List of Contents

What is Agriculture Fertilizers Market Size?

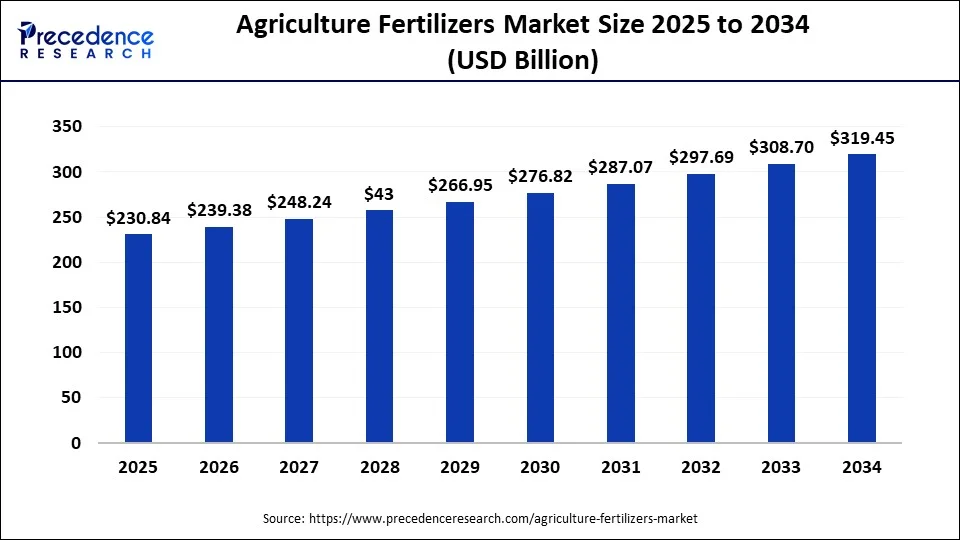

The global agriculture fertilizers market size accounted for USD 230.84 billion in 2025, and is anticipated to hit USD 239.38 billion by 2026, and is predicted to reach around USD 319.45 billion by 2034, growing at a CAGR of 3.68% from 2025 to 2034.

Agriculture Fertilizers Market Key Takeaways

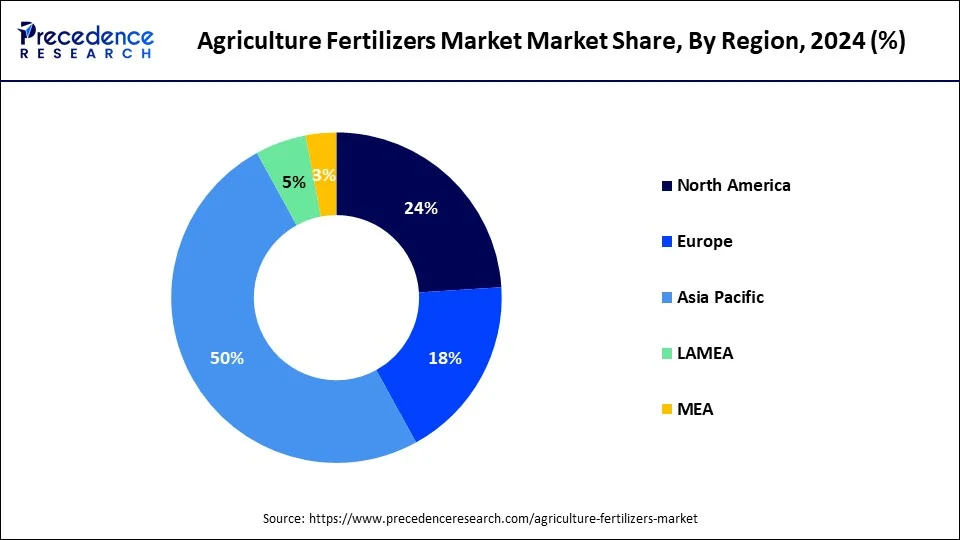

- Asia Pacific contributed more than 50% of revenue share in 2024.

- By Form, the solid form segment has held the largest market share of 63% in 2024.

- By Form, the liquid form segment is anticipated to grow at a remarkable CAGR of 5.3% between 2025 and 2034.

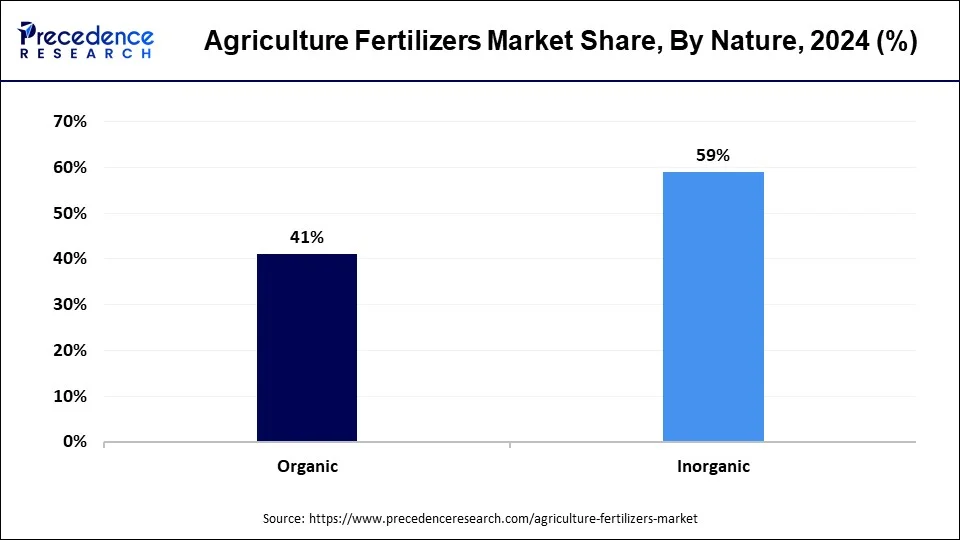

- By Nature, the inorganic segment generated over 58.5% of revenue share in 2024.

- By Product, the nitrogenous fertilizers segment captured the biggest revenue share in 2024.

How is AI contributing to the Agriculture Fertilizers Market?

Artificial Intelligenceis revolutionizing the fertilizers market through precision agriculture, automating fertilizer application, and optimizing nutrient distribution. By interpreting soil health data, it customizes fertilizer use, thereby reducing waste and increasing yields in an eco-friendly manner. AI also ameliorates demand prediction, supply chain management, and inventory, among others. Using predictive analytics in combination with sensor-based insights, it assists farmers in making informed decisions instantly, thus helping to maximize not only the efficiency but also the profit and environmental responsibility in modern agriculture.

Market Outlook

- Industry Growth Overview: Demand for food continues to grow, and particularly the use of precision agriculture is helping to fertlizers often to deliver their main benefits: efficiency, productivity, and safety of new generations worldwide.

- Sustainability Trends: The use of circular nutrient systems, biological fertilizers, and controlled release of fertilizers has been identified as a sustainable agricultural practice that both enhances yield and supports the restoration of the environment through maintaining the soil's long-term vitality.

- Global Expansion: Digital farming ecosystems, AI integration, and strategic investments are characteristic of emerging markets that help global fertilizer access, innovation, and excellence in nutrient management to be strengthened.

- Major Investors: Investments are directed to green agri-tech, AI-assisted fertilizer products, and bio-based alternatives, which are the main drivers of eco-innovation and advanced agronomy solutions for the global agriculture that is sustainable.

- Startup Ecosystem: The startups are making use of AI, sensors, and blockchain technologies in a way that ensures the transparency of the fertilizer distribution, the smart nutrient analytics, and the farmer participation in the platform, which together help modern agriculture to be both efficient and sustainable.

Agriculture Fertilizers Market Growth Factors

The rapidly growing global population and shifting dietary preferences are boosting the growth of the agriculture fertilizers market across the globe. Fertilizers are the rich sources of various nutrients that are needed for the agricultural crops and vegetables to grow. Fertilizers are an essential ingredient or materials that facilitate higher production of crops and improving soil nutrients availability. The increasing awareness among the farmers regarding the benefits of using agriculture fertilizers has significantly boosted its adoption among the global farmers population. According to the United Nations, the global population is projected to reach over 9 billion by 2050. This will create a tremendous pressure on the food supply and thus the demand for the agriculture fertilizers is expected to gain a tremendous momentum during the forecast period. Furthermore, the agriculture industry is facing low productivity owing to various factors such as rapid urbanization, shrinking of agricultural land, and shortage of labor. The rising focus of the population towards participation in manufacturing and services industry is resulting in shortages of agricultural labor.

According to the United Nations Food and Agriculture Organization, approximately 70% of the global population is expected to reside in urban areas in the forthcoming years. Therefore, rising urbanization, rising population, and shrinking of agricultural lands is expected to drive the demand for the agriculture fertilizers to increase agricultural production. Moreover, the rising demand for the organic fertilizers among the farmers owing to the growing demand for the organic fruits, vegetables, and grains among the global population is expected to spur the growth of the global agriculture fertilizers market during the forecast period.

Surging government initiatives and subsidies provided to the farmers to support the farmers and ensure adequate availability of raw materials to the farmers in order to meet the demand for food or agricultural crops is expected to support the growth of the market. In April 2020, according to a national news platform, The Economic Times, Indian government is closely monitoring the distribution and supply of the fertilizers to ensure the adequate supply of fertilizers to the farmers in order to support the fertilizers industry growth in the country.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 230.84 Billion |

| Market Size in 2026 | USD 239.38 Billion |

| Market Size in 2034 | USD 319.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.68% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Nature, Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Form Insights

Depending on the form, the global agriculture fertilizers market was dominated by the solid form segment that accounted for a market share of 63% in 2024. There is a high demand for the dry or solid fertilizers that are available in granules form. The solid agriculture fertilizers are suitable for the slow release formula be4cause it is slowly absorbed by the crops and plants. The slow absorption helps in breaking down the nutrients in the fertilizers. Moreover, the solid form of fertilizers is cheaper and facilitates easy storage and it remains intact in different weather conditions, which is a major advantage of the solid form of agriculture fertilizers.

The liquid form segment is expected to register the highest CAGR of 5.3% from 2025 to 2034. It is available in the form of liquid or in liquid concentrate form that can be mixed with water to make fertilizers. It is highly water soluble and are very much efficient. In the past few years, the demand for the liquid fertilizers has increased rapidly as it can be quickly absorbed by the plants and crops that fuels the growth of the crops and plants in the agricultural fields. Further, the low salt content of the liquid fertilizers does not allow the roots to steer away. The higher solubility of the liquid fertilizers, ease of blending, and ease of handling are the prominent factors associated with the liquid fertilizers that are boosting the demand for the liquid fertilizers across the globe.

Nature Insights

Based on the nature, the inorganic segment accounted for around 58.5% of the global agriculture fertilizers market in 2024. The inorganic are the chemical based traditional fertilizers that are highly used in the agricultural sector across the globe. The nutrient rich salts in inorganic fertilizers like potassium, phosphorous, and nitrogen get quickly dissolved in plants and helps in rapid growth of the crops. The inorganic fertilizers are regulated under strict norms that prescribes the content of nitrogen, potash, and phosphorous to be used in fertilizers to meet the soil and plant requirements efficiently. The easy availability of inorganic fertilizers in various forms such as liquid, solid, water-soluble powder, and liquid concentrates has significant contributions towards the growth of the market.

The organic segment is anticipated to be the most opportunistic segment during the forecast period. The rapidly burgeoning demand for the organic food products among the population, especially in the developed regions is expected to boost organic farming in the forthcoming years and hence, the demand for the organic fertilizers is expected to grow at a rapid rate in the upcoming future. The rising health consciousness and rising awareness regarding the ill-impacts of chemically processed food items has resulted in the growing demand for organic food items, thereby boosting the growth of the organic fertilizers across the globe.

Product Insights

Based on the product, the nitrogenous fertilizers was the dominating segment in the global agriculture fertilizers market in 2024. The demand for the nitrogenous fertilizers is high among the farmers owing to its easy availability, cheap cost, and higher efficiency in growing crops. Urea-ammonium nitrate is one of the prominent crop growth enhancers and it is gaining a rapid traction among the liquid fertilizer manufacturers owing to its higher compatibility with herbicides, pesticides, and growth regulators. This segment is expected to remain dominant throughout the forecast period.

Regional Insights

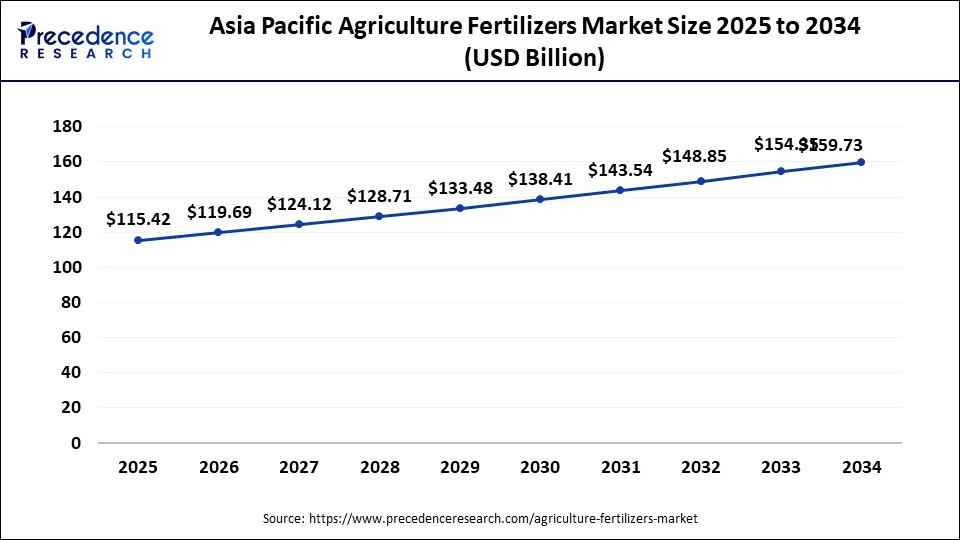

Asia Pacific Agriculture Fertilizers Market Size and Growth 2025 To 2034

The Asia Pacific agriculture fertilizers market size is calculated at USD 115.42 billion in 2025 and is expected to reach USD 159.73 billion by 2034, growing at a CAGR of 3.68% from 2025 to 2034.

Asia Pacific captured a market share of more than 50% and led the global agriculture fertilizers market in 2024. The various nations such as China, India, Vietnam, Thailand, and Indonesia are the prominent consumers of agriculture fertilizers owing to their huge crop yields. These nations are among the top exporters of rice, edible oils, and various other crops across the globe. China is the largest consumer of urea and it accounts for around one-third of the global urea consumption. Urea is mainly utilized in the production of cereals, oilseeds, corn, and soybean.

India Agriculture Fertilizers Market Trends

The current Indian fertilizer market is driven by the big entry of smart agriculture and digital advisory services. Soil testing assisted by Artificial Intelligence and the revolution with nano-fertilizers are the two leading techniques to gain maximum nutrient efficiency. Besides, the government support of self-sufficient production and green farming practices boosts the local growers' capacity.

India is the second largest consumer of urea followed by Indonesia. The cheap costs and favorable government policies regarding the subsidies to the farmers have resulted in the increased utilization of urea for increasing crops production in Asia Pacific. Asia Pacific is expected to remain the fastest-growing market during the forecast period.

United States Agriculture Fertilizers Market Trends:

The U.S. market is combining the data-driven farming approach with advanced fertilizer formulations in order to improve soil quality. The AI models are showing when and how much nutrients should be given to the major crops, while the sustainability programs are encouraging precision application. Local production networks and digital agtech platforms not only make resilience stronger but also support resource-efficient and eco-conscious practices.

What are the Driving Factors of the Agriculture Fertilizers Market in Europe?

The European fertilizer market is moving towards sustainability through the use of biobased and controlled-release formulations. Strong environmental policies promote organic alternatives and the development of innovative systems for nutrient management. The adoption of precision farming technologies is facilitating the efficient use of fertilizers, which is in line with the region's green transition targets. The partnership between the manufacturers and the agricultural institutions is yielding innovations in the area of eco-efficient production as well as in soil regeneration practices.

Germany Agriculture Fertilizers Market Trends:

Germany's fertilizer industry is a forerunner in digital agronomy as well as the sustainability-based nutrient management. Having AI and IoT together enables thorough monitoring of fertilization in accordance with the needs of the different types of soil and crops. The nation's aspiration towards green innovation concurrently leads to nutrient recycling and eco-product creation, thus improving soil health and satisfying the strict environmental standards for modern agricultural ecosystems.

Value Chain Analysis

- Harvesting and Post-Harvest Handling: Getting the crops harvested and their subsequent processing, such as sorting, cleaning, and quality grading.

Key Players: Sahyadri Farms, National Bulk Handling Corporation (NBHC)

- Storage and Cold Chain Logistics: Keeping the agricultural products in their respective controlled environments to maintain their freshness and quality.

Key players: National Bulk Handling Corporation (NBHC), Shree Shubham Logistics (SSL)

- Processing and Packaging: Converting the raw produce into marketable products with proper protective packaging.

Key Players: Nutrien, The Mosaic Company, and Coromandel International

- Distribution to Wholesalers/Retailers: Moving the finished products to the intermediaries for the availability of the products to consumers on a large scale.

Key Players: IFFCO, Chambal Fertilisers

- Export and Trade Compliance: Conducting international trade in such a way that regulations and export standards are not only followed but also very carefully managed.

Key Players: Nutrien, Yara International, The Mosaic Company

Agriculture Fertilizers Market Companies

- Yara International

- Nutrien Ltd.

- The Mosaic Company

- Haifa Group

- Syngenta AG

- ICL Group Ltd.

- EuroChem Group

- OCP Group S.A.

- K+S Aktiengesellschaft

- Uralkali

Recent Development

- In September 2025, the Africa Fertilizer Financing Mechanism and the African Fertilizer and Agribusiness Partnership launched a project providing a $2 million trade credit guarantee to enable Tanzanian suppliers to deliver 60,000 tons of fertilizers to smallholder farmers. (Source: https://www.afdb.org)

- In August 2025, the Sustain Sudan project unites global partners to enhance agriculture, aid smallholder farmers, and create resilient agri-food systems, initially emphasizing fertilizers and later addressing crop protection products. (Source: https://ukragroconsult.com )

Segments Covered in the Report

By Form

- Solid

- Liquid

By Nature

- Inorganic

- Organic

By Product

- Nitrogenous

- Phosphatic

- Potash

- Secondary Micronutrient

- Micronutrient

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client