November 2025

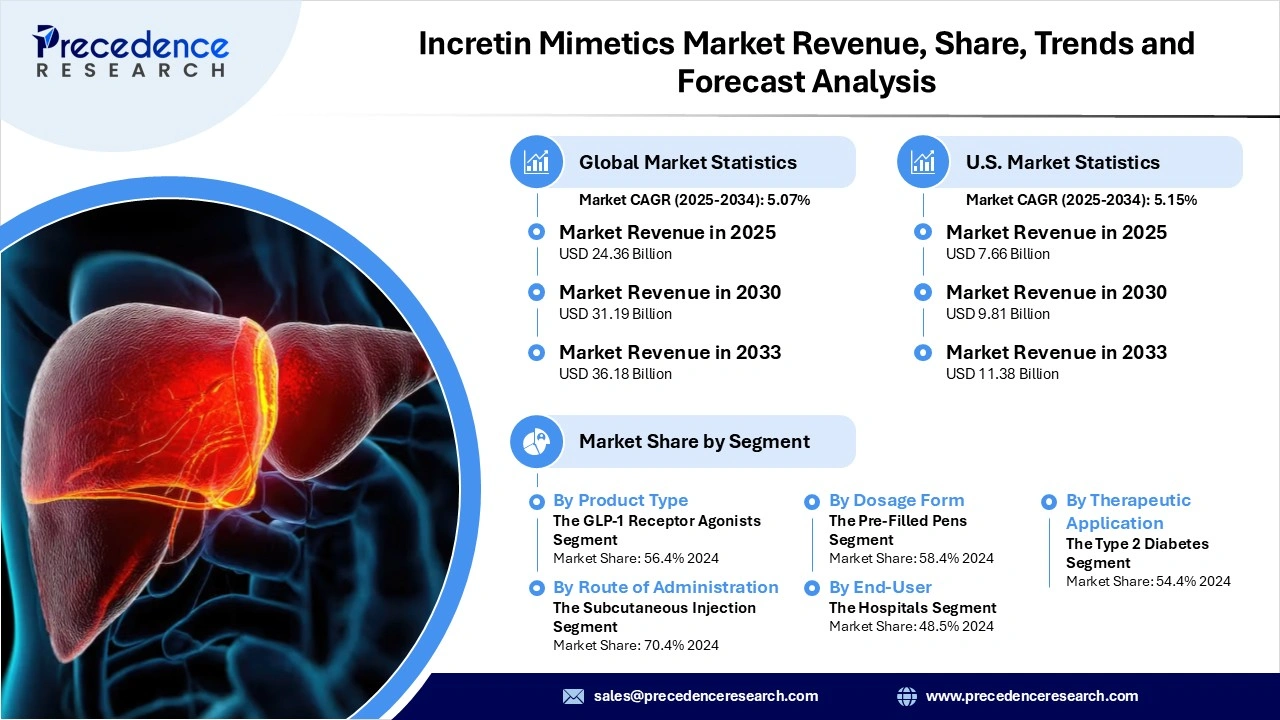

The global incretin mimetics market revenue reached USD 24.36 billion in 2025 and is predicted to attain around USD 36.18 billion by 2033 with a CAGR of 5.07%. This market is growing due to the increasing prevalence of type 2 diabetes and obesity worldwide, which is boosting the adoption of these advanced therapies.

Market growth is significantly driven by the rise in type-2 diabetes mellitus, linked to an aging population, obesity, sedentary lifestyles, and urbanization, which creates a substantial demand for effective and safe treatments. Incretin mimetics, particularly GLP-1 receptor agonists, offer benefits like improved blood sugar control and weight loss, attracting payers, clinicians, and patients. Advances in drug delivery technologies, such as long-acting formulations and oral formulations, enhance patient adherence and expand the market. Moreover, regulatory approvals for wider applications, including obesity and cardiovascular and renal diseases, open new therapeutic areas. Increased healthcare spending, expanded insurance coverage, and growing awareness of metabolic comorbidities among physicians and patients also rapidly increase market adoption and access.

North America led the global incretin mimetics market in 2024, driven by a high prevalence of type 2 diabetes, robust healthcare systems, high disposable income, and early adoption of new treatments. The U.S. holds a significant share, driven by advanced reimbursement models, high awareness of metabolic disease management, and the rapid integration of GLP-1 therapies into standard care.

Asia Pacific is expected to experience the most rapid market growth in the coming years, fueled by rising diabetes and obesity rates in China and India, substantial improvements in healthcare access, increased per capita healthcare spending, and greater penetration of novel therapies from Western countries. The regional market growth is also supported by government programs focused on chronic disease management, the expansion of private healthcare, and strategic launches by multinational pharmaceutical companies adapting to this demographic shift.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 24.36 Billion |

| Market Revenue by 2033 | USD 36.18 Billion |

| CAGR from 2025 to 2033 | 5.07% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7052

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

November 2025

October 2025

July 2025

July 2025