List of Contents

What is the 3D Printing Medical Implants Market Size?

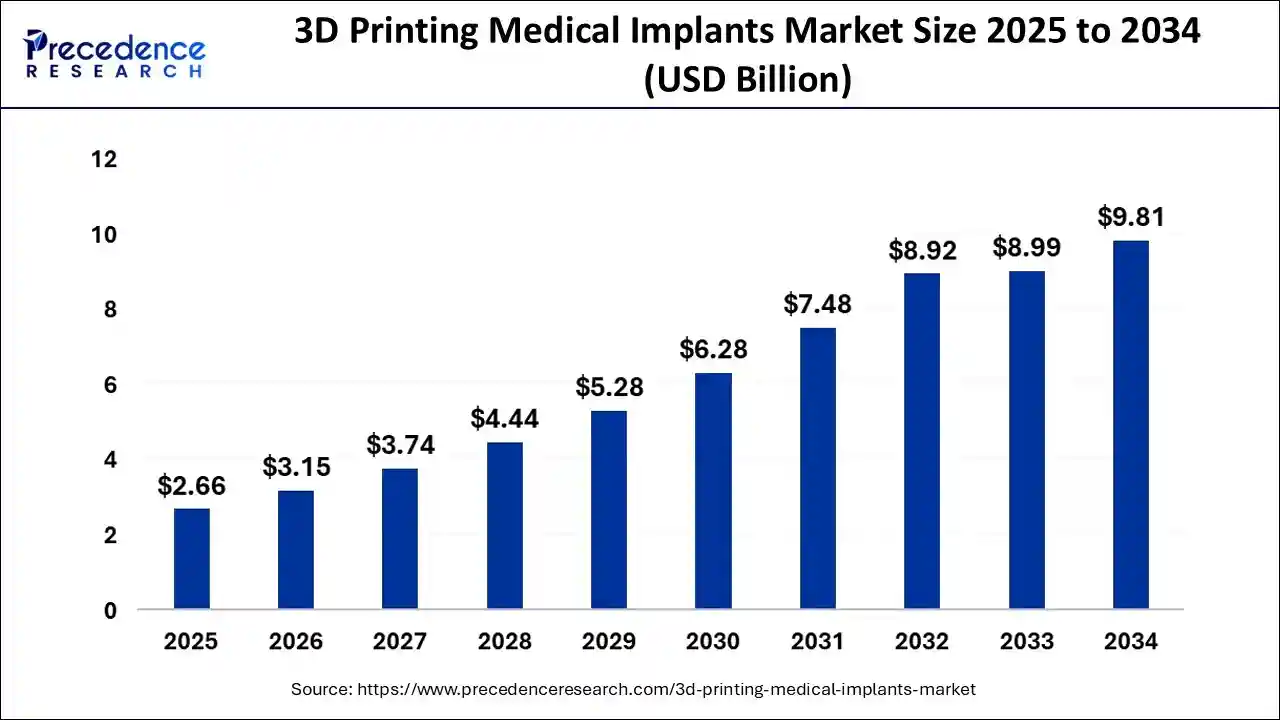

The 3D printing medical implants market size is calculated at USD 2.66 billion in 2025 and is predicted to increase from USD 3.15 billion in 2026 to approximately USD 9.81 billion by 2034 with a CAGR of 15.91%. The rising demand for customized medical implants, technological advancements in 3D printing technologies and increased government support providing fundings for development of advanced manufacturing facilities are driving the growth of the 3D printing medical implants market.

3D Printing Medical Implants Market Key Takeaways

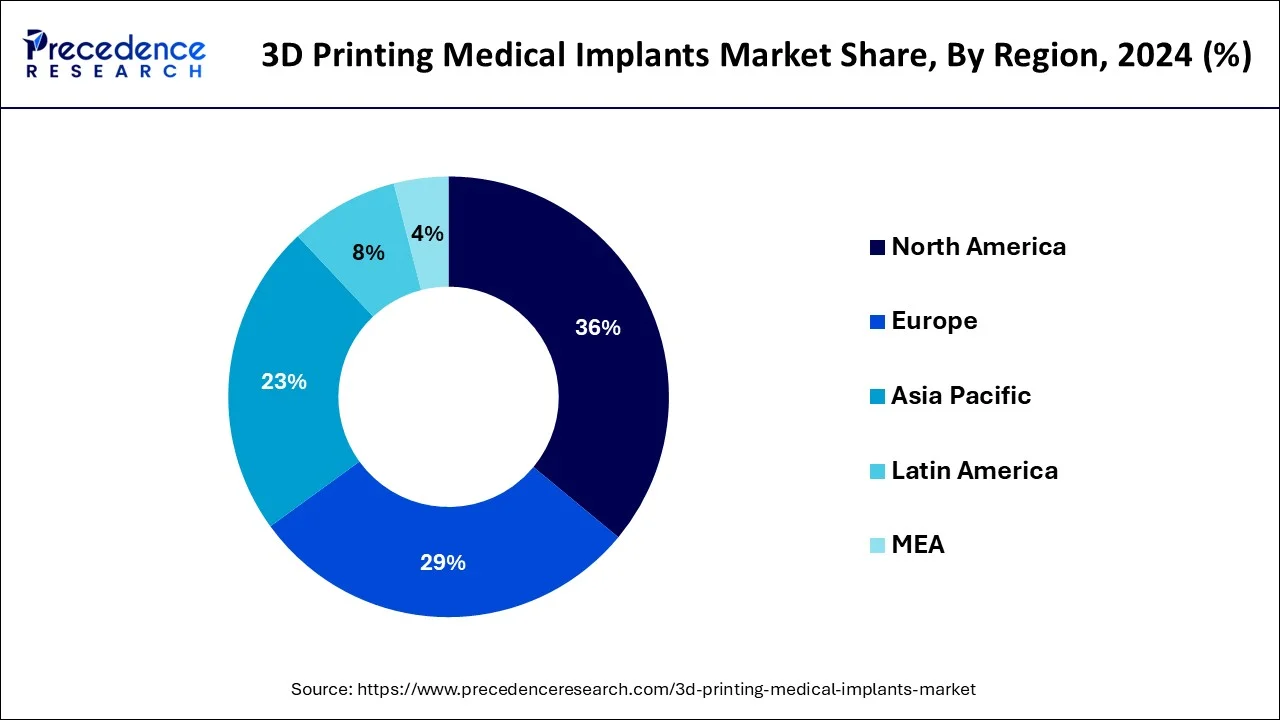

- North America dominated the 3D printing medical implants market with the largest market share of 36% in 2024.

- Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

- By application, the orthopedic segment led the market in 2024.

How is AI enhancing advancements in the 3D printing medical implants Market?

AI integration in development of 3D printed medical implants is enhancing the efficacy, applications and compatibility of medical implants. Utilising AI and machine learning tools for analysing patient data such as diagnostic images and health records for creating customized medical implants suited to the patient's need. Furthermore, AI can assist in altering the mechanical behaviour of the printer, for adjusting the parameters, defect detection by real-time monitoring of printing process and in accurately following the stringent regulations imposed for 3D printing of medical implants thereby streamlining the workflows for manufacturing.

3D Printing Medical Implants Market: Trends, Investments & Initiatives

- In January 2025, Axial3D, a Belfast-based medical technology firm raised $18.2 million in an investment round which will be utilised for scaling its AI-powered 3D medical imaging technology. The patented cloud-based AI platform converts patient scan reports such CT scans and MRI into detailed, 3D printable files and models which can be used for personalized surgical planning, custom implants, prosthetics and medical device testing.

- In November 2024, during the announcement of financial results for Q3 of 2024, Stratasys Ltd., a leader in polymer 3D printing solutions stated the achievement of revenue of $140 million compared to $162.1 million in Q3 2023.

- In September 2024, Amnovis, a leader in 3D printed titanium implant manufacturing declared the delivery of over 50,000 titanium based implants since 2021.

3D Printing Medical Implants Market Growth Factors

- Innovative manufacturing approaches for development and 3D printing of medical implants

- Rising investments and industrial collaborations for boosting R&D

- Growing demand for personalized treatments due to increasing medical surgeries

- Surge in healthcare expenditure in developing countries

- Rising cases of chronic disease across the globe

- Technological advancements in 3D printing technologies allowing creation customized devices tailored to patient's needs

- Incorporation of biodegradable materials in implants to enhance the safety, efficacy and biocompatibility

Market Outlook

- Industry Growth Overview- The market is experiencing rapid growth due to rising demand for patient-specific implants, advancements in additive manufacturing technologies, and increasing adoption in orthopedic, dental, and reconstructive surgeries, supported by strong R&D and healthcare infrastructure.

- Global Expansion- The global market is expanding rapidly, driven by technological advancements, rising demand for personalized healthcare solutions, and increasing adoption in developed and emerging regions. Investment in R&D and healthcare infrastructure further accelerates its worldwide growth.

- Startup Ecosystem- The startup ecosystem for the 3D-printed medical devices market is thriving, with companies innovating in bioprinting, patient-specific implants, and surgical tools. Strong venture capital funding, collaborations with research institutions, and growing demand for personalized healthcare solutions are driving rapid development.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 3.15 Billion |

| Market Size in 2025 | USD 2.66 Billion |

| Market Size by 2034 | USD 9.81 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.91% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End user, Technology |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Future of Global 3D Printing Medical Implants Market

Main target-industry firms, such as 3D Bioprinting Solutions and Cyfuse Biomedical among others, Ltd. focuses on commercial development by implementing approaches such as innovative product introductions, volume expansion, and weighty manufacture investments are expected to grow in the near future with the global 3D printing in medical implants market growth. In the next 10 years, this tendency is projected to continue in global 3D printing in medical implants industry. Further, the outsourcing of printing material result in high product cost. However, key players can optimize the supply chain or develop raw material facilities in-house/ within country. This will help them to reduce the raw material cost and overall product cost.

Segment Analysis

Orthopedic segment is estimated to take over the Application Segment of 3D Printing Medical Implants Market Revenue

Orthopedic application segment will boost growth of the target industry during the forecast period of time. The segmental development will be powered by the adoption of metallic and polymeric implants for complex reconstructions, such as tumor surgery and craniomaxillofacial surgery.

Pharmaceutical and biotechnological companies Segment Is Foreseen to Lead the End user Segment of 3D Printing Medical Implants Market By Revenue

The pharmaceutical and biotechnological companies segment is dominant in terms of revenue during the forecast period of time. The pharmaceutical and biotechnological companies operating in the global industry are continually focusing on the development of the advanced products in order to cater the increasing demand as well as to enhance their market position. This factor is anticipated to augment growth of the segment in the coming years.

Regional Insights

U.S. 3D Printing Medical Implants Market Size and Growth 2025 to 2034

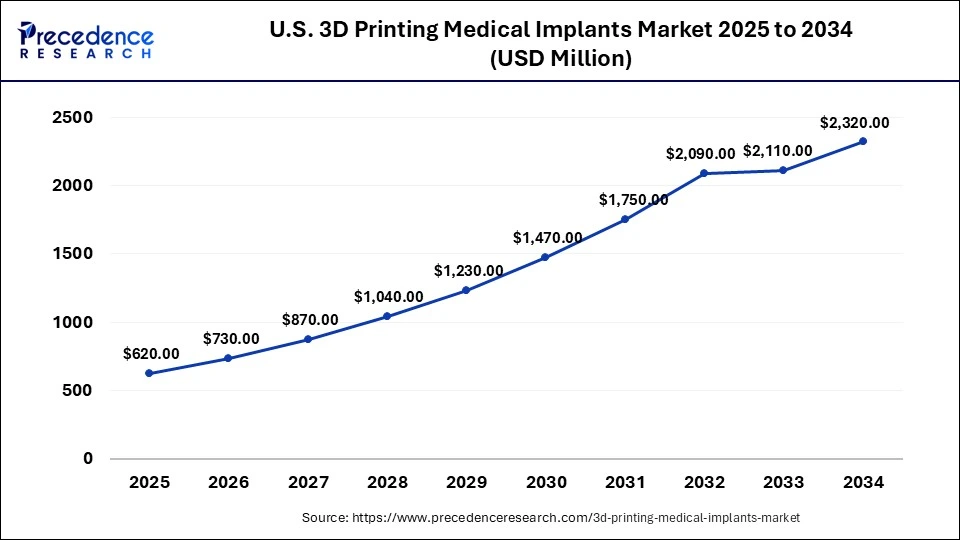

The U.S. 3D printing medical implants market size is evaluated at USD 620 million in 2025 and is predicted to be worth around USD 2,320 million by 2034, rising at a CAGR of 16.13% from 2025 to 2034.

North America is projected to be the Biggest Market for 3D Printing Medical Implants

The research study deals with the industry prospects of 3D printing medical implants products around regions including Europe, North America, Latin America, Asia-Pacific, and Middle East and Africa. North America dominated the 3D printing medical implants market with the largest market share of 36% in 2024. Addition to this, presence of leading players in the region along with strategies that are implemented by the major players in the countries of North America is expected to witness substantial growth in the target industry in the near future. Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

Precision at its Peak- Driving the Growth of the U.S.

The U.S. market is growing due to rising demand for patient-specific implants, advancements in bioprinting technologies, and the increasing prevalence of orthopedic and reconstructive surgeries. Strong healthcare infrastructure, supportive FDA regulatory frameworks, and significant investments in R&D further drive innovation and adoption of 3D-printed implants across hospitals and specialty clinics.

Asia Pacific-Rising Healthcare Infrastructure

The Asia-Pacific 3D-printed medical implants market is growing due to increasing healthcare infrastructure, rising demand for personalized and cost-effective implants, and advancements in bioprinting technologies. Expanding medical tourism, supportive government initiatives, and growing investments by local and international players are further accelerating the adoption of 3D-printed implants across the region.

Innovative Healthcare- China's Rise in Advanced Implant Solutions

China's growth in medical implant innovations is driven by government initiatives promoting advanced manufacturing and healthcare modernization, rapid expansion of hospitals and specialty clinics, and rising demand for affordable, patient-specific solutions. Increasing medical tourism and collaboration with international technology providers also contribute to the sector's rapid development.

Precision and Innovation-Advancing Implant Solutions in Europe

Europe's sector is growing due to increasing demand for patient-specific and complex implants, technological advancements in additive manufacturing, and supportive regulatory frameworks. Rising prevalence of orthopedic and reconstructive surgeries, along with investments in R&D and adoption of advanced healthcare solutions, are further driving the expansion of implant innovations across the region.

Advanced Technology Driving the Growth of the UK Market

The UK's growth is supported by NHS-led initiatives integrating advanced implant technologies into public healthcare, a strong focus on precision medicine, and collaborations between universities and medical device manufacturers. The increasing prevalence of orthopedic conditions and government funding for healthcare innovation also accelerate the adoption of customized implant solutions.

Value Chain Analysis

R&D

- R&D in 3D-printed medical implants aims to develop patient-specific solutions.

- Focuses on improving materials, printing technologies, and implant design.

- Enhances customization, functionality, and compatibility of medical implants.

Clinical Trials and Regulatory Approvals

- Clinical trials and regulatory approvals for 3D-printed medical implants are intricate and continually evolving.

- Regulatory bodies, such as the FDA, require pre-market approval for high-risk implants.

- Manufacturers must prove safety and effectiveness through clinical studies.

- Compliance with quality management systems (e.g., ISO 13485) and manufacturing standards is essential.

Patient Support and Services

- Patient support for 3D-printed medical implants is personalized from consultation to post-operative care.

- Services include custom implant design tailored to the patient.

- Pre-surgical planning using 3D models helps ensure accurate and effective implant placement.

Top Vendors and their Offerings

- BioBots- Develops desktop bioprinters and bio ink platforms capable of printing tissue-mimicking structures, enabling research into customized implants and regenerative scaffolds.

- Formlabs- Provides 3D printing systems and biocompatible materials tailored for patient-specific medical applications, including implantable parts and bespoke medical device components.

- Stratasys- Offers full-scale additive manufacturing solutions for medical devices and implants, with certified materials and printers designed for compliant, patient-specific end-use parts.

- ROKIT- Focuses on biofabrication and 4D bioprinting technologies to produce regenerative implants and tissue engineering solutions that incorporate patient biomaterials for personalized therapies.

3D Printing Medical Implants Market Companies

Leading competitors contending in global 3D printing medical implants market are as follows:

- 3D Bioprinting Solutions

- ANDREAS STIHL AG & Co. KG

- Aspect Biosystems

- Medprin

- Organovo

- Materialise N.V.

- Cyfuse Biomedical

Key Market Developments

- In June 2024, restor3d, a leader in 3D printed, personalized orthopaedic implants secured $70 million in Series A funding round for advancing innovations in 3D-printed implants.

- In June 2024, BellaSeno, a German 3D printing medical implant innovator declared plans for establishing a fully automated production facility for manufacturing resorbable sift tissue and bone reconstruction implants in Australia by mid-2025. The no-touch manufacturing 3D printing facility will utilise AI-driven technology for production of up to 100,000 custom-made breast scaffolds every year.

Major Market Segments Covered

By Component

- Material

- Service

- System

By Application

- Dental

- Orthopedic

- Cranial

- Others

By End user

- Pharmaceutical & biopharmaceutical companies

- Academic institutions

- Surgical centers

By Technology

- Laser beam melting

- Electronic beam melting

- Droplet deposition

- Others

By Geography

- North America

-

- U.S.

- Canada

-

- Europe

-

- Germany

- France

- United Kingdom

- Rest of Europe

-

- Asia Pacific

-

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

-

- Latin America

-

- Brazil

- Rest of Latin America

-

- Middle East & Africa (MEA)

-

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

-

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client