List of Contents

What is the Electric Vehicle (EV) Tire Market Size?

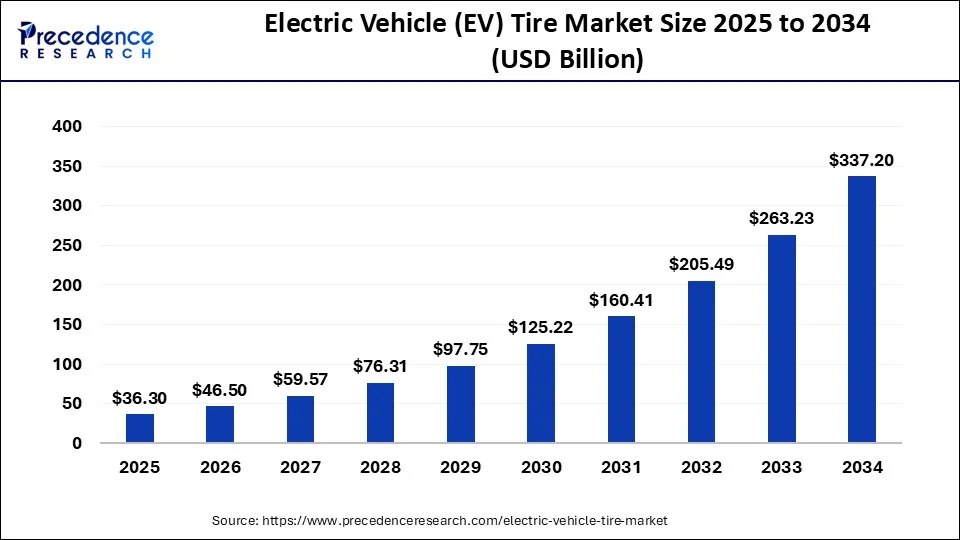

The global electric vehicle (EV) tire market size is valued at USD 36.30 billion in 2025 and is predicted to increase from USD 46.50 billion in 2026 to approximately USD 337.20 billion by 2034, expanding at a CAGR of 28.10% from 2025 to 2034.

Electric Vehicle (EV) Tire Market Key Takeaways

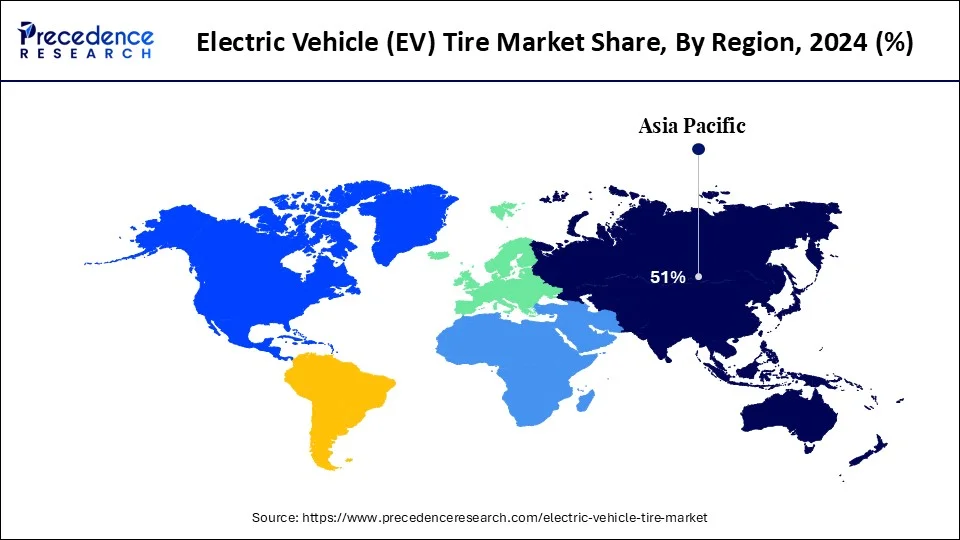

- Asia Pacific dominated the electric vehicle (EV) tire market with a share of 40% in 2024.

- By technology, the radial tires segment dominated the market in 2024.

- By distribution, the OEM pertaining segment led the market in 2024.

Market Overview

A huge preference has been shown towards artificial intelligence in place of the manual operated machines. The market is currently driven mainly by the increasing demand for automated vehicles having advanced safety features with easy to use interface. The launching of the 5G network has also proved to be a boon for the current market, owing to which the electric vehicle tires market showed a tremendous growth during the forecast period. Modern technology clubbed with upgraded version of designs and looks have attracted the market towards the use of advanced equipments. The modern techniques used to design the electric vehicle tires have made them lighter in weight which provide a better economy on road as compared to its rivals. Increased torque which is required to move a vehicle from halt has also affected the market to a great extent. This leads to greater use of energy in the initial phase of a drive with these vehicles. This affect on the initial phase affects the total average provided by the machine. The wall size has also been altered for these tires which show its significant impact on the vehicle's performance.

The growing concentration over the performance of the tires with respect to the number of years it can serve on road, the maintenance factors included during usage of the products, the safety features provided by the tires on road and the technological advancements made for the longer life of the tires have encouraged the leading market players to develop better products overtime. The electric vehicles usually requires better and advanced tires as compared to the internal combustion vehicles pertaining to the increased body weight of the vehicle as a whole along with the batteries which in turn makes a huge impact on the total resistance it presents during the initial motion of the vehicle from a state of rest.

The higher torque which is required during this initial motion of the vehicle from a state of rest is provided by these specialized electric vehicle tires. The noise production of the normal tires also varies as compared to the electric vehicle tires, which is relatively more in the former than the latter which is masked by the humming of the internal combustion engine of the vehicle. This noise is relatively lower for the electric vehicle and moreover the cabin of the electric vehicle is much quieter than its counterparts.

The outbreak of the covid-19 pandemic had disrupted the manufacturing process of the electric vehicle tires pertaining to the reduced transportation facilities available. The strict lockdowns imposed by the various governments had hampered the growth rate of the electric vehicle tires market. Hampered transportation facilities and services had created a shortage of the raw materials that are required for the manufacturing of the electric vehicle tires. Moreover the demand and supply chain of the tires had been disrupted to a great extent. Delay in the supply of the desired products had led to cancellation of huge orders which hampered the total revenue return of the industries. However substitutes were not a second choice as maintaining the quality for the new launching market was essential.

Revolutionizing Performance: How AI Integration is Transforming the Electric Vehicle (EV) Tire Market

AI integration is revolutionizing the market by enhancing performance, safety, and efficiency. Through predictive analytics, AI enables real-time tire health monitoring, optimizing pressure, temperature, and tread wear to extend lifespan and improve energy efficiency. Smart algorithms analyze driving patterns and environmental conditions, allowing adaptive tire behavior for better grip and reduced rolling resistance. AI also aids in design innovation, material optimization, and automated quality control in manufacturing. By supporting connected vehicle systems, AI-powered tires enhance sustainability, reduce maintenance costs, and contribute to the advancement of intelligent mobility solutions for next-generation electric vehicles.

Market Outlook

- Industry Growth Overview: The electric vehicle (EV) tire market is growing rapidly, driven by increasing EV adoption, advancements in tire technology, and demand for energy-efficient, durable, and smart tires optimized for performance and sustainability.

- Sustainability Trends: Sustainability trends in the market focus on eco-friendly materials, reduced rolling resistance, and recyclable designs. Manufacturers emphasize bio-based rubber, low-emission production processes, and circular economy initiatives to minimize environmental impact and enhance tire lifecycle efficiency.

- Global Expansion:The market is expanding globally, driven by growing EV adoption, infrastructure development, and government incentives. Manufacturers are investing in regional production facilities and partnerships to meet rising demand across North America, Europe, and Asia-Pacific markets.

- Major investors:Major investors in the market include leading tire manufacturers, venture capital firms, and automotive giants such as Bridgestone, Michelin, Goodyear, and Continental. These investors fund research in smart tire technologies, sustainable materials, and AI integration to enhance efficiency, performance, and environmental sustainability across global markets.

- Startup Ecosystem:The startup ecosystem in the electric vehicle tire market is growing, driven by innovations in smart tire technology, sustainable materials, and data-driven design. Emerging companies are developing AI-enabled monitoring systems, recyclable compounds, and energy-efficient tires, supported by collaborations with EV manufacturers, investors, and research institutions to accelerate green mobility solutions.

Electric Vehicle (EV) Tire Market Growth Factors

The increased use of batteries instead of using combustible fuel options has boosted the eco-friendly market tremendously. These tires give out less noise as compared to the normal ones due to which unnecessary noise pollution is avoided. On the other hand due to lesser noise provided by the engine the cabin of the vehicle is relatively quieter than its rivals, which in turn gives in the noise of the tires into the chamber. Reduced carbon emissions by the vehicles makes its a primary choice for the market and has become the need for the hour. Better wet grip is provided by the electric vehicle tires which provide a low rolling resistance to the vehicles thus making it easier for the entire body of the vehicle to fall into motion. This low rolling resistance also reduces the braking time of the vehicle and reduces the distance covered when urgent brakes are pressed on. Hence increasing the safety levels for the people outside the vehicle as well as inside.

The heavy weight of the batteries makes the overall vehicle quiet heavy and thus reduces its economy. The development in the batteries sector will positively impact the sales of the electric vehicle tires market. The increased weight of the overall vehicle in turn gives better rigidity and sturdiness on the road during the drive. The cruise measurements can be more accurate pertaining to the quieter rides as a result of the advanced tires technology and reduced noise inside the cabin of the electric vehicle. The reduced rolling resistance has reduced the use of energy for the initial motion of the body of the vehicle from a stationary position which results in saving of energy for further use on the road, thus improving the overall economy of the electric vehicle. A higher range of distance can be spanned with a single battery which is fully charged. Increase in the number of batteries increases the total weight of the vehicle which can show its impact on the average economy of the vehicle.

The electric vehicle tires give a smoother experience to the consumer during a drive which also has a lesser impact on the road. These factors help the electric vehicle tires to propel it's growth during the forecast period. The lower maintenance cost of the vehicle as a whole also helps to drive the market towards the use of electric vehicles. This will in turn facilitate the use of electric vehicle tires which form a perfect match with the advanced technologies used in the functioning of the vehicle on road. Replacement of the old batteries makes it easier for the consumer to deal with breakdowns and does not impose a great expenditure on the user of the vehicle. On the other hand breakdown of an internal combustion engine is hard to deal with. Lower servicing cost of the electric vehicle also creates a parallel attraction for the tire market during the forecast period. This helps the people to keep aside a larger share of their disposable income for future use.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 36.30 Billion |

| Market Size in 2026 | USD 46.50 Billion |

| Market Size by 2034 | USD 337.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 28.10% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Distribution Channel, Type, Technology, Tire Size, Propulsion, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Distribution Channel Insights

The largest market share has been acquired by the OEM pertaining to the heavy sales seen in this sector for EV operated vehicles. The increase in the usage of electric operated public transports in the developed cities and urban areas has also increased the sales of the tires in these regions.

The aftermarket segment in this sector has a secondary place of importance pertaining to its remanufacturing, distribution, retail sales and fixing processes. The original equipments manufacturers have an upper hand over the market owing to the authenticity of products it provides to the consumers. The world will further see a growth in the sales of the electric vehicle which will boost the market to a great extent.

Type Insights

Amongst two wheelers, passenger vehicles and commercial transports, the passenger vehicles are expected to boost the market. The recent development made by the government regarding the benefits for the purchase of electric vehicles has attracted the market towards it. People are opting for the electric vehicles to reduce their travelling cost and take full advantage of the government initiatives. Private vehicle owners prefer to travel by electric vehicles rather than fuel operated vehicles. The increase in the number of individuals opting for jobs outside their native regions also increases the number of private vehicle owners. This increases the number of passenger vehicles in the market. Commercial transports hold a secondary place in the market. The increasing number of people opting for public transports for daily travel has boosted this segment of the market. The government has also taken various initiatives regarding this and boosted the market during the forecast period.

Technology Insights

The technology types introduced in this segment are radial bias and composite. Where, radial tires are seen to capture the market better than its competitors. The active participation of the manufacturers in the R&D of the technology has proved to be fruitful for the company. The radial type of technology shows tremendous momentum during the forecast period. The compatibility shown by the radial type of tires has enhanced the total output provided by the electric vehicles. The increase in the safety features provided by this technology has also increased the demand in the market. This technology provides better performance as compared to its rivals or counterparts when utilized on road. The chances of tire damage are too reduced to a great extent pertaining to the advanced technology used in the manufacturing of the product.

Regional Analysis

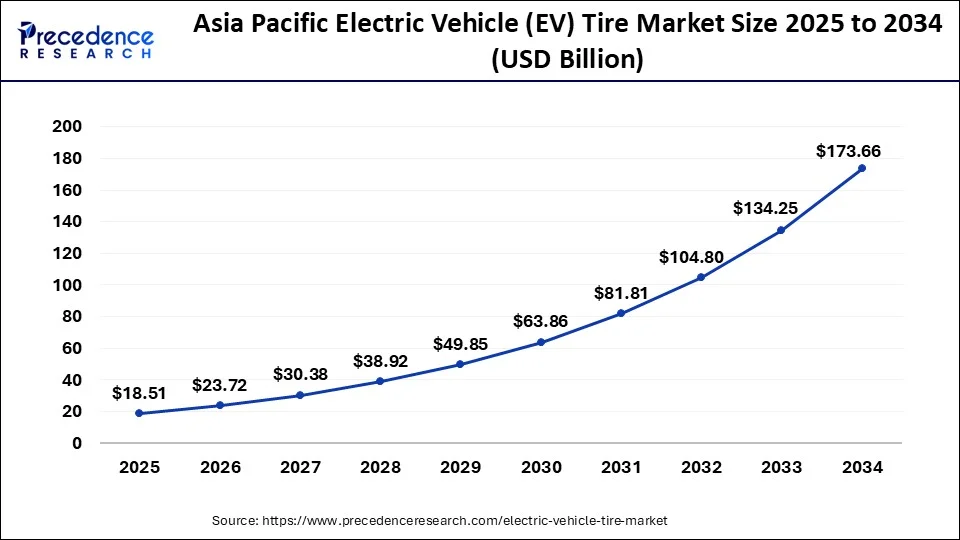

Asia Pacific Electric Vehicle (EV) Tire Market Size and Growth 2025 to 2034

The Asia Pacific electric vehicle (EV) tire market size is evaluated at USD 18.51 billion in 2025 and is predicted to be worth around USD 173.66 billion by 2034, rising at a CAGR of 28.23% from 2025 to 2034.

Asia Pacific dominated the electric vehicle (EV) tire market in 2024 due to the region's rapid adoption of EVs, supported by government incentives, growing environmental awareness, and expanding charging infrastructure. Countries like China and India are witnessing strong EV sales, which drives demand for specialized tires designed for higher torque, efficiency, and reduced rolling resistance. Additionally, increasing investments in local tire manufacturing and research for EV-specific performance features have strengthened the market. Rising urbanization and consumer preference for sustainable mobility solutions have further contributed to the region's leadership in the EV tire sector.

China Electric Vehicle (EV) Tire Market Trends

China is a major contributor to the Asia Pacific electric vehicle (EV) tire market due to its position as the world's largest EV market, driven by strong government incentives, subsidies, and policies promoting green mobility. The country's rapidly growing EV production and sales have fueled demand for specialized tires that optimize efficiency, durability, and safety for electric vehicles. Additionally, China has a robust domestic tire manufacturing industry investing in research and development of EV-specific tire technologies.

What Makes North America the Fastest-Growing Area in the Market?

North America is the fastest-growing region in the electric vehicle (EV) tire market due to rising EV adoption supported by government incentives, stricter emission regulations, and growing consumer demand for sustainable mobility solutions. The region's increasing investment in EV infrastructure, including charging networks, has accelerated electric vehicle sales and, consequently, the need for specialized EV tires. Advanced tire technologies, such as low rolling resistance and enhanced durability for heavier EVs, are being widely adopted by manufacturers to meet regional performance standards. Additionally, major automakers and tire companies in the U.S. and Canada are actively developing EV-specific tires, further driving market growth.

U.S. Electric Vehicle (EV) Tire Market Trends

The market in the U.S. is being driven by its rapidly growing EV adoption, supported by government incentives, tax credits, and stringent emission regulations. The country's expanding EV manufacturing industry and rising consumer demand for sustainable transportation have increased the need for specialized EV tires with low rolling resistance and enhanced durability. Additionally, U.S.-based tire manufacturers are investing heavily in research and development to produce tires optimized for electric vehicles, further strengthening the market.

How Big is the Success for Europe in the Electric Vehicle (EV) Tire Market?

Europe has achieved remarkable success in the electric vehicle tire (EV) market due to strong EV adoption, strict sustainability regulations, and advanced automotive infrastructure. Leading tire manufacturers, research collaborations, and government support for green mobility are fostering innovation, production efficiency, and widespread adoption of specialized tires for electric vehicles. Germany is a major contributor to the market due to its strong automotive industry, high EV adoption rates, and presence of leading EV manufacturers such as Volkswagen, BMW, and Mercedes-Benz.

How Crucial is the Role of Latin America in the Electric Vehicle (EV) Tire Market?

Latin America plays a crucial role in the growth of the electric vehicle (EV) tire market, driven by growing EV adoption, expanding automotive manufacturing, and supportive government initiatives for sustainable transport. Countries like Brazil and Mexico are witnessing rising demand for energy-efficient tires as consumers shift toward eco-friendly mobility solutions. Infrastructure development, partnerships with global tire manufacturers, and regional investments in advanced production facilities further strengthen Latin America's emerging presence in the global EV tire landscape.

How Big is the Opportunity for the Growth of the Middle East and Africa Electric Vehicle (EV) Tire Market?

The Middle East and Africa offer substantial growth opportunities in the electric vehicle tire market due to increasing investments in EV infrastructure, renewable energy adoption, and sustainable mobility initiatives. Rising demand for energy-efficient vehicles, coupled with government incentives and regional manufacturing expansion, is driving the adoption of advanced, durable, and eco-friendly EV tire solutions. South Africa is a major contributor to the market due to its growing adoption of electric vehicles and supportive government initiatives promoting sustainable transportation.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing key materials, including natural and synthetic rubbers, silica, carbon black, and sustainable bio-based compounds.

Key Players: Bridgestone Corporation, Cabot Corporation, Birla Carbon, Orion Engineered Carbons, and Sumitomo Chemical. - Component Manufacturing

Tire components such as tread, sidewalls, and inner liners are designed and manufactured using advanced compounds optimized for low rolling resistance and higher load capacity.

Key Players: Michelin, Continental AG, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., and Hankook Tire & Technology. - Retail Sales and Financing

Finished EV tires are distributed through authorized dealerships, online platforms, and automotive service centers.

Key Players: Discount Tire, Tire Rack, Costco Wholesale, Goodyear Auto Service Centers, and Walmart Auto Care Centers. - Aftermarket Service and Spare Parts

Maintenance services include tire rotation, repair, alignment, and sensor recalibration for smart tires. Replacement parts and sustainability initiatives like tire recycling and retreading are also offered.

Key Players: Bridgestone Retail Operations, Midas, Pep Boys, Firestone Complete Auto Care, and Kal Tire.

Top Companies in the Electric Vehicle (EV) Tire Market & Their Offerings

|

Vendor |

Key Offerings / Products |

|

Michelin |

Provides EV-specific tyres such as the e.Primacy and Pilot Sport EV, designed with ultra-low rolling resistance, enhanced durability to support heavier EV batteries, and advanced noise-reduction features. |

|

Bridgestone Corporation |

Offers EV-compatible tyre lines utilising its ENLITEN™ technology and others that reduce weight, lower rolling resistance, and improve efficiency for electric vehicles, including premium OEM applications. |

|

Goodyear Tire & Rubber Company |

Develops “ElectricDrive Sustainable-Material” (EDS) tyres for EVs emphasising sustainability, long life, lower rolling resistance, and quiet ride tailored for electric mobility. |

|

Continental AG |

Provides a range of EV-optimized tyres featuring technologies like EcoPlus and ContiSilent, addressing high load demands, low noise and reduced energy loss in EVs. |

|

Yokohama Rubber Company |

Offers EV-specific tyres such as the ADVAN Sport EV that incorporate SilentFoam or other noise-reduction tech and compounds suited for heavier EVs and performance driving. |

Other Major Companies

- Falken tire

- Nokian Tyre

- Cooper Tyre and Rubber Company

- Apollo tyre

- Pirelli and co.

Recent Developments

- In April 2025, CEAT launched its calm-technology EV-ready tires, including run-flat and 21-inch ZR-rated options capable of >300 km/h, introducing foam inserts to reduce cabin noise, a key demand for quiet EVs.

(Source: ceat.com) - In June 2025, Apollo Tyres introduced the Aspire 5 Ultra-High-Performance (UHP) tyre in India, designed for EVs and luxury vehicles (sizes 17–20″). It features “Dynamic Contour Technology” and “Tri-Flex Compound” for improved grip, high-speed stability, and acoustics.

(Source: tirereview.com) - In August 2025, Nexen launched its N'FERA Supreme EV ROOT tire, engineered for both EVs and ICE vehicles, offering a 20 % reduction in rolling resistance and a 13 % improvement in wet/dry handling in tests. It also incorporates an AI-powered performance-prediction system to optimize tyre characteristics.

(Source: newsroom.nexentire.com) - In August 2025,Pirelli's smart Cyber Tire was awarded “Vehicle-to-Everything Innovation of the Year.” The tire embeds sensors inside the tread that collect real-time data (pressure, temperature, wear) and communicate with vehicle electronics and infrastructure, marking a shift toward digital tyres.

(Source: tyres.cardekho.com) - In August 2025,ZC Rubber introduced the X-Tech System for EV commercial tires (trucks & buses) that addresses high torque loads, heavier EV weights, and lower rolling resistance through reinforced casing and advanced compounds key for electrified fleets.

(Source: tyrenews.co.uk) - In November 2024, Goodyear's ElectricDrive Sustainable-Material (EDS) tyre won the Tire Technology International Award for Environmental Achievement of the Year. This EV-specific tire uses over 70 % sustainable materials, optimized for wet braking, enhanced handling, lower rolling resistance, and quieter operation.

(Source: just-auto.com) - Ecorun A-A, which was developed in May 2018, by Falken, which is a Japanese company. This company has joined hands with Toyota to develop an electric vehicle. Here A stands as the standard for wet grip performance and also for its efficiency on road. This is a major development which is aimed at achieving a substantial growth during the forecast period.

- Michelin, in March 2021, introduced the production of a developed tire type which aims to reduce the noise during propulsion. This change was almost about twenty percent as compared to the earlier state. Thus providing a quieter environment for the user and the consumer. It has least possible carbon emissions produced during its run on the daily basis. It's sport EV tires and e Primacy have been aiming at providing a seamless experience for the consumers when utilizing the vehicle in real life. These factors aim at boosting the market during the forecast period.

Segments covered in the report

By Distribution Channel

- Aftermarket

- OEM

By Type

- Passenger vehicles

- Commercial vehicles

- Two wheelers

By Technology

- Radial

- Bias

- Composite

By Tire Size

- Up to 14”

- 15-18”

- Above 18”

By Propulsion

- BEV

- HEV

- PHEV

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client