List of Contents

What is the Content Intelligence Market Size?

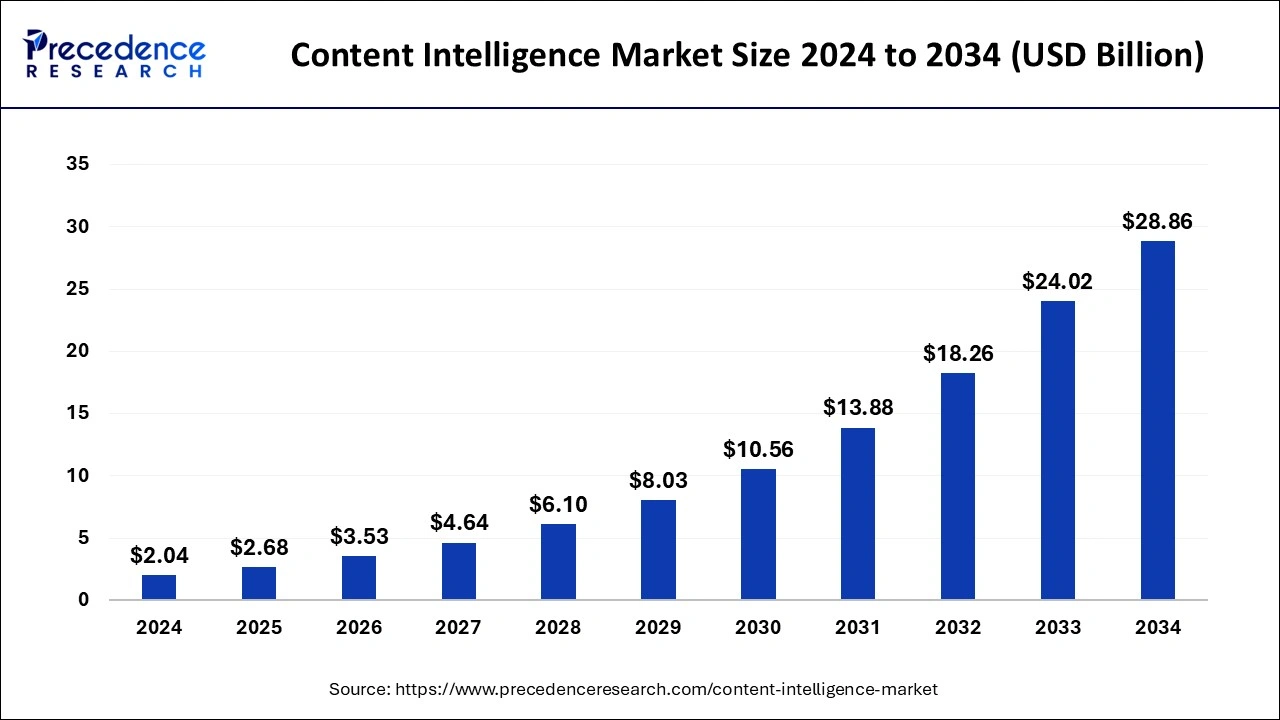

The global content intelligence market size is estimated at USD 2.68 billion in 2025 and is predicted to increase from USD 3.53 billion in 2026 to approximately USD 28.86 billion by 2034, expanding at a CAGR of 30.34% from 2025 to 2034.

Content Intelligence MarketKey Takeaways

- The global content intelligence market is valued at USD 2.04 billion in 2024.

- It is projected to reach USD 28.86 billion by 2034.

- The content intelligence market is expected to grow at a CAGR of 30.34% from 2025 to 2034.

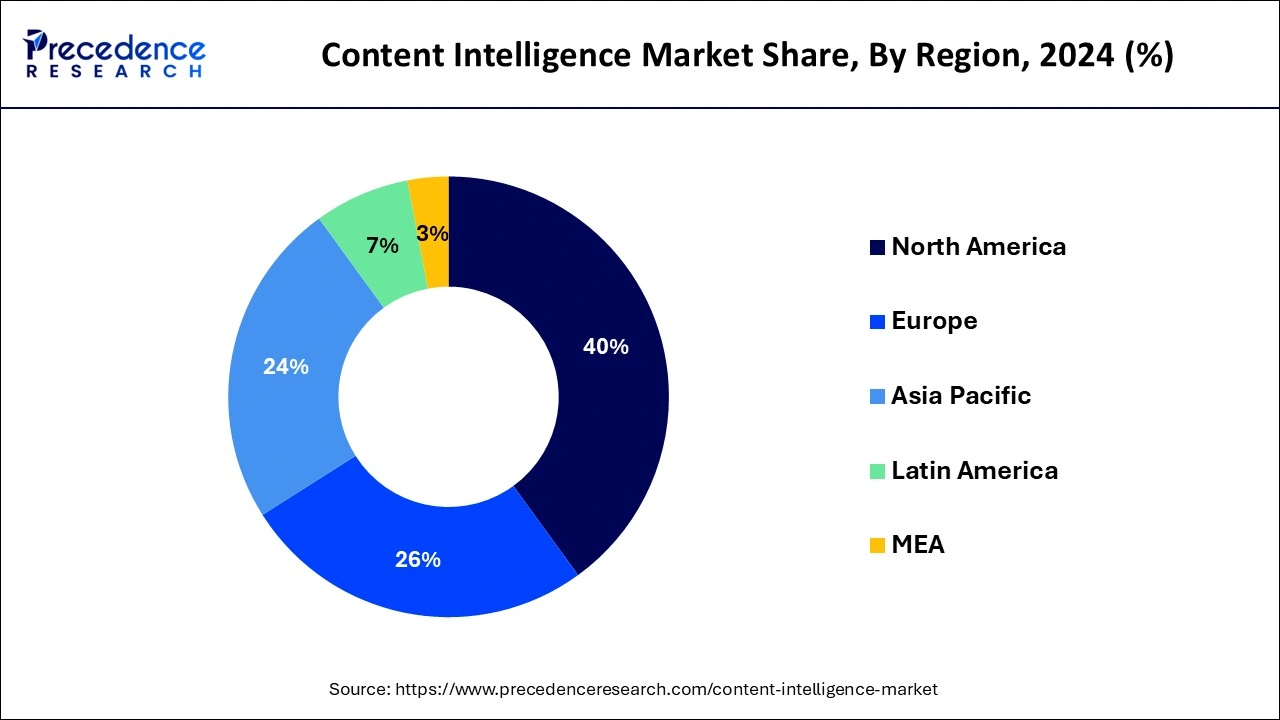

- North America contributed more than 40% of market share in 2024.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

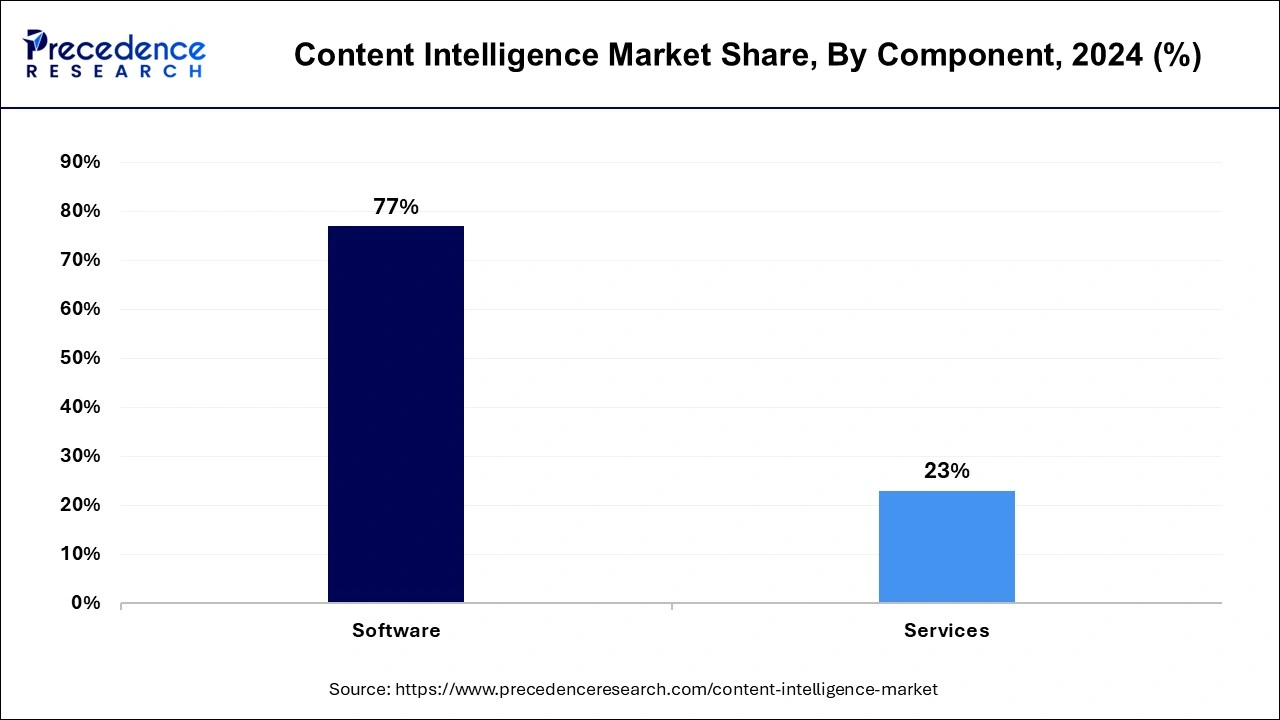

- By component, the software segment has held the largest market share of 77% in 2024.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By enterprise size, the large enterprises segment has generated over 70% of market share in 2024.

- By enterprise size, the SME segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the media & entertainment segment has contributed over 24% of market share in 2024.

- By end-use, the retail and consumer goods segment is expected to expand at the fastest CAGR over the projected period.

What is content intelligence?

Content intelligence refers to the technology and processes used to gather insights and understanding from digital content. It involves analyzing data from various content sources such as websites, social media, and documents to derive valuable insights. This includes understanding audience preferences, identifying trends, and optimizing content for better engagement and effectiveness. Through content intelligence, businesses can make informed decisions about their content strategy, ensuring that the content they produce resonates with their target audience and achieves their goals. By leveraging data analytics, artificial intelligence, and natural language processing, content intelligence helps organizations create more personalized and relevant content, ultimately driving better results and enhancing the overall customer experience.

Content Intelligence Market Data and Statistics

- In September 2022, Messagepoint Inc., a provider of cloud-based CCM software solutions, launched Semantex, a division specializing in an AI-driven content intelligence platform.

- According to Forbes, organizations that use data-driven marketing are six times more likely to be profitable year-over-year.

- Research conducted by Adobe Inc. indicates that the average individual spends approximately 7.8 hours per day engaging with digital content, while teenagers report spending 11.1 hours daily. Moreover, there is a growing demand among users for personalized content.

- Research by HubSpot reveals that companies using real-time marketing are 26% more likely to exceed their sales goals.

- In March 2023, IBM and Adobe joined forces to assist marketing and creative firms in optimizing their content supply chains. This supply chain encompasses the creation, management, review, deployment, and analysis of content by integrating people, processes, tools, insights, and methodologies into a cohesive workflow, providing stakeholders with comprehensive visibility throughout.

- In February 2023, Adobe Experience Cloud expanded its capabilities with additional AI features tailored to enhancing digital experiences. Adobe Sensei GenAI serves as a new assistant for marketers and other customer experience teams, offering support across various Adobe Experience Cloud applications for tasks such as asset creation and personalization throughout the customer journey.

Content Intelligence MarketGrowth Factors

- The exponential growth of digital content across various platforms, including social media, websites, and mobile apps, is a significant driver of the content intelligence market. As per IDC's Digital Universe study, the digital universe is expected to reach 180 zettabytes by 2025, creating a vast pool of data for analysis and insights generation.

- Consumers expect personalized experiences, prompting businesses to invest in content intelligence solutions. Research by Evergage found that 88% of marketers report measurable improvements from personalization efforts, indicating a strong business case for tailored content. This demand for personalized content fuels the adoption of content intelligence tools to analyze audience preferences and behaviors.

- Technological advancements in artificial intelligence (AI) and machine learning (ML) are driving the growth of the content intelligence market. AI-powered content intelligence solutions enable organizations to automate content analysis, identify trends, and deliver actionable insights at scale.

- Businesses are increasingly relying on data-driven insights to inform their content strategies and drive business outcomes. Content intelligence tools empower organizations to extract valuable insights from vast amounts of unstructured data, enabling data-driven decision-making. A survey by NewVantage Partners found that 97.2% of executives report that their organizations are investing in big data and AI initiatives to drive decision-making.

- Rise of Content Marketing: Content marketing continues to be a key strategy for businesses to attract and engage customers. The Content Marketing Institute reports that 91% of B2B marketers and 86% of B2C marketers use content marketing to reach their target audiences. As businesses allocate more resources to content marketing, the demand for content intelligence solutions to optimize content performance and ROI grows.

- Increasing Focus on Customer Experience: Delivering personalized and relevant content is essential for enhancing the customer experience. Organizations are investing in content intelligence to gain insights into customer preferences, behaviors, and sentiments, enabling them to create tailored content experiences.

Content Intelligence Market Outlook

- Industry Growth Overview: The content intelligence market is slated to grow at a high rate between 2025 and 2030 due to the rise of AI-based analytics and personalized marketing strategies. This trend strongly relies on businesses willing to adopt AI-based tools to enhance their content strategies to drive audience engagement and improve ROI, and is led by demand from North America and Europe.

- Global Expansion: Major players are expanding across the Latin American and Middle Eastern geographic regions to take advantage of fast-growing digital content ecosystems. Recently, IBM and HubSpot announced regional partnerships and tailored localized AI content solutions to capitalize on rising digital demand stemming from SMEs (Small and Medium-Sized Enterprises) and E-commerce platforms.

- Key Investors: Venture capital and technology funds are investing heavily in content intelligence startups focused on generative AI, data automation, and predictive analytics. Sequoia Capital and Accel, for example, have backed companies that offer contextual content creation and intelligent audiences.

- Startup Ecosystem: The landscape is beginning to flourish with startups like MarketMuse (U.S.) and Narrato (India) that are providing AI-driven content planning and optimization. Increasingly, these companies are garnering attention for their ability to provide scalable, near-real-time insights to assist digital marketers in reducing their manual workloads.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 30.34% |

| Market Size in 2025 | USD 2.68 Billion |

| Market Size in 2026 | USD 3.53 Billion |

| Market Size by 2034 | USD 28.86 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Demand for personalized content experiences

The rising demand for personalized content experiences is a major driver fueling the growth of the content intelligence market. People today expect content tailored to their specific interests and preferences, whether they are browsing social media, shopping online, or consuming news articles. This demand for personalized content has surged as consumers seek more relevant and engaging experiences. Content intelligence helps businesses meet this demand by providing insights into audience behavior, preferences, and demographics.

By analyzing data from various sources, such as website interactions, social media engagement, and past purchasing behavior, content intelligence enables organizations to create and deliver personalized content at scale. This not only enhances customer satisfaction but also improves engagement and conversion rates. As businesses recognize the value of delivering personalized content experiences, the demand for content intelligence solutions continues to grow, driving innovation and investment in the content intelligence market.

Restraint

Difficulty in accurately measuring ROI and demonstrating value

The difficulty in accurately measuring ROI and demonstrating value poses a significant restraint on the demand for content intelligence solutions. Businesses need to justify their investments in content intelligence by showing tangible returns, such as increased market, improved customer engagement, or cost savings. However, accurately quantifying the impact of content intelligence on these metrics can be challenging. Without clear evidence of the value generated by content intelligence, businesses may hesitate to invest in these solutions or allocate limited resources to their implementation and maintenance. This uncertainty can hinder the widespread adoption of content intelligence across industries, slowing down market growth.

Additionally, the inability to demonstrate ROI may lead to skepticism among stakeholders, further dampening demand for content intelligence tools. Therefore, addressing the challenge of measuring and proving the value of content intelligence is crucial for overcoming this restraint and driving broader adoption in the market.

Opportunity

Offering subscription-based and scalable content intelligence solutions

Offering subscription-based and scalable content intelligence solutions presents significant opportunities in the market. Subscription-based models allow businesses to access content intelligence tools without large upfront costs, making them more accessible to organizations of all sizes, including small and medium-sized enterprises (SMEs) and startups. This flexibility encourages wider adoption of content intelligence solutions across various industries, driving market growth. Scalable solutions enable businesses to adjust their usage and capabilities according to their evolving needs, ensuring efficient resource allocation and cost-effectiveness.

This scalability appeals to enterprises experiencing fluctuating content volumes or those looking to expand their content operations. By offering subscription-based and scalable options, content intelligence providers can attract a broader customer base and establish long-term relationships, leading to increased market share and market. Moreover, this approach fosters innovation as providers strive to continually improve their offerings to meet the diverse needs of their subscribers.

Component Insights

The software segment has held the largest market share of 77% in 2024. In the content intelligence market, the software segment encompasses the various applications and platforms used for analyzing and extracting insights from digital content. This includes content management systems, data analytics tools, artificial intelligence algorithms, and natural language processing software. Trends in this segment involve the integration of advanced AI and machine learning capabilities to automate content analysis, enhance personalization, and improve content optimization. Additionally, there is a focus on developing user-friendly interfaces and scalable solutions to cater to the diverse needs of businesses across industries.

The service segment is anticipated to witness rapid growth at a significant CAGR during the projected period. The service segment in the content intelligence market encompasses a range of offerings aimed at supporting the implementation, integration, and maintenance of content intelligence solutions. Services may include consulting, training, support, and managed services. Trends in this segment include a growing demand for consulting services to develop content intelligence strategies, as well as increased interest in managed services for ongoing support and optimization. Providers are also focusing on offering specialized training programs to enhance user proficiency and maximize the value of content intelligence investments.

Enterprise Size Insights

The large enterprises segment held a 70% market share in 2024.Large enterprises, typically characterized by extensive resources and complex content ecosystems, form a significant segment in the content intelligence market. Trends indicate a growing focus on integrating content intelligence solutions into large-scale operations to optimize content creation, distribution, and engagement strategies. These enterprises seek comprehensive and scalable content intelligence platforms capable of handling vast amounts of data and providing actionable insights to enhance customer experiences and drive business growth.

The SMEs segment is anticipated to witness rapid growth over the projected period. Small and Medium-sized Enterprises (SMEs) typically comprise businesses with fewer than 250 employees. In the content intelligence market, SMEs are increasingly adopting scalable and cost-effective solutions, such as subscription-based models. These businesses often have limited resources and budgets but recognize the importance of leveraging data insights for content optimization. As a result, content intelligence providers are tailoring their offerings to cater to the specific needs and constraints of SMEs, driving growth in this segment.

End-use Insights

The media & entertainment segment has held a 24% market share in 2024. In the content intelligence market, the media and entertainment segment focuses on providing insights and analytics tailored to the needs of media companies, broadcasters, and entertainment platforms. This segment analyzes audience behavior, content preferences, and engagement metrics to optimize content creation, distribution, and monetization strategies. Trends in this segment include the adoption of AI-driven content recommendation systems, personalized content experiences, real-time audience insights, and the integration of content intelligence tools into digital platforms to enhance viewer engagement and satisfaction.

The retail and consumer goods segment is anticipated to witness rapid growth over the projected period. In the content intelligence market, the retail and consumer goods segment refer to businesses operating in the retail industry and manufacturing consumer goods. This segment focuses on analyzing consumer behavior, preferences, and market trends to optimize content strategies. Trends in this segment include personalized product recommendations, targeted advertising, and real-time inventory management. Retailers are leveraging content intelligence to enhance customer experiences, drive sales, and stay competitive in the dynamic retail landscape.

Regional Insights

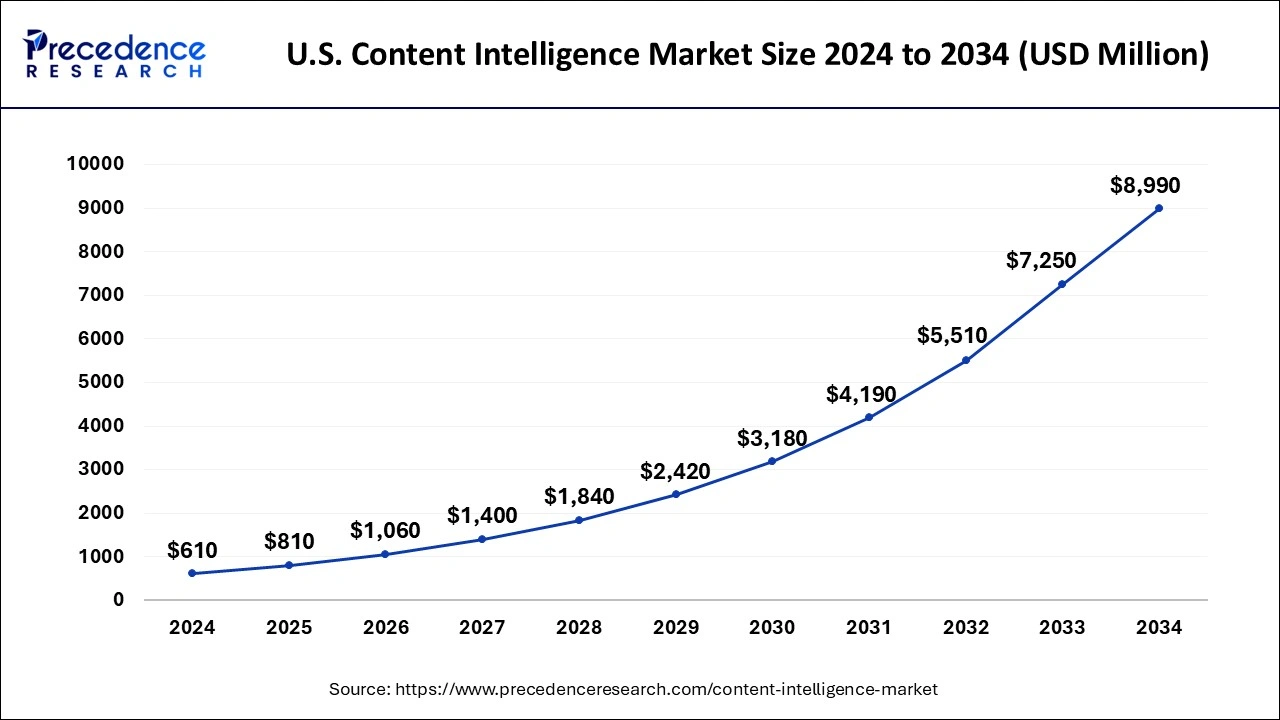

U.S.Content Intelligence Market Size and Growth 2025 to 2034

The U.S. content intelligence market size is estimated at USD 810 million in 2025 and is projected to surpass around USD 8,990 million by 2034 at a CAGR of 30.87% from 2025 to 2034.

North America has held the major market share of 40% in 2024, due to several factors. The region boasts a mature digital infrastructure, widespread adoption of advanced technologies, and a large base of tech-savvy consumers. Moreover, North American businesses prioritize innovation and invest heavily in data analytics and AI solutions, driving the demand for content intelligence tools. Additionally, the presence of key market players and a thriving startup ecosystem contribute to North America's dominance in the content intelligence market.

North America: U.S. Content Intelligence Market Trends

The U.S. dominates the North American market due to its advanced digital ecosystem and widespread adoption of AI and data analytics technologies. Leading technology companies and startups are investing heavily in AI-driven content solutions, driving market growth. High demand from sectors such as marketing, e-commerce, and media fuels the adoption of content intelligence platforms.

Asia-Pacific is witnessing rapid growth in the content intelligence market due to several factors.Increasing internet penetration and smartphone adoption have expanded the digital footprint, leading to a surge in online content consumption. Additionally, rising demand for personalized digital experiences and advancements in artificial intelligence and data analytics are driving the adoption of content intelligence solutions. Furthermore, the region's burgeoning e-commerce sector and evolving regulatory landscape present significant opportunities for content intelligence providers, fostering further growth in the market.

Meanwhile, Europe is witnessing significant growth in the content intelligence market due to several factors.The region's businesses are increasingly adopting digital transformation strategies, driving the demand for content intelligence solutions to optimize their online presence and engage with customers effectively. Moreover, stringent data privacy regulations, such as GDPR, have led companies to invest in compliant content intelligence tools. Additionally, the rise of e-commerce and the increasing focus on personalized customer experiences are further fueling the adoption of content intelligence technologies across Europe.

Asia Pacific: China Content Intelligence Market Trends

China dominates the regional market due to its rapidly growing digital economy and widespread adoption of AI and machine learning technologies. The country's booming e-commerce, social media, and online marketing sectors drive strong demand for content intelligence solutions. Large technology companies and startups are investing heavily in AI-powered content analytics and automation platforms.

Europe: The UK Content Intelligence Market Trends

The UK dominates the regiona due to its advanced digital economy and high adoption of AI-driven technologies. Major media, marketing, and e-commerce companies in the UK are leveraging content intelligence solutions to optimize content creation, personalization, and analytics. The presence of leading technology providers and startups fosters innovation and rapid deployment of AI-powered platforms.

Why did Latin America experience steady growth in the content intelligence market?

As companies pivoted toward digital engagement, Latin America experienced an increase in the adoption of content intelligence. The rise of mobile internet access and social media usage further supported the increasing demand for AI-powered marketing solutions. Corporations in Brazil, Mexico, and Argentina began utilizing analytics tools for customer engagement to reach larger audiences. In addition to innovations from companies, government improvements in internet infrastructure, and the encouragement of startup innovation also contributed to market growth.

Brazil Content Intelligence Market Trends

Brazil was the primary market in Latin America due to accelerated digitalization and widespread personal use of social media as a marketing tactic. Businesses capitalized on AI-powered content solutions to track engagement and automate marketing activities across social media channels. The growth potential of Brazil's technology ecosystem and increasing startup activities created a strong infrastructure for innovation. Given the large number of internet users in Brazil and businesses using a digital-first strategy.

Why did the content intelligence market in the Middle East & Africa grow significantly?

The growth of the content intelligence market in the Middle East & Africa is driven by the increasing digital media consumption, e-commerce activity in the region, and governmental programme implementing peer-to-peer applications of AI and other smart technology. There has also been the growing use of AI tools to guide content personalization, audience analysis, and insight in sectors in the region, notably, the UAE, Saudi Arabia, and South Africa. Furthermore, the growing population of internet users has produced reasonable avenues of growth, especially in smart city projects.

The UAE Content Intelligence Market Trends

The UAE has been a leading driver for the region, owing to early-stage buy-in to AI and evident buy-in to digital initiatives from the government. The current onslaught of government-backed AI initiatives and smart city projects has driven companies to implement intelligent analytics in an evolving sea of media companies. Implementation has revealed methods of targeting audiences more effectively - media and retail companies relying upon AI content tools to assist.

Content Intelligence Market Companies

- Messagepoint Inc.

- Adobe Inc.

- IBM

- ChapsVision

- M-Files

- Brain Corp

- Google Cloud

- MarketMuse

- Idio

- Acrolinx

- Salsify

- Cognitivescale

- Yseop

- Curata

- BrightEdge

Recent Developments

- In March 2023, ChapsVision, a specialist in data processing, completed the acquisition of QWAM Content Intelligence. This strategic move aligns with ChapsVision's goal to position itself as a leading European figure in natural language processing (NLP).

- In February 2023, M-Files, an international leader in information management, announced its acquisition of Ment (formerly Contract Mill Oy), a provider of no-code document automation technology. With this acquisition, M-Files asserts its ability to offer both new and existing clients robust document automation features for rapid implementation.

- In January 2023, Brain Corp, a company specializing in artificial intelligence and robotics technology, teamed up with Google Cloud to develop "BrainOS Inventory Insights." This innovative system is designed to equip retailers with advanced in-store inventory insights, marking a significant advancement in inventory management technology.

Segments Covered in the Report

By Component

- Software

- Services

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- BFSI

- IT & Telecommunication

- Manufacturing

- Media & Entertainment

- Retail & Consumer Goods

- Travel & Hospitality

- Government & Public Sector

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client