List of Contents

What is the Commercial Boiler Market Size?

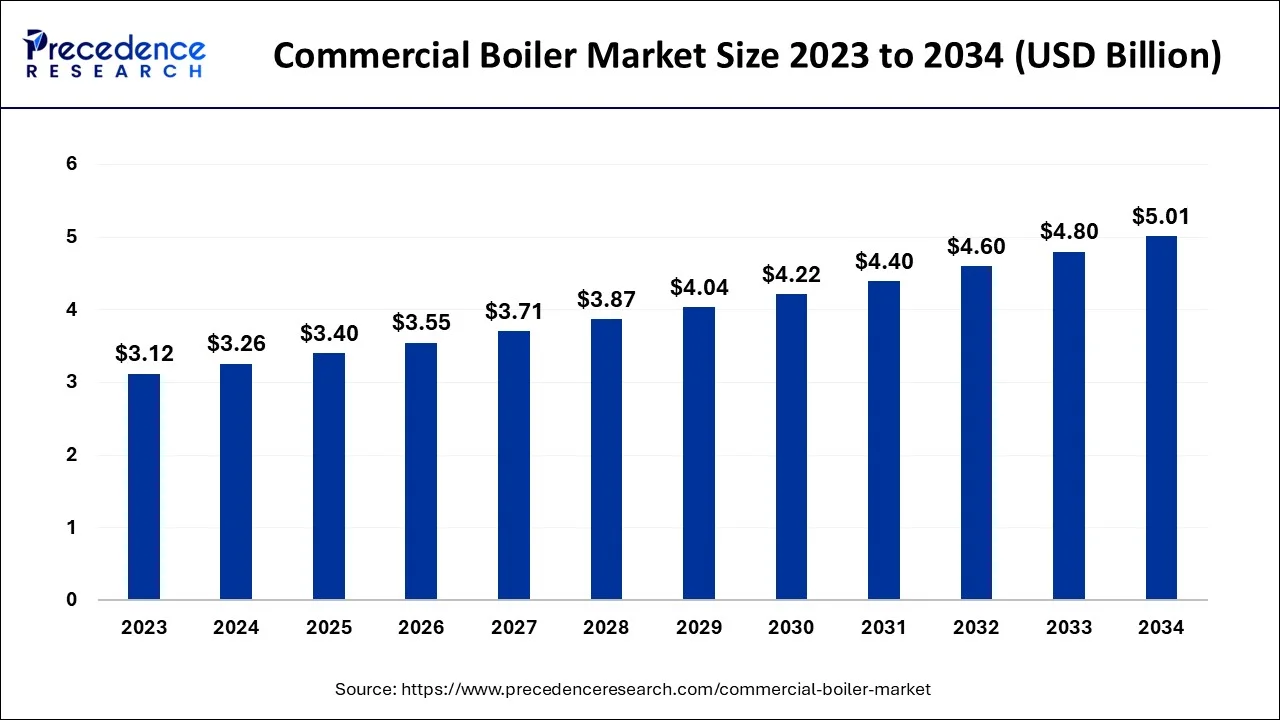

The global commercial boiler market size is calculated at USD 3.40 billion in 2025 and is predicted to increase from USD 3.55 billion in 2026 to approximately USD 5.01 billion by 2034, expanding at a CAGR of 4.39% from 2025 to 2034.

Commercial Boiler MarketKey Takeaways

- In terms of revenue, the commercial boiler market is valued at $3.40 billion in 2025.

- It is projected to reach $5.01 billion by 2034.

- The commercial boiler market is expected to grow at a CAGR of 4.39% from 2025 to 2034.

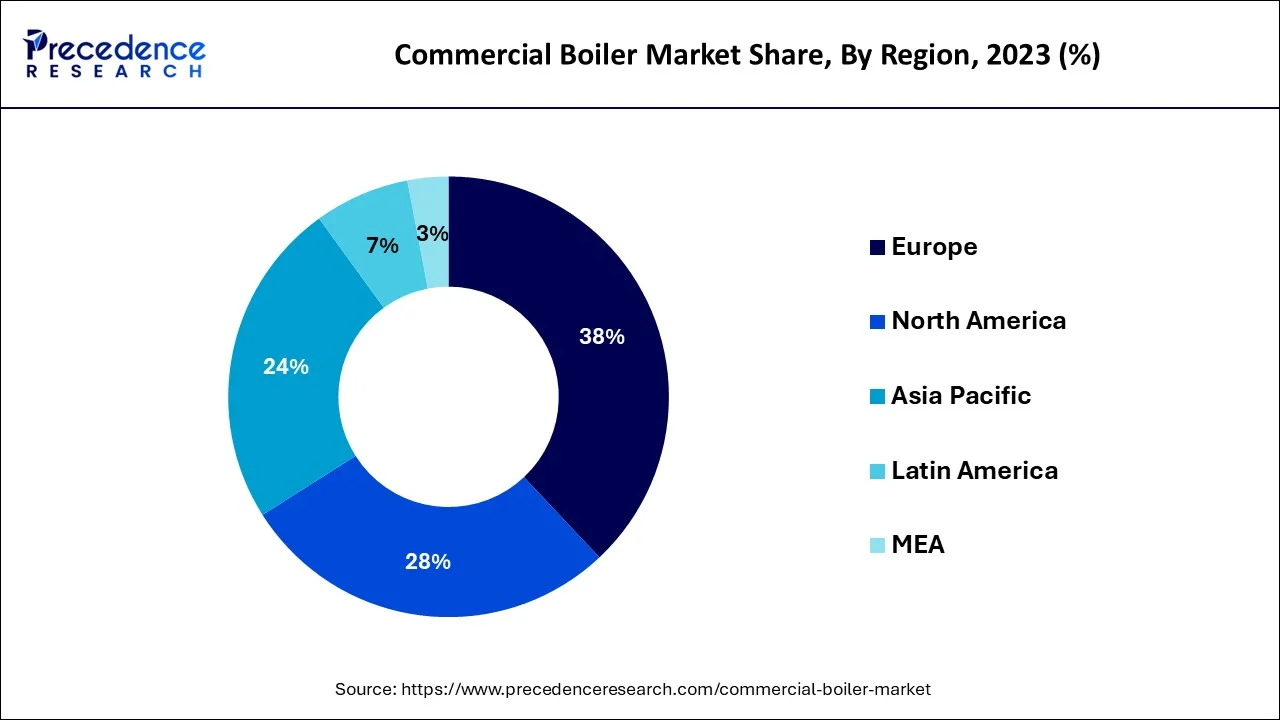

- Europe dominated the commercial boiler market in 2024.

- By fuel, the natural gas segment dominated the market in 2024.

- By technology, the non-condensing segment led the market in 2024.

Commercial Boiler Market Growth Factors

The commercial boilers are pressure systems that heat water for building heating by burning combustible fuels or using electricity. Some boilers use hot water directly, while others use steam-generated water. The heat exchanger transfers heat from the burners or electric coils inside the boiler to the water. The combustion chamber, heat exchanger, burner, and other components make up a commercial boiler. The expanding demand for commercial boilers has been fueled by the growing preference for cost-effective heating systems in commercial enterprises around the world.

The natural gas is utilized more frequently in commercial boilers than solid fuel because natural gas enhances overall efficiency and minimizes dangerous gas emissions. As a result, the government is encouraging the use of natural gas-fired combustion boilers.

In extremely cold countries, commercial boilers are widely used to heat water. The global commercial boilers market is expected to fuel by an increase in the demand for space heating in both commercial and residential buildings, as well as the expansion of the industrial sector. The increased commercial sector investments in the development of economically and environmentally friendly infrastructure are also expected to propel the global commercial boilers market.

The global commercial boilers market is hampered by high boiler production costs. These boilers are very difficult to maintain and install. It must be addressed by the users. The commercial boilers require cylinders with large diameters. The heat radiated by commercial boilers radiators is unbearable.

The global commercial boilers market is expected to rise significantly, owing to rising investments to meet rising energy demand and a fundamental change toward integration of high efficiency heating systems. The expanding healthcare sector, as well as the growth of existing commercial facilities, will influence product acceptance positively. Several government initiatives aimed at expanding green building will boost the commercial boilers market growth during the forecast period.

Although the regulatory standards enforced at the federal, state, and municipal levels frequently overlap and differ, this impacts the market growth. And, as the government continues to tighten down an emission from commercial boilers, it's more crucial than ever for businesses and organizations to ensure that their systems are up to standards.

The commercial boilers market is influenced positively by a demand for energy efficiency in the commercial sectors. The key market players are interested in solutions that will save them money in the long run while also addressing a wide range of requirements. The combustion, controls, and thermal efficiency are all being improved.

In addition, the commercial boilers market is continuing to expand its product offerings into new areas. A large portion of this drive is due to the healthcare business in particular. The industry experts predict that the commercial boilers industry will expand significantly in response to rising demand for hot water in these facilities, as well as linens and cleaning.

Region wise, the expansion of commercial boilers market is also taking place. The key market players are moving to address the growing demand for boilers in polar climatic regions around the world in recent years.

Commercial Boiler Market Outlook

Industry Growth Overview:

The commercial boiler market is expected to experience significant growth from 2025 to 2034, as industries and institutions adopt energy-efficient heating systems to meet emerging building performance standards. The market is driven by rising demand in hospitals, educational campuses, hotels, food processing units, and manufacturing facilities. Furthermore, the Asia-Pacific region is witnessing faster growth due to rapid urbanization, the development of district heating systems in China, India, and Southeast Asia, and ongoing industrial modernization efforts.

Sustainability Trends:

The technological roadmap of the commercial boiler industry is being reshaped by the demand for sustainability and carbon reduction. Manufacturers are adopting hydrogen-ready and hybrid-electric boilers that are compatible with renewable energy sources to achieve net-zero emission targets. Moreover, the push for decarbonization is gaining momentum, and sustainability-focused R&D is likely to become a key differentiator among market leaders.

Global Expansion:

Established producers of commercial boilers are expanding their presence worldwide to improve access for final customers and strengthen supply chain resilience. A. O. Smith Corporation has increased its production capacity in India and Vietnam to meet rising demand in the hospitality and commercial building sectors. Fulton Boiler Company continues to invest in localized service centers across Europe and North America, ensuring faster product delivery and technical support. Additionally, the growing economies in the Asia-Pacific region offer attractive investment opportunities as they expand rapidly due to urbanization and government-supported infrastructure projects.

Major Investors:

Institutional investors and other private equity firms focused on energy infrastructure are also beginning to show interest in the commercial boiler sector. Companies developing decarbonized heating technologies and smart energy management systems are actively receiving funding from investors like Brookfield Infrastructure Partners, BlackRock, and Macquarie Capital. This influx of investment is likely to accelerate innovation and promote the adoption of sustainable boiler systems worldwide.

Startup Ecosystem:

The commercial boiler market is being transformed by a vibrant ecosystem of startups and clean-tech innovators, especially in smart heating, automation, and hydrogen-based solutions. New companies like ThermaFY (UK), Heat Wayv (USA), and Hoval Digital (Switzerland) are emerging to create intelligent, connected systems. These systems enable real-time diagnostics and predictive maintenance to maximize efficiency and reliability. The growing collaboration between established manufacturers and new startup innovators is likely to accelerate the industry's shift toward cleaner, smarter, and more adaptable heating ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.01 Billion |

| Market Size in 2026 | USD 3.55 Billion |

| Market Size in 2025 | USD 3.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.39% |

| Largest Market | Europe |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel, Technology, Product, Capacity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Fuel Insights

Based on the fuel, the natural gas dominates the commercial boiler market during the forecast period. Natural gas is utilized more frequently in commercial boilers than solid fuel because natural gas enhances overall efficiency and minimizes dangerous gas emissions. As a result, the government endorses the use of natural gas-fired combustion boilers.

On the other hand, the coal is expected to grow at rapid pace during the forecast period. The coal is substantially less reactive than gas or atomized oil since it is a solid fuel. Furthermore, the ash content of coal, which is commonly used in utility boilers, is 200 to 1000 times of oil per British Thermal Unit (BTU) of heat provided.

Technology Insights

Based on the technology, the non-condensing segment dominated the market with highest market share during 2020. A non-condensing boiler features a single heat exchanger chamber through which hot gases from the burner flow to heat the water within the exchanger's walls before existing through the exit flue.

On the other hand, the condensing segment is fastest growing segment in the commercial boiler market. The energy bills and a smaller carbon footprint are the two main advantages of utilizing a condensing boiler. As condensing boilers are so much more efficient than traditional boilers at converting fuel into useful heat, one can use less fuel to heat water.

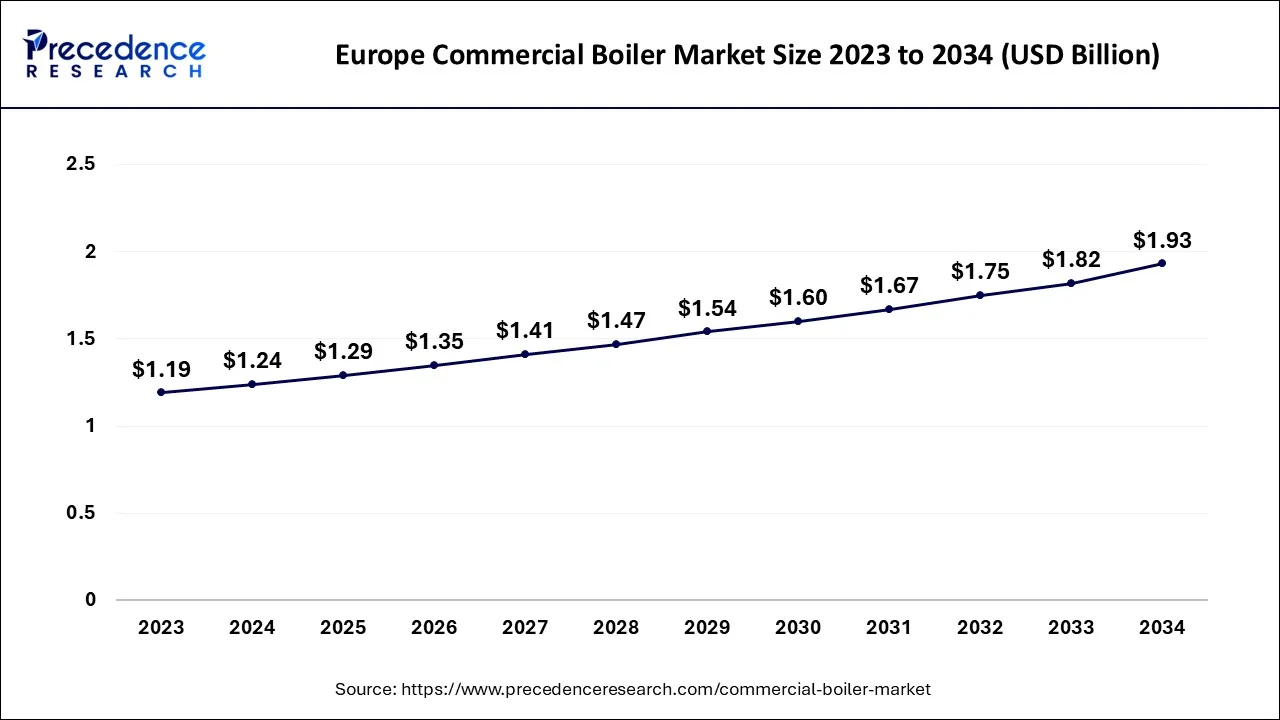

Europe Commercial Boiler Market Size and Growth 2025 To 2034

The Europe commercial boiler market was valued at USD 1.29 billion in 2025 and is predicted to hit around USD 1.93 billion by 2034 with a CAGR of 4.52% from 2025 to 2034.

Europe's dominance is driven by the widespread adoption of condensing boilers, especially in Germany, the UK, and France, where environmental regulations are among the strictest worldwide. The net-zero agreement and Ecodesign Directive established by the European Union have compelled commercial users to switch to low-NOx and high-efficiency heating systems. Additionally, energy optimization in business facilities is being enhanced through investments in intelligent controls and digital performance monitoring via the Internet of Things.

How is the Opportunistic Rise of North America in the Commercial Boiler Market?

Market growth in North America is further driven by rising adoption of natural gas-fired boilers, supported by abundant fuel availability and a growing preference for low-emission systems. Aging infrastructure, coupled with stringent regulatory requirements from the U.S. Department of Energy (DOE), has accelerated the replacement of traditional oil-based units. Additionally, the gradual adoption of smart and connected condensing boilers in hospitals, schools, and office buildings is further strengthening steady market growth.

U.S. Commercial Boiler Market Trends

The U.S. leads the North American boiler market, supported by government initiatives from the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) that promote high-efficiency heating standards. The transition from traditional oil-fired systems to natural gas and condensing boilers has been further accelerated by federal tax incentives and state-level energy efficiency programs. Market momentum is expected to continue through 2030, driven by increasing investment in retrofits and replacement projects in commercial buildings.

What Potentiates the Growth of the Commercial Boiler Market in Asia Pacific?

The rise of commercial complexes in China, India, and Southeast Asia has accelerated urbanization and boosted boiler installation rates. National clean energy missions, focused on increasing energy efficiency and electrification, are driving demand for high-efficiency electric boilers. Global manufacturers are expanding regional operations to meet growing demand and provide customized solutions for industrial and commercial sectors.

China Commercial Boiler Market Trends

China remains a leader in the Asia-Pacific commercial boiler market, supported by rapid industrialization, robust infrastructure expansion, and government initiatives promoting clean energy adoption. Under the 14th Five-Year Plan, the country is accelerating the replacement of coal-based systems with electric and gas-fired boilers. Boiler installations are being driven by growth in commercial construction, particularly in the hospitality, healthcare, and education sectors. The strong focus on electrification and emissions reduction positions China as the most dynamic commercial boiler market in the region.

What are the Major Factors Driving the Growth of the Latin America Commercial Boiler Market?

The Latin American market is driven by rising demand for commercial boilers among mid-sized enterprises. Development in healthcare and educational infrastructure is generating a steady stream of installation projects. Government initiatives focused on energy diversification and sustainability are encouraging the adoption of advanced condensing systems in new commercial projects. Strengthening partnerships between local distributors and international manufacturers is expected to enhance technology access and drive market adoption across the region.

Brazil Commercial Boiler Market Trends

Brazil has emerged as a leading market in Latin America, driven by growth in the commercial real estate sector and government initiatives promoting sustainable building systems. The availability of advanced boiler technologies is increasing through partnerships between Brazilian distributors and European manufacturers. Expansion in commercial infrastructure, particularly in São Paulo and Rio de Janeiro, is expected to further boost market adoption.

What Supports the Growth of the Commercial Boiler Market in the Middle East & Africa?

The market in the Middle East & Africa is being driven by petrochemical plants, refineries, and large institutional establishments. Major initiatives such as Saudi Vision 2030 and the UAE's Energy Strategy 2050 are promoting the adoption of high-efficiency heating technologies. Investments in industrial and healthcare infrastructure are expected to increase the installation of large-capacity, long-lasting systems. The next phase of market development is likely to focus on condensing and hybrid boilers, aligning with sustainability and carbon efficiency objectives.

UAE Commercial Boiler Market Trends

The UAE leads the Middle East & Africa boiler market, driven by strong industrial growth, expanding urban infrastructure, and ambitious sustainability targets under the UAE Energy Strategy 2050. Water-tube boilers continue to dominate energy-intensive sectors, while the commercial sector is rapidly adopting high-efficiency condensing systems. Ongoing emphasis on green building standards and smart infrastructure development is expected to support sustained long-term market growth.

Commercial Boiler Market – Value Chain Analysis

Raw Material Sourcing - The foundation of commercial boiler production lies in procuring high-quality metals and alloys, such as steel, stainless steel, cast iron, and copper, that ensure durability, heat resistance, and efficiency.

- Key Players:ArcelorMittal, Nippon Steel, Tata Steel, ThyssenKrupp

Component Fabrication - Raw materials are processed into boiler components, including pressure vessels, burners, heat exchangers, valves, and piping, ensuring safety and thermal efficiency.

- Key Players: Parker Boiler, Fulton Boiler Company, Cochran Limited

Boiler Manufacturing - Components are assembled into complete boiler systems (steam, hot water, or condensing types) with integrated control systems and energy-efficient features.

- Key Players: Bosch Thermotechnology, A.O. Smith Corporation, Weil-McLain, Vaillant Group, Cleaver-Brooks

System Integration & Testing - Boiler systems undergo rigorous performance testing, safety certification, and integration with heating, ventilation, and control systems to ensure compliance with standards and operational efficiency.

- Key Players: Superior Boiler Works Inc., Slant/Fin Corporation, Weishaupt, Thermax Limited

Distribution & Installation - Finished boilers are distributed to commercial and industrial facilities, contractors, and OEMs, and are then professionally installed, commissioned, and supported after the sale.

- Key Players: Regional distributors, authorized dealers, EPC contractors, Bosch Thermotechnology, Parker Boiler

After-Sales Service & Maintenance - Regular maintenance, retrofitting, efficiency upgrades, and monitoring services ensure longevity, compliance, and optimal performance of installed boiler systems.

- Key Players: Fulton Boiler Service, Cleaver-Brooks Service Division, Bosch Thermotechnology, A.O. Smith Technical Support

Commercial Boiler Market Companies

- Parker Boiler: Specializes in energy-efficient steam and hot water boilers for commercial and industrial applications.

- Fulton Boiler Company: Provides compact, high-quality steam and hot water boilers with advanced thermal efficiency technology.

- Bosch Thermotechnology (Germany): Offers a wide range of commercial and industrial heating solutions, including high-efficiency boilers and thermal systems.

- A.O. Smith Corporation (USA): Produces commercial water heaters and boilers known for durability and energy efficiency.

- Slant/Fin Corporation (USA): Manufactures commercial hydronic heating boilers and radiators with innovative designs for performance and reliability.

- Vaillant Group (Germany): Supplies sustainable and high-efficiency commercial heating and hot water solutions globally.

- Cochran Limited (UK): Specializes in industrial steam boilers and thermal systems with a focus on innovation and safety.

- Superior Boiler Works Inc. (USA): Provides large-scale commercial and industrial boilers with custom designs for diverse applications.

- Cleaver-Brooks (USA): Offers complete boiler room systems including high-efficiency boilers, burners, and water treatment solutions.

- Weil-McLain Solvay S.A. (USA/Global): Delivers reliable and energy-efficient commercial boilers for heating and hot water systems.

Key Companies & Market Share Insights

The various developmental strategies such as business expansion, investments, acquisition, new product launches, partnerships, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players. The major market players are investing in technological developments across their boiler technologies in order to meet the needs of the end users, implying a rise in market share. The increasing R&D spending, as well as strategic partnerships and alliances are some of the primary methods used by leading industry players to achieve a competitive advantage in the market.

Recent Developments

- On November 03, 2025, Oekoboiler Swiss AG expanded its leadership in energy-efficient water heating by integrating advanced heat pumps with solar technology to meet rising demand for sustainable home heating in Switzerland.

- On October 30, 2025, Mitsubishi Heavy Industries Thermal Systems (MHI Thermal Systems) launched two new R290 (propane) air-to-water heat pumps in its "Hydrolution EZY" series for Europe, offering 6kW and 7.1kW capacities with high energy efficiency and low environmental impact.

- In September 2025, Alfa Laval unveiled a new once-through steam generator (OTSG) for compact, molten salt-based modular thermal energy storage systems, enhancing efficiency in single-pass steam applications.

- In May 2025,new products were launched by Viessmann, which is a leading manufacturer of high-efficiency heating and renewable energy systems, to improve the comfort and efficiency for residential and light commercial applications. The launch of Vitocal 100-S and Vitocal 200-S, which are ducted and ductless air-to-air heat pump solutions that meet the demands of homeowners and contractors, represents the commitment of Viessmann to providing advanced solutions.

- In March 2025, a collaboration between HYTING, which is a hydrogen heating systems company with Kampmann, which is a specialist in HVAC technology, was announced. For industrial, logistics, and commercial buildings together they will manufacture a hydrogen-fuelled ventilation and heating system.

- In August 2024, the introduction of the Auriga HP+ R290 (propane), a high-temperature air-to-water monobloc heat pump range, was announced by Baxi. It is a natural refrigerant air source heat pump (ASHP) showing lower environmental impact, with an excellent low Global Warming Potential (GWP) of 3. Furthermore, it is considered the perfect solution for a range of demanding applications, as it offers high flow temperatures up to 80 °C with enhanced sustainability and efficiency.

(Source: https://www.victoriaadvocate.com)

(Source: https://www.heatingandventilating.net)

(Source: https://www.heatingandventilating.net)

Segments Covered in the Report

By Fuel

- Natural Gas

- Oil

- Coal

- Others

By Technology

- Condensing

- Non-condensing

By Product

- Hot Water

- Steam

By Capacity

- Less than 10 MMBtu/hr

- 10-50 MMBtu/hr

- Others

By Application

- Offices

- Healthcare Facilities

- Educational Institutions

- Lodgings

- Retail Stores

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client