List of Contents

What is Nitrocellulose Market Size?

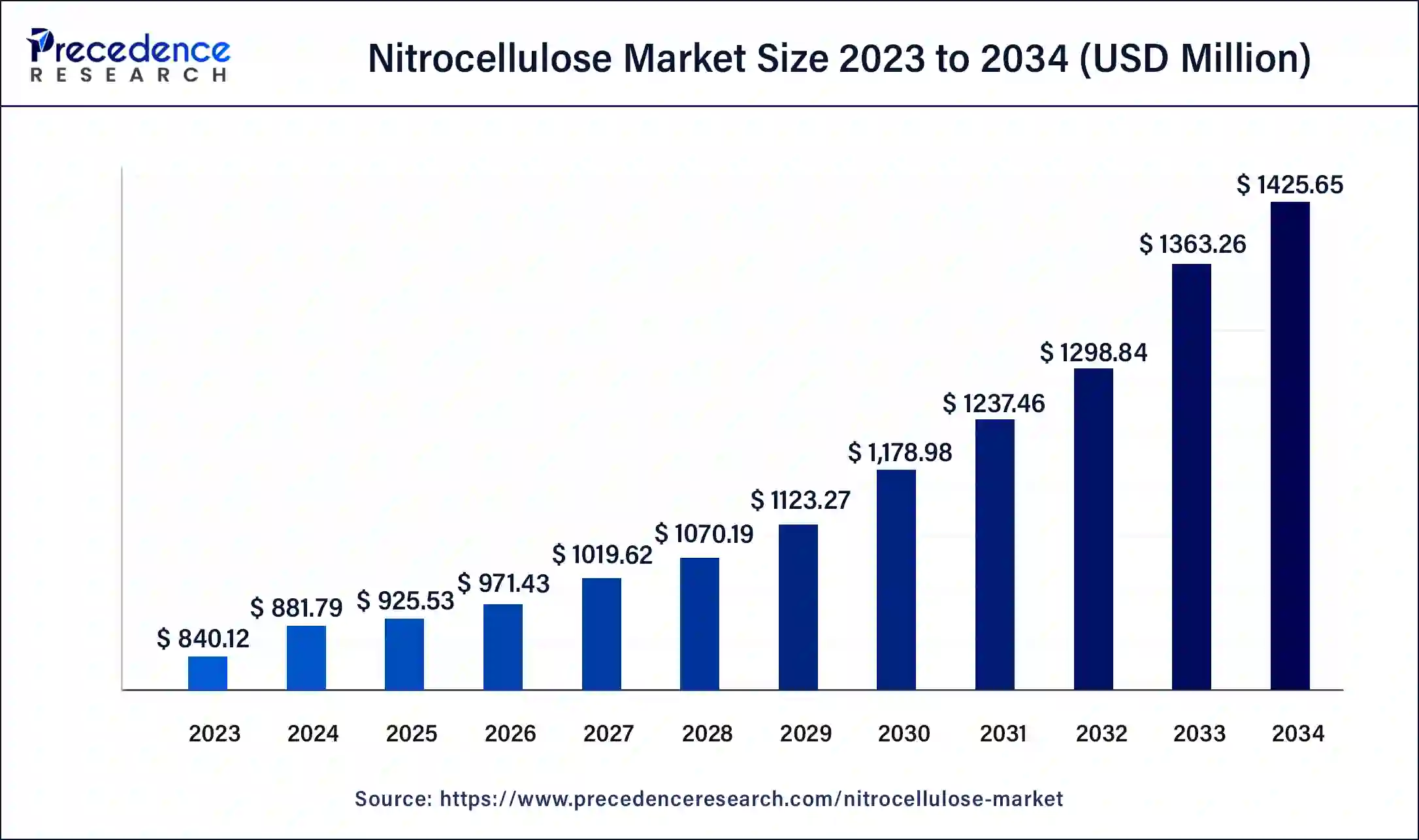

The global nitrocellulose market size is valued at USD 925.53 million in 2025, calculated at USD 971.43 million in 2026 and is expected to reach around USD 1,425.65 million by 2034, expanding at a CAGR of 4.92% from 2025 to 2034.

Market Highlights

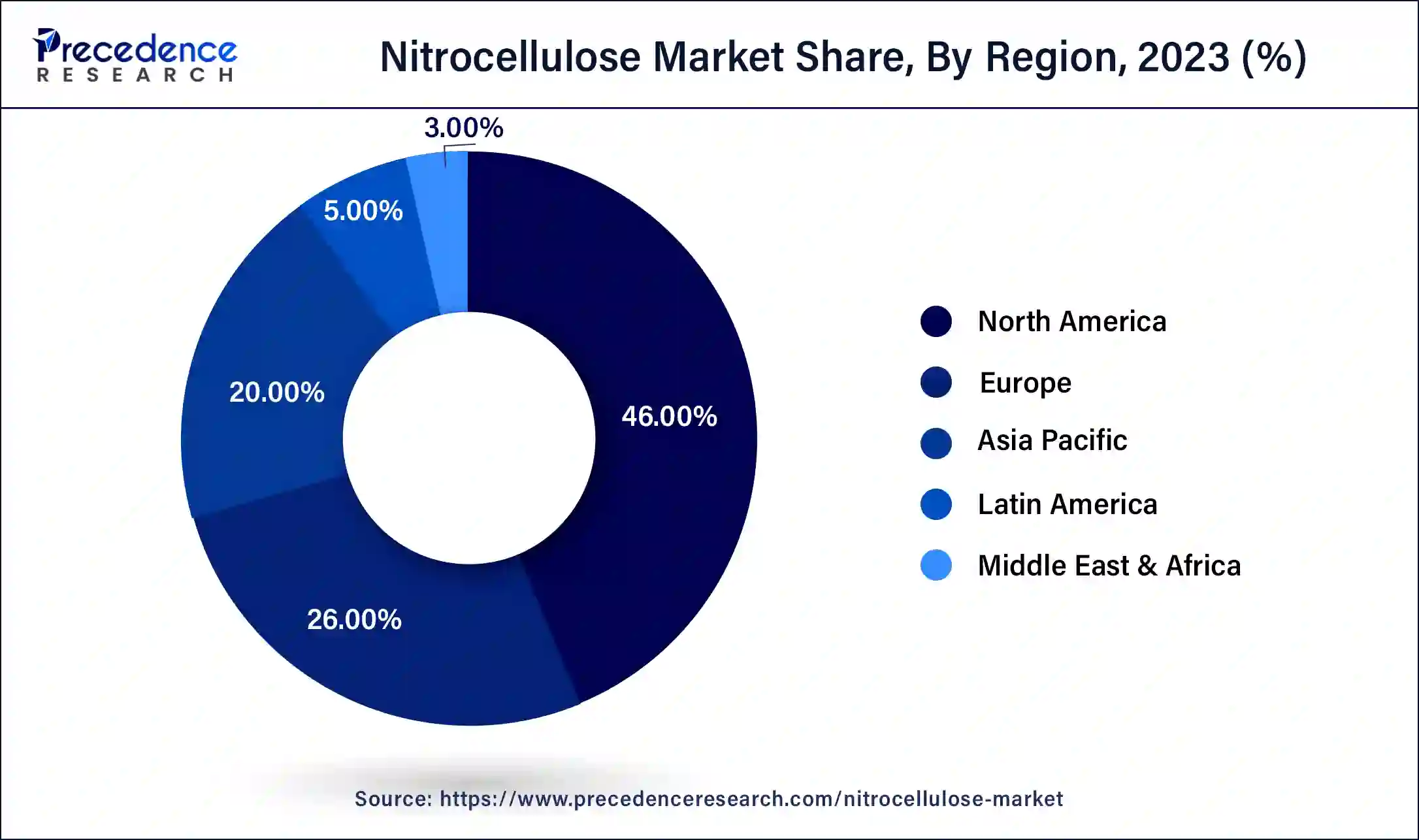

- Asia-Pacific region has contributed more than 46% of market share in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By application, the printing Inks segment has recorded more than 28% of market share in 2024.

- By application, the wood coatings segment is anticipated to witness significant growth over the projected period.

Market Overview

Nitrocellulose, also known as cellulose nitrate, is a compound derived from cellulose through a process called nitration, which involves treating cellulose with nitric acid or a mixture of nitric acid with other acids like sulfuric and hydrochloric acid. Cellulose, obtained from purified sources such as cotton linters or wood pulp, serves as the precursor for nitrocellulose production. One of the defining characteristics of nitrocellulose is its highly flammable nature, making it a valuable component in various applications requiring explosive or combustible properties. It finds extensive use in rockets, propellants, explosives, and other pyrotechnic applications due to its rapid combustion and energy release properties.

The properties of nitrocellulose can vary based on several factors including the source of cellulose, the duration of the nitration reaction, and the ratio of acid to cellulose used during the process. These variations in manufacturing parameters yield nitrocellulose with differing characteristics suited for specific applications. Apart from its role in explosives and pyrotechnics, the nitrocellulose market also finds utility in other fields. It can be employed in the production of plastic films, where its film-forming properties are beneficial, and in printing inks, where it serves as a binder and provides adhesion to surfaces. Therefore, nitrocellulose stands as a versatile compound with a wide range of applications, owing to its unique chemical properties and adaptability to various industrial processes.

Nitrocellulose Market Data and Statistics

- Nitro Quimica is rolling out a new product and enhancing its brand framework. The firm is diversifying its offerings in varnishes and other products, which is anticipated to bolster the overall supply capacity in this market. Moreover, the company has earmarked 2% of its investments for advancing this product line.

- Nippon Paint has forged a partnership with a nitrocellulose company, aimed at boosting wood coatings products. This advancement in the Asia-Pacific area is projected to unlock fresh opportunities for the nitrocellulose market.

Nitrocellulose Market Growth Factors

- The printing industry's evolution towards high-quality and fast-drying inks has propelled the demand for nitrocellulose-based inks, contributing to market growth.

- Nitrocellulose is widely used in wood coatings for furniture and flooring due to its excellent drying properties and durability, stimulating nitrocellulose market's growth.

- Nitrocellulose is utilized in pharmaceuticals for coating tablets and capsules, and with the growth of the pharmaceutical sector, the demand for nitrocellulose is also increasing.

- Ongoing research and development initiatives aimed at enhancing the properties and applications of nitrocellulose are fostering market growth by opening up new avenues of usage.

- Collaborations between key players and strategic partnerships in the industry are driving innovation and expanding market reach, contributing to overall growth.

- Companies investing in the development of new nitrocellulose-based products and technologies are driving innovation and expansion of the nitrocellulose market.

Nitrocellulose MarketTrends

- Growing Demand in Coatings and Paints: Nitrocellulose is widely used in automotive, furniture, and industrial coatings due to its fast drying and high gloss properties. Rising construction and automotive activities globally are driving demand.

- Shift Towards Eco-Friendly Solutions: There is an increasing trend toward low-VOC and environmentally friendly nitrocellulose formulations. Manufacturers are focusing on sustainable production processes to meet regulatory requirements.

- Rising Usage in Printing Inks and Lacquers: Nitrocellulose remains a key ingredient in flexographic and gravure printing inks and proactive lacquers for wood and metal surfaces. Growth in packaging and label printing is boosting its consumption.

- Growth in the Cosmetics Industry: Nitrocellulose is a primary component in nail polishes and other cosmetic products. Rising beauty and personal care trends. Particularly in emerging markets, they are supporting market growth.

- Technological Advancements in Production:Innovations in stabilization of nitrocellulose and improving solubility and drying rates are enhancing its performance and expanding applications in industrial and consumer products.

Challenges and Opportunities: Handling and storage of nitrocellulose requires strict safety protocols due to its flammability. This has promoted research into safer derivatives and blends, creating new market opportunities.

Market Outlook

- Industry Growth Overview:Nitrocellulose is used in coatings, paints, printing inks, and cosmetics. Its market is growing steadily. Asia Pacific is experiencing the fastest growth due to an increase in construction, automotive, and packaging activities. Defense applications that use nitrocellulose in explosives and propellants also contribute to demand. Over the next ten years, the market is expected to grow at a mid-single-digit CAGR despite safety and environmental regulations.

- Sustainability Trends: Manufacturers are putting more effort into producing nitrocellulose products that are safer and more ecologically friendly. This entails creating low-VOC water-based formulations employing more environmentally friendly production techniques and enhancing waste management. Opportunities for high-end sustainable nitrocellulose solutions are being created by end users in coatings and packaging who are also demanding products with less impact on the environment.

- Major Investors: Investment in nitrocellulose is growing, especially in Asia Pacific and Europe. Companies are expanding production facilities to meet rising demand in the industrial and defense sectors. Notable moves include acquisitions and plant expansions to secure supply chains for coatings, printing, and ammunition applications. This shows both confidence in market growth and a strategic focus on safer, high-quality nitrocellulose products.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 925.53 Million |

| Global Market Size by 2026 | USD 971.43 Million |

| Global Market Size by 2034 | USD 1,425.65 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of the building and construction sector along with by evolving beauty trends

Nitrocellulose-based wood coatings play a crucial role in the building and construction industry, especially in applications such as sliding doors, windows, furniture decking, and other architectural elements. The growth of the building and construction sector, fueled by urbanization and infrastructure development worldwide, has significantly increased the demand for furniture and other wood products. Nitrocellulose-based wood coatings offer excellent durability, protection, and aesthetic appeal, making them a preferred choice for finishing wooden surfaces in construction projects. Moreover, nitrocellulose is a key ingredient in nail lacquer formulations.

Its exceptional adhesion to natural nails, along with its ability to form a protective yet breathable layer, makes it an essential component in nail varnish applications. With the global cosmetics industry witnessing steady market growth driven by evolving beauty trends, the demand for nail lacquers and coatings is expected to rise correspondingly.

As consumers seek nail products with long-lasting performance and vibrant colors, nitrocellulose remains a preferred choice for nail varnish manufacturers due to its unique properties and performance. Furthermore, nitrocellulose finds extensive use in explosives, particularly in military applications for driving projectiles. Its high energy content and stability make it an ideal component in explosive formulations used by armed forces worldwide. The consistent demand for military-grade explosives for defense and security purposes contributes to the sustained growth of the nitrocellulose market. The convergence of these factors, including the expansion of the building and construction sector, the growth of the cosmetics industry, and the continued demand for military-grade explosives, collectively drive the market growth of the nitrocellulose market.

Additionally, ongoing innovations in nitrocellulose-based formulations, such as improved durability, eco-friendly compositions, and enhanced performance characteristics, further propel market expansion. As industries continue to prioritize product quality, performance, and sustainability, nitrocellulose remains a versatile and indispensable material across various applications, ensuring its continued relevance and growth in diverse sectors globally.

According to the IBEF, in India, under the Interim Budget 2024-25, capital investment outlay for infrastructure has been increased by 11.1% to Rs.11.11 lakh crore. The FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at USD 26.54 billion and USD 33.52 billion, respectively, between April 2000 and December 2023?.

Restraint

Safety and health concerns associated with nitrocellulose-based manufacturing processes

The use of nitrocellulose dampened with isopropanol in paint and ink manufacturing processes poses significant fire hazards due to the highly flammable nature of these chemicals. Blending machines and stored nitrocellulose are particularly susceptible to fire outbreaks, which can result in severe damage to manufacturing plants and pose risks to personnel safety. Moreover, exposure to high concentrations of solvents like isopropanol can lead to adverse health effects such as dizziness, breathing difficulties, and unconsciousness. Handling strong acids like sulfuric acid, commonly used in industrial processes involving nitrocellulose, also presents hazards to workers. Long-term exposure to these chemicals can result in chronic health issues including kidney and liver damage, central nervous system depression, and permanent eye damage.

Additionally, the decomposition or combustion of nitrocellulose and associated chemicals may release toxic gases such as nitrogen oxides, hydrogen cyanide, and carbon monoxide, further exacerbating health risks for workers and nearby communities. These safety and health concerns associated with nitrocellulose-based manufacturing processes and chemical handling practices are significant factors that can hamper market growth in the market. Compliance with stringent safety regulations and implementation of robust safety protocols are imperative to mitigate these risks and ensure the well-being of workers and environmental protection within manufacturing facilities.

Opportunity

Increasing demand for paints and coatings

The building and construction segment plays a significant role in driving the demand for nitrocellulose, primarily due to its widespread usage in the manufacturing of paints and coatings. These coatings offer numerous advantages such as durability, odorlessness, and hygiene, making them well-suited for various residential and commercial construction applications. Whether it's for walls, doors, windows, or metal structures, nitrocellulose-based paints and coatings provide long-lasting protection and aesthetic appeal with options for both matte and glossy finishes. The increasing demand for paints and coatings in residential areas is fueled by the rising construction activities driven by government initiatives like India's 'Smart City Mission' and 'Housing for All' program. Thereby, the increasing demand for paints and coatings creates a potential opportunity for the nitrocellulose market.

These initiatives are propelling infrastructure development and urbanization, leading to a surge in construction projects and subsequently boosting the demand for nitrocellulose-based coatings. Furthermore, the functional benefits offered by these coatings, such as thermal conduction, light absorption, insulation, anti-skid properties, and reflection, make them highly desirable across various global markets. As construction practices evolve and sustainability becomes a key focus, nitrocellulose-based paints and coatings are expected to witness continued growth and adoption in the building and construction sector worldwide.

In July 2024, Asian Paints unveiled its expansion plan of its Mysuru plant, doubling its production capacity with an investment of Rs 13.50 billion. This strategic move aims to meet the rising demand for paints and coatings in India, spurred by the rapid growth in the housing and infrastructure sectors. The expansion project at the Mysuru plant will increase its annual production capacity from 300,000 kiloliters to 600,000 kiloliters.

Segment Insights

Application Insights

The printing inks segment has held a 28% market share in 2024. The printing ink application segment stands as a dominant force within the global nitrocellulose industry, driven by several key factors. Technological advancements have significantly contributed to the segment's growth, facilitating the development of eco-friendly inks that align with evolving environmental regulations and consumer preferences.

One of the primary sectors fueling the demand for printing inks is the packaging and logistics industry. Printing inks play a crucial role in labeling, branding, and product identification across various packaging materials. Additionally, the proliferation of digital printing technologies has propelled the demand for printing inks, particularly in applications such as outdoor signage and inkjet printing. Environmental concerns have emerged as a pivotal driver shaping the printing ink market landscape. Government authorities are increasingly focused on modernizing printing industry standards to minimize environmental impact.

Nitrocellulose-based lamination ink has emerged as a preferred choice in flexography and gravure printing due to its ability to deliver high-quality, vibrant color results while exhibiting strong laminated bond strength. Furthermore, the inherent characteristics of nitrocellulose-based inks, including minimal odor and solvent retention, make them highly desirable in the packaging industry. These attributes contribute to enhanced product quality and consumer satisfaction, driving the adoption of nitrocellulose-based printing inks across various packaging applications. Therefore, the printing ink segment's dominance underscores its pivotal role in diverse industries and its responsiveness to evolving market dynamics, including technological innovations and environmental sustainability initiatives.

The wood coatings segment is anticipated to witness significant growth over the projected period. Wood coatings play a vital role across various applications, ranging from furniture decking to sliding windows and doors, as well as in carpets and coloring for industrial purposes. Nitrocellulose-based lacquers are particularly prevalent in the manufacturing of musical instruments, such as steel strings for guitars, owing to their excellent finishing properties.

In the United States, especially, nitrocellulose lacquer is widely used for its ability to enhance durability and flexibility when combined with other resins. One of the key advantages of nitrocellulose lacquer is its ease of application, which facilitates convenient touch-ups and repairs, making it a preferred choice in the woodworking industry. In the realm of printing inks, those containing cellulose nitrate are witnessing a surge in demand. These inks are prized for their ability to produce graphics with high brilliance and resolution.

Moreover, their compatibility with contemporary printing machines enables fast-printing speeds, contributing to enhanced efficiency in printing operations. As industries continue to prioritize quality and efficiency in their manufacturing processes, the demand for wood coatings and printing inks containing nitrocellulose is expected to persist and grow. The versatility and performance characteristics of nitrocellulose-based products position them as indispensable components in various industrial and creative applications, driving their continued adoption and market expansion.

Regional Insights

Asia Pacific Nitrocellulose Market Size and Growth 2025 to 2034

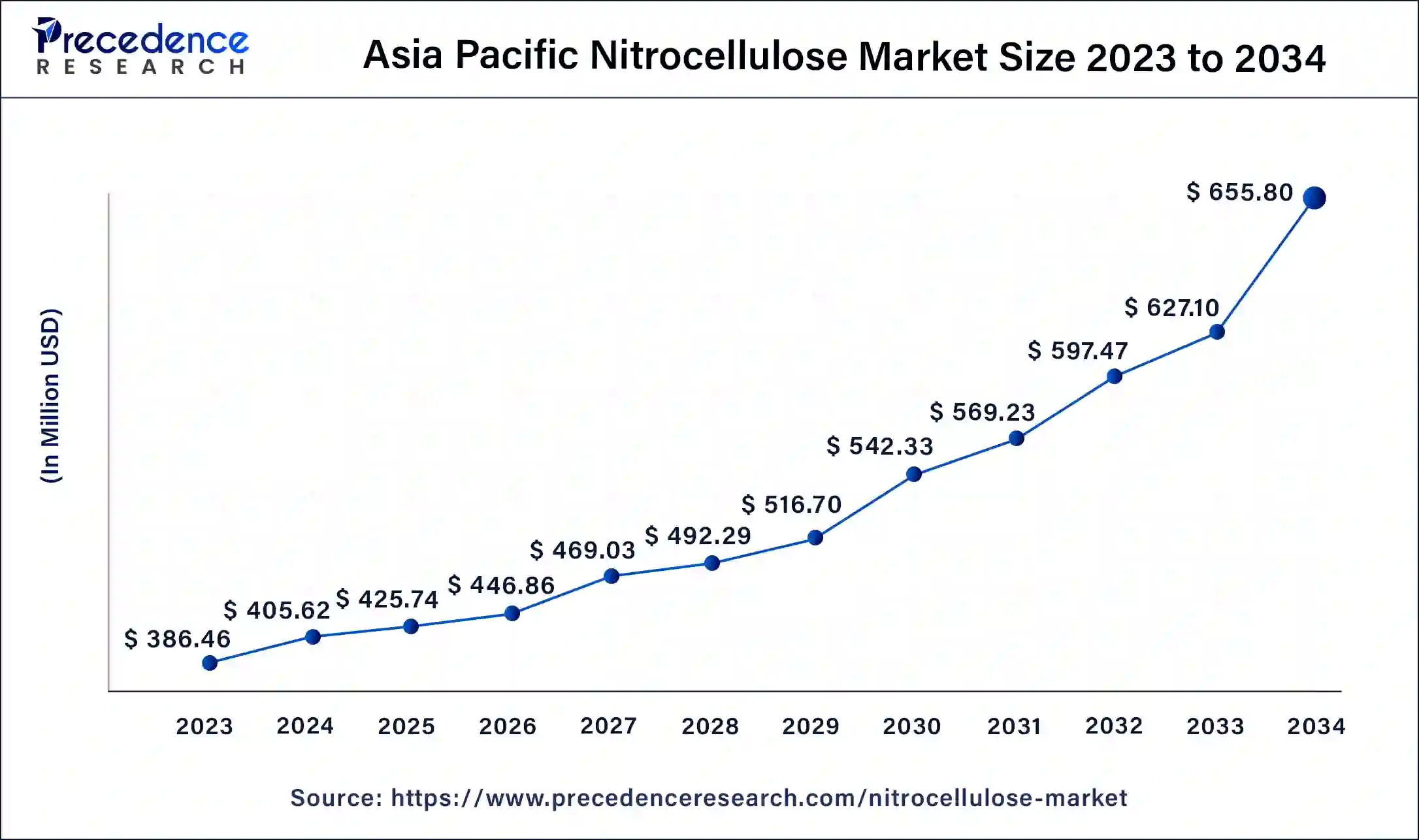

The Asia Pacific nitrocellulose market size is estimated at USD 425.74 million in 2025 and is projected to surpass around USD 655.80 million by 2034 at a CAGR of 5.10% from 2025 to 2034.

Asia Pacific is indeed a dominant force in the nitrocellulose market, accounting for more than 46% of the market's market share in 2024. Asia Pacific has emerged as a dominant force in the nitrocellulose industry, primarily fueled by the expanding application scope within the paints and coatings sector. Countries such as Thailand, India, and China stand out as key players, boasting substantial production capacities and serving as major exporters of nitrocellulose products. The region benefits from robust trade networks and a thriving market for nitrocellulose due to its extensive utilization across various sectors. In particular, nitrocellulose finds widespread application in the formulation of printing inks, automotive paints, wood coatings, and leather tanning and finishes, among others.

The dynamic economies of Thailand, India, and China drive significant demand for nitrocellulose-based products, both domestically and internationally. Moreover, these countries leverage their manufacturing prowess and strategic geographic locations to cater to global markets, further solidifying Asia Pacific's position as a key player in the nitrocellulose industry. With increasing industrialization, urbanization, and infrastructural development across the region, the demand for paints, coatings, and related products is expected to continue rising, sustaining the growth momentum of the nitrocellulose market in Asia Pacific for the foreseeable future.

North America is also poised for significant growth CAGR in the nitrocellulose market, The North America region, particularly the United States and Canada, is poised to witness a surge in demand for nitrocellulose, driven by several key factors. Firstly, the flourishing tourism sector and robust construction industry in these countries are anticipated to stimulate the demand for wooden items. As tourism activities and construction projects continue to expand, there will be a heightened need for wooden furniture, fixtures, and structures, thereby increasing the demand for nitrocellulose-based coatings used in wooden applications.

Canada, specifically, stands out as the fourth-largest manufacturer of wooden furniture globally, a testament to its significant presence in the wooden products market. The burgeoning smart homes sector in the region, coupled with the rising standard of living, is expected to further bolster the demand for nitrocellulose coatings used in wooden applications.

Furthermore, prominent position as a market leader in the automotive sector contributes to the growth of automotive paints. With a robust automotive industry and the presence of renowned automobile manufacturers, Germany experiences a high demand for automotive paints, including those formulated with nitrocellulose. Hence, the confluence of these factors, including the expansion of the tourism sector, growth in construction activities, and the thriving automotive industry, is expected to drive substantial growth in the demand for nitrocellulose products in North America and Germany.

In May 2024, PPG Industries, unveiled its plan to invest USD 300 million to boost its manufacturing capabilities in North America, aimed at meeting the rising demand for paints and coatings in the automotive sector. This investment includes the construction of a new manufacturing facility in Tennessee.

Nitrocellulose Market Companies

- Sichuan Nitrocell Corporation (China)

- Nobel NC (Thailand)

- Nitro Química (U.S.)

- DowDuPont (U.S.)

- TNC (U.S.)

- Hubei Xuefei Chemical (China)

- Hengshui Orient Chemical (China)

- Nitrex Chemicals (India)

- Synthesia (U.K.)

- Xinxiang T.N.C Chemical (China)

- Jiangsu Tailida (China)

Recent Developments

- In August 2025, Colt CZ Group SE announced the acquisition of Synthesia's nitrocellulose division in a deal valued at approximately USD 1.05 billion. This move significantly strengthens Colt's upstream control over propellant-grade nitrocellulose, which is a critical input for ammunition manufacturing. The acquisition supports the company's long-term strategy of securing stable raw material supply amid rising global defense demand.

(Source: https://www.reuters.com) - In April 2025, Rheinmetall announced its agreement to acquire the German nitrocellulose manufacturer Hagedorn-NC to reinforce its domestic supply chain for propellant materials. The deal aims to reduce import dependency and ensure consistent availability of energetic nitrocellulose for European defense programs. This acquisition is part of Rheinmetall's wider expansion strategy as defense modernization accelerates across the EU.

(Source: https://www.ft.com) - In November 2024, a consortium of Polish companies, including Grupa Azoty, PGZ, Mesko, and the Industrial Development Agency, signed a letter of intent to establish a domestic facility for nitrocellulose and multi-base explosive powders. This development aims to bolster Poland's self-reliance in critical defense materials and reduce reliance on imported energetic chemicals. The agreement aligns with the country's increasing investments in defense manufacturing capabilities.(Source: https://www.reuters.com)

- In April 2024, Nippon Paint, a leading paint and coating company, launched its consumer-facing automotive body and paint repair service brand ‘Mastercraft' in India. The company says Mastercraft promises exemplary body and paint work, car decoration services, and ultra-fast repairs, backed by Japanese precision and technology. The Gurugram centre will provide innovative, state-of-the-art technology and green solutions, with a capacity to repair around 2,500 cars annually.

- In March 2025, Evonik's Coating Additives business unit announced a strategic partnership with Nippon Paint China. The agreement combines Evonik's expertise in high-performance additive solutions with Nippon Paint China's market leadership in the coatings industry. The collaboration will focus on creating next-generation products to meet consumers' growing demand for environmentally friendly solutions.

- According to the article published in March 2024, Russia has boosted its imports of an explosive compound critical to the production of artillery ammunition, including from companies based in the U.S. Russian imports of nitrocellulose, a highly flammable cotton product central to gunpowder and rocket propellant manufacture, rose 70% in 2022.

Segments Covered in the Report

By Application

- Printing Inks

- Automotive Paints

- Wood Coatings

- Leather Finishes

- Nail Varnishes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client