List of Contents

What is the Haptic Technology Market Size?

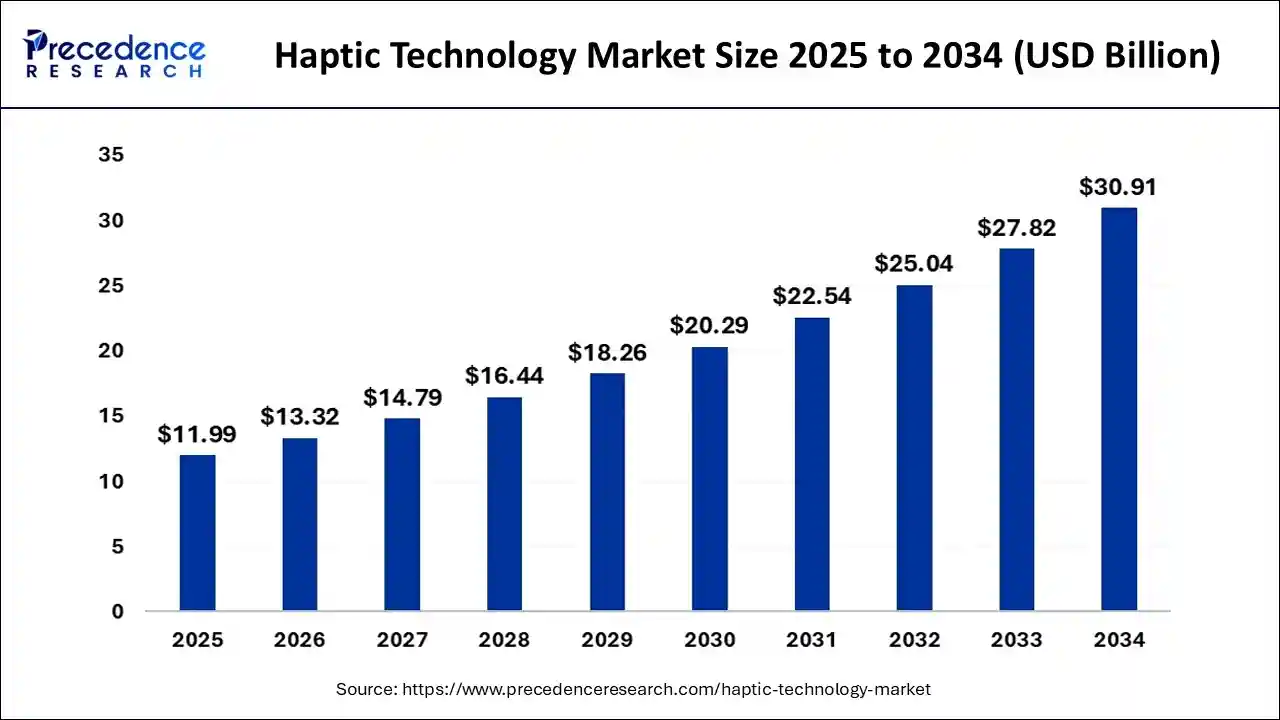

The global haptic technology market size is accounted at USD 11.99 billion in 2025 and predicted to increase from USD 13.32 billion in 2026 to approximately USD 30.91 billion by 2034, expanding at a CAGR of 11.10% from 2025 to 2034.

Haptic Technology Market Key Takeaways

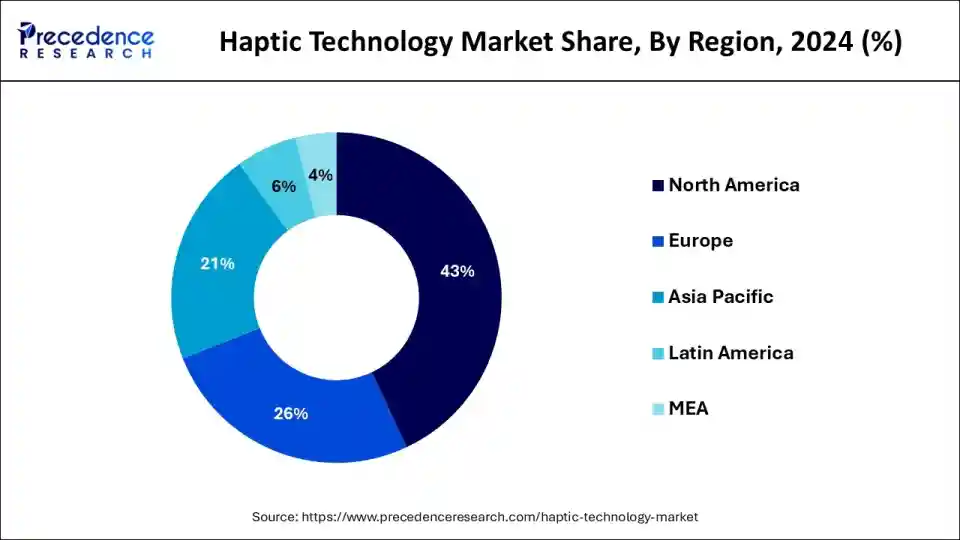

- North America dominated haptic technology market in 2024.

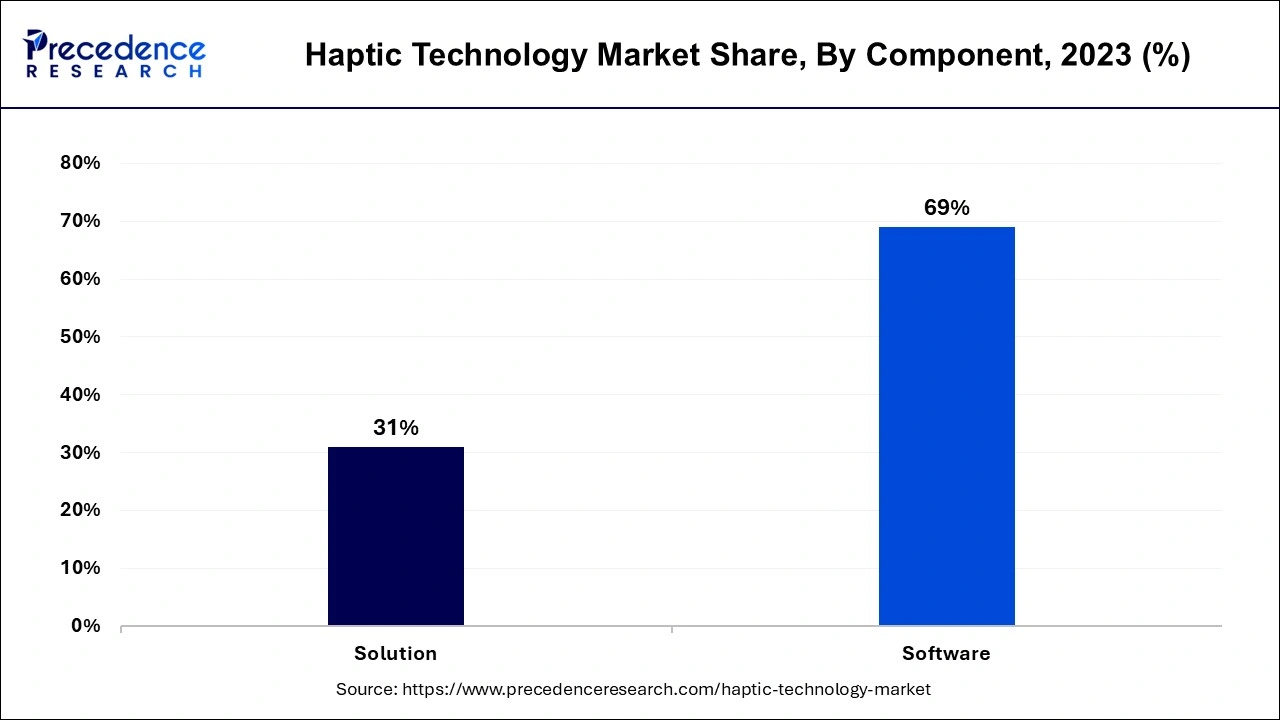

- By component, the software sector led the market in 2024.

- By feedback type, the tactile feedback dominated the market in 2024.

Market Overview

Through pressure, motion, or vibration, haptic technology creates sensory experiences for three-dimensional communication. This method may be applied to many other electrical tasks, such as building better control systems and creating virtual objects. Haptic technology is widely used in a variety of industries, including the automotive sector, wearables, game controllers, phones, and virtual reality. Increased technology integration into consumer electronics devices and touch-enabled household appliances has contributed to market growth. With the use of vibration feedback provided by haptic technology, users may improve touchscreen accuracy.

The market expansion of the haptic technology sector is being driven by the introduction of touch screens in products like music players and household appliances to give consumers with a favourable experience. As customers look for additional game to enhance their gaming experiences, the haptic technology market is also expected to expand. Since the word "haptic" is defined as "able to contact," technologies had a part in the evolution of touch. Haptic technology is being employed on large aeroplanes, and it is used to provide bad responses when it finds faults. Using haptic technology, the inaccuracy or danger was found. The haptic technology market is growing faster and has a greater range of uses. As a consequence of the growing trend of technological integration in augmented reality-enabled gadgets and gaming consoles, the industry for haptic technology is expected to expand. Game input devices such asjoysticks and remote consoles utilize haptic technology to provide different vibration intensities that enhance the user experience. The ability of haptics to mechanically recreate a user's sense of touch is among the key factors fuelling market demand.

Due to disruptions in the manufacturing and supply chain, closures of the public and commercial sectors, lockdown and social distancing norms, and a scarcity of workers, the COVID-19 epidemic has slowed the growth of the haptic technology industry. This has caused a steep fall in the sales of touchscreen devices, consumer electronics, and the automotive sector, which has an impact on how haptic technology is made.

At What Rate Is the Haptic Technology Industry Expanding Around the Globe?

The sales of haptic technology are experiencing significant growth. This growth is being largely driven by increased adoption of haptic feedback in various applications, including automotive displays, AR/VR, gaming, medical devices, and smartphones. As different industries seek to improve sensory engagement and realism, the utilization of haptic feedback has become a valuable component of user experience.

The global haptic technology market is projected to have a strong CAGR through 2032, mainly due to continuous advances in tactile actuators, sensors, and new motion control technologies, resulting in exciting metaverse applications and increased adoption of wearable devices.

Haptic Technology Market Growth Factors

Industry drivers are the many elements that affect the development of the haptic technology market. The rising demand for loT devices is one of the key factors driving the haptic technology market. The need for haptic technology is rising as more people own smartphones, tablets, and other wearable gadgets. The need for haptic technology is being driven by the inclusion of haptic technology in smartphones and tablets to provide a positive touch experience. The market is expanding as a result of rising demand for wristbands, smartwatches, and other wearable technology. The expanding need for cutting-edge technologies in the automotive sector is another significant market driver. The market for haptic technology is growing as a result of the widespread usage of this technology in the automotive sector. The coronavirus epidemic has caused a dramatic decline in the market for haptic technologies. Lockdown restrictions resulted in continual supply chain disruptions, which reduced production and sales volume. When lockdown rules are tightened in some of these locations, it's predicted that manufacturing facilities used to make the product would start up again. Once things get back to normal, the product is expected to grow significantly since more people are purchasing technical items.

Market Outlook

- Industry Growth: The global haptic technology market is set for growth driven by continuing advancements in 5G, AI, and virtual simulation technologies, which establish new use cases for remote operations, gaming, and robotics in medical practice.

- Sustainability Trends: Manufacturers are prioritizing eco-friendly materials, energy-efficient actuators, and recyclable components to address environmental impacts and support sustainability efforts on a global scale.

- Globalization: With an increase in demand for goods, industry players in the Asia-Pacific region, Latin America and Eastern Europe are incentivized to strengthen haptic open innovation by establishing local production capabilities and research and development activity.

- Startup Ecosystem: New startups are shaking up the market with tactile feedback systems that use AI, low-latency haptic sensors, and virtual reality, while attracting significant venture capital and providing opportunities for strategic alliances in multiple regions around the world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.99 Billion |

| Market Size in 2026 | USD 13.32 Billion |

| Market Size by 2034 | USD 30.91 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, Feedback Type, and Geography |

Market Dynamics

Key Market Drivers

- Increasing Consumption of Electronic Devices to Spur Growth: The increased usage of electronic devices like smartphones, tablet, smartwatches, notepads, headset, and earbuds has increased the need for energy storage devices. For instance, according to the Global System for Mobile Communications Association, there will be 5.9 billion distinct users globally by 2025. The electronics industry's adoption of the technology is expected to be accelerated by its various advantages, including improved touchscreen, sound, and visual effects in display touch applications. The market for haptic technology is anticipated to grow as a consequence of the growing trend of technological integration in gaming apps and gadgets that support augmented reality.

- Increasing utilization of haptic technology in gaming applications: Gaming input devices, such joysticks and control consoles, employ technology to deliver varying vibrational intensities and mechanical impulses, creating an immersive user experience. The developing trend of haptic technology integration with dynamic, functional, and contextual user interfaces for augmented reality devices. So, the market for haptic technology will increase significantly with the growing need for interactive audio feedback in gaming applications.

Key market challenges

- High Cost of Force Feedback Haptic Devices - The cost of employing haptic technology is not exorbitant, but the industry for haptic technology has been severely limited by the expense of force-feedback haptic devices, which are more costly than tactile information haptic devices. Customers may experience a simulated haptic feeling in real-time for a range of applications with force haptic feedback technology. Force-feedback haptic devices are used in several sectors, including automobile, healthcare, aerospace, and other industrial enterprises. These devices provide a challenge for wearable technology due to their size. In addition, makers of haptic technology-enabled gadgets like game controllers, cellphones, cars, tablets, etc. have a technological difficulty. The user experience is improved and the gadget is made more user-friendly via haptic technology. However, it becomes challenging for the producers to choose which component would work in a certain system. The significant switching costs associated with this technology may also make it prohibitive for many organizations. This acts as a sizable roadblock to adoption in a number of application sectors. Power-hungry haptic technology-based goods make it difficult to deploy haptic technology in smartphones and other portable gadgets.

Key market opportunities

Adoption of Haptic Technology in education

The haptic technology market will experience rapid expansion thanks to the growing demand for holographic displays, increased use of haptic technology in robotics and education, and other factors. Robots utilising haptic technology, such as gloves, are able to manipulate a robotic hand and other items with complete control. Thanks to haptic technology, the robots can easily control robotic arms. As 3D touchscreen displays are increasingly used in automotive and medical equipment, the industry is growing.

Rising integration of haptic technology in gaming applications for immersive user experience

Through 2030, the gaming industry is expected to experience considerable growth, driven by a rise in the popularity of mobile-based video games. Gamers have a better real-life experience when haptic technology is integrated into gaming consoles and smartphone devices. Gaming controllers with haptic capabilities give video game events like crashes and explosions a tangible feeling of reality, creating significant market development prospects. To meet the growing demand for cutting-edge consoles, a number of market participants in the virtual gaming sector are introducing new devices that use better haptic technology. With instance, Sony declared in April 2020 that their DualSense gaming controller with haptic feedback will be released for the next PlayStation 5. On the L2 and R2 buttons of the controller, DualSense has adjustable triggers that deliver powerful sensations and enhance player interaction.

Component Insights

According to the component analysis, the software sector will be in demand and command the largest market share globally. Numerous advantages of haptic software include better accuracy, more user happiness, quicker response times, and improved gadget performance.

The rise of smartphones, widespread use of haptic-based devices across a variety of sectors, and high penetration of high-end consumer electronics are all driving the software market.

Application Insights

The market is broken down into categories including healthcare, automotive, transportation, consumer electronics, business & industrial, gaming, and military based on the application study. The automobile and transportation sector will have rapid growth and maintain the current trend between 2024 and 2034. The main driving forces behind this development are the advancements in the automotive industry, the rising demand for sophisticated electronic systems among electrical vehicles, the preference for luxury and safety vehicles, and the incorporation of haptics technology into in-car entertainment systems. The technology is employed in steering wheels, dashboards, climate control displays, and accelerator pedals. The top automakers, including BMW, Honda, Toyota, Benz, Tesla, and Audi, are incorporating haptic technology into their vehicles.

Feedback Type Insights

Because it allows users to customise their SMS alerts and other smartphone notifications, the tactile feedback category leads the worldwide haptic technology industry. This has a favourable influence on haptic technology. The market will rise as a result of rising consumer desire for a realistic smartphone experience and the introduction of Internet of Things (IoT)-enabled products like smart watches and wristbands, which will make it easier for people to monitor their health.

Regional Insights

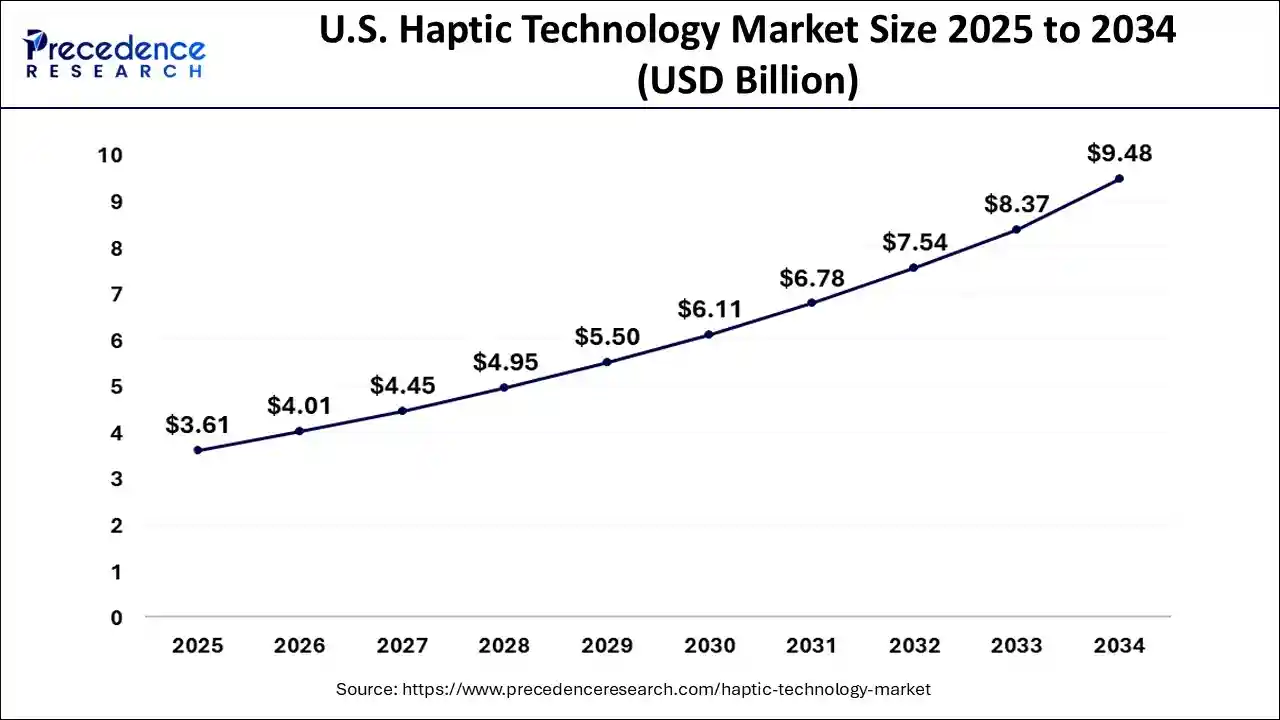

U.S. Haptic Technology Market Size and Growth 2025 to 2034

The U.S. haptic technology market size is evaluated at USD 3.61 billion in 2025 and is predicted to be worth around USD 9.47 billion by 2034, rising at a CAGR of 11.30% from 2025 to 2034.

In the next years, North America is expected to account for a sizeable portion of the global haptic technology industry. This is a result of the region's widespread smartphone use. Additionally, according to data from GSMA Intelligence, 80% of the region's population already uses a smartphone, with that number rising to 91% by 2025.

The market for haptic technology in Europe is being driven by rising consumer expenditure on technologically sophisticated consumer electronic devices. Europe is demonstrating a huge need for touchscreen technology, particularly for applications in the automotive, consumer, and retail industries.

According to projections, Asia Pacific will experience significant development in the next years. This is a result of the presence of significant manufacturers in the area as well as growing nations like China and India. For instance, the Indian electronics market is predicted to develop at a rate of 41% by 2020 and reach a milestone of USD 400 billion, according to the Indian Brand Equity Foundation.

What is Driving Growth of the Haptic Technology Market in Latin America?

Latin America continues on its upward trajectory in the growing haptic technology market, spurred by immersive gaming, smart consumer electronics, and advanced medical training systems. In countries like Brazil and Mexico, we see an increase in the adoption of haptic-enabled smartphones and AR or VR devices.

With the emergence of local tech innovators and increased investment into simulation-based learning and telemedicine, we see a rising demand for haptics to accompany these trends. Moreover, the expansion of the haptic technology market in Latin America is still being supported by the government's digital transformation and smart infrastructure initiatives.

What is Driving Growth of the Haptic Technology Market in Europe?

Europe is by far the largest haptic technology market by region, which is driven by the strong automotive, industrial automation, and healthcare markets. Countries such as Germany, the UK, and France lead in their respective haptic technology by introducing haptic feedback into robots, wearable devices, and the next-generation infotainment system.

The increased consumer demand for immersive gaming experiences and ergonomic devices in Europe further drives the momentum for haptic technology in the region. In addition, the EU regulations boasting tactile safety systems in vehicles and the increased emphasis on assistive technology for elderly users supports the steady adoption of haptics across markets.

What Are the Key Components of the Haptic Technology Value Chain?

The haptic technology value chain encompasses multiple interrelated stages, including sourcing raw materials to integrating end products. Each piece helps to complete the same goal of creating seamless tactile feedback and improving the user experience. Major segments of this value chain include material suppliers, component manufacturers, system integrators, and end-user applications in consumer electronics, automotive, and health care. The interactions among the players are what fuel the optimization of performance, cost, and completion of what is perceived as a haptic system's overall, never-ending quest for innovation.

- Component Manufacturing: Actuators, sensors, and microcontrollers are fundamental to haptic systems, controlling quality and time response. Manufacturers are focused on investing in and facilitating the trend of miniaturization and energy awareness to enable the lightweight devices that are fast becoming the norm.

- System Integration & Design: Integrators work with Original Equipment Manufacturer (OEM) to deliver experiences that drive user feedback in a wide range of devices, including smartphones, wearables, including medical devices.

- Delivery & User Adoption: Partnerships and global distribution channels enable the rapid commercialization and user adoption of technology for tactile devices into consumer products like gaming, infotainment in a vehicle, and simulations for training and education.

Haptic Technology Market Companies

- Citizen Electronics Co. Ltd.

- Immersion Corporation

- Cree Inc.

- Everlight Americas Inc.

- LG INNOTEK

- Merck KGaA

- Lumileds Holding B.V.

- Nichia Corporation

- OSRAM GmbH

- Seoul Semiconductor Co. Ltd.

- Stanley Electric Co.

- Toyoda Gosei Co. Ltd.

Recent Developments

- In February 2021, Immersion Corporation and Faurecia Corporation approved a multi-year licencing deal to allow Faurecia to purchase Immersion's haptic technology solutions. Faurecia will be able to design an intricate, interactive haptic user interface using cutting-edge technology from Immersion Corporation.

- The S9A0H ASIC TouchPadTM solution, which offers a hardware/software platform and enables the greatest degree of firmware security, was introduced by Synaptics Incorporated in January 2022. Scalability is also provided to meet the desire for larger, more smarter, and more responsive haptic-enabled touchpads in order to boost productivity.

Segments Covered in the Report

By Component

- Solution

- Actuators

- Drivers and Controllers

- Others

- Software

By Application

- Consumer Electronics

- Gaming

- Healthcare

- Robotics

- Education

- Research

- Others

By Feedback Type

- Tactile

- Force

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client