List of Contents

What is Food Flavors Market Size?

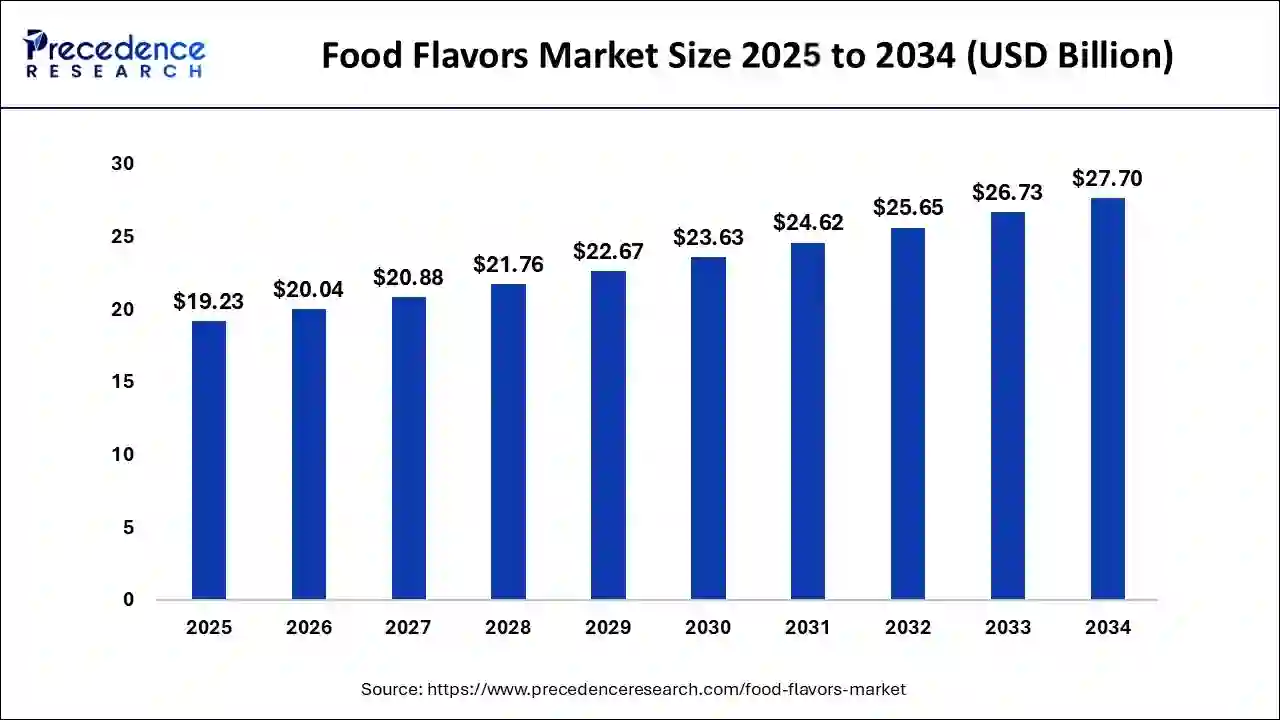

The global food flavors market size is estimated at USD 19.23 billion in 2025 and is anticipated to reach around USD 27.70 billion by 2034, expanding at a CAGR of 4.14% from 2025 to 2034. The food flavors market is driven by the rising demand for natural and clean-label ingredients.

Market Highlights

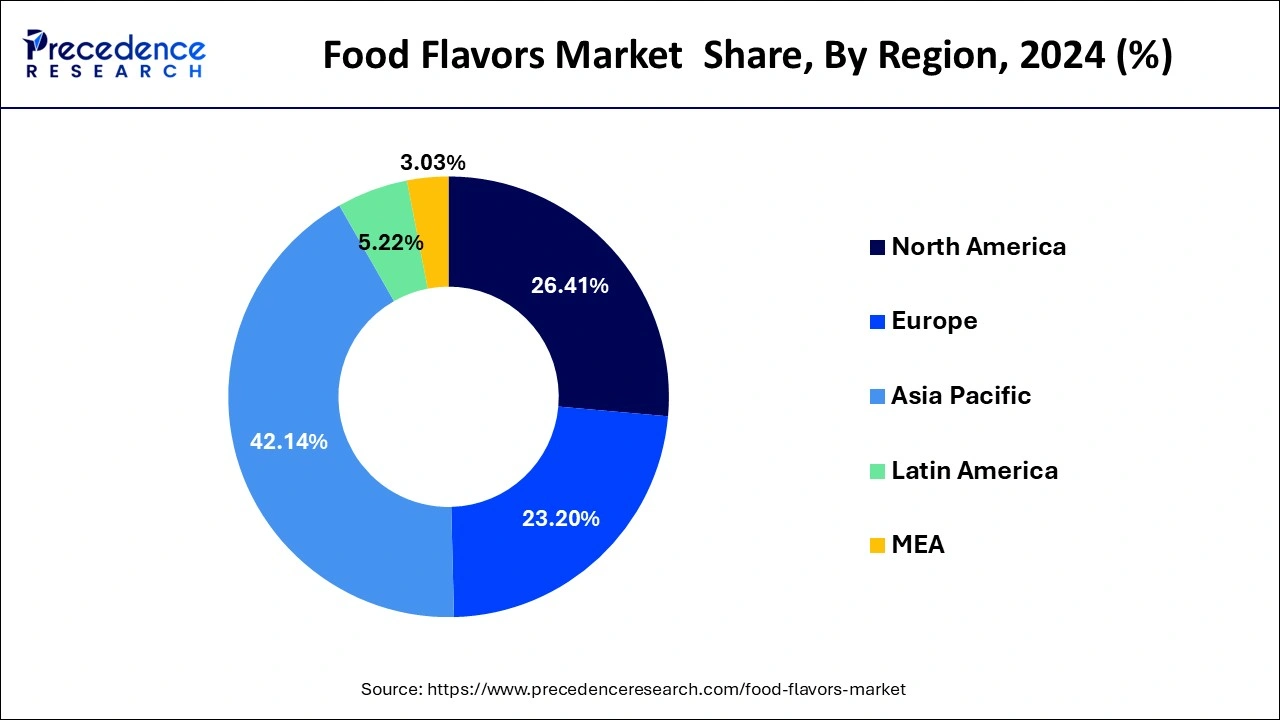

- Asia Pacific led the global market with the highest market share of 42.14% in 2024.

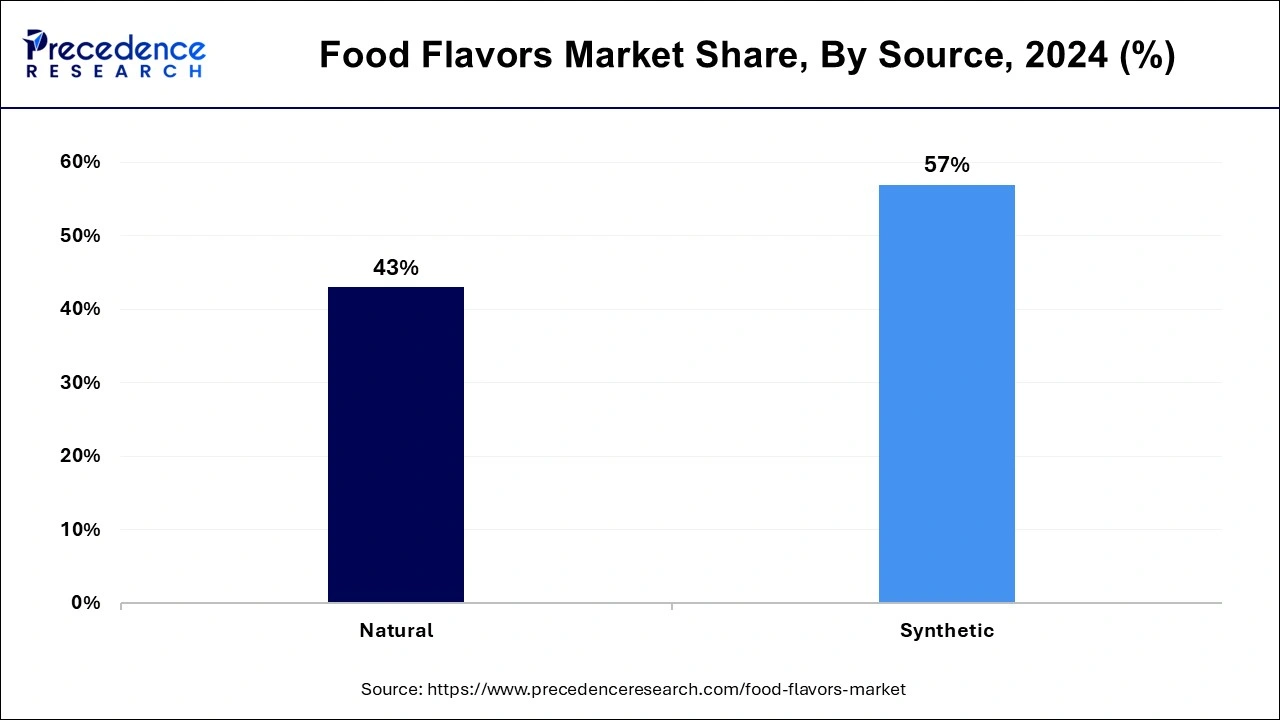

- By source, the synthetic segment accounted largest market share of over 57% in 2024.

- Based on end user, the bakery & confectionery segment is projected to grow at a remarkable CAGR from 2025 to 2034.

How does Ready-To-Eat Impact Food Flavors?

Food flavors are frequently added to food products to enhance their flavor. The primary flavor additives are synthetic and natural flavors. After processing and preserving, perishable foods have a tendency to lose their flavor over time, necessitating the application of flavoring agents to help preserve the flavor. The food and beverage sector needs flavors for a variety of reasons, including the development of new products, the addition of new product lines, and the modification of existing products' flavors.

The rising consumption of various packaged eatable items and beverages is a primary driver of the global industry. All packaged consumables contain flavoring agents among other food additives. The consumption of ready-to-eat food products is popular due to the fast-paced lifestyle and rising number of working women. The market for food flavors will rise as a result of this. Natural food consumption is on the rise, and the food business is constantly looking for novel flavoring ingredients. Players in the food flavor sector have a ton of potential because of these natural flavoring ingredients.

Integration of Artificial Intelligence in Food Industry

Artificial Intelligencedetects many datasets to forecast food quality, safety, and shelf life. These models aid in analyzing production processes, lessening waste, and improving product quality by detecting factors that impact food properties and recommending adjustments to production parameters. AI image recognition can investigate, and sort food products based on quality attributes like size, shape, and color. These systems help automate quality control and ensure help in product quality.

Food Flavors Market Growth Factors

- Consumers have demonstrated a preference for paying extra for grocery items that are certified organic due to the growing awareness of food adulteration and the health risks associated with synthetic food additives. Producers of organic goods benefit from organic certification by charging a fair premium and gaining access to rapidly expanding local, regional, and global markets.

- Interest in fast food and packaged goods has increased due to rapidly rising earnings and urbanization. These factors are anticipated to increase demand for food and beverages since packaged goods need high flavoring loadings to retain the flavor lost during mass production.

- The need for flavors to enhance the flavor of products is also expected to rise as attempts are made to lower the number of calories, salt, and fat in foods.

- Customers are generally well aware of the synthetic substances utilized in food products. Growing consumer interest in clean-label products and improved awareness of natural ingredients may impact natural food essences. By making products with flavors that are produced naturally, the manufacturers are capitalizing on the growing popularity of clean-label products.

- Natural flavors are utilized to give culinary items an authentic taste and flavor. As a result, the industry uses natural extracts and essential oils in several product categories to satisfy this need. As a result, the market for food tastes is expanding due to the increased demand for flavors in the food and beverage industry.

Market Key Trends: A Taste of Innovation

The global food flavours market is undergoing a vibrant transformation, driven by the dynamic interplay of health consciousness, clean-label demand, and culinary innovation. Natural flavours are gaining exceptional traction as consumers lean towards organic and plant-based diets, spurring the demand for fruit-based, herbal, and spice-inspired notes. Another prominent trend is the rise of ethnic and regional flavours, as globalisation encourages food manufacturers to introduce international taste palettes to local markets. Technology-driven developments such as AI-based flavour profiling and encapsulation techniques for better shelf-life and taste intensity are further enhancing the market. Additionally, functional foods and beverages enriched with immunity-boosting and mood-enhancing flavours are drawing attention, especially post-pandemic.

Food Flavors Market Outlook

- Global Expansion: The respective growth is driven by the progression of exotic and spicy flavors, technological advancements in flavor creation, and a focus on sustainability.

- Major Investor: DSM-Firmenich, Givaudan, and International Flavors & Fragrances (IFF) are periodically investing to leverage variations and expansion of their facilities.

- Startup Ecosystem:Cosaic evolves a single ingredient that boosts diverse products by masking off-notes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.23 Billion |

| Market Size in 2026 | USD 20.04 Billion |

| Market Size by 2034 | USD 27.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.14% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Application, and By Form, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Source Insights

Depending upon the origin, the natural segment is the dominant player and is anticipated to have the biggest impact on food flavors. The rising demand for food products that promote wellness and health is a major driver of the global market for natural food flavors. The market for natural food flavors is expected to grow as a result of a number of factors, including the health benefits of some natural colors and flavors, rising purchasing power among consumers, a rise in the demand for organic food products, and a wide variety of products with novel tastes and flavors.

Moreover, many food establishments use the organic flavors to produce real flavor. Additionally, the younger generation prefers to cook with a range of botanicals and adaptogens. This is due to a greater awareness of the detrimental effects of synthetic flavors. Ingredients in artificial flavorings have been linked to cancer and a host of other health issues over time. Many businesses manufacture natural food flavorings because the innovative use of raw materials supplied from organic farms offers the food industry considerable possibilities. The enormous demand for artificial tastes in fast food, packaged meals, and ready-to-eat items also contributes to the expansion of this market.

Application Insights

During the projected period, the beverage segment is anticipated to be the largest in the food flavors market. Due to rising discretionary budgets among consumers, various synthetic flavors, including chocolate fruit and floral flavors, are growing in popularity in developing economies in Asia Pacific and the Middle East. Over the forecast period, the dairy, confectionery, and bread sectors are anticipated to increase significantly. Numerous flavors, including fruit flavors and natural spices, are frequently used in dairy beverages and other dairy products. It is projected that the market would rise because to the rising popularity of cocoa and fruit tastes in the bread and confectionery industries.

Apple, banana, mango, grapes, pineapple, pomegranate, berries and citrus fruits are just a few examples of the many fruits that are highly popular. They are then transformed into syrups and fruit extracts, which are then added to different foods and beverages to change or enhance flavor, aroma, or color. Hence, these applications are driving the beverage segment.

Regional Insights

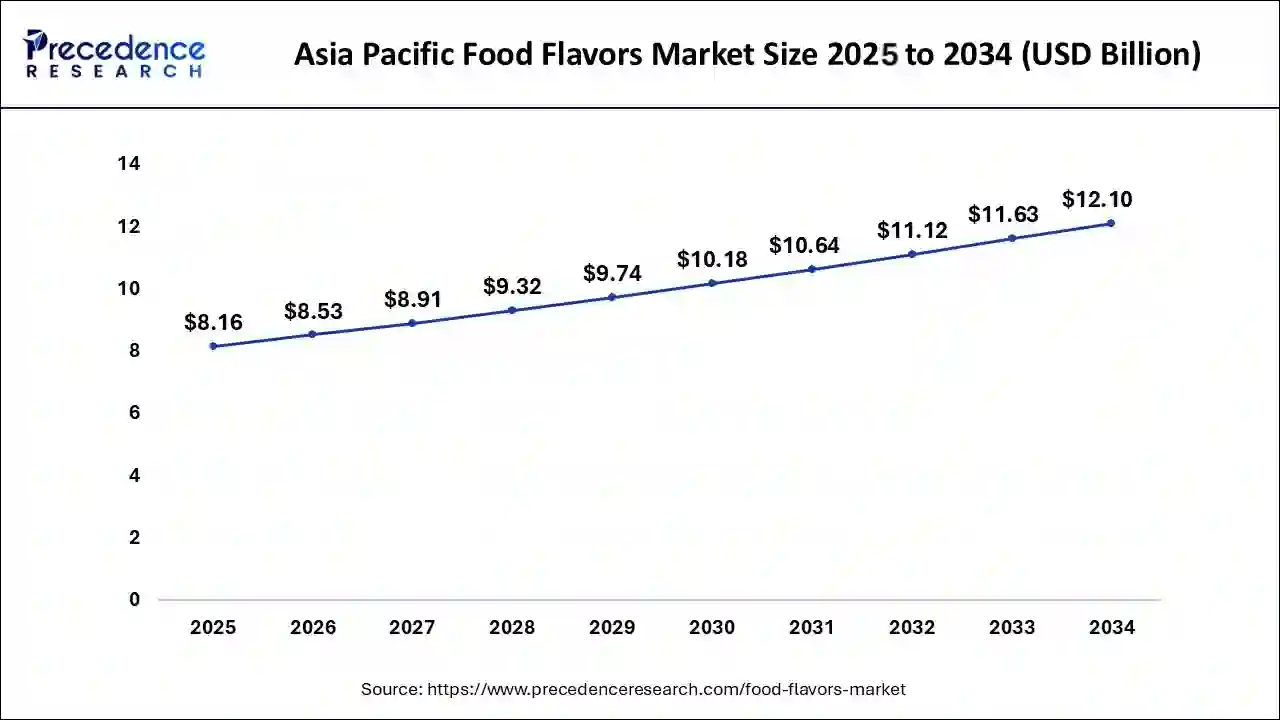

Asia Pacific Food Flavors Market Size and Growth 2025 to 2034

The Asia Pacific food flavors market size is estimated at USD 8.16 billion in 2025 and is predicted to be worth around USD 12.10 billion by 2034, at a CAGR of 4.49% from 2025 to 2034.

The highest market share and dominant position in the food flavors industry belongs to Asia-Pacific due to the increased demand for innovative and improved food items. The high production and sales of the food and beverage industry, the rising purchasing power of the general public, and the growing presence of significant players in the region is driving the food flavor market in the region. Moreover, the market for food flavors in the Asia Pacific region is expanding quickly as a result of the region's high consumption of processed foods and beverages. The Asia Pacific region has a developing economy and a sizable working-class population. One of the key macroeconomic variables supporting the market growth for eatable flavoring agents is population trends. Additionally, chances for numerous mid-tier businesses would be created by investments from various multinationals, particularly from important countries like China, India, and Japan. The use of various ready-to-eat/drink goods is influenced by the growing population of working women and a hectic lifestyle. Additionally, it is anticipated that the region's consumption of baked goods and confectionary items will have a very high growth potential.

Why did the Asia Pacific Dominate the Market in 2024?

The Asia-Pacific region is currently leading the food flavours market, thanks to its rich culinary diversity, rising urbanisation, and increasing disposable income. Countries such as India, China, Japan, South Korea, and Indonesia are at the forefront of this growth. Their strong presence is attributed to both traditional culinary preferences and a booming processed food industry. For instance, India has been actively supporting food innovation through government initiatives like the ‘Production Linked Incentive (PLI) Scheme' for food processing, while China's Five-Year Plan emphasises food safety and technological integration. These efforts have encouraged both domestic and foreign food flavour companies to expand operations, launch localised flavours, and invest in sustainable flavour technologies. The expanding middle class and youth-driven appetite for ready-to-eat and fusion foods further amplify growth.

North America is considered as second-largest region in the consumption of food flavors. This is due to the region's consumption of numerous regional cuisines. Due to the region's migratory population, authentic food products are consumed there, which has prompted the creation of numerous international edible services. American consumers enjoy Indian and Japanese cuisine. Japanese dishes and ingredients like matcha, sushi, and ramen are very popular, which attracts both stores and eateries. Japanese food uses a variety of flavors, including umami. Umami is a flavor that prolongs the flavor of whole foods in Japanese cooking. This significantly contributes to the expansion of this market in North America.

Rising Consumption of Indian & Chinese Cuisine Supports North America

North America, particularly the United States and Canada, is the fastest-growing region in the food flavours market. This growth is fuelled by consumers' increasing demand for clean-label and plant-based foods, with a sharp focus on health and wellness. The region is witnessing significant innovation in natural extracts, functional beverages, and gourmet-inspired snacks. Major food manufacturers are increasingly collaborating with biotech and food-tech firms to launch customised flavour profiles that cater to keto, vegan, and allergen-free diets. Furthermore, rising investments in sustainable sourcing and regenerative agriculture practices are influencing the natural flavour landscape.

Exploring Modern Formats: Drives the Indian Market

The Indian population is stepping into the reinvention of traditional Indian sweets, such as gulab jamun and rasgulla flavors in chocolates and cakes. Alongside, companies are exploring plant-based and botanical flavors, like lemon grass, mint, and curry leaves, etc.

A Surge in Sustainability Trends: Escalates the U.S. Market

The U.S. is emphasizing raising wellness and sustainability trends, flavors, including lavender, chamomile, hibiscus, and jasmine in beverages and desserts, to facilitate a light, refreshing, and often calming experience. As well as many U.S. people are demanding rich, savoury flavours, like Miso, black garlic, porcini, and truffle for snacks and main courses.

Focus on Fusion & Novelty Promotes MEA

The food flavors market in MEA is experiencing a notable expansion due to the increasing efforts in developing fusion and novelty, which fosters the blend of traditional regional flavors with modern formats. This further develops new experiences to encourage consumer desires for both familiarity and novelty.

Extensiveness of Ingredients & Industries: Impacts the African Market

The significant expansion is propelled by the native African fruit baobab and the ancient grain fonio, which are acquiring international popularity due to their nutritional advantages and unique flavor profiles, featuring in numerous health-conscious products. Alongside, they are progressing their industries, such as Archer Daniels Midland (ADM) escalated its Johannesburg office to offer tailored flavor solutions to regional taste preferences.

Food Flavors Market: Value Chain Analysis

- Raw Material Procurement

The process includes sourcing and acquisition of various ingredients, which are then processed into flavor compounds (aroma chemicals, essential oils, extracts, etc.) that meet stringent quality, safety, and regulatory standards.

Key Players: Givaudan S.A., Firmenich International S.A., Symrise AG, etc. - Processing and Preservation

It primarily covers thermal processing (pasteurization, canning), low-temperature methods (freezing, refrigeration), and the use of natural and chemical preservatives (salt, sugar, vinegar, sorbates).

Key Players: Kerry Group, Archer-Daniels-Midland (ADM) Company, Corbion NV, etc. - Waste Management and Recycling

This can be achieved through prevention (source reduction), then redistribution (donating edible surplus), and finally recycling and recovery.

Key Players: Wastelink, Re Sustainability Limited (RE), BioteCH4, etc.

Key Players in Food Flavors Market and their Offerings

- DuPont- It has its comprehensive Nutrition & Biosciences (N&B) business, including food flavors and ingredients, which was united with International Flavors & Fragrances (IFF).

- Archer Daniels Midland- It prominently provides citrus, dairy, and fruit/berry options, as well as savory, sweet brown, cola, and mint flavors.

- Symrise- A major company offers natural solutions derived from fruits, vegetables, and herbs, and a broad portfolio for culinary products, beverages, dairy, and sweets.

- MANE- It explores natural, savory, and sweet flavours for beverages, confectionery, dairy products, snacks, and meat alternatives.

Taiyo International- A firm introduced tea-based flavors, like ceremonial-grade matcha and other green tea extracts like Sunphenon (catechins).

Recent developments

- In May 2025, McCormick & Company unveiled Aji Amarillo as its Flavour of the Year, highlighting the pepper's fruity, tropical notes with moderate heat. This selection reflects the company's commitment to exploring diverse global flavours and catering to evolving consumer tastes. (Sourece: http://news.mccormick.com)

- In September 2024, The Hershey Company declared a new addition to its Kit Kat lineup: Kit Kat Vanilla. The brand's new flavor features crisp wafers enrobed in vanilla-flavored crème. It is now available in standard and king sizes at retailers nationwide.

- In April 2024, according to the company, Glanbia PLC is growing its better nutrition platforms by acquiring Flavor Producers LLC from Aroma Holding Co., LLC. for an initial $300 million plus deferred consideration.

Segments Covered in the Report

By Source

- Natural

- Essential Oil

- Natural Essence

- Others

- Synthetic

- Artificial flavors

- Nature-identical flavor

By Application

- Beverages

- Hot drinks

- Soft drinks

- Alcoholic drinks

- Dairy & frozen products

- Dairy products

- Frozen products

- Bakery & confectionery

- Bakery

- Chocolate

- Confectionery

- Ice Cream

- Savory & snacks

- Savory

- Snacks

- Animal & pet food

- Animal feed

- Pet food

By Form

- Dry

- Liquid & gel

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client