List of Contents

What is the Generator Market Size?

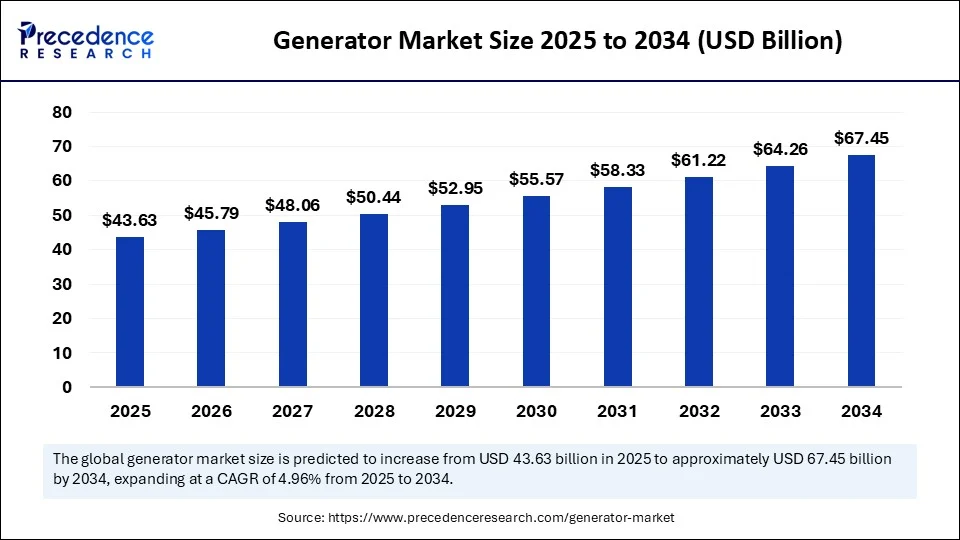

The global generator market size is valued at USD 43.63 billion in 2025 and is predicted to increase from USD 45.79 billion in 2026 to approximately USD 67.45 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034. The market is growing due to rising demand for reliable backup power solutions, driven by the increasing frequency of power outages, rapid industrialization, and the expansion of data centers and infrastructure projects worldwide.

Market Highlights

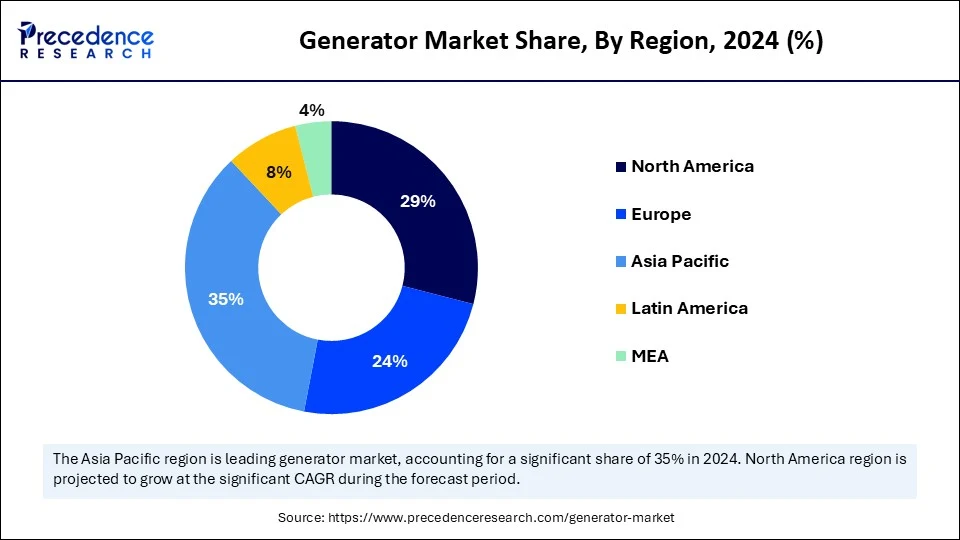

- Asia Pacific dominated the generator market with the largest market share of 35% in 2024.

- North America is expected to grow at a notable CAGR during the forecast period.

- By fuel type, the diesel segment held the biggest market share of 45% in 2024.

- By fuel type, the hybrid segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the commercial & industrial segment captured the highest market share of 35% in 2024.

- By application, the data centers & IT/ cloud facilities segment is expected to grow at the fastest CAGR in the generator market.

- By product type/mode, the standby/backup gensets segment contributed the maximum market share of 40% in 2024.

- By product type/mode, the hybrid/integrated genset+battery systems segment is expected to grow at the fastest CAGR during the forecast period.

- By technology, the reciprocating ICE gensets segment generated the major market share of 60% in 2024.

- By technology, the fuel cell gensets/inverter-based systems segment is emerging as the fastest growing during the forecast period.

How Is Digitalization Transforming Efficiency and Monitoring in the Generator Market?

Digitalization enables the tracking of performance in real-time, predictive maintenance, and remote operation. It is revolutionizing efficiency and monitoring in the generator market. By using cloud-based platforms and IoT-enabled sensors, operators can continuously monitor engine health, load management, and fuel consumption, which lowers operating expenses and downtime. Digital tools-powered predictive analytics ensures greater reliability and prolongs the life of equipment by identifying possible failures before they happen. Digital monitoring systems on smart generators also facilitate smooth integration with energy management systems, increasing their flexibility in response to changing power needs and environmentally friendly procedures. In addition to increasing productivity, this digital revolution is generating new value-added services for consumers.

Market Overview

The global generator market is witnessing steady growth as demand for uninterrupted and reliable power supply continues to rise across residential, commercial, and industrial sectors. Generators are becoming increasingly popular as backup power options due to frequent power outages brought on by aging grid infrastructure, natural disasters, and rising electricity consumption. Large-scale infrastructure projects, data center expansion, and rapid urbanization are further increasing the market demand. Additionally, the industry is changing and becoming more sustainable and efficient because of the incorporation of cutting-edge technologies like eco-friendly generators, hybrid fuel options, and smart monitoring systems. Rising investments are significantly aiding the expansion of the market in the mining, oil, and gas, as well as the construction and healthcare industries.

Generator Market Growth Factors

- Power Outages & Grid Failures: Rising blackouts from aging grids and natural disasters boost demand for backup generators.

- Data Center Expansion: Growing digitalization and cloud adoption increase the need for uninterrupted power.

- Industrialization & Infrastructure Growth: Construction, mining, and oil & gas projects rely on generators for continuous operations.

- Healthcare Demand: Hospitals and emergency services require reliable standby and portable generators.

- Tech Advancements: Smart monitoring, hybrid fuels, and eco-friendly models are making generators more efficient and sustainable.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 43.63 Billion |

| Market Size in 2026 | USD 45.79 Billion |

| Market Size in 2034 | USD 67.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Application / End-Use, Product Type / Mode, Technology / Engine Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Rising Power Outages and Grid Instability

Dependable backup power solutions are becoming more and more necessary for critical infrastructure, homes, and businesses due to the rising frequency of blackouts caused by aging infrastructure, severe weather, and increased electricity demand. Generators are now necessary to maintain service during blackouts, particularly as grids are unable to keep up with the rise in demand. Energy-intensive technologies, such as AI data centers and those related to climate change, are putting more strain on power systems, leading to the growth of the generator market.

- In July 2025, Generac announced a $130 million investment to scale generator production tailored for hyperscale data center demand, as facilities increasingly seek resilient on-site power amid grid unreliability(Source: https://www.ft.com)

Rapid Industrialization and Infrastructure Growth

As industries expand and major infrastructure projects from mining to oil & gas grow in remote regions, the demand for generators as primary power solutions is rising. These areas often lack grid access, making on-site generation indispensable. Construction sites and telecom infrastructure rely on generators for continuous operations, even in power-deficient zones. Such enterprise-level needs for consistent, high-capacity power delivery increasingly drive the generator market.

- In June 2025, Caterpillar unveiled new high-capacity generator engines, ranging from 1,000 to 6,000 horsepower, aimed at supporting AI-driven data centers and industrial facilities with critical power needs(Source: https://www.barrons.com)

Restraints

High Operating and Maintenance Costs

Long-term ownership of generators is expensive due to significant ongoing fuel maintenance and part costs, particularly for large-capacity models. The financial burden is further exacerbated by fuel price volatility, particularly for residential and small business users. In areas where costs are a concern, these high prices frequently deter investment in backup power solutions. Furthermore, unforeseen malfunctions have the potential to stop operations, requiring businesses to set aside funds for backup and redundancy systems. The high lifecycle cost further complicates adoption in developing markets in comparison to renewable alternatives.

- In 2023, Kohler expanded its KD Series industrial generators (including KD700 and KD750), featuring HVO compatibility and improved fuel economy, addressing rising operating costs with more efficient options. (Source: https://www.powersystems.rehlko.com)

Stringent Environmental Regulations

The impact that generators have on the environment, governments are increasingly enforcing strict emissions standards. Advanced emission-control technologies are now frequently needed for compliance, which raises production costs. Even traditional diesel generator sets are being restricted in some urban areas, which reduces their market availability. This tendency is especially noticeable in North America and Europe, where carbon neutrality regulations are accelerating the move away from diesel-based solutions. Manufacturers are forced to redesign product lines, which lengthens time-to-market cycles and increases research and development costs. This frequently results in higher initial costs for buyers of compliant models.

- In June 2025, Cummins Inc. introduced its B6.7 Performance Series engine equipped with stop-start capability and compliant with EU Stage V emissions standards, reducing fuel use and emissions while improving uptime.(Source: https://www.cummins.com)

Opportunities

Advancements in Smart and Connected Generators

The growth of the IoT-enabled generator market is bringing about new possibilities in remote management, real-time monitoring, and predictive maintenance. These characteristics attract commercial and industrial buyers by improving dependability, decreasing downtime, and lowering the total cost of ownership. To facilitate sustainability reporting and compliance, smart generators can also be easily integrated with building energy management systems. The need for digitalized and AI-driven generator solutions is expected to increase as industries place a higher priority on operational efficiency. Manufacturers who invest in cutting-edge connectivity features gain a competitive advantage as a result.

- In January 2025, Generac Power Systems unveiled its Nexus Smart Generator Platform with IoT and AI-driven predictive diagnostics, offering remote monitoring and energy optimization for industrial and residential users.

Integration of Hybrid and Renewable-Compatible Generators

The trend toward hybrid systems, which combine generators with solar wind or battery storage, is being accelerated by rising sustainability goals. Hybrid generator sets are appealing to environmentally conscious companies because they lower emissions, fuel consumption, and operating expenses. Additionally, this integration helps off-grid projects and remote areas where renewable energy sources might not be enough. Businesses are investing a significant amount of money in intelligent hybrid systems that automatically balance energy usage from various sources. It is anticipated that this trend will reshape product portfolios and attract new customers seeking reliable yet environmentally friendly alternatives.

Segment Insights

Fuel Type Insights

Why Did Diesel Generators Dominate the Market?

Diesel gensets dominate the market because they provide the best combination of high power density, quick start/step load capability, and dependable performance under variable loads and harsh conditions. Mission-critical users still prefer diesel for code compliance and black start assurance. The life of the installed base is being further extended by lower carbon fuels like HVO, which reduce emissions without requiring system redesign. When seconds count and data center and industrial footprints expand, diesel remains the go-to option for Tier-rated backup. Additionally, the largest worldwide servicing network for diesel guarantees reliable uptime for vital infrastructure. It is the most dependable choice in both developed and emerging economies due to its unparalleled durability and longer lifespan.

Hybrid (Generator + Battery/Renewables) systems are surging as operators chase fuel saving, noise reduction, and lower emissions while keeping diesel-like resiliency. Optimal loading reduces engine hours, and seamless renewable integration is made possible by pairing BESS with gensets. These data software-defined controls coordinate generators, storage, and PV to meet ESG goals without sacrificing uptime. Construction sites, remote industries, and behind-the-meter microgrids are adopting batteries more quickly due to declining costs and an increase in turkey options.

Application Insights

Why Did Commercial & Industrial Applications Lead the Generator Market in 2024?

The commercial & industrial (incl. construction, mining, oil & gas) lead the generator demand because they need power for a variety of duty cycles, including backup, peak shaving, and prime, both stationary and portable. Multi-MW sets with service networks, rapid delivery, and ruggedization are frequently required for industrial projects in grid-constrained areas. Telemetry compliance and overall lifecycle economies are also important, favoring well-known genset platforms with uptime that has been demonstrated in the field. Commercial & industrial continues to be the main clientele as capital expenditure cycles in infrastructure and energy grow. Because downtime has a direct effect on output and income, these sectors also place a high priority on dependability. The significant reliance on generators in off-grid or remote project sites further cements their dominance of the market.

Data centers & IT/cloud facilities are the fastest-growing segment, with strict availability/tier requirements. On-site power currently relies on diesel, plus fuel cells or hybrid bridges, which grid delays and guarantees SLAs until new transmission and generation catch up. To address step load and N+ redundancy requirements, particularly in high-growth cloud regions, vendors are customizing high-response gensets and alternative prime power. Large capital expenditures in digital infrastructure are guaranteeing this market's continuous growth. Hyperscale's are being forced to find reliable instant backup solutions due to an increase in power outages and latency issues.

Product Type/Mode Insights

Why Did Standby/Backup Gensets Make Up the Largest Share in the Generator Market?

Standby/backup genset units made up the largest share of 40% because mission-critical facilities must adhere to redundancy tiers and codes that require reliable, immediate power. A drop in fuel prices helps keep TCO competitive and enhances sustainability without restructuring. A robust cycle of replacement and upgrade is reinforced, and the massive installed base in hospitals, commercial real estate, utilities, and campuses reinforces the upgrade. Regulations requiring backup solutions in safety-critical industries, such as healthcare, serve to further solidify this dominance. Furthermore, in unforeseen outage situations, their ability to deliver uninterrupted power in a matter of seconds makes them invaluable.

Hybrid/integrated genset+battery systems are the fastest-growing area, as customers seek quiet, cleaner, and more efficient power without compromising uptime. For peak shaving, deep cycling of batteries and proper engine sizing are made possible by DC-coupled architectures fast fast-ramping inverters, and EMS software. Fuel savings, maintenance savings, and simpler compliance are made possible by these systems, which are particularly beneficial for behind-the-meter microgrids and rental fleets. Additionally, by strategically allocating loads between engines and storage, they provide operational flexibility. Businesses dealing with fluctuating fuel prices and sustainability reporting requirements will find this innovation especially appealing.

Technology Insights

Why Did Reciprocating ICE Gensets Dominate the Generator Market in 2024?

Reciprocating ICE gensets dominate the generator market, driven by an extensive worldwide service ecosystem and a wide range of fuel options, including biobag diesel and HVO. They have demonstrated durability and modularity, ranging from KW to multi-MQ, and a quick start load. TCO leadership is maintained across standby and prime applications through constant improvements in combustion controls and aftertreatment, which maintain high efficiency and low emissions. They guarantee consistent recurrent demand worldwide thanks to their broad industry adaptability and their resilience. The technology is also the standard option in areas with erratic or unreliable grid connections.

Fuel cell gensets/inverter-based systems are growing fastest from a smaller base. In areas with lengthy interconnection lines, fuel cells offer cleaner on-site power with high availability, better part-load efficiency, and cleaner waveforms for delicate loads, which are also provided by inverter-based sets. Volumes of these are rapidly increasing as AI data centers, campuses, and upscale residences use them. One of the main drivers of growth is their ability to significantly reduce carbon emissions while maintaining high efficiency. Additionally, these technologies are becoming more commercially viable due to government incentives and R&D investments.

Regional Insights

Asia Pacific Generator Market Size and Growth 2025 to 2034

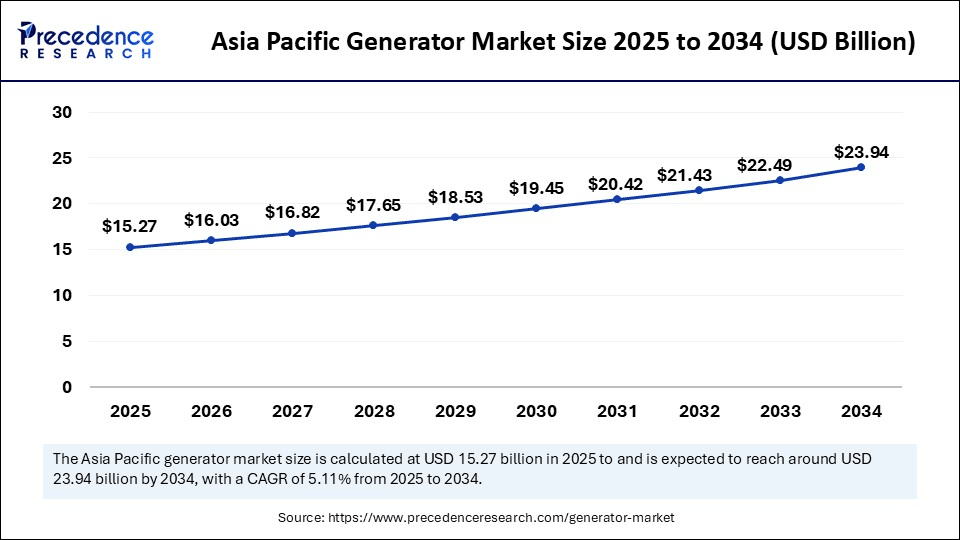

The Asia Pacific generator market size is evaluated at USD 15.27 billion in 2025 and is projected to be worth around USD 23.94 billion by 2034, growing at a CAGR of 5.11% from 2025 to 2034.

Why Did Asia Pacific Dominate the Generator Market?

Asia Pacific dominates the market, driven by a combination of heavy construction, rapid industrialization, and infrastructure growth, as well as frequent grid constraints in both urban and industrial areas. A move toward CPCB IV+ complaint and gas-capable generator sets by stricter emission regulations, and the rental market is still thriving in the mining and construction industries. A robust local OEM presence, accelerated delivery times, and comprehensive after-sales assistance further support Asia Pacific's dominance in volume and demand. The expanding electrification requirements in rural and semi-urban areas are also accelerating the adoption of generators. Additionally, ongoing investment in prime and standby generator solutions is being supported by government-backed infrastructure programs.

Europe Generator Market Trends:

Europe is a market of scale and sophistication due to increasing intermittency from renewables, focus on grid resilience after geopolitical shocks, and emissions regulations are driving investments into increasingly flexible very low-emissions prime and backup solutions. Consistently more, European buyers are demanding less- and hybridized products, "fuel-flexible" gensets, and intelligent controls that enable grid services and emissions reporting, which drives product differentiation and opportunities for service revenue for vendors.

Germany Generator Market Trends:

Germany is the continent's leading adopter, as a function of its large industrial base, extreme sensitivity to energy security, and regulatory focus on emissions and performance efficiency. Germany creates a premium segment in Europe where OEMs win on engineering, not price, long-term service contracts, and solutions that can participate in demand response or ancillary grid services. This market favours suppliers that can provide a combination of sophisticated technical solutions with regulatory compliance and service commitment.

North America is the fastest-growing region in the generator market, driven by significant investment in resilience infrastructure, growing concerns about grid reliability due to extreme weather, and the exponential growth of AI-powered data centers. Customers are using advanced fuel cell systems, natural gas prime sets, and high-response diesel standby more frequently to guarantee smooth power continuity. Supportive policy measures and the quick uptake of microgrids are also facilitating faster adoption of hybridized and cleaner generator technologies. While corporate sustainability goals are opening doors for low-emission alternatives, frequent grid outages have forced businesses to prioritize uninterrupted power.

United States Generator Market Trends:

The United States is at the forefront of the region due to its concentration of the biggest fleet of commercial data centers, diversified manufacturing, and utilities with contracts backed by distributed generation; metropolitan clusters are centers for portable and stationary generators. End-users have increasingly ordering remote monitoring, emissions compliance, and integration with renewables and storage. Policy has also emphasized grid resilience and corporate continuity planning, enabling once-off purchases to become multi-year service agreements that are advantageous to established OEMs and distributors.

India Generator Market Trends:

India is the regional leader by both volume and strategic importance: robust growth in electricity demand, persistent distribution constraints in some areas, and a strong rollout of industrial and digital infrastructure have led to steady procurement of commercial and industrial generators. Decision-makers tend to prioritize lifecycle cost, fuel efficiency, and localized service networks contingent; that trend has further led to a market premium for OEMs who can offer robust hardware, like legislation, spare-parts logistics, and financing. Furthermore, Indian policy has had a strong emphasis on rural electrification and heavy manufacturing, which still supports near-term demand for reliable backup generation.

Generator Market Value-chain Analysis:

- Raw-materials & components

Suppliers obtain engines, alternators, control electronics, metals, and fuel systems that OEMs combine to produce generator sets. - Design & R&D

OEMs develop genset architectures, engines engineered for emissions compliance, digitalized control features, and grid-paralleling offerings to help end users adhere to regulations and their intended needs. - Manufacturing & assembly

Manufacturing locations assemble for final delivery, install the acoustic enclosure, add soundproofing and complete load-bank testing to demonstrate performance before being shipped to the end user. - Distribution, sales & rentals

Distributors, EPC contractors, and Rental Company provide conveyor delivery of gensets to the end user, along with install and temporary power services. - After-sales service, spares & end-of-life

Routine service, remote monitoring, spare part supply and compliance testing during routine service, and recycling to achieve end-of-life management, will ensure reliability and address end-of-life flow.

Generator Market Companies

- Caterpillar

- Cummins

- Generac

- Kohler Co.

- Atlas Copco

- MTU Onsite Energy (Rolls-Royce Power Systems)

- Mitsubishi Heavy Industries (MHI Power Systems)

- Honda Power Equipment

- Briggs & Stratton

- Wärtsila

- Doosan Portable Power

- FG Wilson (a Caterpillar brand)

- SDMO Industries (Kohler Group)

- Himoinsa

- Yanmar Power Technology

- Perkins (aka engine supplier brand)

- Hyundai Power Systems / Hyundai Heavy Industries

- Aggreko

- Kohler-SDMO

- Kohler Power Systems

Recent Developments

- In August 2025, Baseline Energy Services launched the NexGen 400, a 400-kW mobile natural-gas generator with smart sensors that adjust to fuel quality and significantly reduce emissions (90% less NO? and 69% less CO?).(Source: https://www.mrt.com)

- In August 2025, GE Vernova announced a $41 million expansion of its generator manufacturing facility in Schenectady, New York, adding 50 jobs to boost production of H65 and H84 generators for gas turbines.(Source: https://www.timesunion.com)

- In January 2025, Jackery unveiled a suite of new energy products at CES 2025, including a high-efficiency Solar Roof, a mid-size solar generator, and a fast DC-to-DC car charger, enhancing portable and home-based power solutions.(Source: https://www.theverge.com)

Segments Covered in the Report

By Fuel Type

- Diesel

- Gasoline / Petrol

- Natural Gas

- Liquefied Petroleum Gas (LPG / Propane)

- Biogas / Biomethane

- Dual-fuel (e.g., diesel + gas)

- Hydrogen (emerging)

- Hybrid (Generator + Battery / Renewables)

- Others

By Application / End-Use

- Residential backup power

- Commercial buildings & retail

- Data centers & IT / Cloud facilities

- Healthcare (hospitals, clinics)

- Telecom towers / BTS sites

- Construction / Mining / Oil & Gas sites

- Utilities & Grid-support

- Events & Hospitality

- Agriculture & Rural electrification

- Military & Defense

- Others

By Product Type / Mode

- Portable generators

- Standby / Backup gensets (automatic transfer)

- Prime & Continuous power gensets

- Rental gensets / Mobile power solutions

- Containerized & Modular power plants

- Integrated genset + UPS / Battery-hybrid systems

By Technology / Engine Type

- Synchronous alternator-based gensets

- Inverter-based generator systems

- Reciprocating internal combustion engine (ICE) gensets

- Turbine-based gensets (small gas turbines)

- Fuel cell gensets

- Microturbine / Rotary units

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client