List of Contents

What is Pressure Vessels Market Size?

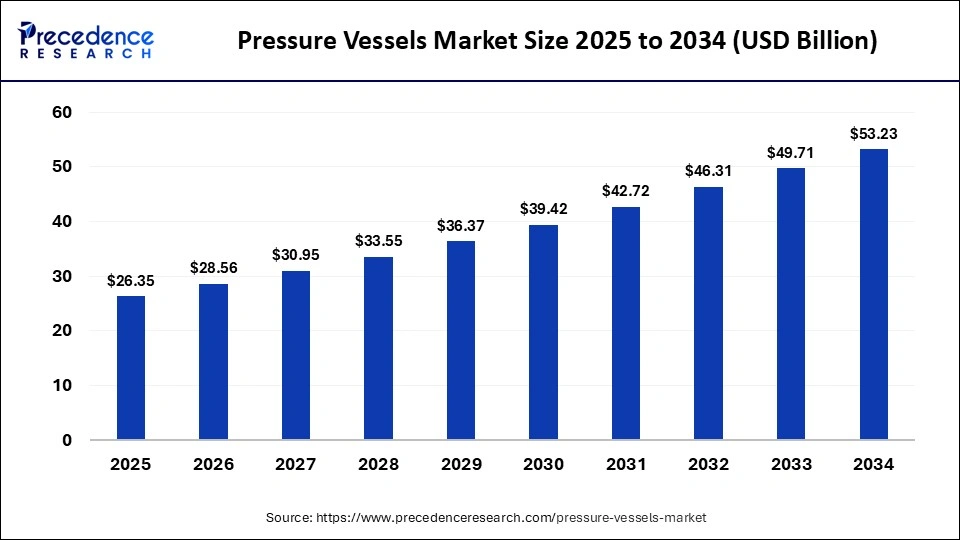

The global pressure vessels market size accounted for USD 26.35 billion in 2025 and is predicted to reach around USD 53.23 billion by 2034, growing at a CAGR of 8.15% from 2025to 2034.

Market Highlights

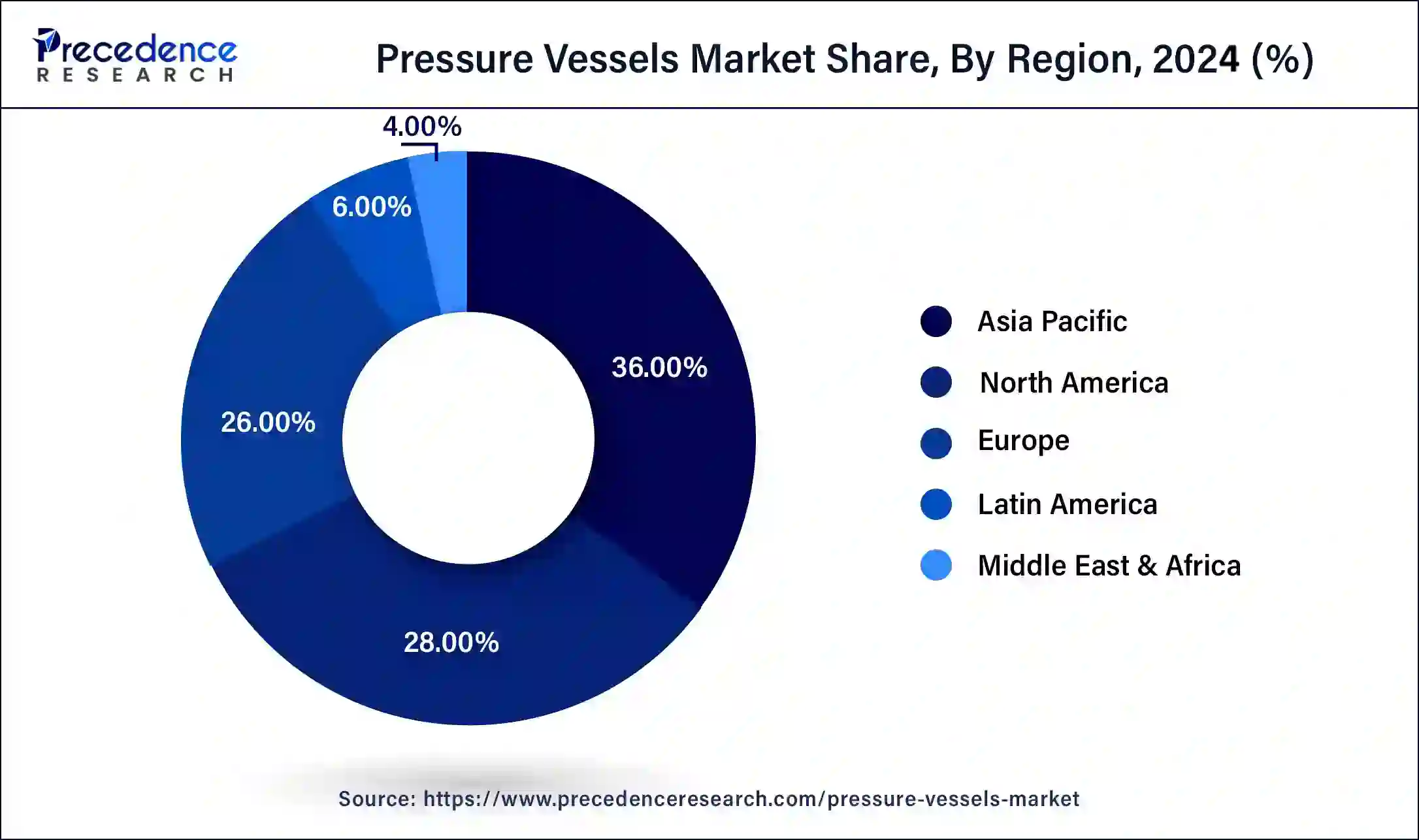

- Asia Pacific led the global market with the largest market share of 36% in 2024.

- By Product, the boiler segment has held the largest revenue share of 60% in 2024.

- By Product, the cargo handling segment is anticipated to grow at the fastest CAGR of 7% over the projected period.

- By Material, the steel segment had the largest market share of 30% in 2024.

- By End-use, the chemical & petrochemical segment has held the biggest revenue share of 41% in 2024.

Pressure Vessels MarketGrowth Factors

Rising adoption of supercritical power generation technologies along with prominent growth in the petrochemical & chemical industry is the key factor that propels the growth of the pressure vessels market. Pressure vessels offer resistance from corrosion and cross-contamination that drives its application in various chemical procedures. Subsequently, the flourishing growth of chemical industry along with the benefits of pressure vessel expected to fuel the market growth.

Further, industrial sector is significantly impacted by the technological innovations particularly in the United States. Hence, the investment for the production & exploration activities in various industries such as oil & gas, power generation, chemicals, and many other sectors have seek hike in the recent past, this expected to augment the market growth over the coming years.

Market Outlook

- Industry Outlook: The industry is consolidating technical expertise, fabrication capacity, and certification credentials. Large fabricators with global quality accreditations and integrated engineering capabilities are expanding service portfolios to include design-for-manufacturability, finite-element analysis (FEA) validation, automated NDT (non-destructive testing), and long-term inspection services.

- Sustainability Trend: Sustainability here is technical and operational: reducing embodied carbon through material optimization, high-strength alloys requiring less mass, increasing the use of recycled steel and low-carbon production techniques, and designing vessels for disassembly and recyclability. Operational sustainability includes leak reduction, monitoring for emissions (esp. fugitive gas), and materials that reduce corrosion-related failures (thus preventing spills and energy losses).

- Major Investment: Investment is flowing into capacity expansion for high-spec fabrication automated plate rolling, robotic welding cells, large-diameter forging/rolling lines, cryogenic tank facilities, composite filament-winding lines for lightweight high-pressure vessels, and advanced NDT laboratories ultrasonic phased array, X-ray CT. Capital also targets digitalization, digital twins for fatigue prediction, integrated asset-management platforms, and remote inspection tooling.

- Start-ups Ecosystem: Start-ups are innovating on materials, manufacturing techniques, and monitoring services: companies developing composite pressure vessels, carbon-fibre-wrapped tanks for lightweight high-pressure storage; firms creating modular, rapidly deployable pressure vessel systems for remote energy projects; sensor-and-IoT startups offering embedded monitoring for pressure, strain, and corrosion.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 26.35 Billion |

| Market Size in 2026 | USD 28.56 Billion |

| Market Size in 2034 | USD 24.31 Billion |

| Market Growth Rate from 2025to 2034 | CAGR of 8.15% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | Product, End User, Material, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Boiler product segment led the global pressure vessels market and accounted for a market share of approximately 60% in the year 2024 due to superior performance of boilers in different industrial processes. Boilers are available in different types that include super thermal power plant, industrial, utility, and supercritical parameter boilers. Boiler manufacturers are mainly focused on offering application-specific products.

The nuclear reactor anticipated to witness the fastest growth rate of around 7% over the analysis period. Increasing demand for energy projected to propel the number of nuclear power plants across the globe, thereby positively impacting the growth of the segment during the upcoming years. A nuclear reactor is a critical part of a nuclear power plant that initiates and controls a self-continued nuclear chain reaction.

Major types of pressure vessels are reactors, boilers, and separators; besides this, there are numerous other types of pressure vessels present that include fractional distillation columns, storage tanks, and heat exchangers. Flourishing growth in the industrial activity along with increasing demand for application-specific product functioning and design expected to fuel the growth of the other segment.

Material Insights

Steel dominated the global pressure vessels market accounting for more than 30% of the value share in 2024. Stainless steel and carbon steel are the preferred choice of materials for the manufacturers on the basis of their properties such as high resistance to corrosion, easy recyclability, low prices, resistance toward shocks & vibrations, excellent tensile strength, and capability to withstand high temperatures or humid conditions.

Nickel & nickel alloys registered robust growth rate over the upcoming period because of the benefits offered by the material over others, such as oxidation & carburization resistance, heat resistance, reliability, along with sustainability in harsh environments. Various types of nickel alloys include incoloy, hastelloy, carpenter alloy 60, and monel. Nickel and nickel alloys are largely used in manufacturing of nuclear reactors.

End-use Insights

Chemical & petrochemical end-use segment headed the global pressure vessels market with a value share of early 41% in 2024. The significant growth of the segment is majorly due to the increasing demand of chemicals and their products for various applications. Furthermore, rising number of chemical facilities in different countries across the globe is one of the significant factors that drive the demand of pressure vessels in the segment.

Pressure vessels are largely used in numerous power generation facilities that include hydro, nuclear, and thermal power plants. The above mentioned factor expected to augment the power generation end-use segment at the fastest growth during the forthcoming period. Other end-use industries include pulp & paper, mining, HVAC & refrigerators, water treatment, and pharmaceuticals. Increasing adoption of pressure vessels across the aforementioned industries attributed to the presence of diverse products, such as boilers, heat exchangers, storage tanks, and reactors.

Regional Insights

Asia Pacific Pressure Vessels Market Size and Growth 2025To 2034

The Asia Pacific pressure vessels market size is valued at USD 9.49 billion in 2025 and is expected to be worth around USD 19.16 billion by 2034, at a CAGR of 4.90% from 2025to 2034.

The Asia Pacific emerged as a global leader in the pressure vessels market with a revenue share of approximately 36% in 2024 and estimated to retain its dominant position throughout the projected period. The prominent growth of the region is majorly due to the rapid expansion of power sector in the region. Shifting trend of power generation towards renewable resources and green energy anticipated to boost the demand for pressure vessels in the region. Rising installation of nuclear powerhouses along with significant expansion of chemical and oil & gas sectors predicted to prosper the market growth in the region.

On the other hand, Europe captured the second-largest position in terms of value in 2024 . Extensive R&D and product innovation by the prime manufacturers expected to augment the product demand across various end-use applications. Central & South America exhibit tremendous growth potential for the market owing to the presence of large number of oil & gas reserves in Venezuela, Argentina, Brazil, and Columbia.

Pressure Vessels Market: A Deep Dive into the Middle East, Africa, and Latin America

Why is Middle East and Africa Analysis growing notably?

The Middle East and Africa (MEA) region is poised for significant growth in the pressure vessels market, driven by increasing investments in oil and gas exploration, petrochemicals, and renewable energy projects. Countries like Saudi Arabia, the United Arab Emirates, and South Africa are leading the charge, leveraging their vast natural resources and energy needs.

Saudi Arabia Pressure Vessels Market Trends

Saudi Arabia dominates the region with massive investments in oil & gas processing, chemical manufacturing, and hydrogen-ready pressure systems under Vision 2030. United Arab Emirates focuses on desalination, nuclear, and power sectors, integrating high-efficiency vessel technologies. Qatar channels demand through LNG expansion and offshore projects requiring high-pressure containment systems. South Africa drives growth through mining, chemical refining, and thermal power generation.

Why Latin America Analysis is another growing Region notably?

In Latin America, the pressure vessels market shows promise, supported by a diverse industrial base and growing energy needs. Key players like Brazil, Mexico, and Argentina are investing heavily in infrastructure and energy projects.

Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing centers on high-quality carbon steels, low-alloy steels, stainless alloys (304, 316L, duplex), nickel alloys for high-temperature/corrosive services, and composite feedstocks (carbon/aramid fibres, epoxy resins) for filament-wound vessels. Sourcing criteria prioritize traceable mill certificates, mechanical-property consistency, and compliance with pressure-vessel material standards.

- Technological Advancements: Technologies reshaping the market include robotic welding and automated seam-tracking for higher throughput and consistent weld quality; advanced non-destructive testing, such as phased-array ultrasonics and computed tomography for internal flaw detection.

Key Companies & Market Share Insights

The global pressure vessels industry is highly competitive and concentrated in nature because of the presence of a numerous manufacturers ranging from large scale to small scale. Major companies adopt various marketing strategies that include geographical expansion with a vision to augment their foothold in the global market.

Pressure Vessels Market Companies

- Babcock & Wilcox Enterprises, Inc.

- IHI Corp.

- Mitsubishi Hitachi Power Systems, Ltd.

- Pressure Vessels (India)

- Alloy Products Corp.

- Samuel, Son & Co.

- Doosan Heavy Industries & Construction.

- Abbott & Co (Newark) Ltd.

- Larsen & Toubro Ltd.

- Bharat Heavy Electricals Ltd.

- Tinita Engineering Pvt. Ltd.

- Mersen, Xylem Inc.

- WCR Inc.

Segments Covered in the Report

By Product

- Nuclear Reactor

- Boiler

- Separator

- Others

By Material

- Titanium

- Hastelloy

- Tantalum

- Steel

- Duplex Steel

- Stainless Steel

- Super Duplex Steel

- Carbon Steel

- Others

- Nickel & Nickel Alloys

- Others

By End-Use

- Chemicals & Petrochemicals

- Power Generation

- Oil & Gas

- Others

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client