List of Contents

What is the Smart Transportation Market Size?

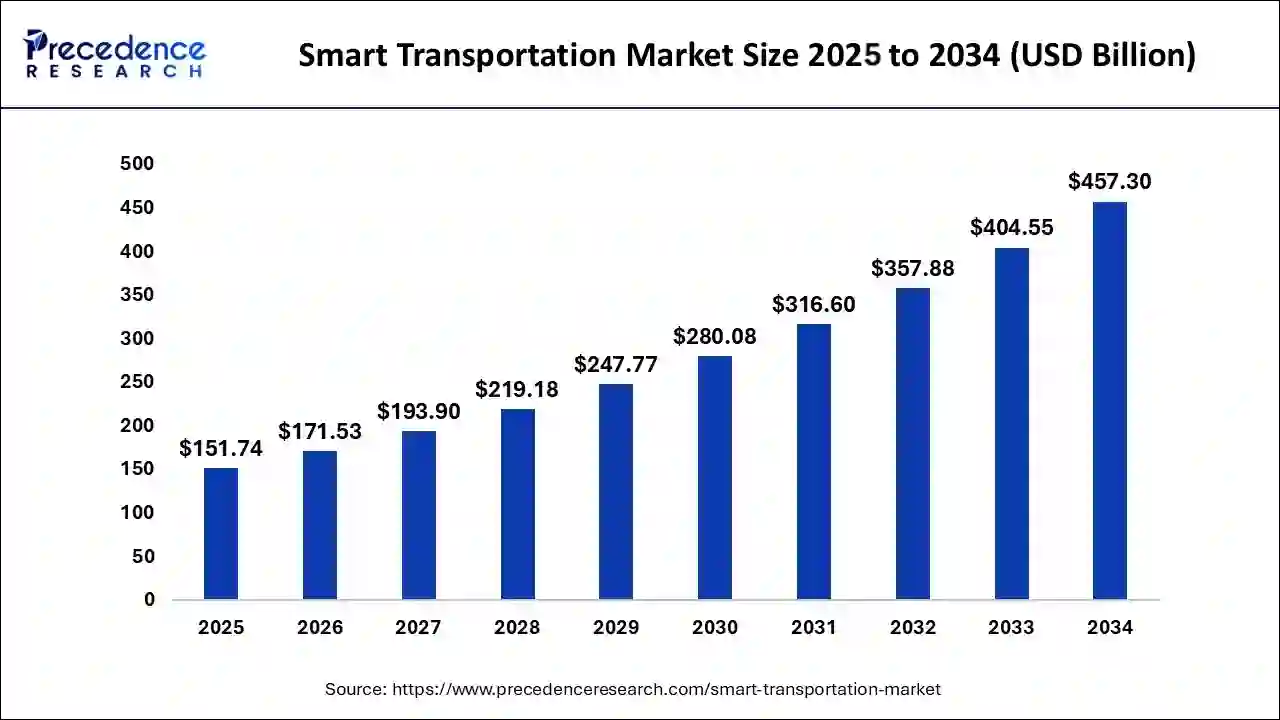

The global smart transportation market size is accounted at USD 151.74 billion in 2025 and predicted to increase from USD 171.53 billion in 2026 to approximately USD 457.30 billion by 2034, expanding at a CAGR of 13.04% from 2025 to 2034. The market growth is driven by the increasing demand for efficient transportation solutions and initiatives taken by governments to promote smart transportation.

Smart Transportation Market Key Takeaways

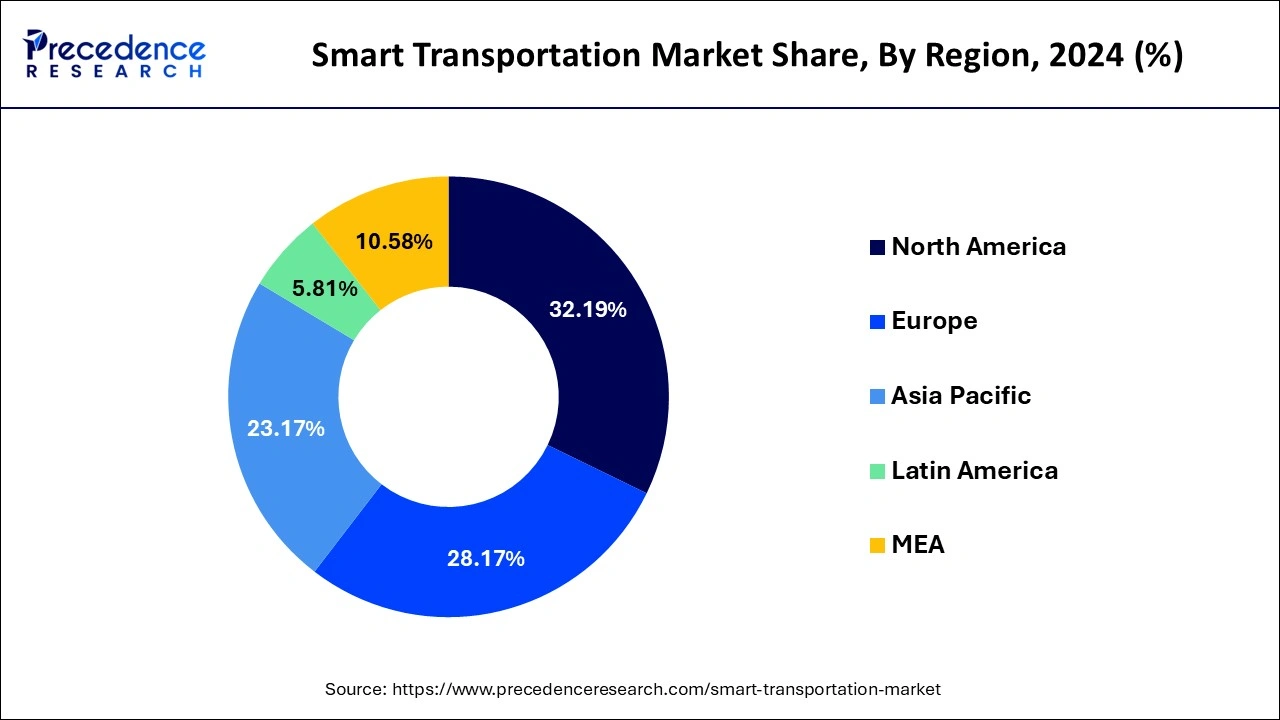

- North America dominated the global smart transportation market with the largest market share of 32.19% in 2024.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By solution, the traffic management systems segment contributed the highest market share in 2024.

- By solution, the parking management systems segment is expected to grow at a significant CAGR from 2025 to 2034.

- By service, the professional services segment captured the biggest market share in 2024.

- By service, the cloud services segments is estimated to be the fastest-growing segment during the forecast period.

Impact of Artificial Intelligence (AI) on the Smart Transportation Market

Integration of AI with conventional transportation systems is revolutionizing the transportation industry by addressing challenges like traffic congestion, road safety, and operational inefficiencies. AI-driven solutions like autonomous driving, predictive maintenance, and intelligent traffic management systems optimize urban mobility and logistics. AI collects real-time traffic data to assist traffic regulators in diverting traffic from congested regions, preventing traffic jams, and lowering collision risks. On the other hand, intelligent traffic systems improve safety and further minimize human error. AI supports efficient fleet management and contributes to more sustainable and smarter urban transportation networks.

The Future of Mobility: A Market Overview of Smart Transportation

Smart transportation is a term that refers to one of the most important and intelligent transportation system-based applications. The Internet of Things technology is used to connect it wirelessly. The technology's primary goal is to collect and control real-time data while also enhancing performance.

The growing demand among transportation authorities to develop smart solutions to control traffic and improve road and passenger safety is driving the growth of the smart transportation market. To improve transportation infrastructure, smart transportation systems incorporate multiple information and communication technologies such as global positioning systems, vehicle-to-grid infrastructure, fiber optics, and the Internet of Things.

Urbanization and globalization have driven the demand for smart railway software, which provides passengers with safety, dependable modern services, and operational efficiency. As the frequency of rail accidents has increased, smart sensor technologies in railway coaches that can detect faults in wheels, bearings, and railway tracks have become more important in preventing accidents. Governments from a variety of countries are also taking steps to construct smart railway networks and adopt new technologies.

Smart Transportation Market Growth Factors

- Increasing adoption of IoT, artificial intelligence (AI), and big data analytics to develop smart transportation boosts market growth.

- Rising government initiatives in smart city development contribute to market expansion.

- The rising awareness about the benefits of smart transportation further propels the growth of the market. It helps to combat urban challenges like increasing pollution and traffic congestion.

- With the growing city population, there are rising concerns about traffic congestion. This, in turn, boosts the demand for smart transportation solutions, like intelligent traffic management systems, which enable smart ways to manage traffic in crowded areas.

- Increasing environmental concerns due to internal combustion engines boost the demand for sustainable transportation solutions. Smart transportation systems, being sustainable and energy-efficient, provide efficient solutions for these concerns.

Market Outlook

- Industry Growth Overview: The growing demand among transportation authorities to develop smart solutions to control traffic and improve road and passenger safety is driving the growth of the smart transportation market.

- Sustainability Trends: Key sustainability trends in the market include the push for electrification and the integration of renewable energy sources to reduce emissions.

- Global Expansion: The Asia-Pacific region is projected to be the fastest-growing market, while North America and Europe currently hold the largest market shares.

- Major investors: Major investors and players in the market include global technology companies like Siemens, Huawei, and Cisco; transportation infrastructure and systems providers such as Alstom, Thales, and Kapsch.

- Startup Ecosystem: The smart transportation market is a rapidly expanding, technology-driven ecosystem, emphasizing enhancing efficiency, safety, and sustainability in urban mobility and logistics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 151.74 Billion |

| Market Size in 2026 | USD 171.53 Billion |

| Market Size by 2034 | USD 457.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Service, Transportation Mode, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rapid urbanization led to increased traffic congestion and heightened pollution levels, underscoring the urgent need for more efficient transportation systems. This, in turn, boosts the adoption of smart transportation systems. Advancements in technologies such as artificial intelligence (AI), the Internet of Things (IoT), big data, and 5G connectivity have paved the way for the development of more sophisticated and interconnected transportation solutions that can significantly enhance mobility within urban environments. Smart technologies play a crucial role in optimizing traffic flow, minimizing travel times, and improving the overall efficiency of transportation networks. For instance, AI algorithms can analyze real-time traffic data to adjust traffic signal timings, while IoT devices can monitor vehicle movements to identify patterns and predict congestion. By leveraging big data analytics, cities can better understand transportation trends and demand, allowing for more strategic planning and resource allocation.

Restraint

Implementing smart transportation systems necessitates substantial upfront investments in infrastructure, technology integration, and ongoing maintenance. Cities must allocate budgets to upgrade physical roadways, install advanced sensor networks, and ensure robust cybersecurity measures to protect sensitive data and systems. One major hindrance is cybersecurity threats, which pose a significant risk, as malicious attacks could disrupt critical services, compromise user safety, and undermine public confidence in these technologies. Stakeholders need to prioritize security protocols and develop resilient systems to mitigate these risks.

Opportunity

The development and deployment of autonomous vehicles, including cars and trucks, hold considerable promise for enhancing safety, efficiency, and accessibility in transportation. These vehicles are designed to reduce human error, which is a leading cause of accidents. They can provide increased mobility options for individuals with disabilities or those unable to drive. Integrating smart technologies into public transportation systems can further enhance service reliability and improve the overall passenger experience, consequently boosting market growth. Features such as real-time tracking, predictive maintenance, and mobile payment systems can reduce wait times, streamline operations, and make commuting more convenient and enjoyable for users.

Value Cain Analysis

- Raw Material Sourcing: The procurement, receipt, and management of raw materials such as steel, plastics, and electronics from suppliers to be used in the manufacturing of smart transport vehicles.

Key Players: ThyssenKrupp and Thales supply - Component Manufacturing: Processing and producing from raw materials and sub-component parts that either add value upon further assembly or are assembled into a final vehicle, such as engines, transmissions, or batteries.

Key Players: Bosch, Continental AG, Denso Corporation - Vehicle Assembly and Integration: An operational phase where all manufactured components are assembled and integrated with smart technology to produce a capable smart vehicle.

Key Players: Volkswagen AG, Toyota Motor Corporation, Mercedes-Benz - Testing and Quality Control: The evaluation of components and finished vehicles, including analytical testing, to ensure the standards for performance, safety, and quality are met, thereby providing a competitive edge.

Key Players: SGS, Intertek, Bureau Veritas, TÜV SÜD - Distribution to Dealers and OEMs: The strategic logistics activities involved in transporting and delivering finished vehicles to dealerships and other manufacturers for sale and further integration.

Key Players: DHL Supply Chain, CEVA Logistics - Retail Sales and Financing: The commercial phase of promoting, marketing, and selling smart vehicles directly to end customers while also undertaking financing arrangements and customer relationship management.

Key Players: Toyota Financial Services, Mercedes-Benz Financial Services (Daimler AG), and Volkswagen Financial Services

Solution Insights

The traffic management systems dominate the smart transportation market during the forecast period. The traffic management system options include route guidance systems, smart traffic lights, and the integration of CCTV cameras to offer real time information. The demand for traffic management technologies will increase as traffic volumes increase and current road infrastructure is used inefficiently.

On the other hand, the parking management systems segment is expected to grow at rapid pace during the forecast period. Among the solutions are installing sensors in the parking facilities to direct cars to available spots and offering information about on-street parking on each block via an application. These solutions result in less traffic congestion and greater efficiency in terms of maximizing parking capacity and revenue generation. As a result, these elements will contribute to the segment's growth.

Service Insights

The professional services dominate the smart transportation market in 2024. The surge in demand for consulting services is expected to propel the professional services category to significant growth during the forecast period. They help to modernize current infrastructure systems by providing implementation support, strategy formulation, and design advice. As a result, these factors will contribute to the growth of the segment during the forecast period.

On the other hand, in 2024, the cloud services segment had the biggest market share. The rising difficulty of capturing and handling the massive amounts of data created by mobile technology and sensors will drive demand for cloud services.

The smart transportation industry is highly fragmented, with a small number of major market players holding a significant part of the market. In terms of market share, the smart transportation market is currently dominated by a few significant competitors. These main market companies are working on increasing their consumer base across international countries, while local governments are focusing on improving transportation infrastructure. The different types of developmental strategies such as joint venture, investments, acquisition, business expansion, new product launches, partnerships, and mergers fosters market growth and offers lucrative growth opportunities to the smart transportation market players. The main smart transportation industry players are concentrating their efforts on expanding their operations in emerging markets. These firms have a history of introducing creative and innovative solutions to expand their product offerings in the smart transportation market.

Regional Insights

U.S. Smart Transportation Market Size and Growth 2025 to 2034

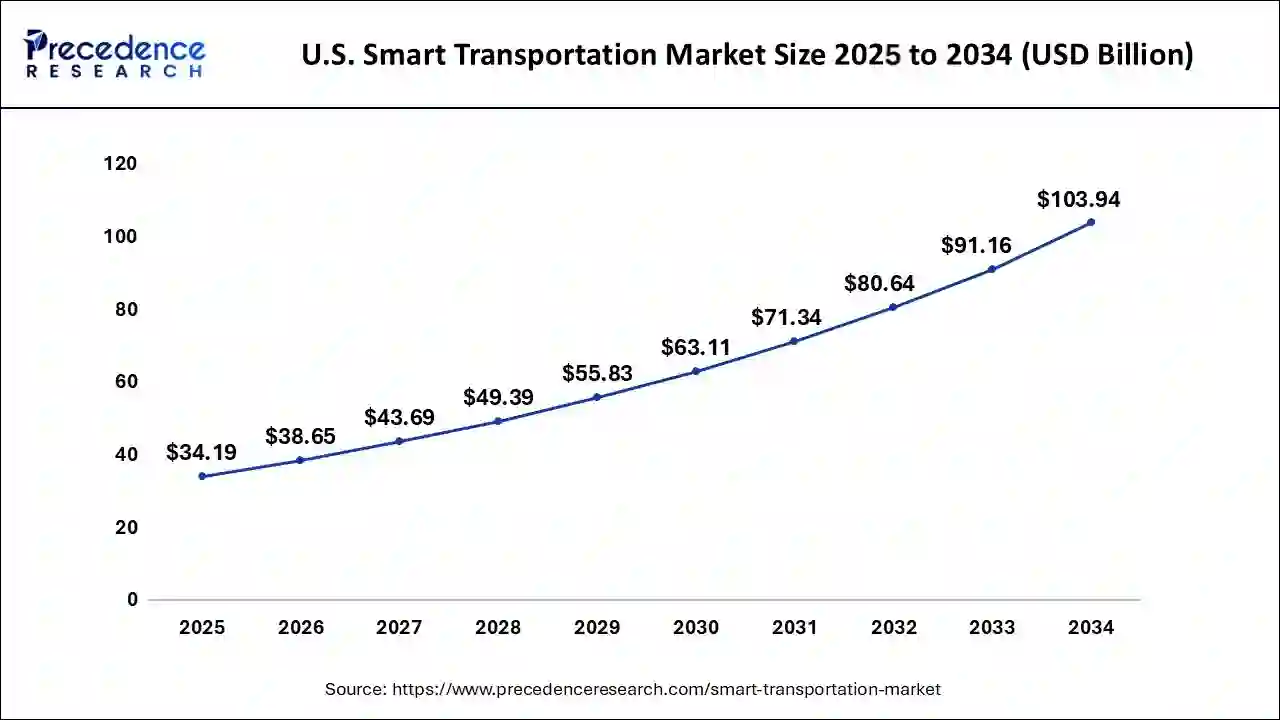

The U.S. smart transportation market size is evaluated at USD 34.19 billion in 2025 and is predicted to be worth around USD 103.94 billion by 2034, rising at a CAGR of 13.14% from 2025 to 2034.

North America dominated the global smart transportation market with the largest market share of 32.19% in 2024. In terms of technical acceptance and infrastructure development, North America is the most advanced region in the world. It is a major player in the smart transportation market. European countries have made significant investments in rail infrastructure maintenance and upgrades. In 2024, North America is expected to have the largest share of the global smart transportation market.

On the other hand, the Asia-Pacific region is expected to have a higher CAGR during the forecast period. It can be linked to regulatory policies that have aided the rapid development of smart transportation infrastructure in nations like South Korea and China.

How did Asia Pacific Thrive in the Smart Transportation Market in 2024?

The Asia-Pacific region is expected to have a higher CAGR during the forecast period. It can be linked to regulatory policies that have aided the rapid development of smart transportation infrastructure in nations like South Korea and China. Many regional governments are investing heavily in large-scale "smart city" projects that combine smart transportation systems to control urban populations.

Technological Advancements Fuel Market Growth in China

In the Asia Pacific, China led the market due to the rapid urbanization along with the extensive adoption of new technologies like AI, IoT, and big data. China's large population is also boosting the demand for integrated mobility services.

Role of Government Initiatives in Boosting the European Market

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the technological innovations, such as autonomous vehicles and IoT, coupled with the ongoing government initiatives to reduce emissions. Europe is home to major technology and automotive companies, which are investing heavily in smart transportation R&D.

How Germany is Leading the Market in Europe?

The growth of the market in Germany is driven by the growing demand to address congestion and sustainability. Germany leads in initiatives such as "Digital Rail Germany, which focuses on digitizing rail infrastructure utilities using systems such as ETCS.

Key Players' Offering

- Siemens: Offers Intelligent Transportation System (ITS) solutions that use big data analytics, AI, and cloud technologies to improve transportation network performance, reliability, and cost-effectiveness.

- Cisco: Delivers smart city transportation solutions that focus on secure and scalable digital infrastructure.

- Thales: Specializes in digital services for urban mobility, using big data and cloud technologies for decision-making.

Smart Transportation Market Companies

- Harris Corporation

- IBM Corporation

- Huawei Technologies Co. Ltd

- Veson Nautical

- Cubic Corporation

- Bentley Systems

- BASS Software

- Amadeus IT Group SA

- DNV GL

- Toshiba

Recent Developments

- In January 2025, the government of Odisha, India, announced that smart devices would soon be installed in all buses as a part of the state government's effort to ensure road safety and reduce accidents.

- In Nov 2023, FirstGroup Plc and Hitachi ZeroCarbon Ltd partnered to lead the UK's inclination for electrical buses as a part of the decarbonization program set by FirstGroup for their bus fleet and infrastructure. The aim of this collaboration is to provide batteries to support the expansion of First Bus's electric fleet, which further enhances air quality and improves consumer experience.

Industry Leader Announcements

- Sh. Zeyad bin Faisal Al Khalifa, Chief Government Affairs Officer, stc Bahrain:

The launch of Bahrain's first digital bus station is not just a technological upgrade — it is a strategic investment in the Kingdom's transport infrastructure and economic future. As Bahrain's main digital enabler, we are proud to support the government's digital transformation agenda by delivering intelligent, connected, and sustainable mobility solutions that serve the people, strengthen infrastructure, and drive national competitiveness. - T.G. Vishwa Prasad, Founder & CEO of People Tech Enterprise:

With THINQX, we are not just launching a vehicle—we are launching a movement. MASS will change how India thinks about transportation. We are proud to lead this change, and we are committed to building India's first fully integrated Mobility Valley in Andhra Pradesh — a hub for EV innovation, manufacturing, and mobility intelligence

Segments Covered in the Report

By Solution

- Ticketing Management System

- Parking Management & Guidance System

- Integrated Supervision System

- Traffic Management System

By Service

- Business

- Professional

- Cloud Services

By Transportation Mode

- Roadways

- Railways

- Airways

- Maritime

By Application

- Mobility as a Service

- Route Information and Route Guidance

- Public Transport

- Transit Hubs

- Connected Cars

- Video Management

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client