List of Contents

Smart Agriculture Market Size and Forecast 2024 to 2034

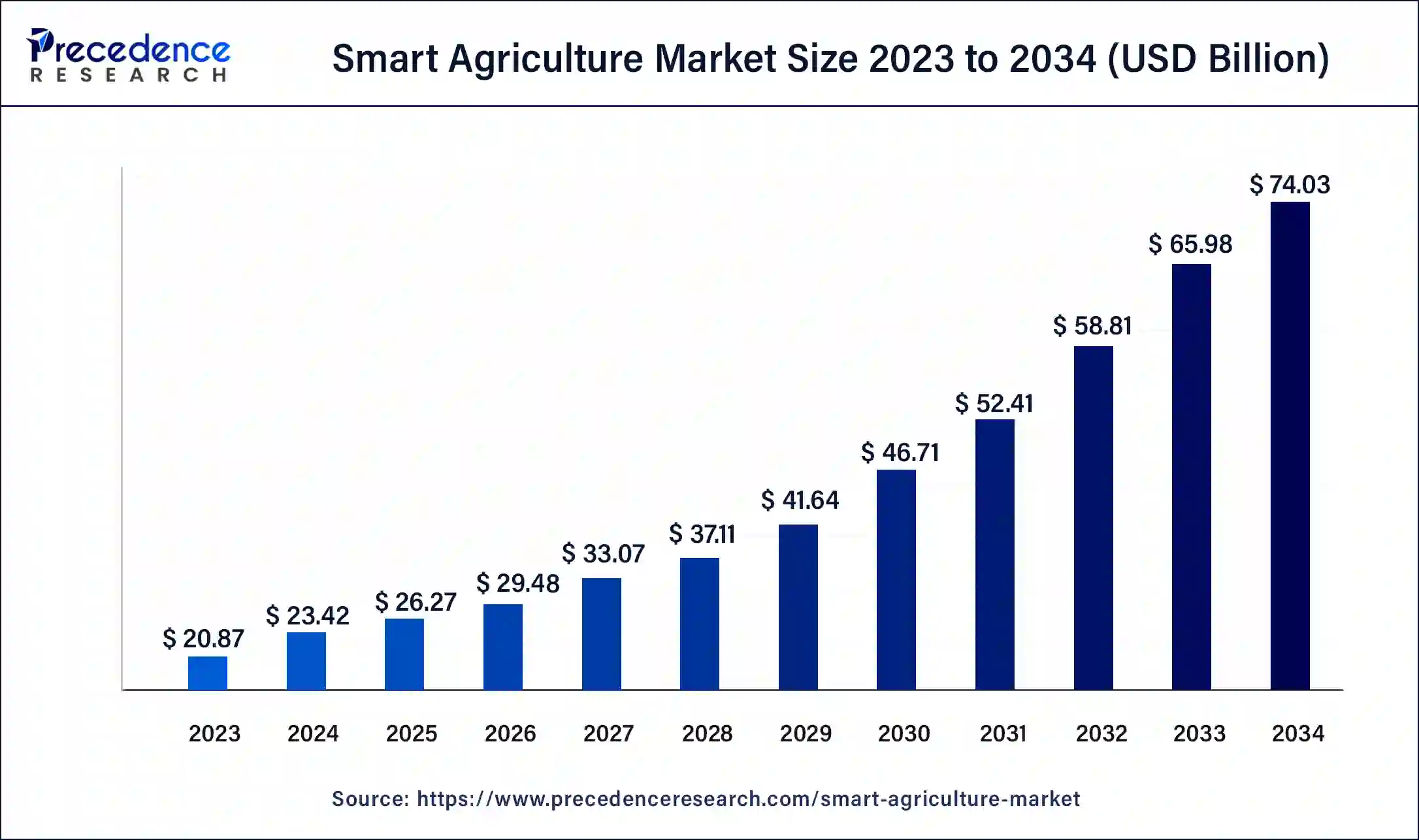

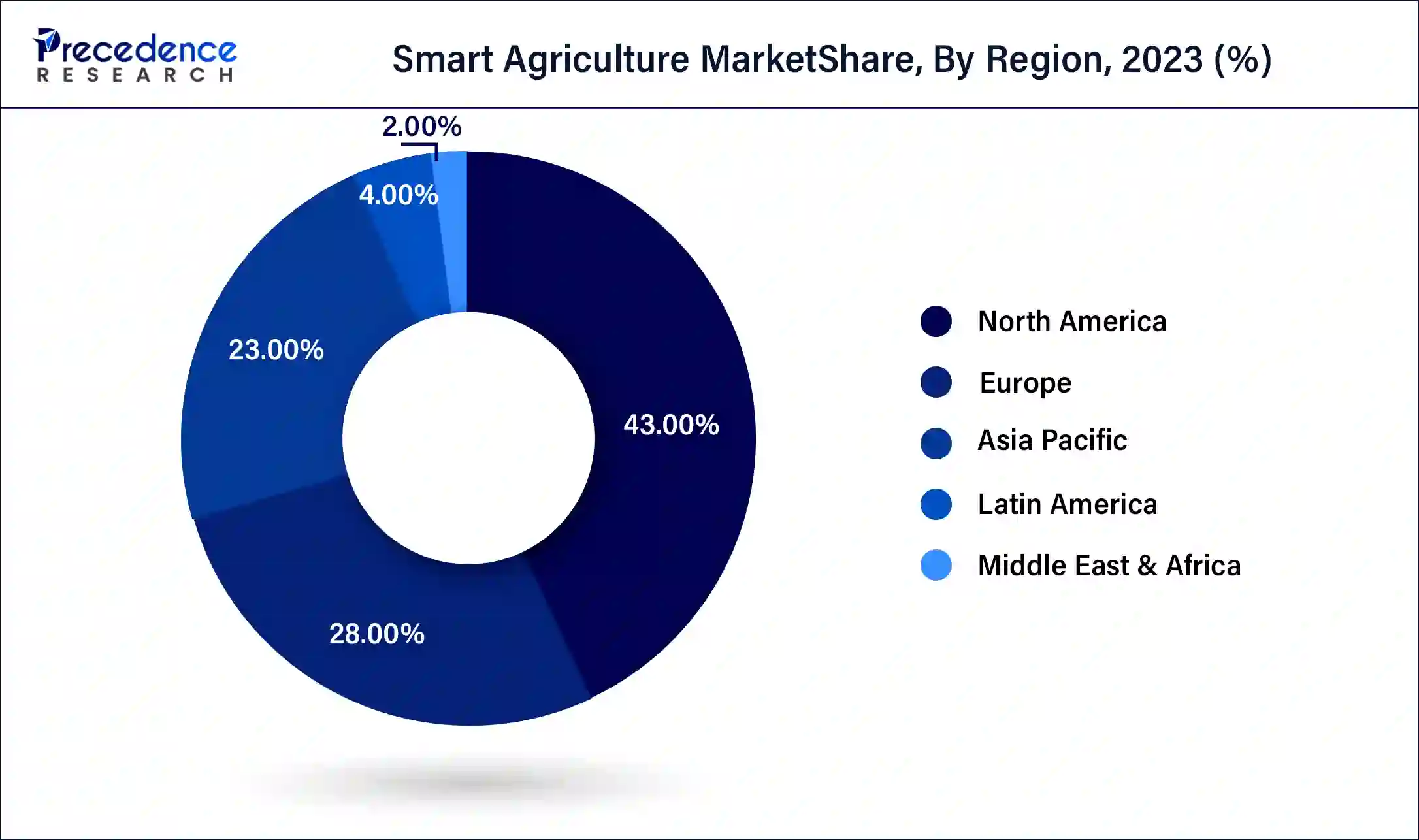

The global smart agriculture market size accounted for USD 23.42 billion in 2024 and is expected to reach around USD 74.03 billion by 2034, expanding at a CAGR of 12.2% from 2024 to 2034.The North America smart agriculture market size reached USD 8.97 billion in 2023.

Smart Agriculture Market Key Takeaways

- North America led the global market with the highest market share of 43% in 2023.

- By offering, the software segment has held the largest market share in 2023.

- By application, the precision farming application segment captured the biggest revenue share in 2023.

- By agriculture type, the livestock monitoring segment registered the maximum market share in 2023.

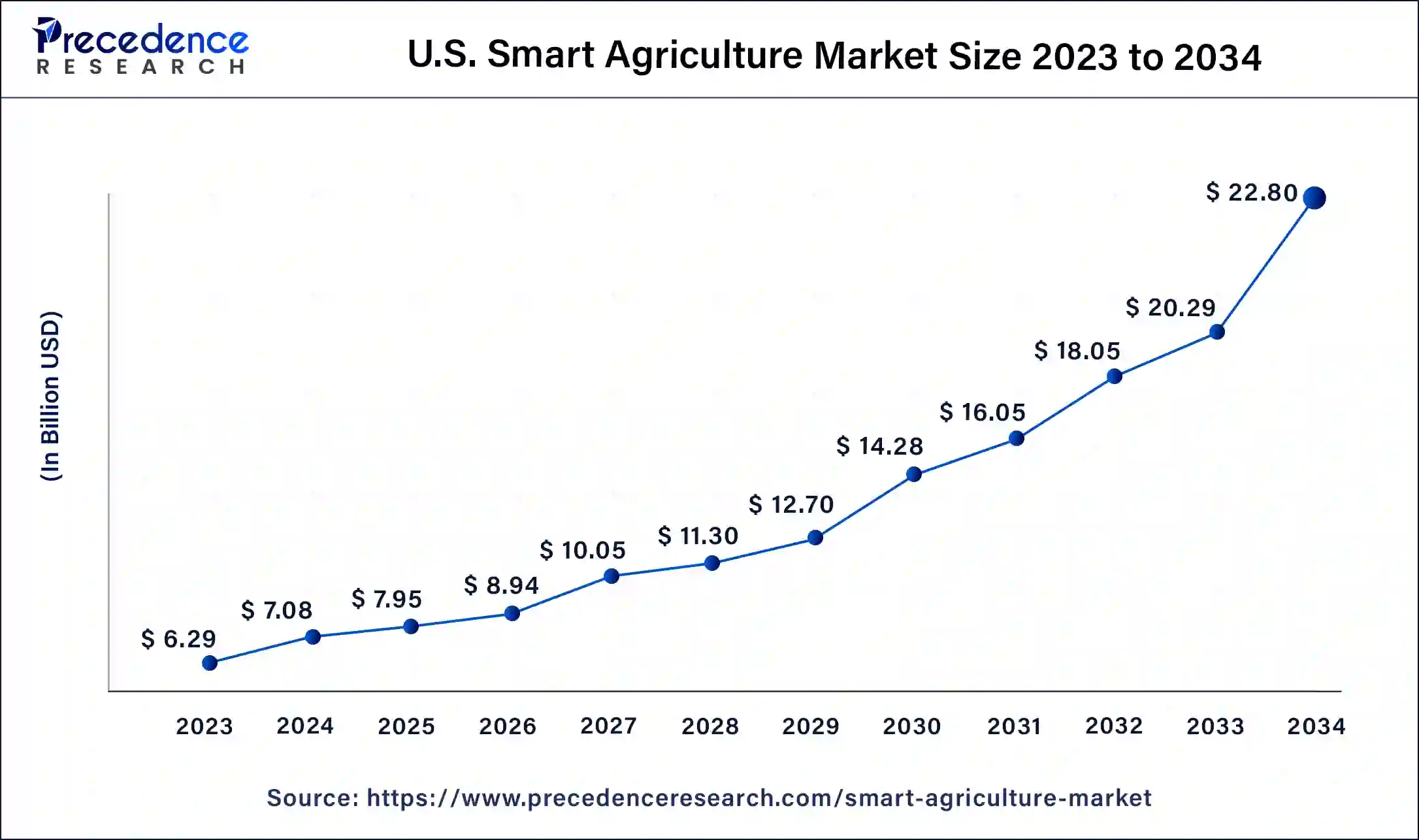

U.S. Smart Agriculture Market Size and Growth 2024 to 2034

The U.S. smart agriculture market size was estimated at USD 6.29 billion in 2023 and is predicted to be worth around USD 22.80 billion by 2034, at a CAGR of 12.4% from 2024 to 2034.

North America dominated the smart agriculture market in 2023 with a revenue share of 43%. The growth of the smart agriculture market in the North America region is attributed to the growing government initiatives and favorable guidelines for the expansion of the agriculture sector. In addition, several market players are collaborating with government agencies to implement the concept of smart agriculture. Moreover, the government in this region is also providing subsidies and tax incentives for the development of smart agriculture markets. All of these factors are driving the growth of the smart agriculture market in North America.

The market in Asia Pacific is expected to expand at the fastest growth rate during the forecast period. The growth of the smart agriculture market in Asia Pacific is being driven by rising government initiatives for agriculture industry. The nations such as Singapore, Japan, and India are taking constant efforts for the growth of smart agriculture market in this region. In addition, the government of these countries is providing financial help for developing smart agriculture. Thus, the rise in adoption of organic agriculture is also supporting the growth of smart agriculture market in Asia Pacific.

- India is leading in organic farming across the globe. For instance, according to the provisional data released by the Directorate General of Commercial Intelligence and Statistics (DGCI&S), the exports of processed food and agricultural products rose by 13% to $19.69 Bn in the nine months of the Financial Year 2022-23 (Apr-Dec).

Union Budget 2023 Highlight

| Agricultural Credit Target with a focus on fisheries, fairy, and husbandry sector | INR 20 Lakh Cr. |

| Aatmanirbhar Bharat Horticulture Clean Plant Program | INR 22,000 Cr |

| Pradhan Mantri Kisan Samman Nidhi | INR 60,000 Cr. |

| Digital Agriculture Mission started by the Modi Government | INR 450 Cr. |

| PM Matsya Sampada Yojana | INR 6,000 Cr. |

Market Overview

Smart agriculture refers to farming practices using technologies and smart devices to improve sustainability, resource management, and production efficiency. Incorporating data analytics, drones, and sensors in farming practice enables precise monitoring of crops, livestock health, and soil conditions. AI-driven insights and automation empower farmers to mitigate environmental impact, reduce waste, enhance yield, and make informed decisions, ensuring a profitable and resilient agricultural sector.

Key players operating in the market are focusing on developing advanced farming equipment integrated with advanced cameras and sensors. Advanced technologies such as biometrics, GPS, and RFID enable precision farming. Additionally, the increasing trend of automation and the rising government support and subsidies to support smart agriculture are likely to contribute to the market growth.

Smart Agriculture Market Growth Factors

Smart agriculture is helping farmers to grow crops with more efficiency by utilizing advanced technologies. One of the key factors driving the growth of global smart agriculture market is growing technological advancements and adopting innovative technologies. The technologies such as internet of things, artificial intelligence, blockchain, and machine learning are creating lucrative opportunities for the growth and development of global smart agriculture market over the forecast period.

Another factor driving the growth of global smart agriculture market is growing government initiatives for the adoption of latest and advanced technologies. In addition, government of various developing and developed regions is providing tax benefits to those market players who are operating in smart agriculture market. Moreover, government is also heavily investing for the growth of global smart agriculture market.

The impact of the COVID-19 pandemic on the growth of global smart agriculture market was quite moderate in nature. The market players operating in smart agriculture market saw growth as well as decline in the sales of food grains and dairy products. The supply chain disruption and trade restrictions had negative impact on the growth of global smart agriculture market. On the other hand, the stringent government regulations regarding food safety and security had positive outlook on the expansion of global smart agriculture market during 2020.

The other factors such as increasing adoption of smartphones and growth of telecom sector are driving the growth and development of global smart agriculture market. The growing usage of smartphones is helping farmers to track and monitor agriculture activities on farm. It also provides accurate information and data and also helps to keep record on various parameters. Thus, this factor is propelling the demand for smart agriculture in the global market over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 20.87 Billion |

| Market Size in 2024 | USD 23.42 Billion |

| Market Size by 2034 | USD 74.03 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Agriculture Type, Offering, Application, Farm Size, Regions |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Driver

Increasing adoption of smartphones and drones

The increasing adoption of smartphones and drones in farming practices drives the growth and development of the global smart agriculture market. Smartphones allow farmers to track and monitor agriculture activities, providing accurate information and data and also helping to keep records on various parameters. Moreover, key players are making efforts to develop advanced farming equipment, which propel the market. For instance,

- In May 2024, DJI, China-based drone maker company, launched the Agras T25 and Agras T50 drones for agricultural applications. These drones are designed to deliver precision services in agricultural operations.

Restrain

Lack of connectivity infrastructure

Lack of internet access in rural areas may create challenges in adopting smart farming solutions, restraining the market growth. Connectivity issues deter farmers from adopting advanced technologies necessary for efficient agricultural operations, limiting their access to data and tools for improving sustainability and productivity in agriculture practices. Addressing this obstacle is necessary for expanding the effectiveness and reach of smart agriculture solutions in rural communities.

Opportunity

Increasing adoption of livestock monitoring solutions in developing countries

The increasing acceptance of livestock monitoring solutions creates immense opportunities in the market. Livestock monitoring solutions enable farmers to track animal's status and well-being from remote locations. The increasing demand for dairy products and milk is expected to accelerate the demand for livestock monitoring technologies, including feeding robots, in the coming future.

- For instance, In July 2023, SK Telecom collaborated with bio venture company uLikeKorea and launched a livestock monitoring system called ‘Live Care,' which allows farmers to monitor the health of their cattle using smart biocapsules.

By Agriculture Type Insight

The livestock monitoring segment accounted for the largest market share in 2023. Livestock monitoring helps farmers monitor livestock health and production to ensure optimal yields. Factors such as rising technological advancements and the increasing size of dairy farms have encouraged market players to develop cost-effective solutions related to livestock management. For instance,

- In September 2022, Defra and Innovation UK funded the FarmSense project. This project provided farmers with automated surveillance to monitor their livestock remotely.

Offering Insights

The software segment dominated the smart agriculture market in 2023 and was valued at USD 3,013.2 million in 2023, growing with a CAGR of 13.5% from 2024 to 2034. The growing technological advancements and adoption of innovative technologies are driving the growth of the segment. The software that is installed in smart agriculture devices and equipment is cloud-based and web-based. This software helps in data collection, data tracking, and data monitoring for farmers and livestock. Thus, the software segment is growing at a rapid pace in the smart agriculture market.

The hardware segment is the fastest growing segment of the smart agriculture market in 2023. The hardware segment is being driven by the rising automation of raw material manufacturing as well as the manufacturing of dairy products. This also helps in the reduction of labor costs, which is positively impacting the growth of the global smart agriculture market. The trend of growing automation technologies is also helping the segment to grow at a strong growth rate.

Application Insights

The precision farming application segment dominated the smart agriculture market in 2023 precision farming helps to monitor the yield of the crops. In addition, it also tracks and maps fields with accurate and precise methods. One of the important applications in this segment is weather tracking and forecasting. Water scarcity and growing environmental concerns are resulting in the expansion of the segment. The agriculture purpose depends heavily on water. This factor is boosting the growth of the segment. The yield monitoring segment accounted revenue share of around 44.3% in 2023.

The smart greenhouse application segment will be the fastest-growing segment of the smart agriculture market in 2023. Smart greenhouse helps in managing water and fertilizers on fields effectively and efficiently. The smart greenhouse also supports determining heating, ventilation, and air conditioning for agricultural purposes. Proper climatic and weather conditions are required for carrying out specific agricultural purposes. All of these factors are propelling the growth of the smart greenhouse application segment over the forecast period.

Smart Agriculture Market Companies

- AG Leader Technology

- AGCO Corporation

- AgJunction Inc.

- Autonomous Solutions Inc.

- Deers& Company

- DroneDeploy

- Farmers Edge Inc.

- GEA Group Aktiengesellschaft

- The Climate Corporation

- DeLaval Inc.

Recent Developments

- In August 2024, Sri Lanka commenced the formulation of its first Climate-Smart Agriculture (CSA) Investment Plan implemented by the Food and Agriculture Organization of the United Nations (FAO) and funded by the Green Climate Fund (GCF).

- In April 2024, the agriculture sector's first purpose-built open-source Micro Language Model for climate-smart agriculture, ‘aksara' was launched by the Bengaluru-based company Google-backed Cropin. The aim behind this launch was to meet the world's increasing demand for nutritious, safe, and sufficient food.

- In April 2024, C-DAC launched the SMART FARM System on the occasion of the 37th Foundation Day in Pune, which is supposed to be the future of agriculture. The aim behind this launch was to help farmers plan fertilization and irrigation based on soil and environmental conditions to ensure maximum yield.

- Trimble released the GFX-350, an android based display for farm auto steering application control, in November 2019. It can be used in conjunction with the NAV-500 and NAV-900 guidance systems to meet a variety of user accuracy requirements.

- In November 2020, AG Leader Technology improved its InCommand displays and expanded its SteerCommand product portfolio to include built in house SteerCommand Z2 and SteadySteer. End users can use a single use interface to steer and operate any farming equipment with these items.

- DeLaval introduced the RC700 and RC550 robot collectors for solid floors in March 2021, with the goal of improving cow comfort. They can handle any manure intake technology.

- John Deere, a major player in the smart agriculture sector, partnered with Solorrow in March 2021 to offer a new site-specific software that uses changeable application maps to do various fertilizing and other field operations.

Segments Covered in the Report

By Agriculture Type

- Precision Farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Yield monitoring

- Livestock Monitoring

- Milk harvesting

- Breeding management

- Feeding management

- Animal comfort management

- Others

- Precision Aquaculture

- Precision Forestry

- Smart Greenhouse

- Water & fertilizer management

- HVAC management

- Yield monitoring

- Others

- Others

By Offering

- Hardware

- HVAC system

- LED grow lights

- Valves & pumps

- Sensors & control systems

- Others

- Sensing Devices

- Soil sensor

- Water sensors

- Climate sensors

- Others

- Software

- Web-based

- Cloud-based

- Services

- System integration & consulting

- Maintenance & support

- Managed services

- Data services

- Analytics services

- Farm operation services

- Assisted professional services

- Supply chain management services

- Climate information services

By Farm Size

- Small

- Medium

- Large

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client