List of Contents

What is the Stone Crushing Equipment Market Size?

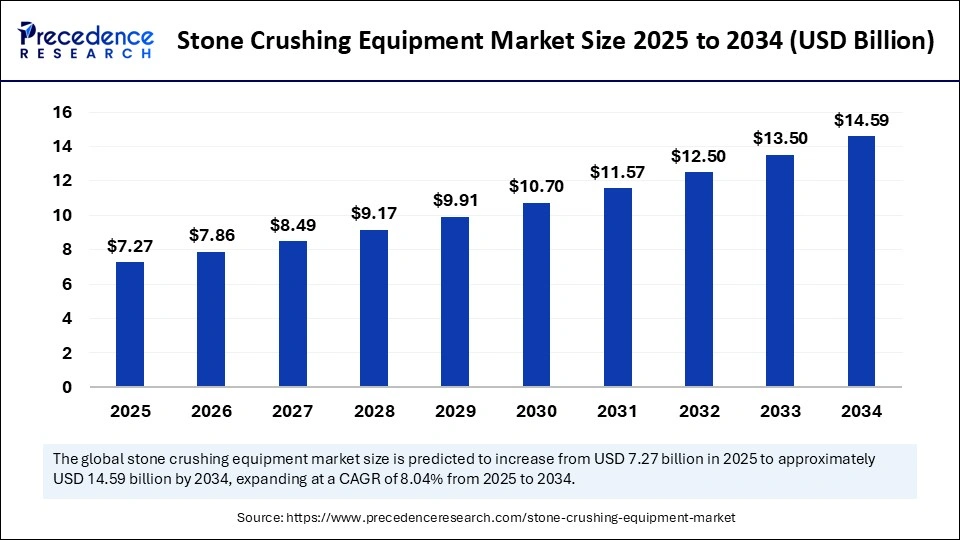

The global stone crushing equipment market size is accounted at USD 7.27 billion in 2025 and predicted to increase from USD 7.86 billion in 2026 to approximately USD 14.59 billion by 2034, expanding at a CAGR of 8.04% from 2025 to 2034. The rising demand for aggregates in construction projects is driving the growth of the stone crushing equipment market. The expanding construction and mining industries significantly boost the need for high-quality aggregates, propelling the market's growth.

Stone Crushing Equipment MarketKey Takeaways

- In terms of revenue, the stone crushing equipment market is valued at $7.27 billion in 2025.

- It is projected to reach $14.59 billion by 2034.

- The market is expected to grow at a CAGR of 8.04% from 2025 to 2034.

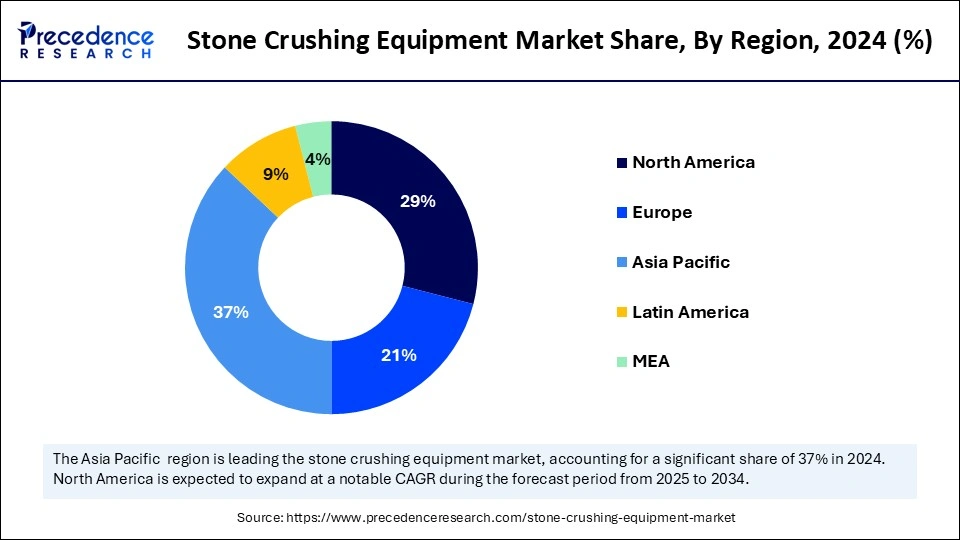

- Asia Pacific dominated the global market with the largest share of 38% in 2024.

- North America is expected to grow at the fastest CAGR between 2025 to 2034.

- By product, the jaw crusher segment held the major market share in 2024.

- By product, the cone crusher segment is expected to grow at a highest CAGR during the forecast period.

- By application, the mining segment contributed the biggest market share in 2024.

- By application, the quarrying segment is expected to expand to the fastest CAGR in the coming years.

Role of AI in Stone Crushing Equipment

Artificial Intelligence plays a crucial role in transforming stone crushing equipment. AI enhances the efficiency of stone crushing equipment by automating the crushing process. AI's predictive maintenance capability identifies flaws in equipment operation. This proactive approach enables timely maintenance of equipment, reducing downtime. Companies are focusing on integrating AI technology with their stone crushing equipment. For instance, AI applications like automated gap adjustments, real-time monitoring, and predictive analytics help stone crushers adjust their settings, monitor the consistency and production process of crushing equipment in real time, and identify predictive maintenance needs. The SBM mineral processing REMAX 600 track-mobile impact crusher, an AI-enabled system, is gaining popularity among various industries for production monitoring and control over stone crushing equipment.

Market Overview

The global stone crushing equipment market is witnessing transformative growth, driven by the rapid expansion of the mining and construction industry and driven need for high-performance stone crushing equipment. The equipment used in the process of quarrying aggregate from mines. With the expanding mining and construction industries, the need for stone crusher equipment is rising. Government and private organizations are investing heavily in infrastructure projects, fostering the need for crushed stones. The expansion of roads, railways networks, buildings, and commercial developments requires a wide quantity of aggregate, creating the need for stone crusher equipment. Ongoing innovative approaches in stone crusher equipment, including integrating AI-driven controls and energy-efficient motors, are enabling advanced and smart stone crushing equipment.

Stone Crushing Equipment MarketGrowth Factors

- Rapid Urbanization and Infrastructure Developments: The rapid growth in urbanization and increasing infrastructure developments are driving the need for aggregates in the construction industry, significantly increasing the adoption of stone crushing equipment.

- Environmental Sustainability: The rising trend of recycling and environmental sustainability drives the need for smart and energy-efficient stone crushing equipment.

- Rapid Growth of the Mining Sector: The expansion of the mining industry and demand for crushed stones and aggregates drive the adoption of stone crushing equipment in the mining extraction process.

- Technological Advancements: Technological innovations in stone crushing equipment, like the integration of automated systems and advanced control capabilities, are driving the adoption of stone crushing equipment in various industries.

- Government Initiatives: Rising government investments in infrastructure developments lead to increased opportunities for advanced technologies and equipment, including smart stone crushing equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.59 Billion |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size in 2026 | USD 7.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

What is the Major Drive of the Global Stone Crushing Equipment Market?

Growing urbanization and industrialization are the major drivers of the global stone crushing equipment market. Rapid urbanization and industrialization lead to increased infrastructure development, construction, mining, and quarrying activities, which drive the demand for stone crushing equipment for aggregates and process extraction materials. Rapid industrialization fuels countries' economic growth and drives investments in construction and infrastructure projects, contributing to increased demand for stone-crushing equipment. Urbanization leads to increased infrastructure development projects, including roads, buildings, and bridges, in which aggregates are required.

Restraint

High Costs and Environmental Concerns

High costs of procuring and maintaining stone crushing equipment create barriers for small construction companies. The cost of crushing equipment depends on their capacity, automation level, and location, where stone crushing is required. This equipment requires a large quantity of electricity and fuel, which are subject to price fluctuations. This significantly impacts on the operational costs. Moreover, environmental concerns are expected to restrain the growth of the stone crushing equipment market. Stringent regularity standards mandate manufacturers to develop equipment with specific environmental requirements. Regulations regarding the limitation of noise pollution, dust pollution, and waste management challenge stone-crushing operations in various locations. Additionally, the stone crushing units require obtaining Consent to Establish (CTE) and Consent to Operate (CTO) from the concerned SPCB/PCC, making the process complex, time-consuming, and costly, limiting the market's growth.

Guidelines for Stone Crushing Operation Plants

- In May 2025, the guidelines for the operation and expansion of stone crushers were established by the Tamil Nadu Pollution Control Board (TNPCB). According to the guideline, a new stone crusher or the expansion of existing ones will not be granted if the site is located within 500 meters of a reserve forest or falls within eco-sensitive zones in the state.

(Source: https://www.thehindu.com) - In May 2025, the High Court of Uttarakhand stopped the expansion of stone crushing units and directed the state to identify fixed zones for crushing and dumping river bed material (RBM) in each district of the state within six weeks. (Source: https://timesofindia.indiatimes.com)

Opportunity

Demand for Mobile Crushers

There is a high demand for mobile and compact stone crushers for more flexibility, mobility, affordability, and on-site crushing applications. Mobile crushers are flexible as they are easy to move in various locations. Mobile crushers reduce transport costs, making them a more cost-effective option, and are suitable for small construction businesses. The rising on-site crushing applications make mobile crushers more appealing, as they reduce the requirement for material transportation to a fixed crushing plant. The rising trend for convenient, more flexible, and sustainable stone crushing solutions has increased the popularity of mobile crushers, contributing to opportunities for more innovations and developments in stone crushing equipment.

Product Insights

The jaw crusher segment dominated the stone crusher market with the largest share in 2024 due to its wide use in construction, mining, cement, and quarrying applications, driven by its cost-effectiveness, reliability, efficiency, and versatility. Jaw crushers can handle large and tough materials, making them ideal for various industries. Ongoing innovation in advancing jaw crushers supports segmental growth.

- In February 2024, a leading global manufacturer of mobile crushing, screening, and conveying equipment, Finlay, unveiled its two novel jaw crusher models, including the J-1170+ and J-1170AS+. These crushers help reduce construction materials waste.

(Source: https://www.terex.com)

The cone crusher segment is expected to grow at the highest CAGR during the forecast period. The cone crusher is widely used for efficient crushing of hard and abrasive materials. The mining and construction industries heavily used cone crushers due to their high efficiency and performance. Technological advancements in cone crushers, including hydraulic adjustments, better wear-resistant materials, and automation systems, are expanding their scope of applications. The popularity of mobile cone crushers is rising due to their flexibility and portability, boosting the segment's growth.

Application Insights

The mining segment held the largest revenue share of the stone crushing market in 2024 due to the high adoption of stone crushing equipment in the mining industry to crush aggregates in mineral extraction processes. Automation and smart crushers, energy-efficient crushing, mobile and modular crushing plants, and eco-friendly crushing solutions are the major innovations in mining crushing equipment. Additionally, ongoing technological advancements, like AI and machine learning integration, 3d printing for crusher components, advanced wear-resistant materials, and decentralized and autonomous crushing operations, are expected to expand stone crushing equipment's capabilities in mining applications.

The quarrying segment is expected to expand at the fastest CAGR in the coming years, driven by increasing demand for stone crushing equipment to produce aggregates and raw materials to use in construction. The rising demand for construction materials ultimately drives the growth of the segment. In addition, rising construction projects, such as bridges, buildings, and roads, boost the need for aggregates that are usually procured from quarries.

Regional Insights

Asia Pacific Stone Crushing Equipment Market Size and Growth 2025 to 2034

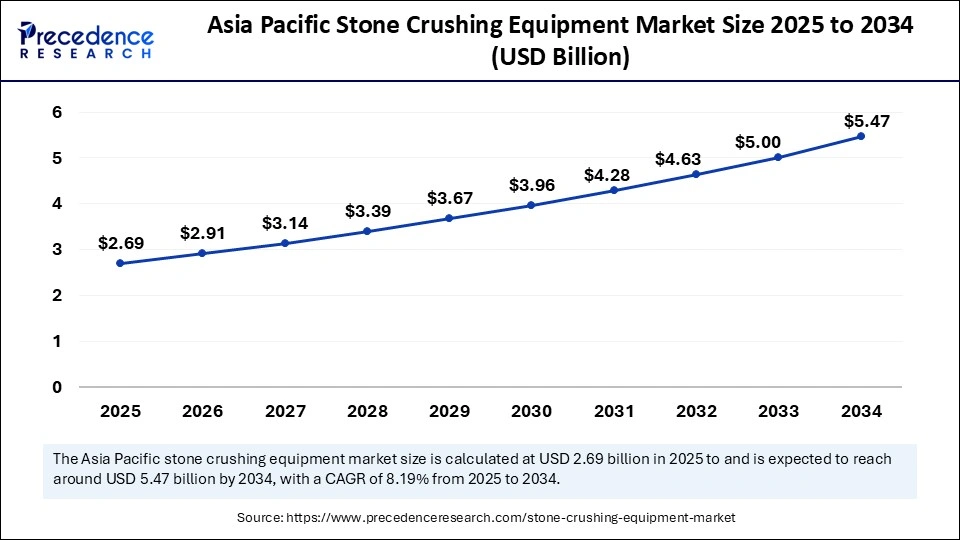

Asia Pacific stone crushing equipment market size is exhibited at USD 2.69 billion in 2025 and is projected to be worth around USD 5.47 billion by 2034, growing at a CAGR of 8.19% from 2025 to 2034.

How does Asia Pacific Dominate the Stone Crushing Equipment Market?

Asia Pacific dominated the stone crushing equipment market by holding the largest share in 2024. This is mai8nly due to the increased infrastructure development projects and expanding construction and mining industries. In the last few years, governments of various Asian countries have made substantial investment in building roads and developing infrastructure, driven by rapid urbanization, industrialization, and a growing population. The region has abundant natural resources, including stones, making it a suitable location for stone crushing operations. The rising mines and quarries in the region further bolster the growth of the market. With the rising construction projects, there is heightened demand for high-quality aggregates, creating the need for advanced stone crushing equipment.

Countries like China, India, and Japan are leading the Asia Pacific stone crushing equipment market. China is the major player in the regional market, driven by the country's robust mining industry and government investments in infrastructure development projects. The mining and construction industries are the major consumers of stone crushing equipment in China.

North American Stone Crushing Equipment Market Trends

North America is expected to grow at the fastest CAGR during the forecast period due to increased construction projects in the region, driven by rapid urbanization, industrialization, and population growth. The increased construction projects are creating the need for aggregates. Additionally, the growing mining sector and government initiatives in infrastructure development are fostering market growth.

The U.S. is a major player in the regional market growth, driven by its strong focus on technological advancements. The U.S. is focusing on developing automated and advanced stone crushing equipment. The U.S. government and major industries are collaborating to explore AI-powered platforms to enhance transparency and efficiency in critical minerals supply chains, including operations related to stone crushing. Rising construction activities further support market expansion.

What Opportunities Exist in the European Crushing Equipment Market?

Europe is considered to be a significantly growing area. The region's strong focus on recycling construction waste creates the need for stone crushing equipment in processing these materials. The increasing infrastructure development projects are driving regional market growth. Moreover, the region's strong focus toward maintaining sustainability is creating opportunities for energy-efficient stone crushing equipment, driving innovations in the market. Germany is the major player in the market. The expanding construction industry and stringent environmental regulations are contributing to the growth of the market in Germany.

Stone Crushing Equipment Market Companies

- Terex Corporation

- Joy Global Inc

- Sandvik AB

- Astec Industries

- BUCY International

- Komatsu Ltd.

- Eagle Crusher Company Inc.

- Mesto Oyj

- Thyssenkrupp

- IROCK Crusher

Recent Developments

- In February 2025, Eagle Crusher Co. announced a plan to launch its next-generation 1200-CC portable crushing and screening plant at Booth #1912 at World of Asphalt/AGG1 between March 25 and 27, 2025, in St. Louis. The Next-Generation 1200-CC features a self-lowering control panel, a fully hydraulic side discharge conveyor, and is available with an onboard cross-belt permanent magnet. (Source: https://rockproducts.com)

- In June 2024, Terex unveiled MAGNA, its new brand for its quarrying portfolio to enhance its high-volume crushing operations. The company has launched this new brand to target large-scale operations in the crushing, mining, construction, and recycling industries. (Source: https://www.terex.com)

Segment Covered in the Report

By Product

- Cone Crusher

- Jaw Crusher

- Impact Crusher

By Application

- Mining

- Quarrying

- Recycling

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client