, the complexity of FISH testing presents another challenge. The process requires highly skilled technicians and advanced laboratory equipment, which may not be available in all healthcare settings, especially in developing countries or low-resource environments. These factors restrict accessibility and hinder the growth potential of the market in certain regions.

Opportunity

Early Disease Detection and Screening

One of the main opportunities in the market is its role in early disease detection and screening. FISH probes can be helpful for early cancer detection and diagnosis, as they target specific genetic changes commonly found in various types of cancers, including gene amplifications, deletions, translocations, and chromosomal rearrangements. They are also used in the early diagnosis of infectious diseases caused by parasites, bacteria, or viruses. Additionally, FISH probes are widely employed for the timely detection of genetic conditions such as Down syndrome, Turner syndrome, or Duchenne muscular dystrophy. All these factors enable parents or loved ones to make informed and timely decisions about potential medical interventions, significantly improving the patient's chances of a healthier and longer life.

The shift toward personalized medicine presents another major opportunity. As healthcare increasingly emphasizes tailored, individual treatments based on genetic profiles, the need for accurate diagnostic tools like FISH probes has grown. The growing use of targeted therapies also requires FISH technology for effective patient care. This trend is likely to drive market growth in the coming years.

Fluorescent In Situ Hybridization (FISH) Probe MarketSegment Insights

Probe Type Insights

The DNA probes segment dominated the fluorescent in situ hybridization (FISH) probe market with approximately 45% share in 2024. This dominance is due to their essential role in detecting specific gene sequences, chromosomal abnormalities, and structural rearrangements. These probes are commonly used in clinical diagnostics, especially in areas like oncology, prenatal screening, and genetic disorder detection. The strength of this segment lies in its high specificity and stability, which allows for accurate visualization of target DNA within cells or tissues.

The RNA probes segment is expected to grow at the fastest rate in the market. The growth of this segment is driven by increasing interest in gene expression analysis, single-cell transcriptomics, and spatial biology. RNA probes assist in directly visualizing RNA molecules within cells, providing valuable insights into transcriptional activity, cellular heterogeneity, and disease mechanisms. Advanced RNA FISH technologies have become increasingly popular today, especially in cancer research, neuroscience, and infectious disease studies.

Label Type Insights

The fluorescent dyes segment led the fluorescent in situ hybridization (FISH) probe market, holding about 50% share in 2024. This dominance is due to their widespread use, affordability, and compatibility with standard laboratory equipment. These dyes are extensively employed in clinical diagnostics, especially for cancer screening and genetic disorder detection, making them the most commercially established and popular segment. They provide high brightness and photostability, which are crucial for the accurate detection of chromosomal abnormalities.

The quantum dots segment is expected to grow at the fastest CAGR during the projection period. They are a newer type of fluorescent labels with superior optical properties. They offer narrow emission spectra, broad excitation ranges, and exceptional resistance to photobleaching, making them ideal for multiplex FISH assays where multiple genetic targets need to be analyzed at once. Their use is increasing even more in clinical and research settings because they can improve throughput and reduce signal overlap.

Application Insights

The oncology segment dominated the market with a 55% share in 2024. The segment's dominance is due to the widespread use of FISH in detecting oncogenic mutations, chromosomal translocations, and gene amplifications, which are essential for diagnosis, prognosis, and therapy selection. FISH has become a key technique in both hematologic and solid tumor studies. The segment also benefits from the rising prevalence of cancer worldwide and the integration of FISH into precision medicine protocols. Advanced imaging systems and multiplex probe panels further boost its adoption and drive growth.

The prenatal & genetic disorders diagnosis segment is expected to grow at the highest CAGR throughout the forecast period. This is because of the widespread use of FISH probes for identifying genetic syndromes such as Down syndrome, DiGeorge syndrome, and many others. Its strength lies in its ability to deliver rapid and accurate results, making it especially valuable in prenatal diagnostics and neonatal screening. As awareness and screening for inherited genetic conditions increase worldwide, the demand for FISH in genetic disease diagnostics will continue to rise.

End User Insights

The hospitals & clinics segment held the largest market share of 50% in 2024. Its dominance is due to direct patient testing, routine genetic screenings, and oncology diagnostics. Hospitals extensively use FISH for hematology, oncology, and prenatal diagnostics to provide accurate, actionable results. Additional factors like strong integration with hospital laboratory networks, trained staff, and established procurement channels further strengthen the segment's leadership.

The research & academic institutes segment is expected to grow at the fastest CAGR in the upcoming period. These institutions extensively use FISH technology for basic research, studying disease mechanisms, and discovering biomarkers. Academic labs often lead in developing new probe designs and labeling techniques, including the use of quantum dots and advanced fluorescent dyes, which improve sensitivity and allow for the simultaneous detection of multiple targets. Additionally, FISH has become essential in educational settings, training future scientists in cytogenetic techniques and molecular diagnostics.

Fluorescent In Situ Hybridization (FISH) Probe MarketRegional Insights

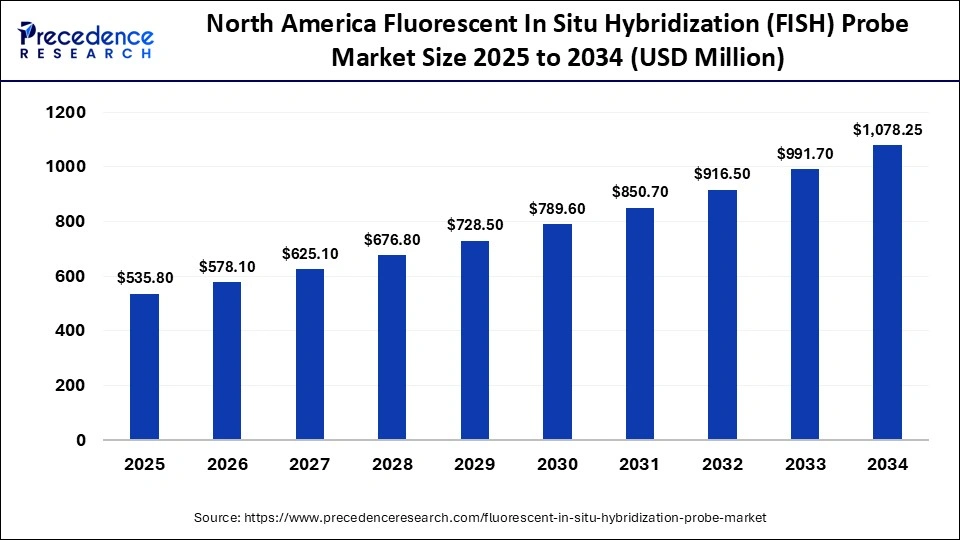

The North America fluorescent in situ hybridization (FISH) probe market size is estimated at USD 535.80 million in 2025 and is projected to reach approximately USD 1,078.25 million by 2034, with a 8.03% CAGR from 2025 to 2034.

Why Did North America Dominate the Market in 2024?

North America led the fluorescent in situ hybridization (FISH) probe market, capturing about 47% of the share in 2024. This leadership is driven by a strong emphasis on biomedical research in the region, focused on developing new diagnostic tools and molecular technologies. Additionally, the presence of a robust healthcare infrastructure, including well-established hospitals, clinical laboratories, and diagnostic facilities, is fueling market growth. Furthermore, the increasing incidence of genetic disorders and cancer in the region is boosting demand for accurate and reliable molecular diagnostic tools like FISH probes

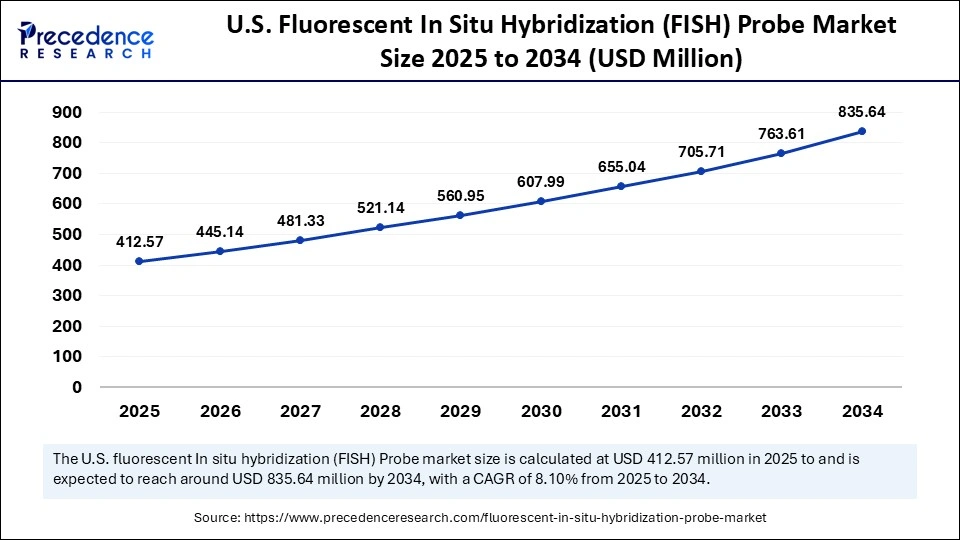

The U.S. fluorescent in situ hybridization (FISH) probe market size is calculated at USD 412.57 million in 2025 and is expected to reach nearly USD 835.64 million in 2034, accelerating at a strong CAGR of 8.10% between 2025 and 2034.

U.S. Fluorescent In Situ Hybridization (FISH) Probe Market Trends

The U.S. is a major contributor to the market in North America due to its robust life sciences and biotechnology infrastructure, which supports extensive research and clinical applications. High adoption of advanced molecular diagnostics in hospitals, academic institutions, and diagnostic labs drives demand for FISH probes. Strong government funding, private investments, and a vibrant startup ecosystem accelerate innovation and commercialization of FISH technologies. Additionally, the presence of leading global players and advanced regulatory frameworks ensures rapid product approvals and widespread market penetration.

Asia Pacific is expected to grow at the fastest rate during the forecast period, driven by increasing healthcare spending, rising public awareness of genetic testing, and rapid technological advancements in countries like China, Japan, and India. The region's increasing burden of cancer and genetic diseases, supported by government initiatives promoting advanced diagnostics, is further fueling the adoption of FISH probes. Additionally, as the region becomes a key hub for biotechnology and life sciences research, the use of FISH probe solutions is poised to expand even more across broader clinical and research applications.

China Market Trends

China is the leading country in the Asia Pacific fluorescent in situ hybridization (FISH) probe market. This dominance is attributed to substantial government investments in genomics infrastructure, such as the Precision Medicine Initiative, and the establishment of over 110 hospitals integrating FISH probes into cancer care. Additionally, China's growing oncology testing demand and the development of domestic manufacturing capabilities have significantly reduced reagent costs, further driving market growth.

Europe is experiencing significant growth in the market, driven by robust healthcare infrastructure, strong governmental support for genomic research, and increasing prevalence of genetic disorders and cancer. Countries like Germany, the UK, and France are at the forefront, with well-established healthcare systems and a high adoption rate of molecular diagnostics. The European Union's Horizon Europe initiative has allocated substantial funding towards molecular diagnostics projects, further bolstering the market. Additionally, the region's emphasis on personalized medicine and active participation in clinical trials contributes to the expanding demand for FISH probes.

Latin America became a notable region of growth in the fluorescent in situ hybridization (FISH) probe market in 2024, driven by expanding adoption of molecular diagnostic technologies, rising prevalence of cancer and genetic disorders, and growing investment in laboratory infrastructure. Over the past few years, public and private healthcare institutions in countries such as Brazil, Mexico, and Argentina have increasingly integrated FISH testing into oncology, cytogenetics, and prenatal diagnostics. The growing burden of cancer across the region has prompted health ministries and diagnostic laboratories to prioritize advanced molecular tools for early detection and precision treatment planning.

Increased partnerships between global biotechnology firms and regional distributors have improved the availability of FISH probes and related reagents. As academic and research institutions in Latin America strengthen their focus on genomic medicine and cytogenetic studies, the demand for FISH probes continues to rise, supported by training initiatives and knowledge exchange programs that expand local technical expertise.

Brazil Market Analysis

In Brazil, the FISH probe market has witnessed steady expansion, supported by advancements in cancer diagnostics, the modernization of pathology laboratories, and the country's growing participation in precision medicine initiatives. Hospitals and diagnostic centers across major cities such as São Paulo, Rio de Janeiro, and Brasília have increasingly adopted FISH assays to identify chromosomal abnormalities in hematologic malignancies, solid tumors, and genetic conditions. Over the past three years, Brazilian research institutions have collaborated more closely with international biotechnology companies to validate new FISH probe panels for local clinical applications.

The Brazilian Ministry of Health's focus on improving cancer care infrastructure, combined with rising investments from private diagnostic networks, has strengthened the use of molecular cytogenetic testing across both public and private sectors. Furthermore, the country's expanding biotechnology ecosystem and active academic research in oncology and genetics have supported local demand for customized FISH probes and automation-friendly hybridization systems. With these developments, Brazil continues to establish itself as a key market in Latin America for advanced molecular diagnostics such as FISH testing.

Fluorescent In Situ Hybridization (FISH) Probe Market Companies

- Headquarters: Santa Clara, California, United States

- Year Founded: 1999 (spun off from Hewlett-Packard)

- Ownership Type: Publicly Traded (NYSE: A)

History and Background

Agilent Technologies was established in 1999 as a spin-off from Hewlett-Packard, inheriting HP’s test and measurement businesses. Since its inception, Agilent has evolved into a global leader in life sciences, diagnostics, and applied chemical markets. The company provides analytical instruments, software, services, and consumables for laboratories worldwide.

Agilent’s core mission is to deliver trusted analytical insights across genomics, proteomics, and chemical analysis. Over the past two decades, it has expanded through acquisitions and innovation in molecular diagnostics, clinical genomics, and cell analysis technologies.

Key Milestones / Timeline

- 1999: Founded following Hewlett-Packard’s spin-off of its test and measurement business

- 2000: Completed one of the largest IPOs in Silicon Valley history

- 2014: Spun off its electronic measurement business as Keysight Technologies to focus on life sciences and diagnostics

- 2018: Acquired Advanced Analytical Technologies and ACEA Biosciences to expand molecular and cellular analysis capabilities

- 2021: Launched Agilent SureSelect and GenetiSure microarray product updates for genetic research and diagnostics

- 2024: Expanded biopharma manufacturing solutions and digital lab informatics portfolio

Business Overview

Agilent operates as a global provider of instruments, software, services, and consumables for laboratories engaged in research, diagnostics, and applied testing. Its core focus areas include life sciences, diagnostics, and chemical analysis. The company’s molecular diagnostic platforms are widely used in cytogenetics, oncology, and infectious disease research.

Business Segments / Divisions

- Life Sciences and Applied Markets

- Diagnostics and Genomics

- Agilent CrossLab Services

Geographic Presence

Agilent operates in more than 110 countries with major manufacturing, R&D, and customer support centers in the United States, Europe, China, and Singapore.

Key Offerings

- Genomic microarrays and FISH probes for cytogenetic and molecular diagnostics

- Chromatography and mass spectrometry systems

- Automated sample preparation and analysis platforms

- Bioinformatics and digital laboratory management software

Financial Overview

Agilent reports annual revenues of approximately $6.8–7.0 billion USD, with steady growth across its diagnostics and life sciences divisions. The company maintains strong profitability driven by recurring revenue from consumables and services.

Key Developments and Strategic Initiatives

- March 2023: Introduced new high-resolution microarray solutions for genomic and cytogenetic research

- November 2023: Expanded Agilent CrossLab digital services for connected lab management

- May 2024: Acquired a molecular diagnostics firm to strengthen its oncology testing portfolio

- February 2025: Announced global sustainability initiative for carbon-neutral operations by 2030

Partnerships & Collaborations

- Collaborations with major hospitals and research institutes for oncology and genetic testing solutions

- Partnerships with biotechnology firms for molecular assay development

- Alliances with academic institutions for precision medicine research

Product Launches / Innovations

- Agilent GenetiSure Microarrays for cytogenetics (2023)

- Agilent SureFISH probes for cancer diagnostics (2024)

- Next-generation bioinformatics software for genomic data analysis (2025)

Technological Capabilities / R&D Focus

- Core technologies: Genomics, mass spectrometry, chromatography, molecular diagnostics, and informatics

- Research Infrastructure: R&D centers in the U.S., China, and Europe

- Innovation focus: Precision diagnostics, integrated laboratory automation, and sustainable biomanufacturing

Competitive Positioning

- Strengths: Broad analytical instrumentation portfolio, strong brand heritage, global customer base

- Differentiators: Integrated platforms combining hardware, consumables, and digital services

SWOT Analysis

- Strengths: Technological leadership, diversified portfolio, global service network

- Weaknesses: Exposure to academic and government funding cycles

- Opportunities: Expansion in biopharma manufacturing and precision diagnostics

- Threats: Competition from Thermo Fisher Scientific and other diversified analytical providers

Recent News and Updates

- April 2024: Agilent launched digital lab management solutions for connected research environments

- August 2024: Expanded molecular diagnostics partnership in oncology testing

- January 2025: Announced sustainable lab consumables line to reduce single-use plastics

- Headquarters: Abbott Park, Illinois, United States

- Year Founded: 1888

- Ownership Type: Publicly Traded (NYSE: ABT)

History and Background

Abbott Laboratories was founded in 1888 by Dr. Wallace C. Abbott, a Chicago physician, as a pharmaceutical manufacturing company. Over more than a century, Abbott has transformed into a global healthcare leader with operations spanning diagnostics, medical devices, nutrition, and branded generic pharmaceuticals.

Abbott’s Diagnostics division is a cornerstone of its global business, providing advanced testing and detection technologies for laboratories and point-of-care settings. The company has played a pivotal role in developing molecular diagnostic systems, immunoassays, and genetic testing solutions, serving hospitals, clinicallaboratories, and research institutions worldwide.

Key Milestones / Timeline

- 1888: Founded by Dr. Wallace C. Abbott in Chicago, Illinois

- 1950s: Expanded internationally and launched antibiotics and nutritional products

- 2006: Introduced the ARCHITECT immunoassay and clinical chemistry analyzers

- 2017: Acquired Alere Inc., strengthening its molecular diagnostics and rapid testing portfolio

- 2021: Launched next-generation Alinity m molecular diagnostics platform

- 2024: Expanded global manufacturing and digital integration for lab diagnostics

Business Overview

Abbott operates as a diversified global healthcare company focusing on improving health outcomes through innovation in diagnostics, medical devices, nutrition, and pharmaceuticals. Its diagnostics portfolio includes molecular and clinical chemistry analyzers, genetic testing systems, and immunoassay platforms widely used for infectious disease and oncology screening.

Business Segments / Divisions

- Diagnostics

- Medical Devices

- Nutrition

- Established Pharmaceuticals

Geographic Presence

Abbott operates in more than 160 countries with major R&D and manufacturing facilities in the United States, Ireland, Singapore, Germany, and China.

Key Offerings

- Alinity diagnostic platforms (immunoassay, clinical chemistry, and molecular testing)

- ID NOW rapid molecular diagnostic systems

- FreeStyle Libre continuous glucose monitoring systems

- Molecular oncology and genetic testing solutions

Financial Overview

Abbott reports annual revenues exceeding $40 billion USD, driven by strong performance in diagnostics and medical devices. The diagnostics division contributes significantly, supported by global demand for infectious disease and molecular testing.

Key Developments and Strategic Initiatives

February 2023: Expanded Alinity m molecular diagnostics test menu for infectious diseases

October 2023: Announced integration of digital connectivity for laboratory workflow optimization

April 2024: Partnered with global health agencies to expand diagnostic access in emerging markets

June 2025: Introduced next-generation molecular diagnostic assays for oncology and genetic applications

Partnerships & Collaborations

- Partnerships with hospitals and laboratories for clinical validation of diagnostic assays

- Collaborations with global health organizations to increase testing access in developing countries

- Academic partnerships for biomarker discovery and precision medicine research

Product Launches / Innovations

- Alinity m Resp-4-Plex molecular test for respiratory pathogens (2023)

- Next-generation oncology genetic testing panels (2024)

- Digital diagnostic connectivity platform for lab automation (2025)

Technological Capabilities / R&D Focus

- Core technologies: Molecular diagnostics, immunoassay systems, biosensors, and medical device integration

- Research Infrastructure: Global R&D network with major centers in Illinois, Germany, and Singapore

- Innovation focus: Rapid molecular diagnostics, AI-driven data analytics, and connected healthcare

Competitive Positioning

- Strengths: Strong brand heritage, diversified healthcare portfolio, global scale

- Differentiators: Integration of diagnostics with digital health and medical device solutions

SWOT Analysis

- Strengths: Broad market presence, high R&D investment, trusted global brand

- Weaknesses: Exposure to regulatory scrutiny and healthcare reimbursement pressures

- Opportunities: Growth in molecular diagnostics, connected devices, and emerging markets

- Threats: Competition from Roche, Thermo Fisher, and other diagnostics leaders

Recent News and Updates

- March 2024: Abbott announced expanded production of Alinity molecular testing systems in Asia

- August 2024: Launched new digital platform for real-time diagnostic data management

- January 2025: Reported strong growth in diagnostics and molecular testing business segments

Recent Developments

- In September 2025, Oxford Gene Technology received the FDA authorization for its CytoCell KMT2A Breakapart FISH Probe Kit PDx, now officially designated as a companion diagnostic for Syndax's menin inhibitor, REVUFORJ, also known as revumenib. This probe enables rapid detection of KMT2A gene rearrangements in acute leukemia patients, helping clinicians identify candidates for targeted therapy. The approval marks a significant milestone in personalized oncology, especially for patients with historically poor prognoses.(Source: https://www.ogt.com)

- In October 2025, MetaSystems Probes announced the rollout of its IVDR-certified XCyting FISH probes across Finland, Portugal, Sweden, and Spain starting October 1, 2025. These high-quality DNA probes are tailored for hematology and solid tumor diagnostics, and the company emphasized ongoing development of new probes based on customer demand. MetaSystems also highlighted its patented mBAND technique and commitment to expanding its product portfolio.

Exclusive Analysis on the Fluorescent In Situ Hybridization (FISH) Probe Market

The fluorescent in situ hybridization (FISH) probe market is exhibiting robust expansion dynamics, underpinned by the escalating demand for precision cytogenetic diagnostics and the proliferation of personalized medicine paradigms. Our analysis suggests the market's growth trajectory is being catalyzed by heightened adoption of molecular cytogenetics in oncology, prenatal and postnatal diagnostics, and hematological disorder profiling.

The implications for industry leaders are clear. Tier I incumbents, Agilent Technologies, Abbott Laboratories, Roche, Thermo Fisher Scientific, and PerkinElmer, continue to consolidate their market dominance, leveraging expansive R&D pipelines, regulatory accreditations, and comprehensive clinical validation portfolios. However, the market's heterogeneity provides fertile ground for Tier II and III players to capture incremental value through innovation in probe specificity, multiplexing capabilities, automation integration, and cost-optimized assay solutions.

Opportunities for value creation are particularly pronounced in the following vectors

- Emerging markets penetration: Expanding healthcare infrastructure and increasing genetic testing adoption in APAC, LATAM, and MENA regions present high-growth corridors.

- Next-generation probe platforms: The shift toward multiplex FISH, 3D FISH, and digital cytogenetics creates differentiation levers for technologically adept entrants.

- Collaborative commercialization: Strategic alliances with diagnostic laboratories, OEM partnerships, and co-development initiatives can accelerate market share acquisition for niche and mid-tier players.

- Integration with AI/ML analytics: Coupling FISH readouts with computational cytogenomics enables enhanced diagnostic throughput, offering both clinical and operational upside.

In aggregate, the market embodies a highly attractive growth landscape, balancing entrenched incumbent dominance with disruptive opportunities for specialized and agile competitors. Stakeholders that align technological innovation with global regulatory navigation and targeted geographic deployment are poised to maximize shareholder value in this expanding molecular diagnostics segment.

Fluorescent In Situ Hybridization (FISH) Probe MarketSegments Covered in the Report

By Probe Type

- DNA Probes

- RNA Probes

- PNA Probes

- Others

By Label Type

- Fluorescent Dyes

- Fluorescent Proteins

- Quantum Dots

- Others

By Application

- Oncology

- Solid Tumors

- Hematologic Malignancies

- Prenatal & Genetic Disorder Diagnosis

- Infectious Diseases

- Drug Discovery & Research

- Others

By End User

- Hospitals & Diagnostic Center

- Research & Academic Institutes

- Biotechnology & Pharmaceutical Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client