List of Contents

Spherical Tungsten Powder Market Size and Forecast 2025 to 2034

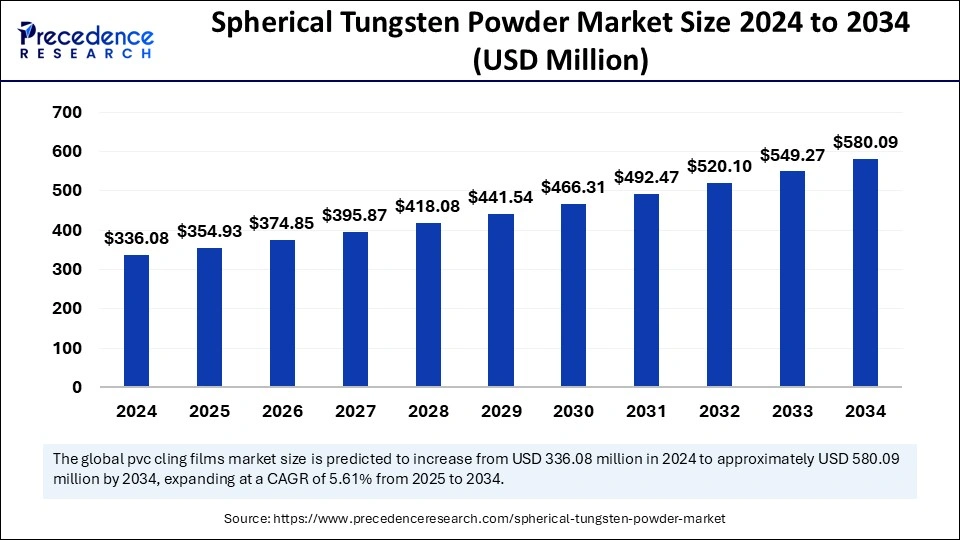

The global spherical tungsten powder market size accounted for USD 336.08 million in 2024 and is predicted to increase from USD 354.93 million in 2025 to approximately USD 580.09 million by 2034, expanding at a CAGR of 5.61% from 2025 to 2034. Increasing demand for additive manufacturing (3D Printing) is the key factor driving the market's growth. Also, innovations in the semiconductor and electronics industries coupled with the increasing use of this powder in manufacturing missile and aircraft components can fuel market growth further.

Spherical Tungsten Powder Market Key Takeaways

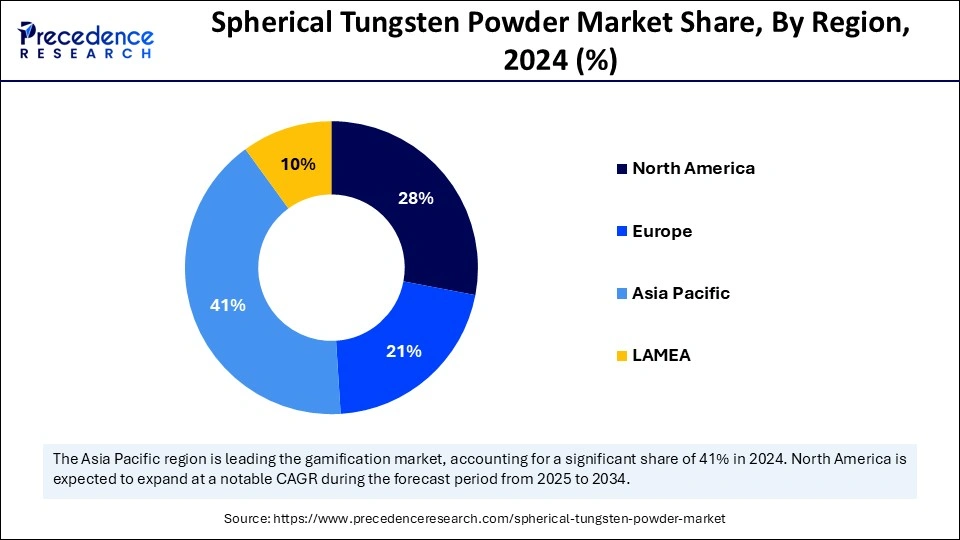

- Asia Pacific dominated the spherical tungsten powder market with the largest market share of 41% in 2024.

- North America is expected to grow at a significant CAGR during the studied period.

- By particle size, the fine segment dominated the market in 2024.

- By particle size, the coarse segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the thermal spraying segment held the largest market share in 2024.

- By application, the 3D printing segment is expected to grow at the fastest CAGR over the forecast period.

- By end-use industry, the aerospace industry segment led the market by holding the largest share in 2024.

- By end-use industry, the electronics industry is estimated to grow at the fastest rate during the projected period.

Role of Artificial Intelligence (AI) in the Spherical Tungsten Powder Market

The integration of artificial intelligence is having a substantial impact on the spherical tungsten powder market. AI-driven solutions are enhancing production processes by improving efficiency, precision, and speed of production. Furthermore, AI automation systems help to decrease operational costs, ensure constant product quality, and increase productivity. Hence, manufacturers are using automated solutions in the overall powder production process.

Asia Pacific Spherical Tungsten Powder Market Size and Growth 2025 to 2034

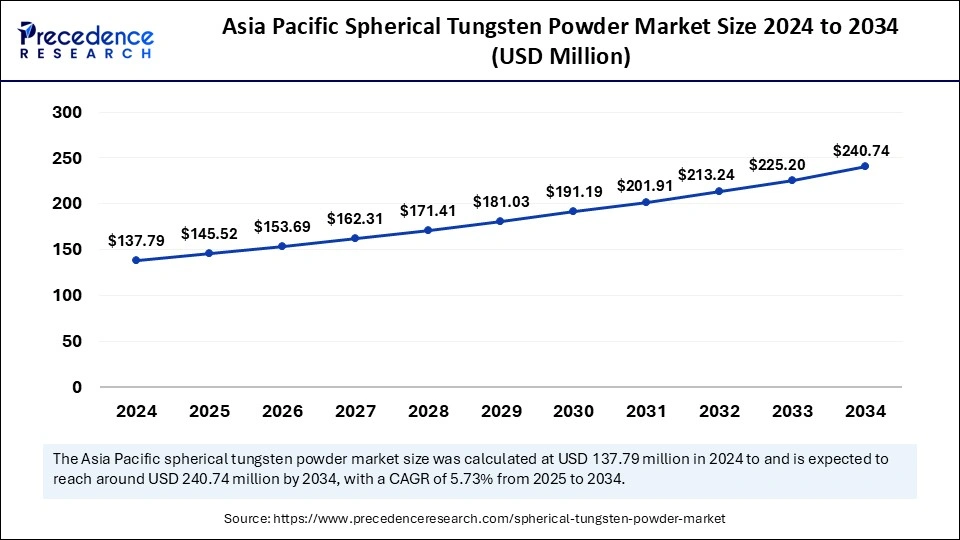

The Asia Pacific spherical tungsten powder market size was exhibited at USD 137.79 million in 2024 and is projected to be worth around USD 240.74 million by 2034, growing at a CAGR of 5.73% from 2025 to 2034.

Asia Pacific dominated the spherical tungsten powder market in 2024. The dominance of the region can be attributed to the ongoing industrialization coupled with the growth of f manufacturing sectors in fast-growing economies such as China, Japan, and South Korea. Moreover, the region's extensive presence in the electronics industry will likely create regional market opportunities in the future.

China Market Trends

In Asia Pacific, China led the market owing to the surge in investments in innovative manufacturing technologies such as precision machining and additive manufacturing, which necessitates the unique characteristics of tungsten powder.

North America is expected to grow at a significant rate in the spherical tungsten powder market during the studied period. The growth of the region can be credited to the well-established automotive and aerospace industries in the region. Furthermore, the region's increasing emphasis on innovation and the use of the latest manufacturing technologies are propelling the demand for high-performance materials.

The U.S. Market Trends

In North America, the U.S. dominated the spherical tungsten powder market. The dominance of the region can be linked to the increasing emphasis on high-performance and sustainable materials, which are boosting the adoption of spherical tungsten powder. Also, the market in the United States is distinguished by substantial investments in research and development initiatives.

Market Overview

Spherical tungsten powder has extraordinary qualities, including good powder fluidity as compared to general tungsten powder. Also, the good electrical conductivity, high degree of density, and good electrical conductivity make it the best material for microelectronic and electrical applications. Applications of the spherical tungsten powder market include porous materials, high-density powder spraying, and 3D printing of tungsten alloys.

Top 5 Tungsten-p Producing Countries in 2024

| Country | Tungsten production |

| China | 67,000 metric tons |

| Vietnam | 3,400 metric tons |

| Russia | 2,000 metric tons |

| North Korea | 1,700 metric tons |

| Bolivia | 1,600 metric tons |

Spherical Tungsten Powder Market Growth Factors

- The increasing demand for tungsten in electronic components applications is expected to boost spherical tungsten powder market growth shortly.

- The rising focus on sustainability and eco-friendly practices across various industries can propel market growth further.

- A stringent regulatory framework associated with the production of spherical tungsten powder will likely contribute to the market expansion over the forecast period.

market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 580.09 Million |

| Market Size in 2025 | USD 354.93 Million |

| Market Size in 2024 | USD 336.08 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.61% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Particle Size, Application, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing industrial applications

The wear resistance, strength, and hardness of tungsten carbide, which is often generated utilizing spherical tungsten powder, makes it a good choice for cutting inserts, tools, wear parts, and other components in sectors like aerospace, automotive, mining, construction, and oil and gas. In addition, the growing use of tungsten concentrate, along with the decreasing tungsten scrap availability, is also impacting market growth positively.

- In December 2024, Wall Colmonoy Corporation, headquartered in Madison Heights, Michigan, U.S., announced the launch of WallCarb HVOF Tungsten Carbide Powders. These powders are specifically designed for thermal spray applications and are engineered to create dense, hard coatings with outstanding wear and corrosion resistance.

Restraint

Environmental concerns

The production of spherical tungsten powder utilized in additive manufacturing necessitates high-energy processes, which can lead to raised resource consumption and carbon emissions. Moreover, the manufacturing process can further create significant waste products, such as byproducts from chemical processing and tailings from mining operations, hindering the spherical tungsten powder market growth further.

Opportunity

Increasing use in additive manufacturing

The spherical tungsten powder market services are extensively utilized in additive manufacturing processes and 3D printing. Spherical tungsten powder plays an essential role in additive manufacturing, especially in 3D printing. Its notable high packing density and flowability enable the generation of intricate geometries with important for producing complex components.

- In November 2023, Continuum Powders launched the upgraded Greyhound M2P 3.0 atomizer, positioning the company among the most carbon-friendly processors of metal powder on the market, delivering industry-leading quality combined with extreme flexibility, improved cycle times, cost competitiveness, and an ideal path towards decarbonization.

Particle Size Insights

The fine particle segment dominated the spherical tungsten powder market in 2024. The dominance of the segment can be attributed to the growing adoption of fine-size particles in applications that require high surface finish and precision, such as in electronics and 3D printing. Additionally, these particles have the ability to create detailed and smooth components, which are important for industries such as aerospace and medicine.

The coarse segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing utilization of spherical tungsten powders in heavy-duty industrial applications and thermal spraying. However, these large-size particles offer superior wear resistance and thermal conductivity, which makes them ideal for coatings.

Application Insights

The thermal spraying segment held the largest spherical tungsten powder market share in 2024. The dominance of the segment can be linked to the rising need for high-performance and durable coatings in industries like automotive, aerospace, and industrial machinery. Spherical tungsten powder's good wear and thermal resistance make it the best choice for protective coatings that improve the performance and lifespan of critical components.

In March 2024, Hardide Coatings launched the first in a new range of ready-coated and enhanced components with a JP-5000 4" copper nozzle used in High-Velocity oxygen fuel (HVOF) thermal spray coating. The tungsten/tungsten carbide-based Hardide chemical vapor deposition (CVD) coating is proven to extend the operational life of HVOF thermal spray copper.

The 3D printing segment is expected to grow at the fastest rate over the forecast period. The dominance of the segment can be driven by the growing use of additive manufacturing technologies among different industries. Spherical tungsten powder's uniform particle distribution and exceptional flowability make it a favorable material for 3D printing applications.

End-User Industry Insights

In 2024, the aerospace segment led the spherical tungsten powder market by holding the largest share. The dominance of the segment is due to the increasing use of spherical tungsten powder in thermal spraying and 3D printing applications. Furthermore, the growing need for high-strength, lightweight components along with protective coatings can adhere to extreme conditions, impacting positive segment growth.

The electronics segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is owing to the current trends of miniaturization and rising functionality in electronic devices. The spherical tungsten powder is used in the manufacturing of conductive pastes, inks, and other electronic components that need high electrical stability and conductivity.

Spherical Tungsten Powder Market Companies

- H.C. Starck GmbH

- Global Tungsten & Powders Corp.

- Buffalo Tungsten Inc.

- Kennametal Inc.

- Tungsten Heavy Powder & Parts

- Elmet Technologies

- Wolfram Company JSC

- Treibacher Industrie AG

- Tejing Tungsten Co., Ltd.

- Chinatungsten Online (Xiamen) Manu. & Sales Corp.

- Xiamen Tungsten Co., Ltd.

- Japan New Metals Co., Ltd.

- ALMT Corp.

- Beijing Tungsten & Molybdenum Group Co., Ltd.

- Ganzhou Grand Sea W & Mo Group Co., Ltd.

Latest Announcement by Market Leaders

- In October 2023, Sweden's Sandvik AB announced it is to acquire Buffalo Tungsten, Inc. (BTI), a manufacturer of tungsten metal powder and tungsten carbide powder headquartered in Depew, New York, U.S. The acquisition of BTI is set to expand Sandvik's presence in the North American market and strengthen its regional capabilities in the component manufacturing value chain.

- In September 2024, Kennametal Inc. announced the expansion of its comprehensive product line of tooling and wear protection solutions for mining applications. The new additions include picks to meet diverse customer demands as well as an innovative round drill steel system designed to improve efficiency and safety.PrimePoint™ features a polycrystalline diamond (PCD) tip, enabling longwall operators to mine longer.

Recent Developments

- In March 2024, Golden Metal Resources plc, a mineral exploration and development company focused on tungsten, gold, copper, lithium, and silver within Nevada, U.S., announced an exploration update on the 100% owned Pilot Mountain project ("Pilot Mountain" or the "Project").

- In April 2023, Masan High-Tech Materials Corporation (MHT) and EQ Resources Limited (EQR) signed an MOU to work together in tungsten exploration, mining, assessing new project opportunities, and new product applications.

- In March 2023, The European Commission announced that it would be investing EUR 10 million in a research project to develop new applications for tungsten carbide. The project is expected to lead to the development of new tungsten carbide products that are more sustainable and have a lower environmental impact.

- In April 2023, China, the world's largest producer of tungsten carbide, announced that it would be increasing its production of tungsten carbide by 5% in 2023. This increase is expected to meet the growing demand for tungsten carbide products in China and around the world.

Segments Covered in the Report

By Particle Size

- Fine

- Coarse

By Application

- 3D Printing

- Thermal Spraying

- Electronics

- Medical

- Others

By End-User Industry

- Aerospace

- Automotive

- Electronics

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client