List of Contents

What is Corrugated Packaging Market Size?

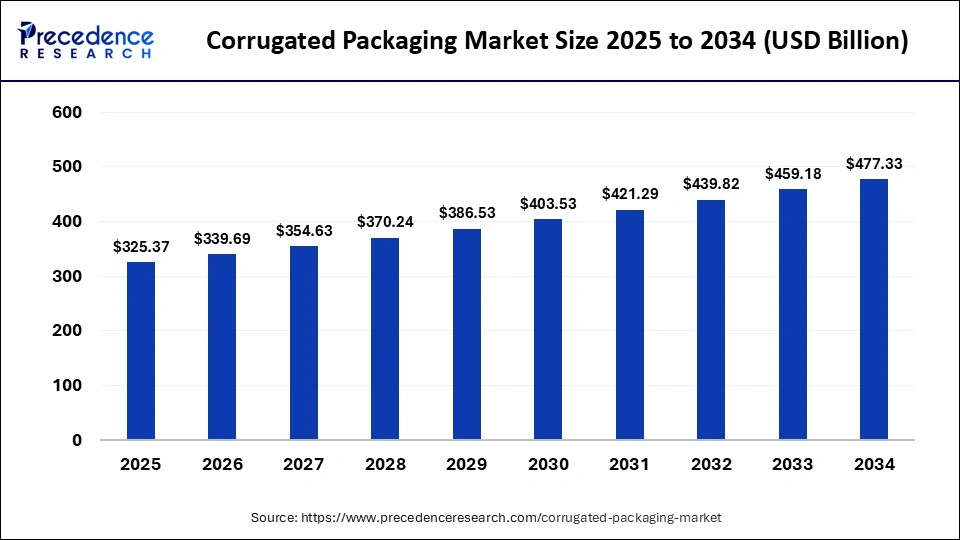

The global corrugated packaging market size is calculated at USD 325.37 billion in 2025 and is predicted to reach around USD 477.33 billion by 2034, expanding at a CAGR of 4.36% from 2025 to 2034. Rising demand for a strong, versatile, and sustainable packing choice that protects the product during shipping and storage is increasing the adoption of the corrugated packaging market.

Market Highlights

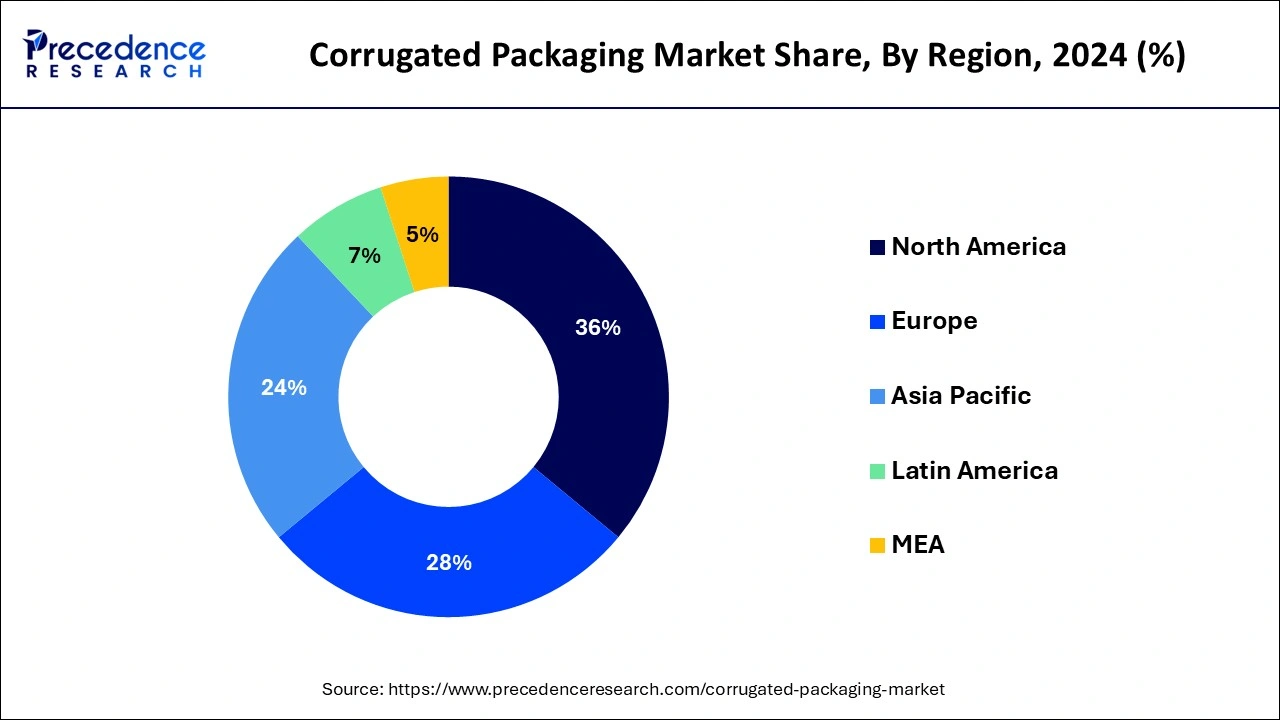

- Asia Pacific led the global market with the highest market share of 35.14% in 2024.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By Package Type, the single wall boards segment has held the largest market share in 2024.

- By Package Type, the double wall boards segment is expected to expand at the fastest CAGR over the projected period.

- By Application, the food & beverages segment captured the biggest revenue share in 2024.

- By Application, the e-commerce segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 325.37 Billion

- Market Size in 2026: USD 339.69 Billion

- Forecasted Market Size by 2034: USD 477.33 Billion

- CAGR (2025-2034): 4.36%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Artificial Intelligence: The Next Growth Catalyst in Contraceptive Drugs

Integrating artificial intelligence into the corrugated packaging industry offers automation of the work process, leading to enhanced efficiency, reduced labour costs, and prioritization of employee safety. Emerging technology such as computer vision, machine learning and 3D printing is noticed to be widely used in the packing industry for sourcing, manufacturing, design, and distribution processes. AI-powered sensors provide real-time monitoring and predictive maintenance which detect anomalies or potential issues before they become a serious problem. The integrated AI algorithm analyses historical recorded data and market trends to optimize the production of the company.

- In September 2024, Glacier has partnered with Colgate and Amazon to build and train an AI model for the use of MRF's optical scanning, to detect and characterize the product based on the material and recyclability. Additionally, it detects biobased plastics and uses the information to improve packaging design for better traceability and recoverability.

Corrugated Packaging Market Growth Factors

- The growing E-commerce retail sales are expanding at a significant rate which is contributing to the growth of the corrugated packaging market. The increasingly complex logistics chain for direct consumer delivery in e-commerce packing is increasing the demand for cost-effective corrugated packaging.

- The popularity of fit-to-product (FtP) or Box-on-demands systems is highly required in e-commerce sellers such as Amazon and Staples which ultimately boosts the corrugated packaging market.

- Corrugated packaging boards are gaining traction due to their sustainability factor which is proving to be important across the value chain. As it is easy to recycle and the pulp and paper industry converts it into new containerboard is meeting consumer preference.

- As the digital printing market is expanding, so is the corrugated sector the flexibility saves in set-up costs and the ability to personalize with brands, regions, stores or individuals brings opportunity growth.

Market Outlook

- Market Growth Overview: The Contraceptive Drugs market is expected to grow significantly between 2025 and 2034, driven by the rising awareness in the public, supportive government policies and funding for reproductive health, innovation in research and developments in drugs, and digital health integration.

- Sustainability Trends: Sustainability trends involve the adoption of greener manufacturing processes and eco-friendly packaging materials to reduce waste and carbon footprint. Product innovation also plays a role, with increased R&D into non-hormonal and plant-based alternatives that address both health concerns and environmental impact.

- Major Investors: Major investors in the market include Bayer AG, Pfizer Inc., Organon Group of Companies, and The Cooper Companies (via CooperSurgical).

- Startup Economy: The startup economy in the market is focused on non-hormonal and novel drug development, digital health and telehealth integration, and innovative delivery systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 325.37 Billion |

| Market Size in 2026 | USD 339.69 Billion |

| Market Size in 2034 | USD 477.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.36% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Package Type, and Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of E-commerce and Related Sectors

The rapid growth of e-commerce in the past decade has tremendously spiked the consumption of corrugated packaging all over the globe. The rising popularity of e-commerce and online retail platforms such as Pepperfry, Amazon, Flipkart, eBay, Wal-Mart, and various others are penetrating the developing and underdeveloped markets at a rapid pace. The significant growth of telecommunications and the IT infrastructure, increased penetration of the internet, rising adoption of smartphones, and rising awareness regarding virtual stores among consumers are the major factors that have boosted the growth of the e-commerce industry across the globe. The rising disposable income and rising standards of living is resulting in the growth in the demand for various personal care, electronics, home products, and food products. The increasing adoption of e-commerce platforms among consumers to buy various types of goods is supplementing the growth of the corrugated packaging market.

- According to a Shopify survey, global e-commerce sales in 2024 were $6.09 trillion worldwide. This number is 8.4% more than the previous years. The market is estimated to rise to $6.56 trillion in 2025.

Restraint

Increase in Raw Material Cost

There are several challenges faced by the corrugated box industry, some of them vary with urgency and intensity depending on the company. The primary challenge the company needs to deal with is rising in raw material prices. The increasing demand and drop in supply is impacting the cost. The corrugated packaging companies need to spend more on raw materials such as kraft paper and many more, and the overall prices as increased in the supply chain. Another reason for the increase in raw material cost is the rising energy cost at the paper mills. This also increases the production cost in the corrugated box industry.

Opportunity

Global Sustainability Initiatives

The future of corrugated packaging is anticipated to grow more towards sustainability with driving factors including consumer awareness about environmental issues, rising preference for recyclability, and eco-friendliness. This trend is meeting the current market demand and setting the stage for a better sustainable and personalized market in the coming years.

Segment Insights

Package Type Insights

The single wall boards segment dominated the global corrugated packaging market. This is attributed to the increased adoption of the single wall boards owing to its durability, strength, and feasible price. The single wall boards are more feasible for packaging and transportation of the majority of the products like food products, small electronic products, personal care, and pharmaceuticals. Hence, the increased adoption of the single wall boards has fueled the growth of this segment across the globe.

On the other hand, the double wall boards segment is estimated to be the most opportunistic segment during the forecast period. The higher strength and durability is needed for the packaging of the heavy products of the electronics, healthcare, and homecare products. The increased popularity of the e-commerce has created a huge demand for the consumer electronics across the globe such as laptops, washing machines, air conditioners, fans, and various other products that needs more protection especially during the transit. Hence, the rising penetration of the e-commerce is fostering the growth of the double wall board segment growth.

Application Insights

Based on the application, food & beverages dominated the global corrugated packaging market in 2024. The food & beverages industry accounts for the highest volume consumption and highest revenue generation in the corrugated packaging market. The food & beverages industry require the corrugated packaging for the storage, handling, and transportation of the processed food products, non-perishables, and fresh produce. Varieties of the corrugated packages is required based on the perishability of the food products. The corrugated packaging is non-reactive, which makes it a popular choice for packaging the food products for longer time period and for transportation. Therefore, the food & beverages industry has a significant contribution in the growth of the global corrugated packaging market.

On the other hand, the e-commerce is estimated to be the fastest-growing segment. This is attributable to the rapidly growing adoption of the online shopping in the developing and the underdeveloped economies. The easy availability of the desired products, easy payment options, availability of feasible EMI options, fast home deliveries, and easy replace and return policies offered by the e-commerce channels is fueling the online shopping across the globe, which in turn is expected to foster the demand for the corrugated packaging in the forthcoming years.

Regional Insights

Asia Pacific Corrugated Packaging Market Size and Growth 2025 to 2034

The Asia Pacific corrugated packaging market size is exhibited at USD 117.13 billion in 2025 and is projected to be worth around USD 174.22 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034.

Asia Pacific dominated the market with revenue share of over 35.14% in 2024. This region is the manufacturing hub of the world. Most of the electronics, homecare, and healthcare products are manufactured in the region and supplied globally. Moreover, the presence of huge population in the region makes it the most lucrative market for the food & beverages industry, which is expected to significantly drive the demand for the corrugated packaging. Moreover, the rising penetration of the e-commerce and various online shopping platforms in the region is fueling the demand for the corrugated packaging. All these factors are expected to foster the growth rate of the Asia Pacific corrugated packaging market in the foreseeable future.

China Corrugated Packaging Market Trends

China's evolving government population policies and a cultural preference for long-acting devices like IUDs. The rising awareness of reproductive health and increasing female workforce participation drives demand for effective family planning options. Online distribution channels are gaining traction for convenience and discretion.

China is a major contributor to the corrugated packaging market. The growing boom of the e-commerce sector in the region increases demand for corrugated packaging for delivery & shipping. The growing export of various goods like textiles, electronics, and many more helps in the market growth. The growing focus on sustainability increases demand for sustainable packaging solutions like corrugated packaging. The increasing individual incomes are increasing spending on consumer goods is fueling demand for corrugated packaging. The growing availability of various e-commerce platforms like Tmall, Alibaba, and JD.com increases demand for corrugated packaging. The well-established manufacturing base in various sectors like consumer goods, electronics, and textiles drives the overall growth of the market.

- According to Volza's Global Export data, China exported 55975 shipments of corrugated packaging boxes.

- According to Volza's India Export data, China exported 106876 shipments of paper corrugated boxes.

India Corrugated Packaging Market Trends

India is significantly growing in the corrugated packaging market. The growing demand for beverages, packaged foods, and processed foods increases the adoption of corrugated packaging. The growing demand for sustainable packaging solutions helps in the market growth. The strong government support for boosting manufacturing capabilities increases the production of corrugated packaging. The rapid expansion of e-commerce due to factors like smartphone & internet penetration supports the overall growth of the market.

North America is estimated to be the most opportunistic market during the forecast period. The stringent government regulations towards the use of eco-friendly packaging materials couple with the increased consumer awareness regarding the usage of environment-friendly materials has fostered the growth of the corrugated packaging market. The joint efforts of the Corrugated Packaging Alliance (CPA) and the American government has significant contributions towards the increased adoption of the corrugated packaging materials across the industries in North America. The major cities in US has banned the use of plastics owing to its harmful impact on the environment and human health, which has triggered the use of sustainable, reusable, and recyclable corrugated packaging in the region. It is estimated that US has more than 1,000 corrugated manufacturing units and over 50% of the corrugated boxes are made using recycled contents. US is among the top importers of the tree fibers that are used for making corrugated boxes.

U.S. Contraceptive Drugs Market Trends

The U.S. landmark approval and distribution of the first non-prescription daily oral contraceptive, Opill, is set to dramatically expand access. Driven by increasing concerns over side effects from hormonal options, demand for non-hormonal solutions and the expansion of telehealth services are also shaping the market. Publicly funded programs, insurance mandates, and ongoing R&D into male contraceptives further contribute to the market's dynamic landscape.

The United States is a key contributor to the corrugated packaging market. The growing expansion of the food & beverage industry increases demand for corrugated packaging for transporting & storing various food & beverage products. The well-established manufacturing sector helps in the market growth. The growing demand from various sectors like processed foods, electronics, and automotive parts increases the adoption of corrugated packaging. The well-developed offline & online retail networks increase demand for corrugated packaging. The growing expansion of the e-commerce sector fuels demand for corrugated packaging, driving overall growth of the market.

- According to Volza's Global Export data, Vietnam exported 229523 shipments of corrugated packaging boxes.

- According to Volza's India Export data, Vietnam exported 924524 shipments of paper corrugated boxes.

How is Europe Rising in the Contraceptive Drugs Market?

Europe's high consumer awareness of reproductive health, proactive government initiatives promoting family planning, and a strong preference for highly effective, convenient options like Long-Acting Reversible Contraceptives (LARCs). The market benefits from continuous innovation in lower-dose and non-hormonal solutions, alongside the integration of telehealth services for improved accessibility and discretion.

United Kingdom Contraceptive Drugs Trends

The U.K. regions' rising accessibility via pharmacies, while oral pills are widely used, particularly among young women, contraceptive devices, increasing digital health platforms, and government initiatives and awareness campaigns. Increasing demand for low-dose and non-hormonal options.

Investments

- In March 2025, Saica Group invested $110 million in the U.S. plant for corrugated packaging. The plant is located in Anderson, Indiana, and the size is 350000 square feet. The facility will produce over 1200000 MSF of corrugated packaging from the year 2026.

Export Of Corrugated Boxes

The global export of Cardboard Corrugated Boxes totaled 290,560 shipments from November 2023 to October 2024. These exports were conducted by 9,992 exporters to 11,788 buyers, exhibiting a growth rate of 74% in comparison to the previous twelve months. A large portion of the exports of Cardboard Corrugated Boxes from around the world is shipped to Vietnam, Costa Rica, and Mexico. Worldwide, the leading three exporters of Cardboard Corrugated Boxes are Vietnam, China, and the United States. Vietnam tops the global exports of Cardboard Corrugated Boxes with 332,452 deliveries, while China follows with 67,650 deliveries, and the United States ranks third with 46,907 deliveries.

Recent Developments

- In March 2025, Oji India Packaging Pvt Ltd, a branch of Japan's Oji Group and a worldwide leader in paper goods, has opened its fifth production plant in India located in Sri City, Andhra Pradesh. This new facility, spanning 43,000 square meters and the biggest of its kind in South Asia, would focus on corrugated boxes and packaging accessories, delivering sustainable and premium packaging solutions to the South Indian market.

- In February 2025, DS Smith's latest product, produced in France, a collapsible box crafted from lightweight small-flute corrugated cardboard, served as an alternative to rigid pre-assembled boxes made of grayboard. Due to its ability to be flattened for shipping, the secondary pack requires less space on pallets, in storage facilities, and while being transported. These logistical benefits aim to decrease CO2 emissions.

- In January 2025, Biedronka collaborated with Mondi on a closed-loop initiative to supply, collect, and reproduce its corrugated packaging in accordance with the retailer's goals for plastic usage and CO2 emissions. The initiative includes processing waste paper at a paper mill located in ?wiecie. The produced paper is subsequently sent to one of Mondi's six facilities in Poland, where it is transformed into corrugated cardboard containers, such as crates for fruits and vegetables.

- In September 2024, Power Adhesive launched its biodegradable hot melt adhesive, designed for use by cartons, corrugated packaging, point of sale (POS) converters, and contract packers. The majority of the key players in the supply chain is working towards sustainable products and processes in the market to support brands and consumers.

- In May 2024, Toyota Motor Corporation collaborated with DAIEI Co., Ltd. and NabiAce Co., Ltd. to create a new corrugated cardboard packaging container. The container is designed to increase loading weight while ensuring ergonomic handling. This lightweight design not only improves upon content loading capacity but also contributes to a 72% decrease in carbon dioxide emissions to improve transport efficiency and promote sustainability.

Contraceptive Drugs Market Value Chain Analysis

- Research and Development (R&D)

This foundational stage involves pharmaceutical companies investing heavily in discovering new hormonal and non-hormonal compounds, as well as optimizing drug delivery methods (pills, patches, injectables).

Key Players: Bayer AG, Pfizer Inc., Merck & Co., Inc., and Johnson & Johnson.

- Manufacturing and Production

This stage focuses on the large-scale production of the active pharmaceutical ingredients (APIs), formulation into final dosage forms, and packaging.

Key Players: Teva Pharmaceutical Industries Ltd.

- Distribution and Logistics

This stage involves storing and transporting products through complex national and international supply chains to wholesalers, hospitals, clinics, and pharmacies. Efficient logistics are crucial to ensure product availability and integrity, especially for products that may require specific temperature control or secure handling.

Key Players: McKesson Corporation, AmerisourceBergen Corporation, and Cardinal Health.

Key Players in Contraceptive Drugs Market & Their Offerings

- Church & Dwight Co., Inc.: This company contributes significantly through its ownership of the Trojan brand, a market leader in condoms and related products, which are a non-drug form of contraception. They also offer a range of emergency contraceptives and vaginal health products, catering to various aspects of reproductive health and protection.

- Reckitt Benckiser Group Plc: A major global consumer goods company that contributes to the market through its Durex brand, one of the most recognized and widely available condom brands worldwide. They focus on expanding access to effective barrier methods of contraception and promoting sexual health education globally.

- Veru, Inc.:Veru is a biopharmaceutical company focused on developing novel, non-hormonal drugs for men's and women's health. Their primary contribution is in R&D for a potential male "contraceptive on demand" pill, aiming to diversify options in the market and shift toward shared responsibility for family planning.

- Organon Group of Companies:Spun off from Merck & Co., Organon is a dedicated women's health company with a broad portfolio of contraceptive products, including the NuvaRing vaginal ring and other oral contraceptives. They are focused on addressing unmet needs in women's health globally and increasing access to a variety of family planning options.

- Pfizer, Inc:Pfizer contributes to the contraceptive market through a range of products, including injectables and oral pills, that are part of its broader pharmaceutical portfolio. Their significant R&D capabilities allow for ongoing innovation in drug formulations and their vast distribution network ensures wide access to their products.

- Teva Pharmaceutical Industries Ltd.:Teva is a leader in generic pharmaceuticals, providing cost-effective generic versions of various oral contraceptives and other hormonal medications. They play a critical role in increasing the affordability and accessibility of contraceptive drugs, which is crucial for public health and family planning initiatives.

- The Cooper Companies, Inc:This company is a major player in the contraceptive devices segment through its subsidiary CooperSurgical, which produces a wide range of intrauterine devices (IUDs) and other LARC (long-acting reversible contraceptives) options. Their contribution focuses on providing highly effective, long-term, non-daily contraceptive solutions.

- Mayer Laboratories, Inc:This company specializes in a range of personal care and sexual health products, including non-latex condoms and lubricants. Their contribution is primarily in providing alternative, non-drug barrier contraceptive methods, catering to individuals with specific sensitivities or preferences.

- Agile Therapeutics:Agile is a women's health pharmaceutical company focused on developing and commercializing a new generation of low-dose, non-daily contraceptive options. Their key product is Twirla, a weekly contraceptive patch that offers a new method of hormone delivery and user convenience.

- TherapeuticsMD, Inc:This company focused on women's health, including a range of hormone therapy and contraceptive products like a vaginal ring and a daily oral contraceptive. They contribute by offering innovative, patient-centric solutions to meet diverse female health needs and preferences.

- Bayer AG:Bayer is a dominant player in the global contraceptive market, known for blockbuster products like the Mirena (hormonal IUD) and Yasmin (oral contraceptive) brands. They invest heavily in R&D and global marketing, offering a wide array of options and driving innovation in IUD technology.

- Afaxys, Inc:Afaxys focuses on providing affordable pharmaceuticals and contraceptives, including oral pills, injectables, and IUDs, to public health clinics and community health centers. Their unique business model supports the public sector by streamlining procurement and ensuring cost-effective access for underserved populations.

- Mithra Pharmaceuticals:A Belgian biotech company focused on women's health, Mithra has developed innovative products like Estelle (a next-generation oral contraceptive) and a hormonal ring. They contribute to the market through R&D in novel, potentially safer estrogen components and new delivery methods for hormonal contraception.

- AbbVie:AbbVie's contribution to the women's health market includes products that address conditions often managed with contraceptives, but its direct role in the contraceptive drugs market is more limited following divestments. Their primary focus has been on other therapeutic areas like immunology and oncology.

Segments Covered in the Report

By Package Type

- Single Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Boards

By Application

- Electronics & Electricals

- Food & Beverages

- Transport & Logistics

- E-Commerce

- Personal Care Goods

- Healthcare

- Homecare Goods

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client