List of Contents

What is the Healthcare Distribution Market Size?

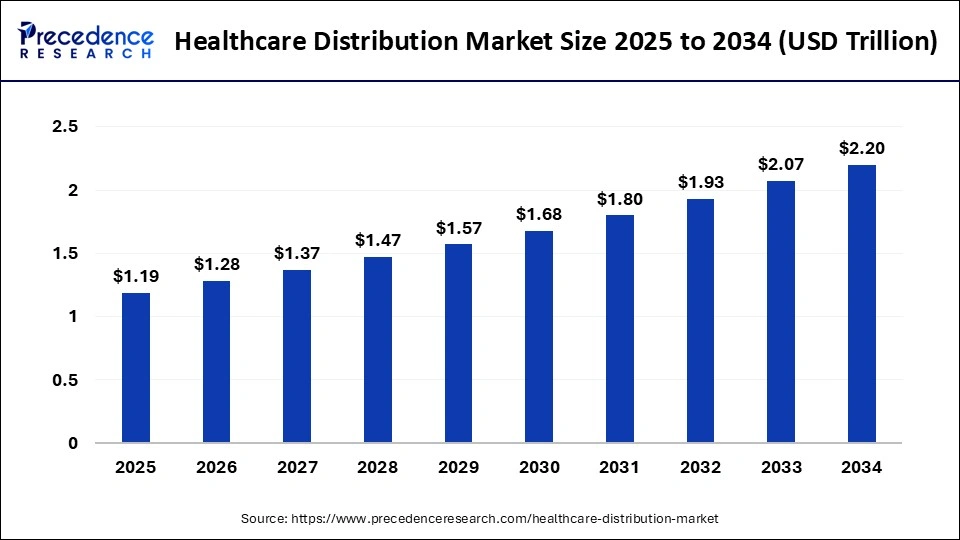

The global healthcare distribution market size is valued at USD 1.19 trillion in 2025 and is predicted to increase from USD 1.28 trillion in 2026 to approximately USD 2.20 trillion by 2034, expanding at a CAGR of 7.08% from 2025 to 2034.

Healthcare Distribution Market Key Takeaways

- The pharmaceutical segment is expected to grow at a 19.7% CAGR during the analysis period, 2025 to 2034.

- The medical devices segment is expected to record a CAGR of 17.9%.

Healthcare Distribution MarketGrowth Factors

- Rising incidence of chronic diseases

- High growth of medical devices industry

- Growing Importance of generics across the globe

- Favorable R&D Investment Scenario and Subsequent Increase in Drug Launches

- Increasing use of technologies such as RFID and Blockchain in logistics

- Growing applications in track and trace solutions

Major Trends in the Healthcare Distribution Industry

Innovation in technology can help drive efficacy across the divided supply chains. For instance, drones, mobile phones, and (IoT) Internet of Things will have a transformative consequence by facilitating gathering and reporting of information and improving discernibility across the existing supply chain. This superior understanding of product appeal often results in reduced costs, decreased inefficiency and lessened time to market. Supply chains that take advantage of mobile technology, help quickenconnect by submitting data to several stakeholders. Information on utilization can be conveyed by health workforces in the clinics to the central logistics administration unit to inform replenishing and future procurement. The mobile technology is not only being exploited for communication, but has also been extensively applied in financial businesses across the world. Alliances in healthcare delivery markets and the appearance of new products is expected at unleashing anupsurge of opportunities in the global healthcare distribution market over the forecast timeframe.

Increasing popularity of generic drugs in the developing regions is expected to open up new avenues for the healthcare distribution market. A generic drug is a replica that is the identical as a brand-name drug in strength, safety, dosage, mode of intake, performance, quality, and intended usage. As generics use identical active ingredients and are revealed to work the similar way in the human body, they have the equivalent risks and advantages as their brand-name medications. However, generic drugs are less costly because generic producers don't have the investment expenses of the creator of a new drug. More generic replicas of successful medications are being retailed worldwide than ever earlier. This requires a robust distribution system across world.

Recent Trends in Halal Ingredients Market

| Trend | Brief Description |

| Rising Global Demand | Halal is seen as a mark of quality and safety by both Muslim and non-Muslim consumers. |

| Strict Certification | Stronger halal laws and traceability rules in Asia and GCC countries. |

| Plant-Based Shift | Growing use of natural, plant-derived, and clean-label ingredients. |

| Beyond the Food Sector | Expanding into cosmetics, pharma, and personal care. |

| Tech integration | Blockchain is used for halal traceability and supply chain transparency. |

| R&D Innovation | Focus on biotech and fermentation for halal proteins and enzymes. |

| Sustainable Sourcing | Emphasis on eco-friendly and ethical ingredient production. |

| Brand Expansion | Companies are widening halal-certified product portfolios. |

| E-commerce Boost | Online sales and global halal expos are increasing accessibility. |

Market Outlook

- Industry Growth Overview: The halal ingredients market is witnessing strong global growth as consumers become more conscious of certified and ethically made goods. Steady growth is being driven by growing demand from consumers, both Muslim and Non-Muslim, who identify halal with quality, safety, and purity. To reach a larger market, sectors including food, drink, cosmetics, and pharmaceuticals are using halal-certified ingredients.

- Sustainability Trends: As manufacturers shift to ethical production methods and environmentally friendly sourcing, sustainability has emerged as a major concern in the halal ingredients market. Sustainable agriculture, traceable supply chains, and energy-efficient manufacturing techniques that respect environmental and halal values are being incorporated by numerous businesses. The growing overlap between clean label organic and halal trends indicates that consumers prefer goods that are both environmentally friendly and compliant with their faith.

- Startup Ecosystem: The halal ingredients startup ecosystem is expanding as creative businesses enter the market to close product gaps in the food, personal care, and pharmaceutical industries. Startups are concentrating on halal-compliant, cruelty-free cosmetics plant plant-based proteins, and natural flavorings. These new players are expanding swiftly thanks to strategic partnerships with established manufacturers and certification organizations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.20 Trillion |

| Market Size in 2025 | USD 1.19 Trillion |

| Market Size in 2026 | USD 1.28 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.08% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

COVID-19 Impact on Global Healthcare Distribution Market

In 2020, the pharmaceutical and medical product supply networks struggled on an international scale to keep pace with the quick spread of the corona virus. The interruption in supply chains because to the COVID-19 pandemic had resulted in a fall in the accessibility of healthcare products across the world. The supply of key raw materials was also severely disrupted due to the forced lockdowns and dearth of manpower. Multiple issues including lack of streamlined link among the regional warehouses resulted in disruption of provision of raw materials between regions. The rapid spread of corona virus highlighted the numerous shortcomings of the healthcare supply chains. This has prompted major companies operating in the healthcare distribution business to take necessary steps to remove the bottlenecks and reorganize the distribution network.

Future of Healthcare Distribution

The rise of specialty healthcare products is presenting new challenges for the healthcare distribution industry. The companies will have to design new supply chains that can cater to the distribution of specialty medications. The healthcare distribution companies are working on the use of data for improving the existing models and offering more value-added services.

Significant Market Trends

Pharmaceutical Segment Reported Foremost Market Stake in 2024

Pharmaceutical segment recorded the prime market share in the global healthcare distribution Market in 2024. The key reason for the hefty share of the pharmaceutical segment is the high production of pharmaceutical products owing to high demand, strong product pipeline of major manufacturers, high investment in research and development for developing effective drugs, initiatives taken by governments for eradicating communicable diseases, and constant launch of new and effective treatments.

The biopharmaceuticals segment is projected grow at the highest CAGR during the forecast period mainly due to increasing awareness regarding use of biologics for the treatment of hitherto untreatable diseases. Other factors responsible for high growth of biopharmaceuticals segment are increasing geriatric population, high prevalence of chronic disorders, and rising cases of cancer worldwide.

Retail Pharmacy End-Users are Projected to Dominate the Healthcare Distribution Market Revenue

The retail pharmacies are involved inhandling large capacity of prescriptions on a regular basis, which is a key factor supporting the progress of the segment. The retail pharmacies also stock products for multiple disorders ranging from cardiovascular diseases to skin disorders. Moreover, the growing trend of retail pharmacy chains and 24X7 pharmacies is also expected to play an important part in the high revenue share of retail pharmacies. The retail pharmacies accounted for the largest revenue in the end user segment with more than 52.9% share in 2023.

Hospital pharmacies will hold a significant share in the global healthcare distribution market mainly due to the high incidence of lifestyle related disorders requiring long hospital stays. Other end-users include specialty pharmacies which stock drugs and medical devices related to specific medical conditions.

Value Chain Analysis

- Raw Material Procurement: Only confirmed vendors who adhere to halal certification requirements are used to source raw materials. Using more natural and plant-based resources promotes transparent supply chains and guarantees sustainability, safety, and ease of compliance

- Retail Sales and Marketing: Transparency in certification and authenticity are key components of retail marketing. Consumer awareness and demand for certified food, cosmetics, and personal care products are increasing thanks to halal labels, digital campaigns, and specialized retail sections.

- Waste Management and Recycling: Manufacturers are adopting practices to minimize waste and promote recycling. Efforts included reusing byproducts, reducing water consumption, and ensuring disposal processes align with halal and environmental guidelines.

Healthcare Distribution Market Companies

The companies focusing on integration of latest technologies into the distribution network are expected to lead the global healthcare distribution market. Leading competitors contending in global healthcare distribution market are as follows:

- AmerisourceBergen Corporation

- McKesson Corporation

- Medline Industries

- Cardinal Health, Inc.

- PHOENIX Group

- Shanghai Pharmaceutical Group Co., Ltd.

- Henry Schein Inc.

- Owens & Minor, Inc.

- Medline Industries

- Rochester Drug Cooperative, Inc.

In order to better recognize the current status of healthcare distribution, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the healthcare distribution market. This research study bids qualitative and quantitative insights on healthcare distribution market and assessment of market size and growth trend for potential market segments.

Recent Developments

- In January 2024, Cardinal Health, Inc., a leading healthcare company, announced its acquisition of specialty networks, demonstrating the company's goal to expand its business within the specialty domain. The aim of this acquisition is clearly to enhance Cardinal Health's market position on a global scale while incorporating highly advanced and innovative technologies and expertise to find out and resolve consumer queries.

- In February 2024, Cardinal Health unveiled its plan to build its logistics center in Columbus with a 350,000-square-foot area, highlighting its target of expanding for robust supply chain. This project was designed to offer a central hub that distributes over-the-counter medical products which strengthening a company's ability to provide pharma products on a large scale.

- In January 2020, Alliance Healthcare came up a new online service that delivers its customers with an easy approach to access its arrangements and order healthcare products online.

- In May 2025, Biokar Diagnostics launched a new Halal‑certified range of dehydrated culture media, starting with four formulations.

https://www.solabia.com - In June 2025, Eevia Health Plc received HALAL certification from Halal Quality Control Group for its production processes and selected product lines.

https://news.cision.com

Major Market Segments Covered

By Product Type

- Biopharmaceutical

- Pharmaceutical

- Medical Device

By End User

- Hospital Pharmacies

- Retail Pharmacies

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client