List of Contents

What is the Industrial 3D Printing Market Size?

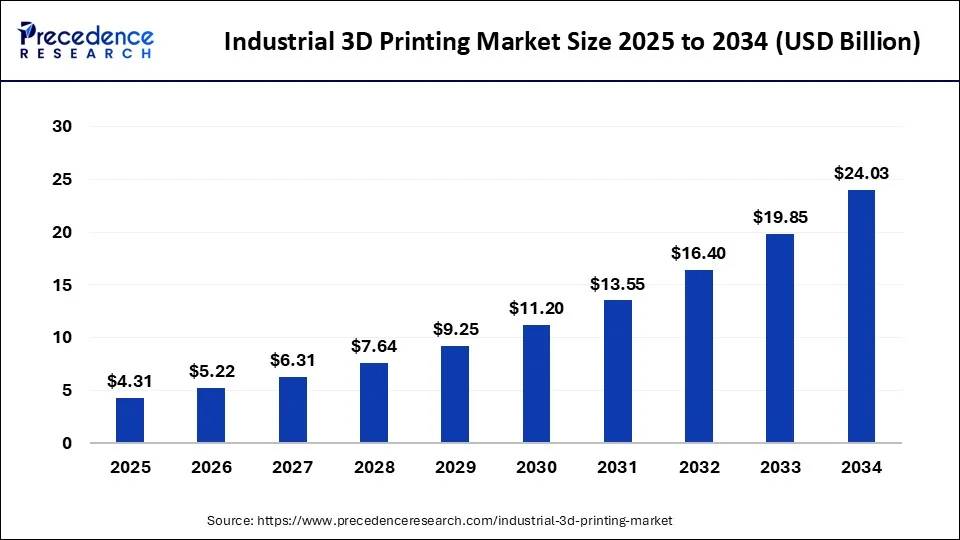

The global industrial 3D printing market size is accounted at USD 4.31 billion in 2025 and predicted to increase from USD 5.22 billion in 2026 to approximately USD 24.03 billion by 2034, representing a CAGR of 21.04% from 2025 to 2034. The industrial 3D printing market is driven by the growing demand for rapid prototyping and customization.

Industrial 3D Printing Market Key Takeaways

- The global industrial 3D printing market was valued at USD 3.56 billion in 2024.

- It is projected to reach USD 24.03 billion by 2034.

- The industrial 3D printing market is expected to grow at a CAGR of 21.04% from 2025 to 2034.

- North America dominated the industrial 3D printing market in 2024.

- Asia Pacific is observed to witness notable growth in the market during the forecast period.

- By component, the hardware segment dominated the market in 2024.

- By component, the software segment is observed to grow at the fastest rate in the market during the forecast period.

- By technology, the stereolithography (SLA) segment dominated the global market in 2024.

- By technology, the fused deposition modeling (FDM) segment will show significant growth in the market during the forecast period.

- By end-user, the manufacturing segment dominated the global market in 2024.

- By end-user, the aerospace & defense segment will witness notable growth in the market during the forecast period.

How is Artificial Intelligence Helping the Industrial 3D Printing Market Growth?

Developers can produce optimized parts using AI-powered generative design technologies that may not be possible with conventional design techniques in the industrial 3D printing market. By examining loads, materials, and performance restrictions, AI algorithms suggest extremely effective architectures that minimize weight and material waste without sacrificing strength. It makes predicted demand forecasting, inventory control, and intelligent scheduling possible, all of which are very advantageous for industrial 3D printing. AI facilitates manufacturers' seamless transition from prototyping to full-scale manufacturing by predicting demand, simplifying production, and optimizing supply networks.

Market Overview

Compared to traditional manufacturing, industrial 3D printing allows for smaller batch production and faster prototyping. Because lead times are shortened, businesses may launch products more quickly and react to changes with less delay. Complex geometries that are frequently unattainable or unaffordable using conventional production methods can be produced with 3D printing. This creates new design opportunities in areas including complex architectural elements, aircraft components, and medical implants.

Industrial 3D Printing Market Growth Factors

- Industrial 3D printers are becoming more capable as new, high-performance materials, including metals, polymers, and composites, are developed for 3D printing. Now that these printers can create parts that are stronger, lighter, and more resilient, new uses in sectors like healthcare, automotive, and aerospace are possible.

- On-demand production, made possible by industrial 3D printing, may greatly minimize supply chain interruptions. Better reactivity to market volatility results from its ability to provide regional production, quicker prototyping, and reduced inventory costs.

- More manufacturers, especially small and medium-sized businesses, are implementing industrial 3D printing market applications as the cost of the tools and materials drops. The market is expanding as a result of additive manufacturing's lower operating costs when compared to conventional manufacturing techniques (such as cutting down on material waste).

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.03 Billion |

| Market Size in 2026 | USD 5.22 Billion |

| Market Size in 2025 | USD 4.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 21.04% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

High levels of customization

High-performance components that adhere to precise requirements are essential to sectors like the industrial 3D printing market. With 3D printing, components with intricate geometries that would be impossible or difficult to do with conventional manufacturing techniques can be made that are both sturdy and lightweight. Customized fuel nozzles or engine parts, for instance, can be 3D printed in the aerospace industry to enhance performance and fuel efficiency by reducing weight without sacrificing strength.

Restraint

Skilled workforce shortage

Expertise from a variety of disciplines, such as mechanical engineering, material science, software programming, and post-processing techniques, is integrated into the industrial 3D printing market. For instance, creating parts that are durable and functional requires an understanding of how different materials, such as metals, ceramics, composites, and plastics, behave under varied printing circumstances. Expertise in these fields is required of skilled individuals, and their scarcity hinders the use and expansion of 3D printing technology in sectors including healthcare, automotive, and aerospace.

Opportunity

Continuous development of new materials for 3D printing

Reliance on lengthy, carbon-intensive supply chains is lessened by the ability to print complicated parts on demand using locally accessible materials. Distributed manufacturing models that save emissions and shipping costs can be made possible by the industrial 3D printing market. New materials may now be printed more quickly and precisely due to advancements in 3D printing processes like direct energy deposition (DED) and continuous liquid interface production (CLIP). This facilitates the expansion of industrial 3D printing applications and speeds up the adoption of novel materials.

Component Insights

The hardware segment dominated the industrial 3D printing market in 2024. In the medical industry, 3D printing hardware is used to create customized implants, prosthetics, and surgical equipment. Because of their accuracy and customization possibilities, which sometimes lead to significant cost and lead time reductions, industrial-grade 3D printers have gained popularity for producing patient-specific solutions. Hardware for 3D printing provides an alternative to mass production for enterprises needing small to medium production runs, enabling on-demand manufacture with little setup. Industries like electronics, healthcare devices, and bespoke consumer items particularly benefit from this versatility.

The software segment is observed to grow at the fastest rate in the industrial 3D printing market during the forecast period. 3D printing software uses machine learning and artificial intelligence features to automate specific design and production procedures. Improving print speed and quality means determining the ideal printing parameters, foreseeing any errors, and adjusting in real-time.

Technology Insights

The stereolithography (SLA) segment dominated the global industrial 3D printing market in 2024. The capacity of SLA 3D printing to create detailed, highly accurate items with smooth surface finishes is well known. In sectors like jewelry, automobile, aerospace, and healthcare that have high requirements, accuracy and smoothness are crucial. SLA is very appealing for applications where look and detail are important because of its ability to manufacture prototypes and final products with little post-processing.

The fused deposition modeling (FDM) segment will show significant growth in the industrial 3D printing market during the forecast period. Since FDM is one of the most affordable 3D printing techniques, it is very appealing to a wide range of sectors. Because FDM printers and materials are relatively inexpensive when compared to other additive manufacturing techniques, small and medium-sized businesses (SMEs) can employ the technology for tooling, prototyping, and even some end-use applications. The variety of FDM printers has increased due to advancements in FDM technology, like the capacity to print on a variety of materials and colors. These developments make it possible to create increasingly complex and precise components, which makes it easier to integrate technology into high-precision industries like electronics and aircraft.

End-user Insights

The manufacturing segment dominated the global industrial 3D printing market in 2024. Specialized tools, jigs, and fittings are frequently needed for manufacturing operations, which can be expensive and time-consuming. These tools can be produced on demand with more flexibility and at a cheaper cost, thanks to 3D printing. In sectors like aerospace and automotive, where parts must be manufactured with precise dimensions to satisfy strict performance and safety criteria, this customization is essential.

The aerospace & defense segment will witness notable growth in the industrial 3D printing market during the forecast period. In aircraft applications, weight reduction is essential since lighter components use less fuel. By employing 3D printing, manufacturers may develop structurally optimized parts to be lighter without sacrificing strength, resulting in significant cost savings over an aircraft's lifetime. Engineers can swiftly develop and test new designs due to fast prototyping made possible by 3D printing. This expedites the design validation process, assisting A&D firms in bringing innovations to market more quickly while improving designs for cost and performance.

Regional Insights

North America dominated the industrial 3D printing market in 2024. North America boasts a well-established industrial base in vital industries like consumer goods, automotive, healthcare, and aerospace. Because of its potential for small-scale production, customization, and rapid prototyping, all of which are very pertinent in these industries, 3D printing has been quickly embraced by these sectors. Robust intellectual property laws in North America foster innovation by giving businesses a secure setting in which to create exclusive goods and technologies. Both startups and big businesses are encouraged to invest in 3D printing by this legislative environment.

Asia Pacific is observed to witness notable growth in the industrial 3D printing market during the forecast period. 3D printing is being utilized more and more for bioprinting, dental implant, and medical devices manufacturing as a result of the growing need for personalized healthcare solutions. Leading the way in this technology's medicinal uses are South Korea and Japan. In sectors like healthcare, where 3D printing is used to create customized implants and prosthetics, customization is especially appreciated. Due to developments in materials science, this trend is spreading quickly throughout Asia Pacific.

Industrial 3D Printing Market Companies

- Stratasys, Ltd.

- Organovo Holdings Inc

- ExOne Company

- Eos GmbH

- Autodesk, Inc.

- Materialise

- Protolabs

- HOGANAS AB

- Optomec Inc.

- CANON INC.

- Arcam AB

- Envisiontec, Inc.

- 3D Systems

- Voxeljet AG

- SLM Solutions

- HP Inc.

- General Electric Company

- GE Additive

Latest Announcements by Industry Leaders

- Ricoh USA, Inc. introduced RICOH All-In 3D Print, a fully managed on-site 3D printing solution with an eye toward the U.S. market. Ricoh UK already has a comparable service and AM center in Great Britain.

Recent Developments

- In November 2024, Caracol, a polymer and composite LFAM hardware expert, will introduce Vipra AM, an emerging robotic metal 3D printing platform for large-scale metal parts. The platform intends to revolutionize the manufacturing of large-format metal components and will be unveiled at Formnext.

- In November 2024, a new software-based method for turning waste PA12 powder into 3D printed parts was introduced by 3D printer company Stratasys.

Segments Covered in the Report

By Component

- Hardware

- Services

By Technology

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Electron Beam Melting (EBM)

- Fused Deposition Modeling (FDM)

- Laminated Object Manufacturing (LOM)

- Others

By End-user

- Manufacturing

- Aerospace And Defense

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client