List of Contents

What is the Skin Rejuvenation Devices Market Size?

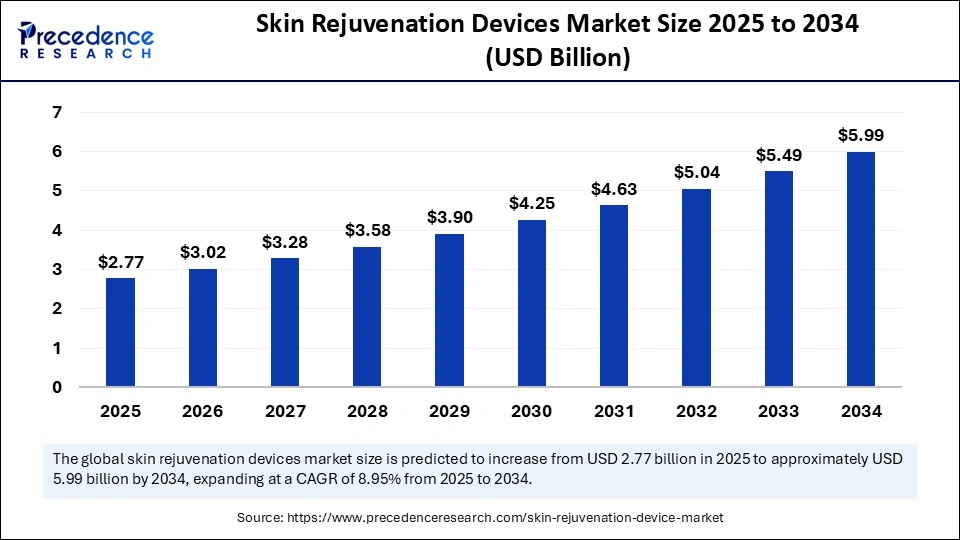

The global skin rejuvenation devices market size accounted for USD 2.54 billion in 2024 and is predicted to increase from USD 2.77 billion in 2025 to approximately USD 5.99 billion by 2034, expanding at a CAGR of 8.95% from 2025 to 2034.

Market Highlights

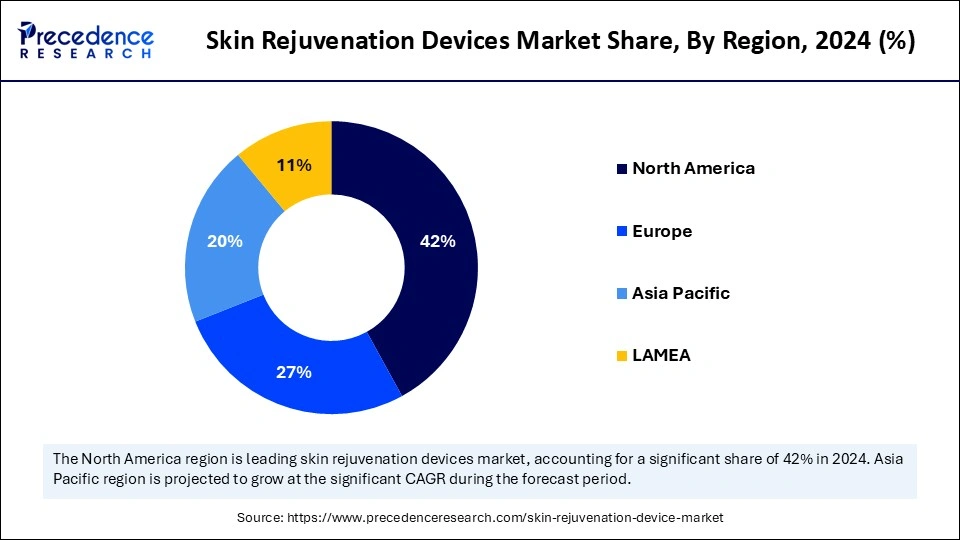

- North America led the market in 2024 while holding 42% of the market share.

- Asia Pacific is seen to grow at the fastest rate during the forecast period.

- By product/device type, the laser and IPL platforms segment led the market with 48% share in 2024.

- By product/device type, the combination/hybrid platforms segment is observed to be the fastest growing during the forecast period.

- By technology, ablative fractional segment dominated the market with the largest share in 2024.

- By technology, the microneedle segment is expected to be the fastest growing during the forecast period.

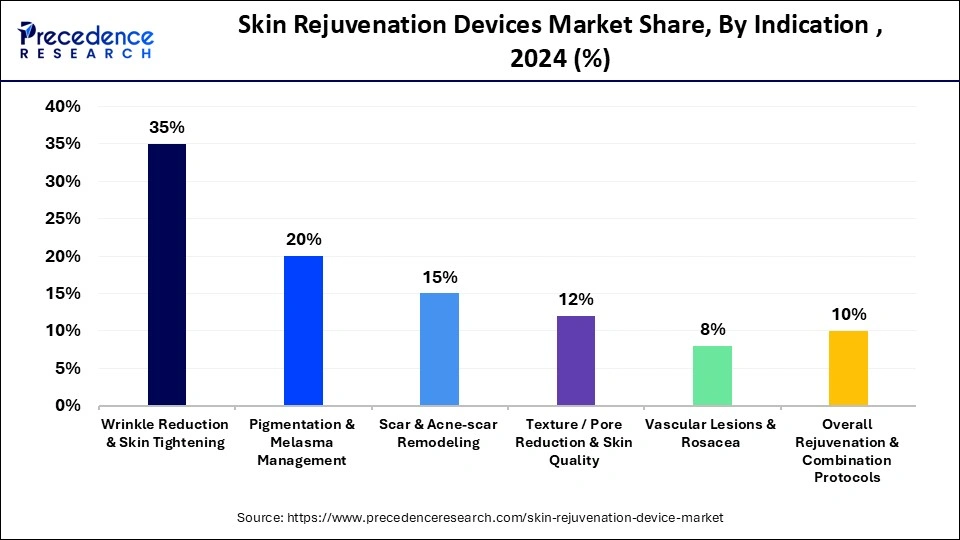

- By indication/clinical use, the wrinkle reduction and skin tightening segment dominated the market with 35% share in 2024,

- By indication/clinical use, the scar and acne-scar remodeling segment is seen to grow at the fastest rate during the forecast period.

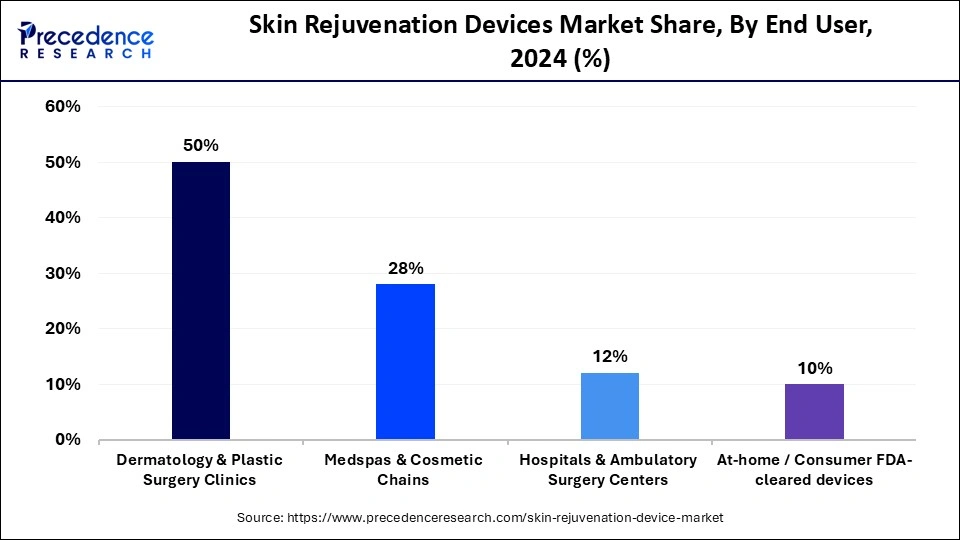

- By end user/channel, the dermatology and plastic surgery clinics segment dominated the market with 50% share in 2024.

- By end user, the medspas and cosmetic chains segment is observed to be the fastest growing during the forecast period.

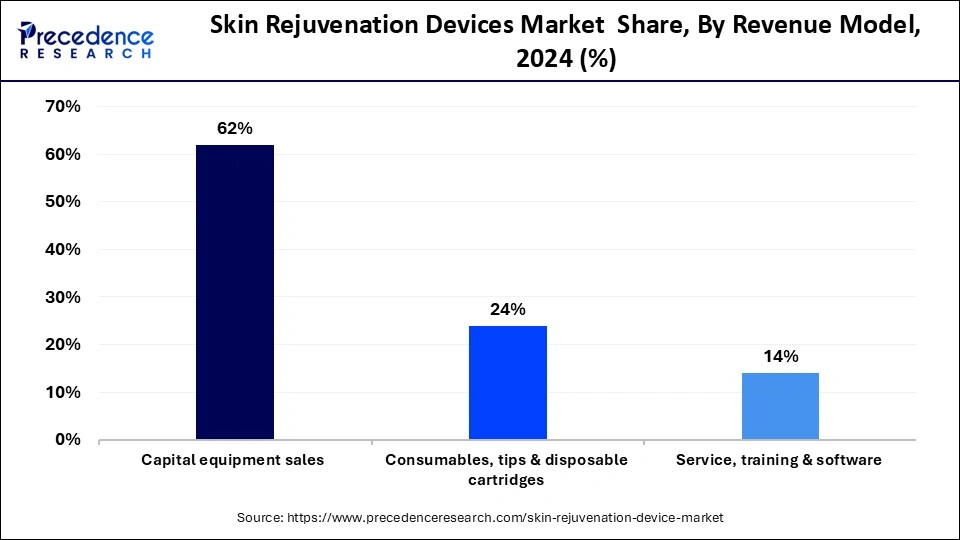

- By revenue model, the capital equipment sales segment held 62% share while dominating the market in 2024.

- By revenue model, the consumables, tips and disposable cartridges segment is expected to be the fastest growing.

Market Size and Forecast

- Market Size in 2024: USD 2.54 Billion

- Market Size in 2025: USD 2.77 Billion

- Forecasted Market Size by 2034: USD 5.99 Billion

- CAGR (2025-2034): 8.95%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The skin rejuvenation devices market covers capital equipment, handpieces, and adjunct consumables used to improve skin appearance and health, reducing wrinkles, treating pigmentation, evening texture, removing scars, improving vascular lesions, and restoring skin tone. Devices span lasers (ablative & non-ablative), intense pulsed light (IPL), radiofrequency (including microneedle RF), microneedling platforms, HIFU, light/LED therapy, cryotherapy and fractional technologies. Revenue drivers include capital system sales, recurring disposable tips/cartridges, service & maintenance contracts, procedure volumes in clinics/medspas, and growing patient demand for minimally invasive, low-downtime treatments.

Role of AI in Skin Rejuvenation Devices?

The role of Artificial Intelligence (AI) in skin rejuvenation devices is becoming increasingly transformative, enhancing both the effectiveness and user experience of treatments. AI enables personalized skincare by analyzing individual skin conditions such as texture, pigmentation, wrinkles, and hydration levels through integrated sensors or connected apps. This real-time analysis allows devices to customize treatment settings for optimal results, adjusting intensity, duration, or treatment mode based on the user's unique skin profile.

Moreover, AI-powered devices often include progress tracking and feedback systems, helping users monitor improvements over time and receive tailored skincare recommendations. For professionals, AI assists in diagnostic accuracy and treatment planning, improving outcomes while reducing the risk of adverse effects.

What are the Latest Trends in the Skin Rejuvenation Devices Market?

Growing Demand for At-Home Devices

Consumers are increasingly preferring at-home skin rejuvenation devices due to convenience, cost-effectiveness, and privacy. Portable LED masks, microcurrent tools, and radiofrequency (RF) devices are gaining popularity among consumers who want professional-like results without visiting clinics.

Integration of AI & Smart Technology

Manufacturers are incorporating AI-driven personalization and app connectivity into skin rejuvenation devices. These smart systems can analyze skin conditions, customize treatment protocols, track progress, and recommend skincare routines.

Rise in Non-Invasive & Minimally Invasive Procedures

There's a strong shift from surgical to non-invasive options using energy-based devices like IPL, RF, ultrasound, and laser-based systems. These deliver visible results with minimal downtime, making them more attractive to a wider demographic.

Combination Technologies for Enhanced Results

New devices often combine multiple modalities such as RF + microneedling, or IPL + cooling systems to improve efficacy and expand treatment versatility for issues like pigmentation, wrinkles, and texture.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 2.54 Billion |

| Market Size in 2025 | USD 2.77 Billion |

| Market Size in 2034 | USD 5.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.95% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product / Device Type, Technology, Indication / Clinical Use, End User / Channel, Revenue Model / Component, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Market Driver

Rising Demand for Non-Invasive Aesthetic Procedures

The Skin Rejuvenation Devices Market is strongly driven by the growing preference for non-invasive and minimally invasive treatments. Consumers are increasingly choosing these procedures because they offer effective skin improvement with minimal downtime, lower risk, and cost advantages compared to surgical options. Technologies such as radiofrequency (RF), intense pulsed light (IPL), and ultrasound are widely favored for addressing wrinkles, pigmentation, and skin laxity. Devices like Thermage FLX and InMode's Morpheus8 are gaining traction in clinics worldwide and even for at-home use, fueled by the rising trend of “prejuvenation” among younger age groups who seek preventive skin care.

Market Restraint

High Cost of Advanced Devices

A major restraint facing the Skin Rejuvenation Devices Market is the high cost of sophisticated equipment. Professional-grade devices often come with hefty price tags, ranging from $20,000 to over $100,000, which limits their adoption by smaller clinics and practitioners, especially in developing regions. Additionally, ongoing costs such as maintenance, consumables, and operator training add to the financial burden. This high cost barrier restricts broader market penetration in emerging economies where budget constraints are a significant challenge, slowing down overall growth despite rising demand.

Opportunity

Expansion of At-Home Skin Rejuvenation Devices

The rapid growth of the at-home skin rejuvenation market presents a significant opportunity for manufacturers and brands. Fueled by the post-pandemic emphasis on self-care and DIY beauty routines, consumers are seeking portable, easy-to-use, and affordable devices that deliver clinical results without needing professional assistance. Brands like NuFACE Trinity+ and Dr. Dennis Gross DRx SpectraLite have successfully tapped into this trend by offering FDA-cleared, app-connected devices that combine convenience with effective skin treatments. This segment's growth potential is amplified by innovations in smart technology and subscription models, creating new revenue streams and expanding market accessibility.

Segmental Analysis

Product/Device Type Insights

The laser and IPL platforms segment led the market with a 48% share in 2024. Laser and IPL devices have become staples in dermatology due to their versatility and ability to treat a wide range of skin concerns including pigmentation, vascular lesions, acne scars, and skin texture irregularities. These platforms provide targeted treatment by delivering energy that stimulates collagen production and promotes skin regeneration, with minimal downtime and high patient satisfaction.

Technological advancements such as improved cooling systems, pulse modulation, and wavelength specificity have enhanced treatment safety and efficacy, driving their widespread use in clinics and medspas. Additionally, many dermatologists prefer laser/IPL treatments because they can customize protocols to suit different skin types and conditions, further boosting market dominance.

The combination/hybrid platforms segment is observed to be the fastest growing during the forecast period. These platforms merge multiple technologies such as radiofrequency (RF) combined with microneedling or IPL with fractional laser to provide synergistic effects that improve treatment outcomes. By addressing multiple skin concerns simultaneously, hybrid devices reduce the need for multiple sessions and offer greater versatility. Their ability to deliver customized, comprehensive treatments appeals to both practitioners looking for multi-functional tools and consumers desiring efficient procedures with better results. This growing preference for combination therapies is driving rapid adoption and fueling innovation in this segment, positioning it as the fastest-growing product category.

Technology Insights

The ablative fractional segment dominated the market with the largest share in 2024. Ablative fractional lasers work by creating microscopic columns of thermal damage in the skin, stimulating the body's natural healing process and collagen production. This technology is highly effective in treating deep wrinkles, acne scars, surgical scars, and uneven skin texture, offering dramatic and long-lasting results.

Despite requiring some downtime, the superior efficacy of ablative fractional treatments makes them highly sought after in both dermatology clinics and plastic surgery centers. Manufacturers continuously improve these devices by refining energy delivery and minimizing side effects, which sustains their market leadership.

The microneedle segment is expected to be the fastest growing during the forecast period. Microneedling devices create controlled micro-injuries that stimulate collagen and elastin production with minimal epidermal damage. When combined with radiofrequency or infused serums, these treatments enhance skin tightening, texture, and scar remodeling with reduced downtime compared to ablative methods.

The minimally invasive nature, affordability, and safety profile make microneedling highly appealing to a broader demographic, including younger consumers and those hesitant about laser procedures. This increasing adoption in clinics, medspas, and even at-home settings is driving rapid growth in the microneedle technology segment.

Indication/Clinical Use Insights

The wrinkle reduction and skin tightening segment dominated the market with a 35% share in 2024. The demand for anti-aging treatments is driven by the increasing aging population worldwide and the desire among younger individuals to adopt preventive skin care measures, a trend known as “prejuvenation.” Wrinkle reduction and skin tightening procedures help restore skin elasticity, reduce fine lines, and improve overall skin firmness, contributing to a more youthful appearance. Innovations in energy-based devices like RF, ultrasound, and fractional lasers have improved treatment efficacy with minimal side effects, further fueling this segment's growth. Clinics and medspas heavily promote these treatments due to their broad appeal and visible outcomes, reinforcing market dominance.

The scar and acne-scar remodeling segment is seen to grow at the fastest rate during the forecast period. Acne and traumatic scars affect millions globally, creating substantial demand for effective treatment options. Technological advancements in laser therapy, microneedling, and RF treatments that specifically target scar tissue by promoting collagen remodeling and skin regeneration have made these therapies more accessible and effective.

Additionally, increasing awareness about available treatment options and the psychological impact of scarring is encouraging more patients to seek professional care. This expanding patient pool, along with improved clinical outcomes, supports rapid growth in this clinical indication.

End User/Channel Insights

The dermatology and plastic surgery clinics segment dominated the market with a 50% share in 2024. These clinics are equipped with advanced devices and staffed by specialized medical professionals capable of administering a broad range of skin rejuvenation treatments safely and effectively.

Patients often prefer medically supervised settings due to the assurance of expertise, customized treatment plans, and access to the latest technologies. The growing demand for complex and combination therapies that require clinical oversight further consolidates the position of these clinics as primary service providers in the market.

The medspas and cosmetic chains segment is observed to be the fastest growing during the forecast period. Medspas offer a more accessible and affordable alternative to traditional clinics, attracting a wider demographic that includes younger consumers and first-time aesthetic treatment seekers. These facilities emphasize convenience, minimal downtime procedures, and non-invasive treatments that fit modern lifestyle preferences.

Revenue Model Insights

The capital equipment sales segment held 62% share while dominating the market in 2024. Capital equipment sales represent the primary source of revenue as clinics, medspas, and cosmetic chains invest heavily in purchasing sophisticated skin rejuvenation devices to offer a wide array of treatments. These high-value one-time purchases are critical for establishing treatment capabilities and attracting patients seeking advanced options. The steady development of new device models with enhanced features drives continuous investment in capital equipment.

The consumables, tips, and disposable cartridges segment is expected to be the fastest growing during the forecast period. Consumables are essential for the operation of many skin rejuvenation devices, such as replacement tips for microneedling pens, laser handpieces, or RF cartridges. The recurring nature of these purchases ensures a continuous revenue stream for manufacturers, often at higher margins compared to the equipment itself. Increasing treatment volumes worldwide, strict hygiene protocols, and patient preferences for single-use components are key factors fueling growth in this segment, making it an attractive area for long-term business expansion.

Regional Insights

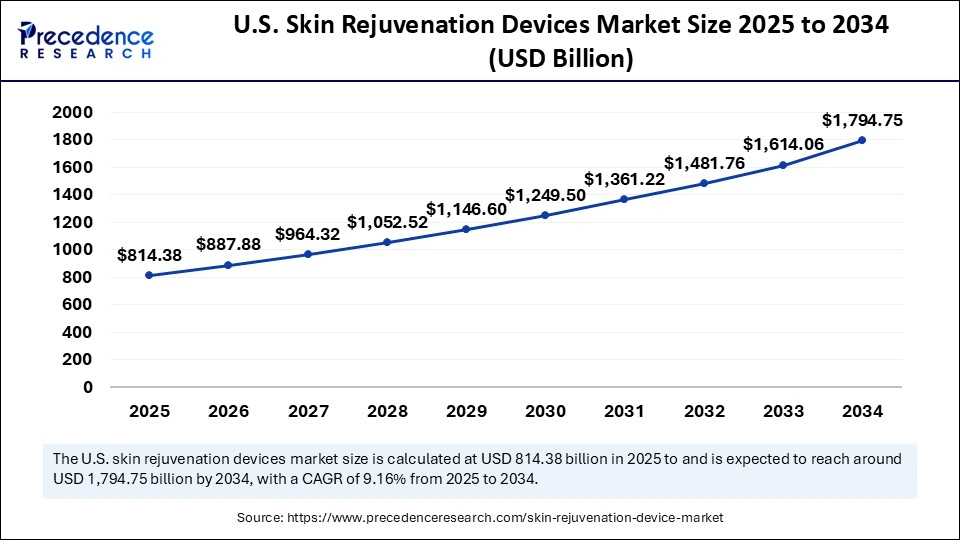

U.S. Skin Rejuvenation Devices Market Size and Growth 2025 to 2034

The U.S. skin rejuvenation devices market size was exhibited at USD 746.67 billion in 2024 and is projected to be worth around USD 1,794.75 billion by 2034, growing at a CAGR of 9.16% from 2025 to 2034.

North America led the market in 2024, holding 42% of the market share. This leadership is supported by advanced healthcare infrastructure, high consumer awareness, and widespread adoption of skin rejuvenation treatments across the U.S. and Canada. The presence of major market players and continuous innovation further strengthen North America's dominance in this space.

Furthermore, North America benefits from well-established regulatory frameworks that facilitate the faster introduction of innovative devices. Additionally, increasing prevalence of skin aging concerns among the aging population and the growing trend of younger individuals seeking “prejuvenation” treatments contribute to sustained demand. The combination of these factors creates a robust ecosystem for the growth of skin rejuvenation devices in this region.

Asia Pacific is seen to grow at the fastest rate during the forecast period, driven by rising disposable incomes, expanding urbanization, increased and growing acceptance of aesthetic treatments in countries like China, India, South Korea, and Japan. Additionally, the rise of medical tourism in this region, driven by cost-effective yet high-quality aesthetic treatments, is expanding the customer base.

The increasing penetration of advanced technologies in emerging markets, coupled with growing urbanization and changing beauty standards, is accelerating adoption. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing awareness about non-invasive cosmetic procedures are supporting market growth. This dynamic environment positions the Asia Pacific as the fastest-growing market in the coming years.

Recent Developments

- In April 2025, Bausch Health (via its aesthetics arm, Solta Medical) unveiled its new Fraxel FTX™ skin resurfacing laser system at the ASLMS (American Society for Laser Medicine & Surgery) conference. It is a dual‑wavelength fractional laser combining 1550 nm erbium‑glass and 1927 nm thulium wavelengths to treat both superficial and deeper skin layers.

- In April 2025, Candela Corporation launched Vbeam Pro, a new laser platform targeting vascular and dermatologic conditions. The device incorporates a 595 nm pulsed dye laser plus a 1064 nm Nd:YAG wavelength, offering flexibility in treating a variety of skin issues.

Skin Rejuvenation Devices Market Companies

- Lumenis

- Candela / Syneron Candela

- Cutera

- Alma Lasers

- Cynosure (Hologic)

- Sciton

- Fotona

- Lutronic

- InMode

- BTL Aesthetics

- Venus Concept

- Jeisys Medical

- Solta Medical (Thermage)

- Merz Aesthetics (device partnerships)

- Classys (HIFU + laser hybrids)

- Hironic / WONTECH (APAC device vendors)

- Endymed Medical (RF fractional tech)

- Kerastem / small specialist OEMs (picosecond/niche lasers)

- Omnilux / Photomed (clinical LED)

- Numerous regional manufacturers & private-label OEMs serving medspa channel

Market Segmentation

By Product / Device Type

- Laser & IPL Platforms

- Ablative fractional lasers (COâ‚‚, Er:YAG)

- Non-ablative fractional lasers (Er:Glass, fractional 1550 nm)

- Picosecond / Q-switched lasers (pigmentation & tattoo)

- Alexandrite / Nd:YAG (vascular, hair adjunct)

- Broad-band IPL systems

- Radiofrequency Devices

- Multipolar RF platforms

- Microneedle RF systems (fractional RF)

- Microneedling Devices (non-RF)

- Manual devices (pens)

- Automated microneedling platforms (powered pens)

- High-Intensity Focused Ultrasound (HIFU) & Ultrasound-assisted

- LED / Light Therapy Devices

- Clinical LED panels

- High-power photobiomodulation platforms

- Combination / Hybrid Platforms (Laser + RF, RF + Ultrasound, Laser + PRP integration)

- Cryotherapy / CoolSculpting-adjunct & Other Modalities

By Technology

- Ablative fractional

- Picosecond & Q-switched (Fastest Growing for pigmentation & tattoo retreatment).

- Microneedle RF

- IPL broad-band

- LED photobiomodulation

By Indication / Clinical Use

- Wrinkle Reduction & Skin Tightening

- Periorbital, perioral, forehead, cheeks, neck

- Pigmentation & Melasma Management

- Scar & Acne-scar Remodeling

- Atrophic acne scars

- Surgical scars

- Texture / Pore Reduction & Skin Quality

- Vascular Lesions & Rosacea

- Overall Rejuvenation & Combination Protocols

By End User / Channel

- Dermatology & Plastic Surgery Clinics (Dominant)

- Medspas & Cosmetic Chains

- Hospitals & Ambulatory Surgery Centers

- At-home / Consumer FDA-cleared devices

By Revenue Model / Component

- Capital equipment sales

- Consumables, tips & disposable cartridges

- Service, training & software (SaaS, AI diagnostics, imaging add-ons)

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client