List of Contents

What is the Power Distribution Component Market Size?

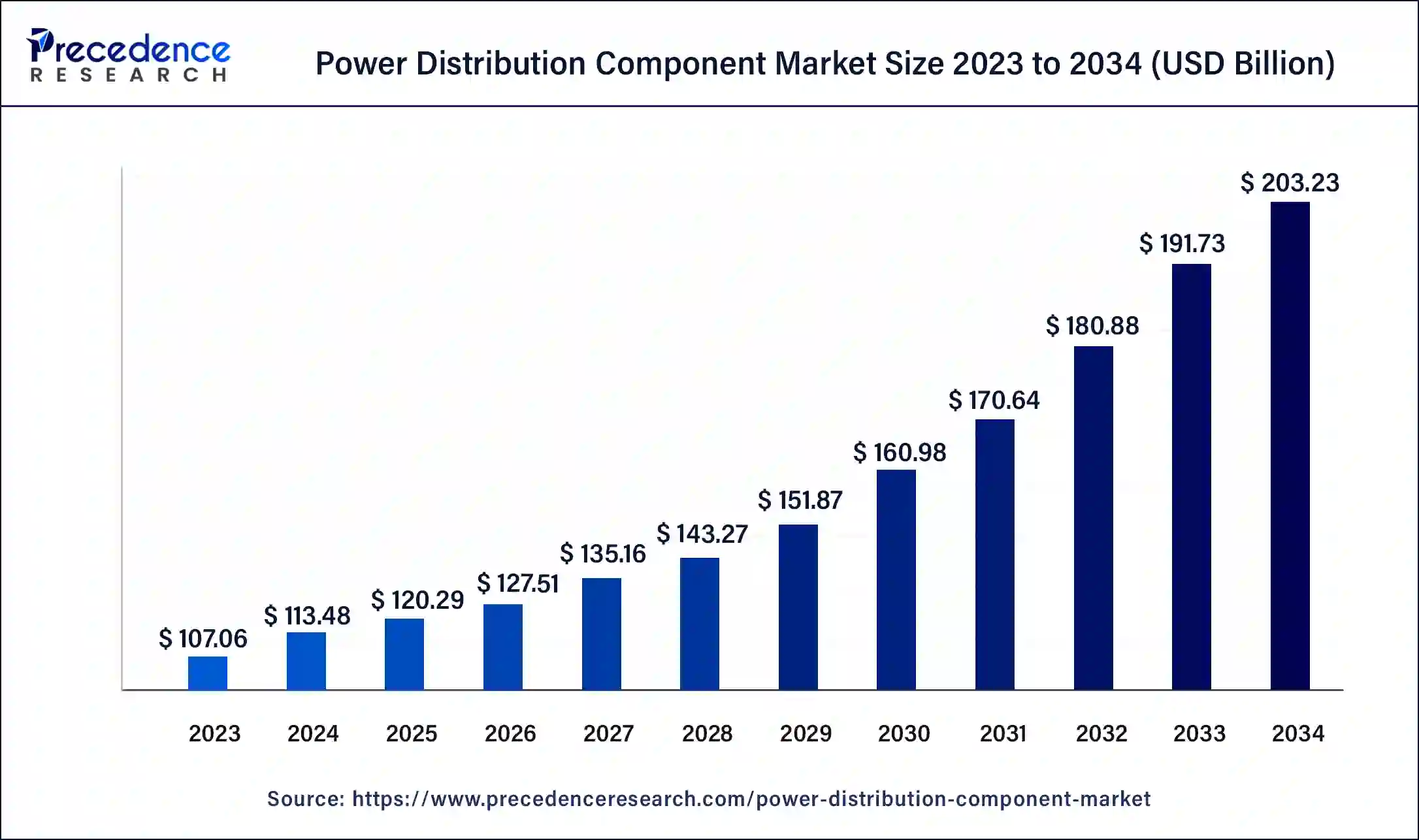

The global power distribution component market size is valued at USD 120.29 billion in 2025 and is predicted to increase from USD 127.51 billion in 2026 to approximately USD 203.23 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034.

Power Distribution Component Market Key Takeaways

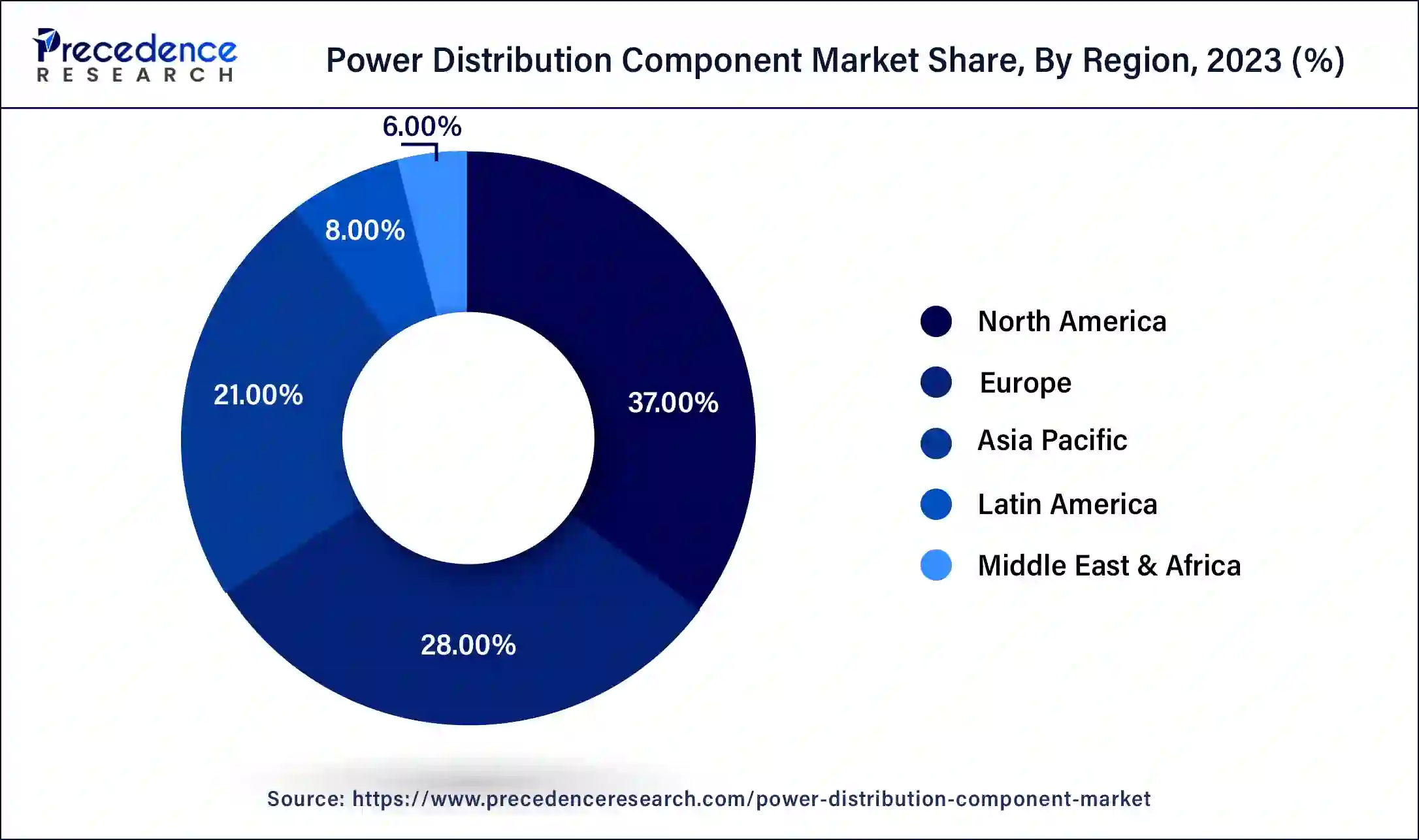

- North America led the global market with the highest market share of 37% in 2024.

- By product type, the distribution panels segment has held the largest market share in 2024.

- By configuration, the fixed mounting segment captured the biggest revenue share in 2024.

- By insulation type, the vacuum insulation segment registered the maximum market share in 2024.

- By installation type, the indoor segment is estimated to hold the highest market share in 2024.

- By voltage rating, the < 11kV segment dominated the market in 2024.

- By current type, the AC segment dominated the power distribution component market in 2024.

- By application, the industrial segment captured the biggest market share in 2024.

Power Distribution Component Market Growth Factors

The spike in demand for effective T&D control systems is a primary driver of the power distribution component market's growth. In addition, the market demand is likely to be accelerated by a rise in demand for refurbishment of existing electrical setups, as well as regulatory and fiscal reorganization across the industrial sector.

Moreover, the absence of reliable and efficient electric network across the developing nations has fostered the demand for the development of efficient power distribution system. Also, with the Government policies and heavy investment in order to develop an efficient energy distribution infrastructure is fueling the market growth.

The rapid urbanization and industrialization in the developing economies such as India and China are expected to boost the market growth. Also, the surge in construction sector is estimated to drive the market growth. With the increasing demand for electric vehicles all over the world, the need for development of energy infrastructure surges and this attribute is anticipated to fuel the growth of the Power Distribution Component Market.

Market Outlook

- Industry Growth Overview:

The power distribution component market is growing, driven by worldwide grid modernization initiatives, the incorporation of renewable energy technology, electrification trends in different fields, and rapid urbanization in emerging economies. Rising adoption of smart grid technologies, IoT-driven components. - Global Expansion:

The power distribution component market is expanding due to rising energy demand, urbanization, and the growth of renewable energy sources, increasing spending in infrastructure such as smart grids. - Major investors:

Major investors include major multinational corporations such as ABB, Siemens, Schneider Electric, Eaton, General Electric, and Mitsubishi Electric.

Market Scope

| Report Highlights | Details |

| Market Size in 2034 | USD 203.23 Billion |

| Market Size in 2026 | USD 127.51 Billion |

| Market Size in 2025 | USD 120.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product,Configuration,Insulation,Installation, Current, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Product Type

The power distribution component market is segmented into switchgear, switchboard, distribution panel, motor control panels, and others based on product type. Due to its utility in a variety of applications ranging from low voltage suburban networks to utility-based distribution infrastructure, the distribution panels segment leads the power distribution component market is expected to grow at a highest CAGR during the forecast period. Its cost effectiveness is also one of the primary elements driving market expansion.

Configuration Insights

Based on the configuration type, the market is divided into fixed mounting, plug-in, and withdrawable. The fixed mount configuration type segment leads the market with remarkable revenue share in 2024 and is expected to grow significantly growth rate during the forecast period. It is because of the demand for fixed mount power distribution components having a greater ampacity and voltage rating infrastructure, making them an excellent alternative for fixed mount power distribution components having a greater ampacity and voltage rating infrastructure, making them an excellent alternative for process plants, manufacturing units, oil & gas exploration & extraction and similar industrial peripherals.

Insulation Insights

Based on the insulation type, the Power Distribution Component Market is divided air, gas, oil, vacuum, and others. The vacuum insulation type segment leads the market in 2024 and is expected to witness highest CAGR during the forecast period owing to its high consumer reliability, leakage-free technology, and its economical price.

Installation Insights

Based on the installation type, the market is divided indoor and outdoor. The indoor Installation type segment dominated the market in 2024 and is expected to grow significantly at a CAGR during the forecast period. It is because of the surge in space constraints and increasing investments in research and development for the growth of smart and compact control equipment.

Voltage Rating Insights

Based on the voltage rating, the < 11kV voltage rating type segment leads the power distribution component market in 2024 and is expected to grow significantly at a CAGR during the forecast period. It is because of the rapid expansion of low-voltage distribution networks across commercial & residential establishments. Furthermore, operational performance, flexible product configurations and aesthetic proximity are some of the attributes that drives the market growth.

Current Insights

Based on the current type, the AC type hit the largest revenue share in 2024. It is due to its lucrative features such as less heat generation, economical energy loss, flexible and effective high-end voltage levels.

Furthermore, the ease of handling conducting properties integrated with ease of transformation, competitive lay-down costs, economic machinery cost and manufacture are few indispensable parameters are some of the attributes that fuels the market growth.

Application Insights

Based on the application, the industrial application type segment leads the power distribution component market in 2024 and is projected to hit highest growth rate during the forecast period owing to development of secure and smart electric infrastructure across the world. Also, expansion of data centers, communication hubs and rapid growth in demand for energy are some of the factors that are anticipated to drive the growth of the Power Distribution Component Market.

Regional Insights

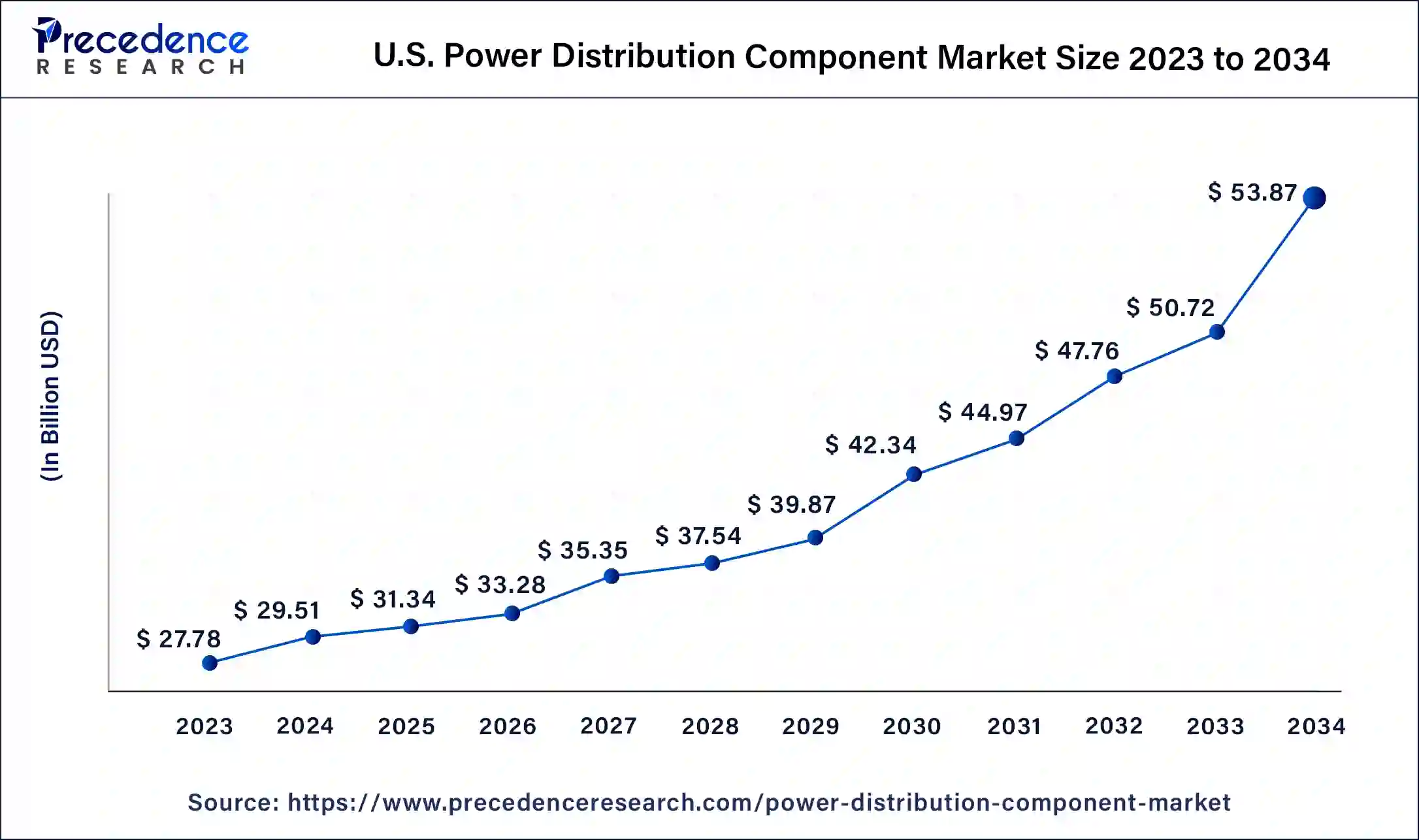

U.S. Power Distribution Component Market Size and Growth 2025 to 2034

The U.S. power distribution component market size is estimated at USD 31.34 billion in 2025 and is predicted to be worth around USD 53.87 billion by 2034, at a CAGR of 6.20% from 2025 to 2034.

North America accounted largest revenue share in 2024 and is expected to grow significantly at a CAGR during the forecast period. It is due to the surge in Government investments in order to develop refurbishment of domestic electric infrastructure and long-distance distribution networks.Furthermore, the growing emphasis on replacing traditional electrical equipment with innovative, high-quality systems is likely to boost market demand.

In the past decade, the power distribution component market across Asia Pacific and LAMEA has seen significant growth owing to the rising demand for restoring the electrical setup and with the heavy Governments investments to develop energy infrastructure. These factors are estimated to boosts the market growth.For instance,On 19th October 2021, Samsung Heavy Industries (SHI) has granted GE Power Conversion a new contract to deliver its SeaGreen Power Take Off (PTO) system, which incorporates GE's latest medium voltage Advanced technology Permanent Magnet Machine (APMM), for Maran Gas Maritime's new LNG carrier. The LNG carrier will be delivered to Maran, the LNG shipping specialists based in Greece, in 2023 and will be built at Samsung Heavy Industries yard in Geoje, South Korea.

Europe's Clean Energy Push Drives Power Grid Boom

Europe is significantly growing in the power distribution component market as the EU's strong drive for carbon neutrality, which increases demand for renewable energy incorporation, grid modernization, and electrification of transport. Europe is quickly transitioning to a low-carbon economy with ambitious renewable energy targets.

UK: Increasing Government Support

With the UK aiming to reach net zero by 2050, a significant part of the strategy is to transition to an electricity system with 100% zero-carbon generation, and much of this is predictable to come from renewable energy. In 2023, Wind power contributed 29.4% of the UK's total electricity generation. Biomass energy, the conversion of renewable organic materials, contributed 5% to the renewable combination. Solar power contributed 4.9% to the renewable mix. Hydropower, including tidal, contributed 1.8% to the renewable mix.

South America: Power Distribution Market Surges on Renewables, Economy

South America is significantly growing in the power distribution component market as growing electricity demand from population and economic drives, government initiatives to upgrade infrastructure, and the increasing expansion of renewable energy sources such as solar, wind, and hydro.

Brazil's $2 Billion Power Surge Ignites Growth

In Brazil, growing electricity demand, leading to investment in infrastructure transformation and expansion. Incessant growth of the Brazilian economy, there has been a growing demand for reliable power distribution. Brazil has six electric power initiatives underway, contributing investments of more than US$2bn, according to the BNamericas project database.

Power Distribution Component Market - Value Chain Analysis

- Raw Material Sourcing

Raw materials for power distribution components contribute copper for its conductivity, aluminum alloys such as ASTM B209 for conductors, and mild steel or other metals for casings and frames.

Key Players: General Electric (GE) and Mitsubishi Electric - Installation and Commissioning

Power distribution component installation and commissioning involve physically installing tools such as switchgear and transformers, followed by severe testing and authentication to ensure the system operates efficiently and safely.

Key Players: ABB and Siemens AG - Product Lifecycle Management:

Managing the whole product journey from initial concept to end-of-life, confirming all data and processes are integrated in the design, manufacturing, engineering, sales, and solution.

Key Players: Schneider Electric and Eaton Corporation

Top Vendors in the Power Distribution Component Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

GE |

Cambridge, Massachusetts |

Problem-solving and leadership |

In 2025, GE Vernova and EnergyHub announced a partnership to enhance DER management and grid optimization. |

|

ABB |

Zürich, Switzerland |

Technology leadership and Automation |

In October 2025, ABB introduced a next-generation low-voltage power distribution solution designed to strengthen the electrical backbone of AI-ready data centres. |

|

Eaton |

Dublin, Ireland |

Strong foundation in ethical practices |

Diversified power management company and global technology leader in electrical systems for power quality, distribution, and control |

|

Schneider |

Rueil-Malmaison, France |

Comprehensive product range |

In October 2025, Schneider Electric, the leader in the digital transformation of energy management and automation, reinforced its commitment to supporting the industry's transition to 800 VDC power architectures. |

|

Siemens |

Munich, Germany |

Global leadership in electrification |

In June 2025, Eaton and Siemens Energy joined forces to provide power and technology to accelerate the delivery of novel data center capacity. |

Segments Covered in the Report

By Product

- Switchgear

- Switchboard

- Distribution panel

- Motor control panels

- Others

By Configuration

- Fixed mounting

- Plug-in

- Withdrawable

By Insulation

- Air

- Gas

- Oil

- Vacuum

- Others

By Installation

- Indoor

- Outdoor

By Voltage Rating

- < 11 kV

- 11 kV to 33 kV

- > 33 kV to 66 kV

- > 66 kV to 132 kV

By Current

- AC

- DC

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client