List of Contents

What is the Space Power Electronics Market Size?

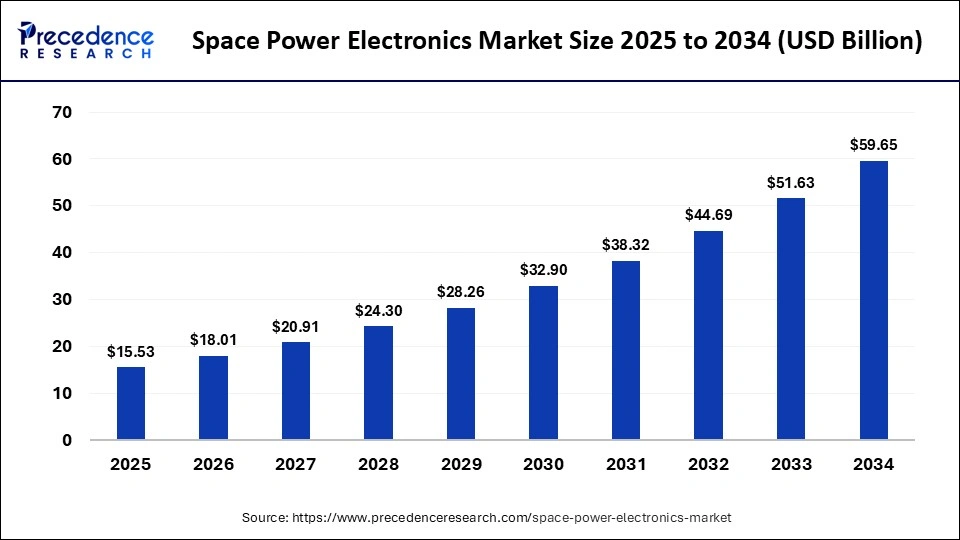

The global space power electronics market size accounted for USD 351.61 million in 2025 and is predicted to increase from USD 415.02 million in 2025 to approximately USD 1,567.49 million by 2034, expanding at a CAGR of 18.07% from 2025 to 2034. The market for space power electronics is growing due to the increasing demand for efficient, reliable, and lightweight power systems to support the numerous satellites, spacecraft and space exploration undertakings currently active globally.

Market Highlights

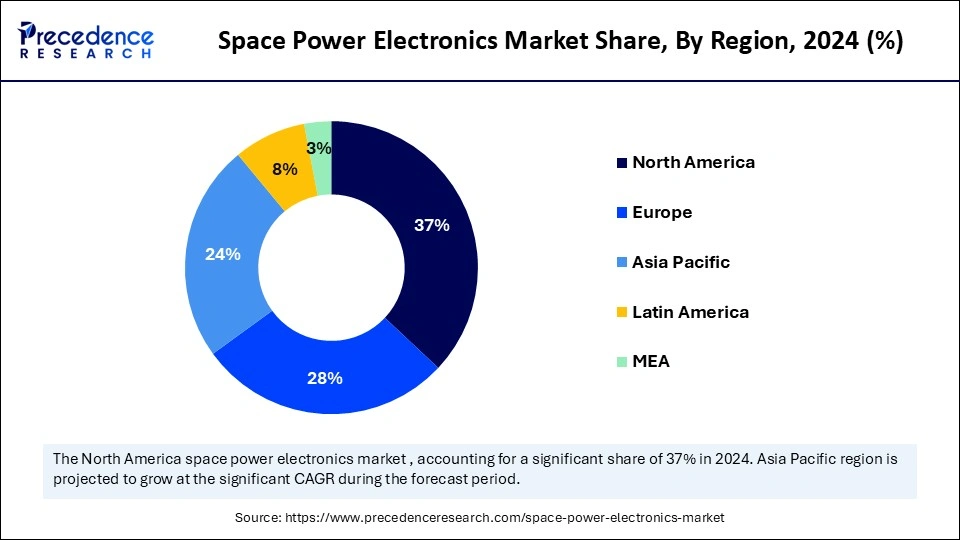

- North America dominated the market with largest market share of 37% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By device type, the power ICs segment held the largest share in 2024,

- By device type, power modules is expected to grow at a remarkable CAGR between 2025 and 2034.

- By component, the DC–DC converters segment captured the biggest market share in 2024.

- By component, solid-state power controllers are expected to grow at a significant CAGR during the forecast period.

- By voltage range, the medium voltage segment contributed the highest market share in 2024.

- By voltage range, the high voltage segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By material type, the silicon (Si) segments held the largest market share of in 2024.

- By material type, SiC & GaN is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the satellite power systems segment led the market in 2024,

- By application, deep-space missions & probes is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the commercial space operator segment generated the major market share in 2024,

- By end-user, defense & military programs is expected to grow at a remarkable CAGR between 2025 and 2034.

Are Power Electronics the Unsung Architects of Space Exploration?

The space power electronics market encompasses electronic systems and components designed to efficiently manage, convert, and distribute power in spacecraft, satellites, launch vehicles, and space stations. These systems include power converters, controllers, regulators, solid-state switches, and distribution units, all optimized to function in harsh space environments (radiation, extreme temperatures, vacuum).

Space power electronics are critical for enabling satellite communication, Earth observation, navigation, deep-space missions, space exploration, and defense applications. Increasing satellite launches drive market growth, rise of private space companies, demand for small satellites (CubeSats), deep-space exploration projects, and government/defense investments in space programs.

The space power electronics market is emerging as a critical enabler of humanity's extraterrestrial ambitions, underpinning the very infrastructure that sustains satellites, spacecraft, and deep space missions. These systems, often invisible to the lay observer, govern the conversion, regulation, and distribution of energy in some of the most unforgiving environments known to science. With satellites proliferating for communications, Earth observation, and navigation, the demand for robust, miniaturized, and radiation-hardened electronics has grown exponentially. Space agencies and private enterprises alike are seeking high-efficiency solutions that reduce payload weight while maximizing power output. The intensifying focus on reusable launch vehicles and interplanetary exploration further magnifies the market's significance. In effect, space power electronics serve as the quiet but indispensable custodians of reliability, efficiency, and endurance in the cosmos.

Artificial Intelligence: The Next Growth Catalyst in X-Ray Detectors

AI is significantly impacting the X-Ray Detectors market by transforming them into intelligent diagnostic tools that enhance efficiency, accuracy, and patient safety. Algorithms, particularly deep learning models, analyze vast amounts of imaging data to detect subtle anomalies, such as tumors or fractures, often with a speed and consistency that aids human radiologists and reduces diagnostic errors. This integration is also key to enabling low-dose imaging protocols, where AI reconstructs high-quality images from lower radiation exposures, improving patient safety without compromising diagnostic accuracy.

Market Key Trends

- Miniaturization: Push toward lightweight, compact, and high-density electronics for small satellites (CubeSats, nanosats).

- Radiation hardening: Increasing demand for electronics capable of enduring harsh cosmic environments.

- Reusable space systems: Power electronics designed for durability to support reusable launch vehicles.

- Hybrid power integration: Growing adoption of solar arrays combined with advanced storage systems.

- Commercialization of space: Private players fueling demand for cost-effective, scalable solutions.

- Sustainability focus: Development of energy-efficient architectures to reduce heat dissipation and extend mission longevity.

Space Power Electronics Market Outlook

- Market Overview: The power management and conversion subsystem in spacecraft, spanning generation, storage, distribution, and electronics, now constitutes a large share of satellite mass and volume; therefore, it is critical to improve the efficiency of spacecraft electronics as a means of supporting growing capabilities for missions.

- Global Expansion: Government space agencies and commercial launch programs are increasingly utilizing small-satellites and deep-space missions around the world, leading to the demand for improved performance in light-weight electronics.

- Research & development:Advances in wide-bandgap semiconductors such as SiC and GaN are advancing power electronics to operate at higher temperatures, frequencies, and voltages, representing reduced size-weight-power trade-offs for space systems.

- Drivers: The increased constellation of satellites, the need for additional on-orbit servicing, and more electric spacecraft architectures creates an increased incentive for, and demand of, modular, efficient power systems that minimize total mass and improve reliability.

- Constraints: Qualification to the space environment continues to be the biggest challenge — radiation effects, reliability in extreme thermal/vacuum cycles, and long mission life have implications for cost and time to market across subsystems.

Market Outlook

- Market Growth Overview: The X-Ray Detectors market is expected to grow significantly between 2025 and 2034, driven by the shift to advanced digital and portable systems, integrated AI for enhanced diagnostics, and growing demand across medical, industrial, and security applications.

- Sustainability Trends:Sustainability trends involve the energy efficiency, eco-friendly materials, and proper disposal and recycling of X-ray equipment and related electronic waste (e-waste) is crucial to prevent environmental contamination.

- Major Investors: Major investors in the market include Anguard Group, Inc., BlackRock, Inc., Gimv and Prime Ventures, and Advent International.

- Startup Economy: The startup economy in the market is a portable and handheld X-ray system, advanced sensor and detector technology, and targeting niche applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 351.61 Million |

| Market Size in 2026 | USD 351.61 Million |

| Market Size by 2034 | USD 1,567.49 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Component, Voltage Range, Material, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

When Power Becomes the Pulse of Space

The primary impetus behind the space power electronics market's growth lies in the escalating deployment of satellites and spacecraft for both commercial and governmental purposes. Communication, navigation, remote sensing, and scientific missions necessitate ever more reliable and efficient power systems. The proliferation of private space enterprises, especially in the United States and ambitious constellations of low-Earth orbit satellites has accelerated demand for advanced electronics. At the same time, national space agencies are undertaking massive investments in lunar and martian missions, where survivability hinges on sustainable energy management. The rise of reusable launch vehicles also compels innovation in power electronics that can endure repeated thermal and mechanical stresses. Together, these currents underscore the market's trajectory as an indispensable driver of the broader space economy.

Restraints

The Cosmic Constraints

Despite this tremendous growth, the space power electronics market is not without formidable challenges. Chief among these are the prohibitive costs of developing radiation-hardened and space-qualified electronics, which often demand specialized materials and lengthy testing cycles. The scarcity of standardization across agencies and manufacturers further complicates interoperability, driving costs higher. Moreover, the harshness of the space environment, characterized by radiation, vacuum, and extreme temperature swings, necessitates painstaking design redundancies that slow innovation. Limited manufacturing capacity, coupled with supply chain vulnerabilities for rare materials, also impedes scalability. Additionally, geopolitical frictions often restrict technology transfers, fragmenting the global supply landscape. These constraints collectively temper the pace of expansion, even as demand intensifies.

Opportunity

Celestial Horizons Await

Despite these challenges, the space power electronics market abounds with opportunities as humanity's cosmic horizons expand. The ascent of space tourism, lunarbases, and planetary exploration missions will necessitate next-generation power systems capable of long-duration functionality. The surge in CubeSats and nanosatellites opens avenues for mass-produced, cost-efficient power electronics. Innovations in superconducting materials and wide-bandgap semiconductors promise leaps in efficiency and resilience. Collaborations between space agencies, private companies, and academic institutions are fostering fertile ecosystems for rapid innovation. Moreover, the advent of in-orbit servicing and manufacturing heralds fresh demand for adaptive, modular power electronics. In sum, the industry is poised at the cusp of extraordinary opportunities, catalyzed by the inexorable expansion of humankind into the heavens.

Segment Insights

Device Type Insights

Why Power ICs Is Dominating the Space Power Electronics Market?

The power integrated circuits segment continue to dominate the space power electronics market, owing to their compact design, reliability, and ability to integrate multiple functions into a single chip. In the unforgiving environment of outer space, efficiency and precision are non-negotiable, and Power ICs provide precisely that with remarkable thermal stability and radiation tolerance. Their ubiquity in satellite subsystems, from communication arrays to propulsion controls, underscores their indispensable role. The drive toward miniaturization of spacecraft further amplifies the relevance of IC-based solutions. With growing reliance on constellations of small satellites for broadband, navigation, and Earth observation, demand for robust Power ICs is rising unabated. Their dominance is unlikely to be dislodged soon, given their versatility and integration capacity.

The cost-effectiveness of power ICs also fuels their adoption across commercial, scientific, and defense missions. Their ability to operate efficiently under fluctuating loads and extreme conditions ensures mission longevity and reliability. Continuous advancements in semiconductor design are expanding their functionality, allowing engineers to incorporate complex power management systems without compromising spacecraft weight or efficiency. This consolidation of performance and durability reinforces their hegemony in the market. Ultimately, Power ICs epitomize the balance between innovation and reliability that space systems demand.

power modules are witnessing the fastest growth trajectory, propelled by the intensifying energy demands of modern space missions. Unlike their compact counterparts, power modules offer higher power-handling capabilities and modular scalability, making them ideal for large satellites and interplanetary probes. As spacecraft transition toward electric propulsion systems, power modules are gaining renewed prominence for managing elevated power levels. They offer the structural flexibility to be tailored to specific mission architectures, a quality highly valued in custom satellite design. This adaptability is catalyzing their expansion across commercial and governmental programs.

Moreover, the rise of reusable launch vehicles and long-duration deep space missions highlights the need for ruggedized modules that can sustain performance over extended periods. Enhanced thermal management systems and fault-tolerant designs are further bolstering their adoption. Increasing collaboration between space agencies and private operators is accelerating module innovations tailored for scalability and redundancy. As power needs surge in tandem with ambitious ventures such as lunar habitats and Mars expeditions, modules are poised to be at the forefront of next-generation power electronics. Their swift ascent mirrors the industry's broader shift toward flexibility and resilience in space infrastructure.

Component Insights

Why DC–DC Converters Dominate the Power Electronics Market?

The DC-DC converters segment forms the backbone of spaceborne power electronics sector, ensuring that energy generated by solar arrays or onboard batteries isseamlessly transformed to appropriate voltage levels. Their dominance stems from the vital role they play in sustaining uninterrupted satellite functionality, whether powering communication transponders, navigation payloads, or thermal control systems. The compactness, efficiency, and radiation-hardened nature of modern converters make them indispensable to both small and large spacecraft. Without these components, stable operation of sensitive payloads would be virtually impossible.

In addition, the unrelenting demand for higher energy efficiency has spurred significant innovation in converter topologies. Today's designs boast reduced switching losses, improved thermal resilience, and enhanced electromagnetic compatibility—all crucial for space applications. With the exponential rise in small satellite launches, DC-DC converters are now produced in more compact and cost-effective packages, ensuring their broad adoption. Their longevity, reliability, and adaptability secure their enduring supremacy in this segment.

Solid-state power controllers (SSPCs) are rapidly emerging as the fastest-growing in the space power electronics market, transforming spacecraft electrical distribution systems with their intelligence and agility. Unlike conventional protection devices, SSPCs integrate monitoring, fault detection, and real-time response mechanisms into a single platform. Their ability to rapidly isolate faulty circuits, thereby preventing catastrophic failures, resonates strongly with mission planners prioritizing reliability. As spacecraft systems become increasingly complex, SSPCs offer the precise control and diagnostic capabilities necessary for modern, distributed architectures.

Their appeal lies in the convergence of protection, automation, and communication within one compact system. This is particularly advantageous for large constellations, where operational efficiency and remote manageability are critical. Furthermore, advancements in materials and miniaturization are making SSPCs lighter, faster, and more efficient. Space agencies are increasingly incorporating these controllers to enhance redundancy and reduce operational risks. Their surging adoption reflects the industry's pivot toward smarter, more resilient power management solutions.

Voltage Range Insights

Why Medium Voltage Is Dominating the Space Power Electronics Market?

The medium voltage systems dominate the space power electronics market due to their wide applicability across satellites, space stations, and orbital vehicles. They strike an optimal balance between efficiency and safety, enabling stable power distribution without excessive insulation or system weight. These systems are particularly suited to small and medium spacecraft, which form the lion's share of launches today. The proliferation of satellite constellations for communication and Earth observation relies heavily on medium-voltage solutions.

Furthermore, medium voltage architectures have benefited from years of refinement, delivering unmatched reliability. Their established performance in radiation-prone and thermally challenging environments reinforces confidence among designers. For commercial operators aiming at cost-effective deployment, medium voltage remains the pragmatic choice. Their universality and adaptability ensure continued dominance as the workhorse of orbital systems.

High voltage systems are witnessing the fastest expansion, fueled by rising interest in electric propulsion and deep space exploration. The colossal energy requirements of ion and Hall-effect thrusters necessitate voltages far beyond medium ranges. Consequently, spacecraft destined for interplanetary voyages and extended operations are increasingly designed with high-voltage architectures. This shift mirrors the industry's ambition to conquer more distant horizons in space.

Technological strides in insulation, fault tolerance, and heat dissipation are alleviating earlier barriers to adoption. Space agencies and private players alike are investing in research to enhance the reliability of high-voltage systems. Their ability to deliver superior efficiency while powering high-demand propulsion units and scientific payloads makes them an irresistible choice for future missions. As human exploration ventures toward Mars and beyond, high voltage will undoubtedly emerge as the linchpin of advanced power electronics.

Material Insights

Why is Silicon Dominating the Space Power Electronics Market?

Silicon remains the dominant material in space power electronics market, owing to its long-established performance record and cost-effectiveness. Its mature manufacturing ecosystem ensures consistent supply and scalability, which is indispensable for the surging demand in satellite constellations. Silicon-based devices have demonstrated admirable resilience in orbital environments, managing radiation exposure and temperature fluctuations with commendable reliability. Their broad utility across DC-DC converters, ICs, and controllers cements their ubiquitous presence.

Silicon Carbide (SiC) and Gallium Nitride (GaN) are rapidly emerging as the fastest-growing materials, revolutionizing the performance envelope of space power electronics. Their superior properties high thermal conductivity, wide bandgap, and exceptional switching efficiency, render them ideal for high-voltage, high-frequency applications. For missions demanding higher power density and lower energy losses, these materials are fast becoming the gold standard.

Their potential shines brightest in electric propulsion systems, high-speed data transmission units, and miniaturized satellite subsystems. Though costlier than silicon, SiC and GaN's capacity to drastically reduce system weight and improve efficiency makes them invaluable for next-generation spacecraft. Ongoing R&D investments are swiftly bridging their affordability gap, accelerating their march into mainstream adoption. They symbolize the paradigm shift from established adequacy to aspirational excellence in space electronics.

Application Insights

Why Is Satellite Power Systems Dominating the Market for Space Power Electronics?

Satellite power systems continue to dominate this market, being the backbone of communication, navigation, weather monitoring, and Earth observation. Virtually every satellite irrespective of size or function, requires sophisticated power conditioning and distribution to operate in unforgiving orbital conditions. From managing solar panel outputs to ensuring uninterrupted payload functionality, power electronics serve as the silent custodians of mission continuity.

The global boom in low-Earth orbit (LEO) constellations amplifies this dominance. With thousands of satellites being deployed for broadband and imaging, demand for efficient, radiation-hardened power systems is scaling exponentially. Their indispensability across civilian, scientific, and defense domains secures their commanding role as the fulcrum of space power electronics applications.

Deep space missions and interplanetary probes are witnessing the fastest growth, propelled by humanity's renewed ambition to explore the Moon, Mars, and beyond. These ventures demand power systems of unparalleled reliability, capable of functioning autonomously for years in extreme environments. Electric propulsion, high-data-rate communications, and sophisticated scientific payloads necessitate cutting-edge power electronics with unmatched efficiency.

The surge of international collaboration and private sector involvement in lunar gateways, asteroid exploration, and Mars expeditions underscores this expansion. Breakthroughs in high-voltage SiC/GaN systems and modular controllers are equipping probes with lighter, more resilient architectures. As exploration transitions from aspiration to execution, deep space missions will increasingly catalyze innovation and growth within the sector.

End-User Insights

Why Commercial Space Operators Are Dominating the Market?

Commercial space operators dominate the market, powered by the proliferation of private satellite constellations and space services. Companies deploying broadband satellites, Earth imaging fleets, and emerging in-orbit servicing platforms rely heavily on robust power electronics for dependable performance. Their entrepreneurial dynamism has accelerated demand for cost-efficient, miniaturized, and scalable systems.

Furthermore, competition among commercial entities drives continuous innovation, prompting suppliers to deliver increasingly efficient solutions. As satellite-based internet and data services extend their footprint globally, commercial operators will continue to underpin market growth. Their dominance reflects not merely volume but the sheer breadth of applications they champion.

Defense and military programs are growing at the fastest pace, spurred by the increasing militarization and securitization of outer space. National security imperatives demand resilient, secure, and highly reliable spaceborne systems for reconnaissance, communication, and navigation. This necessitates state-of-the-art power electronics capable of withstanding deliberate interference and extreme conditions.

Governments worldwide are allocating significant budgets toward defense-oriented space projects, including missile warning satellites, secure communication relays, and high-resolution surveillance. For these missions, uncompromising performance in power distribution and redundancy is paramount. Their accelerated growth trajectory underscores the confluence of geopolitical strategy and technological advancement, ensuring defense programs remain a powerful force reshaping the market.

Regional Insights

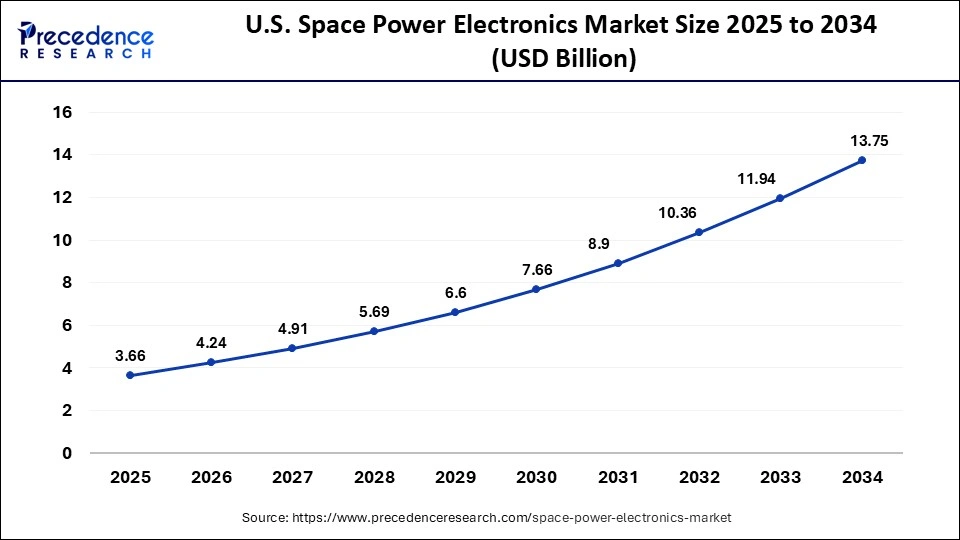

U.S. Space Power Electronics Market Size and Growth 2025 to 2034

The U.S. space power electronics market size is exhibited at USD 91.07 million in 2025 and is projected to be worth around USD 414.41 million by 2034, growing at a CAGR of 18.31% from 2025 to 2034.

The U.S. is integrating AI and machine learning for automated image analysis, improved diagnostics, and lower radiation exposure. Demand is robust across medical imaging, industrial non-destructive testing, and security applications.

Why North America Is Dominating the Space Power Electronics Market?

North America dominated the market, holding the largest market share of 37% in 2024.North America commands the lion's share of the space power electronics market, propelled by the dominance of NASA, SpaceX, and a constellation of aerospace giants. The region's technological sophistication and robust research and development ecosystem foster continuous innovation in energy systems. High government spending on defense satellites, combined with burgeoning commercial ventures, cements its leadership. Moreover, the strong presence of semiconductor innovators accelerates the development of radiation-hardened and high-efficiency components. North America's unparalleled launch infrastructure and investment climate ensure a steady pipeline of projects demanding cutting-edge power electronics. Its dominance is not merely quantitative but also qualitative, setting global benchmarks for reliability and performance.

Concurrently, the region is diversifying its user base, with start-ups and university-led missions gaining increasing prominence. Initiatives such as public-private partnerships fuel collaboration, lowering entry barriers and stimulating innovation. Sustainability has also emerged as a focal point, with American firms investing in energy-efficient designs to reduce waste heat and improve mission duration. Challenges of cost and regulatory scrutiny persist, yet North America's strategic advantage in talent, capital, and institutional support fortifies its supremacy. In essence, the region's dominance is undergirded by a unique confluence of ambition, capacity, and vision.

How Is the Asia Pacific the Fastest-Growing Space Power Electronics Market?

The Asia-Pacific region is the fastest-growing market for space power electronics, driven by national ambitions and the emergence of burgeoning commercial space enterprises. China, India, and Japan spearhead initiatives ranging from satellite constellations to lunar exploration programs, all of which demand advanced power systems. Rising investments in indigenous launch capabilities and space stations amplify the need for resilient, homegrown electronics. The proliferation of small satellite start-ups across India and Southeast Asia further accelerates regional momentum. This dynamism is supported by government funding, strategic policies, and a swelling pool of engineering talent. The region is fast becoming the crucible of growth for space power electronics.

In parallel, collaborations with global aerospace firms bring advanced technologies to local ecosystems, catalyzing knowledge transfer. Asia-Pacific's cost-competitiveness provides an added advantage, enabling mass production of components at lower costs. However, challenges such as dependence on imported semiconductors and regulatory constraints remain. Despite these hurdles, the region's trajectory is upward, fuelled by an unrelenting appetite for space exploration and technological sovereignty. Asia-Pacific is no longer a peripheral participant but a central force shaping the industry's global growth narrative.

What Drives Europe's Strategic Growth in Space Power Electronics Market

Europe is expanding owing to national-focused programs, leading satellite OEMs (Original Equipment Manufacturers) and specialist subsystem suppliers. Europe has a focus on high-reliability and modular designs as well as compliance with standards (using ITAR-free supply chains), ensuring exportability. There are public-private partnerships, funding innovation in efficient power conditioning, power management, and thermal-management integration. Buyers are placing value in traceability and certification; thus, vendors that establish their way through qualification, support, or follow-on support, will achieve or maintain premium positioning in long-term government and commercial contracts

Germany's X-ray detectors market is stringent EU safety regulations and the need for superior image quality. The market serves a wide range of applications, including medical diagnostics, industrial NDT, and security screening, all underpinned by high R&D investment and a growing demand for portable wireless systems in flexible clinical settings.

Why is the Middle East & Africa Emerging in the Space Power Electronics Domain?

The Middle East & Africa is still an evolving market, benefiting from new national space programs (and other initiatives) and investments in earth observation, remote sensing, and communication. The demand is selective, and has taken the shape of smaller constellations and government projects, so rugged, cost-effective power solutions that can be purchased quickly are prioritized. There is little local supply chain, so a first major win will be partnering with an international company or providing a turnkey solution that solves an immediate need. Market growth is prospective, but reliant on continued policy or government support, investing in their own local workforce or engineers, and having infrastructure in place for testing or qualification.

X-Ray Detectors Market Value Chain Analysis

- Component Manufacturing and Material Sourcing: This initial stage involves the production of essential detector components, including scintillators, thin-film transistors (TFTs), photodiodes, and advanced CMOS sensors.

Key Players: Hamamatsu Photonics, Teledyne DALSA, Canon and Siemens Healthineers. - Detector Assembly and Manufacturing: In this core manufacturing stage, the individual components are integrated into the final flat-panel detector (FPD) or other detector systems.

Key Players: Varex Imaging Corporation, Trixell S.A.S., and Konica Minolta. - System Integration and Software Development: This crucial stage involves integrating the detector with the X-ray source, gantry, and advanced imaging software for image acquisition, processing, and analysis.

Key Players: Siemens Healthineers, GE HealthCare, Philips Healthcare, Yxlon International. - Installation, Service, and Post-Sales Support:The final stage involves installing the complex equipment, providing technical support, maintenance, and software updates to ensure optimal performance and longevity.

Key Players: Siemens, GE, and Philips.

Space Power Electronics Market Companies

- Varex Imaging CorporationVarex is a global leader and significant pure-play provider of X-ray imaging components, specializing in the design and manufacture of high-quality X-ray detectors for medical, industrial, and security applications.

- Konica Minolta, Inc.Konica Minolta contributes to the market with innovative digital radiography systems and detectors, focusing on high image quality and workflow efficiency, particularly in medical settings.

- Agfa-Gevaert Group

Agfa provides a comprehensive portfolio of digital imaging solutions, including direct radiography (DR) and computed radiography (CR) detectors, to the healthcare market. - Canon Inc.

Canon is a key player in the medical imaging market, known for developing and manufacturing high-quality, flat-panel detectors with proprietary CMOS (Complementary Metal-Oxide-Semiconductor) technology. - Fujifilm Holdings Corporation

Fujifilm is a major contributor to the X-ray detectors market with its advanced digital radiography systems, including high-performance flat-panel detectors and mobile X-ray solutions. The company leverages its expertise in imaging technology to provide solutions that improve diagnostic accuracy and healthcare efficiency globally. - General Electric Company

General Electric (through its former GE HealthCare division) develops and integrates advanced X-ray detectors into its wide range of medical imaging systems, from general X-ray to CT scanners. - Hamamatsu Photonics K.K.

Hamamatsu Photonics is a leading manufacturer of optoelectronics components, including highly sensitive photodiodes and sensors that are essential for high-performance X-ray detectors. - PerkinElmer, Inc.

PerkinElmer provides specialized X-ray detectors for industrial and security applications, focusing on non-destructive testing (NDT) and threat detection. The company offers a range of high-resolution detectors that ensure quality control in manufacturing and enhance security screening capabilities at borders and airports. - Teledyne DALSA Inc.

Teledyne DALSA is a major supplier of high-performance digital imaging components, including advanced X-ray detectors and cameras used in industrial NDT and medical applications. The company contributes highly specialized sensor technology and expertise in custom solutions to meet demanding imaging requirements. - Analogic Corporation

Analogic provides advanced X-ray technology solutions for medical and security applications, including high-speed and high-resolution detectors. The company contributes significantly to the security screening market with its technology integrated into advanced aviation and checkpoint screening systems. - Thales Group

Thales is a global technology leader that provides X-ray imaging solutions, including high-performance flat-panel detectors, for a wide range of applications from medical to industrial controls. - Varian Medical Systems, Inc. (a Siemens Healthineers Company)

Varian specializes in cancer care solutions, providing X-ray imaging components that are essential for guiding radiation therapy treatments. - Rigaku Corporation

Rigaku is a leading provider of X-ray technologies for industrial and research applications, contributing specialized detectors for materials analysis and non-destructive testing. - Vieworks Co., Ltd.

Vieworks is a global provider of digital imaging solutions, including a comprehensive lineup of flat-panel detectors for medical and industrial applications. The company is known for its wireless and portable detectors that enhance efficiency and flexibility in healthcare settings. - Carestream Health, Inc.

Carestream Health provides medical imaging systems, including a wide range of digital radiography detectors, with a focus on delivering solutions for general radiology and point-of-care diagnostics.

Recent Developments

- In September 2025, NASA's acting administrator, Sean Duffy, has stirred discussions across government, business, and media circles with a striking analogy likening the ascent of the space economy to the formative years of the iPhone.(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Device Type

- Power ICs

- Power Modules

- Power Discrete Components (MOSFETs, IGBTs, Diodes, Rectifiers)

By Component

- DC–DC Converters

- Power Conditioning Units (PCUs)

- Solar Array Regulators

- Battery Charge/Discharge Regulators

- Solid-State Power Controllers (SSPCs)

- Others (Switches, Filters, Bus Systems)

By Voltage Range

- Low Voltage (<100 V)

- Medium Voltage (100 V–500 V)

- High Voltage (>500 V)

By Material

- Silicon (Si)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

By Application

- Satellite Power Systems

- Launch Vehicles

- Spacecraft & Deep Space Probes

- Space Stations

- Military & Defense Payloads

By End-User

- Commercial Space (Telecom, Earth Observation, Navigation)

- Government Space Agencies

- Defense & Military Programs

- Research & Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client