List of Contents

Specialty Polyamides Market Size?

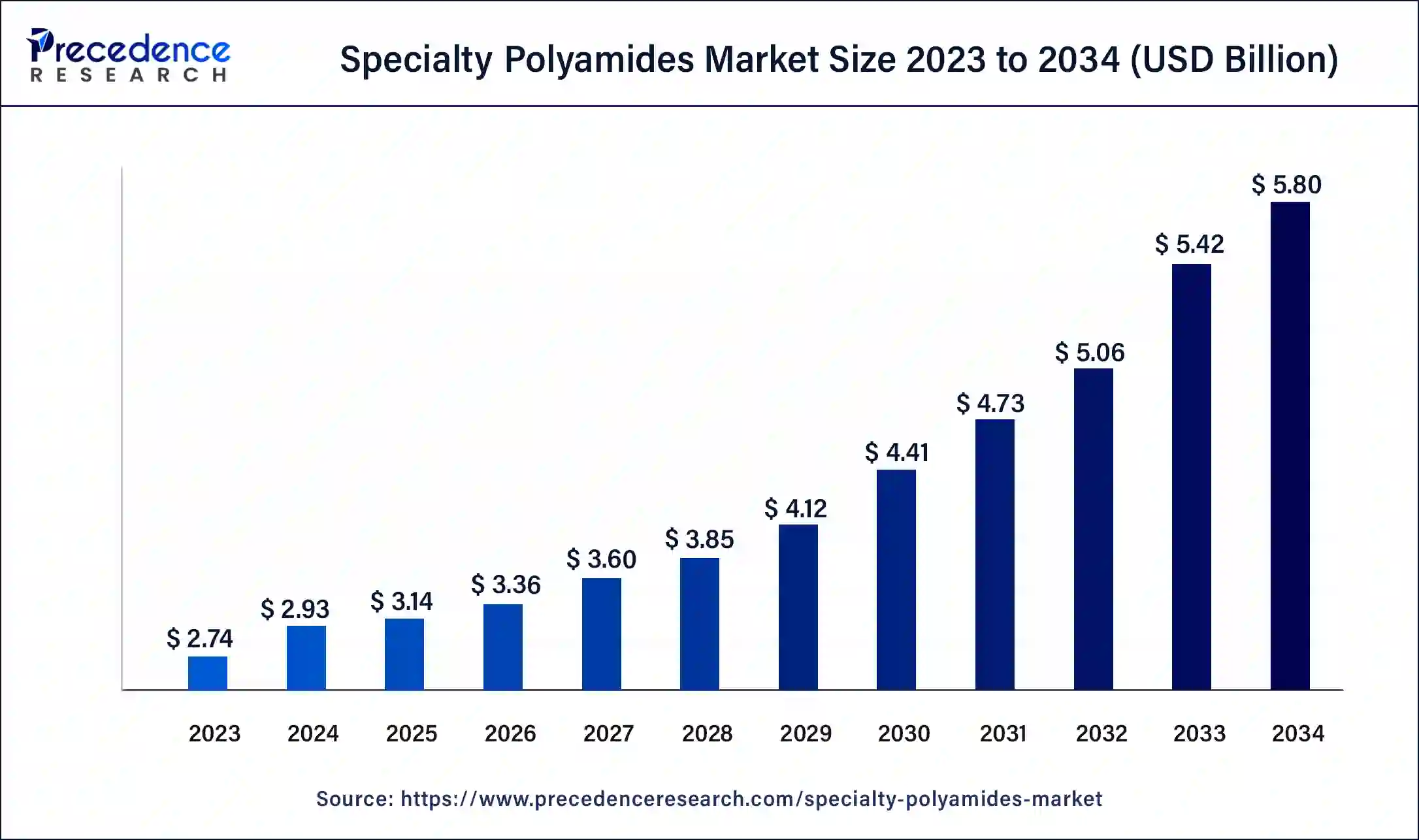

The global specialty polyamides market size is calculated at USD 3.14 billion in 2025 and is expected to reach around USD 5.80 billion by 2034, expanding at a CAGR of 7.07% from 2025 to 2034. The rising demand for lightweight materials across the world is driving the growth of the specialty polyamides market.

Market Highlights

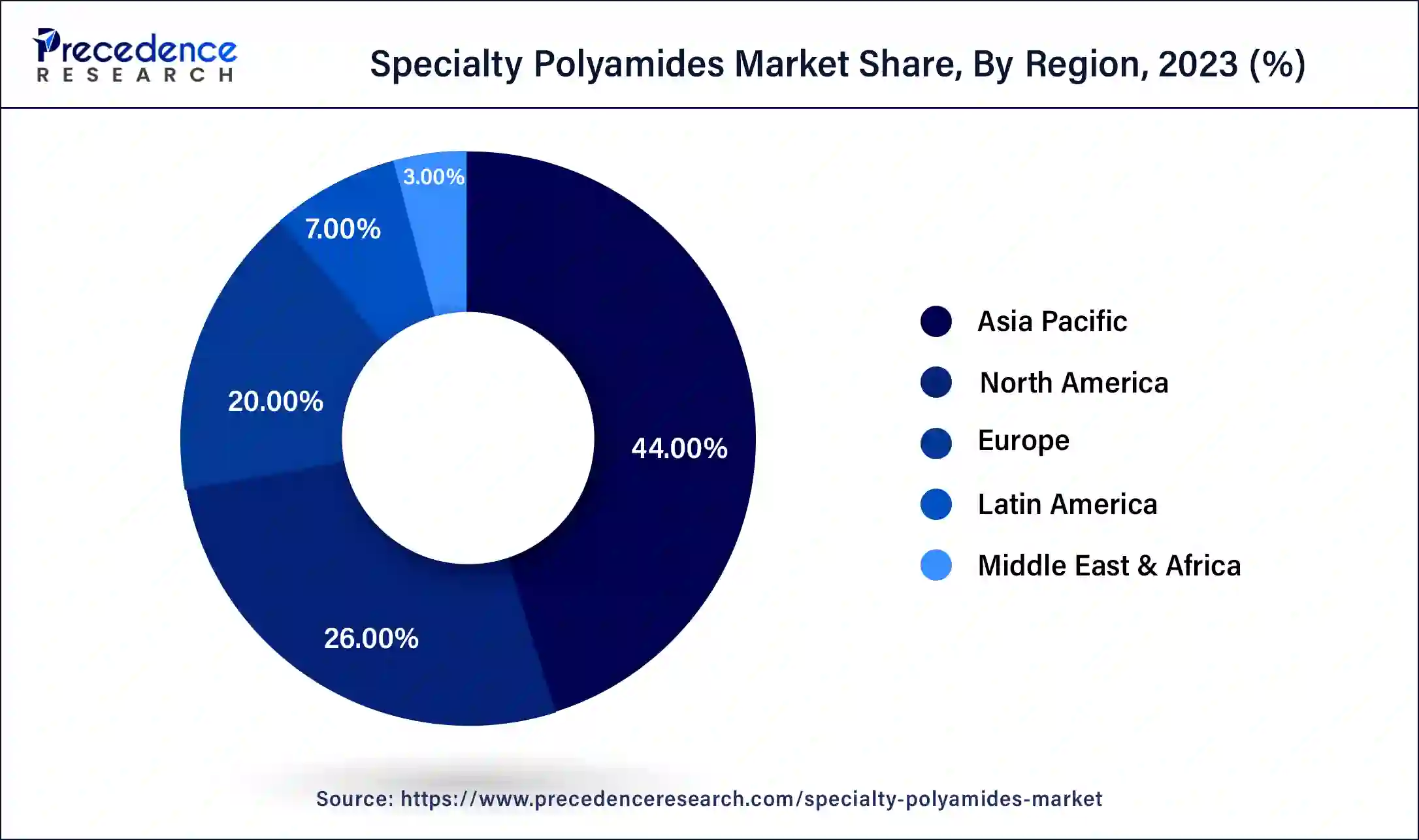

- Asia Pacific led the specialty polyamides market with the largest market share of 44% in 2024.

- North America is expected to attain the fastest rate of growth during the forecast period.

- By product, the high temperature specialty polyamide segment has contributed more than 49% of market share in 2024.

- By product, the long chain specialty polyamide segment is expected to be the fastest-growing segment during the forecast period.

- By end-use, the automotive & transportation segment dominated the market in 2024.

- By end-use, the electrical & electronics segment is expected to be the fastest-growing segment during the forecast period.

What is the Specialty Polyamides Market?

The specialty polyamides market is one of the most important industries in the chemical sector. This industry mainly deals in the manufacturing and distribution of specialty polyamides around the globe. This industry consists of various types of products that mainly include long chain specialty polyamide, MXD6/PARA, high temperature specialty polyamide, and some others.

The demand for specialty polyamides has increased in recent times with the growing number of packaging companies around the world. There are several applications of specialty polyamides in end-user industries, including automotive & transportation, consumer goods & retail, energy, electrical & electronics, industrial coatings, and others. This industry is expected to grow exponentially with the growth in the chemicals and automotive industries.

- In June 2023, the Arkema Group announced the acquisition of Glenwood Private Equity's 54% stake in the listed South Korean company PI Advanced Materials (PIAM), which includes specialty polyamides for an enterprise value of 728 million euros.

How is AI Contributing to the Specialty Polyamides Market?

Artificial Intelligenceis changing the course of the specialty polyamides market by speeding up the process of discovering new materials and the enhancement of production efficiency and sustainability. The use of predictive modeling and digital simulations provides AI with the capability of improving polymer design, quality control, and process reliability. It facilitates the process of real-time monitoring, predictive maintenance, and supply chain optimization, which translates to the reduction of waste, energy usage, and downtime, plus the urging of innovation in the area of next-generation bio-based and sustainable polymer formulations.

Specialty Polyamides Market Growth Factors

- The demand for specialty polyamides from automobile sectors has increased recently.

- Government initiatives to strengthen the energy industry have increased the application of specialty polyamides.

- There is an upsurge in demand for long-chain specialty polyamide across the world.

- There are growing investments from public and private sector entities to develop the specialty polyamides industry.

- The developments in the electronics industry have helped the specialty polyamides market to grow significantly.

- The use of specialty polyamides in building and construction applications accelerates industrial growth.

- The advancements in technologies for manufacturing specialty polyamides.

- The ongoing research and development activities related to polyamide 6/10 and polyamide 6/12.

- The application of specialty polyamides due to several characteristics such as flexibility, lightweight, abrasion resistance, fuel resistance, and some others boosts the specialty polyamides market growth.

Market Outlook

- Industry Growth Overview: The market is on a continuous upward trend due to the growing need for these materials, which are light and strong. The automotive, electronics, and industrial sectors are the main demanders.

- Sustainability Trends: Impact of the environment is being considered, and thus, bio-based polymers, advanced recycling processes, and circular manufacturing are getting regulations that are green and eco-friendly as their main focus.

- Global Expansion: Asia-Pacific is at the forefront as an ever-increasing and the most lucrative region, all thanks to its fast industrialization, increasing automotive production, and its government policies that are very inviting for investors.

- Major Investors:Some of the famous names in the chemical industry, namely BASF, Arkema, Evonik, Solvay, and DuPont, are pouring millions of dollars into investments to gain a better position and more technology in this market.

- Startup Ecosystem: The startups are doing some great research work on bio-based raw materials and sustainable technologies, and they have research collaborations and government-driven initiatives as their sources of backing.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 3.14 Billion |

| Market Size in 2026 | USD 3.36 Billion |

| Market Size in 2024 | USD 5.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising popularity of electric vehicles (EVs)

The trend of EVs has increased across the world in recent times. Nowadays, the adoption of electric vehicles has increased due to the rising prices in oil prices along with growing awareness of people regarding carbon emissions. The application of specialty polyamides in the EV industry has increased the manufacturing of EV components such as batteries, control units, connectors, and some others. Thus, with the growing demand for electric vehicles, the demand for specialty polyamides has increased rapidly, which is likely to drive the growth of the specialty polyamides market during the forecast.

- In February 2024, Honda Motors launched ‘Honda CR-V'. It is a plug-in hydrogen fuel cell electric vehicle that bundles a 17.7-kwh battery that provides a range of around 270 miles along with a 9-inch HD touchscreen, wireless phone charging, wireless Apple CarPlay, and Android Auto compatibility, a 12-speaker Bose premium audio system, dual-zone climate control, heated steering wheel, power-adjustable heated front seats, parking sensors, and bio-based leather seats.

- In October 2023, Celanese Corporation launched two new polyamide solutions. The two solutions, ‘B3 GF330 E' and ‘B3 GF30 E', find applications in electric vehicle (EV) powertrain components and EV battery applications.

Restraint

Mechanical properties and environmental impacts

The usage of specialty polyamides is very prominent in several industries for numerous applications across the world. Although the application of specialty polyamides in various industries is worth mentioning, there are several problems associated with it. Firstly, the mechanical property, such as limited resistance to strong acids and bases, is a major problem faced by this industry. Secondly, after decomposition, these polyamides produce harmful gases that cause environmental imbalance. Thus, deformities in mechanical properties, along with environmental issues associated with the use of specialty polyamides, are expected to restrain the growth of the specialty polyamides market during the forecast period.

Opportunity

Growing developments in glass-fibers reinforced polyamides (PA6-GF)

Advancements in science and technologies related to the development of specialty materials have gained traction recently. Researchers and scientists are currently developing a special type of glass-fiber reinforced polyamide (PA6-GF) due to their superior properties, including shrinkage, stiffness, impact strength, and thermal durability, for use in various applications such as aerospace and automotive.

- In October 2023, Evonik collaborated with Lehvoss. This collaboration is done to launch a fiber-reinforced polyamide named Luvosint ‘PA613 9711 CF' that finds numerous applications in end-user industries.

Segment Insights

Product Insights

The high temperature specialty polyamide segment held the largest specialty polyamides market share in 2024. The growing demand for electrical drives and connectors has driven the market growth. Moreover, the rising application of high-temperature specialty polyamide for manufacturing high-temperature automotive parts, LED packaging, and some other applications is expected to boost the market growth. Furthermore, the ongoing developments in the production of superior-quality high-temperature specialty polyamides are likely to drive the growth of the specialty polyamides market during the forecast period.

- In May 2024, Asahi Kasei announced a joint venture with Microwave Chemical. This joint venture is done to manufacture a polyamide 66 named ‘Leona PA663'. Leona PA663 is a heat-resistant polyamide used for manufacturing airbags and automobile parts.

The long chain specialty polyamide segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing use of polyamide 610 and 612 for various end-user industries has driven the market growth. Moreover, the rising demand for long chain specialty polyamide due to their high dimensional stability and exceptional chemical resistance boosts the market growth. Furthermore, the increasing application of long chain specialty polyamide in manufacturing battery seals, sporting goods, brush bristles, automotive cooling lines, fuel systems, and other applications is likely to drive the growth of the specialty polyamides market during the forecast period.

- In April 2024, Nylon Corporation of America, Inc. (NYCOA) launched NXT amid L. NXTamid L is a long-chain polyamide that offers numerous advantages over PA12 and PA11 resins.

End-Use Insights

The automotive & transportation segment held a dominant share in 2024. The growing developments in the automotive industry have increased the demand for specialty polyamides, thereby driving market growth. Moreover, with the rise in sales of automobiles across the world, the demand for specialty polyamides for manufacturing tires, fan blades, car upholstery, seat belts, air-intake manifolds, fuel systems, cooling systems, switch housing, oil pans, and some others is boosting the market growth. Furthermore, the rising developments in polyamide 66 (PA66), polyamide 6 (PA6), and polyamide 12 (PA12) for use in the automotive and transportation sectors are driving the growth of the specialty polyamides market.

- In March 2024, Cathay Biotech launched a new bio-based polyamide. This new polyamide comes with enhanced solutions that find applications in several end-user industries, including smartphones, automotive, E&E, apparel, and textiles.

The electrical and electronics segment is expected to attain the fastest CAGR during the forecast period. The growing developments in the electronics industry have increased the demand for specialty polyamides, thereby driving market growth. Also, the rising demand for electronic protection devices (EPDs) around the world has driven the market growth. Moreover, the upsurge in the application of specialty polyamides for the production of devices such as MCBs, MCCB, relays, contactors, terminal blocks, and some others boosts the growth of the specialty polyamides market during the forecast period.

- In March 2024, Krisoll launched SOLLAMID. SOLLAMID is a high-performance polyamide 6 and 66 compound that has several applications in the electronics industry.

Regional Insights

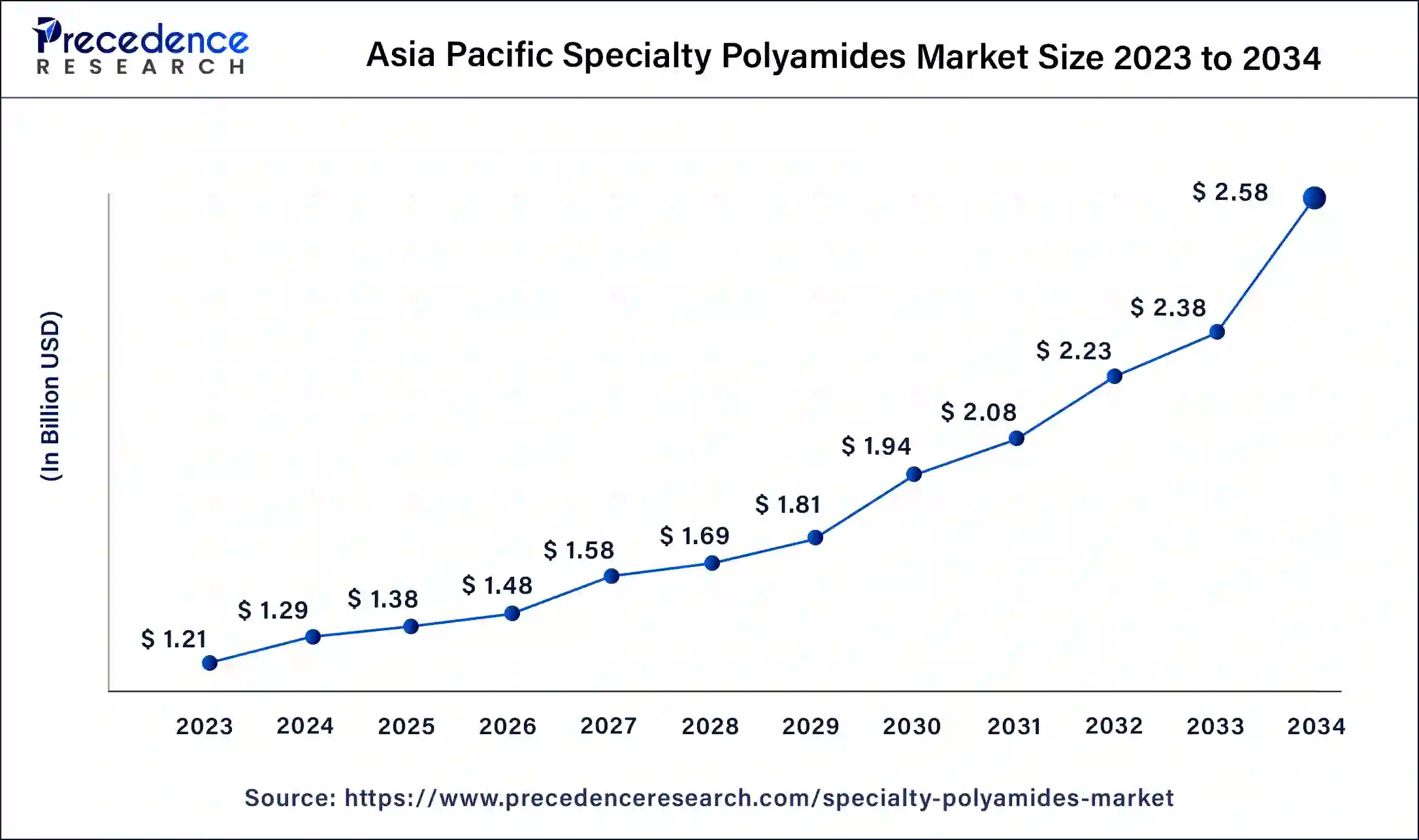

Asia Pacific Specialty Polyamides Market Size and Growth 2025 to 2034

The Asia Pacific specialty polyamides market size is exhibited at USD 1.38 billion in 2025 and is projected to be worth around USD 2.58 billion by 2034, poised to grow at a CAGR of 7.18% from 2025 to 2034.

How is Asia-Pacific Leading in the Specialty Polyamides Market?

This territory is the forerunner in global markets, with expert and industry-friendly policies backing it up. Advanced polymer solutions are variously applied, thanks to the booming sectors of automotive, electronics, and construction.

The large industrial sector in China, combined with constant investment in high-performance materials, contributes to market development. The increasing use of specialty polymers in engineering and electronics applications is a way to both support the market and push forward innovations.

The growing development in the transportation manufacturing industry in countries such as China, India, South Korea, Japan, and some others has increased the demand for specialty polyamides in several applications, such as the manufacturing of boats and trains, and has boosted market growth. Also, the presence of numerous electronics brands such as Xiaomi, Sharp, Samsung, Panasonic, Sony, LG, and some others has increased the demand for specialty polyamides due to their superior properties, such as heat and abrasion resistance, which is likely to drive the growth of the specialty polyamides market in this region.

Moreover, the presence of several local market players of specialty polyamides, such as LG Chem, Asahi Kasei Corporation, Kuraray Co., Ltd., and some others, are continuously engaged in developing specialty polyamides for several end-user industries and adopting several strategies such as partnerships, collaborations, and business expansions, which in turn drives the growth of the specialty polyamides market in this region.

- In June 2024, Raymond announced to invest around Rs 200 crores for expanding the garment and apparel manufacturing facility in India.

- In July 2024, Sony announced a partnership with Mitsubishi. This partnership is done to invest around US$ 53.52 billion for developing the Electrical & Electronics industry in the Asiatic region.

- In February 2024, LG Chem collaborated with CJ CheilJedang. This collaboration is done for manufacturing bio-polyamide in the South Korean region.

What are the Driving Factors of the Specialty Polyamides Market in Europe?

The growth of the region is partly caused by the typified strict environmental regulations and the adoption of eco-friendly materials. The development of recycled and bio-based polyamides is seen as an important step in achieving circular economy and industrial sustainability goals.

The country's high degree of sophistication in the chemical industry, along with its continuous devotion to innovation, are the main factors for product development. The strong R&D capabilities and the focus on performance materials are also contributing to its role as a cutting-edge specialty polyamide producer.

How is North America Performing in the Specialty Polyamides Market?

An important region that is kept by the advanced manufacturing, and the strong automotive and aerospace industries. The growing importance of lightweight materials and sustainability has been a driving force bringing regarding the steady demand for specialty polyamides.

The market takes advantage of the presence of leading-edge research facilities plus a strong manufacturing base. The rising levels of cost-effective raw materials and the focus on performance-driven polymer innovation are giving the market its competitiveness.

North America is expected to be the fastest-growing region during the forecast period. The rising developments in the automotive industry with the presence of numerous automotive companies such as Ford, Rivian, Tesla, Chevrolet, and others have increased the demand for specialty polyamides for numerous applications such as powertrain components, airbag containers, door handles, fuel caps, mirrors, wheel covers, which in turn drives the market growth. Moreover, the presence of several aerospace companies, such as Boeing, L3Harris, SpaceX, Lockheed Martin, and Northrop Grumman, has increased the demand for specialty polyamides for several military and defense applications such as manufacturing components of military aircraft and helicopters, which in turn is driving the market growth.

Additionally, the presence of various local companies of specialty polyamides such as INVISTA, DuPont de Nemours, Inc, AdvanSix, UBE, and some others are developing superior quality specialty polyamides to fulfill the demand from various industries such as automotive and electronics across the North American region, that in turn is expected to drive the growth of the specialty polyamides market.

- In January 2024, Tesla launched the all-new Model 3 in North America. This vehicle supports level 2 autonomy and comes with an electric drivetrain that provides a driving range of up to 341 miles on a single charge.

- In April 2024, Formerra announced a partnership with Evonik. This partnership is done for the production of high-performance polyamides such as VESTAMID L POLYAMIDE 12, VESTAMID E, POLYAMIDE 12 ELASTOMER, VESTAMID D POLYAMIDE 612 that find applications in aerospace industries.

- In July 2023, UBE announced that the US Food and Drug Administration (FDA) had approved UBE NYLON 5036B. UBE NYLON 5036B is a polyamide with excellent properties that finds applications in several end-user industries.

Value Chain Analysis

- Feedstock Procurement: Sourcing of critical monomers and or chemicals, giving priority to the aspects of quality, cost, and sustainability.

Key Players: Shell and S&P Global - Chemical Synthesis and Processing: Making polyamides by taking the raw materials through polymerization and other chemical processes.

Key Players: BASF SE, Arkema, Envalior, Ascend Performance Materials, INVISTA, Kuraray - Compound Formulation and Blending: Blending of not only the polymers but also the additives to achieve the desired mechanical or functional performance.

Key Players: BASF SE, Envalior, Celanese Corporation, Evonik Industries AG - Quality Testing and Certification: The verification that the materials are up to the required standards, are safe, and fulfil the customer's needs.

Key Players: SGS and Intertek - Packaging and Labelling of Specialty Polyamides: The safeguarding of materials and, at the same time, the provision of unambiguous and compliant product identification for the customers.

Key Players: Supreme Industries Ltd. and Time Technoplast Ltd

Specialty Polyamides Market Companies

- Evonik Industries AG

- Arkema S.A

- BASF SE

- Asahi Kasei Corporation

- LG Chem

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V.

- INVISTA

- Kuraray Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Solvay SA

- Radici Partecipazioni SpA

- Ems-Chemie Holding Ag

- Ube Industries Ltd.

- Toyobo Co., Ltd.

- ShanDong DongChen Engineering Plastic Co., Ltd.

- Eurostar Engineering Plastics

Recent Developments

- In October 2025,Syensqo launches Kalix LD-4850 BK000, a low-density, high-performance polyamide designed for the consumer electronics industry's evolving demands. (Source: https://www.indianchemicalnews.com)

- In July 2025, Arkema will construct a new Rilsan Clear transparent polyamide unit in Singapore, following a 50% capacity increase of Rilsan polyamide 11. This US$20 million investment aims for operation by Q1 2026. (Source: https://www.arkema.com/global)

Segments Covered in the Report

By Product

- Long Chain Specialty Polyamide

- MXD6/PARA

- High Temperature Specialty Polyamide

By End-Use

- Automotive & Transportation

- Consumer Goods & Retail

- Energy

- Electrical & Electronics

- Industrial Coatings

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client