List of Contents

What is the Pharmaceutical Contract Packaging Market Size?

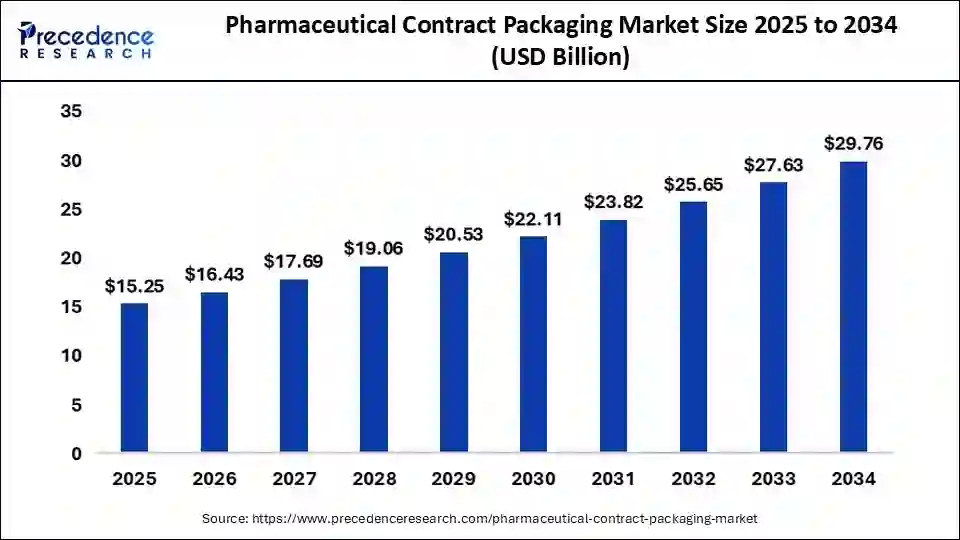

The global pharmaceutical contract packaging market size is calculated at USD 15.25 billion in 2025 and is predicted to increase from USD 16.43 billion in 2026 to approximately USD 29.76 billion by 2034, expanding at a CAGR of 7.71% from 2025 to 2034.

Pharmaceutical Contract Packaging Market Key Takeaways

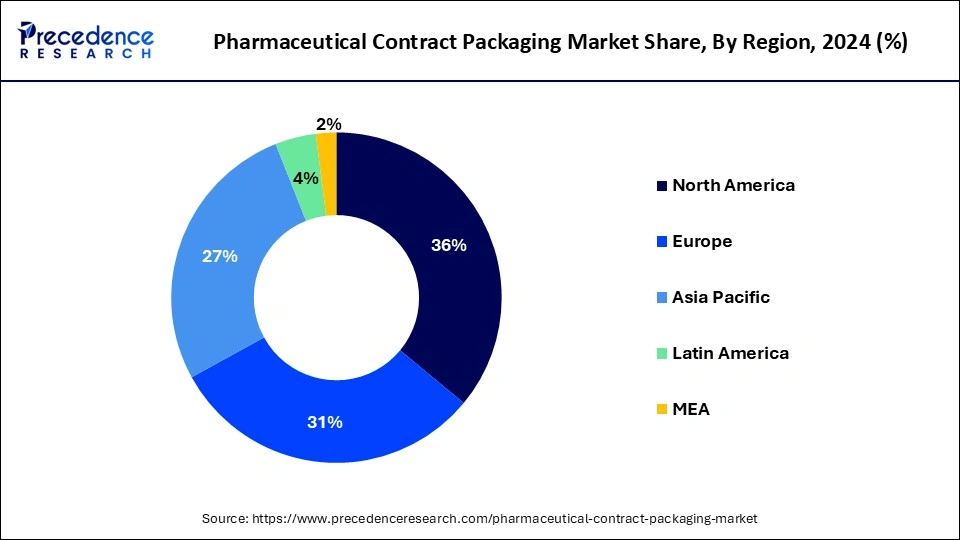

- North America led the global market with the highest market share of 36% in 2024.

- By Product, the primary packaging segment has held the largest market share in 2024.

- By Material, the glass segment captured the biggest revenue share of 35% in 2024.

Pharmaceutical Contract Packaging Market Growth Factors

Pharmaceutical packaging of drugs is a vital facet as the product requires being harmless for patient. Requirement of specialty of packaging has boost up an alternate industry that is contract manufacturing that is being now emerging progressively. Major pharma companies are now subcontracting the task of packaging of end product to those companies who are accomplished and dedicated in handling packaging of medicines. Growth in number of elderly populations, stringent norms on packaging by governing agencies and rising public interest for modernized packaging are certain of the influences which will boost growth of pharmaceutical contract packaging market across the world.

Growth in the pharmaceutical sector will drive the need for pharmaceutical packaging in the marketplace. There is upsurge in the requirement for the drug delivery devices and blister packaging which is also predictable to augment the growth of the market. Intensifying health consciousness and swelling burden on the pharma firms for reduction of the cost is additional reason which is anticipated to further accelerate the growth of the market. Budding over the counter market will also fuel the market growth. Increasing demand for better healthcare facilities will also accelerate the market growth.

Producing tailored and innovative packaging has uncertainties, henceforth, R&D spending in invention is challenging, which is inspiring pharmaceutical producers to elect for contract packaging services that have capable know-how and mandatory infrastructure. The growing production of low-priced generic medicines of branded drugs at the time of patent expiration is projected to bolster the demand for pharmaceutical contract packaging worldwide.

Pharmaceutical Contract Packaging Market Outlook: Opportunities Ahead

- Industry Growth Overview: The growth in the outsourcing trends by the pharmaceutical companies to specialized third parties in order to manage regulatory complexities, assess expertise for specialized products like biologics, and cost control is driving the industrial growth in the market.

- Sustainability Trends: The sustainability trend focuses on the use of recyclable, biobased, and biodegradable mono materials to reduce material waste, and the integration of smart technology for minimizing spoilage and ensuring adherence to regulatory standards and patient safety.

- Major Investors: Large private equity firms are the major investors who are acquiring and collaborating with contract packaging organizations (CPOs) and CDMOs to develop global integrated service platforms. KKR, Blackstone, and Advent International are some of the major investors.

MarketScope

| Report Coverage | Details |

| Market Size in 2034 | USD 29.76 Billion |

| Market Size in 2025 | USD 15.25 Billion |

| Market Size by 2026 | USD 16.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.71% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Among different type of packaging, in 2024, primary packaging segment reported for the major revenue share of more than 40% and predicted to perceive substantial growth during years to come. The primary packaging further classified into vials, bottles, blister packs, ampoules and others. This type of packaging estimated to govern the global pharmaceutical contract packaging market during coming years owed to the cumulative outsourcing of primary packaging activities because of the deficiency of in-house competences and capacities.

Material Insights

Pharmaceutical contract packaging involves different types of packaging material such as paper & paperboard, plastics &polymers, aluminum foil and other. Out of these segments, glass segment held the considerable revenue share of more than 35% in 2024. This growth is attributed to mid sized and small pharmaceutical companies who do not possess glass wrapping abilities. Further, low-priced service offered by the Development and Manufacturing Organizations (CDMOs)and Contract Packaging Organizations (CPOs) for pharmaceutical glass wrapping are likely to spur the market. Plastics and polymers segment is predicted to eyewitness momentous growth rate over the prediction period due to the rising demand for the plastic packaging sector in pharmaceuticals for the delivery and storage of medicines.

The requirement for plastic bottles is escalating from the pharmaceutical sector. This is on account of advantage of plastic bottles for avoiding the requirement for tertiary packaging and safeguards the safety of pharmaceutical product through the supply chain. Ophthalmic, syrups, and nasal medicines are frequently packed in plastic bottles.

Regional Insights

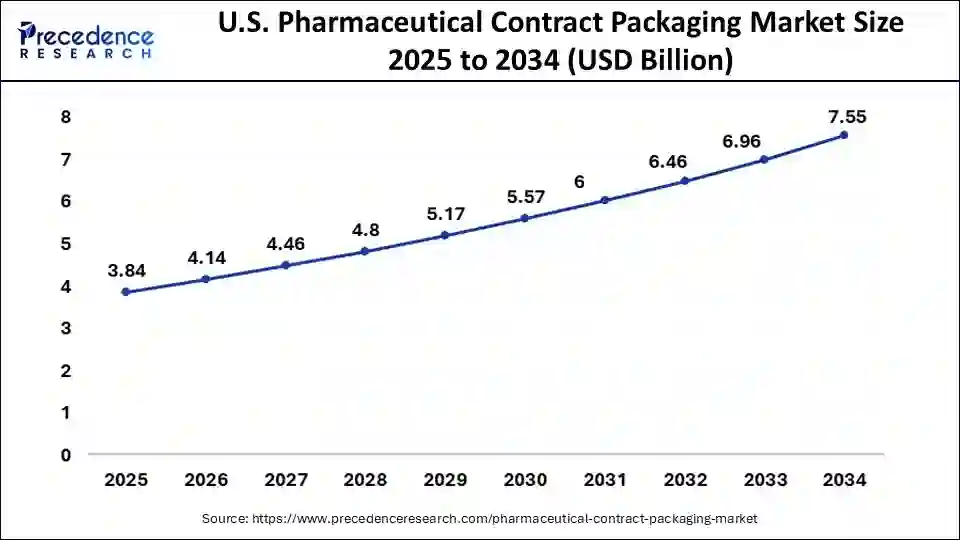

U.S. Pharmaceutical Contract Packaging Market Size and Growth 2025 to 2034

The U.S. pharmaceutical contract packaging market size is valued at USD 3.84 billion in 2025 and is expected to be worth around USD 7.55 billion by 2034, at a CAGR of 8% from 2025 to 2034.

North America accounted largest revenue stake of the global pharmaceutical contract packaging market in 2024, and offers plentiful growth prospects to market vendors throughout the assessment period. The mounting value of the U.S. pharmaceutical exports, the snowballing healthcare expenditure, and the intensifying elderly population are some of the noteworthy influences that will support growth of pharmaceutical contract packaging market in this region during upcoming years. Moreover, the presence of a large number of leading market players, such as Recipharm, Ropack Inc., Reed-Lane Inc., Jones Healthcare Group, Almac Group Limited, and others, is expected to contribute prominently towards the growth of the region.

Robust R&D and the existence of vital global participants in pharmaceutical drugs manufacturing in North America is reinforcing contract pharmaceutical packaging outlook in the region. Followed by North America, APEJ is supposed to be the significant market for contract pharmaceutical packaging on account of booming pharmaceuticals industry in countries including China and India.

- In December 2024, through a new agreement, Eli Lilly and Company and contract development and manufacturing organisation (CDMO) Cambrex will enable external biotech collaborators to accelerate their product development. The partnership will provide biotech companies with accelerated access to clinical development capabilities, including drug development and analytical services.

On the other hand, the Asia Pacific market is observed to expand at a rapid pace during the forecast period due to several factors, including increasing investment in the healthcare infrastructure, growing healthcare demand, rise in healthcare expenditures, increasing incidence of chronic diseases, and increasing outsourcing of services. The region has advanced technology and large-scale manufacturing capabilities, driving the market's revenue growth. The region's robust presence of the pharmaceutical industry, which relies heavily on contract packaging services to cater to the evolving domestic and international needs. Such factors are contributing to the market's growth in the region during the forecast period.

Expanding Manufacturing: The Key Driver in China

The expanding pharmaceutical manufacturing and strict regulation are increasing the demand for pharmaceutical contract packaging solutions. At the same time, the growing use of advanced therapies and products is increasing their use, where their growing exports are also contributing to the same. The government initiatives are also supporting these advancements.

Specialized Packaging Solutions Transforming Europe

Europe is expected to grow significantly in the pharmaceutical contract packaging market during the forecast period, due to growing demand for specialized packaging due to increasing development and transportation of biologics, biosimilars, and personalized medicines. At the same time, the growth in R&D is increasing the outsourcing trends, leading to their increased demand. Additionally, the development of smart packaging solutions is also increasing, which is promoting the market growth.

Robust Industries Powers UK

The presence of robust pharmaceutical industries, focusing on pharmaceutical contract packing solutions, is increasing due to the growth in production rates. Additionally, the growing outsourcing trends, demand for biologics, and technological advancements are driving their demand, where advanced packaging solutions are also being developed by the companies.

Driving Efficiency: Pharmaceutical Contract Packaging Market Value Chain Analysis

- Raw Material Sourcing

Raw materials like high-grade plastics, glass, aluminum foil, and paperboards are supplied from specialized suppliers in the raw material sourcing of pharmaceutical contract packing.

Key players: Berlin Packaging, Schott AG, Bilcare Ltd, WestRock Co. - Material Processing and Conversion

Material processing and conversion of raw materials of pharmaceutical contract packaging includes the conversion of raw materials like plastic pellets into bottles or plastic films and paperboard into injections, blister cavities, and folding cartons with the use of blow molding, cold-forming, or other processes.

Key players: Gerresheimer AG, Bilcare Ltd., WestRock Co. - Recycling and Waste Management

Recycling and waste management in the pharmaceutical contract packing includes segregation of hazardous and non-hazardous materials, where hazardous materials are incinerated and non-hazardous materials are chemically or mechanically recycled.

Key players: Veolia, EcoVeda, Waste Management Inc., Bormioli Pharma.

The Competitive Innovators: Key Players' Offering

- SCHOTT AG: The company produces primary glass and polymer packaging components like ampoules, cartridges, vials, and prefilled syringes.

- WestRock Co.: Secondary and tertiary packaging solutions, line folding cartons, corrugated boxes, leaflets, paperboard packing, etc., are provided by the company.

- Bilcare Ltd.: Different types of blister packing materials and services are provided by the company, where it offers blister films, aluminum oils, and primary or secondary contract packaging services.

- CCL Industries Inc.: Packaging solutions, such as folding cartons and other healthcare packaging solutions, are offered by the company.

- Berlin Packaging: The company offers primary packaging components, dispensing systems, and value-added services like plastic bottles, vials, caps, etc.

Pharmaceutical Contract Packaging Market Companies

- AmerisourceBergen Corp.

- Becton, Dickinson and Co.

- Constantia Flexibles Group GmbH

- FedEx Corp.

- Others

Segments Covered in the Report

By Product

- Primary Packaging

- Ampoules

- Bottles

- Blister Packs

- Others

- Secondary Packaging

- Tertiary Packaging

By Material

- Paper & Paperboard

- Plastics & Polymers

- Aluminum Foil

- Glass

- Others

By Regional Outlook

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client