List of Contents

What is the Cold Chain Packaging Market Size?

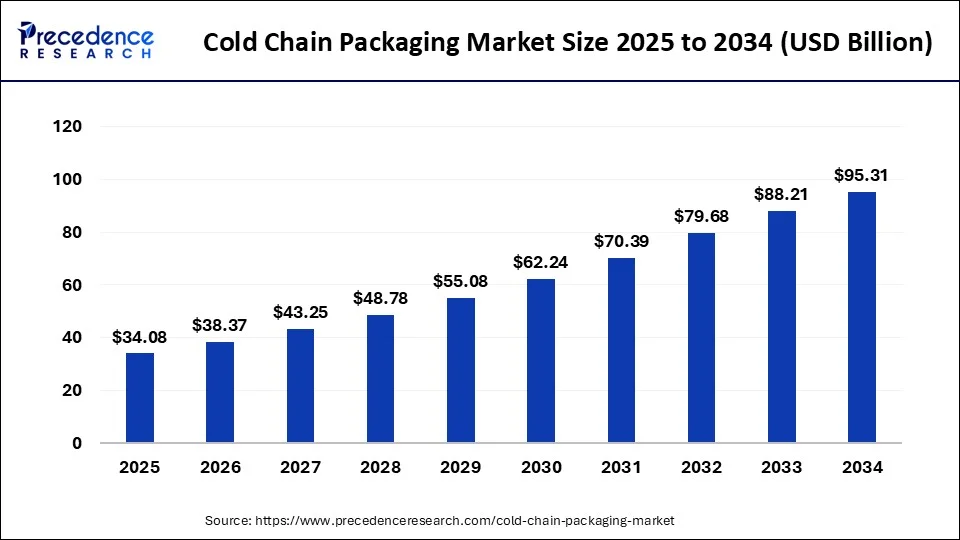

The global cold chain packaging market size is valued at USD 34.08 billion in 2025 and is predicted to increase from USD 38.37 billion in 2026 to approximately USD 95.31 billion by 2034, expanding at a CAGR of 12.15% from 2025 to 2034.

Cold Chain Packaging Market Key Takeaways

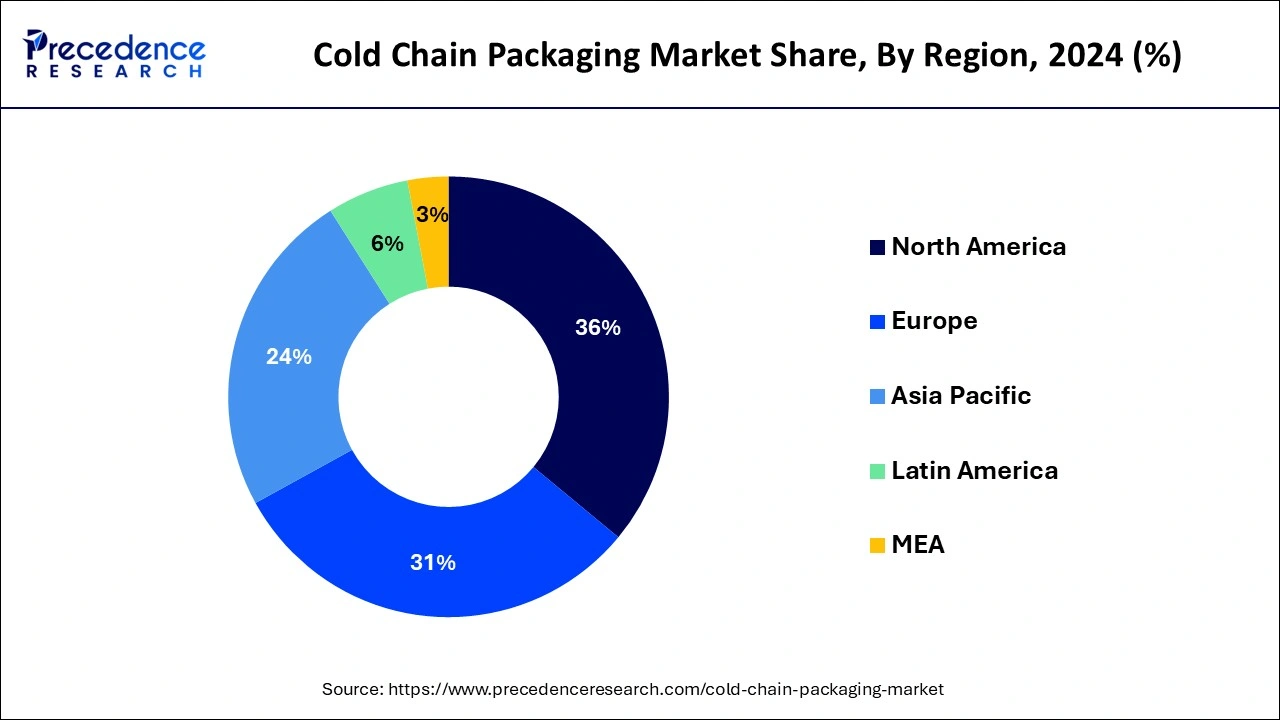

- North America dominated the cold chain packaging market with a revenue share of around 36% in 2024.

- The cold packs segment is growing at a CAGR of 22% from 2025 to 2034.

- The fruits and vegetables segment is poised to grow at a CAGR of 21% from 2025 to 2034.

- The processed food segment is projected to reach at a CAGR of 21.5% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 34.08 Billion

- Market Size in 2026: USD 38.37 Billion

- Forecasted Market Size by 2034: USD 95.31 Billion

- CAGR (2025-2034): 12.15%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Cold Chain Packaging Market Growth Factors

Temperature controlling and monitoring has become an essential part of the modern day logistics that ensures the safety and quality of the product during transportation. The key players in the cold chain packaging market are investing in the development of new and efficient products that can effectively tackle the challenges and complexities associated with the cold chain logistics. The efficient cold chain packaging can reduce miscellaneous losses, keeps the product quality intact, and can increase the profit margins. The rapidly surging demand for the cold chain packaging in the food processing industry is expected to drive the growth of the cold chain market significantly during the forecast period. The rising population, increasing personal disposable income, and changing lifestyle of the consumers are some of the prominent factors that are driving the adoption of the cold chain packaging across the various applications. The demand for the packaged food, processed food, and ready-to-eat food products is surging with the changing lifestyle. The various food products such as dairy food products, sea food, meat, frozen fruits, and vegetables require efficient cold chain packaging during storage and transportation. The rising technological advancements in the food packaging is significantly driving the market growth across the globe.

Cold Chain Packaging Market Outlook

- Industry Growth Overview: The market is projected for substantial growth between 2025 and 2034, driven by rising demand for pharmaceuticals, biologics, and fresh foods, along with expanding e-commerce. This expansion is most pronounced in temperature-monitoring devices, reusable solutions, and hybrid packaging systems.

- Sustainability Trends: Sustainability efforts are focused on developing eco-friendly, reusable, and energy-efficient solutions. Innovations include bio-based phase change materials, recyclable insulation, and reusable containers to reduce environmental impact and meet consumer and regulatory demands.

- Global Expansion:Leading companies are expanding into high-growth regions like Asia-Pacific, Latin America, and Eastern Europe, capitalizing on large populations, growing healthcare sectors, and increasing perishable goods trade. Asia-Pacific is projected to be the fastest-growing market.

- Major Investors: Significant investment is flowing from venture capital, private equity, and large tech corporations, including recent acquisitions by players like Cold Chain Technologies. Investments are driven by high demand for temperature-sensitive products and strong market potential.

- Startup Ecosystem: A maturing startup ecosystem is focused on developing advanced insulation materials, smart packaging with IoT sensors, and subscription-based rent-a-box models to lower entry costs. Emerging firms are attracting considerable funding for scalable, innovative solutions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.15% |

| Market Size in 2025 | USD 34.08 Billion |

| Market Size in 2026 | USD 38.37 Billion |

| Market Size by 2034 | USD 95.31 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Application, Packaging Format, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Depending on the product, the global cold chain packaging market was dominated by the insulated container & boxes segment which accounted for over 58% of the market share in 2024. The high demand for reusable insulated containers and boxes for the purpose of storing fruits, vegetables, and processed food has led to the growth of this segment. The increased pressure on the pharma companies and the top food companies to reduce the costs of manufacturing has led to the increased adoption of reusable insulated boxes and containers, which has a significant role in the growth of this segment across the globe.

On the other hand, temperature-controlled pallet shippers are expected to be the most opportunistic segment during the forecast period. The easy and wider availability of several pallet shippers made of polyurethane, low-density polyethylene, and expanded polystyrene is positively contributing to the growth of the temperature-controlled pallet shippers segment. It is extensively used for shipping biological samples, frozen food products, and vaccines across the globe.

Material Insights

On the basis of material, the insulating materials segment constituted over 66% of the revenue and dominated the global cold chain packaging market in 2024. The insulating materials segment is further segregated into vacuum insulated panel, EPS, cryogenic tank, PUR, and others. The extensive demand for the EPS segment in the shipping sector has led to the dominance of this segment in the global cold chain market.

The refrigerant is expected to be the fastest-growing segment during the forecast period. This segment includes hydrocarbons, fluorocarbons, and inorganics. The surging inclination towards the low global warming potential and low ozone depletion potential gases is driving the adoption of the refrigerant segment. The rising concerns over ozone layer depletion and global warming has shifted the focus towards the adoption of sustainable packaging solutions across the globe. The refrigerant materials can help in effectively counter the challenges related to the global warming. The end users of the cold packaging are inclining towards these packaging materials to reduce costs and achieve sustainability goals. Therefore, this segment is anticipated to be the fastest-growing in the upcoming years.

Application Insights

Depending on the application, the fish, seafood, and meat segment garnered a revenue share of around 26% and led the global cold chain packaging market in 2024. The rising demand for the meat and sea food across the globe and the growing production of the fish and meat across globe is fueling the demand for the cold chain packaging. The bio-physiochemical changes that occurs in the meat and fish products naturally is the major factor that has boosted the adoption of the cold chain packaging in the fish, seafood, and meat sector. The freshness of the meat products needs to be maintained strictly till it reaches the consumer. Therefore, the increased need for maintaining the quality and freshness of the meat products, the demand for the cold chain packaging is higher in this sector.

The processed food is expected to be the most lucrative and opportunistic during the forecast period. The demand for the processed food products such as chocolates, canned food, pickles, jams, and canned meat is higher in the developed nations and it is gaining a rapid traction in the developing countries as well. The presence of high population in the developing nations and the rising disposable income is fueling the demand for the processed food among the population. The easy-to-cook and ready-to-eat food products are gaining rapid traction among the consumers, which is expected to drive the growth of this segment in the forthcoming future.

Regional Insights

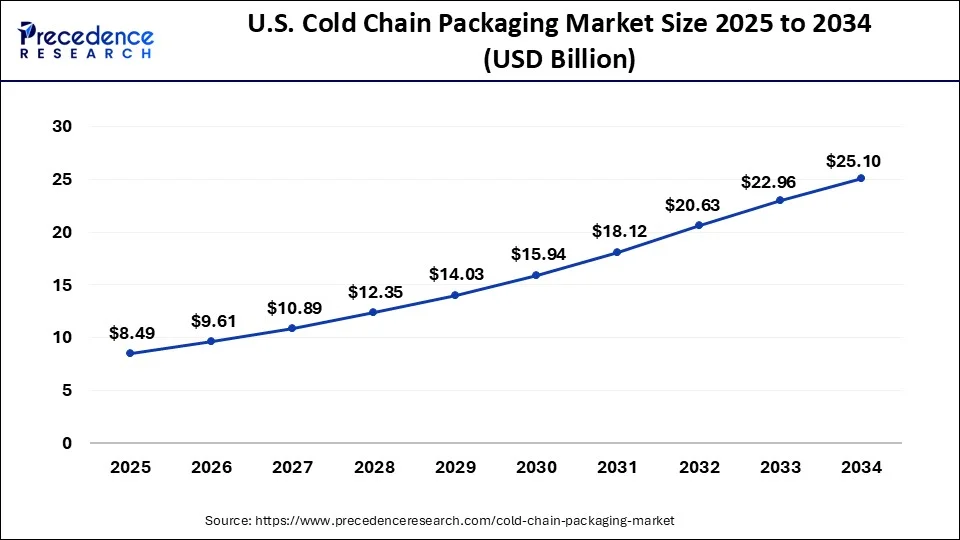

U.S. Cold Chain Packaging Market Size and Forecast 2025 To 2034

The U.S. cold chain packaging market size is estimated at USD 8.49 billion in 2025 and is projected to be worth around USD 25.10 billion by 2034, at a CAGR of 12.84% between 2025 and 2034.

North America was the leading cold chain packaging market accounting for a revenue share of around 36% in 2024. This growth is attributed to the increased production volumes of meat, processed food, and fruits & vegetables. The demand for these processed and fresh food products is higher in the region. Furthermore, the high standard of living, busy and hectic schedule of the consumers, high disposable income, and increased demand for the packaged food has resulted in the higher demand for the cold chain packaging. Furthermore, the presence of top pharmaceutical companies in the region and the development of several drugs and vaccines that requires cold storage has fueled the adoption of the cold chain packaging in the pharmaceutical sector. The rising health consciousness among the consumers is spurring the demand for the organic food products especially fruits and vegetables, which is expected to drive the growth of the cold chain packaging market.

United States Cold Chain Packaging Market Trends

North America's cold chain packaging market is dominated by the United States due to a well-established logistics network, strict regulatory guidelines, and high demand from the food, pharmaceutical, and biotechnology industries. The growth of biologics, specialty drugs, and the export of frozen foods has all contributed to the need for efficient temperature controlled packaging. Companies such as Sonoco ThermoSafe and Pelican BioThermal are investing in sustainable and reusable packaging technologies. In addition, the rise of online grocery platforms and meal kit delivery services continues to spur demand for reliable cold chain packaging across the U.S. market.

Asia Pacific is projected to be the most opportunistic market during the forecast period.This growth is attributable to the surging penetration of the top food processing and pharmaceutical companies in the region. Asia Pacific is the home to around 60% of the global population. The presence of huge youth population, rising employment, changing demographics, and rising disposable income are the major factors that are fueling the demand for the processed food. The growing demand for the fruits and vegetables along with the fresh meat and seafood in the region is another prominent driver of the cold chain packaging market in Asia Pacific.

China Cold Chain Packaging Market Trends

China is the leading country in the Asia Pacific cold chain packaging market and is gaining momentum from accelerated consumption of perishable foods, as well as the growth of pharmaceutical exports. National initiatives such as the "Cold Chain Logistics Development Plan (2021-2025)" are helping to increase investment in refrigerated transport and infrastructure. There is also greater demand for effective cold packaging due to large e-commerce operations and food delivery players such as Alibaba's Freshippo. Chinese manufacturers are investing in environmentally sustainable packaging (e.g., biodegradable, compostable, recyclable, etc.) and smart packaging solutions for maintaining temperature control, while meeting international quality and safety standards.

How is the Opportunistic Rise of Europe in the Cold Chain Packaging Market?

Europe is witnessing significant growth in the cold chain packaging market, driven by rising demand for temperature-sensitive pharmaceuticals, perishable foods, and e-commerce deliveries. Strong regulatory frameworks and increasing investments in advanced insulation and temperature-controlled packaging solutions are accelerating market adoption. Countries like Germany are leading in innovations in sustainable, high-performance cold chain materials. Additionally, the expansion of logistics infrastructure and growing awareness of product integrity are further supporting the region's market rise.

Germany Cold Chain Packaging Market Trends

Germany is a major contributor to the European cold chain packaging market due to its advanced pharmaceutical and food industries, which demand reliable temperature-controlled logistics. The country's strong focus on innovation and adoption of sustainable, high-performance packaging solutions further drives market growth. Additionally, Germany's well-established cold chain infrastructure and stringent regulatory standards ensure product quality and safety, reinforcing its leadership in the region.

What Factors Support the Growth of the Latin America Cold Chain Packaging Market?

The Latin American cold chain packaging market is growing at a notable rate, driven by rising demand for perishable goods, especially high-value exports such as fresh fruits, vegetables, and pharmaceuticals. Main factors include more trade agreements and tighter international regulations on product safety and quality, which require dependable temperature-controlled packaging solutions. Countries such as Brazil, Argentina, and Chile are experiencing more investment in insulated containers, gel packs, and thermal blankets. Although the market is sensitive to price, the need to prevent product spoilage and meet global standards is driving the adoption of more advanced, eco-friendly packaging technologies.

Brazil Cold Chain Packaging Market Trends

Brazil holds a dominant position in the Latin American cold chain packaging market, fueled by its extensive agribusiness sector and a sizable domestic pharmaceutical industry. The market's growth is bolstered by rising health and safety regulations and increasing demand for both fresh and processed perishable foods. The main emphasis is on efficient, affordable insulation and cooling solutions to handle distribution across the country's vast geography and diverse climates. A growing trend towards sustainable, eco-friendly packaging materials is also attracting investment and technological innovation.

What Potentiates the Growth of the Cold Chain Packaging Market in MEA?

The market in MEA is growing due to the need to ensure food security, manage high ambient temperatures, and support the development of the pharmaceutical sector. The Middle East, particularly the UAE and Saudi Arabia, is investing in state-of-the-art logistics infrastructure and smart packaging solutions to handle sensitive imports and domestic products. In contrast, growth in Africa is more focused on basic, essential cooling and packaging to address post-harvest losses and improve the distribution of vaccines and medicines.

Saudi Arabia Cold Chain Packaging Market Trends

Saudi Arabia's vision to diversify its economy and improve food security and healthcare logistics promotes regional market growth. The country is investing in advanced, temperature-controlled logistics and smart packaging technologies, including phase change materials (PCMs) and real-time monitoring devices, to manage high-value pharmaceuticals and imported perishables across extreme temperatures, ensuring the integrity and quality of sensitive goods from origin to final consumption.

Value Chain Analysis of the Cold Chain Packaging Market

- Material Procurement and R&D

The value chain begins with sourcing materials such as polymers and phase change materials (PCMs) for temperature control and with developing innovative, often sustainable, packaging technologies. Activities include R&D on new materials, designing efficient formats, and integrating smart technologies such as IoT sensors.

Key Players: Sonoco ThermoSafe, Cold Chain Technologies, Peli BioThermal, Va-Q-tec, Softbox Systems. - Manufacturing and Production

This involves producing insulated containers, gel packs, and pallet shippers to strict quality standards, using automated processes. The focus is on efficient production to create reliable active and passive packaging systems for specific temperature ranges.

Key Players: Sonoco ThermoSafe, Cold Chain Technologies, Peli BioThermal, Sofrigam, Cryopak, Softbox Systems, Va-Q-tec. - Distribution and Logistics

This stage focuses on efficiently moving finished packaging products and managing the cold chain for temperature-sensitive goods, including refrigerated transport, warehousing, and real-time tracking, ensuring the packaging and, subsequently, the goods reach their destination with integrity.

Key Players: DHL, FedEx, UPS, Americold Logistics, Lineage Logistics. - End-Use Application and Monitoring

This is where packaging is used by industries such as pharmaceuticals and food & beverages to protect sensitive products. Adherence to stringent regulations (e.g., FDA, ISTA standards) is critical, along with continuous temperature monitoring during transit to ensure product integrity and safety.

Key Players: Pfizer, Merck - Post-Use and Sustainability

An increasingly important final step involves managing the end-of-life of packaging materials, driven by sustainability concerns and regulations. This includes recycling programs, developing reusable packaging systems, and using biodegradable alternatives to minimize environmental impact.

Key Players: Cold Chain Technologies, Sonoco ThermoSafe.

Cold Chain Packaging Market Companies

- Cold Chain Technologies (CCT): Provides reusable and single-use thermal packaging solutions for life sciences, including TheraShield for cell/gene therapy and digital monitoring.

- Sonoco ThermoSafes: Offers a wide range of pre-qualified temperature-controlled packaging for pharmaceuticals and biologics, including fully recyclable EOS packaging.

- Softbox:Specializes in high-performance, temperature-controlled packaging (reusable and single-use) for the life sciences logistics sector and clinical trials.

- Pelican Products, Inc. (Peli BioThermal): Offers robust, high-performance thermal protection packaging, including the reusable Crēdo line of passive and active bulk and parcel shippers.

- va-Q-tec:Provides high-performance thermal containers and boxes using innovative vacuum insulation panels (VIPs) and phase change materials (PCMs) for energy-efficient shipping.

- Cascades Inc.: Provides insulated packaging solutions and thermal protection products for temperature-sensitive shipments.

- Creopack: Specializes in eco-friendly cold chain packaging systems for pharmaceuticals and perishable goods.

Cryopak, A TCP Company: Offers temperature-controlled shipping solutions, including gel packs, insulated shippers, and phase-change materials. - Intelsius: Designs advanced thermal packaging and temperature-controlled logistics solutions for global pharmaceutical distribution.

- Sofrigam: Develops innovative thermal packaging systems for biopharmaceuticals and vaccines, ensuring product integrity during transport.

Segments Covered in the Report

By Product

- Insulated Container and Boxes

- Large

- Medium

- Small

- X-Small

- Petite

- Cold Packs

- Crates

- Dairy

- Pharmaceutical

- Fisheries

- Horticulture

- Temperature Controlled Pallet Shippers

- Labels

By Material

- Insulating Materials

- Expanded Polystyrene (EPS)

- Polyurethane rigid foam (PUR)

- Vacuum Insulated Panel (VIP)

- Cryogenic Tanks

- Others

- Refrigerants

- Fluorocarbons

- Hydrocarbon

- Inorganics

By Application

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Fruit and Pulp Concentrates

- Fish, Seafood, and Meat

- Processed Food

- Fruits and Vegetables

- Bakery and Confectioneries

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

By Packaging Format

- Reusable Packaging

- Disposable Packaging

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client