List of Contents

What is the Home Spirometer Market Size?

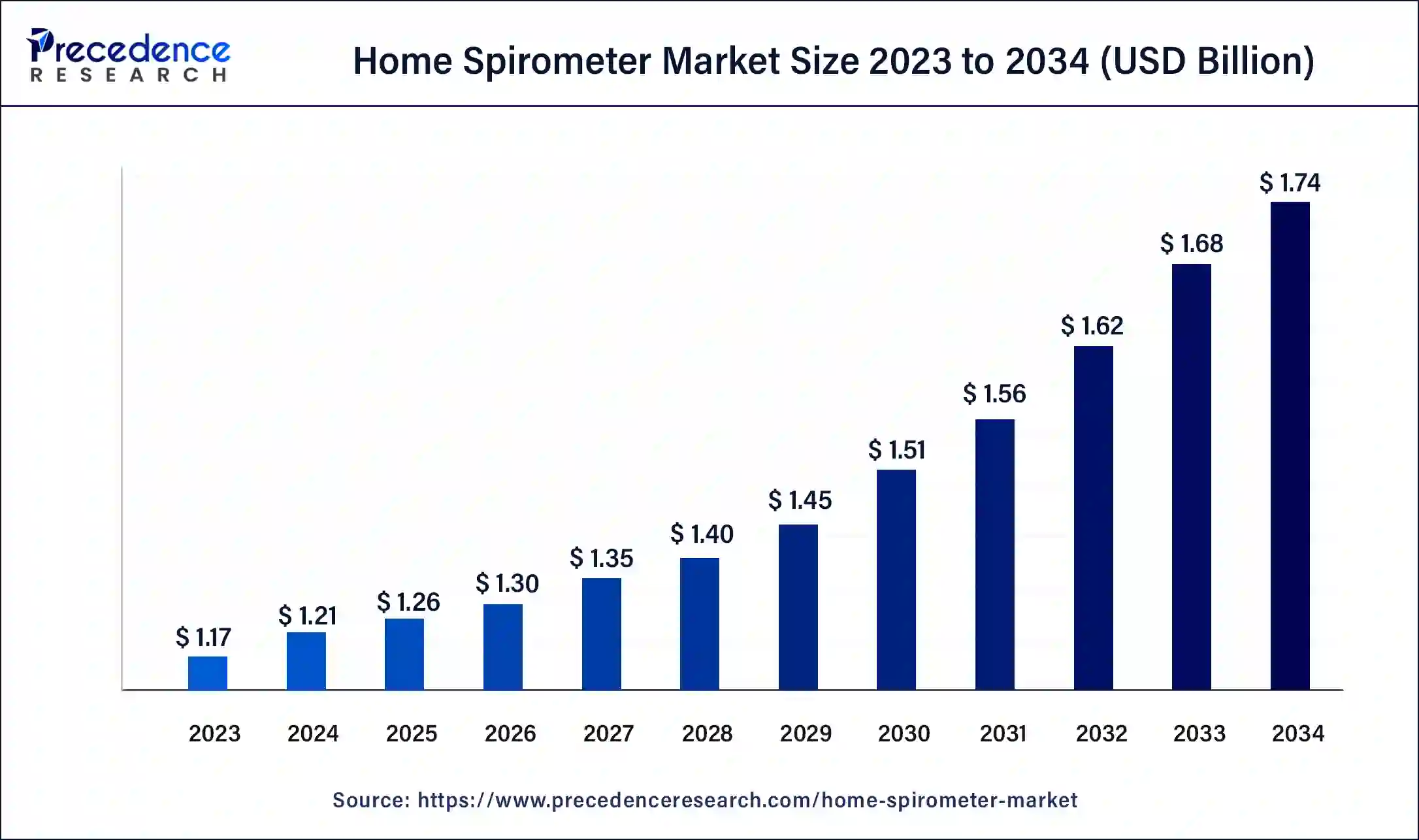

The global home spirometer market size is accounted at USD 1.26 billion in 2025 and predicted to increase from USD 1.30 billion in 2026 to approximately USD 1.74 billion by 2034, growing at a CAGR of 3.70% from 2024 to 2034.

Home Spirometer Market Key Takeaways

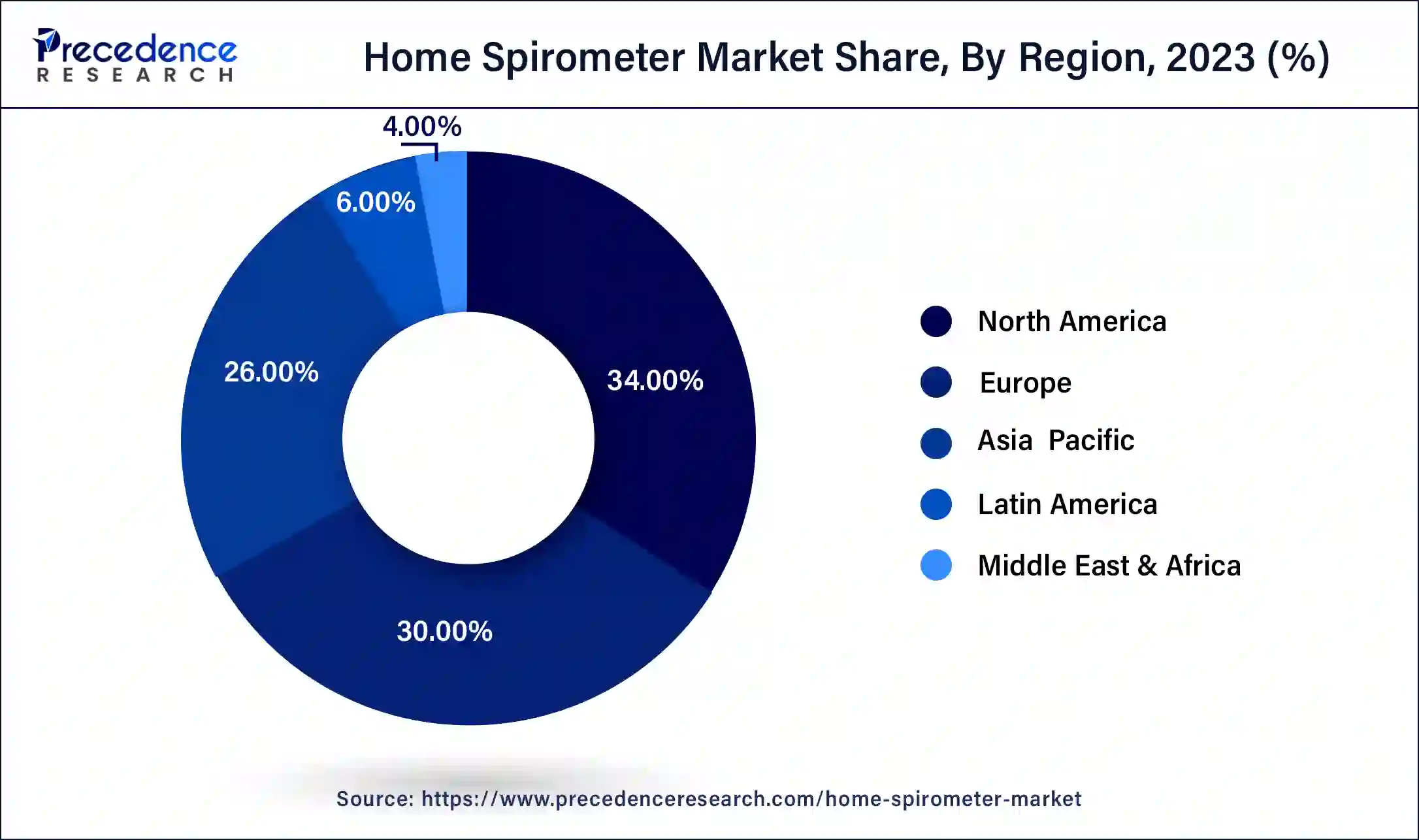

- North America contributed more than 34% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the table-top segment has held the largest market share of 65% in 2024.

- By type, the hand-held segment is anticipated to grow at a remarkable CAGR of 4.2% between 2025 and 2034.

- By technology, the flow measurement segment generated over 61% of revenue share in 2024.

- By technology, the volume measurement segment is expected to expand at the fastest CAGR over the projected period.

- By application, the COPD segment has held the largest market share of 45% in 2024.

- By application, the asthma segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the hospitals and clinics segment generated over 41% of revenue share in 2024.

- By end user, the home healthcare segment is expected to expand at the fastest CAGR over the projected period.

Strategic Overview of the Global Home Spirometer Industry

A home spirometer is a compact medical device that allows individuals to check their lung function conveniently at home. It measures important respiratory indicators like forced vital capacity (FVC), forced expiratory volume in one second (FEV1), and peak expiratory flow rate (PEF). These metrics offer insights into lung health, aiding in the monitoring of conditions like asthma or chronic obstructive pulmonary disease (COPD).

The device, typically handheld with a mouthpiece and digital display, records breath volume and flow rate as users exhale forcefully. This data, tracked over time, helps individuals observe changes in their lung function. Healthcare professionals can then use this information to make well-informed decisions about personalized treatment plans. Home spirometers empower individuals to actively manage their respiratory health, offering a user-friendly and cost-efficient means of monitoring lung function and identifying potential issues early on.

Artificial Intelligence: The Next Growth Catalyst in Home Spirometer

AI is significantly impacting the Home Spirometer market by improving diagnostic accuracy, enabling remote monitoring, and empowering patients with real-time feedback. Artificial intelligence analyzes spirometry data to enhance test quality, offer AI-powered interpretation, and identify patterns that predict future health events. This technology is facilitating a shift from clinical settings to home healthcare, reducing the need for in-person visits and making disease management more accessible and consistent for chronic respiratory conditions like COPD and asthma. The integration of AI with smartphone apps and wearable devices also helps automate data collection and analysis, allowing for more personalized and effective care.

Home Spirometer Market Growth Factors

- Increasing Respiratory Disorders: The rising prevalence of respiratory conditions like asthma and COPD is driving the demand for home spirometers as a convenient tool for monitoring lung function.

- Technological Advancements: Ongoing advancements in spirometer technology, including user-friendly interfaces and wireless connectivity, are fueling market growth.

- Aging Population: With a growing aging population, there is an increased need for at-home respiratory monitoring tools to address the higher incidence of respiratory issues among the elderly.

- Preventive Healthcare Trend: The global shift towards preventive healthcare is boosting the adoption of home spirometers, allowing individuals to monitor their lung health regularly.

- Telehealth Expansion: The expansion of telehealth services has created a surge in the demand for remote patient monitoring tools, including home spirometers.

- COVID-19 Impact: The pandemic has heightened awareness about respiratory health, leading to a greater focus on tools like home spirometers for monitoring and early detection.

- Patient Empowerment: Home spirometers empower patients to actively participate in their healthcare, fostering a sense of control and responsibility for their respiratory well-being.

- Cost-Effectiveness: Home spirometers offer a cost-effective alternative to frequent hospital visits, making them an attractive option for both patients and healthcare providers.

- Rising Healthcare Expenditure: Increasing healthcare spending globally is contributing to the growth of the home spirometer market, as individuals invest in personal health monitoring devices.

- Convenience and Accessibility: The convenience of monitoring lung function at home, coupled with easy accessibility to these devices, is driving their popularity among consumers.

- Government Initiatives: Supportive government initiatives promoting respiratory health awareness and home-based monitoring are positively impacting market growth.

- Remote Patient Management: Home spirometers facilitate remote patient management, allowing healthcare providers to monitor patients' respiratory conditions without physical appointments.

- Awareness Campaigns: Growing awareness through educational campaigns about the benefits of regular respiratory monitoring is expanding the consumer base for home spirometers.

- Integration with Smart Devices: The integration of home spirometers with smartphones and other smart devices is enhancing their usability and contributing to market growth.

- Health and Fitness Trends: The increasing focus on overall health and fitness is driving individuals to invest in tools like home spirometers to track and improve their respiratory health.

- Health Insurance Coverage: The inclusion of home spirometers in health insurance coverage is making these devices more accessible to a broader population.

- Research and Development: Ongoing research and development efforts are leading to the introduction of more advanced and accurate home spirometer models, attracting consumers seeking cutting-edge technology.

- Remote Monitoring for Chronic Diseases: Home spirometers are becoming integral in the remote monitoring of chronic respiratory diseases, contributing to improved disease management.

- Global Pandemic Preparedness: The experience of the COVID-19 pandemic has underscored the importance of home-based healthcare tools, including spirometers, in global healthcare preparedness.

- Consumer Health Awareness: Increasing awareness among consumers about the importance of regular respiratory monitoring for maintaining overall health is fostering the adoption of home spirometers.

- In 2021, Hill-Rom, Inc. revenue was USD 3 billion and in 2020 the company's revenue was USD 2.9 billion.

Market Outlook

- Market Growth Overview: The Home Spirometer market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of respiratory disease, the shift towards home healthcare and telehealth, and growing awareness of respiratory health and the importance of early diagnosis drives the use of spirometers.

- Sustainability Trends: Sustainability trends involve the design for circularity, waste reduction and reprocessing, and shift towards remote patient monitoring and telehealth, enabled by connected home spirometers, inherently reducing the CO2 emissions associated with patient travel to clinics and hospitals.

- Major Investors: Major investors in the market include AlbionVC, Matrix, NuvoAir and Aluna.

- Startup Economy: The startup economy in the market is integrated platforms, targeting underserved needs, and specialized health tech integration.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.26 Billion |

| Market Size in 2026 | USD 1.30 Billion |

| Market Size by 2034 | USD 1.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Prevalence of respiratory disorders and telehealth expansion

The increasing prevalence of respiratory disorders, such as asthma and COPD, is a primary driver for the burgeoning demand in the home spirometer market. As respiratory conditions become more widespread, individuals are seeking proactive ways to manage their health. Home spirometers offer a convenient solution, allowing users to monitor their lung function regularly from the comfort of their homes. This rise in awareness and the need for continuous monitoring contribute significantly to the market's growth. Moreover, the expansion of telehealth services has become a catalyst for increased demand in the home spirometer market.

Telehealth's growing prominence enables remote patient monitoring, making it easier for healthcare providers to assess and manage respiratory conditions without the necessity of in-person visits. This trend aligns with the broader shift towards digital healthcare solutions, fostering the integration of home spirometers into telehealth platforms and driving up their demand as essential tools for remote respiratory health management.

Restraint

Limited accuracy in certain conditions and user compliance challenges

The market for home spirometers faces constraints due to limited accuracy in certain conditions and user compliance challenges. The accuracy of home spirometers may be compromised in specific medical situations or when compared to professional-grade equipment. This limitation raises concerns about the reliability of results, potentially impacting the device's effectiveness in monitoring respiratory health. Users, especially those with limited understanding of proper usage techniques, may inadvertently introduce errors, leading to inaccurate readings. This user-dependent nature poses a challenge to the device's overall reliability and may deter potential users who seek precise and consistent respiratory monitoring.

Moreover, user compliance challenges pose a significant restraint. Ensuring consistent and correct usage of home spirometers is crucial for obtaining reliable data. However, issues such as forgetfulness, lack of motivation, or misunderstanding of usage instructions can compromise the device's intended benefits. Overcoming these challenges requires not only technological improvements but also effective user education and engagement strategies to maximize the utility of home spirometers and enhance their role in managing respiratory health.

Opportunity

Remote patient monitoring expansion and increasing health consciousness

The expansion of remote patient monitoring and the growing emphasis on health consciousness are creating significant opportunities in the home spirometer market. The trend towards remote healthcare services has provided a platform for home spirometers to play a pivotal role in respiratory health management. With telehealth gaining prominence, individuals are increasingly seeking convenient and accessible tools like home spirometers for remote monitoring, presenting a substantial market opportunity. These devices offer real-time data collection, aligning well with the preferences of health-conscious individuals who seek accessible and user-friendly solutions.

Furthermore, the increasing recognition of the importance of preventive healthcare encourages individuals to proactively manage their overall health, including respiratory wellness. In this landscape, home spirometers emerge as user-friendly instruments, allowing individuals to monitor their lung function regularly. This cultural shift towards personal health responsibility positions home spirometers as valuable assets, presenting opportunities for market expansion among a population increasingly dedicated to enhancing their well-being.

Type Insights

In 2024, the table-top segment had the highest market share of 65% based on the type. The table-top segment in the home spirometer market refers to spirometers designed for use on a stable surface, providing a convenient and accessible option for users. These spirometers typically feature a compact design suitable for placement on tables or countertops, offering ease of use and storage. A notable trend in this segment involves continuous efforts to enhance portability and user-friendly interfaces, ensuring that table-top home spirometers remain versatile and efficient tools for individuals monitoring their respiratory health in a home setting.

The hand-held segment is anticipated to expand at a significant CAGR of 4.2% during the projected period. The hand-held segment in the home spirometer market refers to portable devices designed for ease of use, allowing individuals to monitor their lung function conveniently. These spirometers are compact, often featuring a handheld design with a user-friendly interface. A notable trend in this segment involves continuous advancements in technology, enhancing portability, and ensuring accurate readings. The hand-held devices are gaining popularity due to their convenience, making them a preferred choice for users seeking a portable and accessible solution for monitoring their respiratory health from the comfort of home.

Technology Insights

According to the technology, the flow measurement segment has held 61% revenue share in 2024. In the home spirometer market, the flow measurement segment involves the technology used to assess the rate and volume of air expelled during a user's forced exhalation. Traditional flow measurement methods have evolved to include advanced sensors and digital interfaces, enhancing accuracy and user experience. Recent trends in this segment emphasize the integration of smart technology, allowing for real-time data transmission to mobile devices. This technological evolution enhances the overall functionality of home spirometers, catering to a tech-savvy consumer base and contributing to the market's dynamic growth.

The volume measurement segment is anticipated to expand fastest over the projected period. In the home spirometer market, the volume measurement segment involves technology that accurately measures the volume of air exhaled by an individual during respiratory tests. This technology enables precise assessments of lung capacity, aiding in the early detection and management of respiratory conditions. Recent trends in this segment focus on the integration of advanced sensors and digital interfaces, offering users a more seamless and user-friendly experience. The incorporation of smart technology and real-time data tracking enhances the accuracy and accessibility of volume measurement in home spirometers, driving market growth.

Application Insights

According to the application, the COPD segment has held 45% revenue share in 2024. In the home spirometer market, the chronic obstructive pulmonary disease (COPD) segment refers to the monitoring of lung function in individuals diagnosed with this progressive respiratory condition. As a notable trend, there is a growing emphasis on home spirometers for COPD management. These devices enable COPD patients to track their lung health regularly, facilitating early detection of exacerbations and supporting personalized treatment plans. The COPD segment in the home spirometer market reflects a shift towards empowering individuals with chronic respiratory conditions to actively participate in their health management from the comfort of their homes.

The asthma segment is anticipated to expand fastest over the projected period. In the home spirometer market, the asthma segment focuses on devices designed for monitoring lung function in individuals with asthma. These spirometers enable users to track key respiratory metrics, helping manage and control asthma symptoms. A notable trend in this segment involves the integration of user-friendly interfaces and wireless connectivity, enhancing accessibility for asthma patients. The shift towards personalized asthma management, coupled with technological advancements, positions home spirometers as essential tools for asthmatic individuals to proactively monitor their lung health and optimize their treatment plans.

End User Insights

According to the end user, the hospitals and clinics segment has held a 41% revenue share in 2024. The hospitals and clinics segment in the home spirometer market refers to the end users who deploy these devices within healthcare institutions. A notable trend in this segment involves the increasing integration of home spirometers into hospital and clinic settings for remote patient monitoring. Healthcare providers leverage these devices to extend respiratory care beyond traditional appointments, enabling continuous monitoring and timely intervention. This trend aligns with the broader adoption of telehealth solutions, enhancing the efficiency of respiratory health management within hospital and clinic environments.

The home healthcare segment is anticipated to expand fastest over the projected period. The home healthcare segment in the home spirometer market refers to individuals using spirometers for respiratory monitoring within the comfort of their homes. A notable trend in this segment is the increasing preference for home-based healthcare solutions. With advancements in technology and a growing awareness of preventive care, more individuals are adopting home spirometers. This shift signifies a move towards proactive respiratory health management, empowering users to monitor their lung function regularly without the need for frequent clinic visits.

Regional Insights

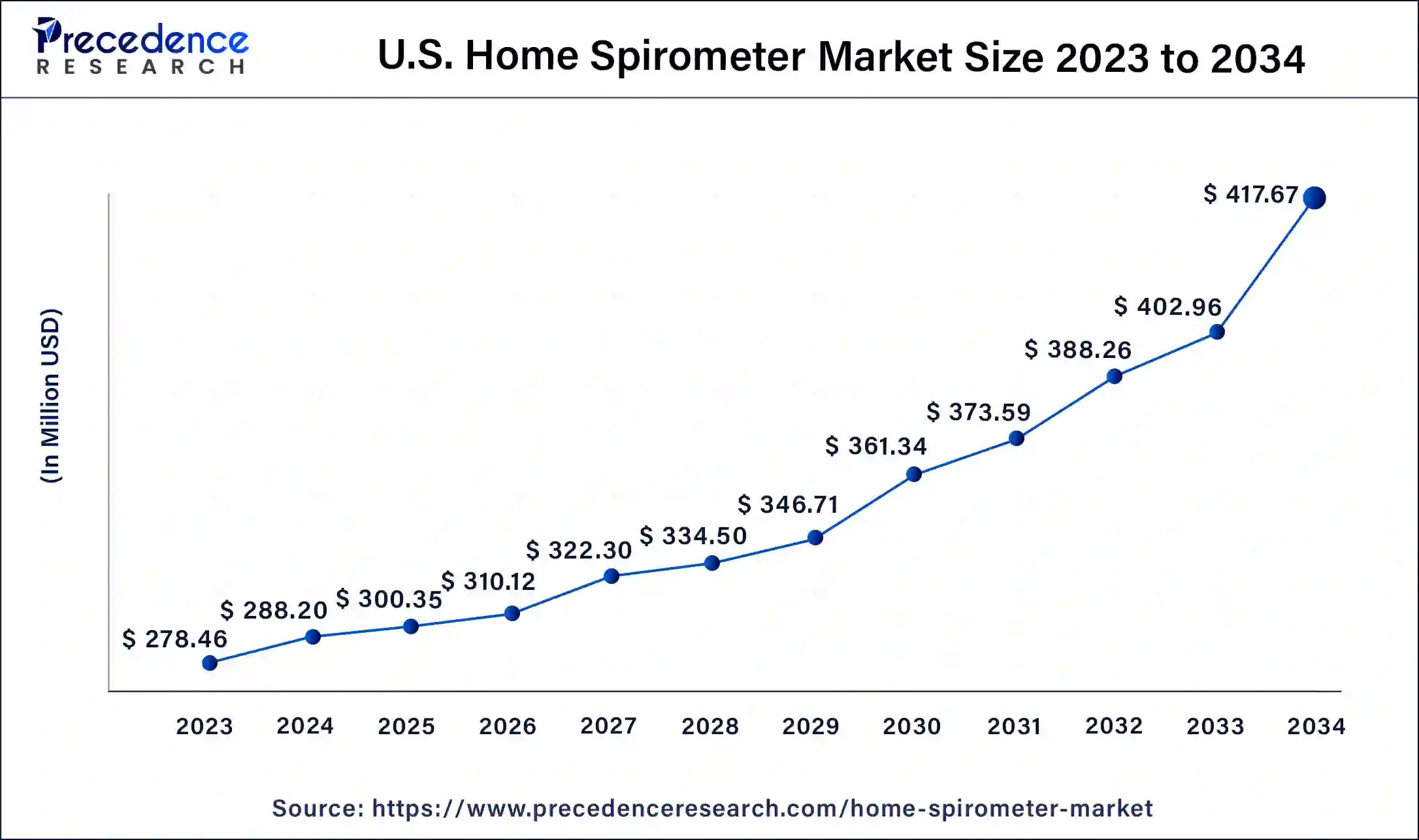

U.S. Home Spirometer Market Size and Growth 2025 to 2034

The U.S. home spirometer market size is valued at USD 300.35 million in 2025 and is expected to be worth around USD 417.67 million by 2034, at a CAGR of 3.78% from 2025 to 2034.

North America has held the largest revenue share of 34% in 2024. North America holds a major share in the home spirometer market due to several factors. The region has a well-established healthcare infrastructure, high healthcare expenditure, and a rapidly aging population. Additionally, there is a growing emphasis on remote patient monitoring, aligning with the prevalent use of telehealth services. The region's technological advancements, coupled with increasing awareness of respiratory health, contribute to the strong adoption of home spirometers. Favorable reimbursement policies and proactive government initiatives further support the market's growth in North America.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands a significant share in the home spirometer market due to a combination of factors. The region experiences a high prevalence of respiratory disorders, driving the demand for accessible monitoring tools. Additionally, increasing healthcare awareness, rising disposable income, and advancements in technology contribute to the adoption of home spirometers. The diverse and aging population in Asia-Pacific further fuels the need for convenient respiratory health solutions, positioning it as a key market for home spirometer growth.

U.S. Home Spirometer Market Trends

The U.S. rising prevalence of chronic respiratory diseases and a widespread shift toward remote patient monitoring. Key trends include advanced technological integrations, such as AI-powered diagnostics and smartphone connectivity, and the increasing convenience of handheld devices for at-home use. Supported by favorable regulations, the market is expanding significantly within the home care setting.

China Home Spirometer Trends

China's high prevalence of respiratory diseases, increased health awareness, and a significant shift toward home-based care. The market is propelled by technological integrations, such as smartphone connectivity and AI potential, to facilitate remote monitoring and early diagnosis. Government-led screening programs are also instrumental in expanding the use of portable spirometers in primary care settings.

Home Spirometer Market Value Chain Analysis

- Research & Development (R&D) and Product Design: This initial stage involves conceptualizing new spirometer devices, focusing on improved accuracy, portability, and user-friendly features like smartphone connectivity.

Key Players: NuvoAir, Vitalograph, and Philips. - Manufacturing and Quality Assurance: This stage involves producing the home spirometers, including the sensor components, electronic hardware, and software.

Key Players: Vyaire Medical and Schiller. - Distribution and Supply Chain Management: This stage focuses on getting the finished devices from the factory to various channels, including distributors, healthcare providers, and direct-to-consumer online platforms.

Key Players: Medline or tech-savvy retailers like Amazon. - Marketing, Sales, and Patient Engagement: This involves marketing the devices to clinicians, hospitals, and directly to patients, often emphasizing features like ease of use and remote monitoring capabilities.

Key Players: NuvoAir and Aluna.

Home Spirometer Market Companies

- Vitalograph Ltd.

Vitalograph is a key contributor to the home spirometer market, offering a range of high-quality, reliable, and easy-to-use devices designed for both clinical and home use. - MIR (Medical International Research)

MIR is a significant player in the market, specializing in the design and manufacture of innovative portable spirometers with advanced, patented technology for accuracy and ease of use. - Schiller AG

Schiller provides a wide range of diagnostic devices, including advanced home spirometers that are known for their precision and reliability in monitoring chronic respiratory conditions. - Nihon Kohden Corporation

Nihon Kohden, a leader in medical electronic equipment, contributes to the home spirometer market with devices that offer high accuracy and user-friendly interfaces. The company leverages its expertise in medical monitoring to provide reliable devices that integrate well with existing healthcare networks. - NDD Medical Technologies

NDD is known for its TrueFlow technology, which provides highly accurate and calibration-free spirometry measurements, a crucial feature for reliable home monitoring. - Contec Medical Systems Co., Ltd.

Contec is a major manufacturer of medical devices in China, providing cost-effective and portable home spirometers that meet a strong demand for affordable healthcare solutions. - Microlife Corporation

Microlife specializes in developing user-friendly medical diagnostic equipment, including home spirometers, that enable patients to easily monitor their health from home. The company contributes by offering highly portable devices designed for maximum convenience and reliability in everyday use. - Fysiomed

Fysiomed is a developer of medical devices and software, contributing to the home spirometer market with innovative solutions focused on physical therapy and respiratory health management. The company integrates its spirometry tools with software platforms for comprehensive patient management and analysis. - CareFusion Corporation (acquired by BD)

CareFusion, now part of BD (Becton, Dickinson and Company), contributed to the market through its expertise in respiratory diagnostics and patient monitoring solutions. BD continues to leverage this legacy to provide a wide range of medical technologies that support respiratory care and diagnostics. - SDI Diagnostics

SDI Diagnostics specializes in manufacturing and supplying simple, reliable spirometers and related supplies for both professional and home use. The company focuses on providing cost-effective and robust devices that meet clinical standards for accuracy and ease of operation. - Cosmed

Cosmed is a global provider of metabolic and body composition testing equipment, including advanced spirometers that cater to both clinical and home-use markets. The company contributes by offering high-precision devices that are often used in sports science and research settings, in addition to standard medical applications. - Jones Medical Instrument Company

Jones Medical focuses on providing practical and durable spirometry solutions that are easy to use for both patients and healthcare professionals. - Bionet America, Inc.

Bionet America supplies a range of medical equipment, including spirometers, that are known for their quality, performance, and advanced features. The company contributes by offering integrated diagnostic solutions that support efficient and accurate patient monitoring in various settings. - Futuremed America Inc.

Futuremed provides medical diagnostic equipment, including a range of spirometers with an emphasis on affordability and ease of use. The company contributes to market accessibility by offering cost-effective solutions for home and clinical use. - Medtronic plc

Medtronic is a global leader in medical technology, and while not a primary manufacturer of standalone home spirometers, its broader respiratory and patient monitoring solutions integrate relevant data and technologies.

Recent Developments

- In 2018, Schiller AG expanded its global presence by inaugurating a new manufacturing facility in Guangzhou, China, showcasing the company's commitment to meeting the increasing demand for medical devices in the Asian market.

- In the same year, Schiller AG demonstrated its commitment to innovation by introducing the CARDIOVIT CS-200 ErgoSpiro System device in November. This device likely aimed to provide advanced cardiovascular and respiratory monitoring capabilities, contributing to Schiller AG's portfolio of cutting-edge medical equipment.

- In 2017, MIR, a medical device company, collaborated with Tactio Health Group based in Canada to pioneer telemedicine solutions specifically designed for Chronic Obstructive Pulmonary Disease (COPD). This strategic partnership aimed to leverage technology for remote monitoring and management of COPD, aligning with the broader trend of incorporating digital health solutions into respiratory care.

Segments Covered in the Report

By Type

- Hand-Held

- Table-Top

By Technology

- Volume Measurement

- Flow Measurement

By Application

- Asthma

- COPD

- Others

By End User

- Hospitals and Clinics

- Home Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client