List of Contents

Cone Beam Computed Tomography Market Size and Forecast 2025 to 2034

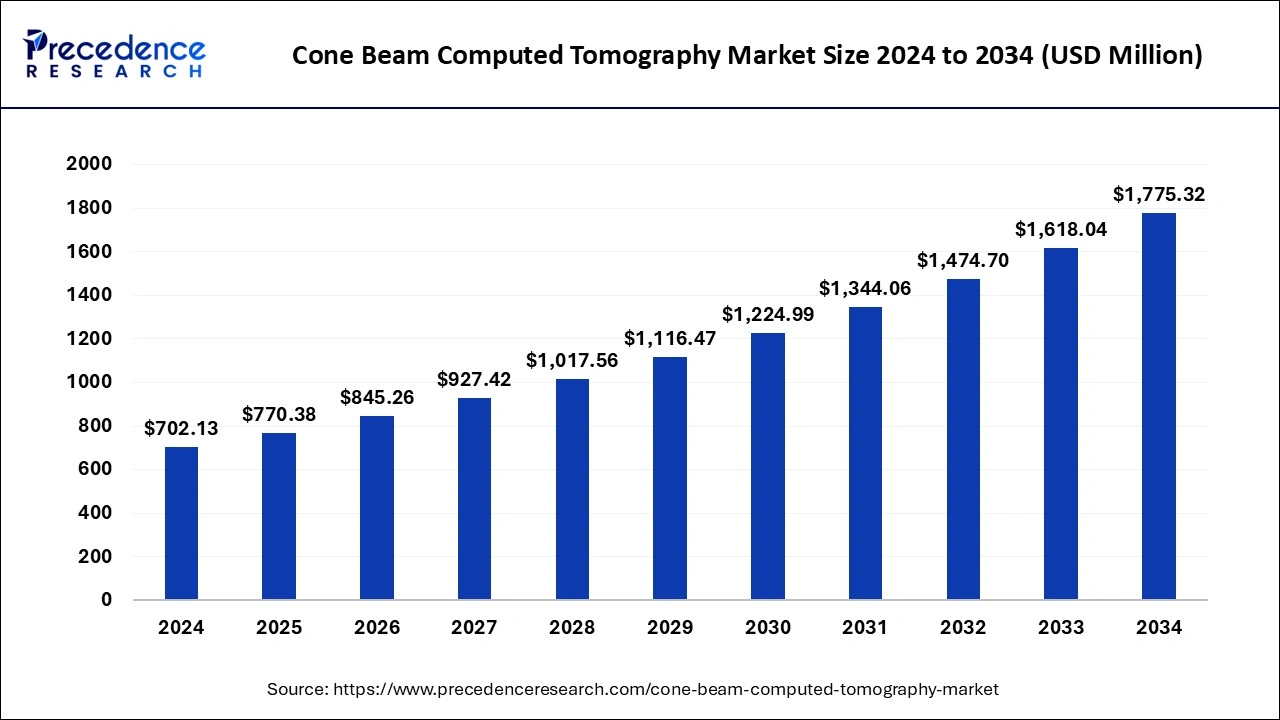

The global cone beam computed tomography market size was accounted for USD 702.13 million in 2024 and is expected to exceed around USD 1,775.32 million by 2034, growing at a CAGR of 9.72% from 2025 to 2034. The growing demand for cone beam imaging for dental applications is the key factor driving market growth. Also, technological advancements in the field coupled with substantial improvements in healthcare infrastructure can fuel market growth further.

Cone Beam Computed Tomography Market Key Takeaways

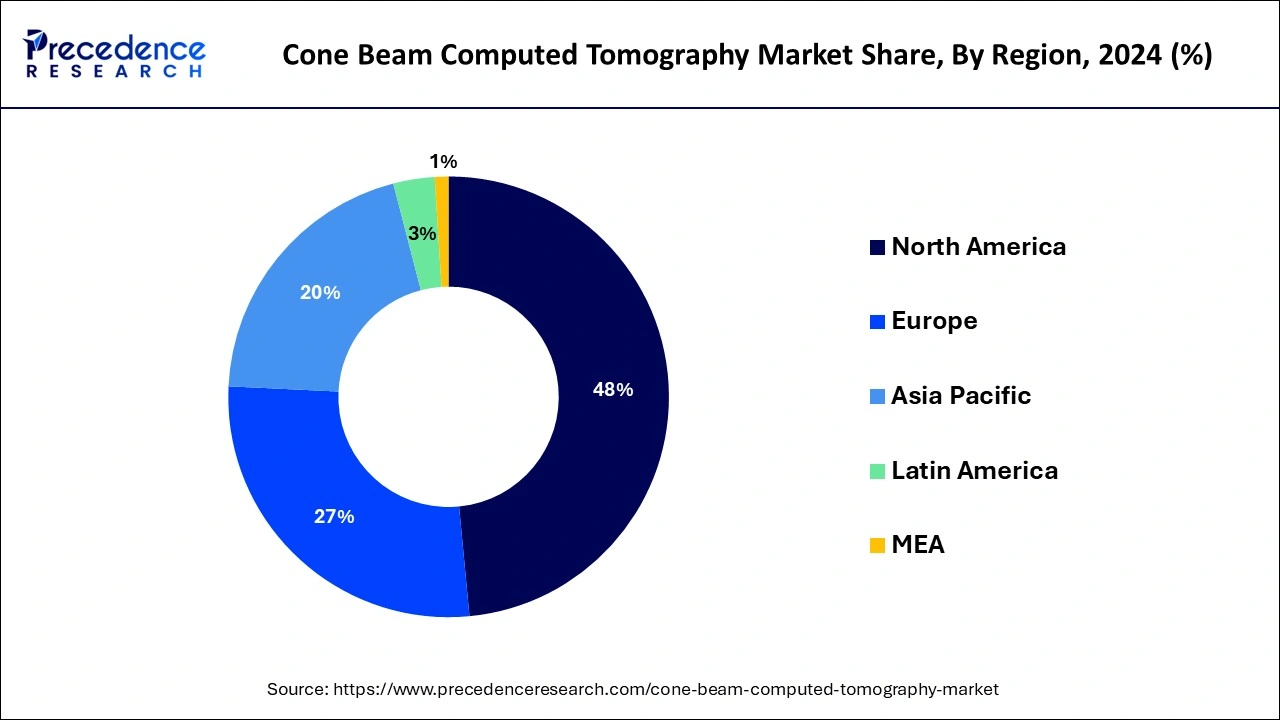

- North America dominated the cone beam computed tomography market with the largest market share of 48% in 2023.

- Asia Pacific is expected to grow at the fastest CAGR of 10.82% over the forecast period.

- By application, the dental implantology segment accounted for the biggest market share of 27% in 2024.

- By application, the orthodontics segment is anticipated to grow fastest over the forecast period.

- By patient position, the seated position segment dominated the market in 2024.

- By patient position, the supine position segment is expected to grow at the fastest rate over the forecast period.

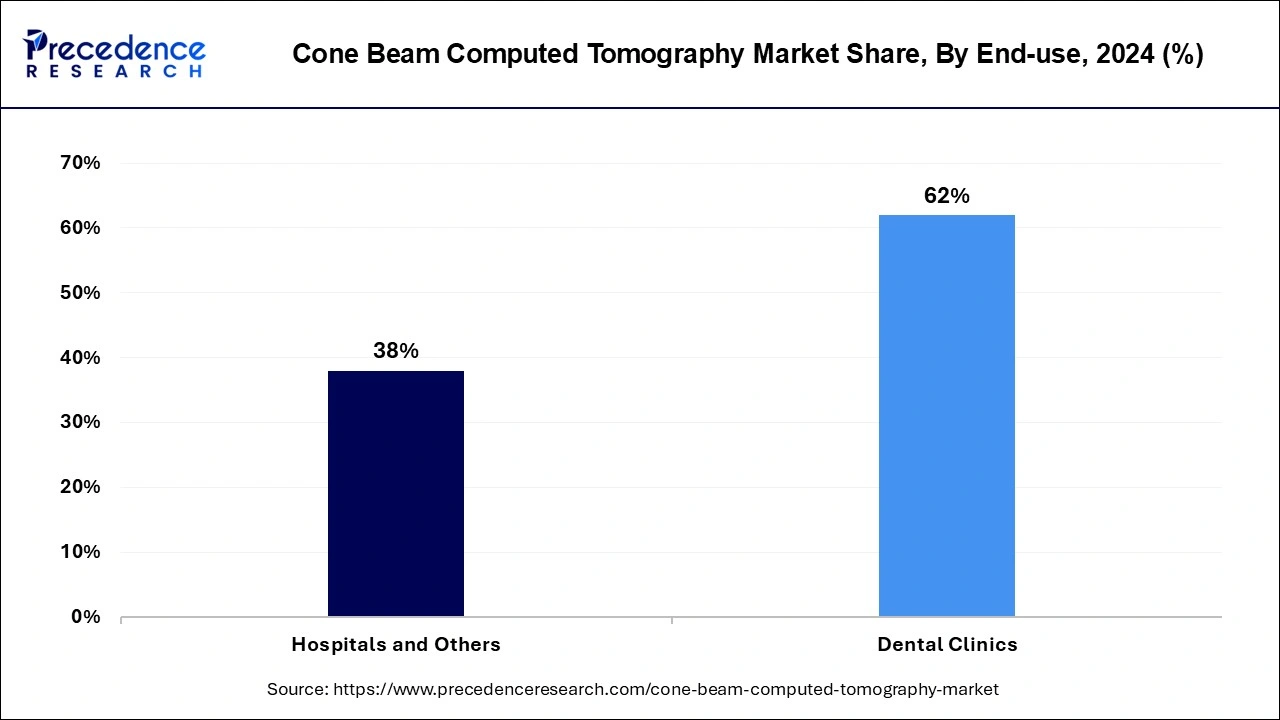

- By end use, the dental clinic's segment generated the maximum market share in 2024.

- By end use, the hospital and others segment is projected to grow at the fastest CAGR during the projected period.

The Role of Artificial (AI) in CBCT Scan Reporting

Artificial Intelligence algorithms can detect and process key patterns with remarkable precision in the cone beam computed tomography market. They can also identify abnormalities, decrease human error, and measure bone density. AI ensures reliable and persistent interpretations, which is essential for treatment planning. Furthermore, AI can combine information from cone beam computed tomographyscans with data from another patient to create individualized treatment plans.

- In March 2024, Philips and Synthetic MR launched an AI-based quantitative brain imaging system. The software suite leverages a combination of three previously released technologies. This partnership aims to revolutionize the detection and analysis of conditions such as multiple sclerosis, traumatic brain injuries, and dementia.

U.S. Cone Beam Computed Tomography Market Size and Growth 2025 to 2034

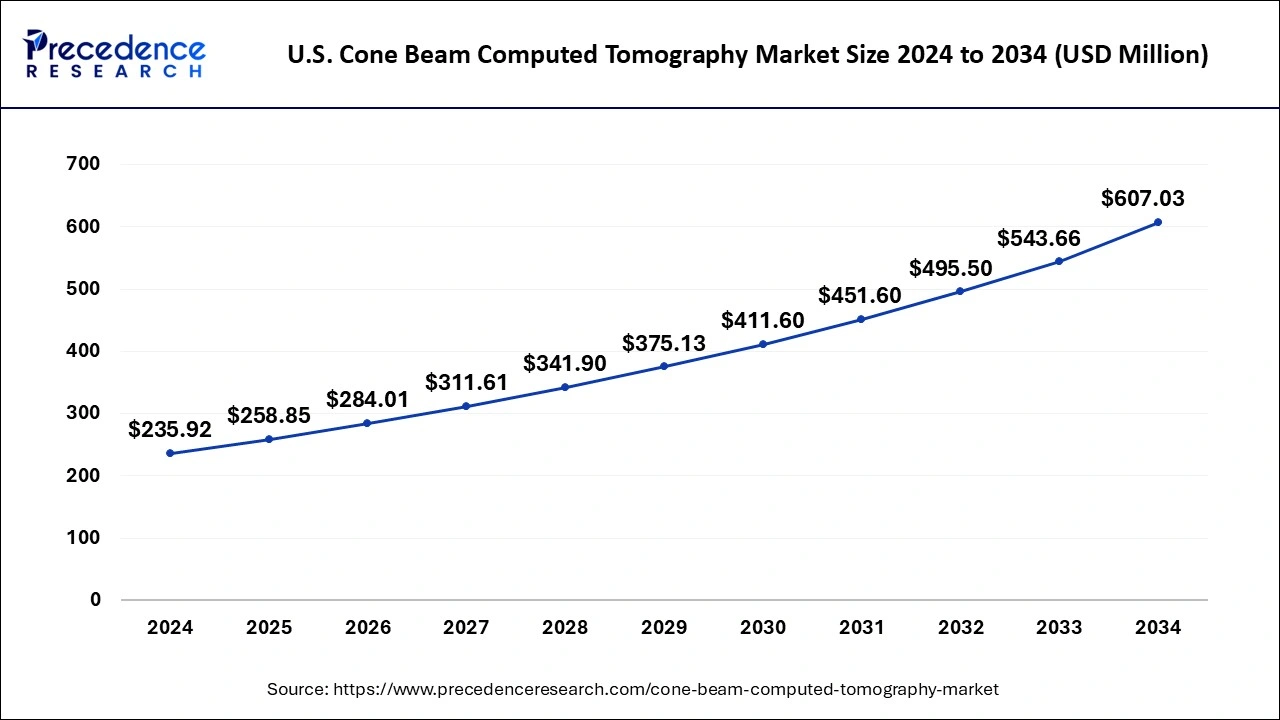

The U.S. cone beam computed tomography market size was exhibited at USD 235.92 million in 2024 and is projected to be worth around USD 607.03 million by 2034, growing at a CAGR of 9.91% from 2025 to 2034.

North America dominated the cone beam computed tomography market in 2023. The dominance of the region can be attributed to the growing awareness about the importance of dental care & and oral health. Also, the increasing access of independent clinics along with other R&D activities in imaging techniques is impacting the market growth positively. Furthermore, in North America US led the market owing to the widespread adoption of CBCT technology in dental care and various other applications.

- In October 2023, PreXion, Inc. introduced the 3-in-1 PreXion3D Evolve CBCT, PAN, and CEPH, as well as the Evolve Sensor intraoral dental digital imaging sensor, to expand its already extensive line of dental imaging products.

Asia Pacific is expected to show the fastest growth over the studied period. The growth of the region can be credited to the surging number of clinics and improved R&D in healthcare facilities. Furthermore, technological advancements are boosting the development of the healthcare industry. Also, in Asia Pacific, China led the market due to increasing medical tourism and a rising volume of dental care procedures.

Market Overview

Cone Beam computed tomography is a special kind of X-ray technology that offers precise images as compared to conventional 2D imaging methods. The cone beam computed tomography market's improved imaging technique is important for applications in ear-nose-throat (ENT), dental, and orthopedic diagnostics systems gained significant traction, particularly with their capability to visualize tedious anatomical shapes without any type of invasive procedures. The CBCT systems provide key opportunities for advanced diagnostic procedures.

Instruments and appliances used in the dental industry, exports by country in 2023

| Reporter | Trade Value 1000USD |

| European Union | 1,800,574.13 |

| Germany | 1,607,444.99 |

| United States | 707,598.22 |

| Switzerland | 646,569.34 |

| China | 607,896.71 |

Cone Beam Computed Tomography Market Growth Factors

- The growing need for accurate orthopedic diagnostics support is expected to boost cone beam computed tomography market growth soon.

- The rising awareness of innovative diagnostic techniques can propel market growth shortly.

- The increasing need for effective breast cancer diagnostics will likely contribute to the cone beam computed tomography market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 702.13 Million |

| Market Size in 2025 | USD 770.38 Million |

| Market Size in 2034 | USD 1,775.32 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.72% |

| Dominating Region | North America |

| Fastest Growing | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Patient Position, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Increasing adoption across medical specialties

The cone beam computed tomography market technology was created for dental applications like implantology, orthodontics, and maxillofacial surgery. Over time, its utility has stretched to other fields, such as orthopedics, otolaryngology, and interventional radiology. In addition, the growing product adoption in interventional radiology for procedures, including ablations and biopsies, is contributing to market expansion.

- In May 2024, Detection Technology, a world leader in X-ray detector solutions, launched indium gallium zinc oxide thin-film transistor (IGZO-TFT) flat panel detectors (FPD) to enhance dental imaging. The new additions to the company's FPD portfolio include X-Panel 1717z FDM for cone beam computed tomography (CBCT) and panoramic imaging and X-Panel 3030z FDM-TG-X for CBCT.

Restraint

Limited reimbursement policies

Reimbursement policies for cone beam imaging can be restricted in various regions. This can make these scans more expensive for individuals and also create financial hurdles for medical professionals. Moreover, the concerns regarding data privacy and security may impact t patients' complaints and reliability in CBCT technology. Cone beam imaging produces a high amount of confidential patient data that needs to be kept safe.

Opportunity

Increasing focus on personalized healthcare

The demand for innovative diagnostic imaging technologies like CBCT is fuelled by the growing trends toward personalized healthcare and precision medicine. Healthcare providers can reduce the risks associated with invasive procedures, by using CBCT imaging. Furthermore, this imaging technique can also streamline treatment plans and optimize treatment outcomes based on the unique features of each patient.

- In September 2024, Carestream Dental secured $525 million in new funding to reduce debt, extend maturities, and invest in innovation. The company also launched the Oral Healthcare Innovation Hub to revolutionize oral healthcare. The new funding positions the company for growth and market expansion through strategic investments and partnerships.

Application Insights

The dental implantology segment led the cone beam computed tomography market in 2024. The dominance of the segment can be attributed to the increasing use of CBCT in dental implantology to carry out smooth diagnostic procedures. In dental clinics, CBCT is used to analyze the implant site, understand the bone density and avoid injuries & complications, and perform post-surgical analysis of the receiver site. Additionally, this method is seen as a crucial technique for cross-sectional imaging.

- In July 2024, Desktop Health, the trusted production-grade medical 3D printing brand of Desktop Metal, Inc., validated Flexcera Smile Ultra+ resin, which is used to 3D print strong and lifelike teeth restorations for use in dental implantology cases. Flexcera Smile Ultra+ dental resin is an FDA (510)k cleared, MDR certified, and CE-marked resin for 3D printed restoratives.

The orthodontics segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the rapid advancements and commercialization in CBCT technology which have propelled affordability and accessibility along with increasing awareness of its numerous clinical benefits. Furthermore, CBCT provides images in many dimensions that are precise for treatment planning.

Patient Position Insights

The seated position segment dominated the cone beam computed tomography market in 2023. The dominance of the segment can be linked to the growing use of seated-position CBCT scans in various dental applications. CBCT scan provides more detailed imaging of teeth than a 2D dental X-ray image. In addition, the 3D imaging technique captures images of bone structures and other soft tissue with keen detail, facilitating precise treatment planning for different procedures.

The supine position segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing recommendations of this position by healthcare professionals during performing procedures like orthodontic surgeries and implant planning. Moreover, this position enables smooth access to the interior structures of the body.

End-Use Insights

In 2023, the dental clinics segment led the market by holding the largest cone beam computed tomography market share. The growth of the segment is due to the increasing product demand across clinic management systems and hospitals. The growing compliance standards and complexity of healthcare infrastructure necessitate convenient software tools to tackle risks and ensure proper adherence.

- In January 2024, Elite Body Home Polyclinic, a leader in aesthetics, dentistry, and healthcare, launched its luxury dental clinic in the heart of Dubai, marking a significant step forward in the city's premium healthcare landscape. Renowned for blending advanced medical technology with personalized care, this move reflects Dubai's ambition to be a global destination for top-tier healthcare services.

The hospital & others segment is estimated to grow at the fastest rate during the projected period. The growth of the segment can be driven by improved infrastructural support offered by these facilities, easier treatment access, and positive reimbursement policies. Furthermore, the surge in personalized medicine and innovations in genomics impact the segment's growth positively.

Cone Beam Computed Tomography Market Companies

- Dentsply Sirona.

- J. MORITA MFG. CORP.

- VATECH

- CurveBeam AI, Ltd.

- Carestream Health Inc. (ONEX Corporation)

- Danaher Corporation

Latest Announcement by Market Leaders

- In October 2024, DENTSPLY SIRONA Inc. announced the voluntary suspension of sales and marketing of its Byte Aligners and Impression Kits while the Company conducts a review of certain regulatory requirements related to these products. The Company's decision was made in consultation with the U.S. Food and Drug Administration (FDA).

- In July 2024, Carestream Health announced enhancements to its ImageView Software and DRX-Evolution Plus System, aiming to improve the technologist experience and patient workflow. The upgrades include new Smart Room Options for the ImageView Software and additional features for the DRX-Evolution Plus Digital Radiography System.

Recent Developments

- In September 2023, Dentsply Sirona revealed a new tool for SureSmile users as well as updates to its cloud-based platform, DS Core. DENTSPLY Sirona's cloud-based platform, DS Core, helps dentists from the time an image is captured until the patient is being treated.

- In March 2023, Planmeca OY launched the Planmeca Viso G3 imaging unit at the International Dental Show 2023. The Planmeca Viso G3 imaging unit offers premium imaging of the whole dentition to dental practitioners around the world and comes with the full benefits of Viso technology.

Segments Covered in the Report

By Application

- Dental Implantology

- Oral and Maxillofacial Surgery

- Orthodontics

- Endodontics

- General Dentistry

- Temporomandibular Joint (TMJ) Disorders

- Periodontics

- Forensic Dentistry

- Others

By Patient Position

- Standing Position

- Seated Position

- Supine Position

By End-use

- Hospitals & Others

- Dental Clinics

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client