List of Contents

White Oil Market Size and Forecast 2025 to 2034

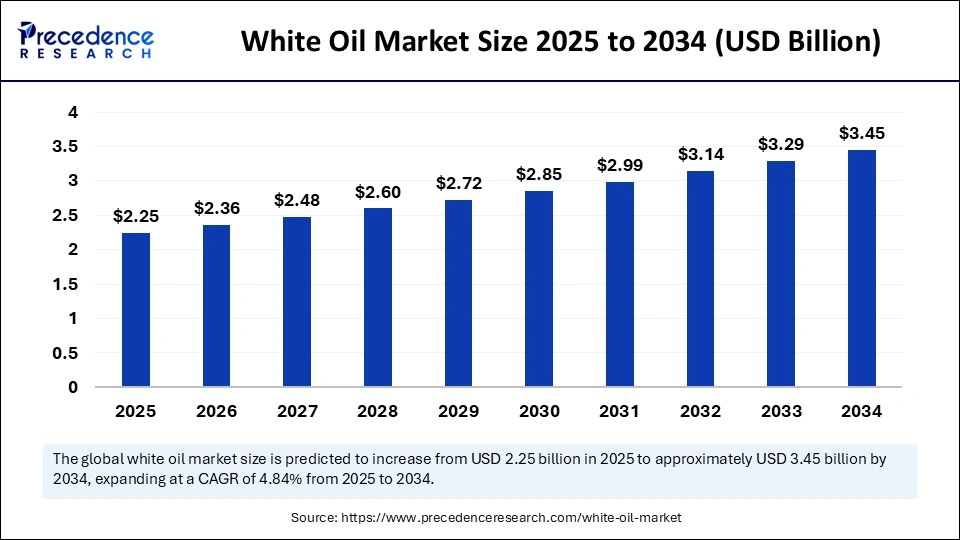

The global white oil market size was calculated at USD 2.15 billion in 2024 and is predicted to increase from USD 2.25 billion in 2025 to approximately USD 3.45 billion by 2034, expanding at a CAGR of 4.84% from 2025 to 2034. The growing demand for white oil from the pharmaceutical, cosmetics, and personal care industries boosts the growth of the market.

White Oil Market Key Takeaways

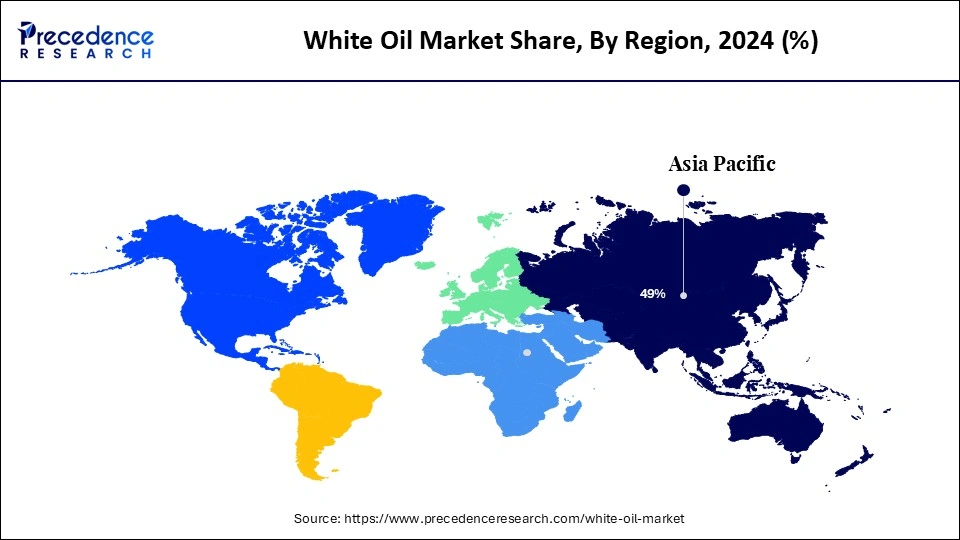

- Asia Pacific dominated the white oil market with the largest share of 49% in 2024.

- Europe is expected to expand at the fastest CAGR during the forecast period.

- By application, the personal care segment dominated the market with the highest share in 2024.

- By application, the adhesives segment is expected to witness significant growth in the coming years.

How does AI Transforms the White Oil Supply Chain and Quality Control?

White oil producers can now market their goods internationally without heavily depending on physical presence, thanks to the quick expansion of artificial intelligence technologies. As AI technologies gain popularity in the development of industrial and chemical products, businesses can more easily reach niche markets and streamline supply chains. Real-time logistics tracking can be possible due to AI technologies. Integrating AI technologies in manufacturing processes significantly improves the production volume of white oil. Moreover, AI helps in the quality control, ensuring white oil products meet stringent quality standards.

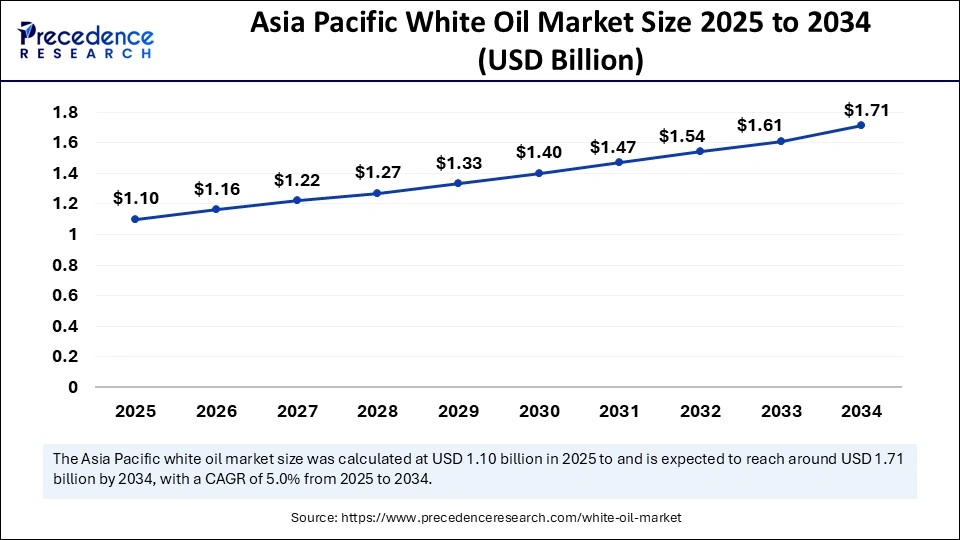

Asia Pacific White Oil Market Size and Growth 2025 to 2034

The Asia Pacific white oil market size was exhibited at USD 1.05 billion in 2024 and is projected to be worth around USD 1.71 billion by 2034, growing at a CAGR of 5% from 2025 to 2034.

Asia Pacific dominated the white oil market with the largest share in 2024. This is mainly due to the increasing demand from adhesives, personal care, and pharmaceutical industries. One major factor in this leadership is the extensive use of white oil in skincare, infant care, and wellness products. There is a high adoption of white oil due to rising consumer awareness and a preference for high-purity ingredients. With the rising construction activities in emerging countries, there is a high demand for high-performance adhesives, in which white oil plays a key role in enhancing their properties. The rising industrial production further bolstered regional market growth.

Europe is expected to expand at the fastest CAGR during the forecast period. The growth of the European white oil market can be attributed to growing applications in various fields. The market in the region is expanding more quickly due to increased use in personal care, agriculture, and pharmaceuticals. Strict quality standards and regulatory compliance encourage the use of premium white oil. White oil is becoming more and more popular in the agriculture sector as it finds applications in pest control formulations. There is a strong emphasis on environmentally friendly practices. However, white oil is widely used in formulating eco-friendly products.

Market Overview

The white oil market is experiencing steady growth, driven primarily by its widespread applications across multiple industries, such as pharmaceuticals, cosmetics, personal care, plastics, and textiles. It is a favored ingredient in formulations where consistency and safety are crucial due to its high-purity chemical stability and nontoxic qualities. White oil is used extensively in products like lotions, creams, and ointments in industries like personal care and cosmetics because of its moisturizing qualities and ability to work well with other ingredients. White oil is also used extensively in the pharmaceutical industry for topical applications, drug formulations, and as a production processing aid.

Additionally, the plastic and polymer industries are contributing to the market's upward trajectory, utilizing white oil as a plasticizer and lubricant in manufacturing processes. The demand for highly refined white oil grades is increasing due to the increasing emphasis on quality and safety standards across end-use industries. Manufacturers are also able to serve niche markets thanks to advancements in processing technologies and a growing trend toward specialized applications, which guarantees ongoing business opportunities in the white oil sector.

- In 2025, the Indian government announced several initiatives to boost domestic oil production, including the New Exploration Licensing Policy and key legislative reforms. Launched to attract investments and ensure a stable supply of raw materials, these measures are set to benefit industries like white oil manufacturing by reducing reliance on imports.

White Oil Market Growth Factors

- Increasing Demand in Pharmaceuticals and Cosmetics: The high purity and nontoxic properties of white oil make it ideal for use in pharmaceutical and cosmetic products, driving demand in these industries.

- Rising Industrial Applications: White oil's versatility in industries like plastics, textiles, and food processing, where it acts as a lubricant, plasticizer, and processing aid, supports its growth.

- Regulatory Support and Safety Standards: Increasing emphasis on product safety and regulatory standards across industries, particularly in pharmaceuticals and cosmetics, is boosting the demand for high-quality white oil.

- Growing Focus on Sustainable and Safe Ingredients: With a rise in consumer preference for nontoxic, hypoallergenic ingredients, white oil's safe profile positions it well in the growing trend toward sustainability in personal care products.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.45 Billion |

| Market Size by 2025 | USD 2.25 Billion |

| Market Size in 2024 | USD 2.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.84% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Innovative Formulation Techniques

The rising focus on developing innovative formulations is expected to drive the growth of the white oil market. The investments in R&D is rising to develop advanced white oil formulations that not only offer superior purity and stability but also provide additional benefits, such as longer shelf life or better absorption properties for personal care products. Concentrate on developing multifunctional products like white oil that can be applied to a range of sectors, such as food processing, pharmaceuticals, and cosmetics. Additionally, consider creating formulations that are simple to modify to satisfy the unique requirements of customers, adding value and encouraging brand loyalty. This could position the company as a pioneer in creating superior, cutting-edge white oil formulations.

Sustainability Through Green Refining

Researchers are developing eco-friendly refining methods that reduce carbon emission, water usage, and waste generation during the production of white oil, which drives the growth of the market. Examine the possibility of substituting components derived from petroleum with bio-based or renewable feedstocks as raw materials. Additionally, you could strengthen your sustainability credentials by incorporating renewable energy sources like wind or solar power into the refining process. By putting these green refining technologies into practice, businesses can satisfy growing regulatory requirements while also appealing to the growing number of environmentally conscious consumers. You can draw in customers who care about the environment as well as those looking to raise their sustainability profiles by establishing your brand as a leader in sustainability.

Restraints

Environmental Concerns and Regulations

Even though white oil is highly valued for its purity, the process of producing it mainly uses petroleum-based feedstock, which can have detrimental effects on the environment. As concerns about climate change grow around the world, governments are passing more stringent environmental laws that require carbon emissions to be reduced and raw materials to be sourced sustainably. White oil producers, especially those that use conventional refining techniques, may see an increase in operating costs as a result of complying with these regulations. Further complicating the white oil market is the possibility that demand for bio-based oils or other environmentally friendly ingredients will shift because of the mounting pressure to use greener substitutes.

Dependency on Oil Refining Technologies

The production of white oil is closely related to specialized refining technologies, which call for sophisticated infrastructure and technical know-how. The products' quality yield and cost-effectiveness can all be adversely impacted by inefficiencies or technological constraints in the refining process. Additionally, the refining and rising energy prices may make it harder for producers to keep profit margins. Furthermore, the capital-intensive nature of refining technology advancements may be a deterrent for smaller producers looking to innovate or improve their production capacities. Because of this dependence on expensive technology, it may be challenging for smaller players to expand or for new competitors to enter the market.

Opportunities

Rising Demand from the Personal Care Industry

The rising demand for white oil in the personal care industry creates immense opportunities in the white oil market. The purity, emollient qualities, and stability of white oil make it a popular ingredient in skincare, haircare, and cosmetic formulations. The need for safe and mild ingredients is rising as people become more conscious of personal hygiene and self-care, particularly in developing nations. Because white oil is hypoallergenic and non-comedogenic, it is perfect for makeup removers, baby care products, and sensitive skin care products. White oil is being used increasingly by companies specializing in clean labels and minimalist products. Manufacturers now have a great chance to customize formulations and packaging for the rapidly expanding personal care industry.

Digital Transformation and E-commerce Expansion

White oil producers can now market their goods internationally without heavily depending on physical presence, thanks to the quick expansion of digital channels in the B2B and B2C markets. As e-commerce platforms gain popularity in the procurement of industrial and chemical products, businesses can more easily reach niche markets and streamline supply chains. Real-time logistics tracking, virtual consultations, online sampling, and digital marketing are some of the tools that can improve customer satisfaction and retention. By using digital tools to increase visibility and credibility, this shift also enables smaller players to compete with larger corporations.

Application Insights

The personal care segment dominated the white oil market with the largest share in 2024. This is mainly due to the heightened adoption of white oil in cosmetics, lotions, baby oils, and moisturizers. White oil is suitable for formulations for sensitive skin because of its superior emollient qualities, non-comedogenic nature, and chemical stability. It is used as a base ingredient in the production of cosmetics. The rising consumer interest in skincare, hygiene, and clean-label products further sustains the segment's position. Strict safety regulations like those set by the FDA bad USP further support segmental growth.

The adhesives segment is expected to witness significant growth in the coming years. The growth of the segment can be attributed to the increasing demand for high-performance adhesives in the construction, automotive, and packaging industries. White oil is used in adhesives because it prevents cracking or breaking under stress. White oil is often used in making eco-friendly adhesives due to its water-resistant properties.

White Oil Market Companies

- British Petroleum

- Renkert Oil, Inc.

- ExxonMobil Corporation

- JX Nippon Oil & Energy Corporation

- Nynas AB

- Petro-Canada

- Royal-Dutch Shell N.V.

- Sinopec Corporation

Latest Announcement by Industry Leader

- In February 2024, Chevron Lummus Global (CLG) announced the commissioning of the world's largest white oil hydroprocessing unit at Hongrun Petrochemical (Weifang) Co., Ltd. in Shandong Province, China. The facility integrates CLG's advanced ISODEWAXING and ISOFINISHING technologies, enabling the production of ultra-pure white oil tailored to specific industrial needs. The Chief Executive Officer of CLG stated "This state-of-the-art facility sets a new benchmark in white oil production, reflecting our commitment to innovation and meeting the evolving demands of the industry.”

Recent Developments

- In March 2024, ExxonMobil Corporation announced the expansion of its white oil product line, targeting pharmaceuticals and cosmetic applications, with a focus on ultra-low aromatic content and enhanced purity standards. This move aligns with the rising global demand for highly refined oils in health and personal care. The company also emphasized sustainability in its production processes, improving its competitive edge.

- In January 2024, Calumet Specialty Products Partners launched a new range of food-grade white oils designed for direct contact applications in food processing and packaging. The oil meets FDA and NSF standards, ensuring safety for consumable use. This development strengthens Calumet's foothold in the food industry segment.

Segments Covered in the Report

By Application

- Adhesives

- Agriculture

- Food

- Pharmaceutical

- Personal Care

- Textile

- Polymers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client