List of Contents

What is Peripheral Interventions Market Size?

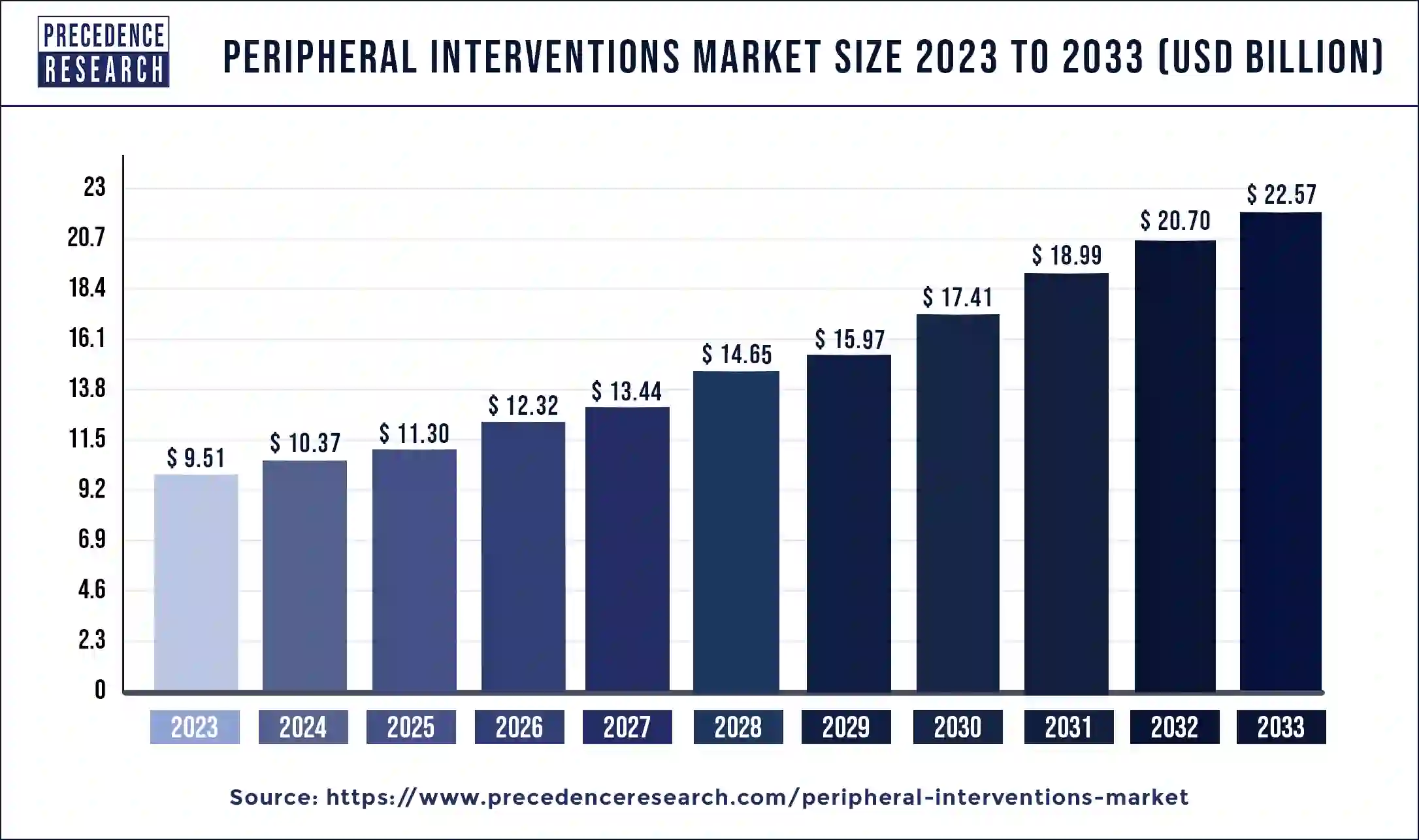

The global peripheral interventions market size is USD 11.30 billion in 2025, calculated at USD 12.32 billion in 2026 and is expected to reach around USD 22.57 billion by 2033. The market is expanding at a solid CAGR of 9.03% over the forecast period 2025 to 2034. The peripheral interventions market is driven by the elderly population proliferating, and peripheral vascular disorders are rising in parallel.

Market Highlights

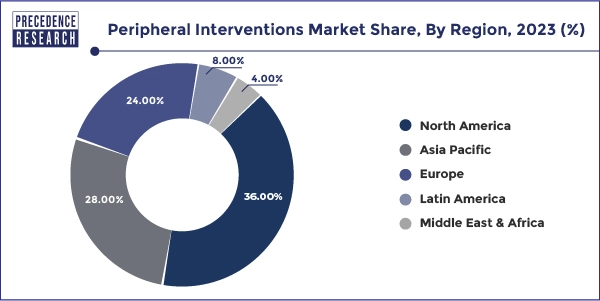

- North America dominated the market with the largest revenue share of 36% in 2024.

- Asia- Pacific is the fastest growing in the peripheral interventions market during the forecast period.

- By type, the catheters segment dominated the market in 2024.

- By type, the stents segment shows a notable growth in the peripheral interventions market during the forecast period.

- By application, the peripheral artery disease segment dominated the market in 2024.

- By application, the venous thromboembolism segment is the fastest growing in the peripheral interventions market during the forecast period.

- By end- user, the hospitals segment dominated the peripheral interventions market.

- By end- user, the ambulatory surgical centers segment shows a significant growth in the peripheral interventions market during the forecast period.

Market Overview

Medical equipment, treatments, and processes for identifying and managing illnesses and ailments impacting the peripheral vascular system are all included in the peripheral interventions market. All blood vessels, including the arteries and veins in the arms, legs, and organs that are not part of the heart or brain, are included in this system. Deep vein thrombosis (DVT), varicose veins, and peripheral artery disease (PAD) are common disorders treated via peripheral procedures. Stents, angioplasty balloons, atherectomy, thrombectomy, and embolic protection devices are among the goods and services offered in this industry. Peripheral vascular disorders are on the rise due to an aging population and rising rates of risk factors like diabetes, obesity, and smoking. This fuels the need for efficient intervention technologies and processes. By averting serious problems and decreasing the need for more intrusive treatments, peripheral therapies can make treatment more affordable overall and sustainable.

Peripheral Interventions Market Growth Factors

- Globally, the prevalence of PAD is rising due to an aging population and bad lifestyle choices like smoking, diabetes, and obesity. This increases the need for less intrusive methods of treating PAD.

- The need for therapies for age-related illnesses like PAD is predicted to increase dramatically as the world's population ages.

- Peripheral interventions appeal to patients and healthcare providers because they are less expensive, require shorter hospital stays, and have quicker recovery times than standard procedures.

- Growth in the market is driven by the development of new and improved devices, like stents and catheters, leading to more effective and efficient operations.

- Peripheral interventions are more readily available to patients thanks to government programs and insurance reimbursement.

Peripheral Interventions Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising investment by market players for opening up new production centres along with rapid prevalence of chronic diseases across the world.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and business expansions. Various healthcare companies such as Abbott Laboratories, Biotronik SE & Co. KG, Teleflex Incorporated, Boston Scientific Corporation, Cook Medical and some others have started investing rapidly for developing advanced medical products to cater the needs of the healthcare sector.

- Startup Ecosystem:Various startup brands are engaged in developing peripheral intervention solutions. The prominent startup brands dealing in peripheral interventions consists of Avinger, Cagent Vascular, SMT and some others.

Peripheral Interventions Market Data and Statistics

- According to reports, venous thromboembolism (VTE) kills 300,000 people and causes 900,000 new cases each year in the United States alone.

- In March 2024, after receiving approval from the US Food and Drug Administration (FDA), Shockwave Medical, Inc., a leader in the development of Intravascular Lithotripsy (IVL) for the treatment of severely calcified cardiovascular disease, announced the device's full commercial availability in the US.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.30 Billion |

| Market Size in 2026 | USD 12.32 Billion |

| Market Size by 2034 | USD 22.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.03% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing prevalence of chronic ailments

Peripheral consequences from chronic illnesses frequently arise and call for medical attention. For example, to restore blood flow in damaged arteries, procedures such as angioplasty, stenting, atherectomy, and peripheral bypass surgery are required for PAD, a prevalent symptom of atherosclerosis. In a similar vein, peripheral neuropathy and peripheral vascular disease are common in diabetic patients and may call for specific care. More early identification and diagnosis of chronic illnesses have resulted from increased access to healthcare services in various areas. As a result, there is a greater need for prompt therapies to stop the advancement of the disease and lessen its consequences. This increased knowledge and ease of access to healthcare are driving the market for peripheral interventions to grow. This drives the growth of the peripheral interventions market.

Restraint

Lack of awareness regarding peripheral artery disease

The lack of knowledge regarding PAD directly impacts the demand for peripheral interventions. If the disease and its effects are not sufficiently recognized, there will be less patient demand for interventions and less incentive for healthcare systems and providers to invest in the infrastructure and resources required to enable comprehensive PAD management. Considering this, the market for peripheral therapies might expand and innovate more slowly than other branches of cardiovascular therapy. This limits the growth of the peripheral interventions market.

Opportunity

Technological advancements in peripheral intervention devices

Vascular architecture can be seen in detail due to developments in imaging technologies like optical coherence tomography (OCT) and intravascular ultrasonography (IVUS). These technologies lower procedural risks and enhance results by enabling more accurate device placement and navigation. To prevent restenosis, therapeutic drugs are released by drug-eluting stents and balloons, which has greatly increased the long-term success rates of peripheral procedures. Using biodegradable stents reduces the possibility of long-term issues related to permanent implantation because they eventually dissolve after providing structural support. This opens an opportunity for the growth of the peripheral interventions market.

Segment Insights

Type Insights

The catheters segment dominated in the peripheral interventions market in 2024. Catheter material innovations, like hydrophilic coatings and biocompatible polymers, lessen the risk of problems, improve mobility, and reduce friction. Real-time visualization and accurate placement are made possible by incorporating imaging technologies like optical coherence tomography (OCT) and intravascular ultrasonography (IVUS) into catheter design. By releasing medication at the intervention site, these catheters lower the likelihood of restenosis and enhance patient outcomes.

The stents segment shows a notable growth in the peripheral interventions market during the forecast period. Considering drug-eluting stents to bare-metal stents, the former dramatically improves long-term outcomes by releasing medication that helps prevent restenosis (re-narrowing of the artery). Modern DES has more flexible designs and smaller struts, which provide better delivery to the target spot and more accessible travel through intricate artery structures. Self-expanding stents can adjust to the changing peripheral artery environment, offering reliable support even in highly mobile regions such as the ankle or knee.

- In August 2022, With the recent CE Mark certification, Medtronic announced the availability of their newest drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES). In addition to improving the Resolute Onyx drug-eluting stent's acute performance and clinical data, the Onyx Frontier DES features a novel delivery mechanism. With an improved delivery mechanism intended to boost acute performance in the most challenging instances and improve deliverability, the DES uses the same best-in-class stent platform as Resolute Onyx DES.

Application Insights

The peripheral artery disease segment dominated in the peripheral interventions market in 2024. Due to the high expenses of consequences such critical limb ischemia, amputations, and concomitant hospitalizations, untreated PAD has a significant financial impact. To lower the long-term expenses of managing PADs, governments and healthcare institutions are investing in early intervention techniques and preventive measures.

The diagnosis and treatment of PAD have improved thanks to the development of cutting-edge medical technologies and gadgets. Treatment outcomes have improved due to innovations such as minimally invasive angioplasty procedures, drug-eluting stents, and atherectomy devices. Introducing drug-coated balloons and bioresorbable stents has created new opportunities for efficient PAD therapy, improving patient compliance and lowering restenosis rates.

- In March 2024, according to BD (Becton, Dickinson, and Company), a prominent worldwide provider of medical technology, an investigational device exemption (IDE) study called "AGILITY" which will evaluate the safety and efficacy of the BD Vascular Covered Stent for the treatment of peripheral arterial disease (PAD), has enrolled its first patient.

The venous thromboembolism segment is the fastest growing in the peripheral interventions market during the forecast period. Venous thromboembolism (VTE) is a dangerous illness that starts as a blood clot in a vein, usually in the lower leg, and travels to the lungs, where it causes a pulmonary embolism that can be fatal. After heart attacks and strokes, VTE is the third most prevalent vascular diagnosis in America, affecting between 300,000 and 600,000 people annually. Worldwide, the frequency of VTE, which includes pulmonary embolism (PE) and deep vein thrombosis (DVT), is rising. Ageing populations, sedentary lifestyles, and increased rates of obesity and chronic illnesses are all blamed for this increase.

Ultrasound, MRI, and CT scans are examples of advanced imaging technologies that have increased the precision and speed of VTE diagnosis. An accurate and timely diagnosis is essential for managing and treating conditions effectively. There is a positive correlation between higher rates of self-reporting and proactive healthcare-seeking behavior and increased patient education regarding VTE risks, symptoms, and treatments.

End-user Insights

The hospitals segment dominated in the peripheral interventions market in 2024. Modern imaging technologies, including CT, MRI, and angiography scanners, are available in hospitals. These technologies are crucial for precise diagnosis and guiding during peripheral procedures. Intensive care units (ICUs) and post-anesthesia care units (PACUs) provide critical postoperative monitoring and treatment. Reimbursement policies for hospital procedures are generally better in government health programs and insurance plans than in outpatient settings. Patient outcomes are improved by applying strict safety regulations and infection control measures.

The ambulatory surgical centers segment shows a significant growth in the peripheral interventions market during the forecast period. Ambulatory surgical centers (ASCs) are renowned for being more affordable than conventional hospital settings. Due to decreased overhead and operating costs, procedures carried out in ASCs usually have lower total costs. ASCs are more appealing for patients and payers due to their cost advantage, encouraging more peripheral intervention procedures in these settings. Peripheral therapies are in high demand due to an aging population and rising rates of chronic illnesses, including peripheral arterial disease (PAD). ASCs can effectively manage these illnesses by providing specialized treatment, making them well-positioned to serve this expanding patient group.

Regional Insights

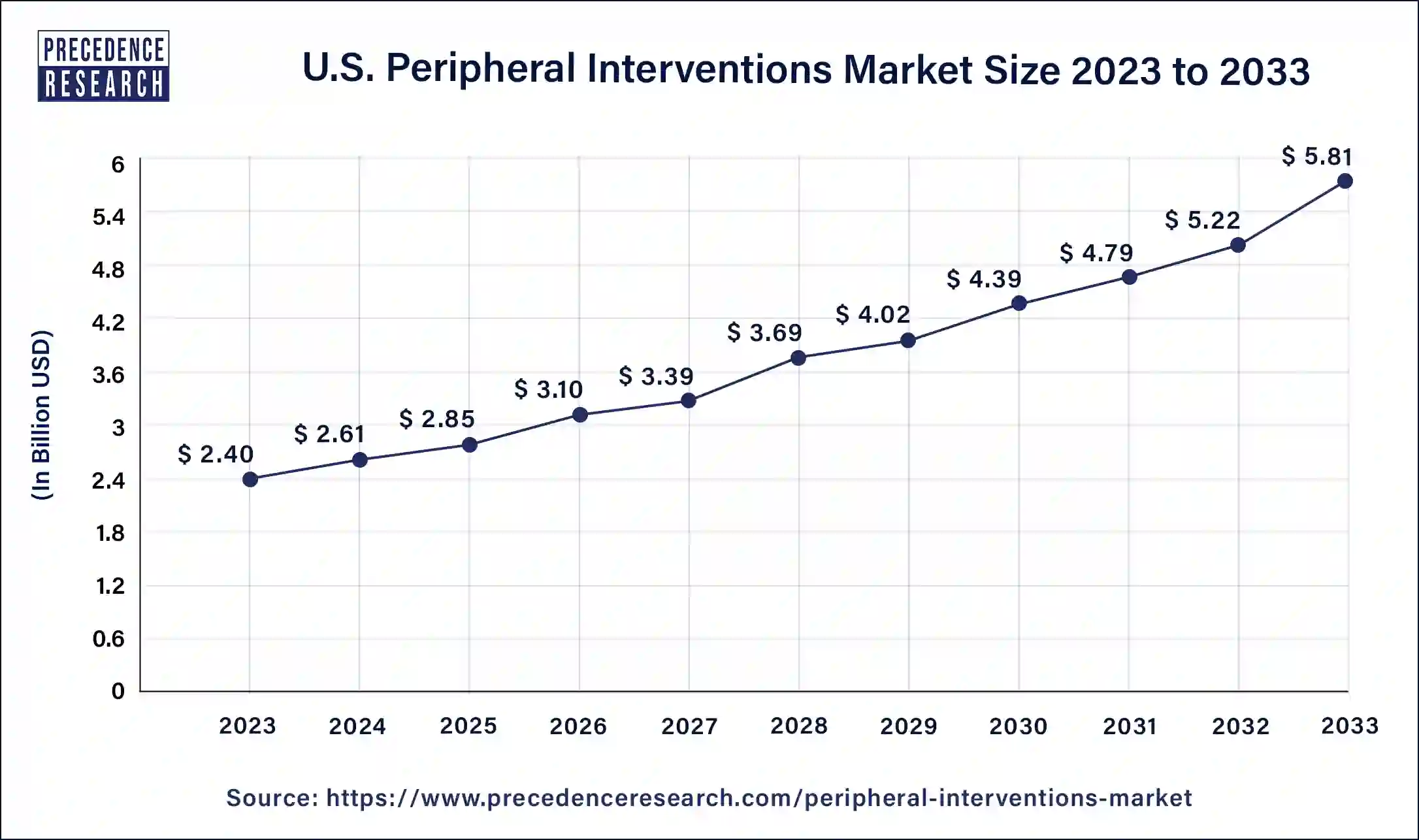

U.S. Peripheral Interventions Market Size and Growth 2025 to 2034

The U.S. peripheral interventions market size surpassed USD 2.85 billion in 2025 and is projected to attain around USD 5.81 billion by 2033, poised to grow at a CAGR of 9.24% from 2025 to 2034

North America had dominated in the peripheral interventions market in 2024. North America has an abundance of cutting-edge hospitals and specialty clinics, especially in the U.S. and Canada. These facilities have highly qualified medical staff who can perform intricate peripheral operations and use cutting-edge medical equipment. Medical device regulations are overseen by Health Canada and the U.S. Food and Drug Administration (FDA). These authorities streamline the approval process for new devices, which offer precise standards and procedures. This facilitates the introduction of cutting-edge peripheral intervention technologies to the market.

Due to the high frequency of peripheral vascular illnesses in North America, which are fueled by risk factors like obesity, diabetes, and an aging population, there is a significant demand for cutting-edge medical therapies.

- In March 2024, The US market debut of Shockwave Medical's intravascular lithotripsy catheter for calcified peripheral artery lesions was announced.

Asia-Pacific is the fastest growing in the peripheral interventions market during the forecast period. One major contributing factor is the increasing prevalence of cardiovascular illnesses, especially PAD. The rising incidence of these disorders is attributed to several factors, including aging populations, bad diets, sedentary lifestyles, and smoking. The need for peripheral interventions is rising as a result. These treatments are becoming safer and more successful thanks to developments in medical technology, which include the creation of new and improved instruments for peripheral interventions. Advances in imaging technologies, bioresorbable stents, and drug-coated balloons are among the innovations improving peripheral therapies' results.

What led Europe to hold a significant share of the peripheral interventions market?

Europe held a significant share of the market. The growing cases of peripheral artery diseases in numerous countries such as Germany, France, Italy, UK and some others has boosted the market expansion. Also, rapid investment by government for strengthening the healthcare sector is expected to drive the growth of the peripheral interventions market in this region.

Why Latin America held a considerable share of the peripheral interventions market?

Latin America held a considerable share of the industry. The rising incidences of cancers in various nations such as Brazil, Argentina, Peru, Venezuela and some others has driven the market growth. Also, rapid investment by market players for opening up new production units coupled with technological advancements in the healthcare sector is expected to boost the growth of the peripheral interventions market in this region.

How is Middle East & Africa contributing to the peripheral interventions market?

The Middle East & Africa held a notable share of the market. The increasing popularity of ambulatory surgical centers in numerous countries including UAE, Saudi Arabia, South Africa and some others has boosted the market expansion. Also, numerous government initiatives aimed at developing the healthcare facilities is expected to accelerate the growth of the peripheral interventions market in this region.

Key Players in Peripheral Interventions Market and Their Offerings

- Biotronik SE & Co. KG: Biotronik SE & Co. KG is a privately held, German-based medical device company founded in 1963 that develops, manufactures, and distributes cardiovascular and endovascular solutions. Its product areas include cardiac rhythm management (CRM), electrophysiology, and neuromodulation, with a focus on life-saving technologies for heart and blood vessel diseases.

- Teleflex Incorporated:Teleflex Incorporated is a global medical device manufacturer headquartered in Wayne, Pennsylvania, that produces a wide range of products for critical care and surgery. This company's diverse portfolio includes numerous solutions for vascular access, anesthesia, surgical, cardiac care, urology, and respiratory care.

- Abbott Laboratories: Abbott Laboratories is an American multinational healthcare company that develops and sells a wide range of health products, including medical devices, diagnostics, nutritional products, and established pharmaceuticals. This company's mission is to help people live the healthiest lives possible through its diverse portfolio. Its products cover various areas, such as cardiovascular and diabetes care, diagnostics, nutrition, and pharmaceuticals.

- Boston Scientific Corporation: Boston Scientific Corporation is a global medical technology company that develops, manufactures, and markets a wide range of high-performance medical devices for interventional medical specialties. The company's products are used to diagnose and treat diseases in areas such as cardiology, endoscopy, neurology, and urology.

- Cook Medical: Cook Medical is a global medical device company that designs, manufactures, and distributes minimally invasive medical devices for nearly 60 clinical specialties. This company provides a wide range of products such as catheters, stents, and needles for procedures in areas such as cardiology, radiology, and surgery.

- W. L. Gore & Associates Inc: W. L. Gore & Associates Inc. is a global materials science company known for its innovation in polymer technology, especially expanded polytetrafluoroethylene (ePTFE), which forms the basis for products like Gore-Tex fabric and medical devices. This company has a diverse portfolio and a unique, lattice-style organizational structure.

- Cardinal Health Inc: Cardinal Health Inc is a global healthcare services and products company that distributes pharmaceuticals and medical products, and manufactures its own medical and surgical products. This company serves a wide range of customers including hospitals, pharmacies, and physician offices.

Recent Developments

- In October 2025, Medtronic launched Neuroguard IEP system. Neuroguard IEP system is carotid stent system designed for the medicals across North America.

- In September 2025, ASAHI INTECC launched velouté and tellus embolization microcatheters. These microcatheters are designed for the healthcare sector of the U.S.

- In March 2025, Shockwave Medical launched Javelin Peripheral IVL Catheter. It is an intravascular lithotripsy (IVL) device designed for treating PAD patients.

Segments Covered in the Report

By Product

- Catheters

- Sheath

- Stents

- Bare Metal Stents

- Drug-eluting Stents

- Guide Wires

- Atherectomy Devices

- Embolic Devices

- IVC Filters

By Application

- Peripheral Artery Disease

- Venous Thromboembolism

- Others

By End-use

- Hospitals

- Catheterization Laboratories

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client