List of Contents

Polyamide Market Size and Forecast 2025 to 2034

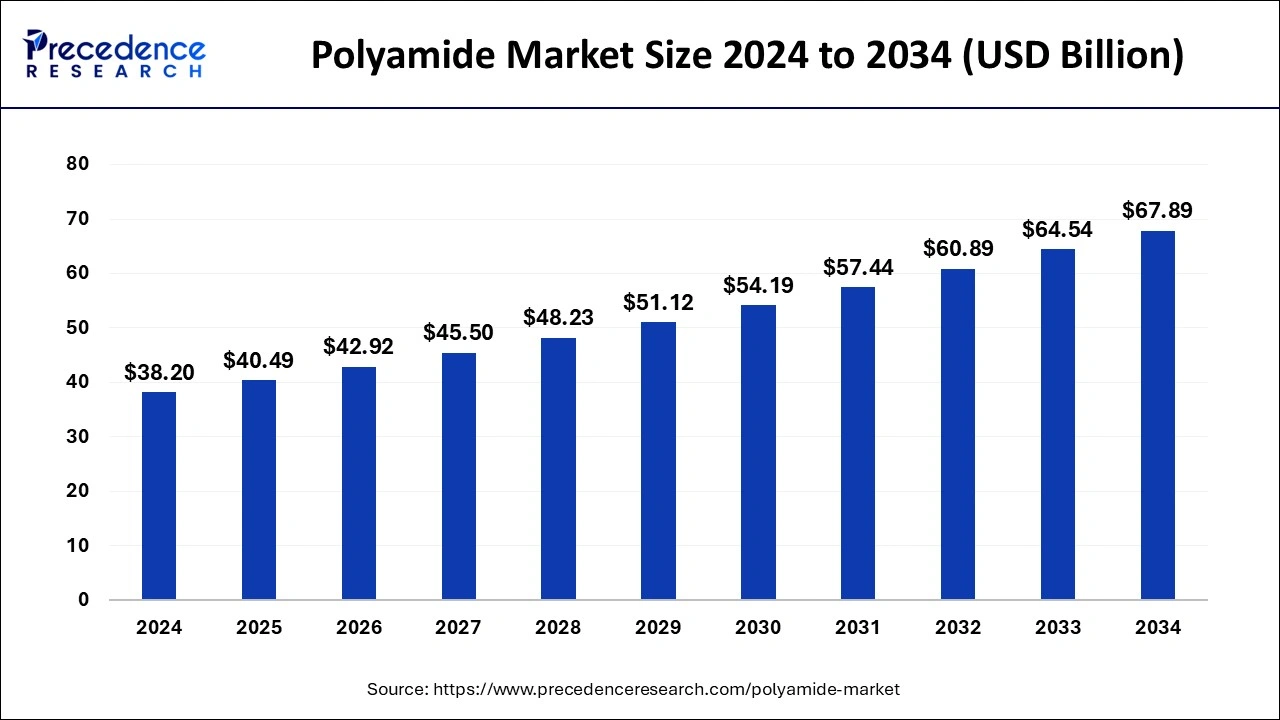

The global polyamide market size was accounted for USD 38.20 billion in 2024, and is expected to reach around USD 67.89 billion by 2034, expanding at a CAGR of 5.92% from 2025 to 2034. The growth of the polyamide market is driven by the increasing demand for lightweight materials in various industries.

Polyamide Market Key Takeaways

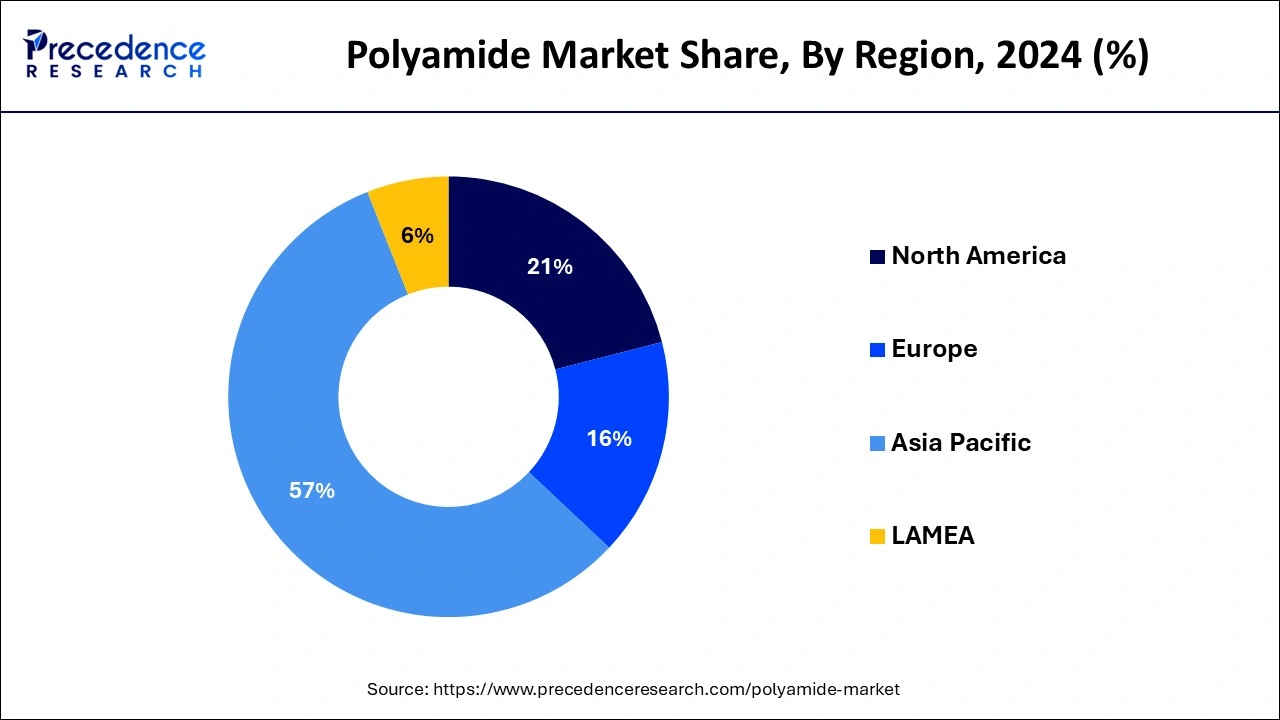

- Asia Pacific led the global market with the highest market share of 57% in 2024.

- North America is expected to reach a CAGR of 2.7% from 2025 to 2034.

- By type, the aliphatic polyamides segment hit 83% market share in 2024.

- The aromatic polyamides segment accounted for 17% of revenue share in 2024.

- The polyamide 6 product segment is growing at a registered CAGR of 2.7%.

- The engineering plastics application segment is poised to reach a CAGR of 2.8% from 2025 to 2034.

Impact of AI on the Polyamide Market

Artificial intelligence (AI) has the potential to significantly optimize polymer manufacturing processes, leading to enhanced efficiency, reduced costs, and minimized waste. By leveraging advanced data analytics, AI can analyze and process vast amounts of data generated throughout the production cycle in real-time. This further allows manufacturers to pinpoint critical process parameters that directly influence the final properties of the produced polymers, including polyamide. For instance, AI algorithms can evaluate factors such as temperature, pressure, and the duration of polymerization stages to determine the ideal combinations that yield favorable mechanical, thermal, and chemical characteristics in the final product. By continuously monitoring these parameters, AI can also facilitate predictive maintenance, identifying potential equipment failures before they occur, thus avoiding costly downtime. In this way, AI not only streamlines production but also enhances the quality and consistency of the manufactured polymers, ultimately leading to a more sustainable and economically viable manufacturing process.

Asia Pacific Polyamide Market Size and Growth 2025 to 2034

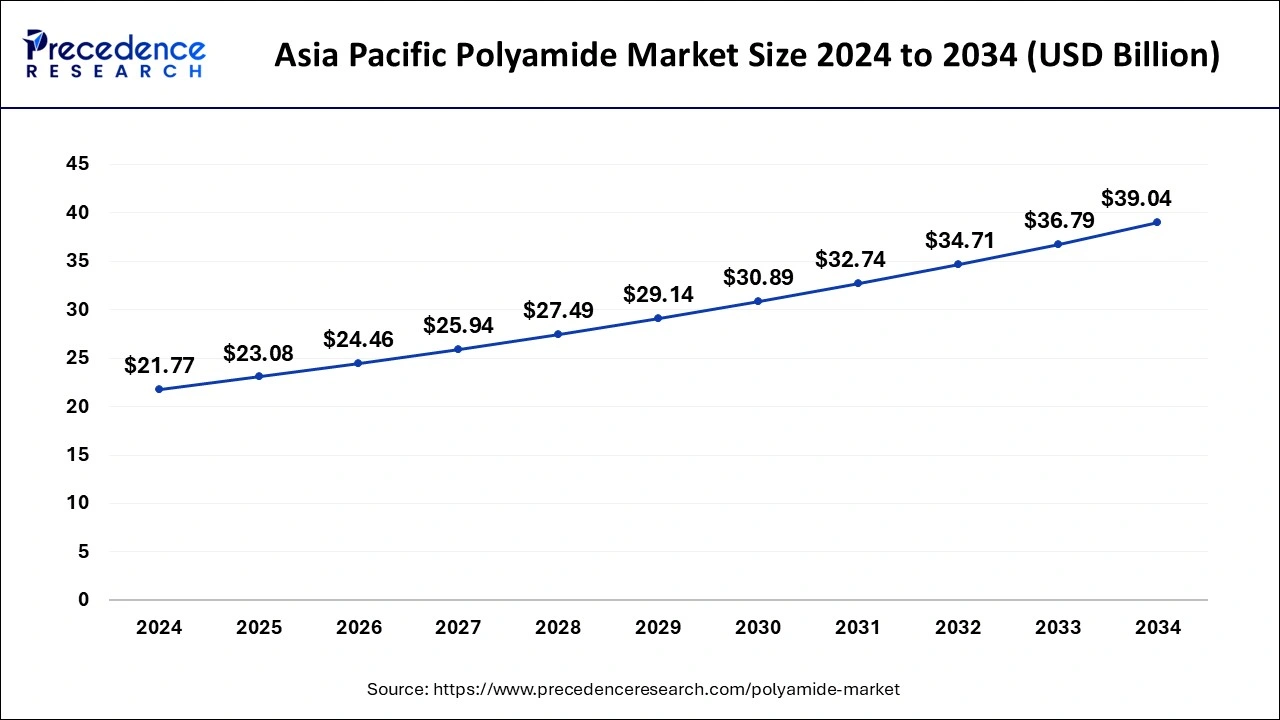

The Asia Pacific polyamide market size was estimated at USD 21.77 billion in 2024 and is predicted to be worth around USD 39.04 billion by 2034, at a CAGR of 6.01% from 2025 to 2034.

Asia Pacific dominated the market with the highest revenue share of over 57% in 2024. The Chinese automobile industry is in the world's biggest. Polyamides are most commonly used in the automotive industry. Polyamide utilization in the automotive sector is increasing at a reasonable rate. After the United States, China has the world's second biggest defense budget. The state's aviation sector is expected to have collected around 6,000 airliner planes by 2033. The increase in travelers prompted the government to invest more in the production of additional flights, which increased the use of polyamide. In the medium term, the China PA ETP market is expected to increase at a rate of 6-8 percent each year. The automotive market will increase at the fastest rate. By 2024, China is expected to control 40% of the worldwide PA market. Leading worldwide ETP manufacturers will expand and improve their supplying capacities in China.

Furthermore, the rapid expansion of the global electrical and electronics sectors is likely to boost market growth. Growth is predicted to be driven by consumers' high disposable income and improved understanding of the usage of bio-polyamides in low-power applications.

The market in North America is expected to expand at the fastest rate in the coming years. This is mainly due to the increasing emphasis on technological advancements in polyamide production processes, particularly to support sustainability. The regional market benefits from robust automotive and aerospace industries, which are major consumers of engineering plastics, driving the demand for polyamides. With the growing emphasis on improving vehicle performance, durability, and environmental sustainability, the demand for high-performance materials is rising in the region's automotive industry. As manufacturers increasingly seek innovative solutions that reduce their carbon footprint, the demand for high-performance polyamides is expected to rise, contributing to regional market growth.

Market Overview

Polyamides can be found as the naturally in wool and silk, also the synthetically in nylon, polyamide 6, and with aramid. Artificial polyamides have properties such as wear resistance, high mechanical strength, low gas permeability and chemical resistance. Because of their eco-friendliness, bio-based polyamides are gaining favor. Polyamide predates polyester by a few years. Polyamide was invented before World War I, but it wasn't commercialized until 1938. Water, petroleum, and other chemicals are also used to make polyamide. However, the way the chemicals are mixed in polyamide differs from how they are in polyester, giving polyamide somewhat different qualities than polyester. Polyamide is widely used in textiles such as carpets and garments. It is also frequently used in the manufacture of things that require both flexibility and strength, including as gears, guitar picks, fishing line, electrical connections, strings, and medical implants.

International demand for the polyamide materials is now increasing at a CAGR of up to 3%. By 2033, the worldwide adoption of the new energy vehicles (those include g pure electric, hybrid, and the fuel cell car) is predicted to reach 45% and the automakers are more and more employing sustainable materials to construct components, which are major growth drivers for the polyamide market. Furthermore, the need for smaller contactors, plugs switches, circuit breakers and other components in the electricals and electronics, and as well as in the industrial consumer goods sectors, expands polyamide materials application potential.

Asia is the world's fastest expanding polyamides market, with China accounting for the majority of that increase. Players are strengthening and extending their production facilities in China as an integrated manufacturer of PA 6/66 in order to enhance capacity and build a strong presence. This will assist local producers in keeping up with evolving trends and developing innovative, high-performance, and environmentally friendly goods and applications.

Polyamide Market Growth Factors

- The increasing usage of polyamide in consumer goods propels the market's growth. Polyamides have long been recognized as important polymers for producing sports equipment, textiles, and household items. Polyamides 6 and 6.6, in particular, have emerged in the realm of commercial polymers, with possibilities for future expansion due to their remarkable qualities. Polyamide resins are used to manufacture engineering plastics, textile filaments, technical yarn, tire, cables, and carpet yarn.

- The rising demand from the automotive industry is likely to boost the growth of the market. With the increased necessity of lightweight automobile parts, the adoption of polyamide increased in the automotive industry. Furthermore, the increasing production of electric vehicles (EVs) is expected to boost market growth.

- With the increasing focus on energy saving, the usage of bio-based fibers for a variety of high-performance applications in the electronics, naval, and automobile industries is rising, contributing to market expansion.

- Technological advancements in polyamide production processes enhance mechanical properties and durability, boosting the demand for polyamide in high-performance applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 40.49 Billion |

| Market Size by 2034 | USD 67.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Applications, and Class |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Polyamide 6 led the global market in the year 2024 it has accounted so for more than 51% of the total global sales. It is further expected to carry on its advantage all the way through the projection period.

Aside from the currently dominating and traditional classes of polyamide-6 and polyamide-66, this effort focuses on the synthesis of novel classes of amides by discriminatory compounding of various diamine and dicroboxlyic acid monomers, with a particular emphasis on niche markets. Furthermore, certain reactive and long fiber-reinforced PA items produced by worldwide commercial organizations to replace some metal-based appliances in household and precision machine products are discussed.

The urgent need to avoid hospital-acquired illnesses throughout the world is expected to increase market expectations for antimicrobial polyamide fabrics. Furthermore, implementation of severe rules by governments throughout the globe to decrease the danger of infection is likely to propel development.

Application Insights

In 2024, the engineering plastics kind led the global market, accounted for more than 56% of total sales. Electrical and electronics, automotive, consumer goods and appliances, and other industries packaging, are included in the engineering plastics section.

Polyamide is commonly used in the automobile industry to make air intake manifolds, engine covers, valve covers, and airbag canisters, as well as exterior components like as handles, grilles, wheel covers, and fuel caps and lids. These components were formerly made of metal, but polyamide allows for lighter, more fuel-efficient vehicles while also lowering production costs.

Food and beverage: Polyamide systems are used in the food and beverage sector to provide good cleanliness in locations where components may come into touch with food. These systems are widespread in food-processing and manufacturing operations.

Robotics: Robotics demands components that are very flexible and robust, and polyamide offers practical answers. It is also used in robotics for wire and cable protection.

Moulding and extrusion compounds have various uses as metal part replacements, such as in the automotive engine components. Nylon intake manifolds are corrosion resistant, lighter, robust, and very less expensive than the aluminum (once tooling expenses are deducted), and they provide greater air flow due to a smooth interior hole rather than a rough cast one. Because of its self-lubricating characteristics, it is beneficial for gears and bearings. Nylon is a strong option for high load parts in electrical applications such as switch housings, and the ubiquitous cable insulators, ties due to its corrosion resistance, electrical insulation, and durability. Power tool housings are another important use.

The use of oleochemicals in a variety of sectors including such cosmetics, beverages, and pharmaceutical is a major driver driving market expansion. This chemical is widely utilized as the emulsifier in culinary goods like cake, pies, and others, increasing market demand.

Polyamide Market Companies

- BASF SE

- AdvanSix Inc.

- Ube Industries Ltd.

- Domo Chemicals

- Toray Industries, Inc.

- Ashley Polymers Inc.

- Ascend Performance Materials LLC

- Toyobo Co. Ltd.

- Lanxess AG

- Huntsman Corporation

- Goodfellow Group

Latest Announcement by Industry Leader

- In October 2024, BASF introduced two new sustainable polyamides: Ultramid LowPCF and Ultramid ZeroPCF. Pedro Serra, Head of Sales PA6 Europe at BASF, said that BASF is the first company to offer both LowPCF and ZeroPCF options in the Polyamide 6 value chain.

Recent Developments

- In July 2024, LyondellBasell (LYB) launched a new line of polyamide-based compounds, called Schulamid ET100. The new grades are engineered with excellent melt flow characteristics, enabling easy injection moulding and demoulding of thin-wall complex parts like door window frames in the automotive industry.

- In January 2024, at the leading international trade fair for technical textiles and nonwovens, BASF launched Loopamid, the first polyamide 6 that is entirely made from textile waste. This innovative material can be recycled over several cycles.

Segments covered in the report

By Product

- Bio-based Polyamide

- Polyamide 6

- Specialty Polyamides

- Polyamide 66

By Type

- Aliphatic

- Aromatic

By Applications

- Engineering Plastics

- Automotive

- Electrical & Electronics

- Consumer Goods & Appliances

- Packaging

- Others

- Fibers

- Textile

- Carpet

- Others

By Class

- Aliphatic Polyamides

- Semi-Aromatic

- Aromatic Polyamides

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client