List of Contents

What is the Household Cooking Appliance Market Size?

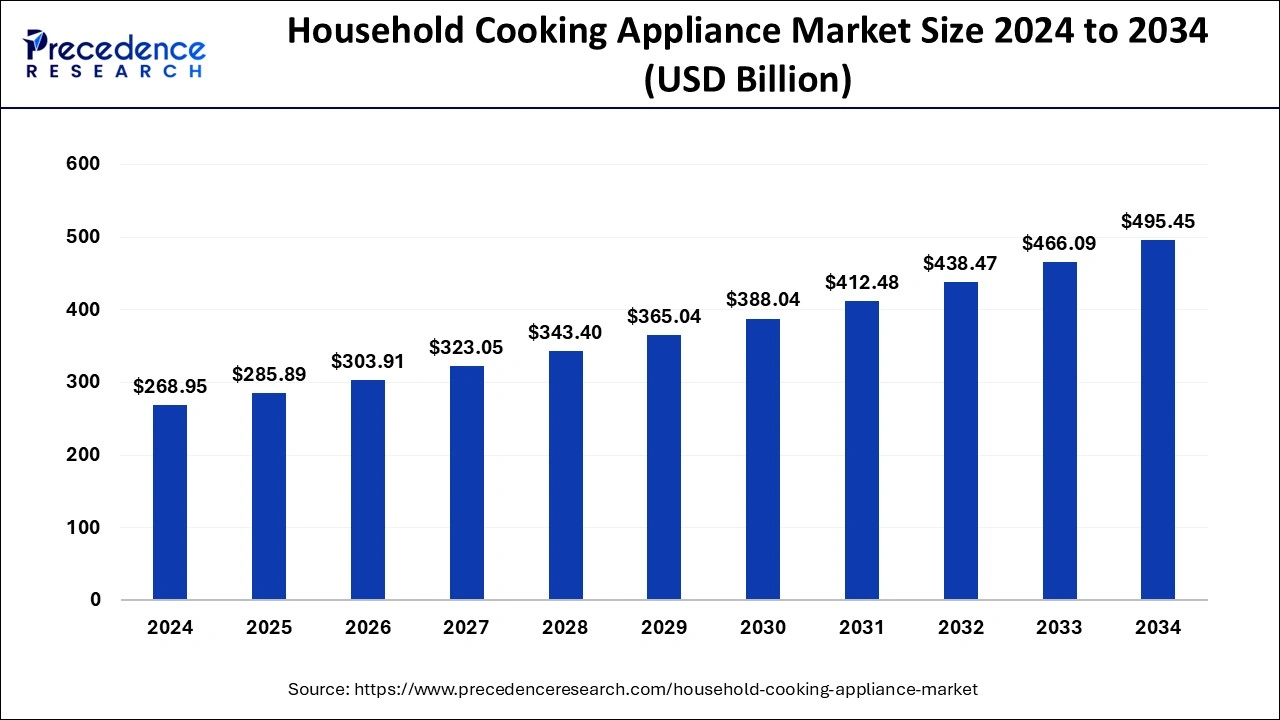

The global household cooking appliance market size is valued at USD 285.89 billion in 2025 and is predicted to increase from USD 303.91 billion in 2026 to approximately USD 495.45 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034. The growth of the household cooking appliance market is driven by the changing consumer preferences toward healthy cooking methods.

Household Cooking Appliance Market Key Takeaways

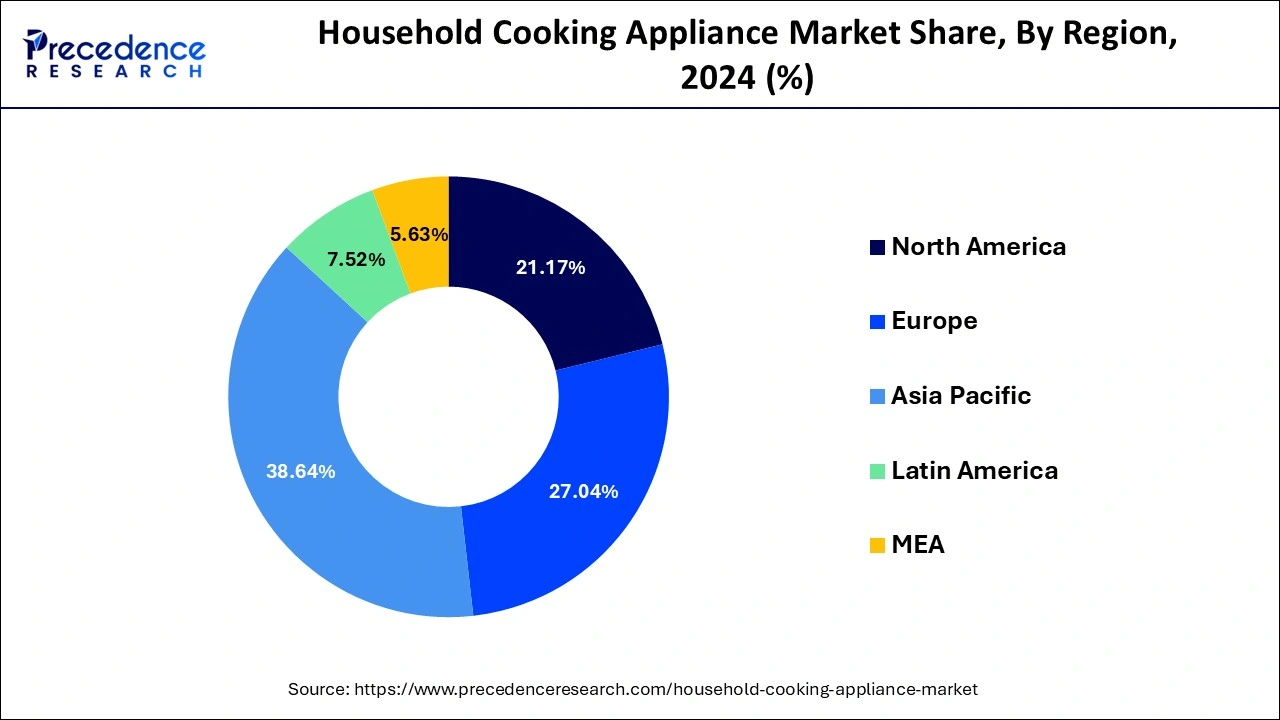

- Asia Pacific dominated the global household cooking appliance market and contributed the largest market share of 38.64% in 2024.

- Middle East and Africa is expected to expand at a CAGR of 9.43% during the forecast period.

- By product type, the cooktops & cooking ranges segment has held the major market share of 47% in 2024.

- By product type, the oven segment is anticipated to grow at the fastest CAGR of 7.04% during the projected period.

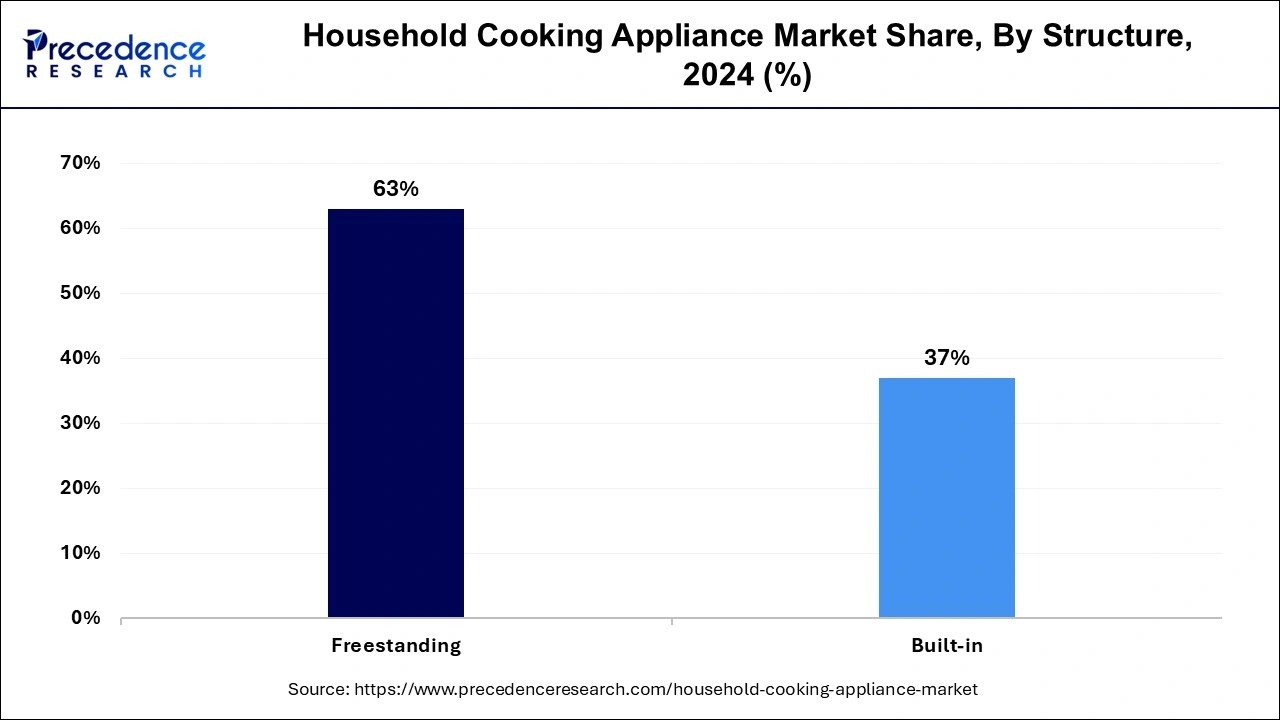

- By structure, the freestanding segment accounted for the biggest market share of 63% in 2024.

- By distribution channel, the offline segment held the highest market share in 2024.

Brains in the Kitchen: How AI is Transforming Cooking Appliances

In today's Era, the conventional kitchen is transforming into a highly efficient and intelligent space due to the rise of smart home technologies. AI-powered kitchen tools are at the forefront of the smart kitchen revolution. Devices like smart ovens can learn the user's habits by gathering data on a daily basis, providing personalized cooking experiences. AI-enabled appliances come with advanced features like pre-programmed recipes, real-time assistance in cooking, and temperature control. Some models are even equipped with cameras, allowing users to monitor the cooking process remotely with the help of a smartphone app.

- In February 2023, Samsung Electronics UK Ltd. launched the latest addition to its Bespoke home appliance range with the Series 7 Bespoke AI Oven, which is designed to make kitchen smarter and more interactive than ever.

The Future of Home Cooking: Inside the Global Appliance Boom

The household cooking appliance market is experiencing significant growth due to the increasing disposable income in many emerging countries. High disposable income significantly improves the living standards of consumers, allowing them to invest in home improvement. This, in turn, boosts the demand for household cooking appliances. Moreover, the rise of e-commerce significantly contributes to market expansion. Due to the expansion of e-commerce platforms, accessibility to household cooking appliances has increased.

Household Cooking Appliance Market Growth Factors

- Increasing expenditure on home improvement is a major factor boosting the growth of the market.

- With the rapid expansion of e-commerce businesses worldwide, the trend of online shopping is rising. Moreover, the availability of a wide range of household kitchen appliances on e-commerce websites attracts more consumers, increasing sales.

- The rising popularity of smart kitchen appliances, which are extremely useful in busy schedules, further boosts the growth of the market.

- The increasing demand for disposable cooking appliances fuels the growth of the market.

- Increasing demand for AI and IoT to regulate and access various smart kitchen appliances in gaining attention of individuals across the globe.

- Increasing disposable income, growing demand for advanced kitchen tools and desire to live luxuries lifestyle are driving factors for the market.

Household Cooking Appliance Market Outlook:

Industry Growth Overview:

The market of household cooking appliances is expected to experience a strong growth between 2025 and 2034, due to the increased urbanisation, the improvement of disposable incomes, and the changing lifestyles of consumers. The use of high-demand niches like smart ovens, induction cooktops, air fryers, and multifunctional countertop appliances be accelerated. City households are spending on higher-quality and integrated solutions, and emerging economies are spending on affordable but fully featured appliances. The market is also being widened by the growing popularity of home cooking and fine dining experimentation.

Sustainability Trends:

Sustainability is also emerging as a key motivator in the entire cooking appliance industry, whereby increasing numbers are looking into energy-efficient appliances, recyclable products, and low-energy consumption products. These brands are investing in a more environmentally-friendly design and appliances that are certified according to the ENERGY STAR or EU EcoDesign certification procedures. The regulatory environment in North America, Europe, and, to some extent, Asia is compelling manufacturers to pursue sustainable manufacturing and product innovation policies.

Global Expansion:

The major appliances companies are moving their activities to major markets in order to exploit the increasing demand and the regional regulatory strengths. Haier, Midea, Whirlpool and LG Electronics are expanding their production and distribution in Southeast Asia, Latin America and the Middle East. This is being done by setting up R&D centres and design hubs in the emerging economies to localise the products to the local cooking preferences and energy requirements. Alliances with technology firms are allowing it to implement connected and smart kitchen solutions quickly around the world.

Major Investors:

Household appliance industry is receiving growing attention from private equity and strategic investors, owing to the stable cash flows, growth in digital, and alignment with ESG. Carlyle Group, KKR, and Blackstone have been interested in a smart and IoT-enabled portfolio of kitchen appliances. Increased use of energy-efficient connected and AI-assisted cooking appliances has led to investment. Investor interest and market valuation are also growing as sustainable and environmentally friendly lines of appliances are being added to the market.

Startup Ecosystem:

The domestic cooking appliance startup ecosystem is developing at an extremely fast pace, particularly in AI-driven, IoT-connected, and smart kitchen applications. June Oven (USA), Tovala (USA), Anova Culinary (USA) and CookingPal (Singapore) among other companies are raising venture capital to manufacture products that blend precision cooking, automation and connectivity. The ecosystem is going global covering North America, Europe, and Asia-Pacific to offer a stream of innovation solutions to a high-end and mid-market consumer.

Market Scope

| Report Coverage | Details |

| Market Size In 2026 | USD 303.91 Billion |

| Market Size In 2025 | USD 285.89 Billion |

| Market Size by 2034 | USD 495.45 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.30% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Structure, Distribution |

| Regions Covered | Asia Pacific, Middle East and Africa |

Market Dynamics

Driver

Changing Consumer Preferences

With the changing lifestyle, consumer preferences also change with time. Consumers are increasingly shifting from conventional cooking appliances to automated cooking appliances to reduce human efforts. These appliances allow people with busy schedules to complete cooking chores without hassle, thereby saving time. There is a high demand for energy-efficient cooking appliances, which further contributes to market expansion. Additionally, consumers are becoming more health conscious and looking for appliances, such as air fryers and multi-cookers, to support their healthy eating habits and cooking methods with less time.

Restraint

High Cost

Despite the number of benefits provided by automated household cooking appliances, factors like the high cost of these appliances and the large amount of electricity needed to work properly hinder the market growth. These appliances are equipped with sensors and monitors, making them more costly than traditional household kitchen appliances. This high cost creates a barrier and discourages low-income consumers from investing in them. Moreover, these appliances require regular maintenance, increasing operational costs.

Opportunity

Rise of Smart Appliances

Technological advancements led to the development of smart cooking appliances, creating immense opportunities in the household cooking appliance market. Smart appliances can connect with Wi-Fi and Bluetooth, which enhances the cooking experience. Moreover, the rising demand for energy-efficient cooking appliances is likely to propel the growth of the market during the forecast period. Market players are actively developing innovative solutions to meet the growing demand for energy-efficient and smart appliances.

- In September 2024, Savant teams up with Monogram Appliances to launch a new Smart Oven. The 30-inch Savant Smart Hearth Oven allows users to manage temperature settings, reminders, cooking modes, and power OFF, all remotely.

Product Type Insights

The cooktops & cooking ranges segment accounted for more than 47% of the market share in 2024. The rising adoption of modular kitchens coupled with availability of cooking appliances in varied sizes, easy to install feature, and easy to uses features are the significant drivers of the cooktops & cooking ranges. These appliances can be operated using gas and electricity. The induction cooktops gained immense traction among the consumers in the past especially in the regions like North America and Europe.

On the other hand, the oven segment is estimated to be the most opportunistic segment during the forecast period. The oven facilitates the households to cook restaurant like dishes. Moreover, the availability of various types of ovens such as microwave and combination ovens is another factor that serves the different needs of the consumers. Technological advancements in the oven segment is expected to boost its adoption among the consumers across the globe.

Structure Insights

The freestanding segment accounted for over 63% of the market share in 2024. This is attributed to the easy availability, availability in different sizes, and easy maintenance of the freestanding cooking appliances. Moreover, the spare parts of the freestanding appliances are easily available. These appliances are require more spaces and are popular among the consumers.

On the other hand, the built-in segment is estimated to be the fastest-growing segment during the forecast period. This segment is gaining popularity as it serves the problem of space limitations of the household. The low and middle-income consumers having small kitchen spaces are increasingly adopting the built-in household cooking appliances and it perfectly serves the modular kitchen spaces. Hence, the segment is expected to grow at a significant rate.

Distribution Channel Insights

The offline segment dominated the global household cooking appliance market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the increased penetration of the supermarkets, hypermarkets, and specialty stores operating in the electronic household appliances. The huge popularity of these stores among the consumers made the offline segment a popular sales channel for the household cooking appliance across the globe.

On the other hand, the online segment is expected to be the most opportunistic segment during the forecast period. This is due to the rising penetration of internet, increasing adoption of smartphones, and growing number of internet users across the globe. According to the ITU, around 4 billion people were using internet by the end of 2019. Moreover, the rapidly growing online retail platforms such as Amazon, Flipkart, Wal-Mart, and eBay are contributing significantly towards the growth of the online sales channel across the globe.

Regional Insights

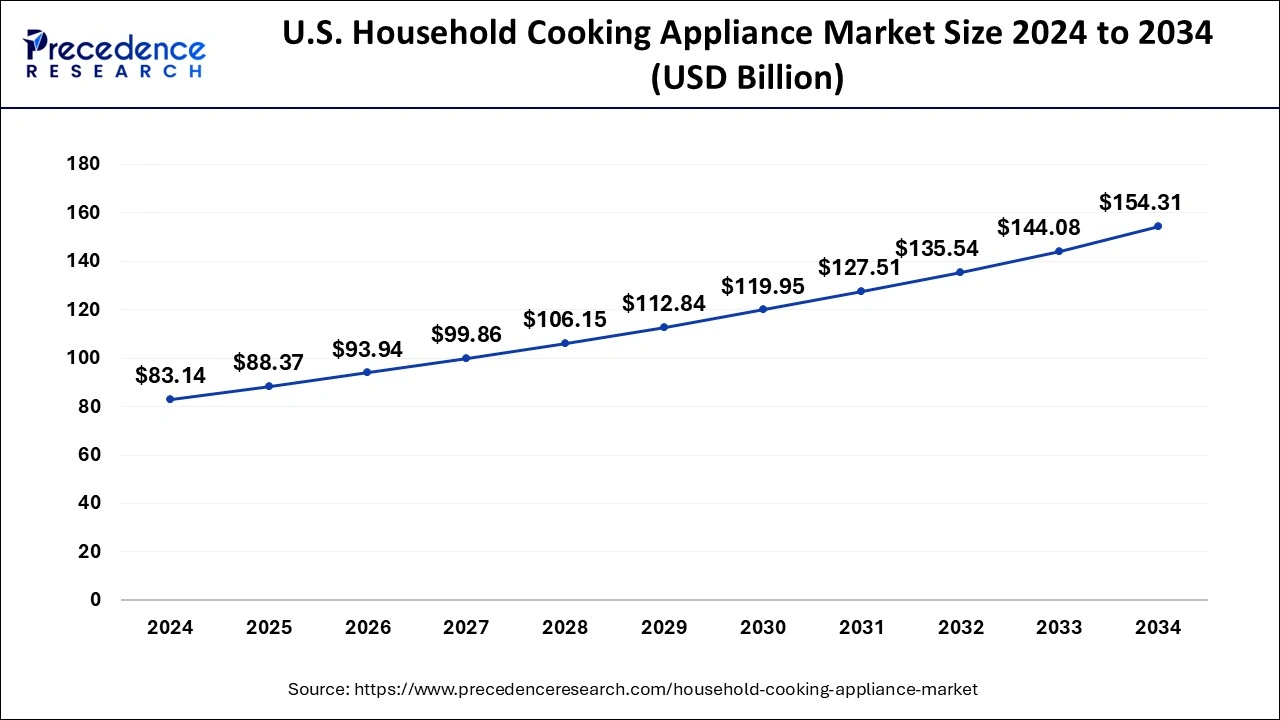

U.S. Household Cooking Appliance Market Size and Growth 2025 to 2034

The U.S. household cooking appliance market size is evaluated at USD 88.37 billion in 2025 and is predicted to be worth around USD 154.31 billion by 2034, rising at a CAGR of 6.37% from 2025 to 2034.

Asia Pacific region accounted for over 38.64% of the market share in 2024. This can be attributed to the presence of huge population, huge number of households, rising disposable income of the consumers, rising demand for the home improvement products, and the presence of top electronic manufacturers in the region. The world's top electronic manufacturers are present in the nations like China, India, and South Korea and the various developmental strategies adopted by them significantly influences the markets across the globe. The availability of cheap factors of production in the region is another factor that makes the region the manufacturing hub of the world.

On the other hand, the Middle East and Africa is expected to be the most opportunistic market during the forecast period, owing to the rising penetration of the home improvement products, rising disposable income, and improving quality of life. The changing spending pattern of the consumers and changing lifestyle are the major drivers of the market in this region.

Household Cooking Appliance Market � Value Chain Analysis

- Raw Material Sourcing

The value chain begins with sourcing key raw materials such as stainless steel, aluminum, copper, glass, plastics, ceramics, and electronic components like sensors, heating elements, and semiconductors. These materials are essential for the structural, thermal, and electrical performance of cooking appliances.

Key Players: ArcelorMittal, Nippon Steel Corporation, Corning Incorporated, BASF SE, Dow Inc. - Component Fabrication

Raw materials are processed and fabricated into critical appliance components, including heating elements, control panels, motors, thermostats, electronic controllers, and outer casings. This stage emphasizes precision engineering, energy efficiency, and safety standards.

Key Players: Emerson Electric Co., Robertshaw Controls Company, Nidec Corporation, Schneider Electric, Panasonic Industrial Components. - Appliance Manufacturing & Assembly

This stage integrates components into complete cooking appliances such as ovens, cooktops, microwaves, air fryers, and induction ranges. Manufacturers focus on energy efficiency, durability, and smart-connectivity features to meet modern consumer preferences.

Key Players: Whirlpool Corporation, LG Electronics, Samsung Electronics, BSH Home Appliances, Haier Group, Electrolux AB, Midea Group. - Design & Smart Technology Integration

Appliance manufacturers and design engineers integrate IoT connectivity, AI-based cooking assistance, voice control, and sensor automation systems. The aim is to enhance user experience, reduce energy consumption, and provide data-driven cooking optimization.

Key Players: Amazon Alexa, Google Home, Apple HomeKit, Samsung SmartThings, LG ThinQ, Bosch Home Connect. - Distribution & Retail

Finished appliances are distributed through both direct and indirect channels � including online platforms, specialty appliance stores, and large retailers. Logistics efficiency, aftersales service, and omnichannel availability play crucial roles in maintaining brand competitiveness.

Key Players: Best Buy, Home Depot, Walmart, Amazon, Alibaba, Flipkart. - After-Sales Services & Recycling

The final stage includes maintenance, repair, and recycling of old appliances to meet sustainability standards. Manufacturers and third-party service providers emphasize product longevity, e-waste reduction, and parts recovery for circular-economy compliance.

Key Players: Whirlpool Service, LG Customer Care, EcoATM, Sims Lifecycle Services, Veolia Environment.

Top Vendors in the Household Cooking Appliance Market & Their Offerings:

- Haier Group Corporation (China): Haier, including GE Appliances and Fisher & Paykel under its umbrella, delivers high-performance ovens, hobs, and smart kitchen systems designed for global markets. The company focuses on IoT integration through its Haier Smart Home ecosystem, driving personalization and efficiency.

- BSH Home Appliances Group (Germany): A joint venture of Bosch and Siemens, BSH manufactures a wide array of advanced kitchen appliances, including pyrolytic ovens, induction hobs, and combination steam ovens. The Home Connect platform allows seamless smart-home integration and remote operation.

- Electrolux AB (Sweden): Electrolux and its AEG brand deliver innovative cooking appliances designed around sustainability and user experience, such as steam ovens, air fry ranges, and induction cooktops. Its focus on low-energy consumption and eco-friendly design strengthens its European footprint.

- Midea Group (China): Midea is a major global manufacturer of home and kitchen appliances, offering smart ovens, air fryers, and induction ranges. The company continues to expand its AI-powered and IoT-enabled kitchen solutions to meet global consumer demands for convenience and automation.

- Panasonic Corporation (Japan): Panasonic's cooking appliances range from inverter microwave ovens to steam convection systems. The company leverages advanced sensor technologies, AI cooking algorithms, and energy-efficient heating solutions for precision cooking performance.

- Breville Group Limited (Australia): Breville is renowned for its premium countertop cooking appliances, including smart ovens, air fryers, and multi-cookers. Its proprietary Element IQ technology and intuitive controls cater to both home chefs and professionals seeking performance and design.

- Ar�elik A.Åž. (Turkey): The parent company of brands such as Beko and Grundig, Ar�elik produces a broad range of built-in and freestanding cooking appliances. The company invests heavily in sustainability and connected kitchen technology, emphasizing smart diagnostics and energy management.

Recent Developments

- In October 2023, Usha International expanded its portfolio of premium kitchen appliances with the launch of its iChef range. The new range includes five products: iChef Steam Oven, iChef Heater Blender, iChef Smart Air Fryer 5.5L, iChef Smart Air Fryer � Digital 5L, and iChef Programmable Kettle.

- In February 2023, Tovala expanded its product portfolio of cloud-connected smart ovens with the launch of the new Tovala Smart Oven Air Fryer. Tovala Smart Ovens offer the busy home cook an all-in-one appliance that can help eliminate unwanted countertop clutter in the kitchen.

Segments Covered in the Report

By Product Type

- Cooktops & Cooking Ranges

- Specialized Appliances

- Ovens

By Structure

- Freestanding

- Built-in

By Distribution Channel

- Offline

- Online

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client