List of Contents

What is the Recycled Plastic Market Size?

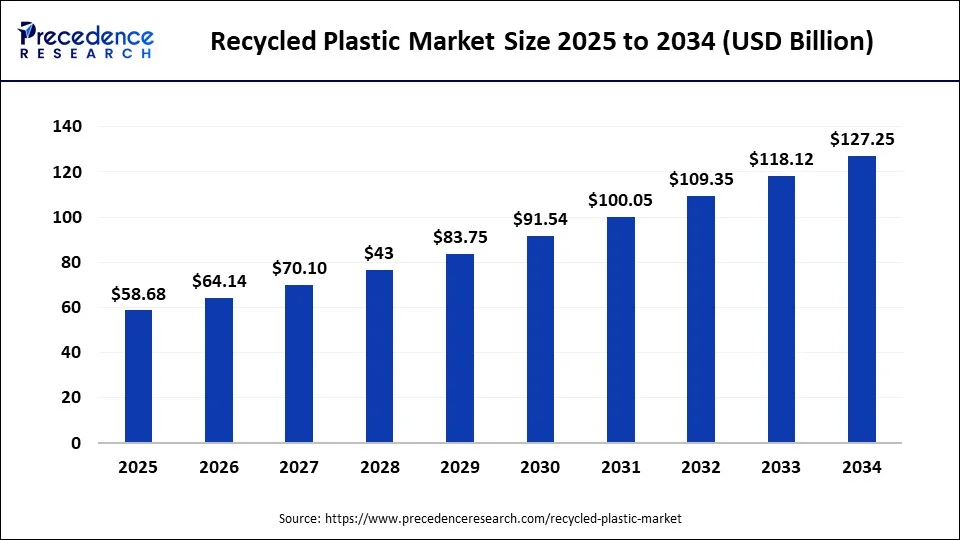

The global recycled plastic market size is valued at USD 58.68 billion in 2025 and is predicted to increase from USD 64.14 billion in 2026 to approximately USD 127.25 billion by 2034, expanding at a CAGR of v% from 2025 to 2034.

Recycled Plastic Market Key Takeaways

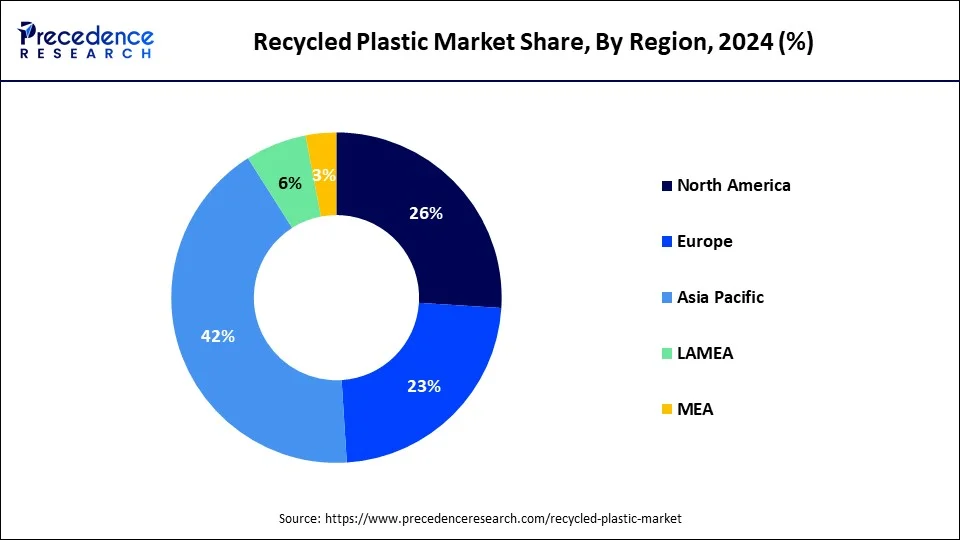

- Asia Pacific has held the highest revenue share 45% in 2024.

- By Source, the plastic bottle segment generated the largest market share of 72% in 2024.

- By Type, the polymer foam segment is anticipated to grow at a notable CAGR of 8.1% during the projected period.

- By Product, the polyethylene segment has held the maximum market share of 28.4% in 2024.

- By Product, the polypropylene segment is anticipated to grow at the fastest CAGR over the projected period.

- By Application, the packaging segment held the biggest revenue share of 39.3% in 2024.

- By Application, the building & construction segment is anticipated to expand at a remarkable CAGR over the predicted period.

Recycled Plastic Market Growth Factors

Recycled plastic is used for the production of light-weight components that are used across various industries such as construction, packaging, and electronics. The rapid growth of the e-commerce across the globe has resulted in the increased sales of various consumer goods. The rising sales through e-commerce has rapidly increased the demand for various packaging products. Therefore, the demand for the recycled plastic is growing rapidly for the packaging of goods. Furthermore, the rising popularity of purchasing electronics such as laptops, Mobile phones, and tablets through e-commerce has exponentially fostered the demand for the recycled plastic as a packaging material across the globe. Thus, the increased demand from the packaging industry is expected to drive the growth of the recycled plastic market across the globe, in the upcoming years.

Furthermore, the rapidly growing building & construction industry is anticipated to drive the consumption of recycled plastic. Recycled plastic is used to manufacture structural lumber, insulation, windows, and fences that are extensively being used in the construction industry. Moreover, the building and construction industry is rapidly growing in the emerging economies. The rising government investments in developing infrastructure and government policies to attract FDIs in the emerging nations is expected to drive the growth of the building and construction industry. Therefore, the rapid growth of the construction industry in the developing nations like China, India, and Brazil is expected to drive the growth of the global recycled plastic market during the forecast period.

The various industries such as footwear, food & beverages, and packaging are opting to use recycled plastic. Major footwear players such as ADIDAS, PUMA, and Reebok are increasingly using recycled plastics to manufacture shoes and other footwear products. The Coca Cola Company announced to invest in development of bottles using 50% recycled plastic. Therefore, increasing investments by the top players across various industries to adopt the use of recycled plastics in manufacturing their products is expected to foster the growth of the global recycled plastic market.

Market Outlook

- Industry Growth Overview:

The recycled plastic market is growing, driven by growing public challenges over plastic pollution is increasing consumer preference for eco-friendly packaging and products. Innovations in recycling technologies involve modern sorting systems and chemical recycling. Major industries such as automotive, packaging, and building and construction are massive consumers of recycled plastics. - Global Expansion:

The recycled plastic market is experiencing global expansion, as rising government regulations, increasing environmental awareness, and demand from industries such as packaging and automotive. Asia Pacific, significantly driven by strong demand from sectors like packaging, automotive, and construction, coupled with government initiatives. - Major investors:

Major investors in the recycled plastic industry include large asset managers such as Vanguard and BlackRock, major chemical and waste management companies such as Indorama Ventures, Dow, LyondellBasell, and Veolia, and specialized impact investors and investment funds.

MarketScope

| Report Coverage | Details |

| Market Size by 2034 | USD 127.25 Billion |

| Market Size in 2026 | USD 64.14 Billion |

| Market Size in 2025 | USD 58.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.01% |

| Largest Market | Asia Pacific |

| Asia Pacific | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Source Insights

Based on source, the plastic bottle segment accounted for 72% of revenue share in 2024 and is projected to sustain its dominance over the forecast period. This can be attributed to the extensive use of plastic bottles for the packaging of soft drinks, oils, water, pharmaceuticals, and many more. The plastic waste generated from packaged drinking water is very much high. Therefore, this segment accounted for over 72% of the market share in 2024.

On the other hand, polymer foam segment is growing at a significant rate. Packaging sheets and packaging foam are extensively being used in the impact resistant packaging of electric and electronic products. Various manufacturers such as Sony Electronic, Honda Motors, and Panasonic Corporation are now increasingly using the recycled plastic foam that would contribute to the growth of this segment.

Product Insights

Based on product, the polyethylene segment dominated market with revenue share of 28.4% in 2024. This can be attributed to its extensive use in the food & beverages and consumer goods industry for the packaging of products. Polyethylene is commonly used as a packaging material for milk, garbage bins, laundry detergents, and many more products, thereby boosting the segment growth.

On the other hand, polypropylene is estimated to be the most opportunistic segment during the forecast period. Polypropylene is widely used for packaging, labelling, automotive components, medical devices, and various other products. Therefore, this segment is expected to grow at a rapid pace during the forecast period.

Application Insights

The packaging segment dominated the market with 39.3% revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This due to the rapid growth of the e-commerce across the globe. The volume of orders through e-commerce platforms have increased dramatically that resulted in the extensive use of recycled plastic for the packaging of products, thereby fostering the growth of this segment.

On the other hand, building & construction is estimated to be the fastest-growing segment. The rapidly growing construction industry that uses recycled plasticto manufacture structural lumber, insulation, windows, and fences is boosting the demand for the recycled plastic. The developing regions like Asia Pacific is expected to foster the growth of this segment owing to rapid industrialization and urbanization in the region.

Regional Insights

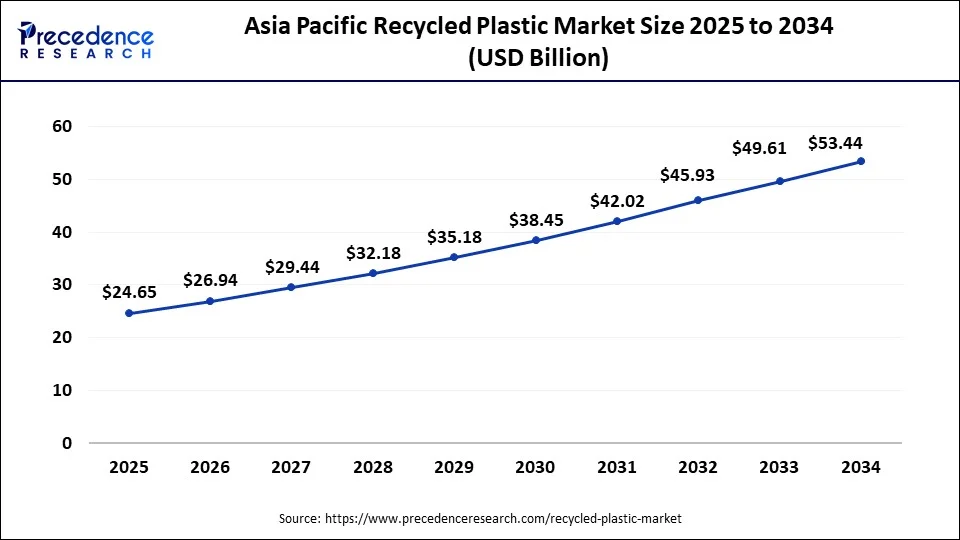

Asia Pacific Recycled Plastic Market Size and Forecast 2025 to 2034

The Asia Pacific recycled plastic market size is calculated at USD 24.65 billion in 2025 and is expected to be worth around USD 53.44 billion by 2034, growing at a CAGR of 9.50% from 2025 to 2034.

Asia Pacific dominated the global recycled plastic market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. Asia Pacific accounted for a market share of over 45% in 2024.The rapid growth of the building & construction industry, e-commerce industry, and several other industries have significantly contributed towards the growth of the region. Rising government initiative and policies to attract FDIs and foster industrial development in this region is a key factor that boosted the usage of recycled plastic in Asia Pacific.

The recycled plastic market in India has seen significant growth in the market. The growth is driven by rising government initiatives for a shift towards the use of eco-friendly solutions and sustainability, with rising environmental concerns driving the growth of the market in the region. Rising consumer awareness for sustainable practices and initiatives for recycling plastics generated from various sectors, and the application of recycled plastics in various sectors, such as construction for coating, packaging, and electronics, drives the growth of the market in the country. The key players are a significant factor that plays a crucial role in the growth of the market with heavy investments and innovations, which further boost the growth and expansion of the market in the country.

Europe is the second largest market for recycled plastic followed by North America. The rising penetration of e-commerce, growing construction industry, and rapidly growing automotive industry is expected to drive the demand for the recycled plastic in this region in the upcoming years.

UK: Advancement in Fire Protection Systems

Plastic packaging waste generated in the UK adds up to more than two million metric tons yearly. The UK has implemented major policies to solve the plastic pollution challenges and encourage a circular economy, like the carrier bag charge and bans on certain single-use plastics such as UK and devolved governments have introduced various pieces of legislation to ban some single-use plastic products, which drives the growth of the market.

North America's Recycled Plastic Boom: Efficiency, Quality, Automotive Integration

North America is significantly growing in the recycled plastic market, as strict government policies, strong business sustainability promises, increasing consumer environmental awareness, and advancements in recycling techniques. The major in the recycling process is cultivating efficiency and quality. The automotive field uses recycled plastics in components such as interiors and bumpers to lower vehicle weight and enhance fuel efficiency.

U.S.: Presence of Major Key Players

The presence of many major U.S. organizations and brands has set determined targets to use high percentages of recycled content, which drives the growth of the market. The U.S. is spending on progressive recycling technologies, including chemical recycling and AI-based sorting systems, which enhance the efficiency and quality of the recycled results.

Recycled plastic market - Value Chain Analysis

- R&D:

R&D processes include advanced sorting and separation machinery, chemical recycling, mechanical recycling advancements, and the development of high-value recycled products.

Key Players: Veolia Environnement S.A. and Waste Management, Inc. - Distribution Network Management:

Recycled plastic organization, distribution network management (DNM) is a significant part of the entire reverse and forward supply chain, concentrating on the effective movement of materials from waste generation points to recycling services.

Key Players: SUEZ and Republic Services, Inc. - Waste Management and Recycling:

Waste management and recycling in the recycled plastic industry comprise collection, sorting by type, cleaning, and shredding, trailed by mechanical processes such as melting and pelletizing or developed chemical processes like depolymerization, pyrolysis, and gasification, to create novel plastic products.

Key Players: Biffa Group Limited and MBA Polymers Inc.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Top Vendors in the Recycled Plastic Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

REMONDIS SE & Co. KG |

Lunen, Germany |

Extensive service portfolio across the entire supply chain |

REMONDIS gathers and recycles over 30 million tonnes of recyclables every year. From plastics to organic materials. |

|

Shell International B.V. |

Netherlands |

significant investments in R&D and low-carbon solutions |

Increase the amount of recycled plastic in Shell-branded packaging to 30% by 2030 |

|

Waste Connections |

Spring, Texas |

large landfill network, consistent financial performance |

Waste Connections' greenfield recycling facilities in Commerce City, Colorado, feature AI-powered sorting technology. |

|

CLEAN HARBORS, INC. |

Massachusetts, United States |

Robust service |

Clean Harbors recycled 1.9 million metric tons of materials in 2024 |

|

Covestro AG |

Leverkusen, Germany |

Sustainability and the circular economy |

In July 2025, Covestro India signed an MOU with CSIR-NCL to develop sustainable polyurethane upcycling solutions. |

Recent Developments

- In June 2025, NMMC, on World Environment Day 2025, launched the Plastic and E-waste Recyclothon at NMMC headquarters in collaboration with the project Mumbai, which aims to create a plastic-free city by eliminating plastic pollution, aligning with the rising environmental concerns and pollution in the city.

- In May 2025, PPG announced the launch of PPG EnviroLuxe Plus powder coatings, which are made of industrial plastic waste up to 18%. This launch focuses on rising environmental concerns and helps in eliminating industrial plastic waste. The coating material produced is used to enhance the durability and aesthetic appeal of the product, aligning with sustainability while minimizing the carbon footprint by providing long-lasting protection and enhancing performance.

- In May 2025, Toyoda Gosei Co., Ltd. launched and developed a new technology to recycle high-quality plastic from plastic automotive parts. This recycling of waste plastic aligns with the rising environmental concerns. To achieve this, they have collaborated with Isono Co., Ltd to procure quality raw material for recycling. This technology accelerates horizontal recycling for reuse in the same parts and contributes to CO2 reduction.

Segments Covered in the Report

By Source

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Others

By Product

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

By Application

- Packaging

- Building & Construction

- Textiles

- Electronics

- Automotive

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client