List of Contents

What is the Industrial Wastewater Treatment Market Size?

The global industrial wastewater treatment market size is calculated at USD 19.41 billion in 2025 and is predicted to increase from USD 20.63 billion in 2026 to approximately USD 34.11 billion by 2034, poised to grow at a CAGR of 6.44% during the forecast period from 2025 to 2034. The market growth is attributed to the increasing need for sustainable wastewater management solutions driven by industrial expansion and stringent environmental regulations.

Industrial Wastewater Treatment Market Key Takeaways

- The global industrial wastewater treatment market was valued at USD 18.28 billion in 2024.

- It is projected to reach USD 34.11 billion by 2034.

- The industrial wastewater treatment market is expected to grow at a CAGR of 6.44% from 2025 to 2034.

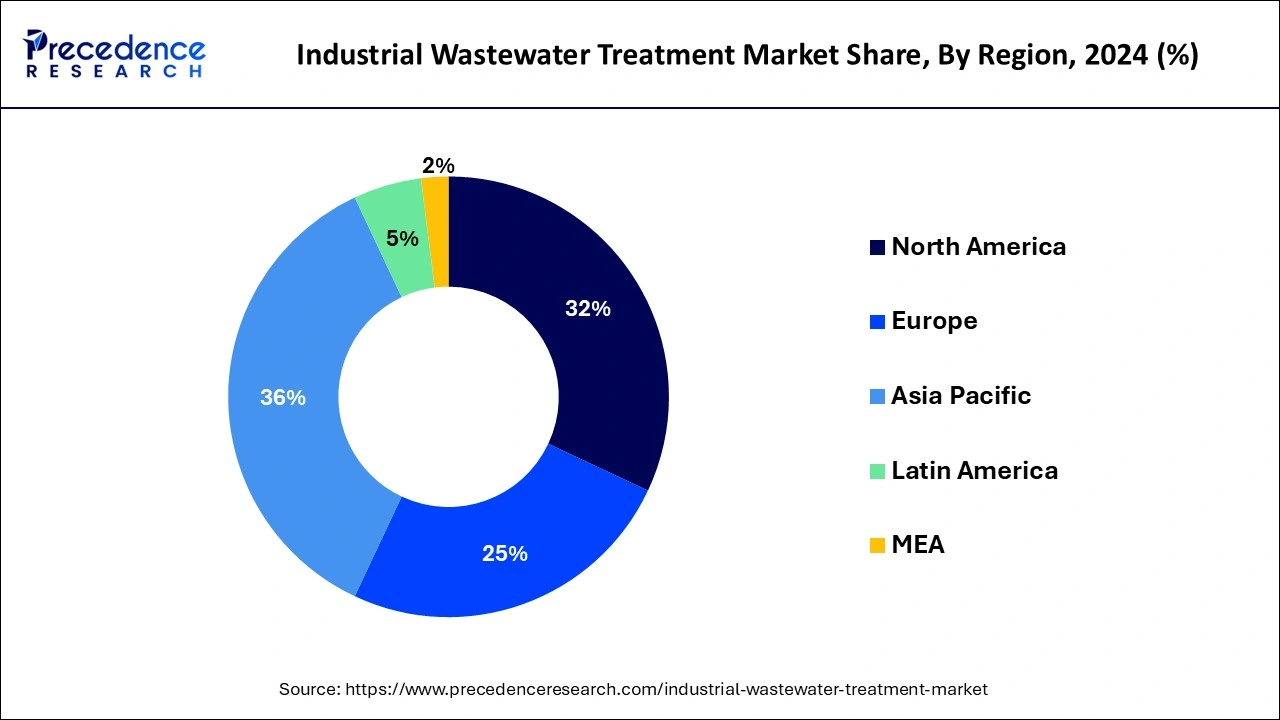

- Asia Pacific contributed more than 36% of market share in 2024.

- Europe is estimated to witness the fastest CAGR between 2025 and 2034.

- By type, the corrosion inhibitors segment has held the largest market share in 2024.

- By type, the scale inhibitors segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the boiler feed water segment generated largest market share in 2024.

- By application, the chemical production segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the biological treatment segment held the largest market share in 2024.

- By technology, the membrane bioreactor segment is expected to expand at the fastest CAGR over the projected period.

- By end use industry, the oil & gas segment generated largest market share in 2024.

- By end use industry, the chemical production segment is expected to expand at the fastest CAGR over the projected period.

Impact of Artificial Intelligence on the Industrial Wastewater Treatment Market

AI increases the productivity and quality of the processes in industrial wastewater treatment and the facility's decision-making process. Machine learning processes monitor data in real-time to estimate system capabilities, identify inefficiencies, and suggest remedial solutions. Operating costs are therefore kept low, and pollution levels are low. Modern algorithms in machine learning water quality indicators such as pH value, turbidity, and chemical content are kept undamaged at the highest possible level corresponding to the most rigorous requirements. Smart technologies in equipment management diagnose likely failures before they occur and, therefore, reduce the loss of time, improving the reliability of plants in general.

What is industrial wastewater treatment?

The industrial wastewater treatment market focuses on the purification and treatment of wastewater generated by industrial processes before discharge into the environment. Driven by environmental regulations and corporate sustainability initiatives, the market employs various technologies to remove pollutants and contaminants from industrial effluents. Key components include physical, chemical, and biological treatment methods. The market addresses diverse industrial sectors such as manufacturing, chemicals, pharmaceuticals, and energy.

Ongoing advancements in treatment technologies, coupled with a rising awareness of water scarcity, underscore the market's importance in promoting responsible industrial practices and minimizing the environmental impact of industrial wastewater discharge. As the industrial wastewater treatment market evolves, there's a growing emphasis on sustainable practices, the reuse of treated water, and the integration of innovative technologies, reflecting a commitment to environmental stewardship and resource conservation.

Wastewater Treatment Market Growth Factors

- Increasing environmental regulations worldwide mandate industries to adopt effective wastewater treatment, driving the demand for industrial wastewater treatment solutions.

- Growing corporate emphasis on sustainability fuels investments in advanced wastewater treatment technologies, aligning with broader environmental and social responsibility goals.

- Rising awareness of water scarcity underscores the importance of efficient wastewater treatment, promoting responsible water management practices among industries.

- Ongoing innovations in treatment technologies, including membrane filtration, biological treatment, and advanced oxidation processes, offer enhanced pollutant removal efficiency and reliability.

- Industrial wastewater treatment finds applications across diverse sectors, including manufacturing, chemicals, pharmaceuticals, and energy, presenting a broad market scope.

- The emphasis on water reuse and recycling creates opportunities for wastewater treatment providers to offer solutions that align with sustainable resource management.

- The integration of digital and smart technologies in wastewater treatment processes enhances efficiency, monitoring, and optimization, reflecting the industry's technological evolution.

- The adoption of decentralized treatment systems allows industries to address wastewater treatment on-site, offering flexibility and minimizing the environmental impact of transportation.

- Collaborations between public and private entities in wastewater treatment projects create synergies, combining expertise and resources to address complex industrial wastewater challenges.

- Wastewater treatment processes increasingly focus on resource recovery, extracting valuable by-products such as biogas or nutrients, contributing to the circular economy concept.

- Opportunities abound in emerging markets where industrialization is on the rise, prompting global expansion for wastewater treatment providers.

- Industry exhibits resilience to economic fluctuations as wastewater treatment remains a critical aspect of industrial operations, ensuring compliance and sustainability.

- Businesses adopting adaptive water management strategies benefit from a comprehensive approach to wastewater treatment, considering both current and future environmental challenges.

- Integration of green chemistry practices in industrial processes encourages environmentally friendly production methods, necessitating effective wastewater treatment solutions.

- Public awareness and education campaigns about the environmental impact of untreated industrial wastewater create opportunities for companies providing eco-friendly and responsible treatment solutions.

Industrial Wastewater Treatment Market Outlook

- Industry Growth Overview: The industrial wastewater treatment market is expected to experience rapid growth from 2025 to 2030, supported by more stringent discharge regulations, industrial growth, and growing initiatives to promote water reuse. Growth is supported by increasing investment in advanced filtration, biological treatment, and zero-liquid discharge systems, especially in Asia-Pacific and North America.

- Sustainability Trends: Sustainability has influenced the industry with firms emphasizing circular water management, energy-efficient treatment plants, and reduced sludge generation. Companies such as Veolia and Ecolab are heavily investing in green treatment technologies and digital monitoring to accommodate new carbon-neutral and water-positive commitments.

- Global Expansion: Key players are expanding and moving into newly developed industrial areas in Southeast Asia, Latin America, and the Middle East to serve growing manufacturing opportunities. SUEZ and Xylem announced a hosted regional project to improve wastewater recycling and desalination capacity in industrial parks.

- Primary Investors: Institutional and individual investors boosted financing in water technology companies because of their strong alignment with environmental, social, and governance (ESG) principles and inherent high barriers to entry. The two largest deals included the acquisition of firms that developed digital water analytics and membrane technology by investment groups, including BlackRock and Brookfield.

- Startup Ecosystem: The startup ecosystem flourished with innovations in AI-powered monitoring, microbial treatment, and modular recycling units. For example, Gradiant (U.S.) and Indra Water (India) attracted investment funding for relevant and scalable wastewater management solutions that are cost-effective and sustainable.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.44% |

| Market Size in 2025 | USD 19.41 Billion |

| Market Size in 2026 | USD 20.63 Billion |

| Market Size by 2034 | USD 34.11 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, By Technology, and By End Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Water scarcity concerns and technological advancements

Water scarcity concerns and technological advancements synergistically drive the surge in market demand for industrial wastewater treatment. Heightened awareness of water scarcity positions efficient wastewater treatment as a pivotal strategy for responsible water management. Industries, recognizing the imperative to minimize their water footprint, increasingly invest in advanced treatment solutions to address this critical resource challenge.

Simultaneously, technological advancements propel the market forward by offering innovative and more effective wastewater treatment options. Cutting-edge technologies such as membrane filtration, advanced oxidation processes, and intelligent monitoring systems enhance treatment efficiency, enabling industries to meet stringent environmental standards. The convergence of water scarcity concerns and technological progress creates a compelling narrative, fostering a robust market demand as businesses strive to not only comply with regulations but also adopt sustainable practices in water usage and discharge, ensuring the long-term viability of water resources.

Restraint

Operational and maintenance expenses and energy consumption

Operational and maintenance expenses, coupled with high energy consumption, act as significant restraints on industrial wastewater treatment. The deployment and upkeep of advanced treatment technologies involves substantial operational costs, including skilled personnel, equipment maintenance, and compliance monitoring. This financial burden can deter some industries, particularly smaller enterprises, from adopting sophisticated wastewater treatment solutions, limiting market expansion.

Moreover, the energy-intensive nature of certain treatment processes contributes to increased operational costs and carbon footprints. Industries must grapple with the challenge of balancing effective wastewater treatment with the associated energy consumption. As sustainability becomes a focal point for businesses, finding cost-effective and energy-efficient solutions becomes imperative to alleviate the financial strain on industries and encourage broader adoption of environmentally responsible industrial wastewater treatment practices.

Opportunity

Development of smart wastewater treatment technologies and decentralized treatment solutions

The surge in market demand for industrial wastewater treatment is notably fueled by the development of smart wastewater treatment technologies. Integrating digital and smart solutions enhances the efficiency and monitoring capabilities of wastewater treatment processes. Advanced sensor networks, real-time data analytics, and automation optimize treatment operations, enabling industries to meet environmental standards with precision and effectiveness. This technological evolution aligns with the industry's commitment to innovation, sustainability, and regulatory compliance.

Furthermore, the adoption of decentralized treatment solutions contributes significantly to the market's growth. The industrial sector is increasingly acknowledging the advantages of on-site wastewater treatment, diminishing the reliance on centralized facilities and mitigating the environmental impact linked to transportation. Decentralized systems provide a flexible, cost-effective solution, adept at addressing unique local challenges. This trend stands out as a pivotal driver, adeptly meeting the diverse and evolving requirements of industrial wastewater treatment while aligning with sustainability goals and optimizing resource utilization.

Type Insights

By type, the corrosion inhibitors segment registered its dominance over the global market. Corrosion inhibitors are chemical compounds added to wastewater treatment processes to mitigate the corrosive effects of contaminants. In the industrial wastewater treatment market, corrosion inhibitors play a crucial role in preserving equipment integrity. Trends indicate a growing preference for environmentally friendly inhibitors, aligning with sustainable practices. Ongoing research focuses on enhancing inhibitor effectiveness, especially in harsh industrial environments, while minimizing the ecological impact.

By type, the scale inhibitors segment is predicted to witness significant growth in the market over the forecast period.Scale inhibitors prevent the formation of scale, a mineral deposit, in industrial wastewater systems. In the market, trends reflect a shift towards advanced scale inhibitors that offer improved efficiency and are compatible with diverse industrial processes. The demand for scale inhibitors is rising, driven by their ability to optimize equipment performance and reduce maintenance costs. Additionally, trends showcase a focus on tailored inhibitor solutions to address specific scaling challenges in various industrial settings.

Application Insights

By application, the boiler feed water segment is predicted to witness significant growth in the market over the forecast period. Boiler feed water treatment in industrial wastewater treatment involves purifying water to meet stringent quality standards for use in boilers. The process removes impurities and contaminants to prevent scale formation, corrosion, and fouling. Trends in this application include a shift toward advanced membrane technologies, such as reverse osmosis, and the integration of digital monitoring for precise control, ensuring optimal boiler performance and longevity.

The chemical production segment is projected to grow at the fastest rate over the projected period. Chemical production wastewater treatment addresses the complex effluents generated in chemical manufacturing. Trends in this application focus on sustainable practices, with an emphasis on resource recovery and the adoption of advanced oxidation processes. Industry is witnessing a move towards closed-loop systems, minimizing water usage and enhancing overall efficiency in treating wastewater from chemical production processes.

Technology Insights

By technology, the biological treatment segment registered its dominance over the global market.Biological treatment in the industrial wastewater treatment involves the use of microorganisms to break down pollutants in wastewater. Employing bacteria and other biological entities, this eco-friendly process transforms contaminants into harmless by-products. Recent trends showcase an increasing adoption of advanced biological treatment techniques, optimizing microbial activity through bioaugmentation and biofilm technologies.

The membrane bioreactor segment is projected to grow at the fastest rate over the projected period. A Membrane Bioreactor (MBR) combines biological treatment with membrane filtration, offering a compact and efficient solution for wastewater treatment. MBR technology utilizes membranes to separate solids, producing high-quality treated water. Trends in the industrial wastewater treatment market indicate a rising preference for MBR systems due to their small footprint, superior effluent quality, and adaptability to various industrial applications. This underscores a shift towards advanced technologies that prioritize both environmental sustainability and process optimization.

End-use Industry Insights

By the end-use industry, the oil and gas segment has led the global market.In the oil & gas sector, the industrial wastewater treatment addresses the complex challenge of managing wastewater from extraction, refining, and processing operations. Trends include the adoption of advanced treatment technologies for oil removal, compliance with stringent environmental regulations, and a growing focus on water reuse. Sustainable solutions are pivotal as the industry navigates water-intensive processes, enhancing treatment efficiency and minimizing environmental impact.

The food & beverage segment is anticipated to expand at the fastest rate over the projected period. In the food & beverage sector, the industrial wastewater treatment market focuses on treating effluents from food processing, packaging, and beverage production. Trends involve innovative biological treatment methods, water conservation initiatives, and compliance with food safety standards. Growing awareness of sustainability drives the adoption of resource recovery practices, such as capturing and reusing by-products, emphasizing the industry's commitment to responsible wastewater management.

Regional Insights

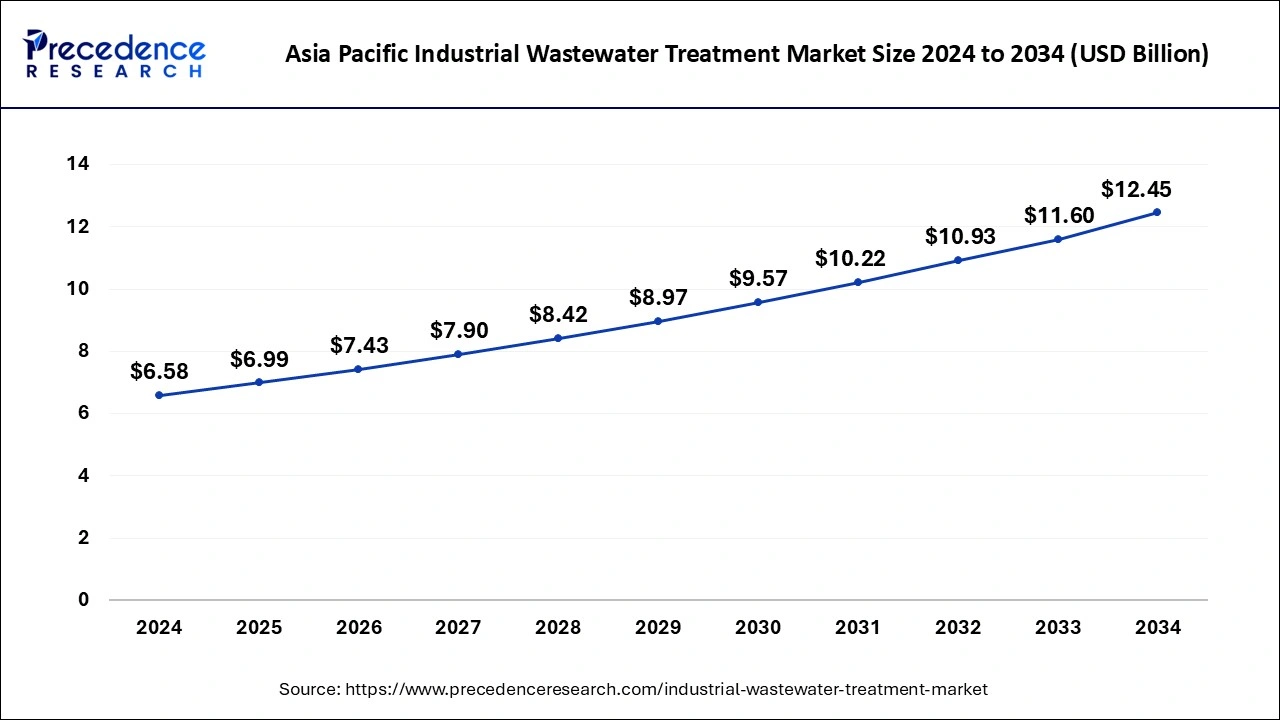

Asia Pacific Industrial Wastewater Treatment Market Size and Growth 2025 to 2034

The Asia Pacific industrial wastewater treatment market size is valued at USD 6.99 billion in 2025 and is expected to reach USD 12.45 billion by 2034, growing at a CAGR of 6.58% from 2025 to 2034.

Asia Pacific: China Industrial Wastewater Treatment Market Trends

Asia-Pacific has held the largest market share of 36% in 2024. The region is witnessing robust growth in the industrial wastewater treatment market, propelled by rapid industrialization and stringent environmental regulations. Increasing investments in advanced treatment technologies, such as membrane filtration and biological treatment, reflect the region's commitment to sustainable practices. The market experiences a shift towards decentralized treatment solutions, addressing diverse industrial needs and fostering innovation in response to the escalating demand for efficient and eco-friendly wastewater management.

Europe: Germany Industrial Wastewater Treatment Market Trends

Europe is estimated to observe the fastest expansion.In Europe, the industrial wastewater treatment market is characterized by a strong emphasis on circular economy principles and green initiatives. Stringent regulatory frameworks drive continuous advancements in treatment technologies, with a notable focus on resource recovery. Decentralized treatment solutions gain traction, aligning with the region's commitment to localized and efficient wastewater management. Collaborative public-private partnerships and a growing awareness of water scarcity underscore Europe's leadership in adopting environmentally responsible industrial wastewater treatment practices.

In North America, the industrial wastewater treatment market exhibits dynamic trends marked by a concerted effort to enhance sustainability in industrial practices. Stringent environmental regulations drive investments in advanced treatment technologies. The region emphasizes decentralized treatment solutions, promoting localized and efficient wastewater management. Collaborative initiatives and technological innovations underscore North America's commitment to addressing industrial wastewater challenges while adhering to stringent environmental standards.

North America: U.S. Industrial Wastewater Treatment Market Trends

The U.S. market is growing steadily, driven by stricter environmental regulations and increased demand from key industrial sectors. Advanced technologies such as membrane filtration and digital monitoring are being widely adopted to enhance efficiency and compliance. Investments are focusing on upgrading existing facilities, implementing modular systems, and promoting water reuse and resource recovery.

China's is experiencing strong growth, driven by rapid industrialization and stricter environmental regulations. Industries are increasingly focusing on water reuse, resource recovery, and energy-efficient treatment solutions. Advanced technologies such as membrane filtration, oxidation processes, and smart monitoring systems are seeing higher adoption. Investments are shifting towards upgrading existing facilities, modular systems, and zero-liquid discharge solutions rather than constructing new large-scale plants.

The market in Germany is growing steadily, driven by stricter environmental regulations and sustainability initiatives. Chemical treatment remains the dominant technology, while membrane and advanced treatment systems are gaining traction. Industries are increasingly focusing on water reuse, nutrient recovery, and energy-efficient solutions. Investments are shifting towards upgrading existing facilities, modular systems, and digital monitoring to meet emerging standards.

Why did Latin America grow at a rapid rate in the industrial wastewater treatment market?

The industrial wastewater treatment market in Latin America saw growth resulting from rising environmental considerations and new government formalization of policies on the management of industrial waste. With this focus, countries such as Brazil and Mexico initiated investments into modern treatment systems for the treatment of wastewater generated by their food, textile, and oil industries. The international investments and partnerships resulted in significant opportunities for technology transfer and upgrading existing infrastructure. Moreover, water scarcity and sustainability programs also provided great opportunities for increased growth in recycling initiatives and zero-liquid discharge systems.

Brazil Industrial Wastewater Treatment Market Trends

Brazil held a dominant position in the regional market with strong demand from its petrochemical, pulp, and beverage industries. In line with those industries adopting all aspects of sustainability, the government worked with industries to install a more efficient wastewater treatment system to help with the discharge levels that were required. International companies partnered with local Brazilian companies to gain increased access to new technology. There was also rising awareness by the public and a tightening of reuse policies that enabled Brazil to raise market awareness of using more advanced biological and chemical treatments to help improve water efficiency while also protecting the surrounding environment.

Why did the industrial wastewater treatment market grow significantly in the Middle East & Africa region?

The industrial wastewater treatment market saw significant expansion in the Middle East & Africa region, bolstered by increasing industrialization and water scarcity. Countries were developing investments in desalination and water reuse projects to support their manufacturing sectors. Countries in the GCC were early leaders in smart water management initiatives, while countries in Africa were beginning to pursue decentralized treatment approaches. The region had enormous prospects for new investment in zero-liquid discharge and renewable-powered treatment facilities.

Saudi Arabia Industrial Wastewater Treatment Market Trends

Saudi Arabia dominated the regional market, supported by robust government initiatives and plans like Vision 2030 that concentrated on enhancing sustainable water usage and creating best-practice behaviours. Rapid industrial growth from the petrochemicals and mining sectors fuelled increases in wastewater treatment. Australian companies continued investing in membrane processes and advanced filtration technologies. Collaborations with global firms like Veolia and SUEZ were expanding local capabilities and expertise, thereby positioning Saudi Arabia as a leader in advanced industrial commercial water management solutions in the Gulf region.

Industrial Wastewater Treatment Market Companies

- Veolia Environnement S.A.

- Suez S.A.

- Ecolab Inc.

- AECOM

- Xylem Inc.

- DuPont de Nemours, Inc.

- Thermo Fisher Scientific Inc.

- Calgon Carbon Corporation (A Kuraray Company)

- 3M Company

- A. O. Smith Corporation

- Kemira Oyj

- Danaher Corporation

- Honeywell International Inc.

- Siemens AG

- Kurita Water Industries Ltd.

Recent Development

- In January 2025, Oriental Weavers, a global leader in woven carpet manufacturing, inaugurated an expanded industrial wastewater treatment plant at the group's spinning factory. The facility incorporates four consecutive treatment stages and handles a capacity of 1,250 cubic meters per day, showcasing the company's commitment to sustainable manufacturing practices.

- In August 2024, Ilim Group launched an advanced wastewater treatment system at its new KLB Mill in Ust-Ilimsk, Russia. The facility, which will become the largest kraftliner production site in the country, aims to produce 600,000 tons of finished products annually. By 2025, Ilim Group targets a total annual output of 4.6 million tons of finished products, strengthening its position as a global leader in unbleached packaging materials. The plant incorporates state-of-the-art wastewater treatment technology, a first of its kind in Russia.

- In July 2024, IDE Technologies, a global provider of water treatment solutions, announced its contract with CleanEdge Water Pte Ltd. to build a state-of-the-art wastewater treatment plant for the mining industry in India. CleanEdge Water, headquartered in Singapore, specializes in delivering integrated industrial wastewater solutions across Southeast Asia and India on a BOOT basis. This collaboration highlights the growing focus on efficient water management in industrial applications.

Latest Announcements by Industry Leaders

- June 2024 – SUEZ

- Chairman and CEO – Subrina Soussan

- Announcement - SUEZ, a global leader in circular solutions for water and waste management, unveiled three new projects in Asia during the Singapore International Water Week (SIWW), showcasing its cutting-edge approach to water management in both the municipal and industrial sectors. The announcement highlighted the company's ongoing commitment to addressing critical water challenges and climate change through innovation. "I'm pleased to announce our three new projects in Asia at the Singapore International Water Week, a great platform that fosters collaboration between public authorities and the industry," stated the company's spokesperson. SUEZ emphasized that Asia, where its journey began over 70 years ago, remains a key strategic market. The company, alongside its local partners, is determined to drive progress and implement sustainable solutions to tackle pressing water and climate issues in the region.

Segments Covered in the Report

By Type

- Corrosion Inhibitors

- Scale Inhibitors

- Coagulants & Flocculants

- Anti-foaming Agents

- Chelating Agents

- pH Adjusters and stabilizers

- Biocides & Disinfectants

By Application

- Boiler Feed Water

- Chemical Production

- Cooling Towers

- Closed Loop Chillers

- Air Compressors

- Air Washers

- Pharmaceutical Production

- Others

By Technology

- Biological Treatment

- Membrane Bioreactor

- Activated Sludge

- Reverse Osmosis

- Membrane Filtration

- Sludge Treatment

- Others

By End Use Industry

- Oil & Gas

- Food and Beverage

- Chemical

- Mining

- Power

- Pharmaceutical

- Pulp & Paper

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client