List of Contents

What is the Submerged Arc Furnace Market Size?

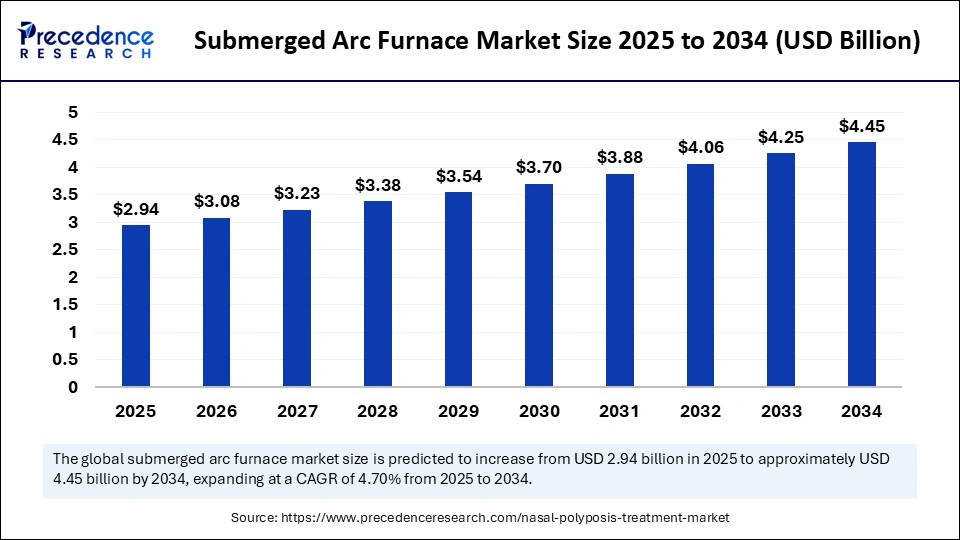

The global submerged arc furnace market size is calculated at USD 2.94 billion in 2025 and is predicted to increase from USD 3.08 billion in 2026 to approximately USD 4.45 billion by 2034, expanding at a CAGR of 4.70% from 2025 to 2034. The submerged arc furnace market is driven by rising demand for high-quality ferroalloys and increased steel production across industrial and infrastructure sectors.

Market Highlights

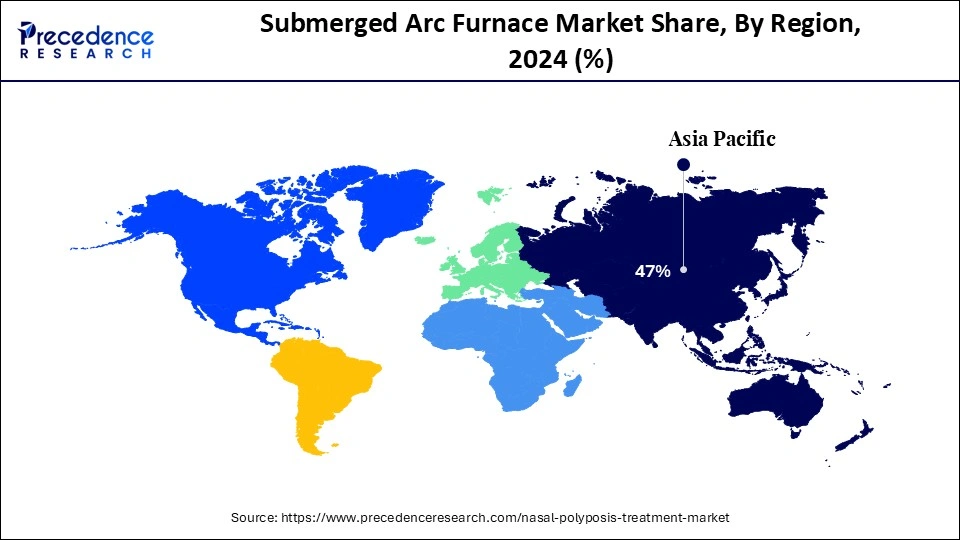

- Asia Pacific America dominated the market, holding the largest market share of 47% in 2024.

- The Latin America is expected to expand at the fastest CAGR of 16% between 2025 and 2034.

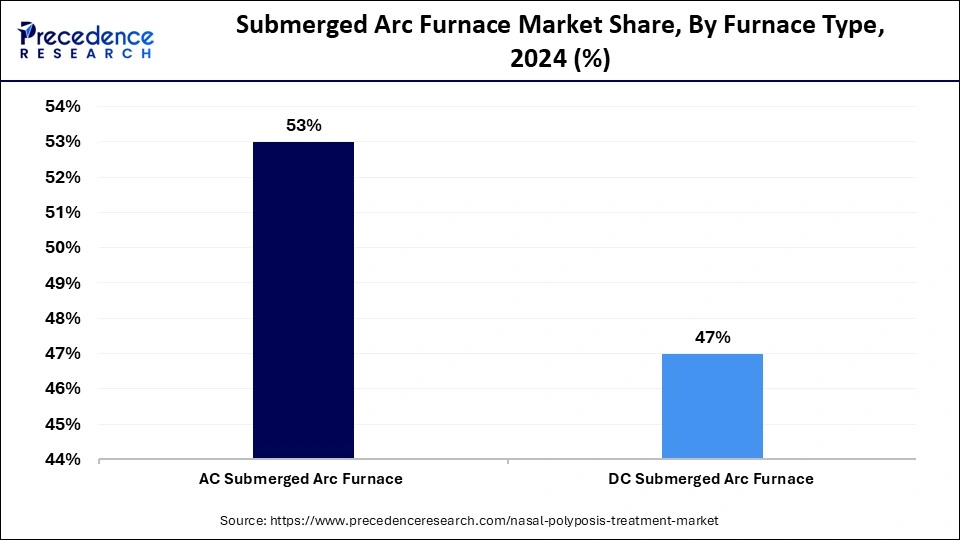

- By furnace type, the AC submerged arc furnaces segment held the largest market share of 53% in 2024.

- By furnace type, the DC submerged arc furnaces segment is projected to grow at a remarkable CAGR of 20% between 2025 and 2034.

- By application/smelting process, the ferroalloy production segment contributed the highest market share of 38% in 2024.

- By application/smelting process, the silicon metal production segment is growing at a solide CAGR of 25% between 2025 and 2034.

- By capacity/furnace size, the 200-500 tonnes segment accounted for the largest market share of 35% in 2024.

- By capacity/furnace size, the above 500 tonnes segment is poised to grow at a strong CAGR of 22% between 2025 and 2034.

- By automation/operation mode, the manual operation segment held the largest market share of 50% in 2024.

- By automation/operation mode, the semi-automatic operation segment is expected to expand at a remarkable CAGR of 18% between 2025 and 2034.

Electrifying Heavy Industry: Decarbonizing Steel, Ferroalloys, and Metals Production

A Submerged Arc Furnace (SAF) is a large capacity metallurgical furnace used to smelt such metals as ferroalloys, silicon metal, pig iron, and other metallurgical products under a controlled electric arc. In contrast to open arc systems, SAFs have the arc completely immersed in a blanket of charge material, which provides high heat conduction and even smelting. The furnace consists of such important units as systems of power supply, electrodes, furnace lining, and automated controls. These furnaces may be designed as AC or DC furnaces, depending on the mode of operation and preferred output in terms of metallurgical product.

The increasing demand for ferroalloys and specialty metals by the steel and automotive industries has been one of the key growth drivers, which is fueled by the growth of infrastructure worldwide and the industrialization in the emerging economies. There has been a growing focus on energy-saving metallurgical technologies and automation, which has seen the use of the latest SAF systems with smart monitoring, digital twin technology, and AI control systems become widespread. Electric vehicle production and the growth of renewable energy development are also contributing to the need to use high-quality alloy materials to encroach on SAF installations indirectly.

Key Technological Shifts in the Submerged Arc Furnace Market

The submerged arc furnace market is experiencing some significant technological changes that define efficiency, sustainability, and operational excellence in the metallurgical operations. The SAFs are fitted with modern automation and AI-based control systems and data analytics to streamline smelting activities to achieve uniform quality and minimize human interventions. With these systems, manufacturers are capable of monitoring temperature, voltage, and feed rates with high precision, which enhances energy use and increases the life of furnaces. The management of the electrode, heat recovery, and refractory materials has become more eco-efficient and has led to a reduction in the energy loss and maintenance costs.

Submerged Arc Furnace Market Outlook

The submerged arc furnace market is a high-growth market because it is witnessing the increasing steel and ferroalloy production, improvement of technology in the furnace efficiency, and the increasing interest in energy optimization and automation in all metallurgical industries to support the rising development of infrastructure and manufacturing machinery globally.

The market growth is high in Asia-Pacific, Europe, and the Middle East due to increased industrialization, increasing metallurgical investments, and the modernization of the current furnaces. Emerging economies are embracing the use of sophisticated submerged arc technologies in order to increase production levels and minimize effects on the environment.

The major investment partners are the major metallurgical and energy companies, including SMS group, Tenova, and Steel Plantech, which invested so much in automation, sustainability, and digital furnaces to improve the productivity, operational safety, and cost effectiveness of all plants and processing units of the world.

Start-ups are actively creating new technology that can control furnaces through smart, AI-driven process control and sustainable alloy manufacturing. New technology companies are working with industry players in order to create digital twin models and eco-friendly furnace systems for cleaner and quicker operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.94 Billion |

| Market Size in 2026 | USD 3.08 Billion |

| Market Size by 2034 | USD 4.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.70% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Furnace Type, Application / Smelting Process, Capacity / Furnace Size, Automation / Operation Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Submerged Arc Furnace Market Segment Insights

Furnace Type Insights

AC Submerged Arc Furnaces: The AC submerged arc furnaces segment held a 53% share in the submerged arc furnace market in 2024, due to its universal application in the manufacturing of ferroalloy, silicon metal, and pig iron. The use of an AC furnace is cost-effective, less complicated in design and operation is demonstrated to be reliable when it comes to high-scale metallurgical processes. They have stable arc control, efficient heat distribution, and are easier to maintain, unlike DC counterparts, and are suitable for continuous high-volume production. They are industrially attractive, as they are flexible to a large variety of raw materials and smelting applications. Also, the development of the power supply system and electrode technologies has enhanced efficiency in energy use and decreased the cost of operation in the AC SAFs.

DC Submerged Arc Furnaces: The DC submerged arc furnaces segment captured a 20% share of the market in 2024 and is expected to grow significantly due and its superior energy efficiency and reduced electrode usage, and improved process stability. The DC furnace possesses one electrode arrangement that has constant arc control and even smelting, which translates to increased metal recovery and quality of product. The further increase in the use of automation, online control systems, and AI-based monitoring is enhancing the accuracy and energy control of DC SAFs even more. The ongoing development of high-current rectifiers along with digital furnace control systems is likely to speed up the development of DC furnaces in the advanced industrial markets.

Application / Smelting Process Insights

Ferroalloy Production: The ferroalloy production segment led the market while holding a 38% share in 2024, motivated by the increasing demand for ferrochrome, ferromanganese, and ferrosilicon, which are used in the steel-making and foundry industry. The submerged arc furnace is very important to the production of these alloys in a very efficient way since it provides controlled high temperature in reduction smelting. The fast industrialization, construction of infrastructure, and the expansion of the steel industry across the world have increased the production of ferroalloy. Technological developments that have boosted efficiency in energy consumption and automation of the processes have also contributed to the dominance of the segment.

Silicon Metal Production: The silicon metal production segment is expected to grow at a significant CAGR over the forecast period, with a 25% market share, due to the rising demand in the electronics, photovoltaic, and chemical sectors. Silicon metals are important raw materials used in semiconductors, aluminum alloys, and solar panels. Submerged arc furnace plays a major role in making high-purity silicon by burning quartz with carbon at high temperatures. The transition to green energy and the blistering development of photovoltaic installations based on solar energy are increasing the consumption of silicon

Pig Iron Production: The submerged arc furnace market has recognized pig iron production as an important area of application due to the contribution of the furnace in manufacturing high-quality iron to be used in the steel and casting industry. They help control the temperature, reduce emissions, and use more energy effectively than regular blast furnaces. SAFs are also a viable solution to the sustainable production of pig iron, as the processing ability of different iron-bearing raw materials in reduced amounts of coke consumption. The rise in the demand for construction-grade steel and automobiles demand has raised the demand to have smelting of iron in efficient technologies.

Capacity/Furnace Size Insights

200 to 500 tonnes: The 200-500 tonnes segment held a 35% share in the submerged arc furnace market in 2024. Its capability of working with all types of raw materials and its ability to keep the performance constant, and minimal downtime for maintenance. The growing steel demand, modernization of metallurgical factories, and the growing infrastructure development work in Asia-Pacific and Europe have also contributed to the dominance of this segment. The 200- 500 tonnes are viewed as the most versatile category with the ability to give flexibility on both new installations and furnace capacity upgrades.

Above 500 tonnes: The above 500 tonnes segment is poised for substantial growth in the market, holding a 22% share in 2024. Integrated steel plants and industrial clusters prefer these enormous furnaces because they want to achieve economies of scale. The new technology of electrode, heat recovery, and automated control of the process is providing the opportunity to operate ultra-high capacity units safely and efficiently. The large furnaces are being massively invested in by emerging economies, particularly China and India, to increase domestic production capacity and lessen reliance on imports.

100 to 200 tonnes: The compact furnaces are favored by the producers and alloy manufacturers because they are flexible, cost less to install, and require less expensive. They have high-efficiency smelting capacity to niche markets, including specialty ferroalloys and silicon alloys. Also, the 100-200 tonnes can be started and shut down in a shorter time, thus it is best suited to the variable production settings.

Automation / Operation Mode Insights

Manual Operation: The manual operation segment led the market while holding a 50% share in 2024. This is mainly because of its extensive use in developing territories and in cost-sensitive sectors. Manual furnaces are easy and less expensive to install, maintain, and can be easily set to a majority of smelting processes. Although the efficiency of such systems might be lower than that of automated systems, they are still favored due to their reliability, ease of troubleshooting, and the ease with which they can be used in an environment with limited access to skilled automation engineers. The dominance of the segment indicates the ever-present need for traditional but reliable furnace setups.

Semi-Automatic Operation: The semi-automatic operation segment is projected to grow at a significant CAGR over the forecast period, holding an 18% share in 2024. The need to move the industry to partial automation to ensure high accuracy in the process, less labor reliance, and high safety standards is contributing to this growth without the entire cost of complete automation. The semi-automatic furnaces are provided with digital monitoring systems, temperature and electrode regulation, which enhance the optimization of the energy consumption and shorten the time of smelting. The segment is especially advantageous in the case of mid-sized manufacturers interested in the gradual change of operations.

Fully Automatic Operation: The fully automatic operation segment is also making significant progress due to the growing pace of automation among industries to improve consistency in the production process, minimize human directives, and ensure the organizations comply with the standards set by the environment. These systems have long-term pay-offs despite the initial high cost, as they provide efficiency, predictive maintenance, and better safety. The shift toward fully automated furnaces is likely to be in accelerate as metallurgical industries are geared towards sustainability, accuracy, and cost-effective mass production.

Submerged Arc Furnace MarketRegional Insights

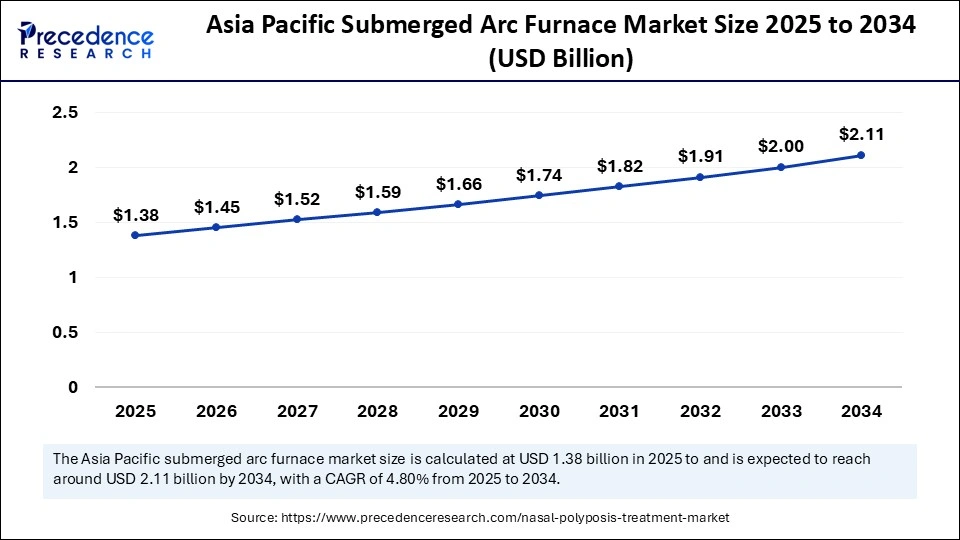

The Asia Pacific submerged arc furnace market size is expected to be worth USD 2.11 billion by 2034, increasing from USD 1.38 billion by 2025, growing at a CAGR of 4.80% from 2025 to 2034.

How Did Asia Pacific Dominated the Submerged Arc Furnace Market in 2024?

Asia Pacific held the largest share in 2024, driven by the fact that it is becoming very industrialized, more steel and ferroalloy are being produced, as are the massive infrastructure projects being put up in China, India, and Southeast Asia. High investments by the government in the construction, transportation, and energy industries are creating a steady flow of high-quality metals, and this is driving SAF installations.

Moreover, the technological modernization, including automation and sophisticated control systems, is also assisting regional manufacturers to become more efficient and to comply with tougher emission standards. In addition, nations are focusing on greener metallurgy by incorporating renewable energy and advanced designs of the furnace to be carbon-neutral worldwide.

China Submerged Arc Furnace Market Trends

It is a growing market, and the Submerged Arc Furnace in China is a steadily expanding market with the strong steel, ferroalloy, and metal smelting industries that constitute the infrastructure and manufacturing base of the country. The urge of the government to pursue urbanization, renewable energy, and intelligent manufacturing is still driving a surge in demand for high-performance materials, increasing the usage of SAF. The change to clean industrial practice has promoted the creation of low-emission furnaces and alloy production by recycling. These investments are also supported by the efforts of the Chinese in its so-called Green Manufacturing initiatives, which are part of its national carbon neutrality targets up to 2060. The SAF market in China will continue to grow with the increase in industrial capacity and environmental regulations, which will help the country move towards smarter and more efficient metallurgical processes.

Latin America is observed to grow at the fastest rate during the forecast period, the growth is driven by great industrial infrastructure, technological advancement, and a powerful need for high-quality ferroalloys and specialty steels. The area boasts of large metallurgical firms that have already invested in modernization and new furnaces that consume less energy. The ongoing R&D spending and digitalization of production facilities have made Latin America a fastest growing region in the market. Players in the region fragmented in the market are focused on the efficiency of furnaces, their reliability, and environmental safety.

Brazil Submerged Arc Furnace Market Analysis

The Brazil submerged arc furnace market is one of the mainstays of the steel and ferroalloy production nexus of the country, as the source of materials that constitute a major upkeep of the construction, automotive, and heavy engineering sectors. Modernization efforts and sustainability processes resulted in huge growth in 2024, with manufacturers retrofitting furnaces with technologies that are energy efficient and automation systems. The focus on minimizing carbon footprints by using sophisticated emission reduction and computerized monitoring is high. The strategic capital investments will focus on expanding the smelting capacity at high environmental standards. The high-quality alloy production focus coverage serves the increase in domestic demand by the electric vehicle and infrastructure segments.

The European submerged arc furnace market is witnessing sustainable growth because of the high level of focus on the current metallurgical technologies, energy efficiency, and environmental compliance in the region. The steel and ferroalloy industries in Europe are also modernizing, and much of the investments in the modernization process are being channeled toward the modernization of the furnace systems in order to make them more productive and less polluting.

The carbon neutrality targets and the Green Deal by the European Union are prompting industries to consider designing SAFs in an eco-friendly way that incorporates renewable sources of power and emission mitigation mechanisms. Market growth is further supported by demand for high-quality alloys by the automotive, aerospace, and construction industries. Furthermore, European manufacturers are on the frontline of technological changes with automation, IoT-based monitoring, and predictive maintenance, which allow improving the performance of furnaces and their reliability throughout the working process.

Germany Submerged Arc Furnace Market Trends

German manufacturings strong base is causing the growth of the market because it needs high-performance materials to promote precision engineering and lightweight vehicles. The market is also being influenced by the rising investment in green metallurgy and digital fire control systems. The German manufacturers are paying attention to the increased automation of the processes, using AI and data analytics to make the smelting as efficient as possible, without violating stringent environmental standards. Due to the trend toward decarbonization and circular production methods, the use of energy-saving SAFs with heat recovery and emission-reduction systems has been adopted.

Submerged Arc Furnace Market Value Chain

This stage includes the procurement of critical inputs required to build and operate submerged arc furnaces: graphite/carbon electrodes (for arc generation), refractory bricks and linings (to contain high‐temperature operations), power supply and transformer equipment, and feedstocks (ore, alloy raw materials, slag additives). High‐quality electrodes and refractories reduce downtime, maintenance costs and energy losses, thereby enabling higher furnace throughput and reliability. Suppliers offering proprietary electrode technologies, high‐temperature resistant refractories or optimized electrical power systems capture upstream value by providing greater operational efficiency or longer campaign lifetimes. Key challenges in this input segment include raw material price volatility (for carbon/graphite, refractory minerals), energy cost exposure, and the requirement to meet metallurgical purity and performance standards in demanding metallurgical environments.

This is the heart of value creation in the SAF market. Original equipment manufacturers (OEMs) and engineering firms design, fabricate and install the furnaces, with complete systems comprising electrodes, furnace shell, cooling systems, dust-gas handling (off‐gas capture and treatment), power conversion units, control systems and automation. Furnaces can be AC or DC submerged arc types, each with differing performance, cost and energy profiles. For example, AC‐SAFs dominate in many ferroalloy operations due to lower capital cost and wide adoption, while DC/advanced variants offer higher efficiency and lower energy per ton but often higher capital or installation complexity, and engineering contractors that deliver turnkey solutions, including process optimization, off‐gas capture, automation and integration with feedstock handling, capture significant midstream value. They enjoy barriers to entry through high capital intensity, specialization in metallurgical processes, and long project execution times. Value drivers include energy efficiency, yield optimization (less slag losses, higher alloy recovery), maintenance downtime reduction, and environmental compliance (emissions, waste gas cleaning). Midstream firms also capture aftermarket value through spare parts, refractories, electrode replacements and service contracts.

Once the furnace is commissioned, downstream value resides in how the furnace is operated, the performance outputs (ferroalloys, silicon metal, other alloys), the cost per ton of output, and ongoing maintenance and service performance. End‐users are typically metallurgical producers (ferrochrome, ferromanganese, ferrosilicon, silicon metal, calcium carbide etc). These producers derive value through high throughput, lower energy input per ton, high alloy purity, lower emissions and lower maintenance/repair downtime. Value capture at this stage flows to furnace operators who integrate furnace output into supply chains, sell alloys into steel or specialty metal value chains, and derive operational margin improvements via optimized SAF performance. Additionally, downstream service providers (maintenance, automation upgrades, digital monitoring of furnace performance, electrode optimisation programmes) capture value by enabling improved uptime, energy savings and longer furnace life. The aftermarket and retrofit market (upgrading older SAFs to more efficient models, improving controls, dust/gas capture) is a growing value segment in markets driven by energy cost containment and tighter environmental regulation.

Submerged Arc Furnace Market Companies

Corporate Information

- Headquarters: Munich, Germany

- Year Founded: 1847

- Ownership Type: Publicly Traded (FWB: SIE)

History and Background

Siemens AG was founded in 1847 by Werner von Siemens and has grown into one of the worlds largest industrial technology conglomerates, with operations spanning automation, electrification, and digitalization. Over nearly two centuries, Siemens has established a global reputation for engineering excellence, providing advanced technologies that power industries, cities, and infrastructure worldwide.

In the Submerged Arc Furnace (SAF) Market, Siemens is a leading provider of automation, power distribution, and process control systems that enhance the efficiency, safety, and energy management of metallurgical and ferroalloy production facilities. Siemens digitalization solutions and drive technologies are widely used in SAF operations for applications such as ferrochrome, ferromanganese, and silicon metal production, where precise control of electrical parameters and temperature is crucial.

Key Milestones / Timeline

- 1847: Founded in Berlin, Germany

- 1966: Consolidated operations into Siemens AG

- 2000s: Expanded into metallurgical automation and industrial electrification systems

- 2016: Introduced Totally Integrated Automation (TIA) for heavy industrial furnaces

- 2023: Released digital twin and simulation platforms for electric furnace optimization

- 2024: Partnered with major metallurgy firms to develop smart SAF systems integrating AI and predictive control

Business Overview

Siemens operates as a global industrial technology leader providing solutions in automation, energy management, and digital industries. In the Submerged Arc Furnace Market, Siemens offers integrated solutions including SIMATIC PCS 7 automation, SINAMICS drives, SIMOTICS motors, and SIPROTEC protection systems. These technologies improve operational stability, reduce power losses, and enhance productivity in metallurgical processes.

Business Segments / Divisions

- Digital Industries

- Smart Infrastructure

- Mobility

- Siemens Energy (Affiliated Spin-off)

Geographic Presence

Siemens has operations in over 200 countries, with engineering and manufacturing centers in Germany, the United States, China, and India.

Key Offerings

- Automation and control systems for submerged arc furnaces

- High-performance SINAMICS variable frequency drives for furnace control

- Power distribution and protection systems for high-current industrial loads

- Digital twin solutions for real-time process simulation and optimization

- Energy management platforms for metallurgical and smelting facilities

Financial Overview

Siemens reports annual revenues exceeding 77 billion (approx. 83 billion USD), with significant contributions from its Digital Industries and Smart Infrastructure divisions supporting metallurgical applications.

Key Developments and Strategic Initiatives

- April 2023: Launched digital control suite for SAF operations integrating predictive analytics

- September 2023: Expanded partnership with metallurgical equipment manufacturers in Europe and India

- May 2024: Introduced hybrid energy management systems for furnace efficiency improvement

- January 2025: Developed AI-based real-time process optimization platform for submerged arc furnaces

Partnerships & Collaborations

- Collaborations with global metallurgical technology firms for SAF modernization

- Partnerships with steel and ferroalloy producers for digital furnace retrofits

- Alliances with universities for R&D in metallurgical process automation

Product Launches / Innovations

- SIMATIC PCS 7 SAF Process Control System

- AI-enhanced SINAMICS Drive Module for high-current applications

- SIPROTEC Furnace Protection Suite(2025)

Technological Capabilities / R&D Focus

- Core technologies: Automation, power electronics, AI-driven process control, and smart electrification

- Research Infrastructure: Global R&D hubs in Germany, China, and the U.S.

- Innovation focus: Digital twin simulation for furnace performance, predictive maintenance, and energy efficiency

Competitive Positioning

- Strengths: Deep expertise in automation and electrification, global service presence, and digital integration capabilities

- Differentiators: Ability to combine hardware, software, and AI for fully integrated SAF process control

SWOT Analysis

- Strengths: Strong global brand, technological innovation, and large-scale industrial capabilities

- Weaknesses: High capital investment and system complexity for smaller operators

- Opportunities: Rising demand for energy-efficient metallurgical operations

- Threats: Growing competition from specialized regional automation firms

Recent News and Updates

- March 2024: Siemens deployed AI-based monitoring system for ferroalloy furnaces in South Africa

- July 2024: Partnered with Indian steel producer for SAF digital transformation project

- January 2025: Launched new drive system to improve arc stability and reduce power losses in SAFs

Corporate Information

- Headquarters: Xian, Shaanxi Province, China

- Year Founded: 2006

- Ownership Type: Privately Held

History and Background

Xian Abundance Electric Technology Co., Ltd. was founded in 2006 as a manufacturer specializing in industrial power control systems, high-voltage drives, and automation equipment. Over the past two decades, the company has developed into one of China prominent suppliers of electric control systems for metallurgical and furnace applications, particularly for submerged arc furnaces (SAFs) used in ferroalloy and silicon metal production.

The company core competency lies in designing and manufacturing high-current rectifier systems, furnace transformers, thyristor converters, and inverter drives, all optimized for heavy industrial conditions. Xian Abundance serves both domestic and international metallurgical enterprises, delivering efficient, reliable, and cost-effective SAF electrical solutions.

Key Milestones / Timeline

- 2006: Founded in Xian, China as an industrial automation equipment manufacturer

- 2010: Launched first generation of medium-voltage inverter drives for metallurgical applications

- 2015: Expanded product line to include silicon-controlled rectifier (SCR) systems for submerged arc furnaces

- 2020: Developed intelligent furnace control and power distribution systems

- 2024: Introduced AI-based monitoring platform for SAF performance optimization

Business Overview

Xian Abundance Electric Technology Co., Ltd. focuses on providing comprehensive electrical solutions for submerged arc furnaces and other metallurgical equipment. Its systems control and optimize power usage, electrode positioning, and temperature regulation, critical for achieving consistent product quality and energy savings in ferroalloy smelting operations.

Business Segments / Divisions

Industrial Power Conversion Systems

Automation and Control Equipment

Furnace Electrical Engineering Solutions

Geographic Presence

Headquartered in Xian with production and service facilities in Shaanxi Province, Xian Abundance supplies clients across China and exports to Southeast Asia, India, Russia, and the Middle East.

Key Offerings

- High-current rectifier transformers for submerged arc furnaces

- Medium- and high-voltage inverter drives and control panels

- Thyristor and IGBT-based furnace power regulation systems

- Automation systems for electrode positioning and current stabilization

- AI-enabled monitoring and maintenance diagnostic systems

Financial Overview

Xian Abundance Electric Technology reports estimated annual revenues of 50 to 80 million USD, supported by strong domestic demand and increasing international partnerships in metallurgical equipment supply.

Key Developments and Strategic Initiatives

- March 2023: Developed modular SCR-based control system for high-capacity SAFs

- September 2023: Expanded R&D on intelligent inverter control for silicon metal production

- April 2024: Released AI-enabled SAF performance optimization software

- January 2025: Began collaborations with steel and ferroalloy plants for digital furnace modernization

Partnerships & Collaborations

- Partnerships with metallurgical engineering firms for integrated furnace projects

- Collaborations with Chinese universities for power electronics and furnace automation R&D

- Alliances with international distributors for expansion into export markets

Product Launches / Innovations

- High-Capacity Thyristor Control System (2023)

- Digital Power Conversion and Monitoring Suite (2024)

- AI-Based Furnace Data Analytics Platform (2025)

Technological Capabilities / R&D Focus

- Core technologies: Power conversion, rectification, inverter drive design, and AI-assisted process control

- Research Infrastructure: R&D laboratory in Xian specializing in high-current industrial applications

- Innovation focus: Intelligent furnace power management, digital diagnostics, and automation integration

Competitive Positioning

- Strengths: Cost-effective solutions, localized manufacturing expertise, and flexible product customization

- Differentiators: Deep specialization in high-current power systems for submerged arc furnaces

SWOT Analysis

- Strengths: Proven expertise in metallurgical power control, growing export market, and tailored engineering services

- Weaknesses: Limited global brand recognition

- Opportunities: Expansion into energy-efficient furnace modernization projects

- Threats: Strong competition from established multinational automation providers

Recent News and Updates

- May 2024: Xian Abundance supplied advanced power control systems to a ferrochrome plant in India

- August 2024: Launched AI-integrated power monitoring suite for large-scale submerged arc furnaces

- January 2025: Signed long-term cooperation agreement with Middle Eastern alloy producer for SAF automation solutions

Other Companies in the Submerged Arc Furnace Market

- Hammers Industries Inc.: Hammers Industries manufactures and supplies industrial-grade steel processing and fabrication equipment. The company specializes in customized steel forming, melting, and refining systems designed for high efficiency and precision in metal production facilities.

- YUEDA Stainless Steel Co., Ltd: YUEDA Stainless Steel produces a wide range of stainless steel sheets, coils, and plates used in construction, automotive, and industrial applications. The company focuses on corrosion resistance, surface finish quality, and advanced rolling technology to meet international standards.

- DOSHI Technologies Pvt. Ltd.: DOSHI Technologies provides steel processing machinery and automation solutions, including continuous casting systems and rolling mill components. The company expertise lies in integrating advanced engineering designs for improved energy efficiency and production quality.

- Tata Steel Processing & Distribution: Tata Steel Processing & Distribution, a division of Tata Steel, offers value-added steel processing services such as slitting, cutting, and surface treatment. The company ensures high product consistency and supply chain optimization for automotive, construction, and industrial clients.

- DongXong: DongXong is engaged in the manufacture and export of steel and metal processing equipment, including melting furnaces, rolling mills, and continuous casting systems. The company emphasizes cost-effective, durable machinery tailored for small and large steel producers.

- Paul Wurth S.A.:Paul Wurth, part of the SMS Group, is a global leader in ironmaking and steel plant engineering. The company provides integrated solutions for blast furnace design, energy recovery, and green steel technologies, focusing on environmental efficiency and digital process control.

- Electrotherm (India): Electrotherm manufactures induction melting furnaces, rolling mills, and metallurgical equipment for steel and foundry industries. The company innovations in energy-efficient melting and refining systems have strengthened its presence in both domestic and international steel equipment markets.

- Outotec Oyj: Outotec, now part of Metso Outotec, offers advanced metallurgical technologies for mineral and metal processing. The company provides sustainable solutions for steelmaking, including smelting, refining, and waste recovery systems that align with circular economy and green manufacturing goals.

Recent Developments

- In July 2025, Thyssenkrupp Industrial opened up its high-tech plant at its Duisburg, Germany, location at a cost of approximately USD 850 million. The production lines will be automated to streamline the activities and consolidate the companys status as a market leader in the submerged arc furnace market.(Source:https://www.marklines.com)

- In October 2024, Tenova entered into a contract with Tata Steel to install an advanced arc furnace in its Port Talbot facility in Wales. The furnace will become operational by the close of the year 2027 and will play a major role in increasing the production of Tata Steel in Western Europe.(Source: https://m.economictimes.com)

- In January 2024, Metso Outotec won a major order with FACOR to supply 2 75 MVA submerged arc furnace at its site at Bhadrak in Odisha, India. The furnaces will also have a combined capacity of 300,000 tons per year, which will strengthen Metso Outotec as a market leader in the world market.(Source: https://www.metso.com)

Submerged Arc Furnace MarketSegments Covered in the Report

By Furnace Type

- AC Submerged Arc Furnace

- DC Submerged Arc Furnace

By Application/Smelting Process

- Ferroalloy Production (ferrosilicon, ferromanganese, ferrochrome)

- Silicon Metal Production

- Pig Iron Production

- Fused Alumina & Refractory Materials

By Capacity/Furnace Size

- Less than 100 tonnes

- 100 to 200 tonnes

- 200 to 500 tonnes

- Above 500 tonnes

By Automation/Operation Mode

- Manual Operation

- Semi-Automatic Operation

- Fully Automatic Operation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client