List of Contents

What is the Dermatology Imaging Market Size?

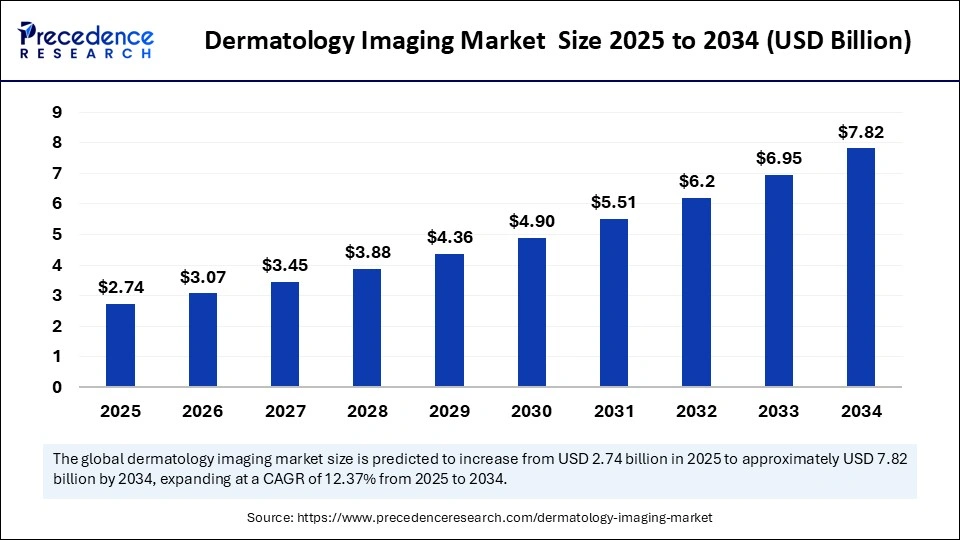

The global dermatology imaging market size was estimated at USD 2.44 billion in 2024 and is predicted to increase from USD 2.74 billion in 2025 to approximately USD 7.82 billion by 2034, expanding at a CAGR of 12.37% from 2025 to 2034.

Market Highlights:

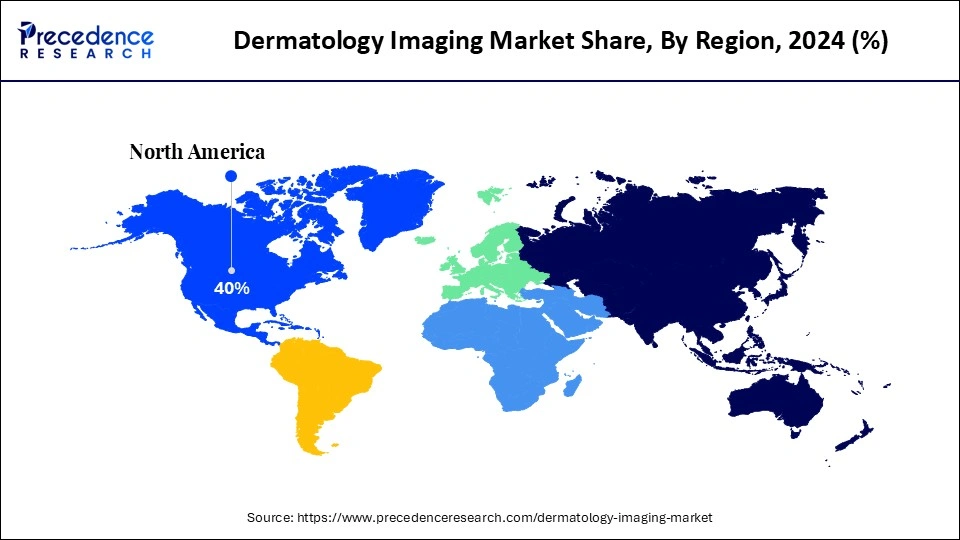

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia Pacific is observed to be the fastest growing region during the forecast period.

- By product type, the imaging systems segment captured the biggest market share of 40% in 2024.

- By product type, the software segment is observed to be the fastest growing during the forecast period.

- By technology, the optical coherence tomography segment contributed the highest market share of 35% in 2024.

- By technology, the high frequency ultrasound segment is observed to be the fastest-growing segment during the forecast period.

- By end-user, the hospitals segment generated the major market share of 40% in 2024.

- By end-user diagnostic clinics segment is seen to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 2.44 Billion

- Market Size in 2025: USD 2.74 Billion

- Forecasted Market Size by 2034: USD 7.82 Billion

- CAGR (2025-2034): 12.37%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The dermatology imaging market is witnessing rapid growth, driven by increasing prevalence of skin disorders such as skin cancers, psoriasis, and other inflammatory dermatoses, as well as rising demand for cosmetic dermatology services. The dermatology imaging market consists of devices and systems used for visualizing, diagnosing, monitoring, and planning treatment of skin conditions, diseases, and aesthetic issues.

These include technologies like dermatoscopes, digital photographic imaging, multispectral imaging, confocal microscopy, optical coherence tomography (OCT), total‑body photography, teledermatology imaging platforms, and other imaging solutions. The purpose is to provide high‑resolution, non‑invasive insights into skin lesions, pigmentation changes, vascular conditions, cancers, and other dermatological abnormalities, enabling early diagnosis, improved treatment planning, and better patient outcomes

Role of AI in Dermatology Imaging Market:

AI models help identify suspicious moles, pigmented lesions, or other skin abnormalities earlier and more reliably than possible with naked‑eye examination alone. Tools like DermaSensor use AI to classify lesions in real time. Based on imaging data, patient history, demographics, AI can help predict which lesions have higher risk for malignancy, or which patients are likely to progress or benefit from more aggressive monitoring or treatment. AI aids in reducing inter‑observer variability. For instance, high‑resolution imaging plus AI segmentation or classification can lead to consistency among different practitioners.

What are the Latest Trends in the Dermatology Imaging Market?

- Increasing integration of AI/machine learning into imaging systems for automated lesion detection, risk prediction (e.g. malignancy), image segmentation, and diagnostic assistance.

- Growth of teledermatology / remote imaging: cloud storage, remote evaluation, smartphone‑compatible imaging, enabling diagnosis in underserved or remote locations.

- Rise of portable and handheld imaging devices, dermatoscopes, smartphone adaptors, compact multispectral cameras for more flexible, in‑field, and point‑of‑care usage.

- Expansion of total‑body photography and automated mole mapping tools for monitoring patients with high risk of skin cancer or with many lesions.

- Multispectral & hyperspectral imaging, as well as higher resolution imaging (confocal, OCT) becoming more common to detect subtle skin changes.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.44 Billion |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size by 2034 | USD 7.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Driver

Rising Prevalence of Skin Disorders and Skin Cancer

The growing incidence of skin-related conditions particularly skin cancer is a major driver of the dermatology imaging market. Conditions such as melanoma, basal cell carcinoma, psoriasis, eczema, and chronic wounds are increasingly being diagnosed worldwide due to environmental factors, aging populations, and lifestyle changes. Early and accurate diagnosis is crucial in these cases, making dermatology imaging tools indispensable in clinical settings.

Technologies like dermoscopy, optical coherence tomography (OCT), and high-resolution total-body photography systems allow non-invasive, detailed visualization of skin lesions and anomalies. The availability of such devices supports better clinical decisions, reduces unnecessary biopsies, and improves patient outcomes. For example, the U.S. sees over 5 million cases of non-melanoma skin cancer annually, creating a strong demand for diagnostic precision and early intervention, which in turn fuels the uptake of advanced imaging tools in dermatology.

Market Restraint

High Cost of Advanced Imaging Technologies

Despite their clinical benefits, dermatology imaging systems often come with high capital costs, which can be a significant barrier to adoption particularly in low- and middle-income regions. Advanced imaging devices such as OCT systems, confocal microscopes, and AI-powered diagnostic software can cost tens of thousands of dollars, in addition to ongoing costs for software upgrades, maintenance, and staff training.

Smaller clinics, dermatology practices in rural areas, or healthcare systems with limited funding may find it difficult to justify or afford such investments, even when patient demand exists. This pricing challenge also extends to patients, especially in markets where dermatological diagnostics are not reimbursed or are considered elective. As a result, the high cost remains a limiting factor that slows down the penetration of advanced dermatology imaging technologies globally.

Market Opportunity

Integration of Artificial Intelligence (AI) and Teledermatology

The convergence of AI and teledermatology represents a transformative opportunity for the dermatology imaging market. AI-powered image analysis tools can assist clinicians in detecting malignancies, classifying skin conditions, and monitoring lesion changes over time with a high degree of accuracy and consistency. These systems can significantly reduce diagnostic errors, particularly in early-stage skin cancers or atypical lesions, and support clinicians in high-volume practices. Simultaneously, the rise of teledermatology platforms, especially post-COVID has expanded the reach of dermatology care to remote and underserved populations.

Segmental Insight

Product Type Insights

The imaging systems segment led the market with 40% share in 2024. Imaging systems, such as dermatoscopes, total body photography devices, and digital skin analyzers, remain the core of dermatological diagnostics. Their widespread use in hospitals and specialty dermatology clinics for detecting skin cancers, lesions, and inflammatory conditions has solidified their market position. The demand for high-resolution, real-time imaging and advanced visualization tools is particularly high in clinical settings, supporting the segment's dominance.

The software segment is observed to be the fastest growing during the forecast period. Software solutions are gaining momentum as dermatology imaging becomes increasingly digital. AI-powered diagnostic tools, cloud-based image storage platforms, and teledermatology interfaces are transforming how images are captured, analyzed, and shared. These platforms enhance diagnostic accuracy, enable remote consultations, and support longitudinal tracking of patient progress, making them highly attractive in modern healthcare workflows. This strong shift toward digital health integration is expected to propel rapid growth in the software segment.

Technology Insights

The optical coherence tomography (OCT) segment led the market with 35% share in 2024. OCT is a non-invasive imaging technique that provides cross-sectional views of skin tissues with micrometer-level resolution, making it highly valuable for detecting and monitoring skin cancers and other abnormalities. Its ability to deliver real-time, high-resolution images without needing a biopsy positions OCT as a preferred tool in dermatology practices. The increasing use of OCT in academic research and clinical diagnosis supports its significant market share.

The high frequency ultrasound segment is observed to be the fastest growing segment during the forecast period. High-frequency ultrasound is rapidly emerging in dermatological diagnostics due to its ability to assess deeper skin layers, soft tissue structures, and subcutaneous lesions with precision. It is increasingly being used for applications such as tumor margin delineation, pre-surgical planning, and monitoring treatment response in inflammatory skin conditions. The growing interest in non-invasive, safe imaging for both medical and cosmetic purposes is expected to drive this segment's expansion.

End-User Insights

The hospitals segment led the market while contributing 40% share in 2024. Hospitals remain the primary users of dermatology imaging systems, benefiting from large patient volumes, access to multidisciplinary care teams, and the ability to invest in advanced diagnostic equipment. Their role in diagnosing complex dermatological and oncological cases, including melanoma and other skin cancers, solidifies their leadership. Integration with electronic health records (EHR) and comprehensive imaging infrastructure further support their dominant market position.

The diagnostic clinics segment is seen to grow at the fastest rate during the forecast period. Specialized diagnostic clinics are becoming increasingly important in the dermatology landscape, offering focused services with faster turnaround times and more personalized care. These clinics are rapidly adopting advanced imaging technologies, including AI-enhanced diagnostic tools and portable imaging devices, to improve diagnostic efficiency and patient engagement. As more patients seek convenient and specialized skin care solutions, the diagnostic clinics segment is expected to experience robust growth.

Regional Insights:

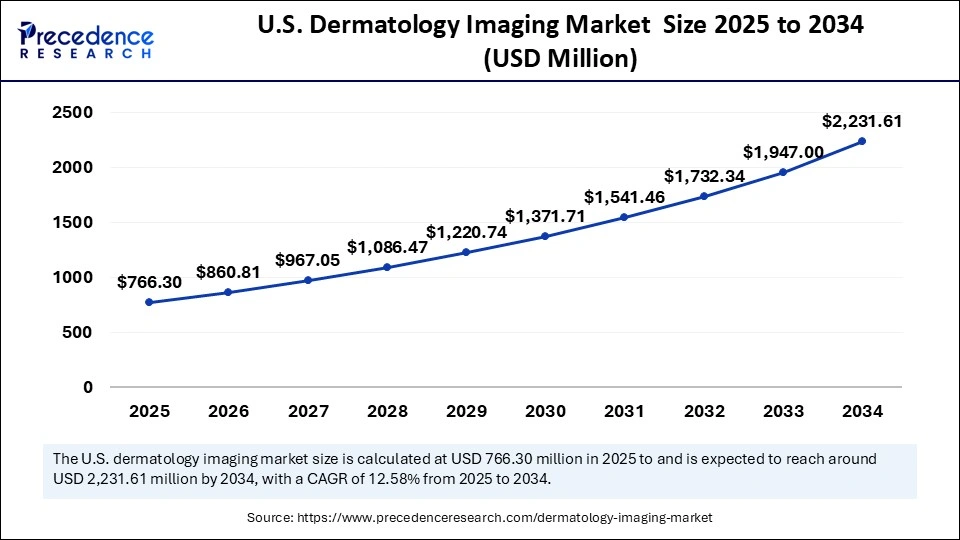

U.S. Dermatology Imaging Market Size and Growth 2025 to 2034

The U.S. dermatology imaging market size was exhibited at USD 682.22 million in 2024 and is projected to be worth around USD 2231.61 million by 2034, growing at a CAGR of 12.58% from 2025 to 2034.

North America led the market while holding 40% of the market share in 2024.This regional dominance can be attributed to the high prevalence of skin disorders, particularly skin cancer, in countries like the United States. Advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of cutting-edge dermatology imaging technologies have further fueled the market. Additionally, a high concentration of dermatology specialists, strong awareness among patients, and frequent product launches by U.S.-based imaging companies contribute to North America's leadership position in this market.

Asia Pacific is observed to be the fastest growing region during the forecast period. The Asia Pacific region is experiencing rapid growth in the dermatology imaging market due to increasing incidence of skin conditions, expanding healthcare access, and rising demand for cosmetic dermatology. Countries like China, India, Japan, and South Korea are investing significantly in healthcare modernization, which includes the adoption of advanced imaging tools. Furthermore, growing awareness, medical tourism, and government support for AI-integrated health technologies are accelerating market growth in this region.

Dermatology Imaging Market Companies:

- Canfield Scientific

- MELA Sciences

- Fotofinder Systems

- Visiomed Group

- CAMPBELL SCIENTIFIC

- Dermlite

- Lucid, Inc.

- 3Derm Systems

- CureMetrix

- Fotomed

- DermaScan

- Nikon Corporation

- Konica Minolta

- Leica Microsystems

- Samsung Medison

- Medtronic

- GE Healthcare

- Phillips Healthcare

- Siemens Healthineers

- Canon Medical Systems

Recent Developments:

- In Jan 2024, FDA approved a real‑time, non‑invasive skin cancer screening tool using AI to detect melanoma, basal cell carcinoma, and squamous cell carcinoma. Enhances early detection.

- In March 2024, Wireless digital dermatoscope with AI capabilities and cloud storage, high resolution camera; improves efficiency and accuracy in dermoscopy and trichoscopy.

Dermatology Imaging Market Segmentation

By Product Type

- Imaging Systems

- Diagnostic Imaging Systems

- Therapeutic Imaging Systems

- Software

- Diagnostic Imaging Software

- Therapeutic Imaging Software

- Imaging Devices

- Portable Imaging Devices

- Non-portable Imaging Devices

By Technology

- Optical Coherence Tomography (OCT)

- Time-Domain OCT

- Spectral-Domain OCT

- Swept-Source OCT

- Confocal Microscopy

- Laser Scanning Confocal Microscopy

- Spinning Disk Confocal Microscopy

- High-Frequency Ultrasound

- B-Mode Ultrasound

- 3D Ultrasound

- Photographic Imaging

- Standard Photography

- High-Resolution Photography

- Laser Imaging

- Near-Infrared Laser Imaging

- Visible Light Laser Imaging

By Application

- Skin Cancer Diagnosis

- Melanoma Detection

- Non-melanoma Skin Cancer

- Acne Treatment

- Severe Acne

- Moderate Acne

- Psoriasis

- Psoriatic Dermatitis

- Plaque Psoriasis

- Wound Care & Management

- Chronic Wounds

- Acute Wounds

- Other Dermatological Conditions

- Eczema

- Rosacea

- Alopecia

By End-User

- Hospitals

- Public Hospitals

- Private Hospitals

- Diagnostic Clinics

- Dermatology Clinics

- Medical Imaging Centers

- Research Institutes

- Academic Institutions

- Private Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client