List of Contents

What is Dairy Ingredients Market Size?

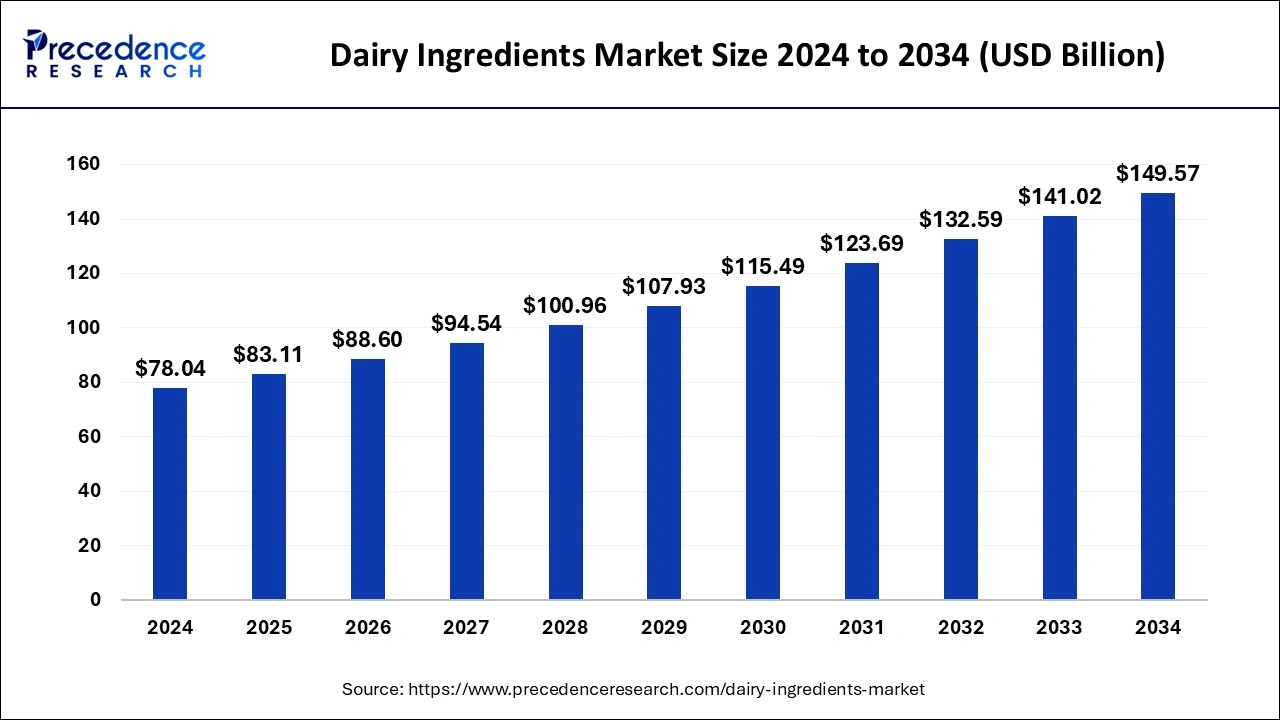

The global dairy ingredients market size is estimated at USD 83.11 billion in 2025 and is anticipated to reach around USD 149.57 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034. Market growth is attributed to the increasing consumer demand for high-quality, functional, and protein-rich dairy ingredients across diverse food and beverage applications.

Market Highlights

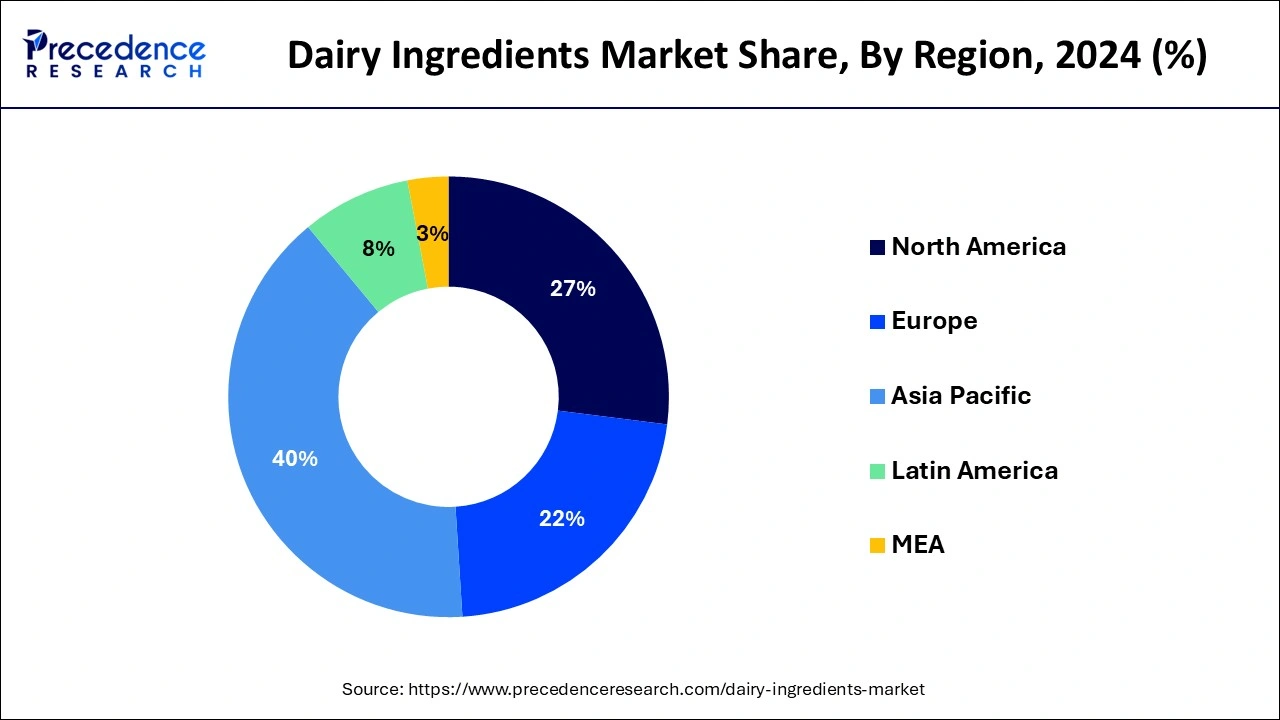

- Asia Pacific dominated the global dairy ingredients market with the largest market share of 40% in 2024.

- North America is expected to expand at a solid CAGR during the forecast period.

- By product, the milk powder segment contributed the highest market share in 2024.

- By application, the confectionery and the bakery segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 83.11 Billion

- Market Size in 2026: USD 88.60 Billion

- Forecasted Market Size by 2034: USD 149.57 Billion

- CAGR (2025-2034): 6.72%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Strategic Overview of the Global Dairy Ingredients Industry

Daily ingredients are there ingredients that are obtained from milk. They provide many health benefits and nutritional benefits, along with a good flavor which helps in the growth as it has a unique texture, flavor and excellent nutritional values. These dairy ingredients are used in many foods. Due to the disruptions in the supply chain and logistics, the pandemic had affected the dairy ingredients market. Due to strict lockdown and government regulations, there was a loss in the demand for liquid milk which also caused the pressure in procurement of milk for various reasons. The industry has grown spontaneously post pandemic. The International dairy trade has increased in the recent years. An extensive use of the dairy ingredients in many baby food products in various nations shall increase the demand for the dairy ingredients market.

Artificial Intelligence: The Next Growth Catalyst in Dairy Ingredients

The impact of artificial intelligence on the primary industries sector has been notable. Using AI technologies helps producers better organize the implementation of manufacturing operations based on large amounts of data obtained at different stages of production. CI Continuous integration capability via AI-based predictive analytics enables organizations to anticipate demand patterns, and better manage their stock and avoid losses. Applying of AI in product development has resulted to new roll of dairy inputs that are trendy in the market like the plant base and functional dairy products. Additionally, the recently implemented advanced automation methods in packaging and distribution departments through AI decrease labor expenses and optimize supply chains.

Dairy Ingredients Market Growth Factors

- Rising consumer preference for natural and minimally processed ingredients is driving the demand for high-quality dairy ingredients.

- Increased consumer awareness of protein's role in maintaining health is boosting the consumption of dairy proteins in various product categories.

- Advancements in dairy processing technologies are improving the efficiency and quality of dairy ingredient production.

- Expansion of the global e-commerce sector is providing new distribution channels for dairy ingredient suppliers.

- Growing preference for dairy ingredients in personalized nutrition is stimulating innovation in product formulations tailored to specific health needs.

- A surge in demand for dairy-based snacks and convenience foods is creating new applications for dairy ingredients in the snack food industry.

- Increased investments in R&D for dairy ingredient functionality are opening up opportunities for specialized ingredient development.

Market Outlook

- Market Growth Overview: The dairy ingredients market is expected to grow significantly between 2025 and 2034, driven by the rising popularity of high-protein diets, leading to increased demand for whey protein and casein used in sports nutrition and health supplements. Furthermore, the expanding bakery and confectionery industries are major consumers of dairy ingredients like milk powder and butter, further contributing to market growth.

- Sustainability Trends: Sustainability trends focus on reducing the carbon footprint through feed additives, renewable energy, and improved herd management. The industry is adopting a circular economy approach by upcycling by-products and conserving water resources. Increased consumer demand for ethical sourcing and animal welfare is driving greater transparency via clean labels and certifications.

- Major Investors: Major investors in the market includes, Dairy Farmers of America and Fonterra Cooperative Group, Nestlé and Lactalis Group acquire, and Zero Cow Factory.

- Startup Economy: The startup economy in the market is the collective economic output and influence of new ventures that leverage technology and novel business models to innovate across the traditional dairy value chain.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 83.11 Billion |

| Market Size in 2026 | USD 88.60 Billion |

| Market Size by 2034 | USD 149.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Livestock, Form, Production Method, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing Consumer Demand for Functional Foods

Rising consumer demand for functional foods is expected to drive growth in the dairy ingredients market. These ingredients help with digestion, protection from diseases, and overall health and tastes, including current co-health-based personalized nutrition. Suppliers are creating customized dairy ingredients with vitamins, minerals, and bioactive compounds for acceptance of the vehicles of wellness food. Increased evolution of functional dairy products is reasonably expected to propel innovations in the formulation of yogurts, cheeses, and beverages, thus fuelling the market in the coming years.

Restraint

Hamper Growth Due to Price Volatility of Raw Materials

The volatility in the price of raw materials, such as milk, whey, and casein is anticipated to hamper the growth of the dairy ingredients market. Weather changes, governments' actions, and unstable markets for basic supplies make the production of these products unpredictable for producers. This, in essence, is highly undesirable, not only because the price remains volatile with wide fluctuations, which harms manufacturers trying to forecast such expenditures and keep the price of their products reasonable. There are growing trend for dairy ingredient suppliers to change their system of pricing which may hamper the flow of investment or cause higher costs to the end consumer of production. Therefore, manufacturers might find it extremely difficult to maintain the profit margin hence slowing down the growth of the market.

Opportunity

High Demand for Dairy-Based Protein Products

The high demand for dairy-based protein products is likely to create significant opportunities in the dairy ingredients market. Beverage consumers especially of sports nutrition and weight management products are demanding higher quality proteins in their products like whey and casein for muscle building and nutritional benefits. These ingredients supply all-round essential amino acids which make them suitable for protein supplements, functional foods, and drinks. The processors are diversifying their line of dairy proteins to meet such market niches as elderly persons or athletes. Furthermore, the rise in health and fitness concerns continues to promote the need for dairy proteins to be used in the production of health-enhancing goods and services, stimulating market development.

Segment Insights

Product Insights

The milk powder segment contributed the highest market share in 2024. Out of all the most common types of dairy ingredients, this segment is expected to grow as it is a direct substitute for fluid milk. It is used in many applications like infant nutrition, bakery and even dairy. The hotel industry uses skimmed milk powder for many of its dishes. As milk powders are easy to store and they have a good shelf life compared to the pure milk. The market for milk powder is also expected to grow during the forecast. Milk powder also has an extensive application in infant foods, tea, coffee and other milk beverages.

Application Insights

The confectionery and the bakery segment dominated the market in 2024. Products like butter are extremely valuable for a bakery industry. It helps in bringing a nice color, taste and texture to various cakes, biscuits and croissants. Use of vvarious ingredients in bakery and confectionery have led to a growth in the market share. Use of butter, is strongly associated with a good image for the product.

Regional Insights

Asia Pacific Dairy Ingredients Market Size and Growth 2025 to 2034

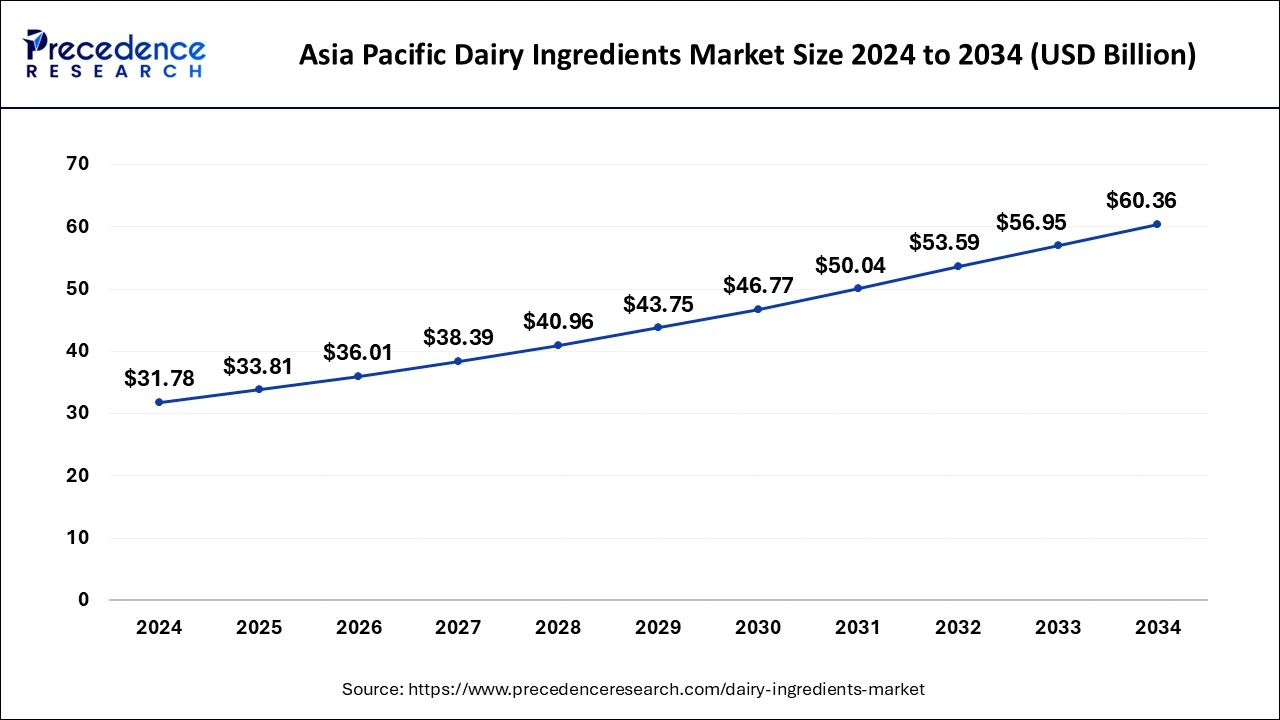

The Asia Pacific dairy ingredients market size is estimated at USD 33.81 billion in 2025 and is anticipated to be surpass around USD 60.36 billion by 2034, rising at a CAGR of 6.74% from 2025 to 2034.

Asia Pacific dominated the global dairy ingredients market with the largest market share of 40% in 2024. The growth of this region is driven by the rising demand for plant-based diary alternatives. A rising number of consumers are adopting a plant-based or flexitarian diet for health, environmental, or ethical reasons. Plant-based dairy substitutes, such as almond milk, oat milk, and soy-based products, are gaining popularity and are being incorporated into a wide range of food and beverage products. For instance, companies like Oatly, a Swedish oat milk producer, have expanded their presence in the Asia Pacific region, capitalizing on the rising consumer interest in plant-based alternatives to conventional dairy. This shift reflects a broader movement toward sustainable and cruelty-free food choices.

China Dairy Ingredients Market Trends:

The increasing consumer health awareness. Manufacturers are focusing on value-added products such as specialty cheeses and organic milk to cater to the demand from increasingly affluent consumers willing to pay a premium. Growth is further accelerated by advancements in cold-chain logistics and e-commerce expansion, improving accessibility nationwide.

In the North American market countries like United Kingdom, France and Germany where proteins are majorly used the demand for infant nutrition or formula food is growing in countries like France and Germany. New Horizons are added to this market by having organic whole milk powder, which has led to a growth in the market. The growth in various regions is primarily because of rapid urbanization, increased convenience stores and advancements in the dairy processing. As the production of milk is good in India, It provides a great potential for the dairy ingredients market to grow in the coming years.

U.S. Dairy Ingredients Trends:

The health-conscious consumer base. Brands are emphasizing transparency and sustainability to build trust while competing with the growing popularity of plant-based alternatives and flexitarian diets. Premiumization remains a key strategy, with consumers paying more for specialty and value-added dairy options. Technological advancements and a focus on ethical practices are essential for producers aiming to remain competitive and meet evolving consumer demands.

How is Europe Rising in Dairy Ingredients Market?

The consumer demand for healthy, functional, and high-protein products. A strong emphasis on sustainability, ethical sourcing, and transparency is evident, influencing purchasing decisions and encouraging eco-friendly practices.

How is the Middle East & Africa Drive Dairy Ingredients Market?

Saudi Arabia Dairy Ingredients Trends

The increasing consumer focus on healthy, fortified, and low-fat products aligns with government health initiatives. Strong emphasis on domestic production under Vision 2030 is boosting local supply and technological investments. E-commerce and modern retail are rapidly expanding distribution channels for premium and diversified offerings, including growing interest in plant-based alternatives.

Dairy Ingredients Market Value Chain Analysis

1. Raw Material Sourcing (Milk Production and Collection)

This initial stage involves the breeding and care of dairy animals to produce raw milk, which is then collected from individual farmers or cooperatives. Ensuring the quality and freshness of the milk is critical, requiring a reliable cold chain and efficient logistics to transport it to processing plants. Key players include thousands of small, medium, and large dairy farms, as well as milk collection centers and cooperatives like Dairy Farmers of America (DFA) and Amul.

2. Processing and Manufacturing

At this stage, raw milk is transformed into various ingredients through processes like separation, filtration, and drying. This includes producing bulk ingredients like whey protein, milk protein concentrates, lactose, and casein, which are then used in a wide range of food and beverage products. Major manufacturers leverage advanced technology to ensure product quality, functionality, and safety.

Key Players: Royal FrieslandCampina N.V., Fonterra Co-operative Group, Nestlé S.A., Lactalis International, and Kerry Group.

3. Research, Development, and Formulation

This stage focuses on developing new dairy ingredient applications and improving existing formulations to meet evolving consumer demands for health, wellness, and specific dietary needs. R&D teams innovate with ingredients to enhance nutritional profiles, functional properties (e.g., texture, stability), and create tailored products like precision fermentation dairy protein. This segment is vital for staying ahead of market trends, such as the demand for high-protein and lactose-free options.

Key Players: Nestlé S.A. (Orgain brand), Arla Foods amba, and specialized food science and ingredient technology companies.

4. Distribution and Marketing

The finished dairy ingredients are distributed to food and beverage manufacturers, bakeries, and nutritional supplement companies through various channels, including direct sales and third-party logistics providers. The marketing effort focuses on highlighting the nutritional and functional benefits of the ingredients to prospective industrial buyers. Effective logistics, especially maintaining the cold chain for temperature-sensitive products, is crucial for market penetration.

Key Players: Bunge Loders Croklaan, Cargill, and a network of specialized food ingredient distributors.

5. End-Product Manufacturing and Retail

In this final stage, dairy ingredients are incorporated into a vast array of final products, such as infant formula, yoghurts, cheese, functional beverages, and sports nutrition supplements. These products are then sold to end consumers through retail channels, including supermarkets, convenience stores, and online platforms. The success of this stage relies on understanding consumer trends and effective branding to drive sales.

Key Players: Danone S.A., Nestlé S.A., Yili Group, Saputo Inc., and various smaller, specialized food companies.

Dairy Ingredients Market Companies

Dairy Ingredients Market Companies

- Nestlé S.A.: As one of the world's largest food and beverage companies, Nestlé utilizes vast quantities of dairy ingredients for its diverse product portfolio, including infant formula, yogurts, and confectionery. They contribute by demanding high quality and incorporating dairy into innovative, health-focused consumer products globally.

- Schreiber Foods Inc.: This company is a major producer of private-label cheese, yogurt, and other dairy products for restaurants, retailers, and institutions worldwide. They contribute to the market by efficiently processing large volumes of raw milk into various core dairy ingredients that serve global food service supply chains.

- Savencia S.A.: Specializing in high-value cheese products and other dairy specialties, Savencia contributes to the premium segment of the market. They focus on innovation in formulation and branding, catering to sophisticated consumer tastes and expanding the application range of dairy ingredients in gourmet products.

- Glanbia PLC: Glanbia is a global nutrition group and a key player in performance nutrition and high-quality dairy ingredients such as whey protein and concentrates. They contribute significantly to the functional food and sports nutrition markets by producing specialized, science-backed dairy ingredients.

- Gujarat Cooperative Milk Marketing Federation Ltd. (Amul): A dominant player in the Indian dairy market, Amul contributes by processing the milk from a vast network of cooperative farmers into a wide array of products including butter, cheese, and milk powders. Their expansive reach helps meet the massive domestic demand in one of the world's largest dairy-consuming nations.

- Fonterra Cooperative Group: As a leading global dairy company, Fonterra processes vast amounts of New Zealand milk into high-quality dairy ingredients for international markets. They contribute significantly to the global supply of specialized ingredients used in infant formula, food services, and functional nutrition applications.

- Royal FrieslandCampina N.V.: This multinational Dutch cooperative is a major producer of milk powders, dairy ingredients, and functional products for consumers and industrial customers worldwide. They contribute through extensive R&D, focusing on sustainability and the production of innovative, high-value ingredients for health and nutrition markets.

- Arla Foods: A European dairy cooperative, Arla supplies a wide range of dairy ingredients globally, known for their high quality, natural origins, and sustainable sourcing practices. They contribute by focusing on clean-label solutions and expanding into organic and specialty dairy ingredient segments.

- Lactalis Group: A global leader in dairy, Lactalis produces a vast array of cheeses, milks, and other dairy products, integrating them into international food supply chains. They contribute through massive production capacity and a diverse product portfolio that addresses various market needs across the globe.

- Dairy Farmers of America Inc.:The largest dairy cooperative in the US, DFA supplies a significant portion of America's milk and produces a wide range of dairy ingredients, including butter, cheese, and milk powders. Their contribution ensures consistent supply and helps stabilize the domestic market through efficient processing and distribution networks.

- Agropur Cooperative: A major North American dairy industry leader, Agropur processes milk into high-quality products and ingredients like fine cheeses and functional dairy proteins. They contribute through innovation in ingredient technology and by meeting the stringent demands of the food and beverage industry across Canada and the US.

Recent Developments

- In September 2024, Three prominent East Coast dairy cooperatives, Agri-Mark, Maryland & Virginia Milk Producers Cooperative Association, and Upstate Niagara Cooperative, have joined forces to launch Integrated Dairy Ingredients (IDI). Beginning in January 2025, IDI will focus on marketing and selling high-quality dairy ingredients. The company's mission is to deliver comprehensive dairy ingredient solutions while building lasting partnerships with customers, contributing to a sustainable dairy industry.

- In November 2023, Nestlé unveiled its innovative N3 milk, derived from cow's milk and enriched with essential nutrients like proteins, vitamins, and minerals. This new product also contains prebiotic fibers, a low lactose content, and boasts over 15% fewer calories compared to traditional milk. The development of N3 milk aligns with growing consumer demand for healthier and functional dairy products.

- In September 2024, Arla Foods Ingredients launched a campaign aimed at encouraging dairy manufacturers to create innovative high-protein products. With over four in ten global consumers citing protein as the most important ingredient, the company emphasized the evolving conversation around protein, focusing on its nutritional quality. As demand for high-protein dairy items continues to rise, manufacturers face challenges in areas such as differentiation, processing, taste, and texture, pushing the industry towards new solutions and product offerings.

- In September 2025, Strauss Group will launch “animal-free” dairy products in Israel, starting with CowFree Symphony cream cheese and Yotvata CowFree drink, developed in collaboration with Imagindairy. (Source: https://www.just-food.com)

- In September 2025, FSSAI initiates a festive season drive for food safety, enhancing checks on sweets and dairy; Food Safety on Wheels to conduct spot testing.(Source:https://www.storyboard18.com)

Latest Announcements by Industry Leaders

- In August 2024, 1.5 Degree launched a variety of plant-based dairy products at the 7th India International Hospitality Expo 2024. Founder and Director Vedansh Goyal commented about the growing need for plant-based foods, noting the increasing demand in the sector. Goyal also emphasized the importance of their research and development efforts and collaborations with leading global researchers to ensure international standards are met. Goyal stated, “The plant-based food product category is essential as consumers seek alternatives to traditional dairy products. At 1.5 Degree, we focus on delivering delicious and nutritious plant-based options without compromising taste. Our R&D lab employs top global technologists to ensure our products meet international standards. Our brand name reflects our alignment with the UN Mission to limit global warming to 1.5 degrees Celsius. We have partnered with NIFTEM and the Government of India to establish a cutting-edge facility, reinforcing our commitment to quality and sustainability while reaching a broad audience with our premium products.”

Segments Covered in the Report

By Product

- Milk Powder

- Casein & Caseinate

- Whey Ingredients

- Lactose

- Proteins

By Application

- Pediatrics

- Sports Nutrition

- Medical Nutrition

- Health Foods

- Bakery

- Dairy

By Livestock

- Cows

- Other livestock (Buffaloes, goats, sheep, and camels)

By Form

- Dry

- Liquid

By Production Method

- Traditional Method

- Membrane Separation

- Ultrafiltration

- Reverse Osmosis

- Nanofiltration

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client