List of Contents

What is the Recycled Metal Market Size?

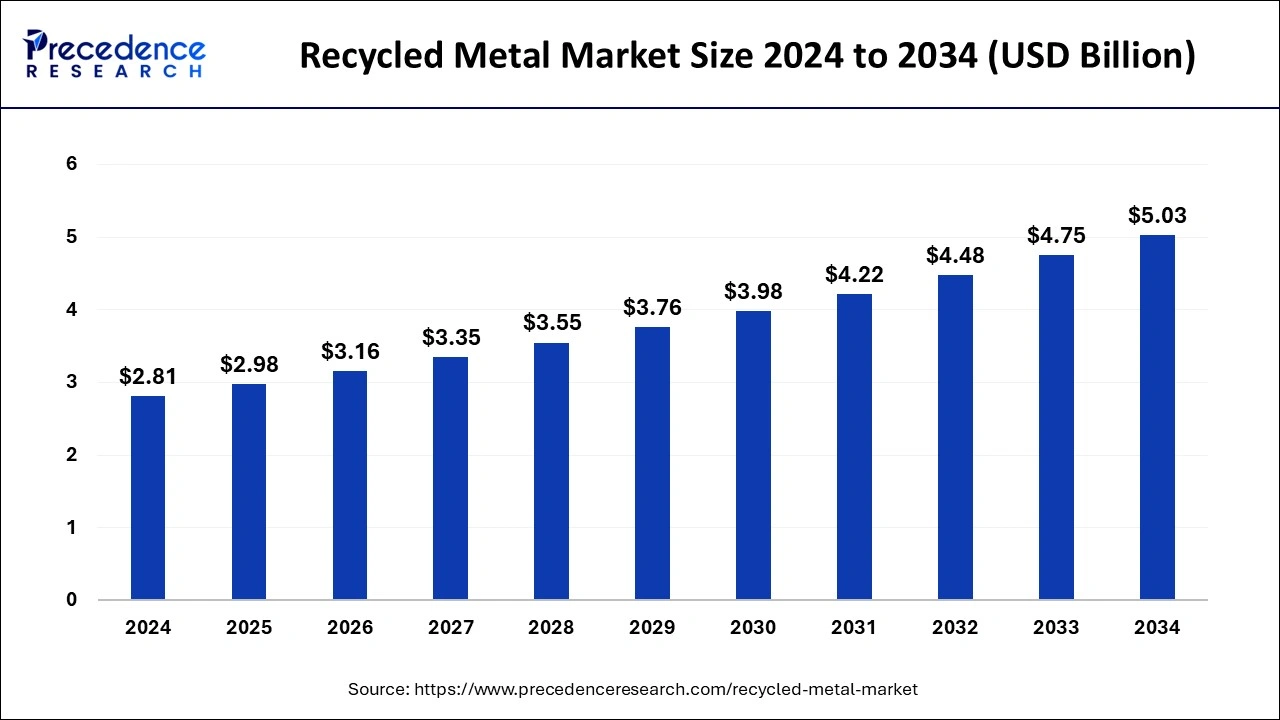

The global recycled metal market size is valued at USD 2.98 billion in 2025 and is predicted to increase from USD 3.16 billion in 2026 to approximately USD 5.03 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034.

Recycled Metal Market Key Takeaways

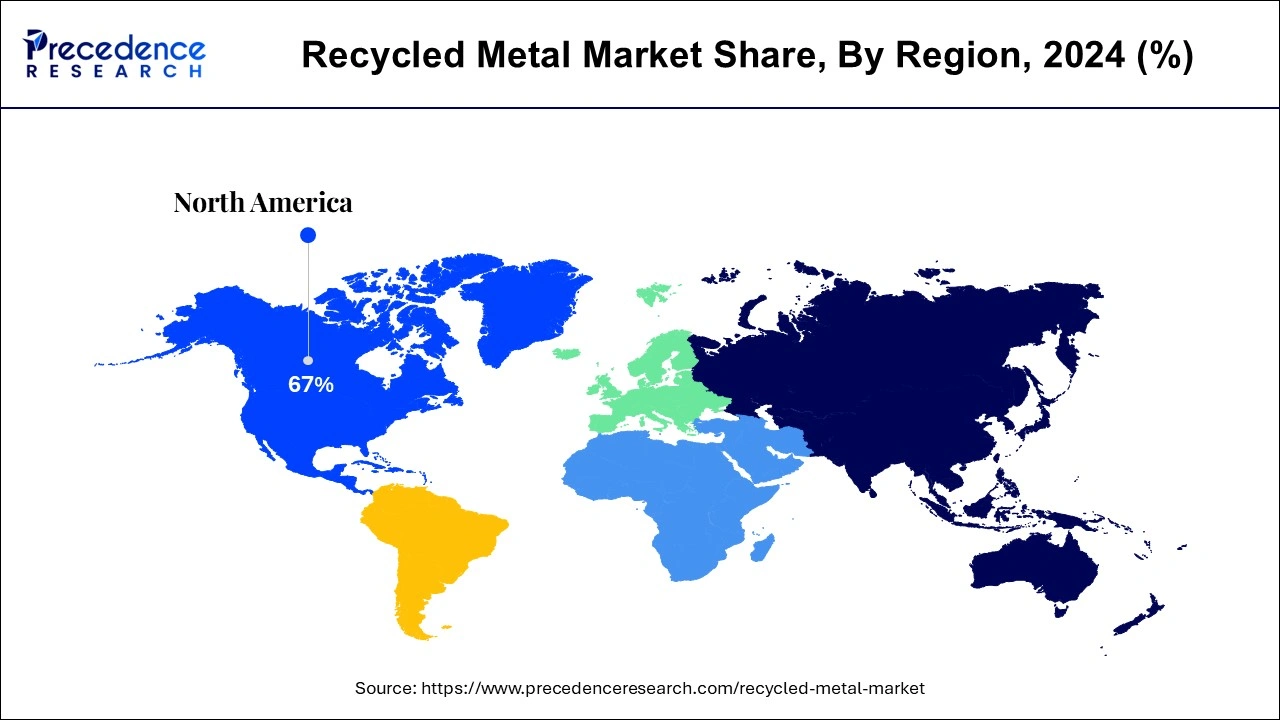

- Asia Pacific led the global market with the highest market share of 67% in 2024.

- By metal type, the ferrous segment has held the largest market share in 2024.

- By end user, the transport & automotive segment captured the biggest revenue share in 2024.

The Green Gleam: The Role of AI in Improvement

AI is now entering the recycled metal market and greatly enhancing accuracy, speed, and sustainability. AI-based vision systems and robotic arms separate metals for high purity and hence recover them to the maximum. Advanced sensor fusion techniques aid in alloy classification, thus resulting in high-quality output. AI also aids market intelligence with real-time price prediction, demand forecast, and supply chain optimization. AI-based quality inspection periodically ensures material quality standards; moreover, it enables predictive maintenance, reducing downtime while improving equipment efficiency. AI-based optimization techniques reduce power consumption and emission levels in industrial processes like smelting.

Market Outlook

- Industry Growth Overview:

The recycled metal market is growing, increasing due to environmental mandates, cost benefits, and growing demand from major sectors such as construction and automotive. Strict government regulations and an increasing global focus on sustainability are driving the adoption of recycled metals - Global Expansion:

The recycled metal market is experiencing global expansion due to rising environmental challenges, the circular economy, and the increasing costs of primary metal extraction. The Asia Pacific region is the primary area for global expansion in the recycled metal organizations, presently dominating the market and projected to have massive growth potential. - Major investors:

Major investors in the recycling metal market include organizations in the recycled metal industry, including Global Scrap Processors, AIF Capital, Umicore, Dowa Holdings, and Sims Metal Management.

Recycled Metal Market Growth Factors

- Development of construction and infrastructure projects keeps the demand for recycled metals, being the cheaper and sustainable raw material.

- With a rise in automotive, electronic, and industrial applications, the demand is supporting the market's growth reduction in the extraction of the primary metal.

- Greater environmental consciousness and proper regulations concerning mining operations are pushing more into alternative, recycled products.

- Growing capital infusion in recycling technologies improves efficiencies in recovery and quality of recycled products, resulting in wider dispersion.

- Increased urbanization and industrialization trends are creating larger volumes of scrap in developing countries, which is stimulating the entire recycling ecosystem.

Market Scope

| Report Highlights | Details |

| Market Size By 2034 | USD 5.03 Billion |

| Market Size in 2026 | USD 3.16 Billion |

| Market Size in 2025 | USD 2.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Base year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mental Type, End User, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Metal Type Insights

The ferrous segment dominated the global recycled market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The ferrous metal includes iron, steel, stainless steel, and titanium. These metals are extensively used in the construction, electronics, and industrial machineries production. The increased volume usage of such electronics and industrial machineries and construction across the globe have resulted in the increased consumption of ferrous metals that made this a leading segment in the market.

The non-ferrous segment is estimated to be the fastest-growing segment during the forecast period. This is attributable to the rising usage of aluminium in various end use industries such as building & construction, industrial machineries, aerospace, and automotive. The aluminium is a durable and light-weight metal and hence its consumption is growing all over the globe.

End User Insights

The transport & automotive segment dominated the global recycled market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The extensive usage of recycled metals in the transport and automotive sector across the globe has had increased the consumption of the recycled metal in this end use application, making it the most dominant segment.

The construction segment is estimated to be the most opportunistic segment during the forecast period owing to the rising investments in the developing nations like China, India, and Brazil for infrastructural development. The rapid urbanization and rapid industrialization is boosting the consumption of recycled metal in the construction industry, thereby fueling the market growth.

Regional Insights

Asia Pacific Recycled Metal Market Size and Growth 2025 to 2034

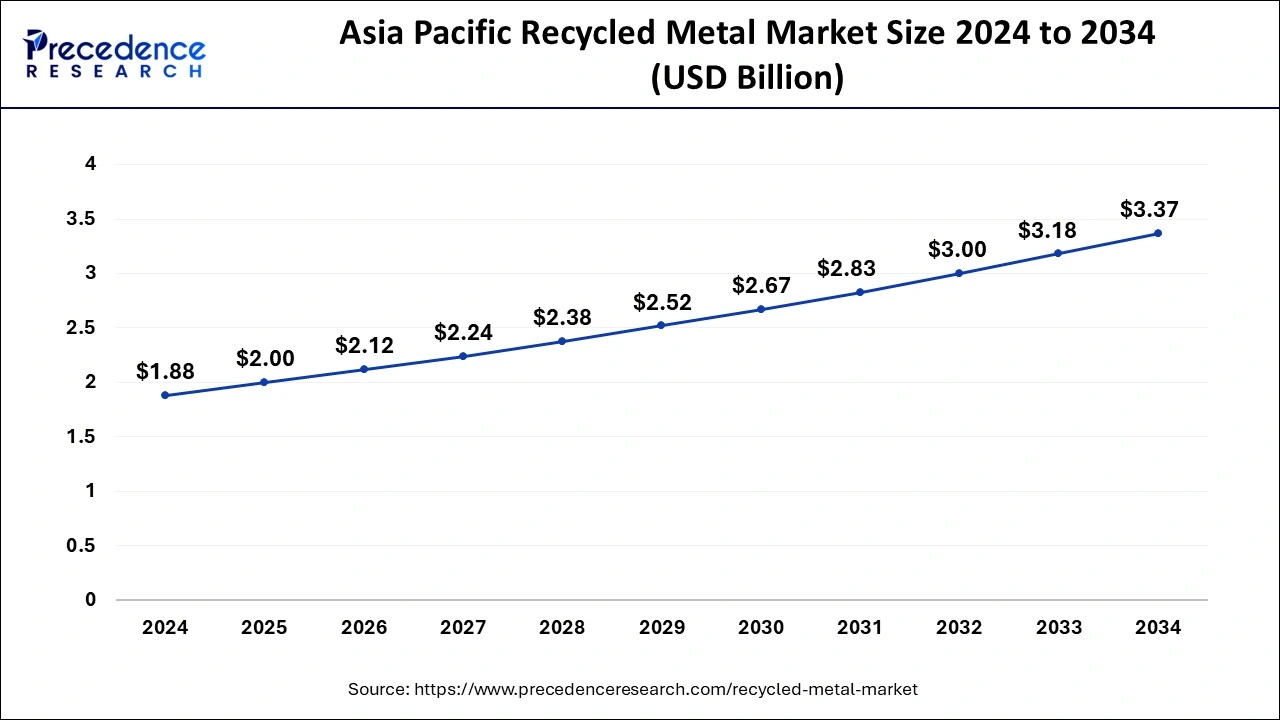

The Asia Pacific recycled metal market size is exhibited at USD 2.98 billion in 2025 and is predicted to be worth around USD 3.37 billion by 2034, at a CAGR of 6.03% from 2025 to 2034.

Asia Pacific dominated the global recycled metal market with a share of over 67% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. Asia Pacific is the highest consumer of the recycled metal. The development of improved waste management system and recycling technologies coupled with increased awareness regarding the deteriorating environmental concerns is fostering the growth of the market in this region. Moreover, Rising urbanization and rapid industrialization is augmenting the demand for the recycled metal in the region. According to the Indian Brand Equity Foundation, India requires an investment of more than US$ 750 billion by 2022 in the development of infrastructure in order to achieve sustainable development. China is planning to invest more than US$2.5 trillion in transport and construction sector that is expected to boost the demand for the recycled metal significantly. These rising investments by the developing economies in the growth of the infrastructure is boosting the market growth.

North America is expected to be the most opportunistic market. This is attributable to the highest production of steel in US, increased environment consciousness, and rising demand for the aluminium from the automotive sector for manufacturing of electric vehicle. The automotive sector is expected to drive the demand for the non-ferrous metals in the upcoming years that may propel the growth of the recycled metal market in the region. Further, rising government initiatives to reduce carbon footprint is encouraging the different industries to adopt recycled metal, thereby fostering market growth in the region.

U.S. Metal Recycling: A Modern Marvel of Mature Infrastructure and Strict Regulation

In the U.S., modern recycling infrastructure, strict environmental regulations such as the Resource Conservation and Recovery Act (RCRA), and government initiatives. The U.S. has a mature and widespread network of scrap metal suppliers, processing services including advanced shredders and sorting technologies, and assortment systems which effectively gather and process large volumes of both ferrous and non-ferrous scrap metal.

- In July 2025, Toyota Tsusho America, Inc., a subsidiary of Toyota Tsusho Corporation, completed the acquisition of Radius Recycling, Inc., a leading North American recycling company with a network of over 100 locations.

Europe: Strong Government Regulations

Europe is significantly growing in the recycled metal market due to strong environmental regulations, the push for a circular economy, and industry-driven sustainability initiatives. The European Union's Green Deal and Circular Economy Action Plan goal to double the use of recycled materials, which drives industries to increase their reliance on secondary materials.

UK: Increasing Demand for Recycling Metal

In the UK, steel producers, such as Tata Steel and British Steel, are converting their conventional furnaces to EAFs, which use scrap metal as a significant raw material. This creates a high domestic demand for recycled metals.

South America: A Rising Demand from Automotive and Construction Industries

South America is significantly growing in the recycled metal market as rising demand from major sectors such as construction and automotive, combined with government initiatives driving sustainable development and the circular economy. Countries such as Brazil and Chile are also leading copper recycling processes due to their large mining resources, with the region beginning to diversify into other non-ferrous metals, which contributes to the growth of the market.

A Can-Do Attitude: Brazil's Path to a 97.3% Recycling Rate

In Brazil, growing industrialization, urbanization, increasing consumer spending, and strong demand from major sectors such as packaging and construction are expected. Brazil is becoming the new worldwide benchmark for aluminium can recycling. Abratalas' Executive Chairman, Catilo Candido, explains the approaches that have led to this outstanding success. In 2024, Brazil reached a 97.3% recycling rate, keeping an average above 95% over the last 15 years.

Recycled Metal Market - Value Chain Analysis

- Raw Material Sourcing:

Recycled metal raw material sourcing predominantly contributes to gathering industrial, consumer, and demolition scrap, as well as e-waste, through direct relationships with scrap dealers or online marketplaces.- Key Players:Aurubis AG

- Key Players:Aurubis AG

- Distribution and Sales:

Recycled metals are significantly distributed and wholesaled through a multi-tiered supply chain involving local scrap yards, large processing facilities, and major manufacturers in industries like construction, automotive, and packaging.- Key Players: Sims Limited

- Key Players: Sims Limited

- Product Lifecycle Management:

This process contributes advanced sorting, purification, and remanufacturing techniques that give discarded metals a second life.- Key Players: REMONDIS SE & Co. KG, and Tata Steel

Top Vendors in the Recycled Metal Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

CMC |

Irving, Texas |

leading position in the steel industry |

CMC Recycling is a leader in the recycled metals industry. |

|

Tata Steel |

Mumbai, India |

Strong R&D and innovation |

Tata Steel targets 15 million tonnes of green steel production via recycling by 2040, scaling its India capacity to 40 MTPA by 2030. |

|

GFG Alliances |

United Kingdom |

Sustainability strategy |

GFG Alliance, between July 2024 and February 2025, used Tahmoor to provide more than $98.6 million to support the Whyalla steelworks. |

|

European Metal Recycling |

Hamburg, Germany |

A strong focus on sustainability and ESG values, |

In November 2024, Global recycler European Metal Recycling (EMR) secured a £3.4mn ($4.3mn) grant from the Advanced Propulsion Centre (APC) to support a new metals processing facility. |

|

Norsk Hydro ASA |

Norway |

Fully integrated aluminum value chain |

Hydro's strategy is to increase its recycling of post-consumer aluminium scrap to between 850,000 and 1.2 million tonnes per year by 2030. |

Recent Developments

- In May 2025, the Union Minister of Coal and Mining, India, introduced a fully dedicated website for non-ferrous metal recycling and a stakeholders' portal to offer a structured, authentic, and sustainable recycling ecosystem for India. Minister Reddy said, "India is committed to building a circular economy that optimally utilizes its resources. "This will not only provide real-time visibility into the recycling landscape but also empower stakeholders to make informed decisions, bridge gaps, and unlock the full potential of our non-ferrous metal sector.”

- In June 2025, the first SMM global recycled metal industry forum was held in the country, Malaysia to discuss the status of the recycling industry and its potential future development. Many recycling associations and well-known businesses participated in the conference. As the sector is rapidly evolving, this conference marked a significant step taken by marketers to meet the global demand for recycled metals owing to their extensive applications in diverse sectors.

- In February 2024, a global leader in metal recycling, Sims Metal, announced its investment in a new electric car flattener and opted to replace its previous model at a local site on Alles Avenue. This equipment is expected to minimize carbon emissions by up to 9.6 tons annually. It shows the company's alignment with sustainable initiatives. It also complies with Rhode Island's 2021 Act on climate, highlighting its significance on a global scale.

Segments Covered in the Report

By Metal Type

- Ferrous

- Non-Ferrous

By End User

- Construction

- Transport & Automotive

- Industrial Machinery

- Electronics

- Defense

- Packaging

- Military

- Consumer Goods

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client