List of Contents

What is Smart helmet Market Size?

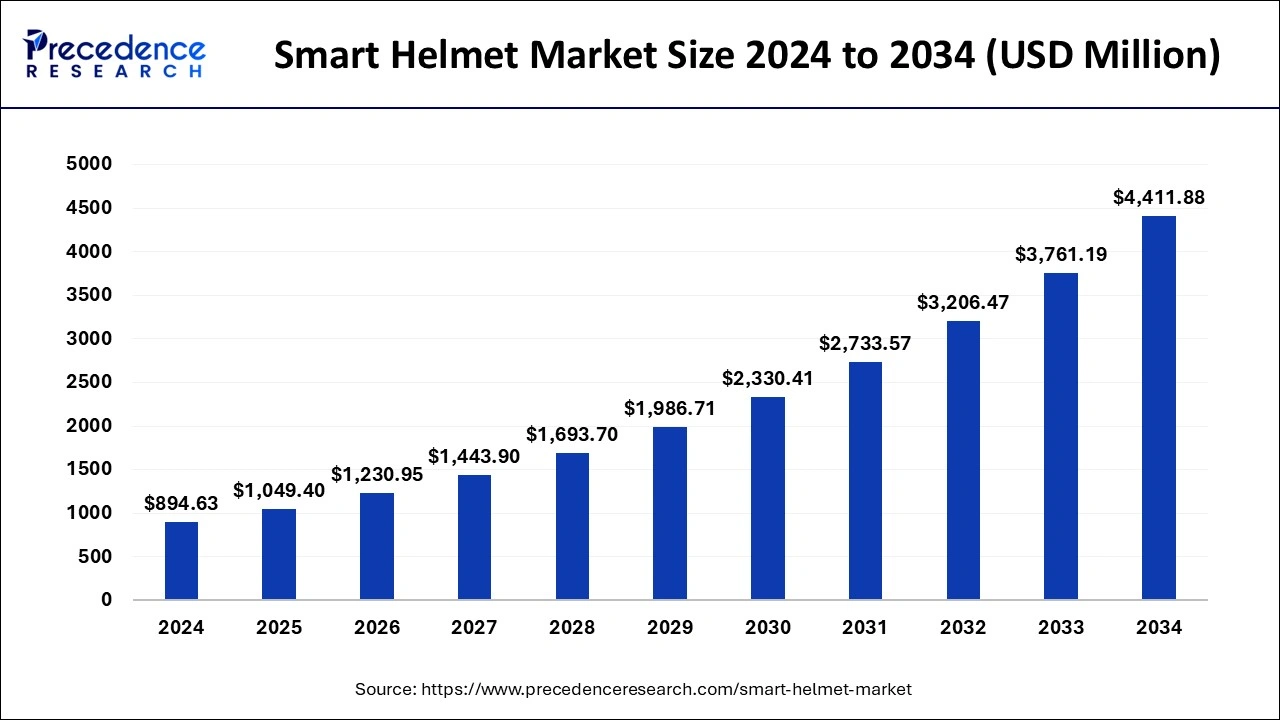

The global smart helmet market size is estimated at USD 1,049.40 million in 2025 and is anticipated to reach around USD 4411.88 million by 2034, expanding at a CAGR of 17.30% from 2025 to 2034.

Markrt Highlights

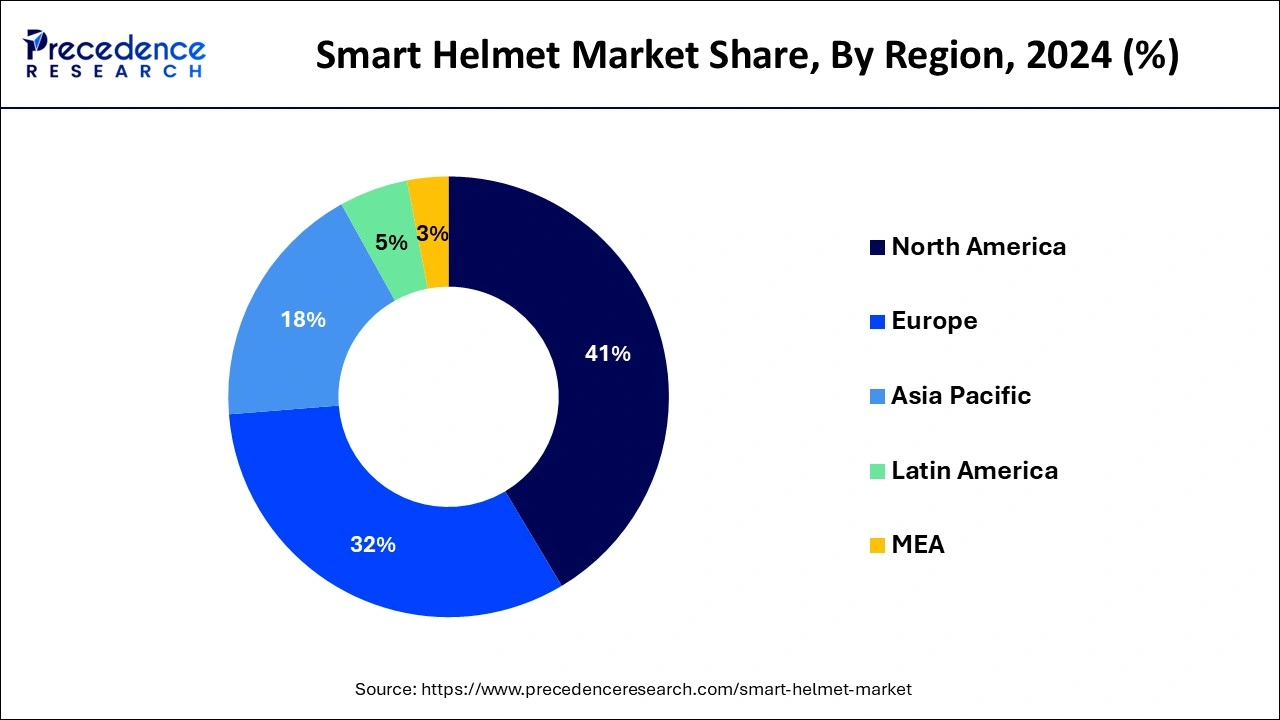

- North America dominated the global smart helmet market with the largest market share of 41% in 2024.

- Asia Pacific is expected to expand at a solid CAGR of 24.83% during the forecast period.

- By type, the full face segment contributed the highest market share of 59% in 2024.

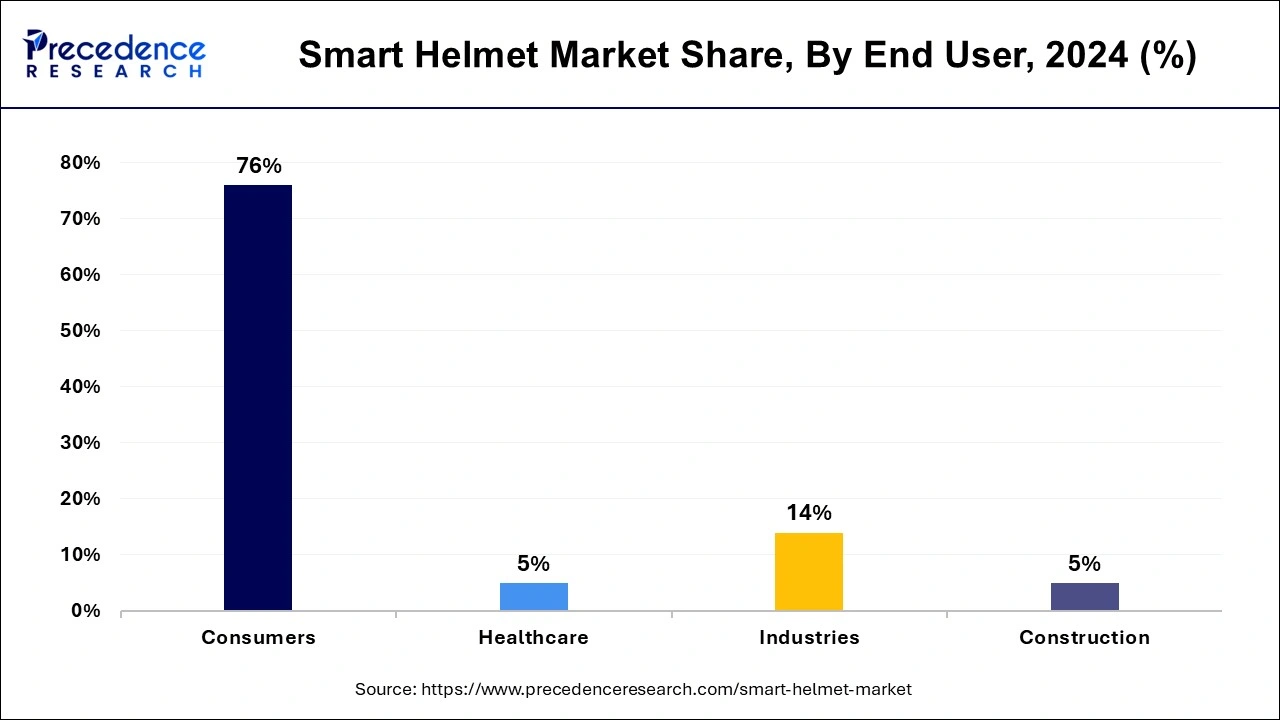

- By end user, the consumer segment accounted for the highest market share of 76% in 2024.

- By end user, the manufacturing segment is expected to grow at a notable CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 1,049.40 Million

- Market Size in 2026: USD 1,230.95 Million

- Forecasted Market Size by 2034: USD 4411.88 Million

- CAGR (2025-2034): 17.30%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Strategic Overview of the Global Smart Helmet Industry

The death of the people around the world due to road accidents is about 1.3 million and around 30 to 40 million people suffer major injuries that cause lifelong disabilities was generated in the report by World Health Organization. The seriousness of these accidents of the motorcycle riders can be reduced by 37% with the use of helmets. In the past, many lives have been saved due to the use of helmet. As is an increase of two wheeler sales, particularly in the middle class families and the changing preferences of the consumers for the protection and comfort provided by these types of helmets are some of the driving factors for this market. Many nations across the world are making mandates on wearing the helmets while driving. In order to cut down the tragic deaths or head injuries that could lead to death across the world.

Artificial Intelligence: The Next Growth Catalyst in Smart Helmet

Artificial Intelligenceis fundamentally transforming the smart helmet market by enhancing safety from a reactive to a proactive system. By processing real-time data from integrated sensors and cameras, AI algorithms can predict and alert users to potential hazards, such as fast-approaching vehicles or dangerous gas leaks, before an accident happens.

AI also enables crucial hands-free operation through voice commands, a 360-degree field of vision, and automatic emergency response systems that send location data to first responders in case of a crash. Beyond immediate safety, AI analyzes behavioral and environmental data to monitor for fatigue or distraction, providing insights that help industries improve long-term safety protocols and ensure regulatory compliance.

Smart helmet Market Growth Factors

The motorcycles or the bicycles are safe as compared to cars in case there is an accident. So the helmet is used to minimize the likelihood of any severe head or brain injuries. That could affect the person. So these happen to be the driving factors. Also, wearing the motorcycle helmet reduces the risk of death by almost 40% and reduces the 70% risk of injuries. There are improvements in the policies which are aiming to reduce the road traffic accidents in the years. By promoting the use of motorcycle helmets. Also, when he incentives are provided for the helmet suppliers to produce advanced helmets for the protection of the consumers. So the stringent government rules and safety regulations across the nations is helping the market grow. This is an increased utilization of motorcycles and bicycles. Road traffic accidents may not be avoided, but the death and fatal injuries caused by those accidents can certainly be prevented with the use of these safety helmets. In the low income countries, the middle class people opt for motorcycles as this happens to be the popular means of travel. The motorcycle users are at an elevated risk of being injured if there is a crash between the motorcycle and heavier vehicles and there is also an increase in the number of head injuries and fatalities due to the use of the motorcycles.

Market Outlook

- Market Growth Overview: The Smart Helmet market is expected to grow significantly between 2025 and 2034, driven by the increasing safety concerns, stringent regulations, and the rapid integration of AI and AR technologies. Strong growth is projected across consumer (motorcycle, cycling) and industrial (construction, mining) segments as advanced features like real-time monitoring and communication become standard.

- Sustainability Trends: Sustainability trends focus on emerging through the use of eco-friendly materials like recycled plastics and natural fibers. Manufacturers are focusing on energy-efficient designs with optimized battery life and exploring modular structures to extend product lifespan and reduce e-waste.

- Major Investors: Major investors in the market include Sony, Qualcomm Incorporated, Google (Alphabet Inc.), and General Electric (GE).

- Startup Economy: The startup economy in the market is focused on technology-driven solutions, using AI, AR, and IoT to develop specialized safety and communication features for niche consumer and industrial segments

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD4411.88 Million |

| Market Size by 2025 | USD 1,049.40 Million |

| Market Size by 2026 | USD 1,230.95 Million |

| Growth Rate from 2025 to 2034 | CAGR of 17.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Type, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

On the basis of the technology used the market is segmented in to the helmets that have Bluetooth connectivity, signal indicator and brake function, communication system, integrated video camera, contact list, temperature measurement. Integrated Communication system segment of the helmet is expected to dominate the market in the future. The ICS is incorporated in smart helmets for all functions and applications to be controlled with the help of voice orders. So when a phone is connected to a helmet. Various functions can be performed hands-free simply by talking to the operator through the microphone, which is present in the helmet, and it will help in finding direction, making call and performing many other functions. Apart from this sub segment, in the contact list temperature measurement segment is also expected to grow. The helmets are integrated with thermal imaging solutions which helps in checking the elevated body temperatures of the person this feature was used during the COVID pandemic.

Type Insights

Based on the type of helmet the market is segmented as open face, full face and half head. Out of these three, the full face segment contributed the highest market share of 59% in 2024 and it will continue to grow during the forecast. By wearing a full face helmet, the users are able to keep their head safe from any road accidents or hazards. As it provides an articulating mask, the full face helmet helps to prevent the wind and the dirt from touching the eyes. The open face helmet is expected to grow at a good rate in the future as it provides a better visibility and flexibility compared to the full face helmet, these properties are attributed to the increase in its sales.

End User Insights

On the basis of the user, the market can be divided into the consumers, the industry sectors, healthcare, construction industries and many more. Out of all these, the consumer segment accounted for the highest market share of 76% in 2024 and it is expected to grow during the forecast.

As people riding their bikes, bicycles or motorcycles have safety concerns due to increased road fatalities, this segment is expected to grow. There's an increased demand for advanced helmets in the healthcare industry and it is expected to grow during the forecast. During the pandemic in UAE, Italy and China, the authorities had adopted fast screening fever detector helmet which enabled them in screening the body temperatures and they were the main players during COVID-19.

Regional Insights

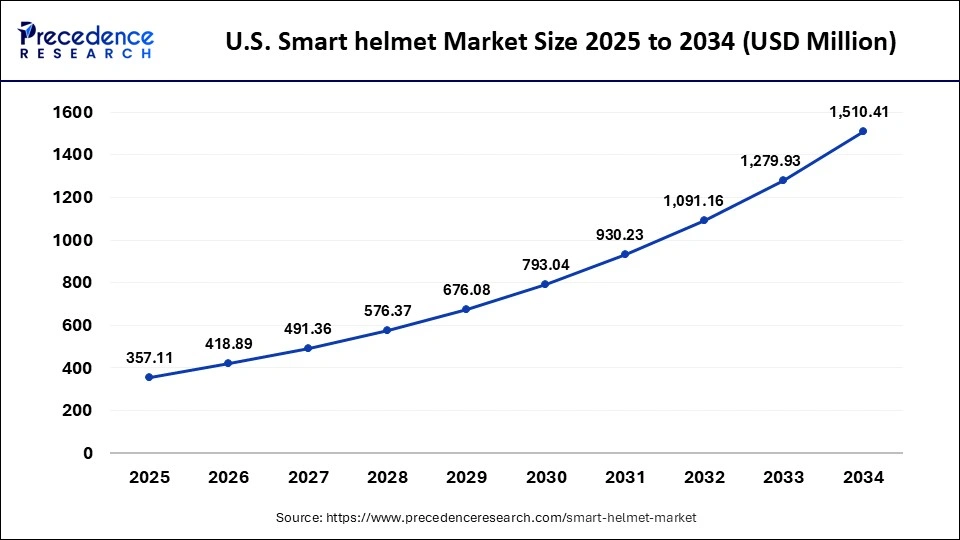

U.S. smart helmet Market Size and Growth 2025 to 2034

The U.S. smart helmet market size is evaluated at USD 357.11 million in 2025 and is predicted to be worth around USD 1510.41 million by 2034, rising at a CAGR of 17.37% from 2025 to 2034.

U.S. Smart Helmet Market Trends:

The U.S. has stringent industrial safety regulations and high consumer awareness of advanced safety features. The market's expansion is characterized by the increasing integration of AI and AR technologies for proactive hazard detection, communication, and navigation across industrial and consumer applications.

How Did North America Dominate the Smart Helmet Market?

North America dominated the global smart helmet market with the largest market share of 41% in 2024. The engineers and the governments are initiating various campaigns to promote the use of the helmet amongst the people especially those who ride bicycles and motorcycles. Demand for the helmet has increased as there are new bikes that are launched in the market. Also electronic bikes that are launched in the market so there's a great opportunity provided for the manufacturers of the helmet. In order to widen their portfolio and meet the continuous demand. In order to ensure greater safety more research and development activities are undertaken by various nations.

In the Asia Pacific region or other developing nations, the motorcycle industry has led to a significant increase in the sales of the helmets. Rapid urbanization and emerging economics like India and China have maximum users of two wheelers and also the manufacturing sector in this area happens to be the key driver for the sales of the helmets. The construction workers and firefighters are also adopting advanced wearable technology in order to ensure their safety, similar trends are seen across the markets in Africa and Middle East. The local strict rules in developing nations for motorcycles helmets are leading to a growth in the market. Apart from all these factors and increased traffic condition due to four Wheelers and the cost of transport that had increased have led to an upsurge in the manufacturing and sales of motorcycles and thereby increasing the sales of the helmets or demand for the helmets.

China Smart Helmet Trends:

China has extensive technology integration (including AI, IoT, and 5G) and the dominant consumer demand from a vast population of two-wheeler users. Government backing and a strong local manufacturing ecosystem accelerate product innovation and competitive pricing across both consumer and industrial segments.

Smart Helmet Market Value Chain Analysis:

1. Technology & Component Manufacturing

This foundational stage involves the design and production of the high-tech components that make a helmet "smart," such as sensors (GPS, motion, gas), cameras, communication modules (Bluetooth, Wi-Fi, 5G), and heads-up displays (HUDs) for Augmented Reality (AR). Key players are primarily tech companies and specialized sensor manufacturers focused on R&D, miniaturization, and component reliability.

Key Players: Bosch Sensortec, Qualcomm Incorporated, Sony, Vuzix Corporation, Microsoft (Hololens tech).

2. Hardware Integration & Manufacturing

At this stage, traditional helmet manufacturers integrate the electronic components into the physical helmet shell, ensuring functionality, durability, and compliance with safety standards (e.g., DOT, OSHA, CE). This requires specialized engineering to balance the added weight of electronics with comfort and safety performance.

Key Players: LIVALL (Shenzhen Qianhai LIVALL IOT Co., Ltd), Babaali, Forcite Helmet Systems, Sena Technologies, Inc., 3M Company, Coros Global Inc.

3. Software & Application Development

In this stage, tech firms and the helmet manufacturers themselves develop the software and mobile applications that power the smart features, such as data analytics, AI-driven alerts, navigation, and seamless connectivity. This software is crucial for interpreting sensor data, managing user interfaces, and ensuring a smooth user experience.

Key Players: Google (Android integration), Apple (iOS integration), specialized software developers (often internal teams of helmet manufacturers), AI firms.

4. Distribution & Sales

The finished smart helmets are distributed through various channels, including direct-to-consumer (D2C) online platforms, e-commerce giants, specialty retail stores (e.g., motorcycle shops, safety equipment suppliers), and enterprise sales teams for industrial applications. This stage focuses on logistics, market reach, and providing product education to consumers and B2B clients.

Key Players: Amazon, Alibaba Group, specialized B2B industrial suppliers (e.g., Grainger, Fastenal), and the D2C sales channels of manufacturers like Forcite or LIVALL.

Smart Helmet Market Companies

- DAQRI: DAQRI was a major player in the industrial smart helmet space, primarily focused on augmented reality (AR) technology for workers in industries like construction and manufacturing. Their helmets integrated sensors and cameras to provide real-time data overlays and enhance situational awareness, though the company is no longer active in this market.

- Sena Technologies Inc: Sena is a global leader in Bluetooth communication systems, contributing to the market by producing integrated communication modules for motorcycle helmets. They offer smart helmets with features like intercom systems, premium audio, and AI-based noise cancellation, enhancing safety and connectivity for riders.

- Forcite helmet systems: Forcite developed a pioneering smart motorcycle helmet that integrated a heads-up display and camera, providing riders with visual alerts for road hazards, navigation, and traffic. Their focus on an advanced rider assistance system (ARAS) was aimed at proactively improving safety and the riding experience.

- Bell Sports Inc.: A prominent American helmet manufacturer, Bell contributes to the market by producing high-quality helmets for motorsports, motorcycling, and cycling that incorporate advanced safety technologies. While primarily known for its traditional helmets, the company is listed as a major player in the smart helmet space, likely indicating its continued focus on integrating new technologies.

- TORC helmets: TORC Helmets participates in the market by offering motorcycle helmets that include integrated technology like speaker pockets and high-quality materials. The brand focuses on combining rider safety with modern connectivity and comfort features to meet the demands of tech-savvy motorcyclists.

- Lumos helmet: Lumos focuses specifically on smart helmets for urban mobility, primarily targeting cyclists and e-bike users. Their products are distinguished by integrated, highly visible LED lights, turn signals, and automatic brake lights that significantly enhance rider safety on the road.

Recent Developments

- Jarvis Pink launched a series of intelligent helmets with a variety of technology integration such as noise reduction, Bluetooth and Wi-Fi networking, built-in memory, and voice modulation for a comfortable on-road experience to the riders.

- Foresight Helmet Systems launched a smart motorcycle helmet, which incorporated an LED light strip, a wide-angle camera, VOIP intercom and a Bluetooth unit.

- DAQRI, A leading helmet manufacturer, partnered with another company, the collaboration incorporates longstanding experience of Ubimax which has a technologically advanced AR, SmartGlass hardware and gives consumers a greater ability to understand the importance of AR in various business processes.

- LIVALL, a manufacturer of helmet provided a smartphone connected cycling safety helmet for outdoor enthusiasts. Sena Technologies launched an helmet with the smartphone connectivity communication system and other features that provide superior experience to the customers.

Segments covered in the Report

By Technology

- Integrated video camera.

- Integrated communication system

- Bluetooth connectivity

- Contact list temperature measurement

- Signal indicator and brake function

By Type

- Full Face

- Open Face

- Half Head

By End User

- Consumers

- Health care

- Industries

- Construction

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client